Yellow Brick Road Holdings Limited has announced that it is to create a “much simpler business” by disposing of its head office wealth business functions and focusing on mortgages, which will see CEO Frank Ganis step down from his role. Via The Adviser.

In an update to the ASX, YBR revealed a new business strategy which would not include wealth advisory – but instead focus on mortgages, both through distribution and servicing, as its mortgage businesses “offer significant leverage to the market”.

Under the new structure, YBR would retain its franchise network (which currently consists of 115 branches and more than 140 accredited business writers) that has an underlying mortgage book of approximately $7.6 billion.

According to the company, the present value of the net trail commission receivable as of the end of the calendar year was around $15.7 million.

YBR will also retain Vow Financial aggregation, which reportedly has a network of 505 broker firms with more than 1,000 accredited brokers origination around $785 million in mortgage settlements per month.

The underlying mortgage book is reportedly around $39.8 billion with net trail commission receivable at $13.6 million.

The new YBR group will also retain its mortgage servicing arm, via the manufacture and servicing of mortgage originations through its existing Resi Mortgage Corporation business.

The Resi and Loan Avenue brands under this business have a current underlying mortgage book of around $1.8 billion and net trail receivable of $18.5 million, according to YBR.

The Resi sales team currently sources and services the mortgage distribution networks and mortgage funding entities and will reportedly undertake the credit function for the YBR group’s intended securitisation programme, when that comes to fruition.

This securitisation programme will be taken “in joint venture with a major US alternative asset manager” and intends to manufacture and fund mortgage products for YBR’s in-house and third-party distribution outlets.

According to YBR, the joint venture is “in the later stages of final due diligence and negotiation and documentation in this long and complex process with multiple parties”.

Speaking of the Resi business, YBR said: “This existing business allows us to more closely manage and track mortgage application and approval times and outcomes and assist in directing flow to the most appropriate funding sources and is an essential component of the mortgage value chain, particularly in the post Hayne Royal Commission period. It allows us to bring our distribution partners closer to the process of approving loans.”

Wealth business to be ‘disposed of, outsourced, or otherwise restructured’

In order to “concentrate its efforts” as a mortgage distribution, servicing and manufacturing group – and “reduce significantly the cost-to-income ratio of the business” – the YBR board has reportedly decided to commence a process to “dispose of,outsource or otherwise restructure the head office wealth business functions”.

This will therefore result in “a headcount reduction to the business overall”.

While YBR franchisees will still be able to distribute wealth products and give wealth advice to their existing and future clients, it is intended that this would be done under a separate Australian Financial Services Licence (AFSL) with one or more third parties.

“Going forward, the cost of maintaining YBR’s AFSL and associated compliance functions and liabilities would then no longer be borne by the YBR Group.

“The restructure of the wealth business is expected to significantly reduce our cost base allowing us to run a leaner and more cost-effective organisation,” the update reads.

However, YBR said that “there is no certainty that the securitisation initiative or the wealth restructure process will result in a definitive proposal or transaction, however YBR will continue to implement the operational improvements and the restructure of key operational roles.”

Given the changes, Group CEO Frank Ganis will step down from his role to take up a part-time position where he will “consult to the group on a number of initiatives, including “building [its] securitisation programme and funding partnerships, growing [its] brands, continue operational and customer service improvements, and industry advocacy”.

Executive chairman Mark Bouris will oversee the transition of the YBR Group to the “new, streamlined business structure”.

The move comes following a difficult year for the brokerage brand, with its unqualified audit-reviewed half-year report for the six months to 31 December 2018, reporting a net loss after tax (NLAT) of $34.15 million.

However, the company’s most recent financial results for the quarter ending 31 March 2019 (3Q19), recorded an operating cash surplus of $40,000, a $110,000 increase from a deficit of $70,000 in the previous quarter.

The increase was partly driven by a 5 per cent reduction in its operating cash outflows (excluding its branch and broker share of revenue), which declined from $8.4 million to $8 million.

