We look at the latest from the RBA in the light of current international issues.

https://www.rba.gov.au/media-releases/2020/mr-20-01.html

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We look at the latest from the RBA in the light of current international issues.

https://www.rba.gov.au/media-releases/2020/mr-20-01.html

Its the last day of January, so the RBA has released their credit aggregates to the end of December 2019 and APRA released their latest modified Monthly Authorised Deposit-taking Institution Statistics.

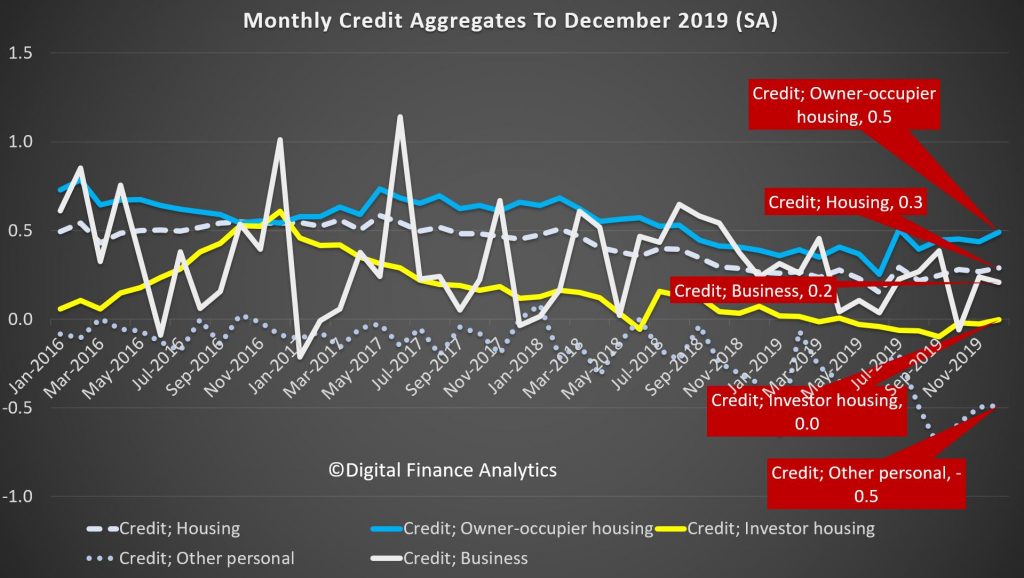

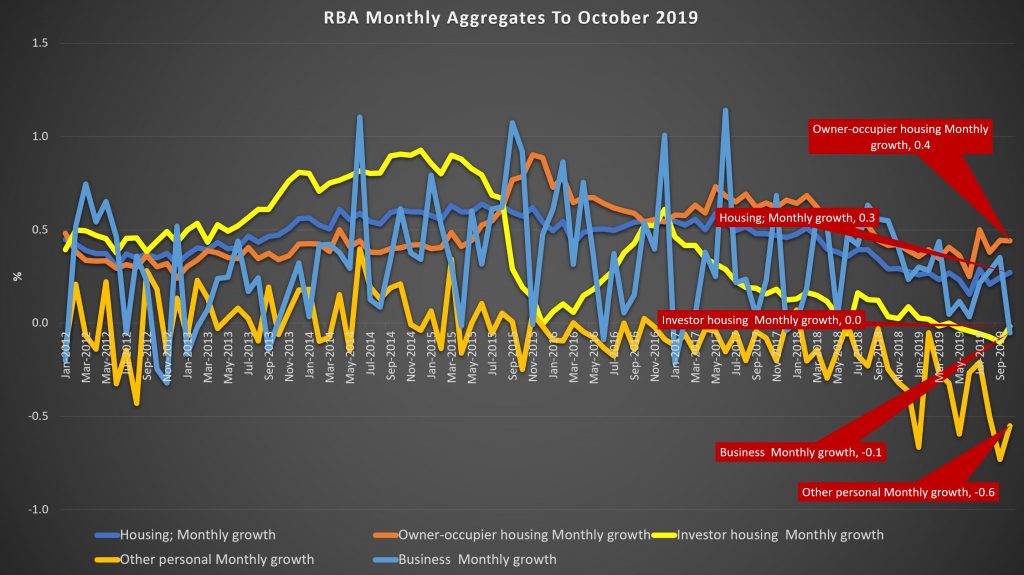

