The Reserve Bank of Australia surprised nobody when it left official interest rates on hold on Tuesday at the record low of 1.5 per cent for the 13th consecutive month.

Governor Philip Lowe said he’d done that despite the fact that there is some light appearing on the economic horizon.

“Labour markets have tightened further and above-trend growth is expected in a number of advanced economies, although uncertainties remain,” he said.

The bank has an “expectation that growth in the Australian economy will gradually pick up over the coming year”, he said.

That positive note is challenged by some, with Stephen Anthony, chief economist with Industry Super Australia, telling The New Daily that there was not real evidence that things would improve soon.

“I’d say to the bank, ‘Stop pretending you do know and issuing statements based on faith’,” he said.

“Central banks are practicing faith-based economics and the quantitative easing and rate cut policies of recent years have created zombie economies.”

You can argue the toss about the RBA’s view but the ‘zombie’ economy is creating opportunities for those wanting to borrow to buy property.

Steve Mickenbecker, director with rate watch group Canstar, said there had been some declines in interest-only interest rates for property in recent times.

“I was a little surprised to see the decline in interest-only loans because they had been increasing as APRA had told the banks it wanted to see less investment and interest-only lending,” he said.

“Most of the fall has been triggered by moves by St George/Bank of Melbourne who may have responded to seeing their lending volumes fall.”

The average interest-only investment rate has fallen 0.71 per cent to 4.93 per cent with the best deal in the market sitting at 4.14 per cent.

This is welcome news for interest-only borrowers “who have stuck it out with investor interest-only loans and, on average, copped a 40-basis point rise over the last 12 months, adding $116 per month to the cost of a $350,000 mortgage”, said Sally Tindall, Money Editor at rate watch site RateCity.

Deals for those wanting principle and interest investment loans have dropped marginally to 4.73 per cent with the best deals at around 4.09 per cent, according to Canstar.

For home buyers there has been some downward movement with average rates down 0.17 per cent to 4.73 per cent while the best deals are at a low 3.65 per cent.

Mr Mickenbecker said: “I’ve had anecdotal evidence that there are some better deals for owner-occupiers being offered for new customers but not for existing customers.”

Ms Tindall said traditional home owners have good opportunities in the current environment if they’re prepared to really shop around.

“Australians opting to live in their properties and pay down their debt can nab a rate as low as 3.44 per cent.”

There are even rock bottom investment deals available.

“While there are 510 owner-occupier loans under 4 per cent, investors have just 49 to choose from,” she said.

The RBA’s decision came ahead of Wednesday’s GDP data, which is expected to show the economy is growing marginally slower than the RBA’s most recent annualised forecast of 1.75 per cent.

Dr Anthony said the economy has effectively been “set adrift” by the “economics of faith”.

“The question is when you ride a bike more and more slowly, at what point do you fall off?”

Tag: Mortgage Rates

Westpac eases IO lending conditions

Westpac has dropped its fixed rates on interest only loans while bringing in new introductory offers on a number of variable rate products.

The bank has decreased rates on its Fixed Rate Home and Investment Property Loans with IO repayments by as much as 30 basis points. This sets the new fixed rates for owner occupiers between 4.59% p.a. and 4.99% p.a. while rates for investors lie between 4.79% p.a. and 5.19% p.a.

“We regularly review our rates. We’ve been adjusting some over the past few months to remain competitive and ensure we meet our composition targets – i.e. the regulator’s 30% sector cap on IO loans,” a bank spokesperson told Australian Broker.

Rates for fixed rate interest only investor loans locked in for between six and 10 years remain unchanged.

Westpac has also brought in a two year introductory offer on its Flexi First Option Home and Investment Property Loan for new lenders. Refinancing and foreign lending is excluded.

Changes include an increased discount for the first two years of the Flexi First Option Home Loan for P&I payments and the introduction of a similar discount for Flexi First Option IO investor loans. After two years, the loan will roll over to the base rate:

2 year intro rate Discount Base rate P&I owner-occupier 3.88% p.a. 0.71% p.a. 4.59% p.a. P&I investor 4.18% p.a. 0.96% p.a. 5.14% p.a. IO owner-occupier 5.18% p.a. None 5.18% p.a. IO investor 4.88% p.a. 0.77% p.a. 5.65% p.a. The bank has also removed its revert rate discount from all Flexi First Option Home Loans for owner occupiers and investors.

All changes came into effect on 30 August.

Lenders offering lower interest rates, incentives in lead up to spring

From The Real Estate Conversation.

Competition for good-quality borrowers is hotting up in the lead up to spring, with lenders offering lower interest rates, fee waivers, or lower deposits for favoured customers.