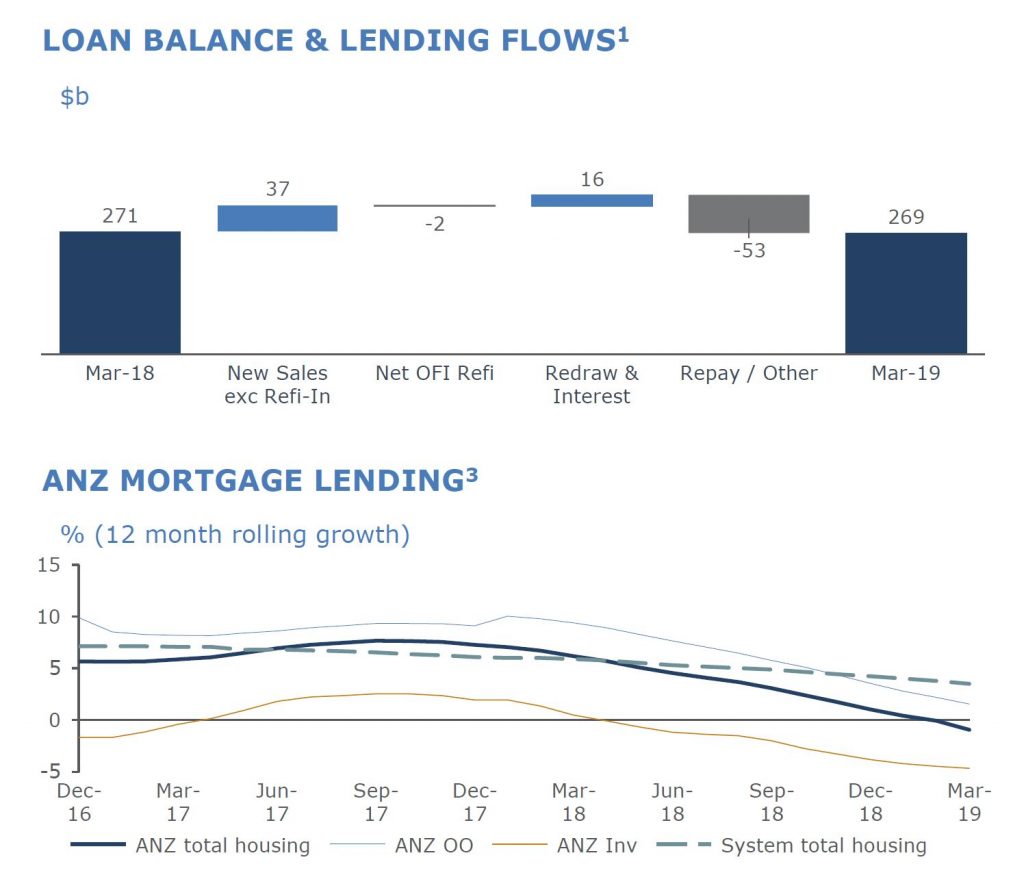

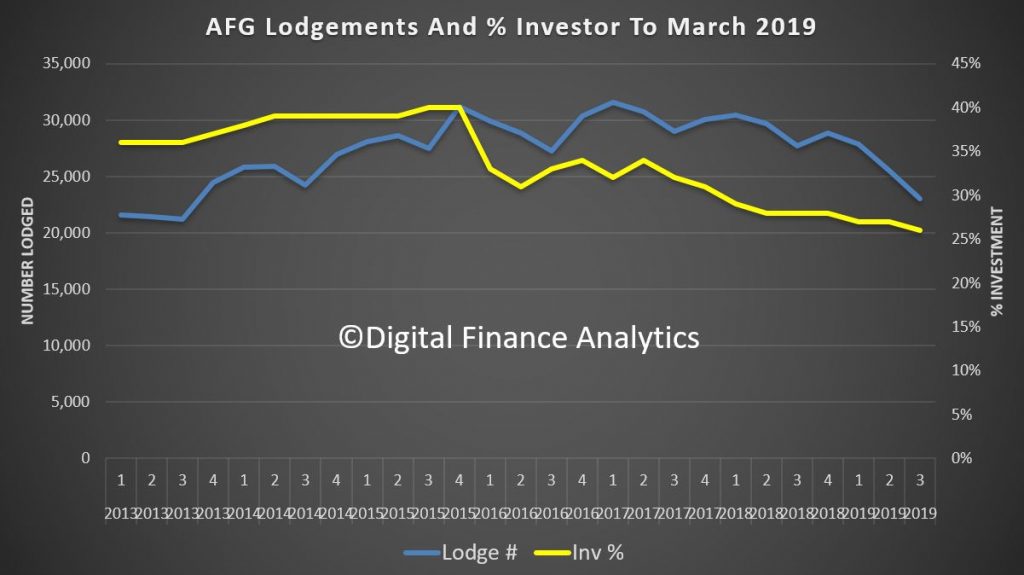

The improvement in YBR’s cash position was also reported against a backdrop of falling home lending volumes, with settlements declining by 20 per cent in 3Q19, from $3.1 billion to $2.5 billion.