Looking at the RBA data first, over the past month housing credit stock (the net of new loans, repaid loans and existing loans) rose by 0.3%, driven by owner occupied housing up 0.5%, while investment loans slide just a little, but rounded to zero. Personal credit slid another 0.5% while business credit rose 0.2% compared with the previous month. These monthly series are always noisy, and they are also seasonally adjusted by the RBA, so there is plenty of latitude when interpreting them.

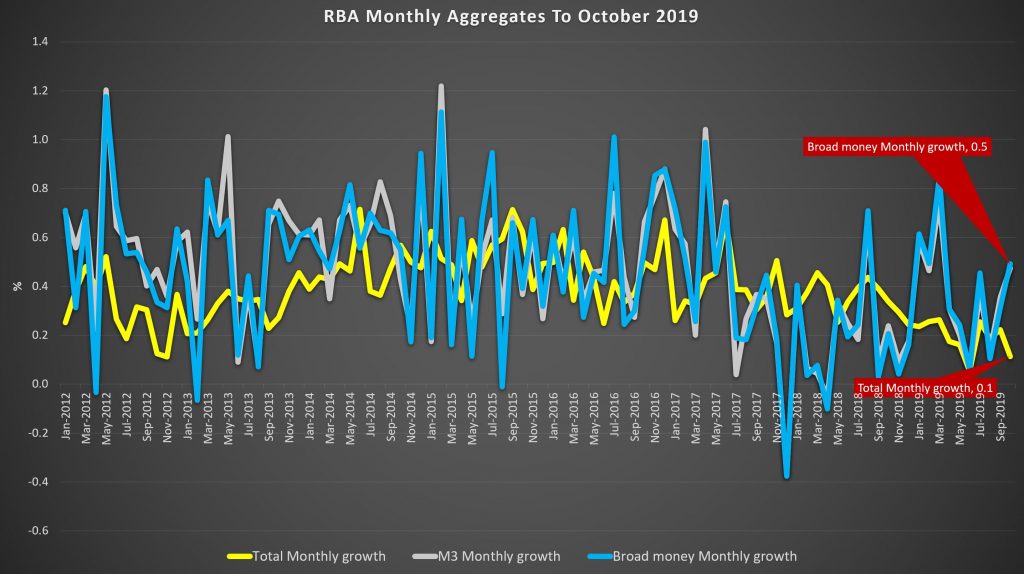

But overall, total credit grew by 0.2% over the month, while the broad measure of money rose just 0.1%.