Twenty-three lenders have dropped their home loan rates since 1 July, according to mortgage comparison site, Mozo.

“While Spring is traditionally peak season for buying and selling, there is an unusually high level of competition in the home loan market this year,” said Mozo director, Kirsty Lamont.

“The rate cutting frenzy is being fuelled by lender competition for ‘higher quality’ mortgage customers – particularly owner occupiers paying principal and interest repayments,” she told SCHWARTZWILLIAMS.

Preparing for the busy spring season

Lenders are positioning themselves for the busy spring season.

“Spring is traditionally buying and selling season so we naturally expect a boost in listings over the next few months,” said Lamont.

“We’re predicting that this spring, in particular, will be a bumper property season as vendors look to sell up at the top of the market, with prices expected to plateau in the next year,” she said.

Banks targeting low-risk professions, such as doctors

Some lenders are targetting particular low-risk professions. For example, ANZ is allowing specific buyers, such as doctors, to halve deposits for interest-only investment loans.

Borrowers can be saving thousands of dollars a year

While the average reduction in interest rates is 15 basis points, a handful of lenders have cut by more than double that, Mozo found.

Westpac slashed mortgage rates by up to 85 basis points this week, and waived fees on some products.

Lamont said 66 lenders now offer variable interest rates on mortgage products of less than 4 per cent.

Mozo’s research found the most competitive variable rate in the market for a $300,000 owner-occupier loan is 3.44 per cent, which is 120 basis points lower than the average Big 4 bank variable rate.

“The difference between the big banks’ rates and the lowest on the market adds up to $2,496 a year for the average borrower on a $300,000 loan,” said Lamont.

Mozo also found a number of lenders are providing cash-back offers, fee waivers, and other perks for new borrowers in time for the peak spring property season.

What do lower interest rates mean when household debt is already at record highs?

Lamont said tighter lending requirements would go some way to preventing borrowers from overextending themselves, and that borrowers should “future proof” themselves for higher interest rates.

“There is always a risk that home borrowers will become complacent and take on more debt with interest rates at rock bottom levels,” she said.

“However, we’ve also seen a flurry of lenders toughen their loan criteria off the back of pressure from APRA by lifting their interest rate buffer used to assess whether borrowers can afford to take out a mortgage.

The onus is on home buyers to “future proof themselves against mortgage stress by factoring in at least a two per cent increase in their mortgage rate,” recommended Lamont.

Virgin Money introduces raft of rate changes

Effective 8 August, Virgin Money will introduce multiple rate changes across a raft of mortgage products.

A new broker note released today listed these changes which include:

- Increasing the standard variable rates for owner occupied and investment interest only loans for new and existing customers

- Increasing the fixed interest only rates for both owner occupied and investment loans

- The lender no longer accepting Rate Lock requests for pre-approvals or for off-the-plan purchases

The standard variable interest only rates will be raised by 25 basis points for new and existing customers.

Reference Rate Rate (p.a.) Virgin Money variable interest only rate (owner occupied) 4.89% Virgin Money variable investment interest only rate (investment) 5.19% For new owner occupied interest only customers, the rates will be as follows:

Current rate (p.a.) New rate (p.a.) Change Borrowings $75,000 to $499,999 LVR less than or eual to 70% 4.14% 4.39% +0.25% Borrowings $500,000 to $749,999 LVR less than or eual to 70% 4.09% 4.34% +0.25% Borrowings $750,000 and above LVR less than or eual to 70% 4.04% 4.29% +0.25% For new investment interest only loans, the rates will be as follows:

Current rate (p.a.) New rate (p.a.) Change Borrowings $75,000 to $499,999 LVR less than or eual to 70% 4.14% 4.39% +0.25% Borrowings $500,000 to $749,999 LVR less than or eual to 70% 4.09% 4.34% +0.25% Borrowings $750,000 and above LVR less than or eual to 70% 4.04% 4.29% +0.25% Virgin Money will also be changing its fixed interest only rates as follows:

Owner occupied – LVR 70% and under Term Current rate (p.a.) New rate (p.a.) Change 1 year 4.24% 4.39% +0.15% 2 year 3.99% 4.39% +0.40% 3 year 3.99% 4.49% +0.50% 4 year 4.34% 4.69% +0.35% 5 year 4.49% 4.79% +0.30%

Investment – LVR 80% and under Term Current rate (p.a.) New rate (p.a.) Change 1 year 4.34% 4.49% +0.15% 2 year 4.05% 4.49% +0.44% 3 year 4.14% 4.49% +0.35% 4 year 4.44% 4.89% +0.45% 5 year 4.59% 4.99% +0.40% Finally, Virgin Money will not be accepting rate lock for pre-approval applications or for off-the-plan purchases. Once a property has been found for a pre-approval application, then rate lock can be requested however.