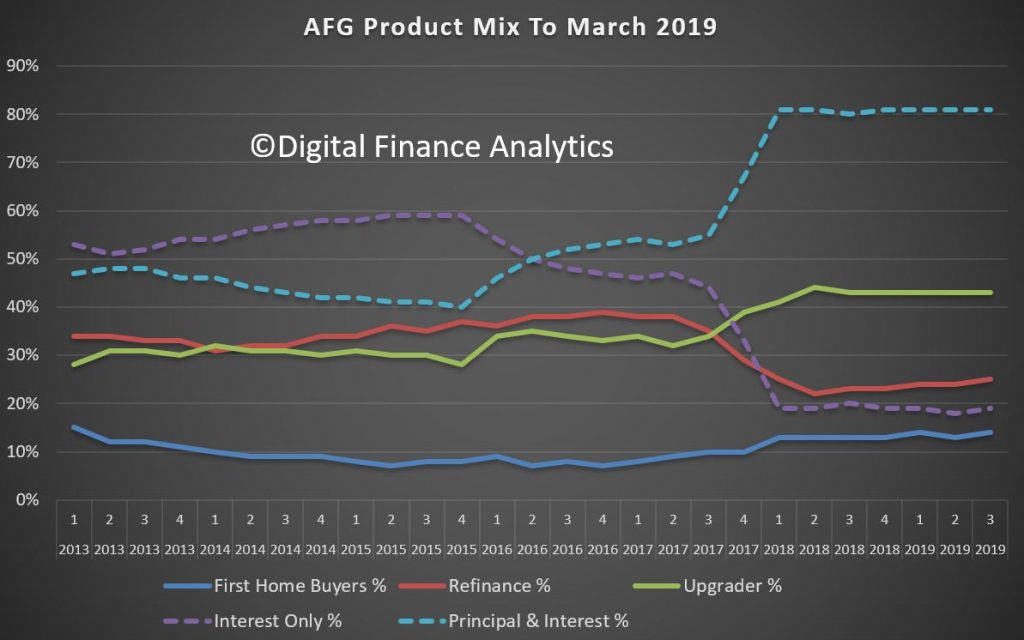

The group stated that its lending performance was “impacted by regulatory factors and the royal commission into banking and financial services”.

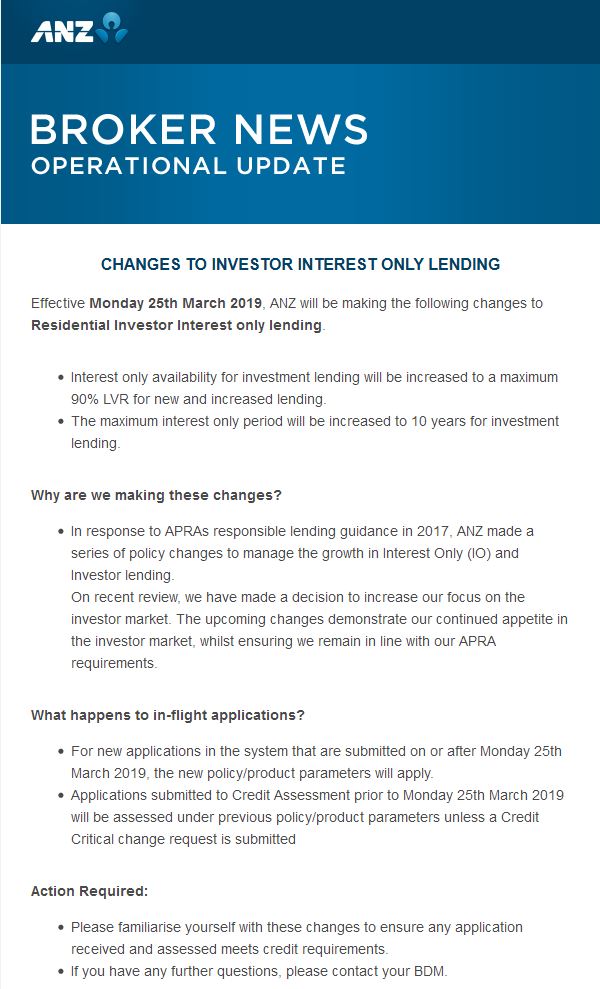

Its decision to offload its wealth business follows a spate of similar divestments, with several major banks – including CBA and ANZ – announcing in the past year that they would offload their wealth businesses and run “more simplified” banking businesses.