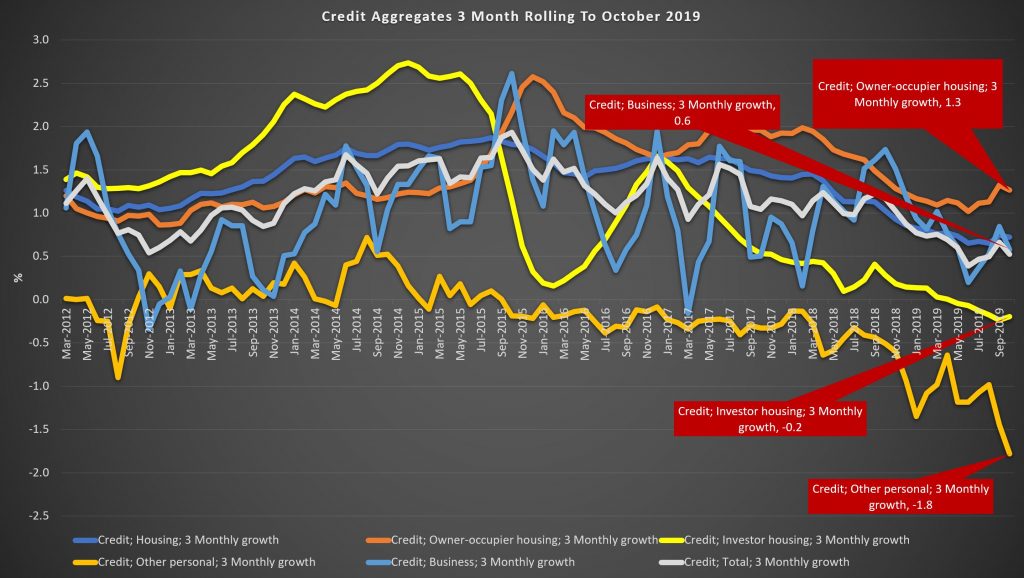

The three month derived series helps to spotlight the key movements over the past few years. Credit growth for owner occupation rose 1.4%, and it has been rising a little since the May election, and the loosening of lending standards by APRA, and lower rates later. Its low point was a quarterly rise of 1% a few months ago. Investment lending continues to shrink, at 0.1%, but the rate of decline has eased from September, again thanks to loser lending standards. However this also reflects a net loan repayment scheme that many households, in the current tricky environment are on. Personal lending is still shrinking, falling at 1.6%, though the rate of slowing is reversing from a low of minus 1.8%. Business credit is o.4%, but has been falling since October where it stood at 1.8%, reflecting a serious downturn in business confidence and demand for credit. For businesses, the economic backdrop has been a challenging one. The global economy is sluggish and household spending is soft. In this environment business investment in the real economy has lost momentum across the non-mining sectors – weighing on credit demand. Rolling total credit for 3 months is 0.6%, up from a low of 0.5% a couple of months back.