Teachers Mutual Bank Tweaks Mortgage Rates

Effective 1 August Regional lender Teachers Mutual Bank (TMB), along with its subsidiaries Unibank and Firefighters Mutual Bank, have announced a series of rate changes “in line with our regulatory obligations and current rates available across the market”. They say “Due to business and prudential requirements, we have placed restrictions on certain interest only home loans“.

Once again we see a differential shift, with interest only loan rates being lifted, whilst rates on some owner occupied principal and interest loans below specific LVR’s and value are reduced. This underlines the current behaviour where specific types of “low risk” borrowers are being recognised. Expect more of the same from other market participants.

This also means if you are the right type of borrower, there are some good rates available, whereas others, especially interest-only borrowers will not be so fortunate. We are seeing risk-based pricing emerging via the back door!

The bank increased the interest only variable rate by 20 basis points to 5.66% p.a. (comparison rate 5.71% p.a.). Interest only rates for the Solution Plus Home Loan rose by between 30 and 50 basis points depending on the LVR. Rates span between 4.49% p.a. (comparison rate 4.74% p.a.) and 4.67% p.a. (comparison rate 4.29%).

Rates for the principal & interest Solutions Plus Home Loan were decreased by 15 basis points to 4.39% p.a. (comparison rate 4.64% p.a.) for those borrowing between $240,000 and $499,999 where the LVR is greater than 80% and less than or equal to 90%.

Why a small rise in interest rates will hurt like the 1980s

Costs for many homebuyers have jumped by up to 150 basis points over the past 12 months and are expected to continue rising even if low inflation means an official rate hike from the Reserve Bank of Australia is unlikely in the near term.

Owner-occupier borrowers are paying between 30 and 40 basis points more and rates on interest-only and investor loans are up by 70 to 150 basis points, according to consultancy Digital Finance Analytics (DFA).

There has been a small decrease in average principal and interest, owner-occupier loans because of regulatory pressure on lenders to encourage borrowers to reduce debt.

If anything, this week’s inflation data gives households a breathing space in which to pay off debt before rates do rise. Financial and mortgage advisers recommend borrowers review their finances so they’re ready for when rates turn.

“Paying more of your debt off while interest rates are at near record lows is a great way to take control of your debt,” says Tim Mackay, an independent financial adviser with Quantum Financial. “Interest rates will eventually start to rise and every time it happens, it’s a little more out of your pocket. The faster you pay your debt off, the less overall interest you will have to pay over the term of your loan.

Other strategies include locking in a fixed rate loan, ramping up extra payments and reducing other debt.

Wealthy feel the pinch

Affluent households – with two incomes and combined annual salaries totalling more than $150,000 – are increasingly facing financial distress because they have taken out large loans with small deposits to pay huge asking prices for real estate hotspots like Melbourne and Sydney, says DFA.

Debt of more than half the households in NSW is 4.5 times income, says Martin North, DFA principal. The national average is just under half households financing similar debt amounts.

“This is a big deal,” North says. “Especially in a rising interest rate environment. It means households have little wriggle room. Granted, many will be holding paper profits in property which has risen significantly in recent years but this does not help with servicing ongoing debt.”

Financial distress among property buyers has increased by 10 per cent over the last 12 months despite the lowest cash rates on record, according to Consumer Action, a federal government-sponsored financial counselling centre.

Property buyers say rising mortgage payments are the chief reason the family budget can’t cover all expenses.

Consumer Action claims the numbers being counselled are an “iceberg tip” of families around the nation struggling with high costs of living, underemployment, flat incomes and rising mortgage costs. The RBA estimates household debt has blown out to nearly twice annual incomes.

Questionable loans

An estimated $50 billion worth of mortgages, equivalent to about 5 per cent of home loans, would fail the latest round of underwriting criteria introduced in response to regulatory pressure and growing household debt, says DFA.

Many younger buyers, typically aged 25-34 , believe home ownership has slipped beyond their reach and plan to become life-long renters, says the Grattan Institute. This is a big shift in national aspirations and retirement planning, which has traditionally assumed retirees own their homes.

Economists warn about static incomes, the highest underemployment since records began in 1978, rising out-of-cycle mortgage increases and rising property prices in the nation’s most populous states.

For example, house price growth during the past 12 months in Melbourne is nearly 22 per cent, or more than 10 times the official rate of inflation. In Canberra it is more than six times the rate of inflation and Sydney five times.

