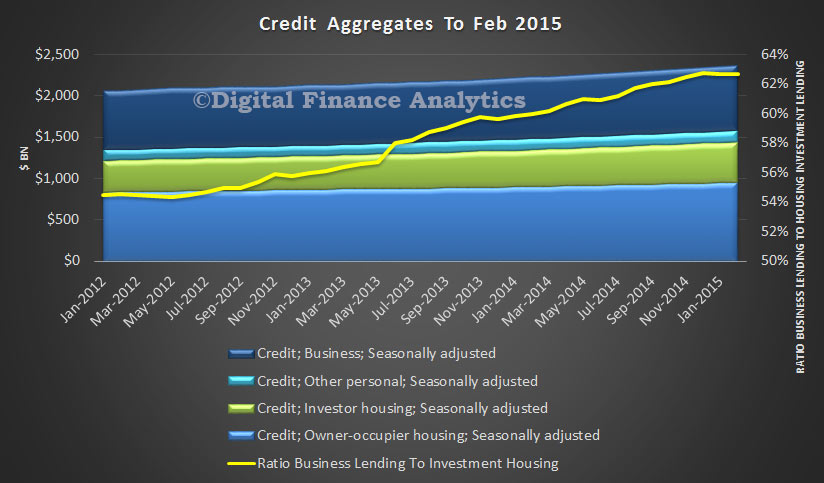

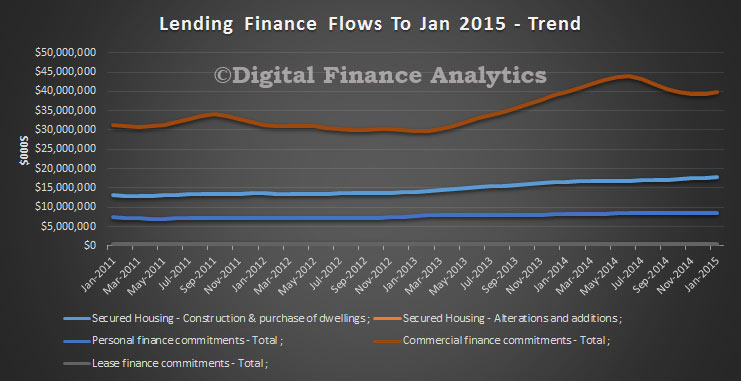

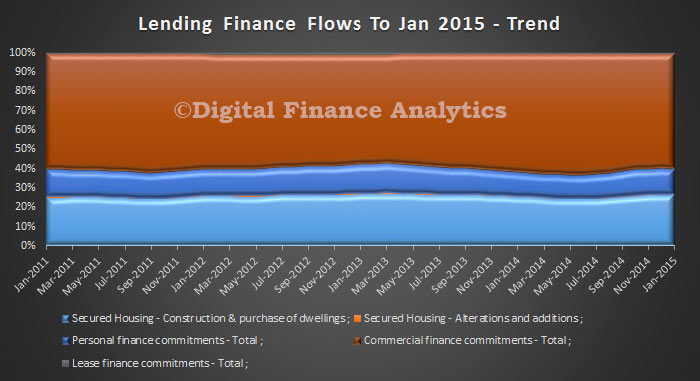

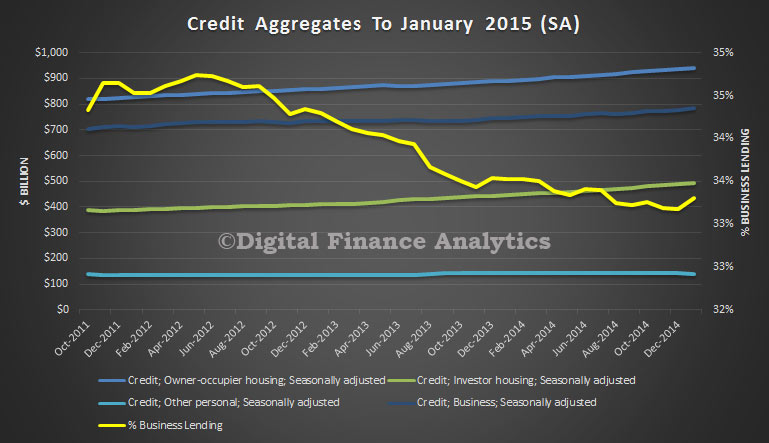

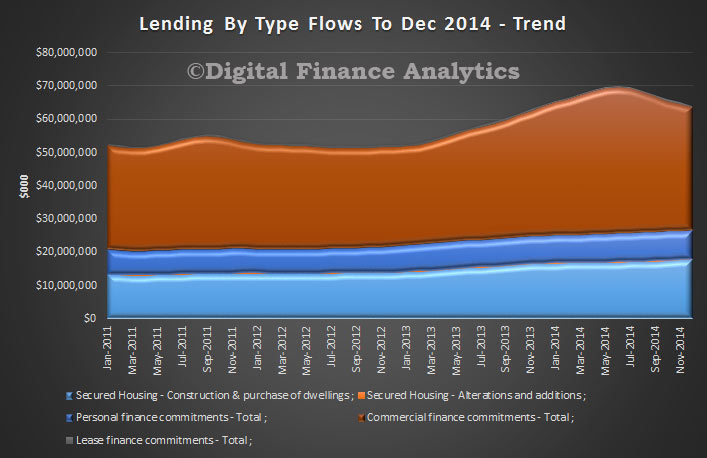

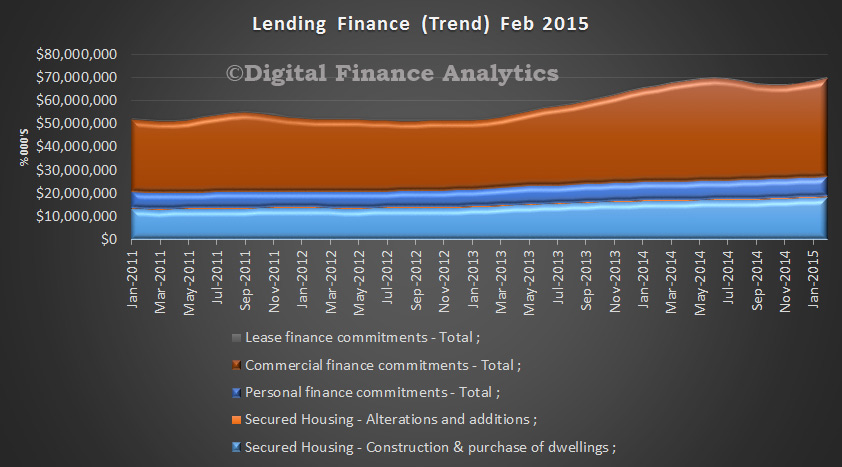

The ABS data today provides an insight into the various categories of Finance to February 2015. The total value of owner occupied housing commitments excluding alterations and additions rose 1.0% in trend terms, whilst the value of total personal finance commitments fell 0.1%. The value of total personal finance commitments fell 0.2%. The trend series for the value of total commercial finance commitments rose 2.9%. Revolving credit commitments rose 4.8% and fixed lending commitments rose 2.1%. So, we see a rise in commercial lending (which of course includes investment property lending.) The rate of momentum in housing lending on the other hand appears to be slowing somewhat.