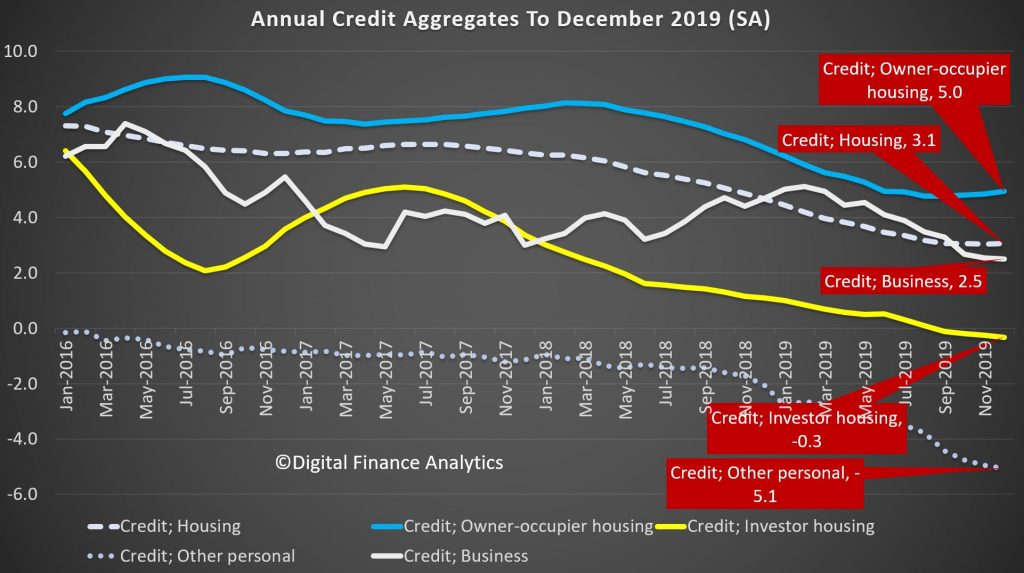

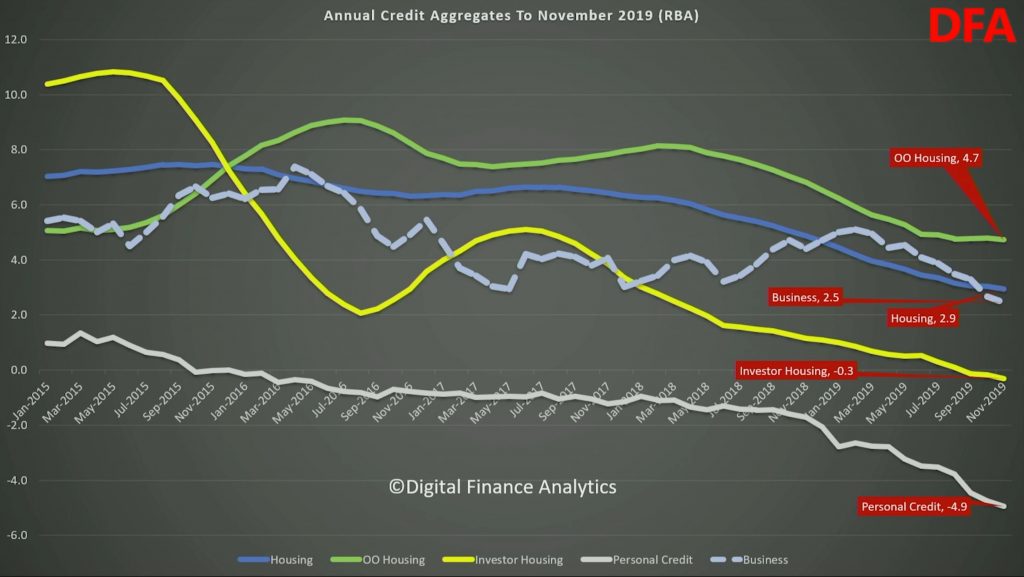

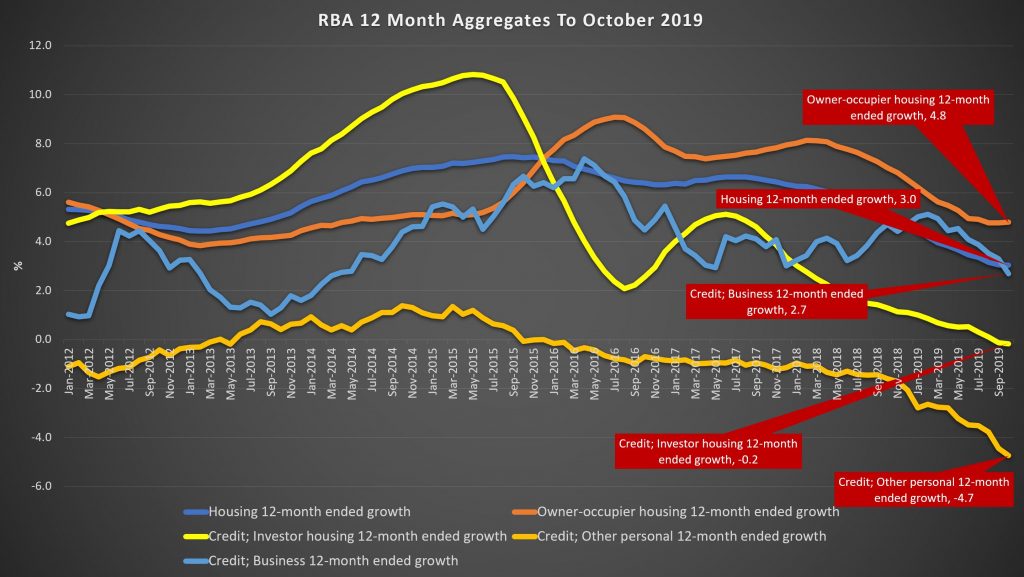

Turning to the annualised data series, housing credit is at 3.1% up from 3.03% last month. Annual owner occupied housing is up 5% from a low of 4.7% in August, while investor loans are down 0.3%, which is the largest fall we have ever seen. Personal credit is 5.1% lower, and that is another record low, while business credit grew by 2.5% on an annual basis, which is the lowest its been for years.

