APRA release their quarterly property exposure lending stats for ADI’s today. There are some interesting data points, and some concerning trends and loosening of standards recently. I will focus on the new loan flows in this post.

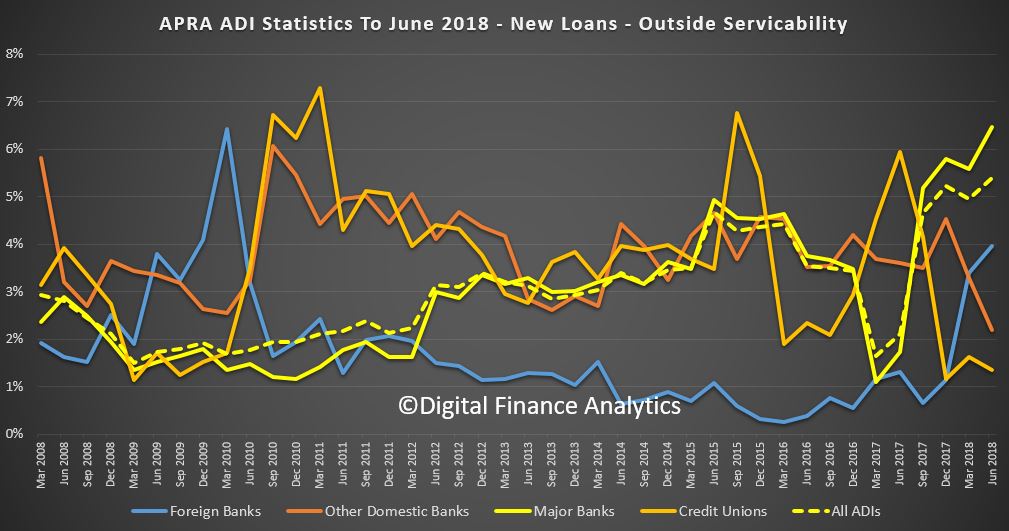

First the rise in loans outside serviceability continues to rise, now 6% of major banks are in this category a record, reflecting first tightening of lending standards, but second also their willingness to break their own rules! This should be ringing alarms bells. APRA?

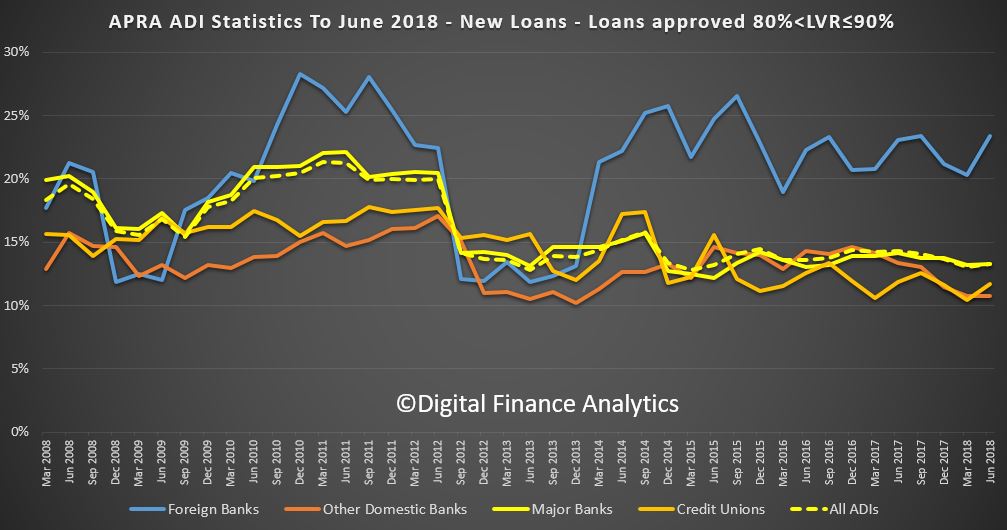

Foreign Banks are writing the greater share (relative percentage) of 80-90% LVR loans. Other lenders tracking lower.

