You can join our podcast live tomorrow 12:30 on the link below. I reveal our latest mortgage stress results for March and discuss my latest scenario modelling. You can also ask a question live!

It will also be available afterwards on replay.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

You can join our podcast live tomorrow 12:30 on the link below. I reveal our latest mortgage stress results for March and discuss my latest scenario modelling. You can also ask a question live!

It will also be available afterwards on replay.

Damien Klassen, Head of Investments at Nucleus Wealth highlights some important issues….

He runs a superannuation fund that only buys liquid assets in separately managed accounts. So, an investor’s return is their return. They can’t rely on tax mingling, unlisted asset revaluations or other accounting tricks that master trusts use. So some may say its sour grapes. But he highlights some surprising facts. Anyone remaining in certain funds bears the brunt of the losses as others chose to leave.

Most superannuation funds, and especially industry funds have significant balances in unlisted assets. Many are telling you that these assets haven’t lost money, or are only down a little despite sharemarkets being down close to 30%. This gives rise to perverse incentives for superannuants:

Rough numbers? I suspect right now that the median superannuation fund will pay you about 7% to leave.

Chant West gave us a quick preview of superannuation fund returns for March:

From Chant West:

“Growth funds, which is where most Australians have their superannuation invested, hold diversified portfolios that are spread across a wide range of growth and defensive asset sectors. This diversification works to cushion the blow during periods of share market weakness. So while Australian and international shares are down at least 27% since the end of January, the median growth fund’s loss has been limited to about 13%.”

Some quick maths.

Chant West’s definition of a growth fund is one that has 60-80% of its assets in growth equities.

Let’s call it 70% exposure to shares, 5% cash and 25% to a composite bond fund.

If shares are down “at least” 27%, cash is unchanged, and a composite bond fund is down about 5%, then the implied return is a loss of -20%.

Chant West says the loss is only 13%.

There is 7% missing.

And that assumes that the 25% is in composite bonds, more likely it is higher risk unlisted assets.

Now, individual funds will have different performance obviously. Our own growth fund is down less than 1% over the same time frame, but we took dramatic and aggressive measures at the end of January that I know others did not.

The superannuation market is $3 trillion. It is the market. If, somehow, almost every superannuation fund worked out the same thing we did and sold equities at the end of January, the market would have fallen in January. They didn’t.

The answer is superannuation funds have unlisted assets that they are not writing down. They are pretending that the prices are mostly unchanged from January.

A few industry funds have written down assets. For example, AustralianSuper has revalued its unlisted infrastructure and property holdings downwards by 7.5%.

Um, have they looked at the rest of the market? The listed property sector is off more than 40%. Airports? Down 30%+. Private Equity? Ha! You are telling me that illiquid shares are worth a few per cent less while listed shares are down 25%+ and illiquid bonds aren’t even trading?

The writedowns help, but are nowhere near the level the assets would sell for today.

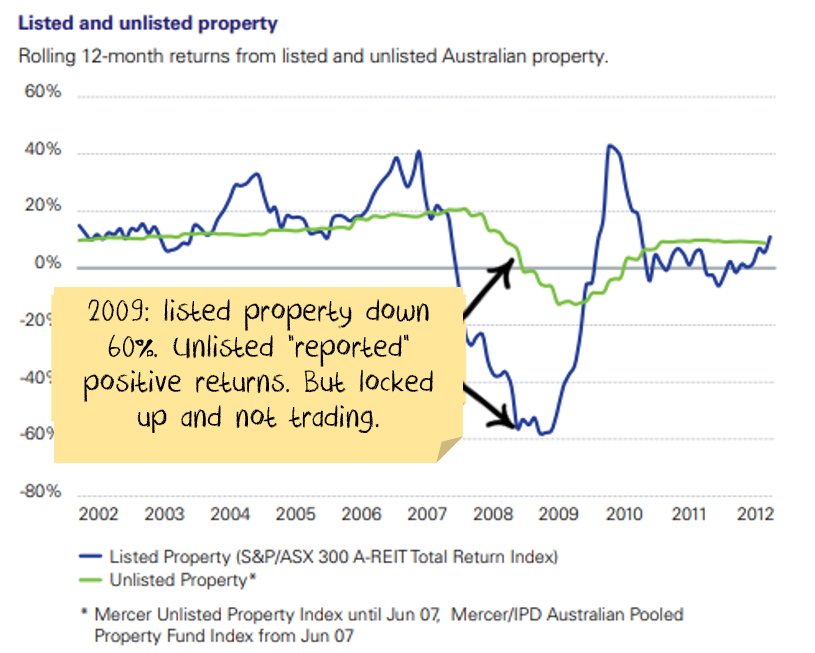

A great example is unlisted property funds during the financial crisis. Unlisted property funds invest in effectively the same assets as listed property funds, the underlying properties are worth the same, the performance differs because of how it is reported:

The problem is that if you own a fund that reports like this, you can be diluted if other investors leave. And any contributions you make now are at inflated prices. To illustrate with an extreme example, let’s say:

The other problem with a typical superannuation fund (but not some of the newer ones that use a separately managed account structure) is your tax is mixed with other investors. Rodney Lay from IIR recently highlighted the issue:

…unit trust investors face another risk – being subject to the taxation implications of the trading activities of other investors. Net redemption requests may require the manager to sell underlying portfolio holdings which, in turn, may crystallise a capital gain… …During the GFC some investors had both (substantial) negative returns plus a tax bill on the fund’s crystallised gains. Good times!!!

So, if you are a loyal soldier sticking with a superannuation fund that continues valuing unlisted assets at last year’s prices then:

But at least your superannuation fund will be able to “report” higher returns.

We discuss the rent buy decision with Damian Klassen Head of Investments, Nucleus Wealth, and the broader issues of asset allocation in these uncertain times.

Note Nucleus Wealth DISCLAIMER: This presentation has been prepared by Nucleus Wealth and is for general information only. Every effort has been made to ensure that it is accurate, however it is not intended to be a complete description of the matters described. The presentation has been prepared without taking into account any personal objectives, financial situation or needs. It does not contain and is not to be taken as containing any securities advice or securities recommendation.

Furthermore, it is not intended that it be relied on by recipients for the purpose of making investment decisions and is not a replacement of the requirement for individual research or professional tax advice. Nucleus Wealth does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this presentation.

Except insofar as liability under any statute cannot be excluded, Nucleus Wealth and its directors, employees and consultants do not accept any liability for any error or omission in this presentation or for any resulting loss or damage suffered by the recipient or any other person. Unless otherwise noted, Nucleus Wealth is the source of all charts; and all performance figures are calculated using exit to exit prices and assume reinvestment of income, take into account all fees and charges but exclude the entry fee. It is important to note that past performance is not a reliable indicator of future performance. This document was accompanied by an oral presentation, and is not a complete record of the discussion held. No part of this presentation should be used elsewhere without prior consent from the author.

Governments have turned a corner on the Coronavirus, now prioritising preventative measures to combat its spread rather than minimising economic and market impact.

In today’s webinar, hear from Nucleus Wealth’s Head of Investment Damien Klassen, Chief Strategist David Llewellyn Smith and Head of Operations Tim Fuller, as they cover “How to invest during Coronavirus pandemic”

In this episode, we cover why the economic impacts of Coronavirus will far exceed that of SARS did in 2003, the time for cautious investing being now, countries and sectors to avoid investment in, and as always our investment implications wrap-up.

To listen in podcast form click here: http://bit.ly/NucleusPod

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.

Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

Nucleus Wealth’s Head of Investment Damien Klassen, Tim Fuller, and Dr. Steven Hail discuss cover “MMT: coming to a politician near you!”

Dr. Hail holds a PhD in Economics and is a lecturer in the topic at the University of Adelaide, where he uses a modern monetary frame to understand macroeconomic issues.

Topics on the agenda included: background on Modern Monetary Theory, countries closest to considering MMT and how Australia could potentially employ it, MMT’s relationship to Bonds & Inflation, legistlative hurdles in the way and much, much more

To listen in podcast form click here: http://bit.ly/NucleusPod

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

Nucleus Wealth’s Head of Investment Damien Klassen, Chief Strategist David Llewellyn Smith and Tim Fuller, discuss “Will Coronavirus create a Market Hangover?”

Topics include the pandemic spreading as the Chinese new year fast approaches, if the data can be trusted, Australian and macro implications if Chinese growth slows, how similar this is to the Chinese SARS outbreak in 2003, and as always we wrap up with our investment outlook

To listen as a podcast click here http://bit.ly/NucleusPod

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance.

Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

Nucleus Wealth’s Head of Investments Damien Klassen, Head of Operations Tim Fuller, as well as ex-fund manager, Analyst, and blogger Kevin Muir of ‘The Macro Tourist’ discuss ‘Is Inflation back from the Dead?’

Topics this week include a background on world markets and why growth and inflation have been so stagnant, Modern Monetary Policy, why Kevin believes inflation is just around the corner and the best option to deal with global debt, and their outlook on where China and Australia’s economy moving to.

The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.

Note: DFA has no commercial relationship with Nucleus.

In the latest from Nucleus Wealth, Head of Investment Damien Klassen, and Head of Operations Tim Fuller, chat with Economist and Hon. Prof. of the University College of London, Steve Keen.

You can find Steve’s work at: https://www.patreon.com/ProfSteveKeen

Topics include credit creation and its limits, weighing up its pro’s and con’s, central banks reaching the end of the road for interest rate cuts with debt being at near record highs, the drivers of weak demand and inflation globally, Modern Monetary Theory (MTT) and its differences with Keynesian Stimulus, which countries are closest to incorporating MMT, Steve’s ideas for central banks depositing directly into citizens bank accounts and “Universal Basic Carbon.” Nucleus Wealth is a Melbourne based investment house that can help you reach your financial goals through transparent, low cost, ethically tailored portfolios.

Listen in podcast form: http://bit.ly/NucleusPod

Disclaimer: The information on this podcast contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen and Tim Fuller are an authorised representative of Nucleus Wealth Management. Nucleus Wealth is a business name of Nucleus Wealth Management Pty Ltd (ABN 54 614 386 266 ) and is a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796

Courtesy of Nucleus Wealth’s Damien Klassen. Damien runs the investment side of Nucleus, selecting stocks suggested by analysts and implementing the asset allocation