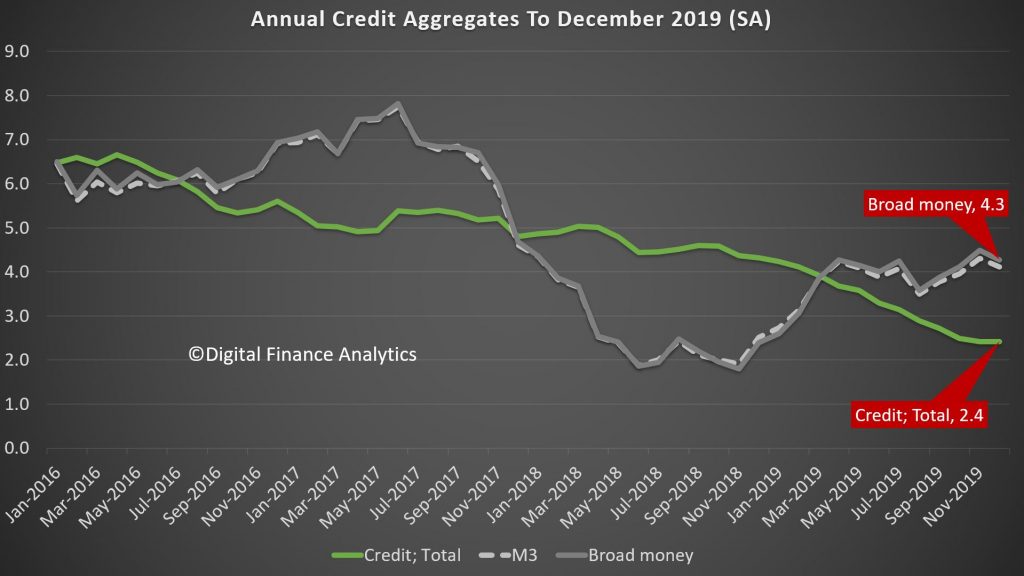

As a result, total credit grew 2.4%, which is the lowest level of growth since 2010, following the global financial crisis. Credit growth has progressively eased after peaking at 6.7% during the 2015/16 financial year. Key to the slowdown was the housing downturn as the cycle matured and lending conditions tightened. On the other hand, broad money is growing at 4.3%, and is significantly higher than last year, which we attribute to the positive terms of trade (thanks to iron ore prices and commodity volumes and RBA open market operations).

So while sentiment bounced after the May Federal election, which removed uncertainty around tax policy for the sector, as the RBA has lowered rates since June by a total of 75bps, with further cuts likely and APRA easing mortgage serviceability assessments; growth is anemaic, and of course sentiment is now in the gutter, thanks to the bushfires, coronavirus, and lack of income growth. While many analysts are predicting a bounce in credit in 2020, and a sentiment turnaround, pressure on global commodity prices and weak international tourism, as well as the drought are likely to take their toll.

We are also seeing more applications for mortgages being received, but also higher rejection rates, so we will see if this will really lead to stronger credit. And given such weak credit, we still question the veracity of the CoreLogic price series, which seems to exist in a different world. Our data supports much weaker average home price growth.