Prices are falling in Darwin and Perth but the national average is 10 per cent. The wide divergence in prices makes it harder for regulators to impose a single, national strategy.

Mortgage payments required to service the growing debt are rising as lenders respond to regulatory pressure to slow buyer demand with out-of-cycle rate rises.

Mistaken criteria

Lenders are comfortably within the 2.5 per cent buffer between the mortgage rate offered and the rate they use for affordability assessment.

But they are reviewing their assessment of household debt and capacity to repay using more sophisticated analysis of household expenditure and borrowers’ reported expenses.

Regulator the Australian Securities and Investments Commission (ASIC) discovered an improbable correlation between the regulatory standard required by lenders and mortgage brokers and tens of thousands of loan applications, suggesting household expenses were being assessed to qualify for a loan, rather than meet standards.

It revealed lenders were often too generous in their assessment of borrowers’ capacity to pay because original assessments understated spending before deducting mortgage payments.

Unsurprisingly, expenses of more affluent households are significantly higher. “This helps to explain why we are seeing more affluent households getting into mortgage stress territory,” says North.

Toughest conditions in 30 years

Households are on notice that they could face some of the toughest borrowing conditions in nearly 30 years if interest rates rise 200 basis points, or eight typical rate hikes, as floated by the Reserve Bank of Australia earlier this month.

“Record low interest rates have made it possible for households to service much larger mortgages as they’ve chased rising house prices,” says Brendan Coates, a research fellow with the Grattan Institute, an independent think tank.

“Even a relatively small rise in interest rates paid by households would crimp their spending. Our research shows that if interest rates rise by just two percentage points, mortgage payments on a new home will take up more of a household’s income than at any time since the late 1980s.”A 200 basis point rise would push the headline rate for interest rates to about 7.25 per cent.

The impact on family budgets would be equivalent to a rate of 17 per cent, the highest since Bob Hawke was prime minister.

In 1989 the Australian economy was turning from boom to bust in the wake of a global turndown and local lending excesses after deregulation of the financial sector. It was immortalised by then-Treasurer Paul Keating’s quip about a “recession we had to have” and subsequent mortgage defaults, bankruptcies and a stalled property market.

Median house price in Sydney were about $170,000 and average weekly wages around $500. Since then house prices have increased by more than six times as salaries rose by 2.5 times.

The Grattan Institute’s warning follows the RBA’s signal that the cash rate (at which it lends to commercial banks) could rise by 200 basis points to 3.5 per cent.

“With interest rates across the globe at historic lows, the risk of an interest rate rise is real,” says Coates. “And because wages are not rising fast, households are burdened by big interest payments for much longer.

“While the RBA would lift interest rates cautiously, another disruption to international financial markets like 2008 could sharply increase banks’ funding costs, raising mortgage rates.”

Suncorp Lifts Fixed Investor Loan Rates

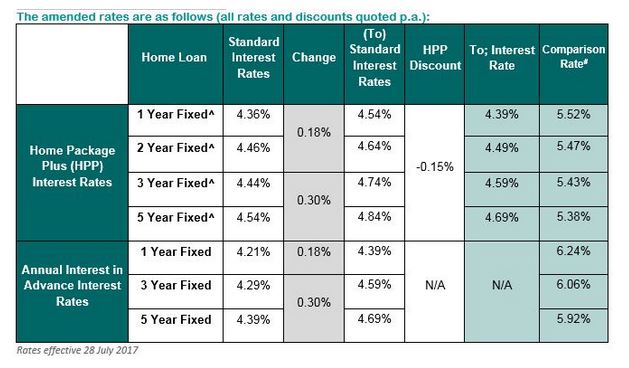

Suncorp has lifted rates on new and in flight fixed investment home loan offers effective today, impacting Home Package Plus Fixed, Standard Fixed and Annual Interest in Advance Loans (AIIA) interest rates.

They say this is to “ensure the bank remains compliant with regulatory caps on investor and interest only lending.”

They say this is to “ensure the bank remains compliant with regulatory caps on investor and interest only lending.”

‘Disingenuous’: Former bank exec questions back book repricing

A former major bank executive says lifting rates for existing interest-only borrowers has little to do with the regulatory pressures the banks claim they are under.

Following a hefty round of rate hikes for interest-only borrowers last month, former Barclays CEO of mortgages Steve Weston says it was surprising to see the banks’ tactics.

“On the one hand, they talk about wanting to rebuild trust with consumers and do all the right things and they’ve got the ABA engaged with a number of well-intended initiatives to ‘make banking better’,” Mr Weston said, responding to a question at the Vow Financial commercial conference in Hobart on Friday. “But then they do things that appear anything but customer-friendly.