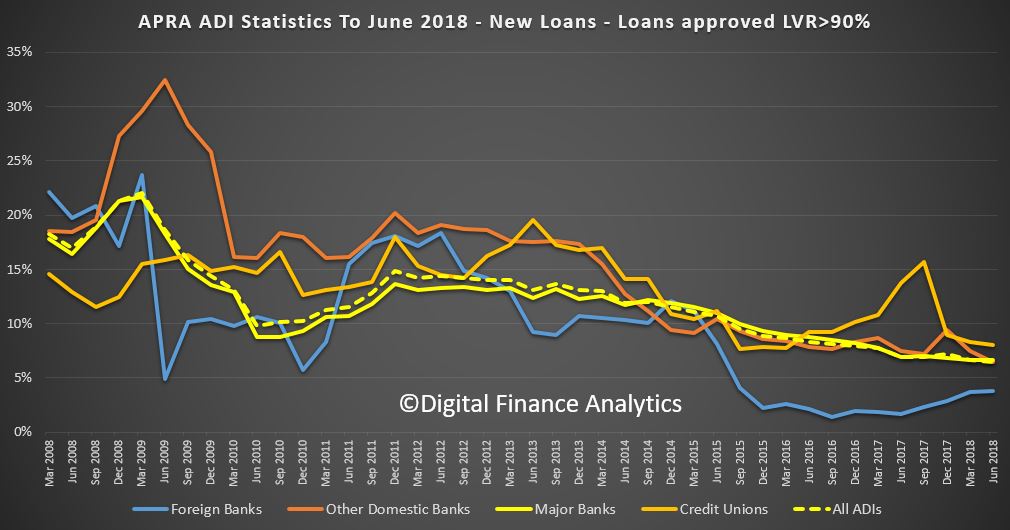

Foreign Banks are lending more 90+ LVR loans in relative percentage terms.

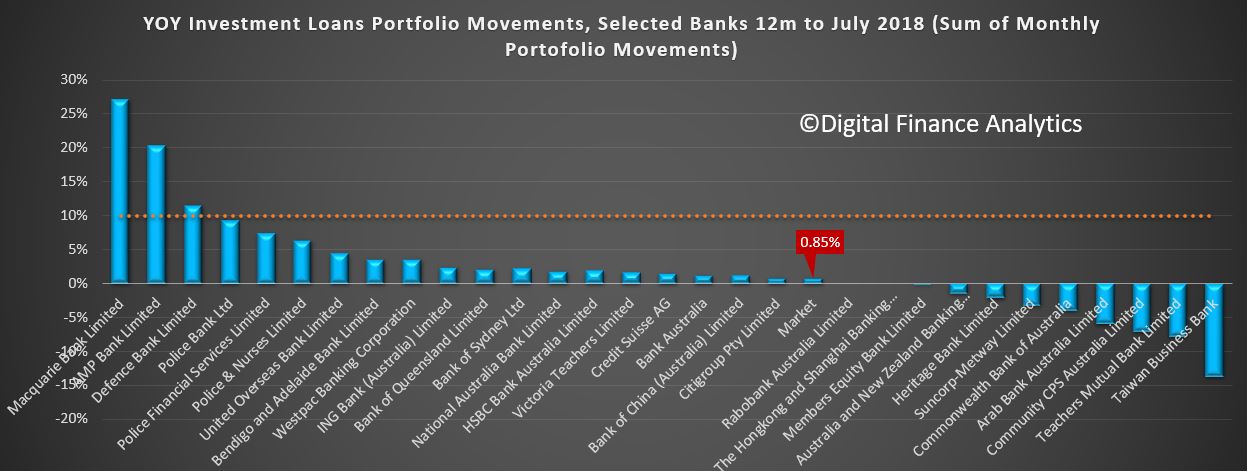

New investor loans are moving a little higher for Credit Unions and Major Banks, suggesting a growth in volumes.