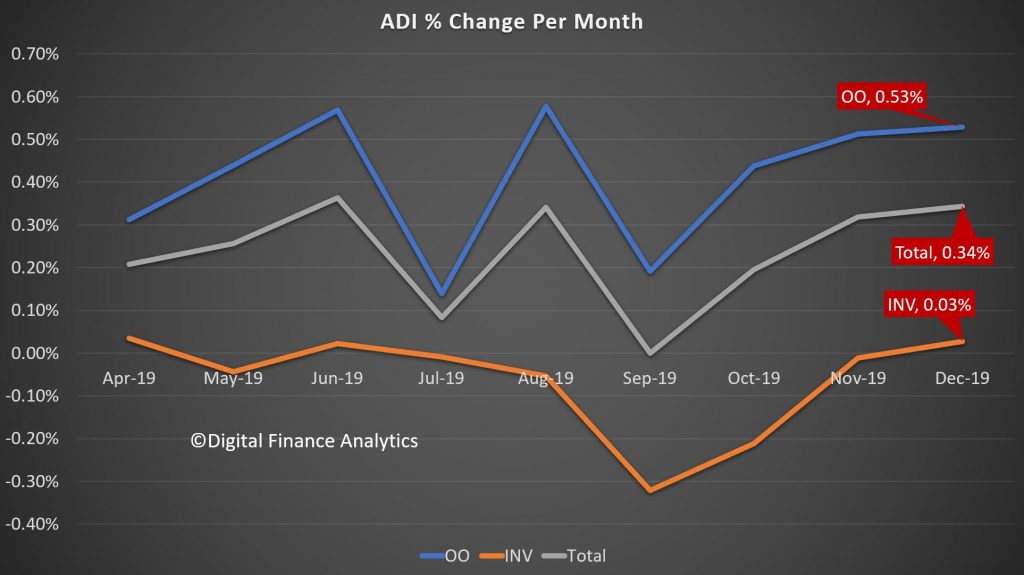

Turning to the APRA Bank series, the total value of mortgages lent (in original terms) grew by 0.34%, which is stronger than the market (0.3%), suggesting that the banks may be clawing back some business from the non-bank lenders, who have been quite active over the past couple of years. Within that owner occupied loans rose by 0.53% in the month, while investment loans grew 0.3%. The rate of growth remains slow.

The total stock of loans did rise, up around $5 billion dollars to $1.09 trillion for owner occupied loans, and up only slightly to $644 billion, giving total exposures of $1.74 trillion, a record. The mix of investment loans fell to a low of 36.9%.

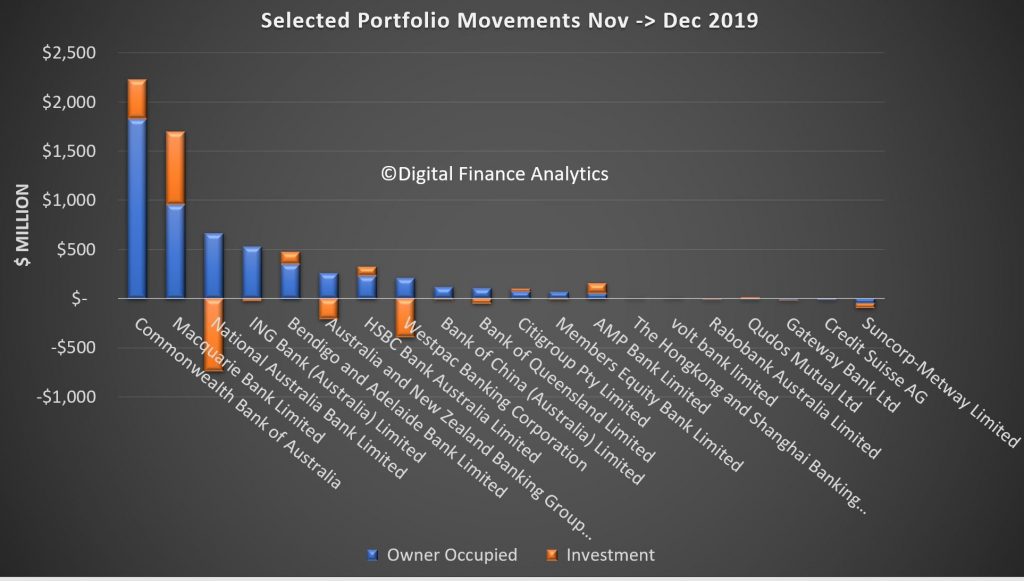

Finally we can examine the portfolio movements by individual lender, which reveals that, according to the data submitted by lenders (which may include some adjustments) CBA grew their portfolio the strongest, up more than $2.2 billion, including both owner occupied and investor loans, followed by Macquarie which continues to drive investor lending very hard, while NAB, Westpac and ANZ grew their owner occupied loans, while dropping their investor lending balances. Bendigo Bank, AMP and HSBC were also active in growing their investor loans. Neo-lender Volt Bank made an appearance in our selected list, while Suncorp dropped the value of both their owner occupied and investor loans. This highlights that lenders are steering quite different paths in their underwriting and marketing strategies. Time will tell whether the new loans being written are more risky.