“During June, the four major banks announced reductions in their principle and interest owner-occupier rates of between 0.03 per cent and 0.09 per cent, along with increases in their interest-only rates of between 0.30 per cent and 0.35 per cent.”

Mr Weston explained that the media statements from the banks all claimed they had to reprice their interest-only mortgages to meet APRA’s requirement to limit the flow of new interest-only lending to 30 per cent of new residential mortgage lending.

“The key word there is ‘new’. The equation to measure that 30 per cent is all the loans that settle that month – no more than 30 per cent can be IO. The back book doesn’t come into the measure at all,” he said.

“And I wonder how much consideration was given to the impact the rate changes will have on customers. Encouraging existing borrowers to make principle repayments is broadly sensible, although for some, like investment loan borrowers who also have an owner-occupier loan, this may prove sub-optimal from a tax planning perspective.”

Weston further commented that each of the media releases also stated that the rate changes were not related to the bank levy.

“Typically when you see out-of-cycle rate increases, they are justified by an increase in funding costs or the need to hold more capital. But not this time. This time the banks have been clever in using an APRA cap on new lending and using it to justify increasing rates for existing customers. What has been really surprising is the lack of mainstream media commentary about the rate increases.

“Making the changes even more surprising was that in the May Budget, the Treasurer instructed the ACCC to monitor changes in mortgage pricing by those banks impacted by the bank levy. The Treasurer even asked the ACCC chairman to let him know if he finds any evidence of the bank levy being passed on in higher mortgage rates. Whether it was co-incidental or not, the additional income that will be generated by these rate changes all but equates to the bank levy. So it will be interesting to watch how this plays out.”

According to Mr Weston, who was general manager of broker platforms at NAB before joining Barclays in 2012, the Australian banks could have achieved the 30 per cent limit by tightening their credit policies and increasing rates on new loans.

“The back book didn’t need to be touched,” he said.

“At the very least, the banks could have waited until the interest-only loan period expired before increasing rates. They could have written to customers and advised them about the benefits of commencing principle repayments and letting them know that their interest rate would increase at the end of their interest-only term if they didn’t commence making principle repayments at that time.

“These don’t feel like the actions of banks who want to build trust with customers. To me it feels more like taking an opportunity to increase profits. Actually, it feels very un-Australian,” Mr Weston said.

Bankwest Tweaks Mortgage Rates

In a note to brokers late on Friday, Bankwest announced that for customers with existing interest-only loans, the following changes will take effect in October 2017:

• 0.25 per cent p.a. increase for interest-only investor home loans; and

• 0.35 per cent p.a. increase for interest-only owner-occupier home loans.Effective Tuesday, 25 July 2017, the following changes will apply to applications for new lending:

• 0.15 per cent p.a. reduction for new principal and interest investor lending on the Complete Variable and Premium Select Home Loans;

• 0.12 per cent p.a. reduction in the standard rate for principal and interest owner-occupier lending on the Premium Select Home Loan to match the existing acquisition special; and

• 0.05 per cent p.a. increase for new interest-only owner-occupier lending on the Complete Variable and Premium Select Home Loans.

Bankwest said that customers with existing interest-only lending will receive correspondence from the lender closer to the effective date, and that construction loans paying interest-only until fully drawn (IOUFD) will not be impacted by this change.

“Bankwest is mindful of its broader obligations as a responsible lender and aims to balance the needs of customers, shareholders and regulators when reviewing products and pricing,” the bank said.

“These changes are being made in line with regulatory guidance and customers can consider moving to our lower principal and interest rates so they pay less interest over the life of their home loan.”

Expect a Flurry of Mortgage Rate CUTS!

The round of mortgage rate repricing which we have been tracking for the past few weeks, with investor loan portfolios being strongly repriced, and owner occupied loans less impacted, has created a significant well of opportunity for banks to selectively offer attractor rates to principal and interest borrowers.

In addition, funding costs are now lower, and the yield curve is less strongly indicating future increases, thanks to changes in the US financial markets and news that the ECB will continue its bond buying programme.

In addition, funding costs are now lower, and the yield curve is less strongly indicating future increases, thanks to changes in the US financial markets and news that the ECB will continue its bond buying programme.

So we expect to see a flurry of selective, targetted offers, aimed at acquiring new business and supporting loan portfolio growth.

ANZ for example is offering a 31 basis point drop for new two-year fixed residential investment loan for customers paying principal and interest (P&I), falling from 4.34 per cent per annum (p.a.) to 4.03 per cent p.a.

First time buyers may also benefit from keen rates, but only in some cases by asking for them.

Remember this will be for new loans. Existing borrowers will still be saddled with higher costs.