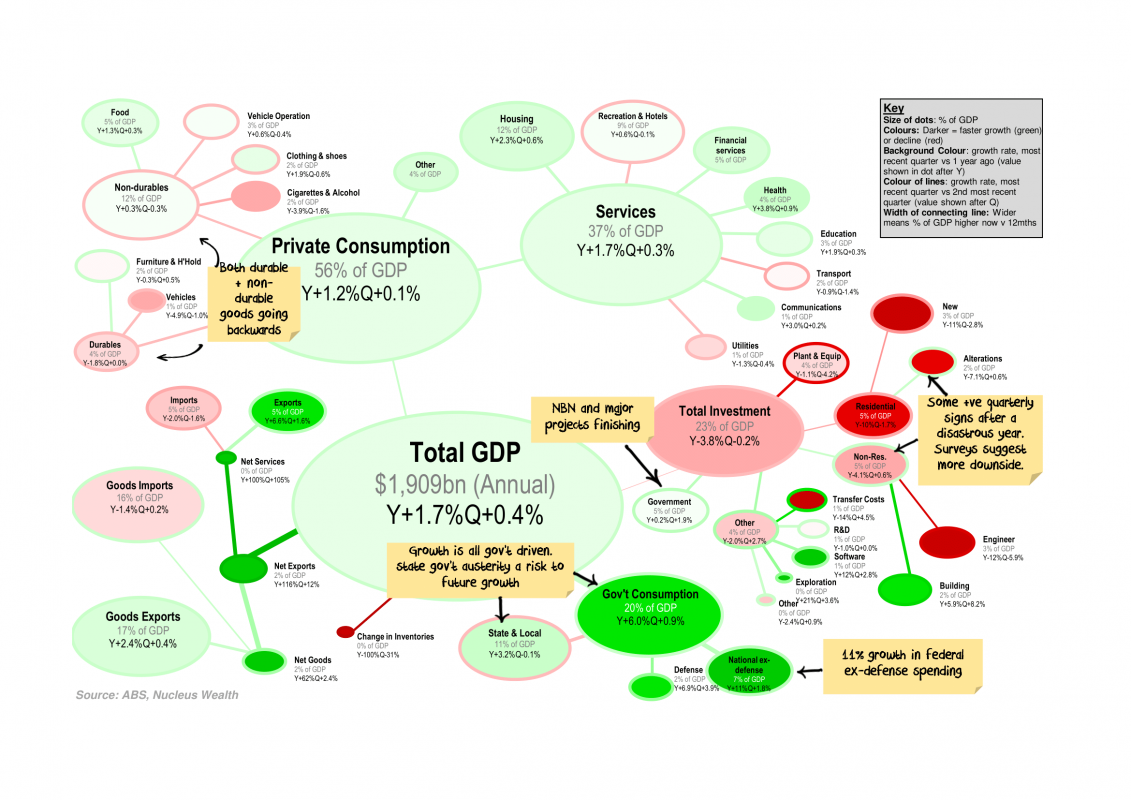

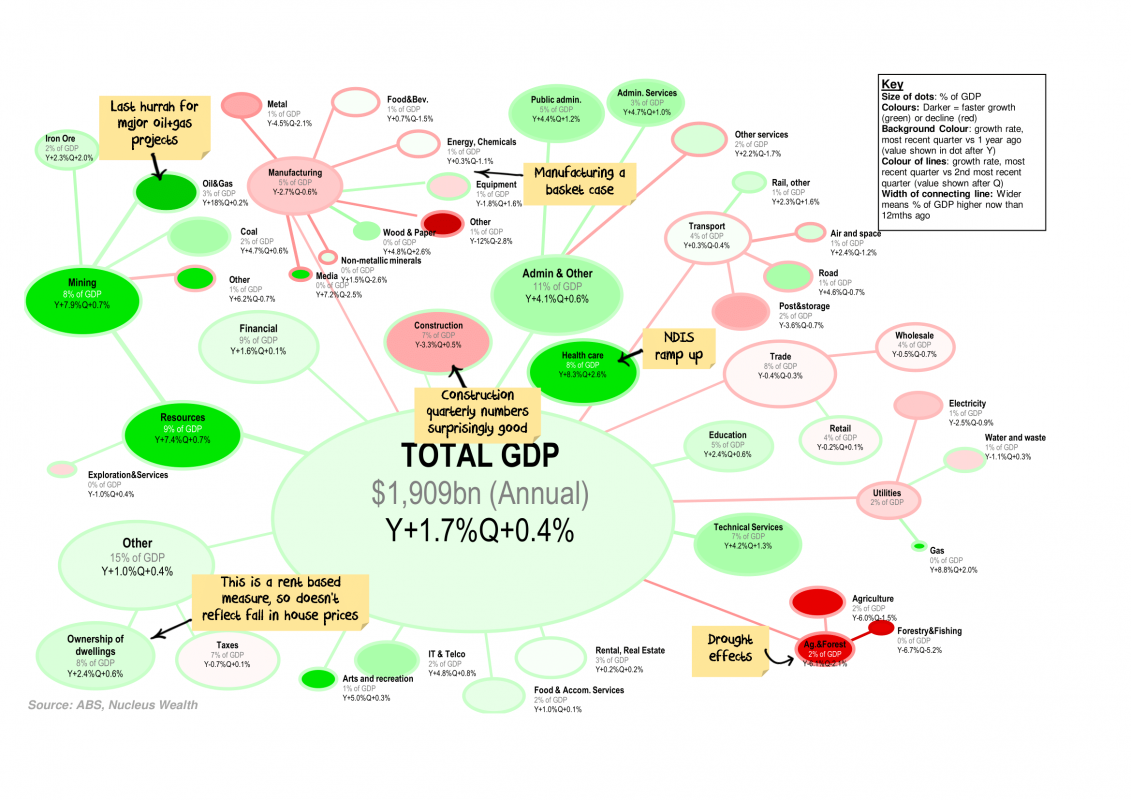

Every quarter I like to look at the changes in Australian GDP and which categories are responsible for the growth / decline. Each bubble represents a category of GDP proportionate to its size, colours represent the growth rate.

Click the charts for a large version and commentary:

This quarter the key takeaways include:

Damien Klassen from Nucleus Wealth penned this recently. It is an excellent summary of the critical issue in play – Can rising house prices drive the rest of the economy on their own without a construction boom? Note the disclaimer below.

I’ve written a few times recently about the imbalances in the Australian economy and how messed up the Australian housing cycle is. It looks as if the Australian economy is hanging on to positive growth based on one factor. Without that factor, there is significant economic downside. The one economic question that matters:

Can rising house prices drive the rest of the economy on their own without a construction boom?

