We have just completed the latest DFA household survey, and in today’s DFA Video we summarise some of the main themes which we will cover in more detail in later posts. In the video blog we discuss the key demand and supply issues and make some observations about the future direction of house prices.

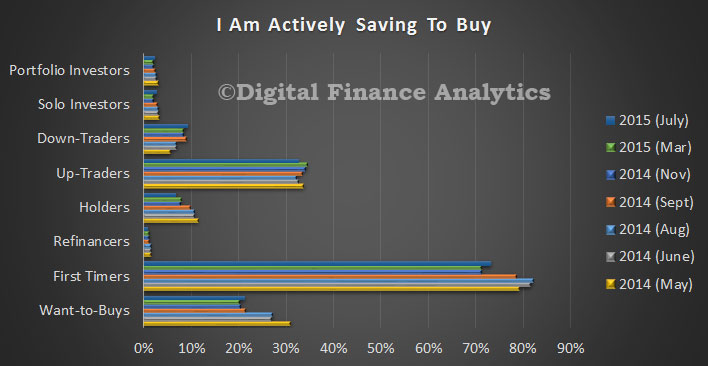

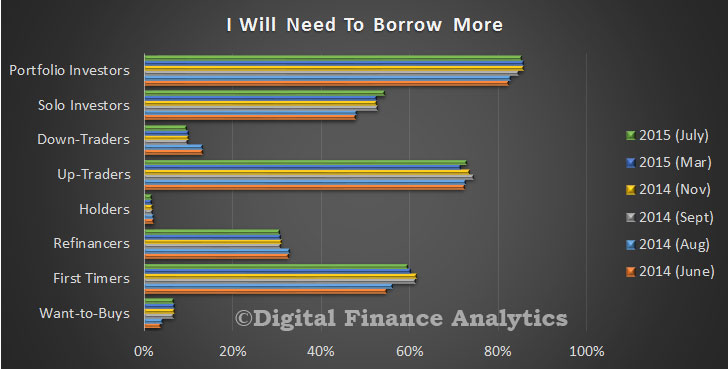

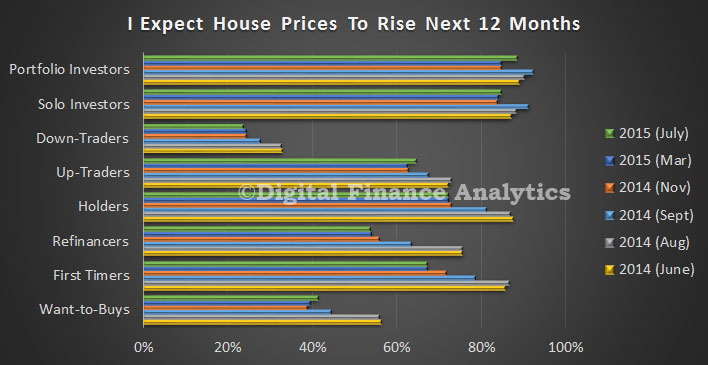

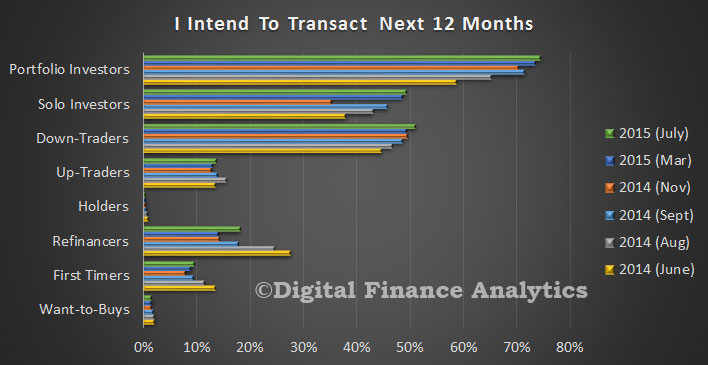

In essence, demand for property is still strong. Investors are still keen to purchase, first time buyers are flocking to the investment sector, down-traders are looking to property for income, so are keen to grab an investment property, and the number of portfolio investors is rising. We also see a significant rise in the number of investors via SMSF. Some are bringing their purchase decision forward to try and avoid credit tightening later. Foreign investors remain active (and are finding ways to buy established property – still.) Rental income is static, but investors are still getting benefits from negative gearing, and believe further capital gains will be delivered (again tax efficient). Geographically speaking, investors are most positive in Sydney, least in Perth. Property is seen as an investment asset class.

On the owner-occupied side of the ledger, first time buyers are finding it hard to purchase, thanks to a lack of suitable property, contention with investors, and tighter underwriting standards. Our surveys also highlight the low interest rates on deposits is making saving for a larger deposit harder. There is considerable interest in refinancing to a lower interest rate, and recent “great” deals on offer are encouraging more churn.

The proportion of property inactive households continues to rise.

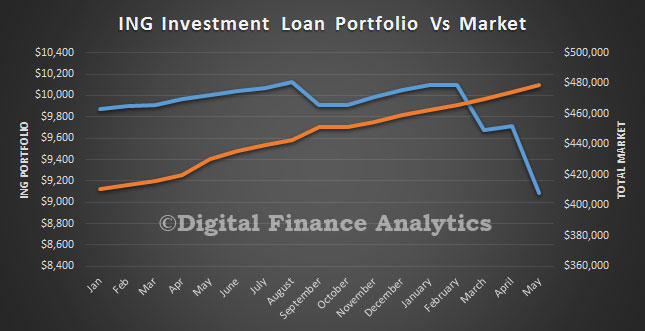

On the supply side, there are concerns about the supply of property, and the supply of mortgage finance. We think mortgages for investment loans will be harder to get, will cost more, and some will miss out. Ongoing repricing and less discounting will provide to wider margins for the banks. Non-banks and some of the players operating below the 10% guide growth rate are still wanting to do deals.

To offset this, we expect to see rates for owner occupied refinance to be discounted, and a fierce battle for customers is breaking out. Discounts are still on offer here and other incentives are in play.

Brokers will need to change their tune a little, and tap some of the smaller players on behalf of their clients. Absolute volumes of investment loans are likely to fall, but owner occupied refinancing will likely fill the gap.

So on balance we think the demand/supply disequilibrium will continue to support house prices in the eastern states in coming months, although momentum will fall from current levels. The tweaks to interest rates, of a few basis points will not be large enough to kill the golden goose, (and for many are offset thanks to negative gearing) but the higher serviceability buffers and lower LVR ratios will make it harder for some to enter the market.

The killer blow to house prices will be a substantial rise in interest rates – if rates were to rise just 150 basis points, that would be enough to put many households under pressure. But in the current environment, we do not think a rise in rates is likely for a couple of years, so property momentum has some way to go.