We review the latest BIS stats on debt to GDP and debt servicing ratios. How is Australia tracking?

Tag: Household Finances

Households Hold All The Wrong Records…

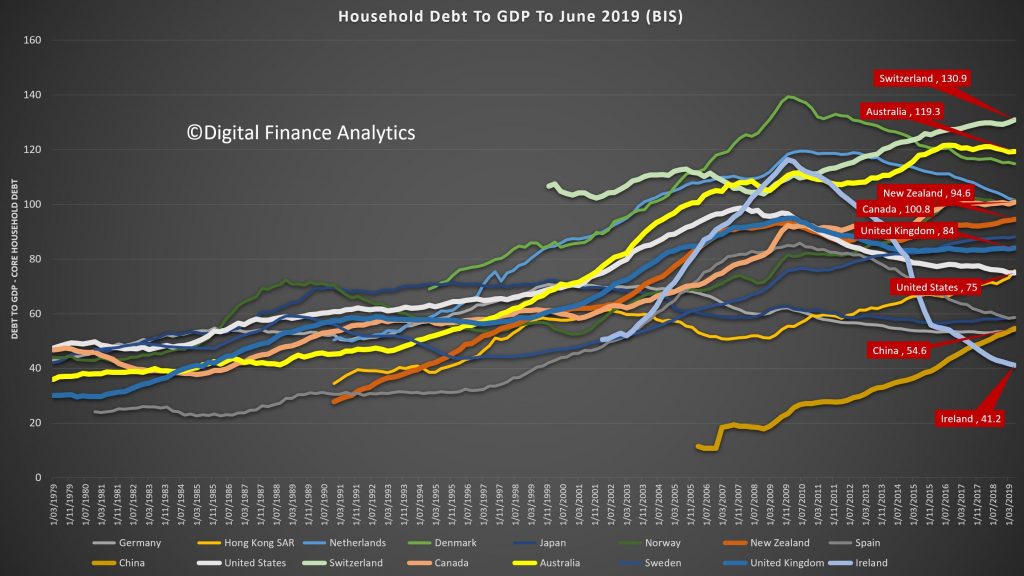

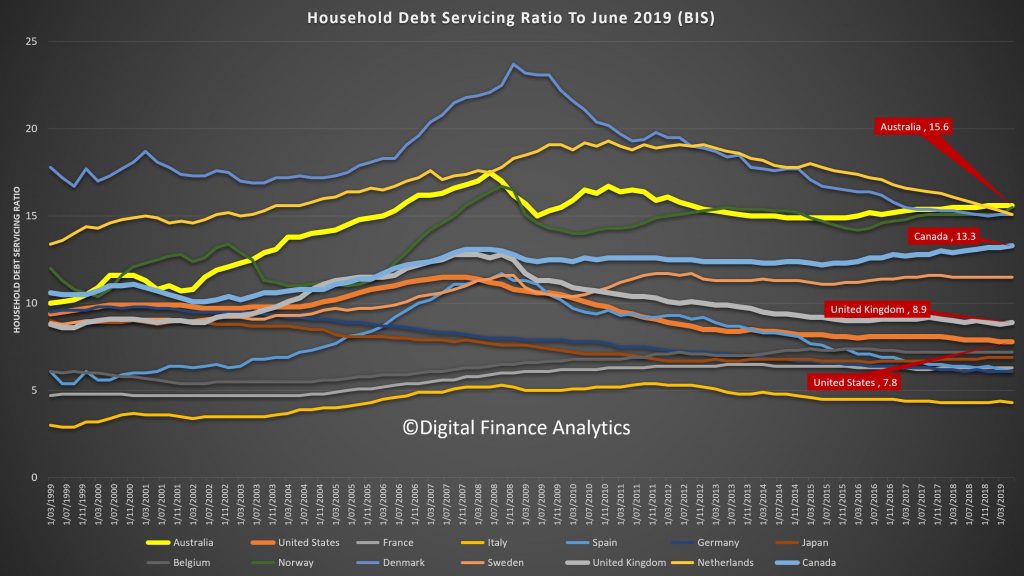

The BIS have released their latest comparative stats for household debt to GDP and household debt servicing ratios. And congratulations Australia, we headed the list with the highest debt servicing ratios in their series, and the second highest debt to GDP. Both alarming.