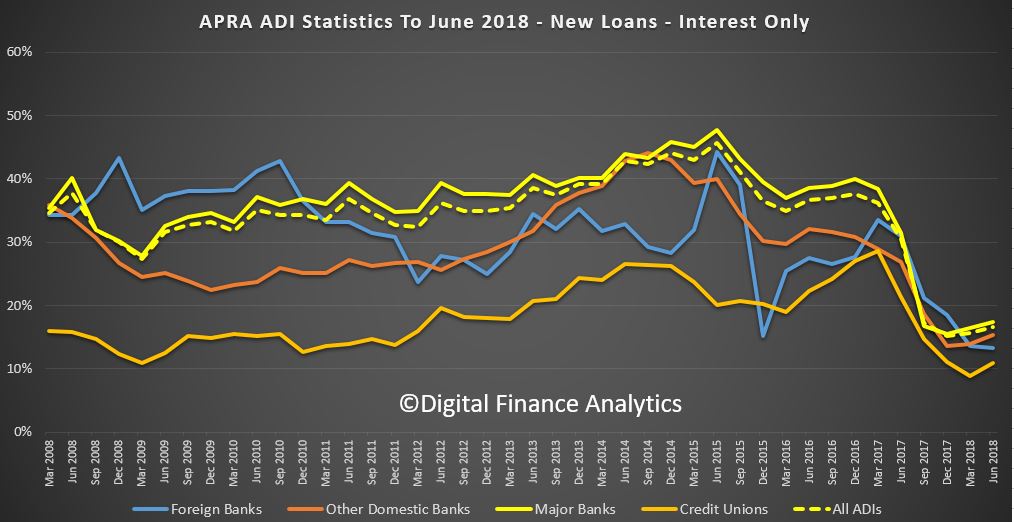

The share of interest only loans dropped below 20% but is now rising a little, as lenders seek to grow their books.

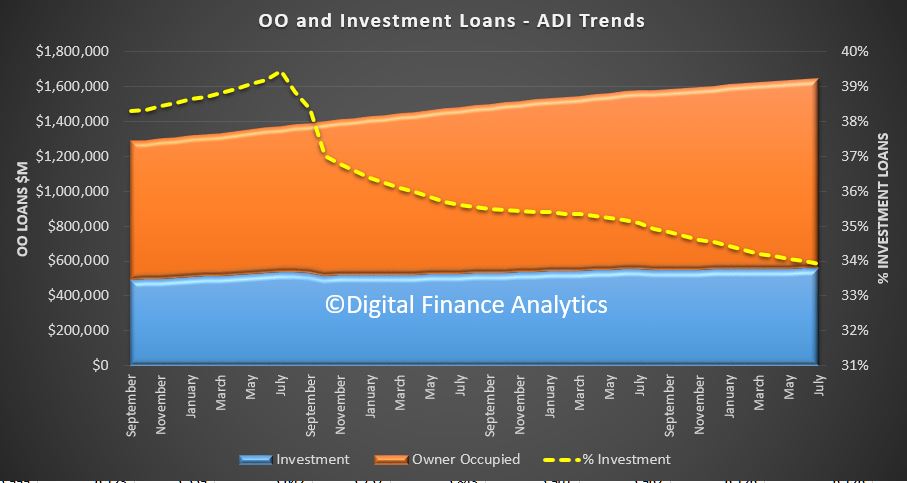

ADIs’ residential term loans to households were $1.62 trillion as at 30 June 2018. This is an increase of $86.6 billion (5.6 per cent) on 30 June 2017. Of these:

- owner-occupied loans were $1,076.4 billion (66.4 per cent), an increase of $76.7 billion (7.7 per cent) from 30 June 2017; and

- investor loans were $544.0 billion (33.6 per cent), an increase of $9.9 billion (1.9 per cent) from 30 June 2017.

Note: ‘Other ADIs’ are excluded from all figures.