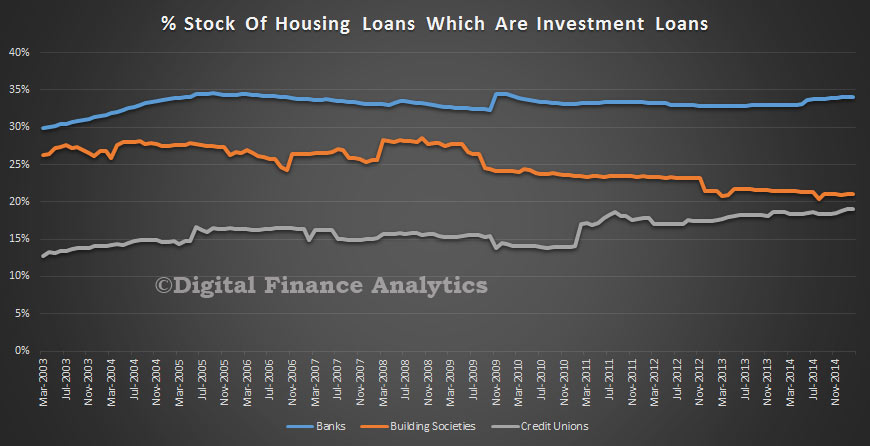

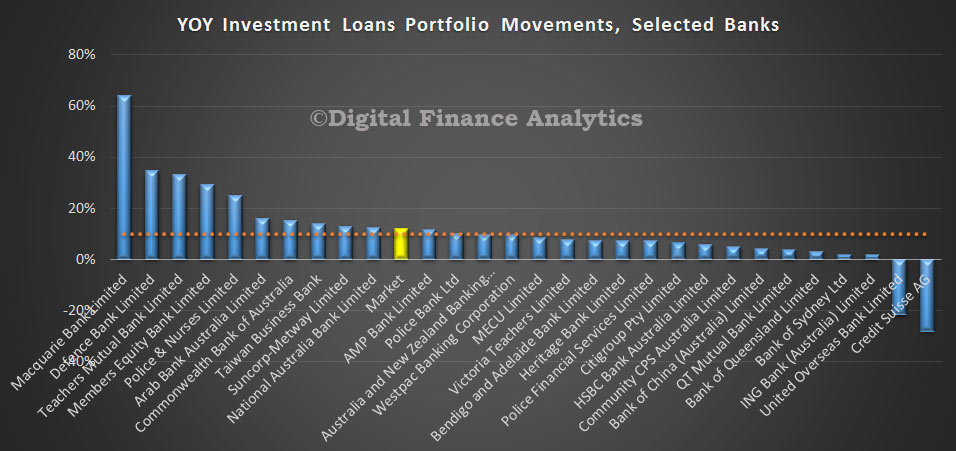

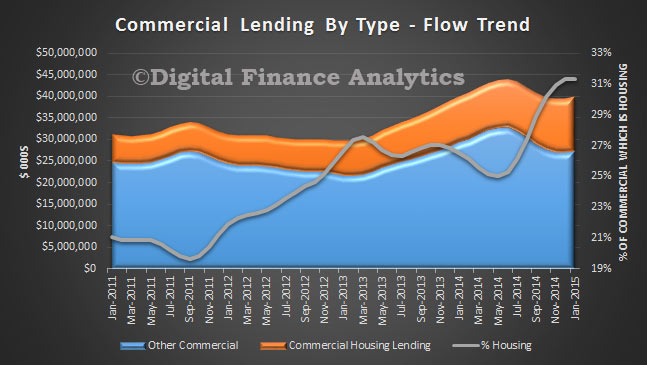

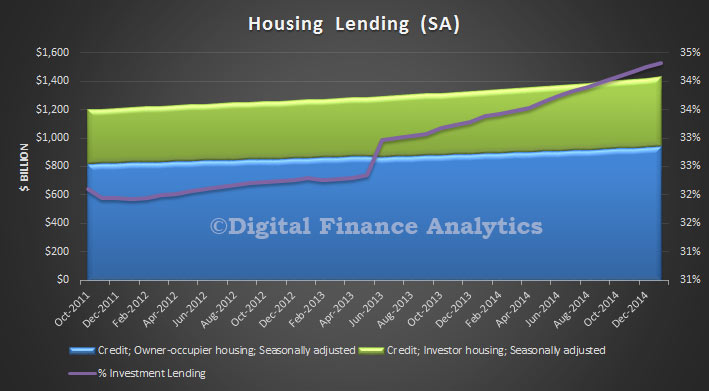

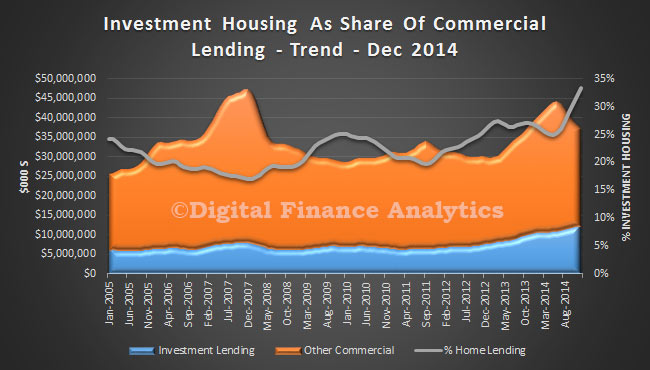

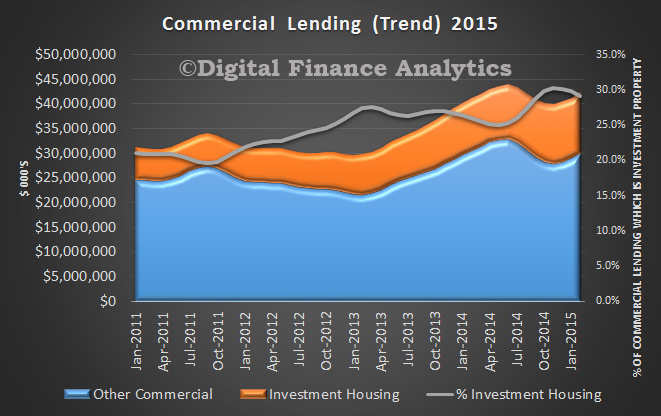

Looking at the relative share of investment property lending, we see it has turned down from a peak of 30.3% of all commercial lending to just of 29%, but still high compared with 2011. Banks are still preferring to lend for housing, though we are seeing a rise in commercial lending which is not property aligned – this is to be welcomed, and we need to see more, as productive lending to business will translated into real economic growth, whilst lending for property purchase inflates house prices, bank balance sheets, and household net wealth in book value terms.

Looking at the relative share of investment property lending, we see it has turned down from a peak of 30.3% of all commercial lending to just of 29%, but still high compared with 2011. Banks are still preferring to lend for housing, though we are seeing a rise in commercial lending which is not property aligned – this is to be welcomed, and we need to see more, as productive lending to business will translated into real economic growth, whilst lending for property purchase inflates house prices, bank balance sheets, and household net wealth in book value terms.