And in closing, its interesting to note APRA’s release today saying that

The Australian Prudential Regulation Authority (APRA) will expand its quarterly property data publication to include new and more detailed statistics on residential mortgage lending.

In a letter to authorised deposit-taking institutions (ADIs) today, APRA confirmed the next edition of its Quarterly Authorised Deposit-taking Institution Property Exposures (QPEX) publication would include additional aggregate data on residential property exposures and new housing loan approvals.

The decision is part of APRA’s to move towards greater transparency, and will enable more in-depth market analysis by industry analysts, media and other interested parties.

The updated QPEX publication will also feature:

• reporting of additional sector-level statistics for the ‘Mutual ADI’ category; and

• clarified definitions for reported items, specifically for unreported loan-to-value ratios.

APRA Executive Director of Cross-Industry Insights and Data Division, Sean Carmody said: “APRA’s updated Corporate Plan commits us to increasing transparency of both our own operations and the industries we regulate. One of the key ways we can do that is by releasing more of the data we collect.

“With the ADI sector heavily reliant on commercial and residential property lending, enhancing QPEX will translate to greater transparency and sharper insights into one of the most crucial contributors to the economy.”

Consultation is continuing separately on a proposal for quarterly publication data sources to become non-confidential. This would mean that more of the underlying data may be disclosed to the public on a dis-aggregated basis. While this consultation remains open, APRA will continue to publish industry and peer group aggregate data, and mask data in QPEX where an individual entity’s confidential information could be revealed.

The next QPEX will be published on 10 March 2020 for the December 2019 reference period.

The letter to industry and non-confidential submissions can be found at: https://www.apra.gov.au/authorised-deposit-taking-institution-publications-refresh

We believe that the dis-aggregated data should indeed be released – because sunlight remains the best disinfectant to quote Supreme Court Justice Louis Brandeis. Compared with the disclosures in other markets, Australia is so behind the times, on the pretext of confidentially. So we endorse the need for more granular data to help separate the lending sheep from the lending goats.

The latest Jolly Swagman podcast is highly recommended. Ex RBA chief argues that the current RBA’s approach of targeting the wealth effect as a channel for monetary policy is “least attractive channel” because it risks igniting housing booms.

Ian Macfarlane was Governor of the Reserve Bank of Australia from 1996 to 2006. He is the author of The Search For Stability and Ten Remarkable Australians.

Jonathan Kearns The RBA’s Head of Financial Stability spoke at Business Forum at the 32nd Australasian Finance and Banking Conference.

Banks have a central role in facilitating activity in modern economies. While that role is just as important today as it was prior to the financial crisis, the nature of banking has changed. And given developments in technology, data and competition, banking will need to continue to evolve. Today, I am going to discuss these changes in banking, past and prospective.

To put these changes in context, first I want to consider the special role that banks play in the economy. I will then focus on how banks have changed in Australia since the financial crisis, and outline some of the issues facing banks today that could see banking change in the coming years (my remarks for Australia apply to all Authorised Deposit-taking Institutions, ADIs, but to fit with the international literature I will use the term ‘banks’ and also because the word banks rolls off the tongue more easily). While the Australian banking system remained well capitalised and profitable through the financial crisis and by and large continued to service the economy, it was still affected and the lessons learned internationally have resulted in important changes to Australian banks.

Four characteristics jointly define why banks have a special role in the economy today:

The first three of these defining characteristics all relate to three key benefits that come from public authorities. In particular, banks have: (i) the ability to accept deposits; (ii) an account at the central bank; and (iii) access to emergency central bank liquidity. The three benefits provide banks with a special role in the economy.