Looking at the household debt to GDP ratios first, to June 2019, the average across advanced economies is 72.8. This gives a proxy for how easily households will be able to service and repay their loans, the lower the less risk there is.

The United States is a little above the average at 75, the UK, at 84, Near Zealand stands at 94.6, similar to Canada, while Australia comes in at 119.3 and Switzerland leads the pack at 130.9.

On the debt servicing ratios, we have taken first spot, at 15.6, with Canada at 13.3, the UK 8.9 and the US 7.8. The DSR is the average of income required to service a loan. So, the lower the better. Note this is across ALL households whether they borrow or not, so it takes account of the amount being repaid and the proportion borrowing. Note also the the Australian data has risen from 2014, despite rate cuts.

Conclusion, Australians is over leveraged, and mainly into property.

Some Hard Facts About The Australian Economy

The ABS published a scorecard on the Australian economy and we discuss the results.

Superannuation, The Good, The Bad And The Ugly

We look at a global study of superannuation (pensions) and see where Australia stands, and also discuss the elephant in the room – poor returns in a low rate environment.

https://www.monash.edu/business/monash-centre-for-financial-studies

Mortgage Games People Play

We examine the question of whether extending the duration of mortgage makes financial sense (and for who?).

The Insurance Renewal Trap

Research shows there is no reward for loyalty, it pays to shop around.

Belling The Inequality Cat! [Podcast]

We review a recent “The Conversation” article on the question of rising wealth inequality in Australia – is it real – or is it not?