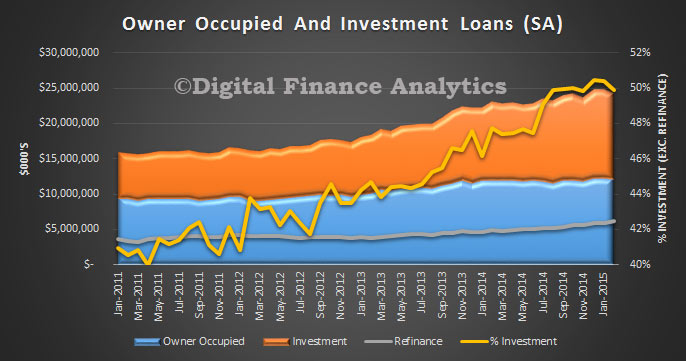

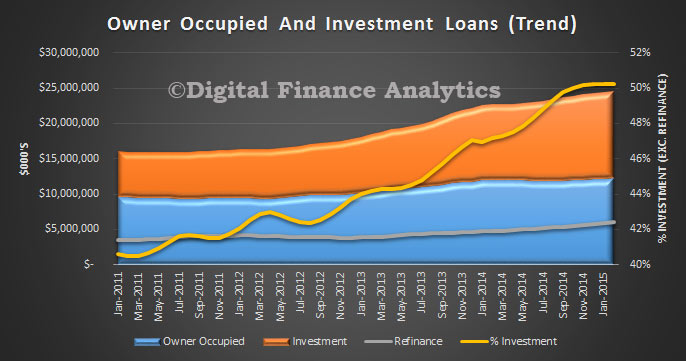

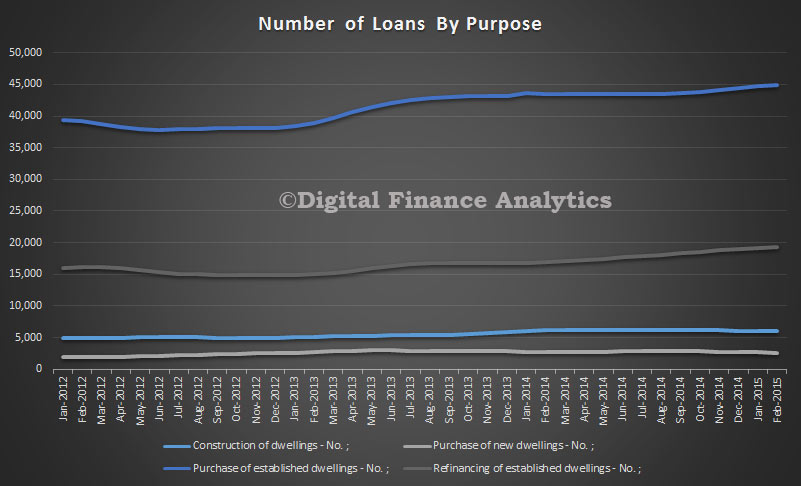

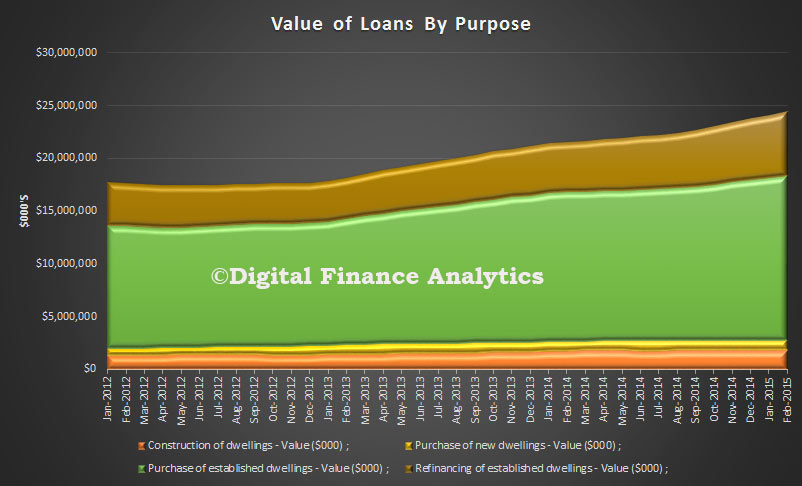

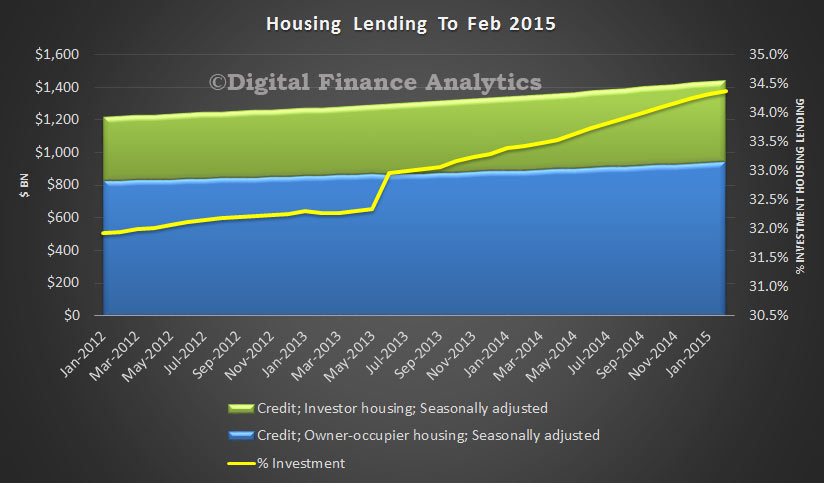

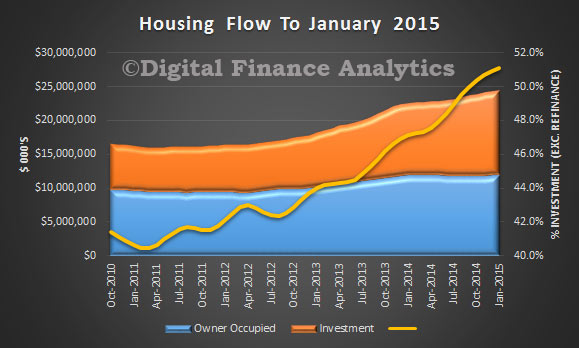

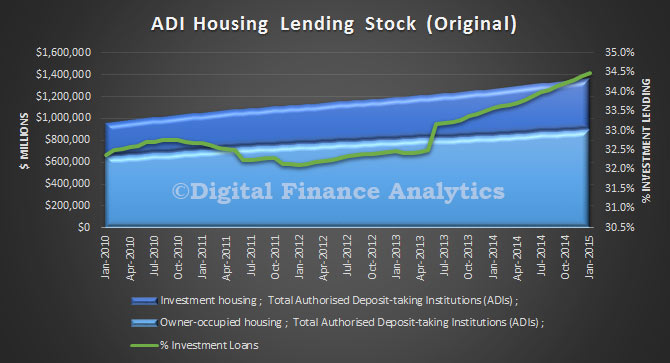

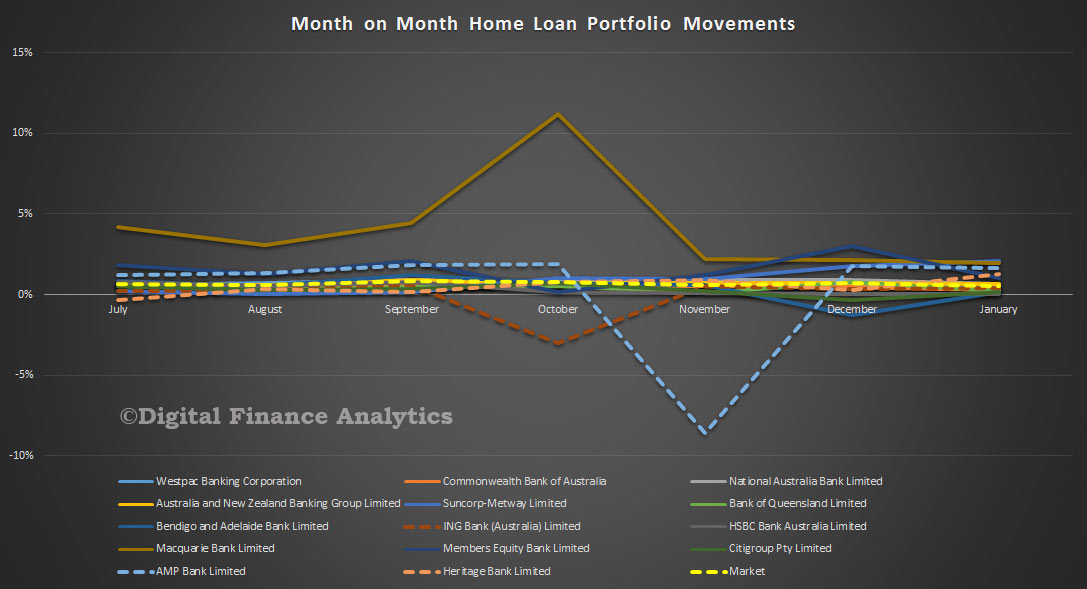

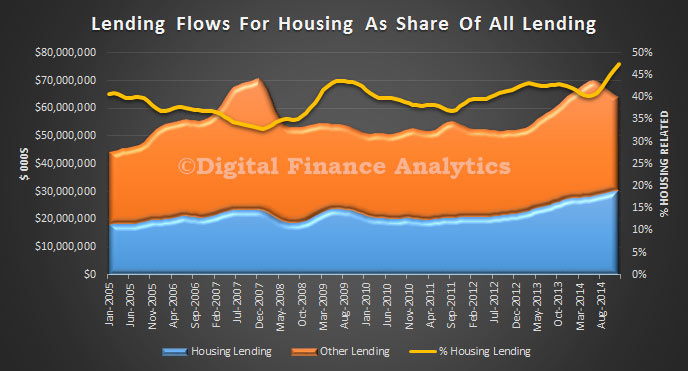