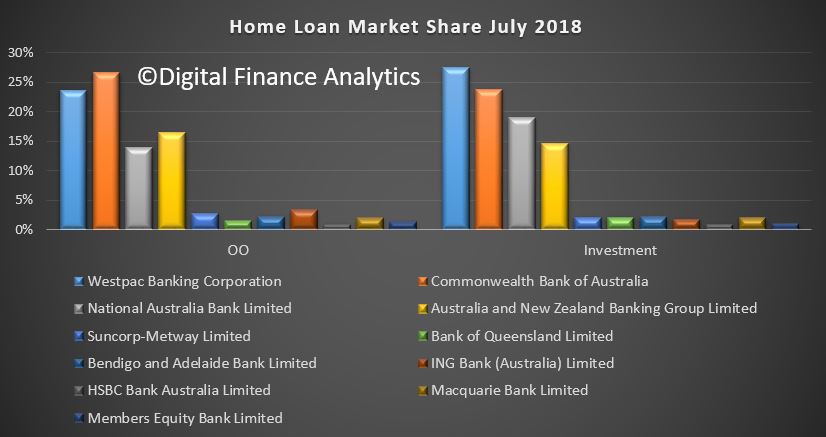

ADIs with greater than $1 billion of residential term loans held 98.9 per cent of all such loans as at 30 June 2018. These ADIs reported 5.9 million loans totalling $1.60 trillion. Of these:

- the average loan size was approximately $272,000, compared to $261,000 as at 30 June 2017 and

- $461.3 billion (28.8 per cent) were interest-only loans.

New housing loan approvals

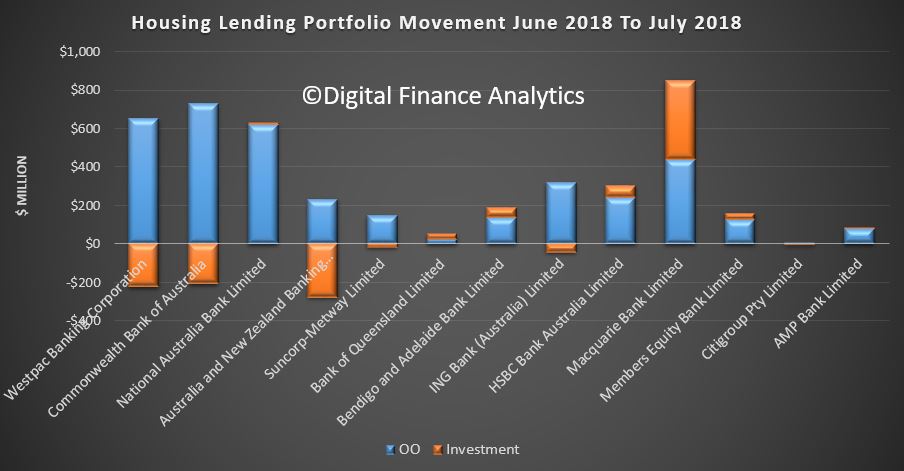

- ADIs with greater than $1 billion of residential term loans approved $378.1 billion of new loans in the year ending 30 June 2018. This is a decrease of $5.9 billion (1.5 per cent) on the year ending 30 June 2017. Of these new loan approvals:

- owner-occupied loan approvals were $260.6 billion (68.9 per cent), an increase of $10.6 billion (4.3 per cent) from the year ending 30 June 2017;

- investment loan approvals were $117.5 billion (31.1 per cent), a decrease of $16.6 billion (12.4 per cent) from the year ending 30 June 2017:

- $51.1 billion (13.5 per cent) had a loan-to-valuation ratio (LVR) greater than 80 per cent and less than or equal to 90 per cent, a decrease of $3.4 billion (6.2 per cent) from the year ending 30 June 2017;

- $25.8 billion (6.8 per cent) had a LVR greater than 90 per cent, a decrease of $3.6 billion (12.2 per cent) from the year ending 30 June 2017; and

- $61.2 billion (16.2 per cent) were interest-only loans, a decrease of $74.4 billion (54.9 per cent) from the year ending 30 June 2017.