There are three main areas to indicate if this is the case. Two have come out with more negative data since I last posted. One is a glass half empty: better current conditions, worse future conditions.

Can rising house prices drive the rest of the economy on their own without a construction boom?

For the optimists, the answer is a resounding yes. House prices have not only stopped falling but have risen over the last few months. Buyer queues are out the door for limited supply which will inevitably mean rising house prices. And Morrison’s 95% lending for first home buyers hasn’t even begun yet. Investors will follow first home buyers, which will lead prices higher and then upgraders will start buying again. Rising property prices will mean consumers will start spending once more, construction will recommence, and a new Australian economic growth cycle will begin.

It would appear that the Federal Government has this belief.

Can rising house prices drive the rest of the economy on their own without a construction boom?

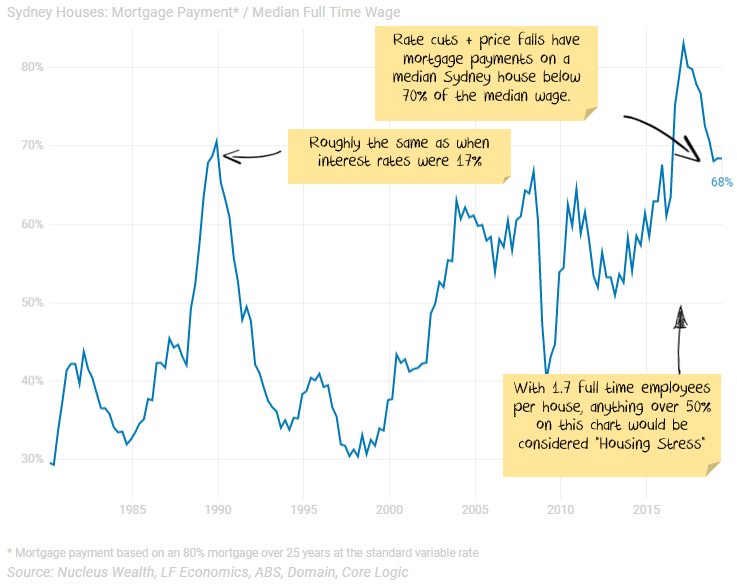

The poorer arguments mounted by pessimists tend to have a moral angle: house prices are too high for children to afford, they will have to come down to a level that an ordinary person on a regular salary can afford. If that occurs, house prices will fall 30-40%. While these arguments are compelling from a social justice perspective, or on a long term basis, the same arguments have been valid for 15 years. Timing is important:

Other weak arguments base the downturn on extrapolating no intervention from governments. We know the current government is hell-bent on intervening in the housing market.

The better argument is that even if construction approvals rebound, employment would fall for at least another year as the construction decisions made over the past two years affect the number of people employed. And construction approvals are not rebounding.

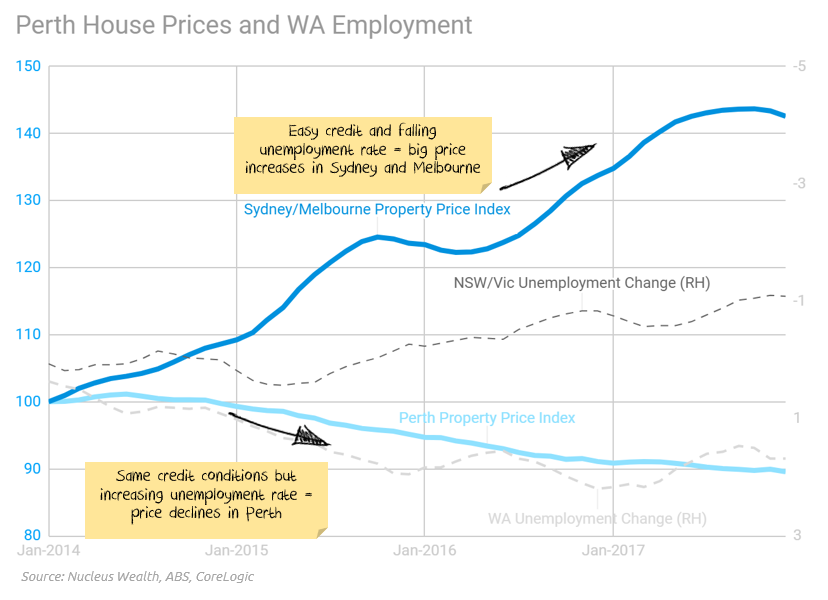

Rising unemployment in Perth led to a 10% house price fall in the 2012-2017 period while Sydney/Melbourne house prices boomed. What is to stop the same fate for Australia as a whole?