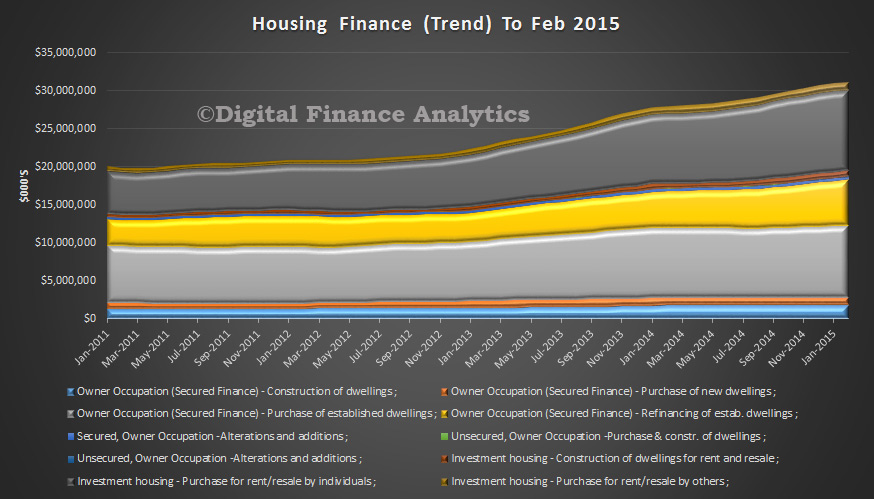

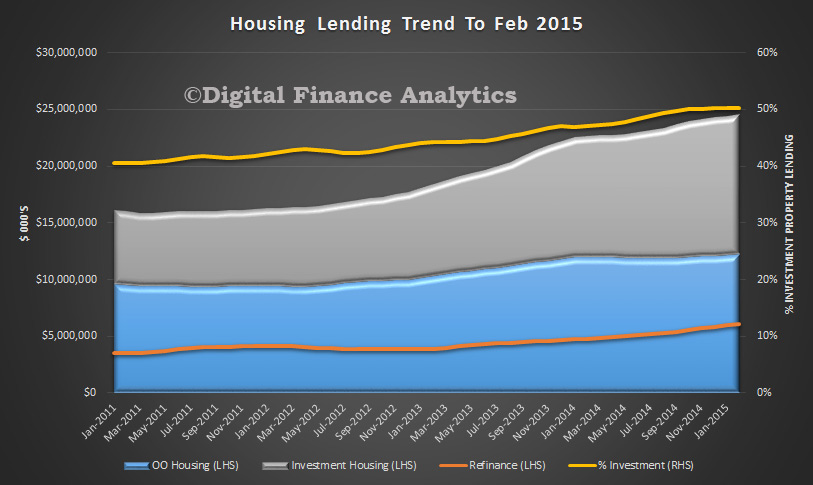

Turning to housing lending, values still rising and a total of $31 billion was lent for property across all categories in the month. This is a record.

Turning to housing lending, values still rising and a total of $31 billion was lent for property across all categories in the month. This is a record.

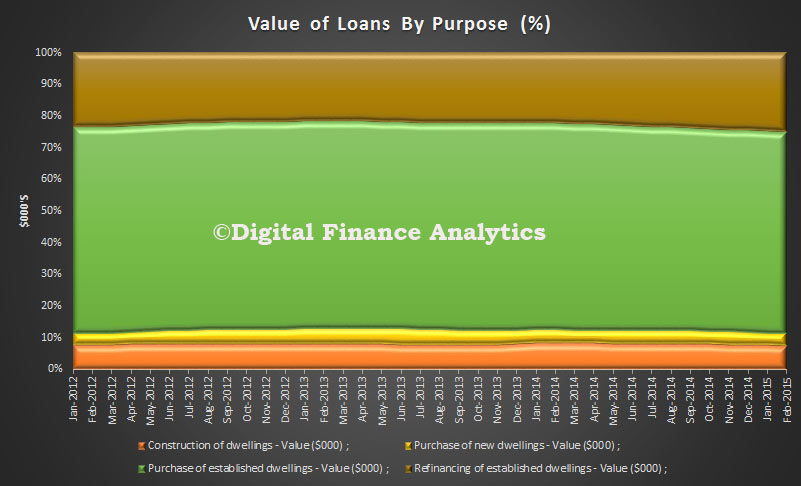

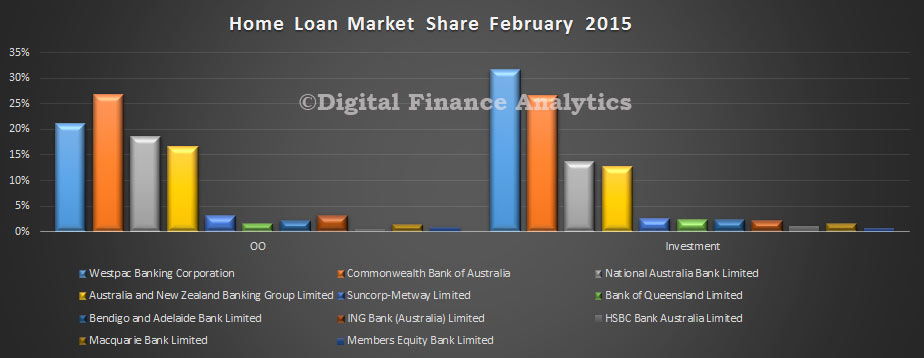

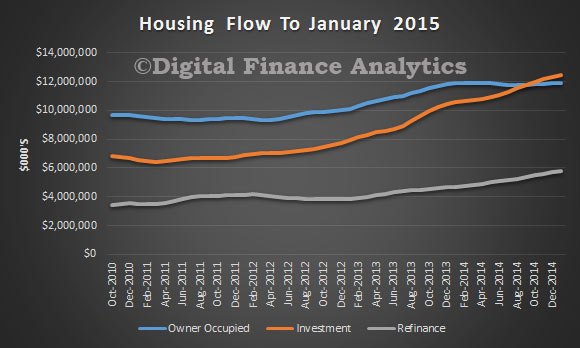

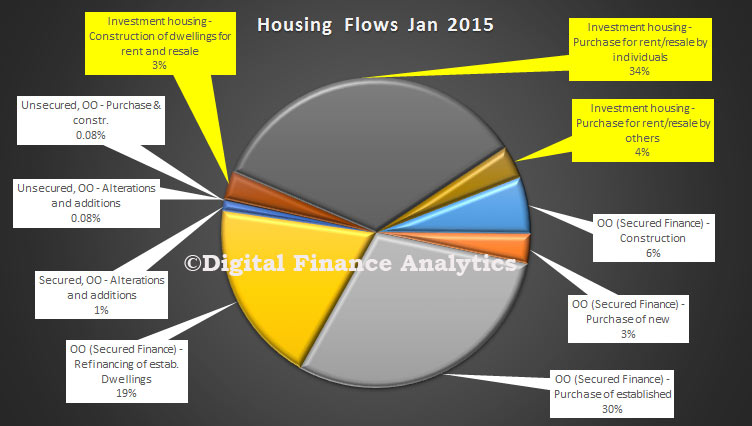

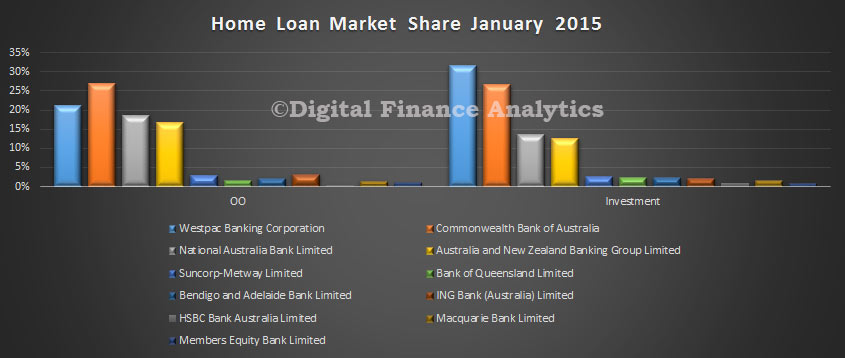

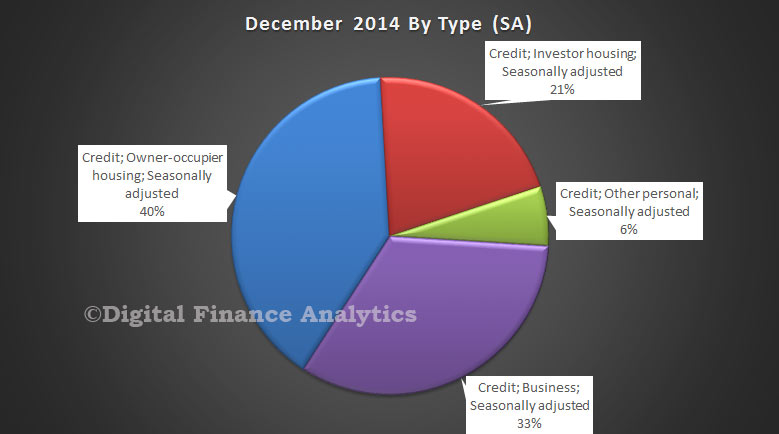

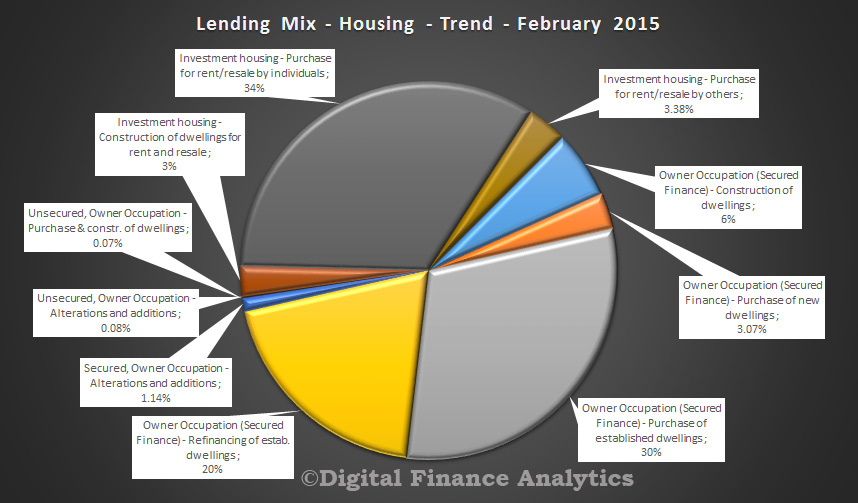

Looking at the mix, 38% was for investment housing, 30% for owner occupation, and 20% for refinance.

Looking at the mix, 38% was for investment housing, 30% for owner occupation, and 20% for refinance.

We see that just of 50% of secured loans (excluding refinance) were for investment purposes. Refinance was high, in response to the RBA rate cut in February.

We see that just of 50% of secured loans (excluding refinance) were for investment purposes. Refinance was high, in response to the RBA rate cut in February.