The Property Supply Demand Disequilibrium

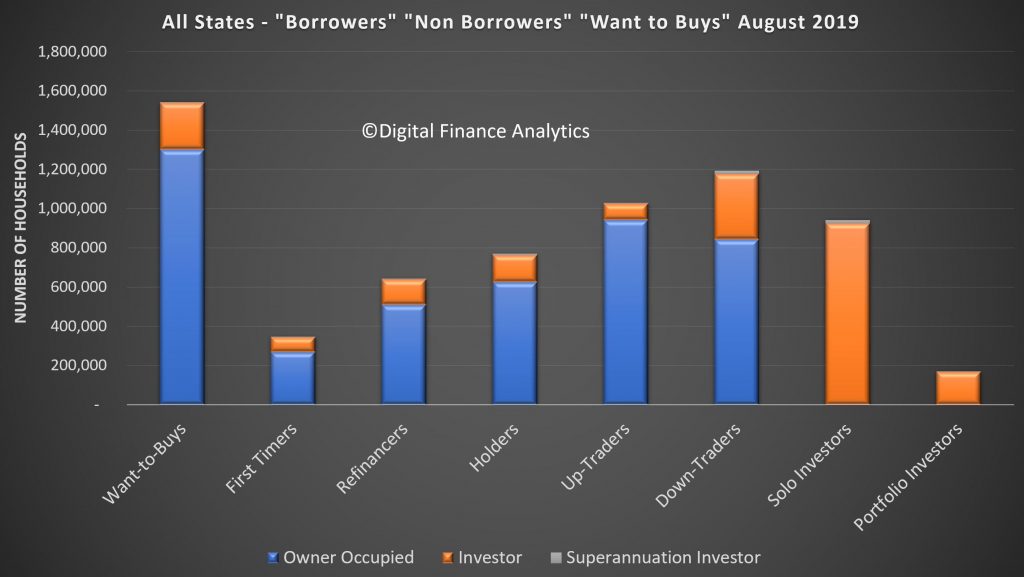

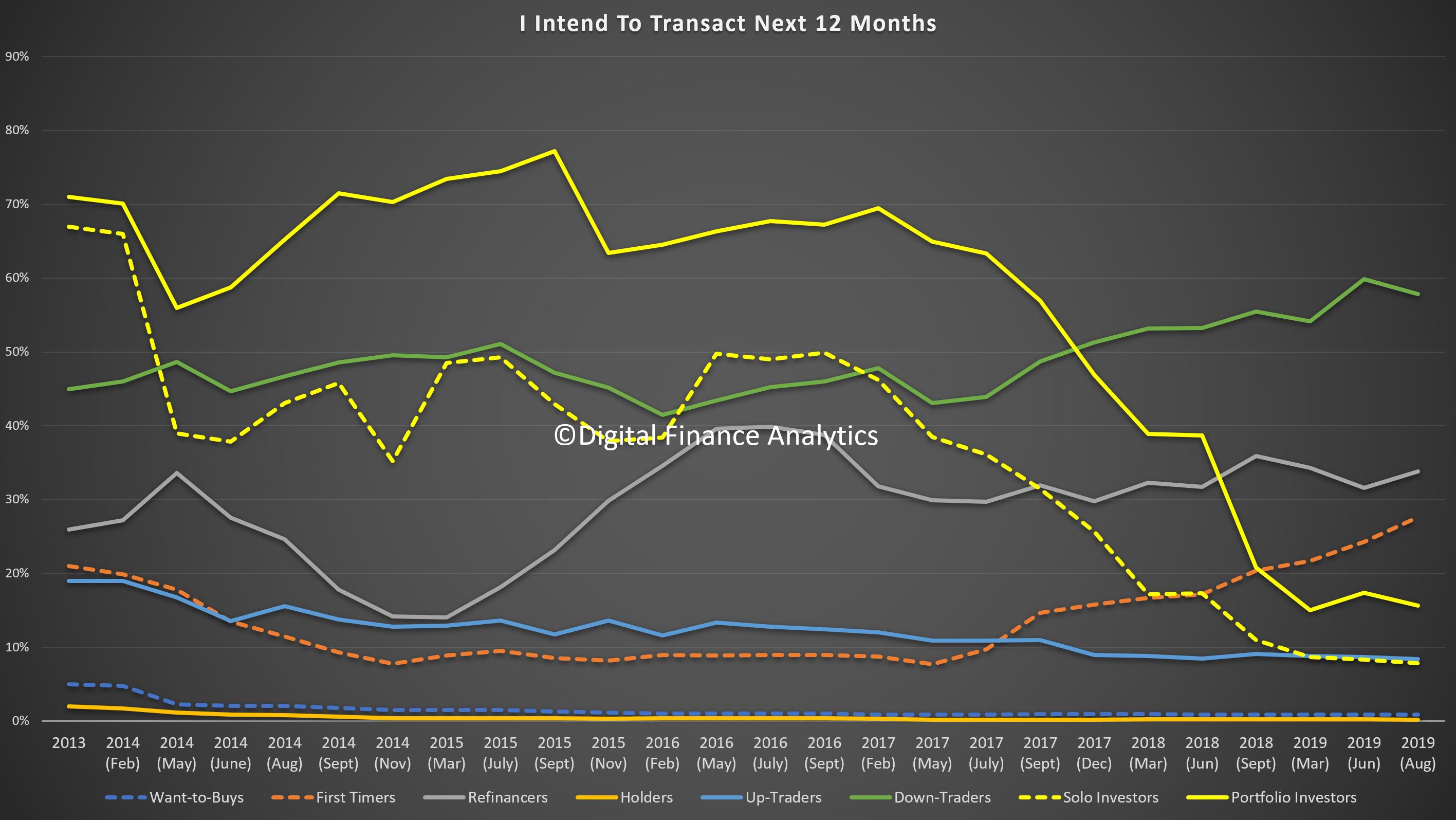

Digital Finance Analytics will be releasing the results from our rolling household surveys over the next few days. This is the first in the series.

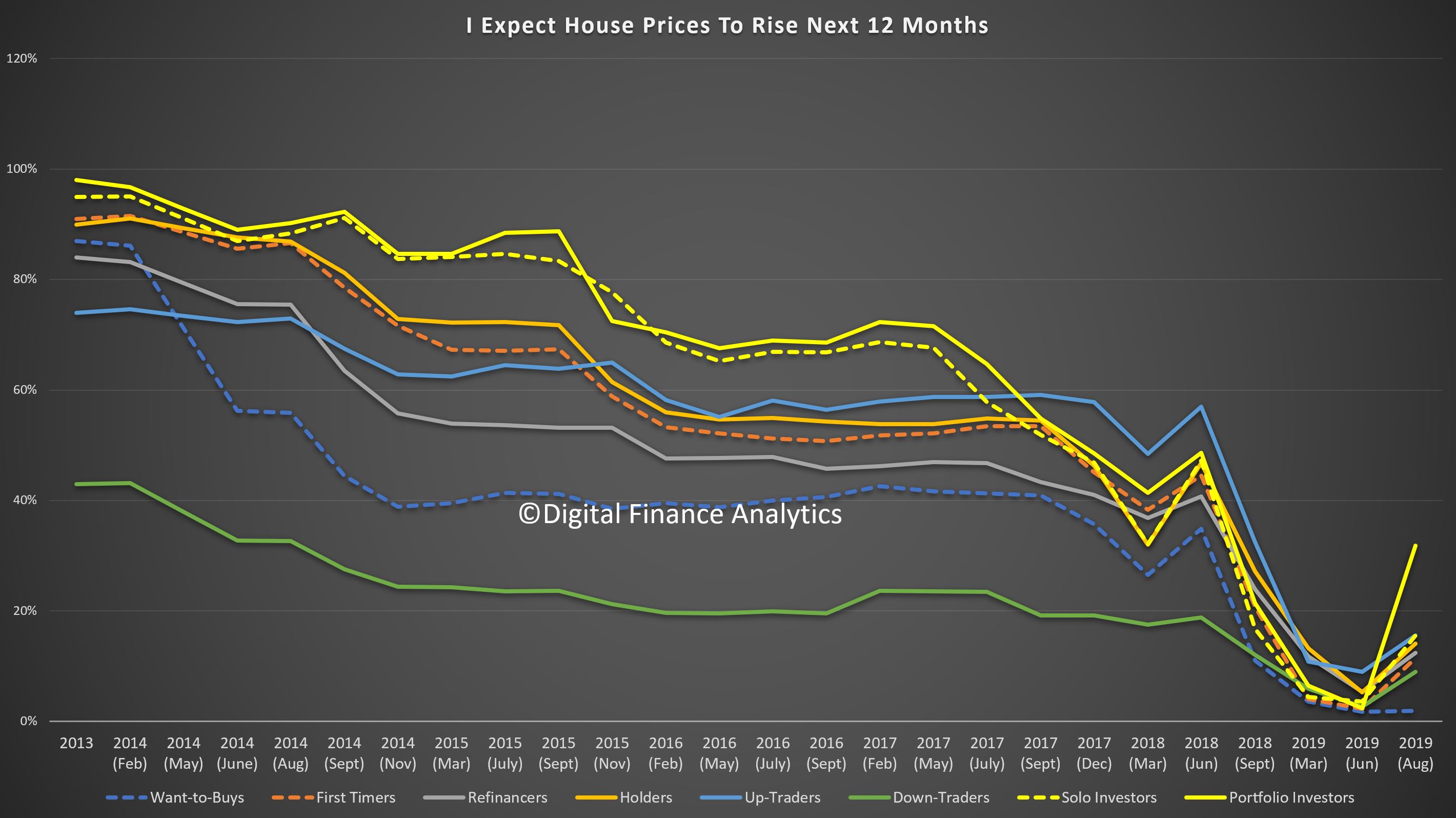

These are the results from our 52,000 households looking at property buying propensity, price expectations and a range of other factors.

We use a segmented approach to the market for this analysis, and in our surveys place households in one of a number of potential segments.

Want To Buys: households who would like to buy, but have no immediate path to to purchase. There are more than 1.5 million households currently in this group.

First Timers: first time buyers with active plans to purchase. There are around 350,000 households in this segment.

Up-Traders: households with plans to buy a larger property (and sell their current one to facilitate the up-sizing. There are around 1 million households in this group.

Down Traders: households wishing to sell and down size, sometimes buying a smaller property at the same time. There are around 1.2 million households in this group.

Some of these households will hold investment property as well. We categorise investors into one of two groups.

Solo Investors: households with one or two investment properties. There are about 940,000 of these.

Portfolio Investors: households with more than two investment properties. There are around 170,000 of these.

Finally we also identify those who are planning in refinance existing loans, but are not intending to buy or sell property – flagged as Refinancers, and those with no plans to buy, sell or refinance – flagged as Holders.

It is the interplay of all these segments which drives the property market and demand for mortgages.

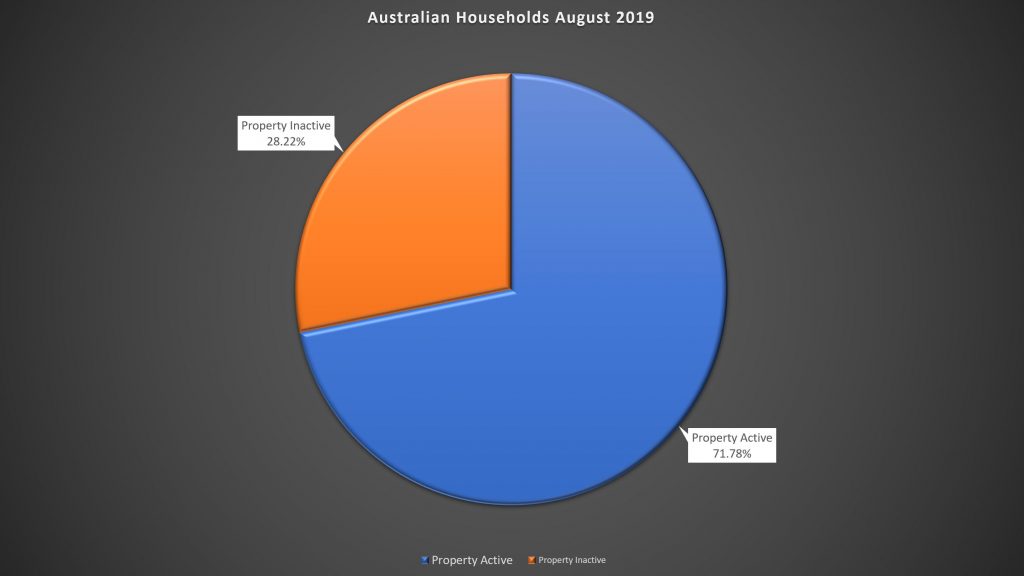

Around 72% of households are property active – meaning they want to buy, sell, or own property. More than 28% are property inactive, meaning they rent, live with parents or in other arrangements. Our surveys track all household cohorts. A greater proportion are falling into the inactive category.

Intention To Transact Is Rising (From A Low Base)

We ask about households intentions to transact in the next 12 months, and whether they will be buy-led (seeking to purchase a property first) or sell-led (seeking to sell a property first). (Click on Image To See Full Size).

Property investors are still coy (hardly surprising given the fall in capital values, the switch to P&I loans and receding rentals. But Down Traders, First Time Buyers and Refinancers are showing more intent.

We will look at the drivers by segment in a later post.

