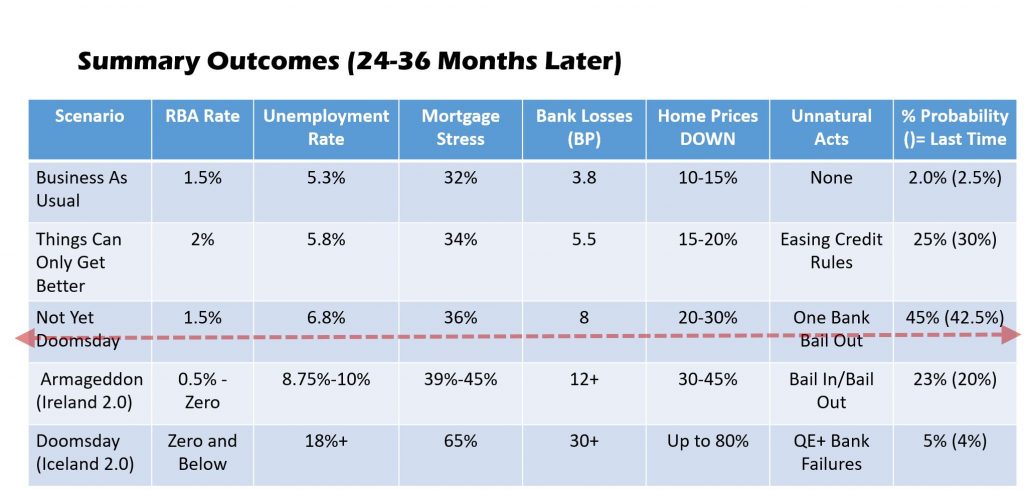

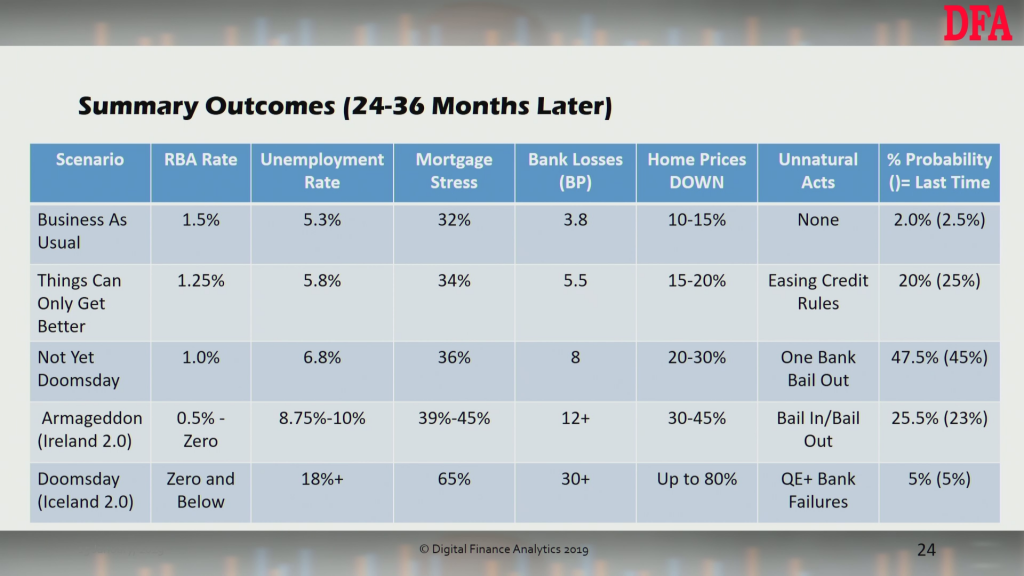

We have updated our scenarios to take account of potential RBA rate cuts later in the year, revised mortgage stress and household confidence data and other factors. We also updated our probability allocation. Here is a summary.

Our central scenario is one of home price fall, peak to trough, of up to 30%. A deeper fall, in the event of international financial stability is also possible. We do not think the RBA has any hope of lifting rates from current emergency levels, having dropped them too low previously.

We discussed these updates during yesterdays live stream Q&A event. Here is a high quality edited version.

You can also watch the recorded “live” version, including the chat replay here: