The percentage of Australian residential mortgages which are more than 30 days in arrears has risen to its highest level in three years, according to Moody’s Investor Service. These results were of 31 May this year and are likely to climb further.

“The increase in the 30+ delinquency rate across Australia raises the risk of mortgage defaults and is therefore credit negative for Australian residential mortgage-backed securities or RMBS,” said Alena Chen, vice-president and senior analyst at Moody’s.

Underemployment and the slowing pace of home price growth will constrain mortgage performance for the remaining months of the year, the agency said.

The report, titled RMBS – Australia: Mortgage Delinquency Map: Arrears Will Continue to Rise from Three-Year High is authored by Chen.

It notes that mortgage performance decreased in all eight states and territories in the 12 months prior to 31 May 2016 reaching 1.50% from 1.34% the year before.

Levels in Western Australia, Tasmania and the Northern Territory reached their highest levels since Moody began taking records in 2005. In South Australia, the most recent delinquency rate was just 0.1% below the state’s record high.

The worst performing state was Western Australia with the 30+ delinquency rate rising 0.69% to 2.33% in the year prior to 31 May 2016. This trend began in 2014 and follows the end of the mining boom. Poor housing market conditions have also contributed, Moody’s said.

Nationwide, the postcodes with the highest number of mortgage arrears were those exposed to the resource and mining sectors. Sydney had the lowest delinquency rates due to stronger housing market conditions.

Across all states, capital cities registered lower percentages of arrears than more regional areas.

However, Moody’s warned that the increasing supply of new-build apartments in Sydney and Melbourne will exert pressure on home prices and raise the risk of further mortgage delinquencies and losses.

However “while mortgage delinquencies will continue to rise, the deterioration in performance should be moderate,” the agency said.

Tag: Moody’s

M&A Is In Very Late Cycle Mode Says Moody’s

Mergers, acquisitions and divestitures tend to accelerate when profits are nearing a cyclical peak says Moody’s.

Once it becomes apparent that organic revenues will fall short of expanding rapidly enough to supply sufficient earnings growth, companies often either look to the outside to acquire growth or attempt to divest underperforming businesses.

The previous two record highs for yearlong M&A activity involving at least one US-based company as either buyer or target occurred in the third quarter of 2007 and 2000’s first quarter. The cycle peaks for the yearlong averages of pretax profits from current production were set prior to the tops for M&A, in Q4-2006 and Q4-1997, respectively.

Between the peaks for profits and M&A, yearlong M&A posted scintillating average annualized growth rates of (i) 32.5% from Q4-2006 to Q3-2007 and (ii) 37.2% from Q4-1997 to Q1-2000. Similarly, M&A advanced by 15.9% annually, to a record $3.325 trillion, between profits’ latest peak of Q1-2015 to Q1-2016’s new zenith for M&A.

Latest Ratio of M&A to Profits Hints of Final Stage for Current Upturn

Since 1988, the ratio of M&A to pretax operating profits has averaged 90%. Nevertheless, the ratio of M&A to profits changes considerably throughout the business cycle. For example, the ratio of M&A to profits increased from its 73% average of the first four years of 2002-2007’s business cycle upturn to 121% during the recovery’s final two years. Moreover, after averaging 58% of profits during the first seven years of 1991-2000 economic recovery, M&A soared to 197% of profits during the upturn’s final three years.

The current recovery has followed the same pattern. Through the first five years of the current recovery through June 2014, M&A averaged 74% of pretax profits from current production. However, for the following two years ended June 2016, M&A averaged 144% of profits. As inferred from the recent historical trend, the 154% ratio of M&A to profits for the year-ended June 2016 suggests that the current business upturn is much closer to its demise than to its inception.

Rebound by Equities Contradicts What Occurred Following M&A’s Prior Two Record Highs

The continuation of subpar profitability offers no assurance of new record highs for M&A, especially if some combination of higher share prices amid above-average earnings uncertainty increases the risk of overpaying for business assets. At some difficult to define inflection point, persistently soft profits begin to weigh on M&A.

The previous two record highs for M&A suggest that M&A is likely to recede amid below-trend profits once the market value of US common stock crests. Immediately after M&A’s yearlong sum peaked in Q3-2007, the market value of US common equity set a new record high in October 2007. Similarly, March 2000’s then record high for the market value of US common stock occurred at the very end of an earlier record high for the yearlong sum of M&A.

Though the moving yearlong sum of M&A is likely to continue to fall from its latest zenith of Q1-2016, the market value of US common stock’s moving 20-day average has rebounded by 16% from its most recent low of February 15, 2016. Nevertheless, M&A has been unable to respond positively to higher share prices owing to how both business sales and profits have yet to convincingly establish rising trends. The fact that Q3-2016’s moving yearlong sum of M&A was down by -12% from its Q1-2016 peak hints of a growing sense among prospective buyers that business assets are grossly overvalued. The longer M&A slides amid a rising trend for share prices, the greater the likelihood that an equity market bubble has formed.

ING’s Updated Strategic Plan Is Credit Positive

Moody’s says On 3 October, ING Groep N.V. announced that it will accelerate plans to digitalize its retail business, and, in addition to previously announced cost cutting, will cut another €900 million by 2021 as part of its updated “Think Forward” strategic plan. The updated plan will help the bank preserve profitability, a credit positive.

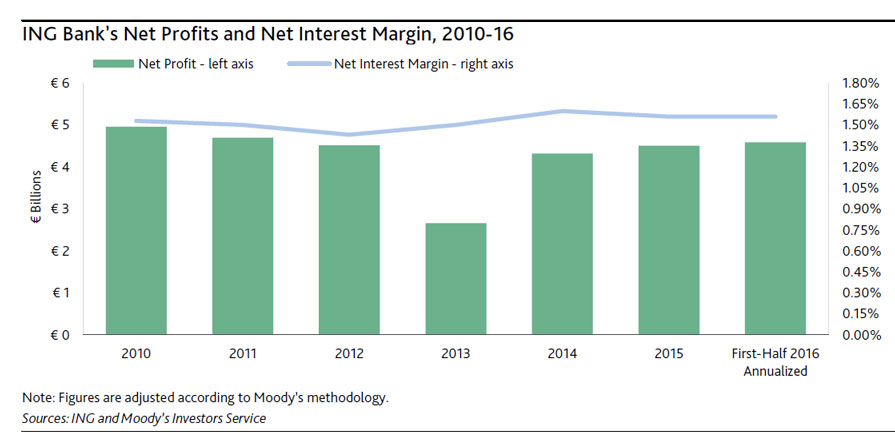

Although ambitious, we believe the updated plan can be implemented as scheduled, which will help ING preserve its profitability and reach its 50%-52% cost/income target ratio by 2021 (versus 56.2% as of June 2016), a good performance relative to the European Union bank average of 63%. ING is accelerating its transformation plan amid persistent low interest rates that negatively pressure its net interest margin and what it estimates is a 52% increase in regulatory costs in 2016.

The new measures aim to reduce ING’s cost base, focus on direct banking and gain primary relationships with customers. ING expects to meet these targets by merging Record Bank (unrated) within ING Belgium and building a single bank platform for the Dutch and Belgian entities; accelerating the retail bank’s digitalization; closing about 600 of 1,245 branches in Belgium; building a uniform range of products for retail customers in other markets including Spain, Italy, France, Czech Republic and Austria; and optimizing support functions globally. Through these measures, ING plans to reduce staff by 7,000 by 2021 (including 3,500, or 34%, of its workforce in Belgium and 2,300, or 18%, in the Netherlands). ING expects IT expenses of about €800 million between now and 2021, but forecasts the upgrades delivering €900 million of gross annual cost savings during the same period. The restructuring costs will be covered by a €1.1 billion provision, €1 billion of which will be booked in the fourth quarter of this year.

Since announcing its Think Forward plan in 2014, ING has improved its group common equity Tier 1 capital ratio to 13.1% as of June 2016, from 10% in 2013, and the bank has increased its return on equity to 10.8%, which is within its 10%-13% target range. ING also resumed dividends to shareholders in 2015.

Although ING’s profitability and net interest margin have increased since 2013, they have started reaching a plateau especially in the Netherlands and Belgium, and its cost-to-income ratio (including regulatory costs) increased above its 50%-53% target. Belgian deposit rates have fallen to the legal minimum, leaving the bank with no headroom to further re-price its liabilities there. ING’s new set of measures seek to adapt the bank’s business model to margin pressure arising from a prolonged low rate environment and increased customer expectations in digital banking.

‘Rising risks’ for banks in commercial property

Higher vacancy rates for office properties combined with growing settlement risks for newly-built residential apartments add up to a credit negative for Australia’s major banks, says Moody’s Investors Service via InvestorDaily.

A new report by Moody’s Investors Service has concluded that the risks from commercial real estate are rising for the big four banks, but they remain “manageable”.

After a hiatus in the years following the global financial crisis, Australia’s major banks have been steadily growing their exposures by 5 per cent or more each year from December 2013 onwards.

There are two major risks in the commercial property sector, according to Moody’s.

First, there are higher vacancy rates in office properties in Brisbane and Perth due to an increase in supply (and weak demand).

Second, there is growing settlement risk from a potential oversupply of newly-built residential apartments in Sydney, Melbourne and Brisbane.

The second risk factor could negatively affect property development companies as well as the broader market, said Moody’s – “especially in the context of tighter lending restrictions imposed by the major banks recently”.

However, Australia’s major banks should be able to manage the risk because they have limited their exposure to the high-risk commercial property segments, said Moody’s.

The major banks’ commercial real estate loans as a percentage of total committed exposures is “moderate” at around 6-8 per cent, said Moody’s.

Australia’s big banks also tightened their lending criteria to the commercial real estate sector following material losses in the aftermath of the GFC, said the ratings house.

“As a result, we see foreign bank branches being more at risk of current headwinds in this segment, and expect the major banks’ CRE impairment levels to remain at moderate levels,” said Moody’s.

A stress test of the major banks’ commercial real estate exposures indicates only a “mild deterioration” in Common Equity Tier 1 ratios under a “severe stress” scenario, said Moody’s.

Canadian Banks To Hold More Mortgage Loan Risk

Moody’s says Canada’s Department of Finance announced that it will launch a consultation process with market participants this fall on lender risk sharing, a policy that would require mortgage lenders to absorb a portion of loan losses on insured mortgages that default. Currently, banks are able to transfer virtually all of the risk of insured mortgages to mortgage insurers, and indirectly to taxpayers through a government guarantee.

Any changes to the provisions of mortgage insurance to impose risk sharing on mortgage lenders would be credit negative for Canada’s six large banks, which account for approximately 72% of mortgage lending in the country, because it would reduce their asset quality and risk-adjusted profitability. The six banks are The Toronto-Dominion Bank, Bank of Montreal, Bank of Nova Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada and National Bank of Canada.

The details of the Department of Finance’s plan have yet to be released, and it may be some time before they emerge. Possible approaches include imposing first-loss deductibles on banks, whereby the lender would be responsible for an initial portion of the loss, with the insurer only bearing losses beyond that deductible amount. Another option would be to divide losses between the lender and insurer on a pro rata basis, or to charge the lender a fee for a defaulted mortgage. In any case, the concept of the lender retaining some risk on insured mortgages will support stability in the housing market in Canada by encouraging prudent underwriting standards.

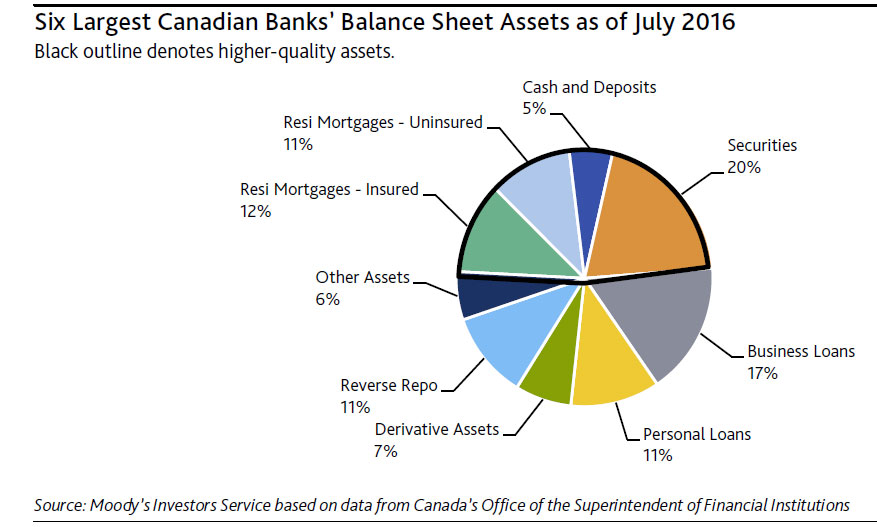

Canadian banks’ high asset quality is largely the result of their significant holdings of government-insured residential mortgages, uninsured mortgages, securities, cash and deposits with financial institutions, which comprise about half the aggregate system’s balance sheet. Canadian mortgage portfolios and home equity lines of credit have performed well historically, owing to the high use (approximately 50%) of government backed mortgage insurance, and conservative underwriting practices. Government-supported insured mortgages make up 12% of total assets. This insurance is primarily sold either directly to the borrower, who is legally required under Canada’s Bank Act to obtain insurance if the loan-to-value of the mortgage exceeds 80%, or is held by the lenders themselves on a portfolio basis as a liquidity and capital management tool.

Canadian banks currently make a solid margin on insured mortgages for which they bear no risk and have no regulatory capital requirements. Under any risk-sharing arrangement, depending on the degree of loss shared and any offsetting concession on insurance premiums paid, profitability on a significant asset class will change. On balance, we expect that risk-adjusted profitability will decline, although a detailed analysis at this point is not possible.

European banks are a global risk factor – Moody’s

According to Moody’s, throughout this year, European banks, and Deutsche Bank in particular, have helped trigger global financial market sell-offs.

The troubled plight of these institutions was encapsulated by the admission of Credit Suisse CEO Tidjane Thiam that European banks are “not really investable as a sector.” The declining prospects of traditional business lines, high capital requirements, nonperforming loans, and regulatory offenses have battered share values. Bank equity prices in the Eurozone Stoxx index now trail last year’s high by 48%.

Yet euro-denominated bonds from the banking sector carrying the modest yield of 1.15% in the Bloomberg Barclays index seem to point to sturdy balance sheets. However, easy ECB monetary policy and the protections offered to senior bank debt may obscure the risks facing this sector.

Warning signs can been seen in equity prices that value banks as less than the book value of their assets, and in European contingent convertible hybrids that are junior to other bank bonds holding a substantial risk premium with the composite yield of 7.04%. As this sector persists in contributing to global financial market uncertainty, the potential remains for negative spillovers to risk assets worldwide.

Canadian LMI’s Will Need More Capital

According to Moody’s, Canada’s national banking and insurance regulator, the Office of the Superintendent of Financial Institutions (OSFI), published for comment draft guidelines on changes to capital requirements for mortgage creditor insurers.

The draft advisory provides a new standard approach for residential mortgage insurance that is more risk sensitive and incorporates new key risk and loss drivers including creditworthiness, remaining amortization, and outstanding loan balances.

These new capital requirements, if implemented as drafted, would increase overall capital for Canada’s mortgage insurance industry and Canadian Crown corporation, Canada Mortgage and Housing Corporation, a credit positive.

The draft guidelines require a supplemental capital requirement for mortgages insured in Canada’s 11 largest metropolitan areas when those cities show indications of high house prices relative to income levels, similar to bank capital requirements introduced earlier this year. This supplemental charge will create a capital cushion for mortgage insurers’ exposures in cities whose housing markets have had rapid price appreciation, such as Vancouver, British Columbia, and Toronto, Ontario. We believe required capital for mortgages in

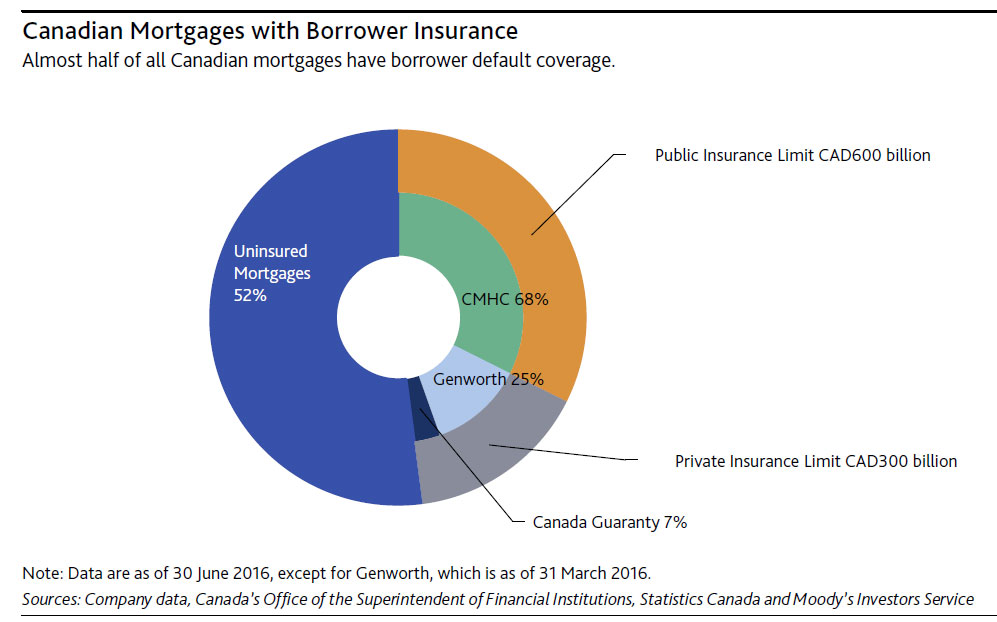

these cities will increase.Of the CAD1.6 trillion in outstanding Canadian mortgage debt, including home equity lines of the credit, almost half are covered by creditor insurance (see exhibit). This insurance is primarily sold either directly to the borrower, who is legally required under the Bank Act to obtain it if the mortgage’s loan-to-value ratio exceeds 80%, or lenders purchase the insurance on a portfolio basis as a liquidity and capital management tool.

The Canadian government limits its mortgage insurance guarantee to CAD900 billion, which is shared among only three entities. CMHC, which as a crown corporation with government agency status, effectively makes any policies it writes a direct contract with Canadian government. Under legislation, CMHC’s insurance-in-force is limited to CAD600 billion. The Canadian government also provides a 90% guarantee on the insurance in force of two private-sector insurers, Genworth and Canadian Guaranty Insurance Company of Canada, in the event that one of them fails. This CAD300 billion guarantee is shared between the two insurers.

These and other recent actions by Canadian policymakers will assist in slowing rapid house price appreciation and corresponding mortgage growth, reducing the prospect of a sharp housing price correction that would increase credit losses at Canadian banks. Increasingly, elevated housing prices have driven up Canadian household indebtedness, a key threat to the stability of the Canadian banking system. Since 2008, Canadian policymakers have implemented a series of changes to the rules for government-backed insurance, including limitations on amortization, premium increases and elimination of specialized product offerings.

We do not believe this has any credit implications for Canadian banks that hold insured mortgages because their exposures to mortgage insurers are already backstopped by the Canadian government.

Another Revenue Challenge

According to Moody’s the new Focus on US Banks’ Sales Practices Is Another Revenue Challenge.

Last Tuesday, Thomas Curry, head of the US Office of the Comptroller of the Currency (OCC), indicated during testimony before the US Senate Banking, Housing and Urban Affairs Committee that his agency will conduct a horizontal review of sales practices at the nation’s largest banks. Later, Consumer Financial Protection Bureau (CFPB) Director Richard Cordray added that his agency would be “doing a joint action” with the OCC.

We believe regulators will conduct a particularly thorough review of the industry’s sales practices in response to the media and political spotlights on Wells Fargo & Company’s (A2 stable) recently disclosed wrongdoings, the unauthorized opening of up to 2.1 million deposit or credit card accounts. For the banks, the additional regulatory focus is credit negative because it will increase scrutiny on deposit fees, which are a meaningful contributor to their revenue.

Deficient sales practices have only been highlighted at Wells Fargo and nowhere else. Nonetheless, in underscoring the need for a broader review, Mr. Curry highlighted the importance of incremental product sales and fees, noting that protracted low interest rates put the industry, not just Wells Fargo, “under enormous margin pressure.”

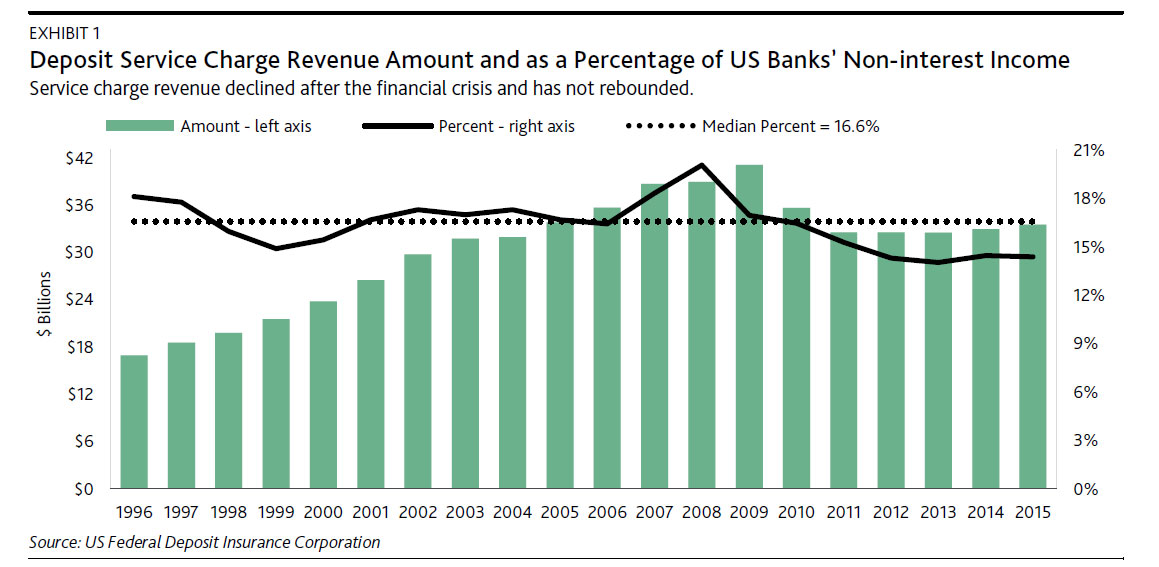

As shown in Exhibit 1, Federal Deposit Insurance Corporation (FDIC) data show that service charges on deposit accounts are significant for the industry, totaling nearly $34 billion in 2015, or 14% of total noninterest revenue. Large as this number is, it has fallen in absolute terms and as a percentage of non-interest income since the 2008-09 financial crisis, primarily because of heightened regulation. The additional exams announced last week will only reinforce existing scrutiny over specific revenue sources, such as overdraft fees.