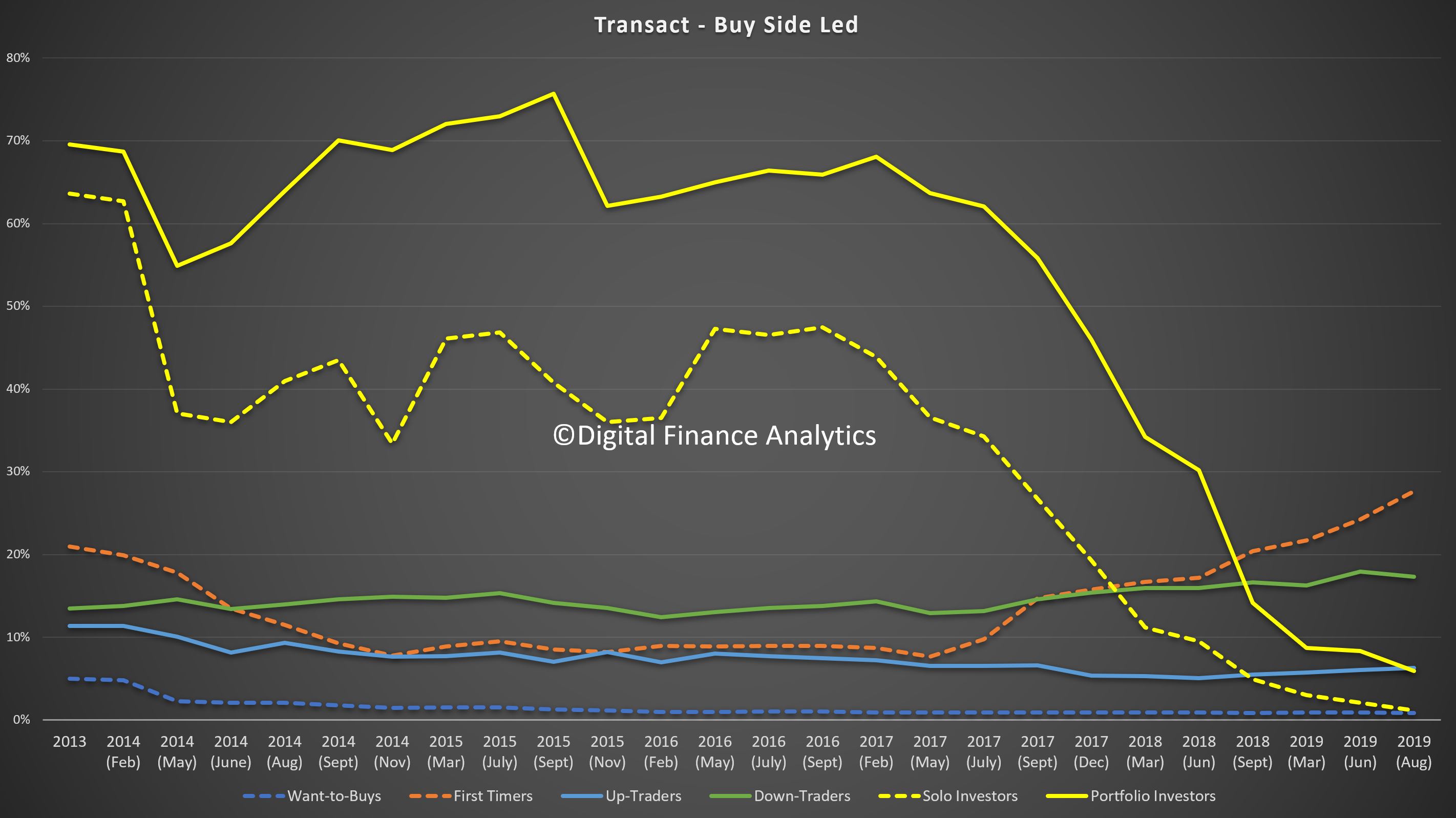

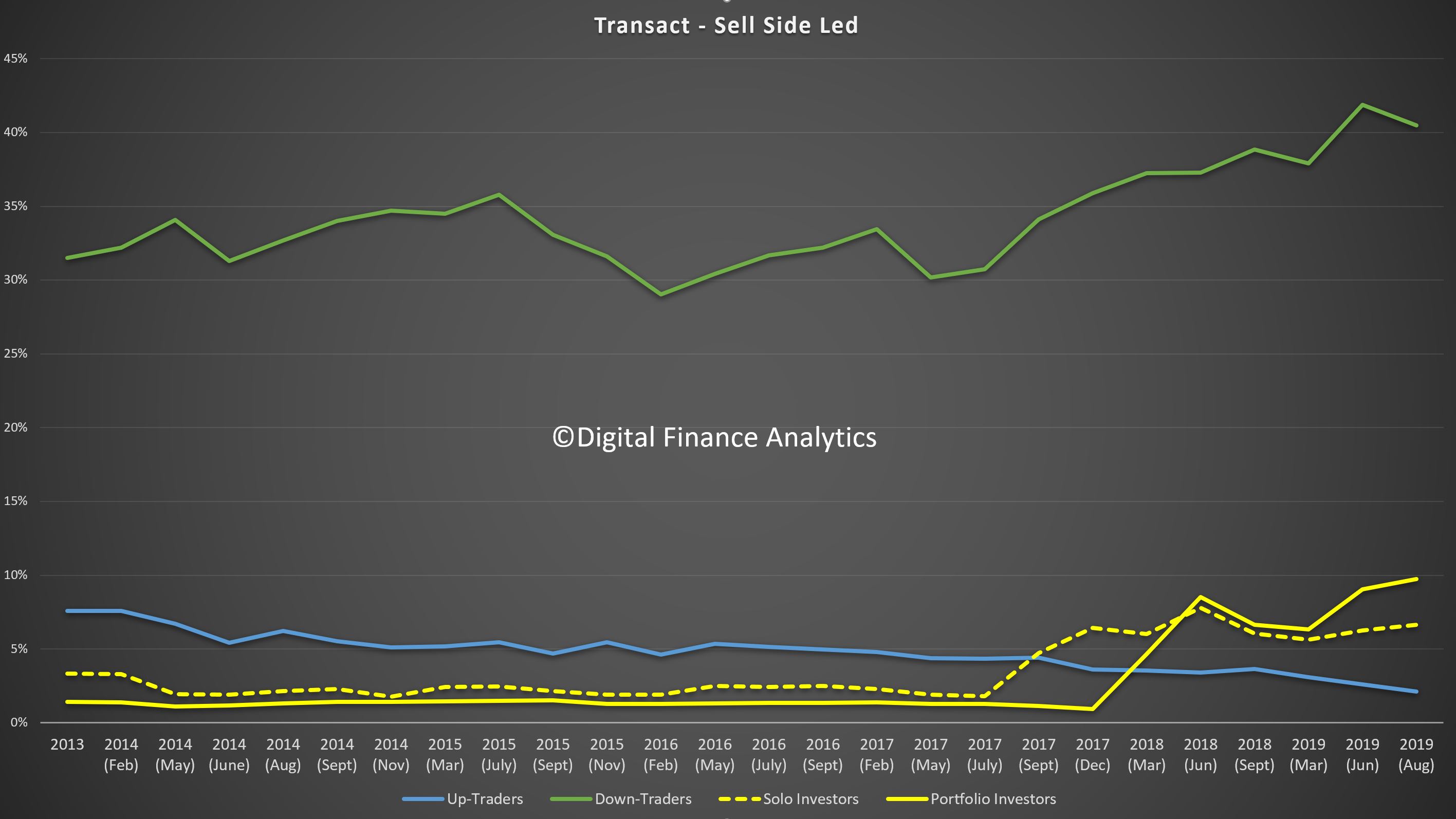

But the Buy Side and Sell Side Analysis is telling

Those seeking to buy are being led by First Time Buyers and Down Traders.

Those looking to sell are being led by the Down Traders, and Property Investors. In fact this suggests we will see a spike in listings as we move into spring.

Our equilibrium model suggests that currently supply is not meeting demand (adjusted for property types and locations) in a number of prime Sydney and Melbourne locations, within 30 minutes of the CBD. But beyond that demand is below current supply, and more is coming.