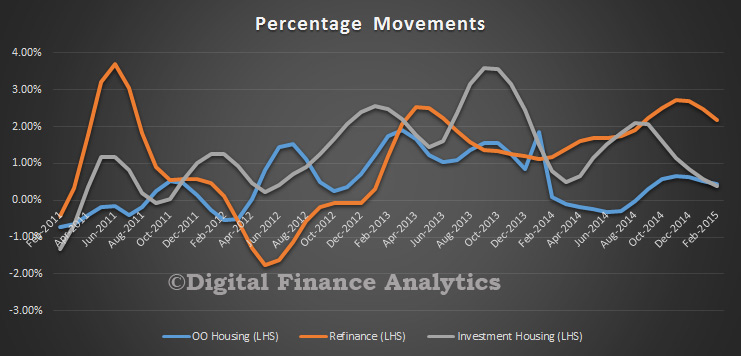

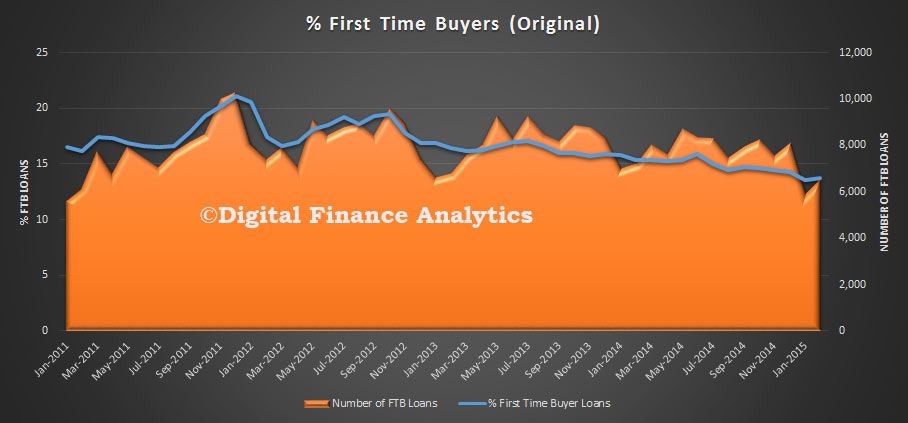

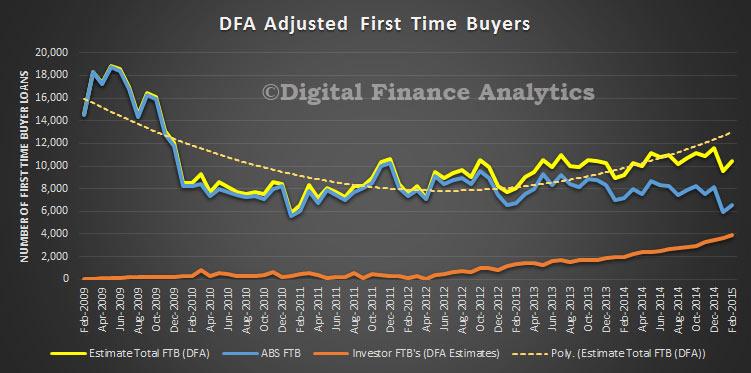

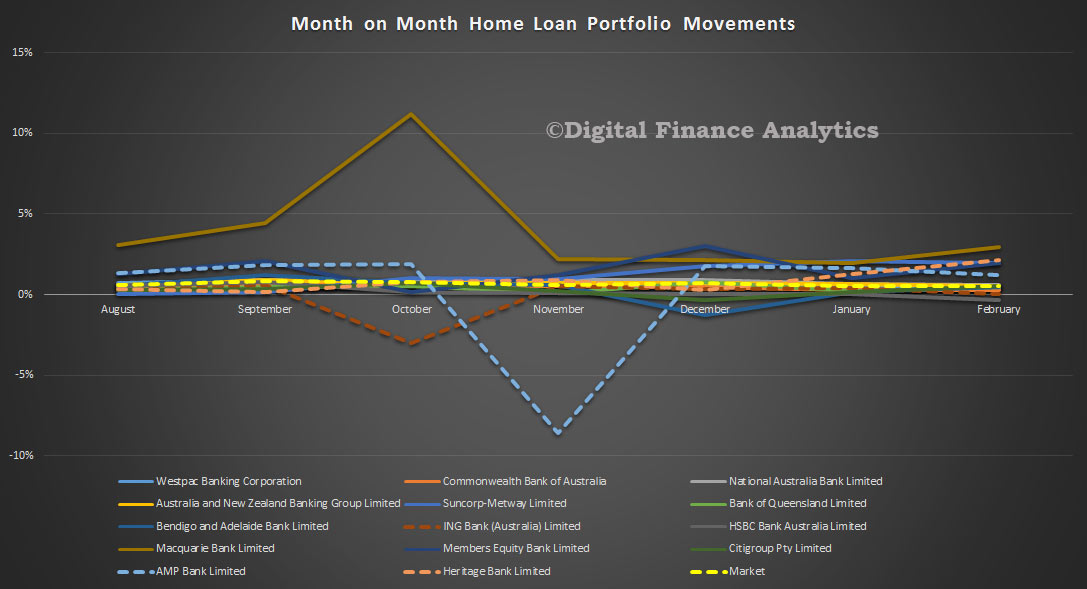

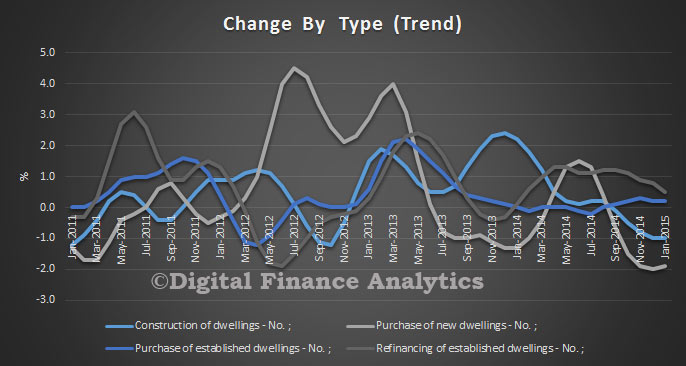

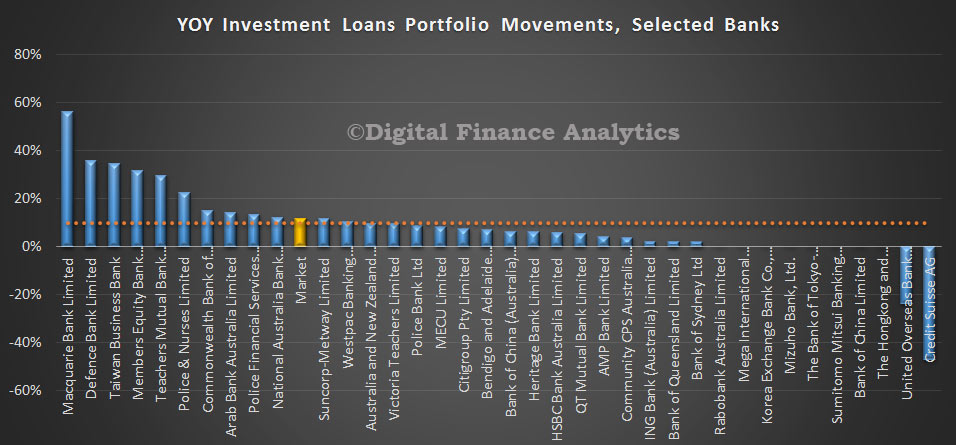

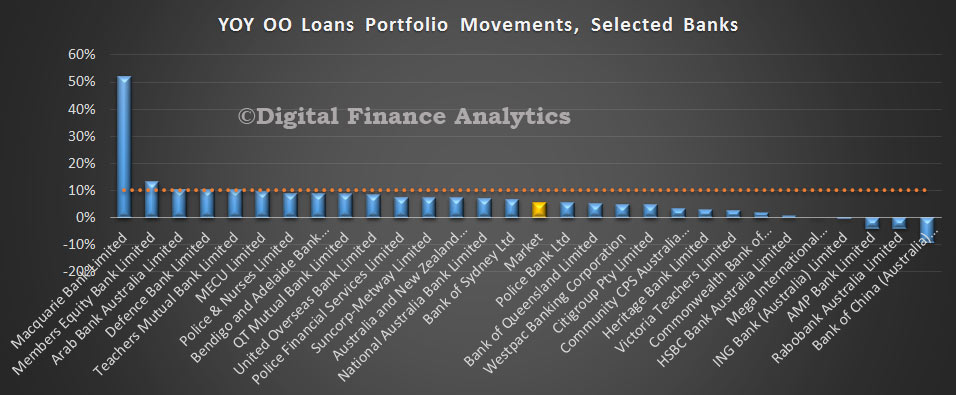

Looking at the percentage movements, month on month, we see the rate of growth slowing across the board, with investment lending slowing the most. This could well indicate a potential turning point in the months ahead, despite strong demand for investment property in the system.

Looking at the percentage movements, month on month, we see the rate of growth slowing across the board, with investment lending slowing the most. This could well indicate a potential turning point in the months ahead, despite strong demand for investment property in the system.