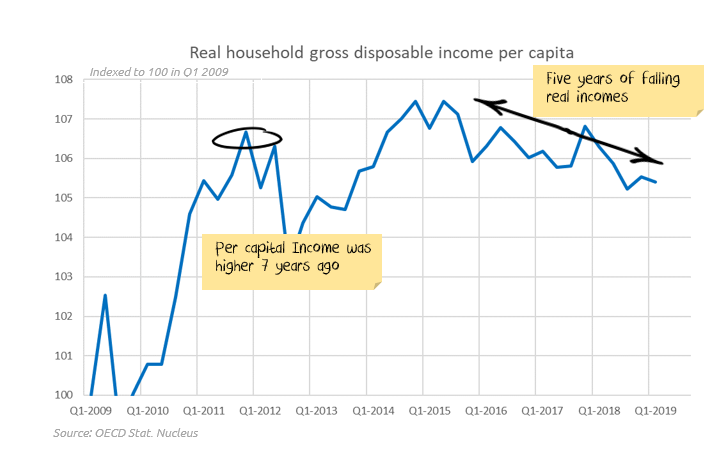

Per capita income has gone nowhere for 7 years, so it is hard to see any rescue coming from that front:

If rising unemployment does mean house prices fall further, then there are a range of probable adverse effects. There are some seriously negative economic effects if the effects snowball. And we won’t even get started about the impact on a fragile Australian housing market if an international shock (Brexit, Trade wars, Hong Kong unrest, corporate debt accidents, European recession) hits.

You don’t need to buy into the entire negative story to be cautious. If employment holds up, then the positive story has a chance (assuming benign international conditions). But, if unemployment rises, then Australia won’t need a global shock to see house prices resume a downward path.

When presented with an asset class that has limited upside in positive scenarios and significant downside in adverse scenarios, I usually opt to avoid the asset class and look for returns elsewhere.

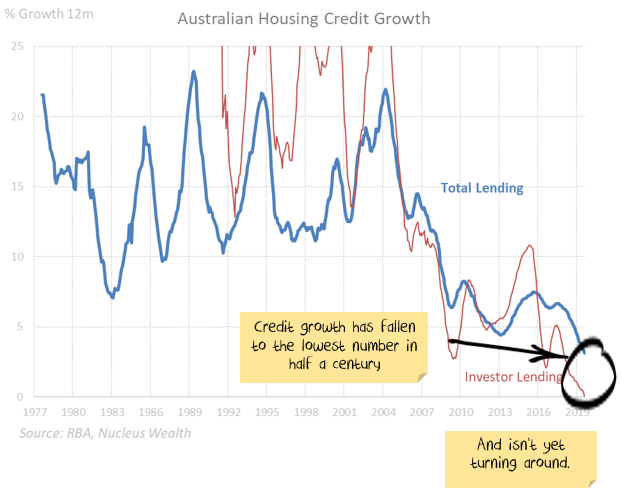

The Royal Commission into banking reversed the credit boom and was enough to see house prices down around 10%. This came even while most other factors affecting house prices were still positive.

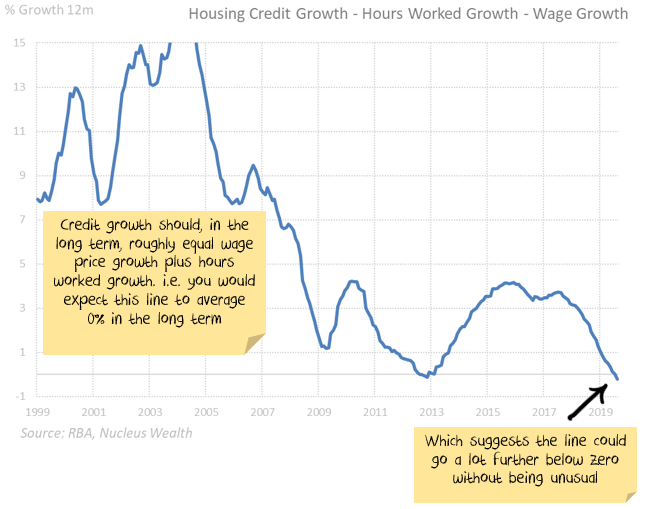

Will the Morrison government manage to get the already over-levered Australian households to take on even more debt? If I am too bearish, particularly in the short term, this is where you will see the effects. So far there are none:

On the regulatory front, the Westpac v ASIC responsible lending court case win for Westpac has the potential to lead to easy lending conditions. ASIC is taking the case to the Federal court, so we are in limbo for some time.

There is not enough space here to go into the detailed links between house prices and unemployment. Indicatively, during the 2012 to 2017 housing boom years, the Perth market faced mostly the same factors as Sydney/Melbourne except for (a) slightly weaker population growth and (b) rising unemployment. And Perth property prices fell more than 10% while the rest of Australia boomed.

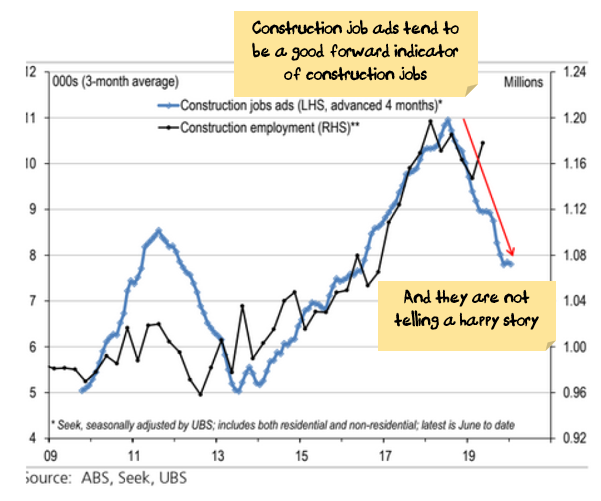

We are expecting considerable job losses in the construction sector.

Having said that, construction jobs have been resilient so far. Forward indicators (job ads and approvals) continue to point to sizeable job losses.

Source: ABS, Seek, UBS

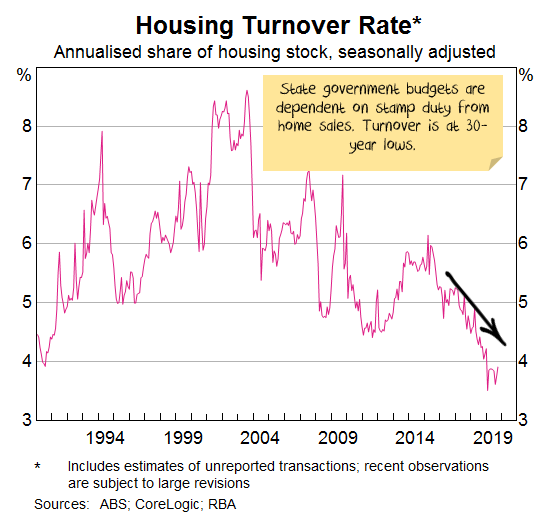

Add to this scenario, job losses from state government austerity as budgets have been struck by falling transaction numbers in the housing market:

Finally, any global shock (trade wars, recessions, debt crises) is likely to be transmitted to the housing market through higher unemployment.

Foreign demand was substantial for both the boom and the bust:

China cracking down on its capital account and deteriorating relations between Australia and China suggests foreign investment will remain low.

The question is whether Hong Kong unrest translates to increased demand for Australian property.

So, the answer to the one question

Can rising house prices drive the rest of the economy on their own without a construction boom?

will be found in whether increases in unemployment remain contained.

I’m skeptical. But if I’m wrong, the charts above will be where we will see the signs.

Recent data suggest my skepticism is warranted.

Disclaimer

This blog contains general information and does not take into account your personal objectives, financial situation or needs. Past performance is not an indication of future performance. Damien Klassen is an authorised representative of Nucleus Wealth Management, a Corporate Authorised Representative of Nucleus Advice Pty Ltd – AFSL 515796.