On this basis, we expect to see some local price uplifts, but not a return to the rises a couple of years back. What is clear, is that the property investment sector continues to slumber, and Down Traders are getting more desperate to sell.

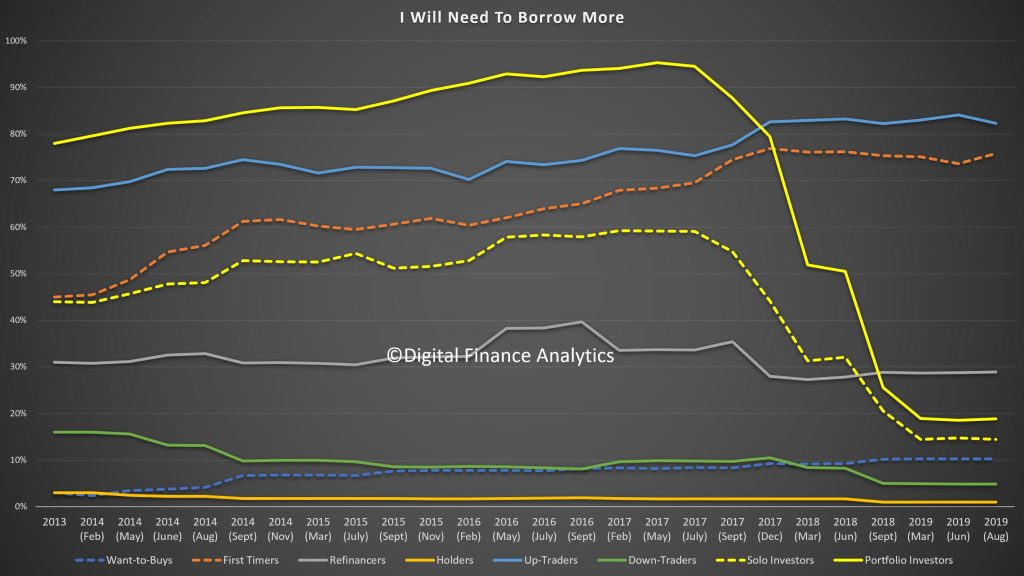

Finally, today demand for more credit is coming from Up-Traders, First Time Buyers and Refinancers. Not Investors.

And price expectations seem to be on the improve, driven by investors. But it is still lower than a couple of years ago.

Next time we will dive into the segment specific drivers.

The Housing Debt Trap Is Sprung On Older Australians [Podcast]

We review the latest AHURI report. Its not pretty.

The Latest Mortgage Stress And Rate Cut Data [Podcast]

We review the latest data from our rolling household surveys for July 2019.