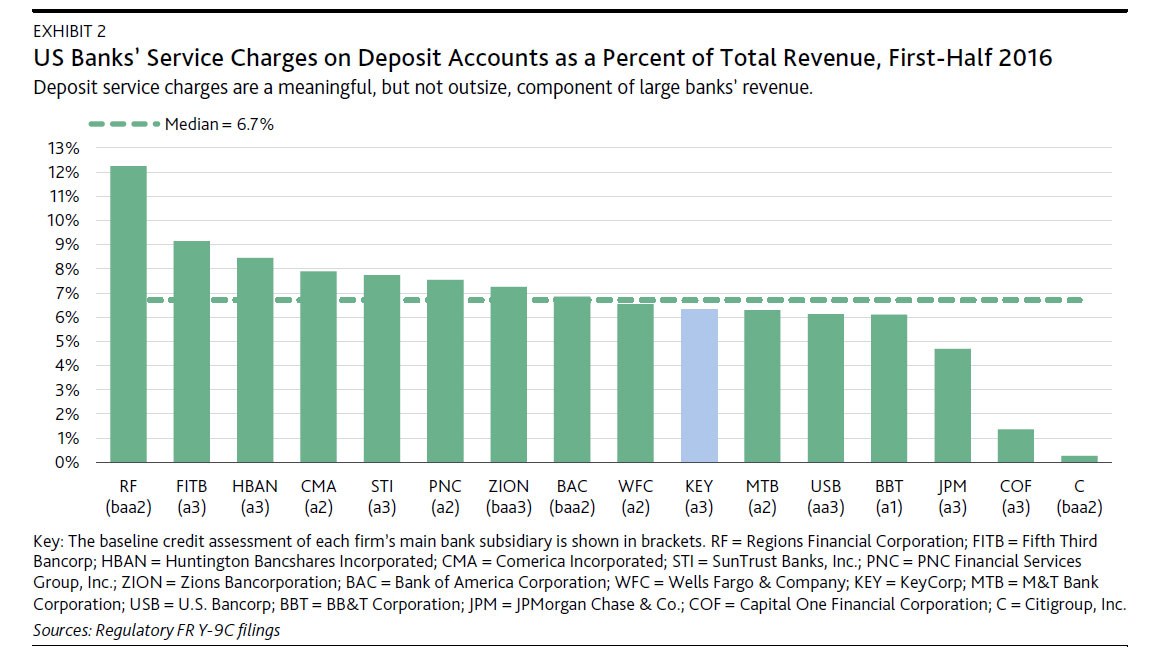

The misconduct at Wells Fargo has put all large banks in the regulators’ crosshairs. Exhibit 2 shows that for most large banks, deposit service charges are a meaningful contributor to overall revenue; that is, the combination of net-interest income and non-interest income. Specifically, for the first six months of 2016, 16 large banks reported a median contribution to total revenue of 6.7% from service charges on domestic deposit accounts, with one bank in the group, Regions Financial Corporation (Baa3 review for upgrade), earning 12% of its total revenue from this source.

Although some senators at last week’s hearing highlighted their worry that inappropriate sales practices could be widespread, that determination has not yet been made. Regardless, we believe the revelations at Wells Fargo will cause banks to tread cautiously before rolling out more aggressive sales initiatives in the current environment. That alone will constrain their revenue growth

Deutsche Bank Looks to Settle US Mortgage Legal Exposure at a Reasonable Cost – Moody’s

According to Moody’s on 15 September, Deutsche Bank AG announced in a filing that it has commenced negotiations with the US Department of Justice (DoJ) aiming to settle civil claims in connection with the bank’s underwriting and issuance of residential mortgage-backed securities (RMBS) and related securitization activities between 2005 and 2007. Eliminating the claims’ litigation tail risk at a manageable cost would be credit positive for Deutsche Bank, but negotiations have just begun and the final cost of settlements of complex capital markets litigation remains very difficult to predict.

At the end of the second quarter of 2016, Deutsche Bank had €5.5 billion of litigation reserves, for a variety of legal matters, but the bank has not disclosed the size of reserves for any specific action. For the analysis below, we have assumed that at least half of the litigation reserve could be made available for a possible DOJ settlement. If Deutsche Bank can eliminate this tail risk and settle within or near the assumed reserve of €2.75 billion (or $3.1 billion), it would be positive for bondholders.

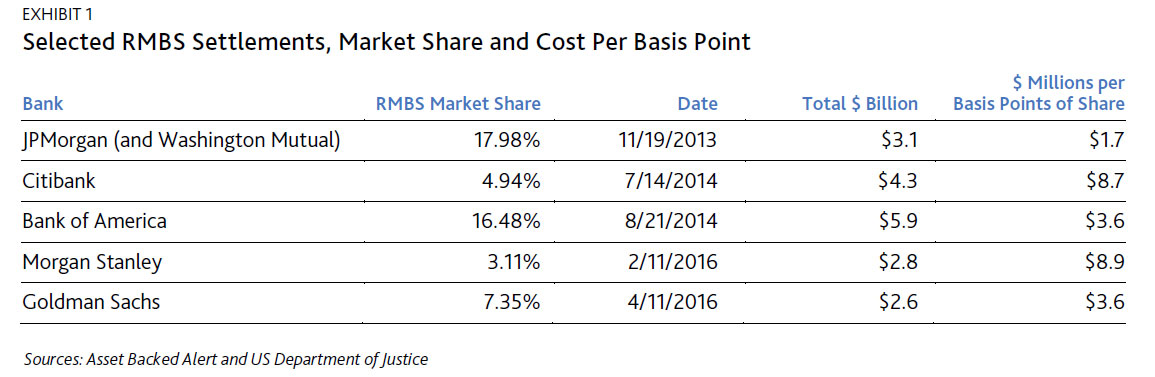

Deutsche Bank has indicated its willingness to consider settlements at a cost broadly in line with peers’ prior settlements. However, as Exhibit 1 indicates, peers’ settlements have varied widely, ranging from $1.7 million to $8.9 million per basis point of RMBS league table share. Based on Deutsche Bank’s 6.4% market share, a settlement in the low end ($1.7 million per basis point) or even at the mid-point ($3.6 million per basis point) of the settlement range would be well covered by our assumed DOJ settlement reserve. However, a DB settlement at the high end of announced peer settlements ($8.9 million per basis point) would total $5.7 billion. A settlement of $5.7 billion would require an addition to our assumed DOJ settlement reserve of €2.4 billion, which would dent 2016 profitability (pretax earnings for first-half 2016 totaled €1 billion), a credit negative. Basing litigation exposure solely on market share is a crude approximation, but it helps dimension the adequacy of reserves and potential income statement effect.

The commencement of these negotiations is not surprising since Deutsche Bank management set a strategic objective to resolve crisis-related litigation and remove uncertainty hanging over the bank. As the complex negotiations proceed, we also expect that management have strong incentives to resist a quick settlement with the DOJ that is more expensive than the prior settlements of peers. These incentives include preserving flexibility with respect to paying coupons on its additional Tier 1 (AT1) securities. Even a settlement requiring an additional $2.4 billion of reserve should still leave Deutsche Bank with sufficient flexibility to pay its 2017 AT1 coupons. We expect this flexibility to increase given the EBA’s announced intention to bifurcate Pillar 2 capital requirements into required and guidance components, with only the required component factoring into the calculation of the Maximum Distributable Amount for AT1 coupon payments.

Finally, Deutsche bank’s current Baa2 rating and stable outlook already incorporates the possibility of a modest loss (and substantial litigation costs) in 2016 and the potential for limited profitability in 2017.

Rate Hikes Will Be the Least of Market Worries – Moody’s

Moody’s says the Fed does not set interest rates in a vacuum. Indeed, the federal funds rate is shaped by a host of drivers that are hardly limited to labor market conditions.

Despite warnings from high-ranking Fed officials that ultra-low interest rates are not forever, recent soundings of business activity, as well as the nearness of November 8’s Presidential election, weigh against a hiking of the federal funds rate prior to the FOMC’s December 14 meeting. Moreover, recent data question whether 2016 will be home to even a single rate hike.

In a September 12 speech, Fed governor Lael Brainard presented a convincing case favoring an extended stay by exceptionally low benchmark interest rates. On several occasions, Governor Brainard challenged the wisdom of a preemptive rate hike that intends to thwart inflation before it takes hold. Given “the absence of accelerating inflationary pressures” and the limited scope for lowering of fed funds in the event recession risks rise, Brainard argues for the continuation of a highly accommodative monetary policy. Basically, the macroeconomic costs of mistakenly hiking rates too early are viewed as well exceeding the potential inflationary costs of waiting too long to confront inflation. The damage done by a premature rate hike may be harder to repair than the damage resulting from above-target price inflation.

However, there is an alternative view that views ultra-low interest rates as doing more harm than good because of how cheap money (i) boosts savings in order to compensate for negligible interest income and (ii) forces investors to purchase riskier assets offering higher, though volatile, returns.

Futures now sense 2016 will end without a rate hike

As measured by the CME Group’s FedWatch tool, fed funds futures assign an implied probability of only 12% to a hiking of fed funds at the September 21 meeting of the FOMC. Thereafter, the implied likelihood barely rises to 20% for the November 2 meeting and climbs no higher than 47% for the FOMC’s deliberations of December 14. For now, the futures market does not expect a single rate hike for 2016.

The latest declines by the implied probabilities of rate hikes at the FOMC’s remaining three meetings for 2016 stemmed from lower than expected August readings for retail sales and industrial production. Despite the latest indications of subpar business sales, US equities rallied. Moreover, an accompanying drop by the VIX index hinted a narrowing of the high-yield spread that recently widened from September 8’s 18-month low of 508 bp to September 14’s 538 bp. Nevertheless, at some point, the corporate earnings outlook will overrule the now predominant influence of Fed policy. Unless business sales soon accelerate sufficiently, market participants will begin to fret over the adequacy of earnings for 2016’s final quarter and all of 2017.