Bank deposits become a risk-free asset for households and business in Australia because they have an effective government ‘guarantee’ (up to a limit) and receive the first claim on banks’ assets.[1] Bank deposits are liquid because banks, in addition to the cash banks hold for depositors’ physical withdrawals, have accounts at the central bank which enable their customers to make direct payments to the customers of other banks.[2] It is because banks have accounts at the central bank that they are central in the payments system. Further, even in tumultuous times, deposits are liquid because of banks’ access to convert (potentially illiquid) assets into highly liquid deposits at the central bank and, in the worst case, because the Financial Claims Scheme pays out deposits in a timely manner. These policies give depositors the confidence that their deposits are safe and can be withdrawn on demand.

These benefits help to mitigate the core risk of banking: maturity and liquidity transformation creates the risk of a run. With access to stable deposits and central bank liquidity, banks are able to safely do more maturity and liquidity transformation.

These three benefits go hand in hand with banks’ critical role in taking deposits and intermediating and financing economic activity. Because of this role, banks are subject to prudential regulation. Prudential regulation has benefits and costs. In economics, we typically try to equate marginal costs and benefits when determining how much of something we should have.

From society’s perspective, prudential regulation has benefits in that it reduces the risks to depositors and to the economy from bank failures. But there are also ‘costs’ to more regulation, notably that it makes banks’ intermediation more expensive. To calibrate the optimal amount of regulation, policymakers try to balance these costs and benefits.

We can also think of the costs and benefits of prudential regulation from the perspective of banks. For banks, regulation can increase their costs. But it also provides banks with significant benefits. Even in normal times, because they are prudentially regulated, banks can take in deposits that are a relatively cheap source of stable funding. But the benefits are even greater in financial turmoil, when having deposits that are relatively sticky and access to central bank liquidity is particularly valuable.

Globally, the financial crisis delivered a severe shock to the banking system, and to the economy, that far exceeded what was generally thought likely or even possible. Before the crisis, it was widely thought that banks had become more sophisticated in managing their risk and that financial and macroeconomic volatility had declined. As a result, a severe financial shock was judged to be exceptionally unlikely. But then the financial crisis came along, which internationally resulted in bank failures and severe recessions. This led to a re-evaluation of how likely and extreme banking shocks could be. Globally, authorities recognised that the benefits of tighter prudential regulation – avoiding banking crises – would outweigh the costs.[3]

Similarly, from the banks’ perspective, it became apparent that the benefits that came with their special role in the economy were even greater than previously appreciated, because shocks to the financial system, and hence the impact on their balance sheets, could be more severe than was previously thought likely. Indeed, in some countries the benefits of being a bank were so great that some non-banks converted to being a bank to get those benefits.[4]

The international reassessment of banking regulation led to the ‘Basel III’ reforms. The reforms focused on improving banks’ resilience, limiting banks’ maturity transformation and ensuring that they improved their credit assessment and management of risk.

Despite the extreme shock globally, the Australian banking system performed remarkably well through the crisis. In Australia, there was significant fiscal and monetary stimulus, and various measures were enacted to support the banking system, and there was also a bit of luck. However, the good performance of the Australian banks, to a large extent, reflected the strength of prudential regulation prior to the crisis and banks’ own management of risks. But given the lessons learned internationally, it was apparent that there were still improvements to be made in Australian banking.

The Basel III reforms have been adopted in Australia, on or ahead of schedule, strengthening a prudential regime that was already tighter than global minimum standards. The reforms encouraged banks to put greater emphasis on incorporating the cost of capital and liquidity into all aspects of their operations.

Tier 1 capital ratios have increased by 50 per cent since 2006, with most of this being CET1 capital (Graph 1). At current levels, banks’ Tier 1 capital ratios are estimated to be well within the range that research has shown would have been sufficient to withstand the majority of past international banking crises.[5]

A consequence of this has been a reduction in risk-taking. Banks sold some of their higher risk assets that were not providing sufficient rates of return. Notably, Australian banks have pulled back from international banking activity in the United Kingdom and Asia, where the returns had been disappointing and had often not met banks’ cost of capital (Graph 2). They also expanded their exposure to mortgage lending, which requires much less capital because of the collateral protecting these loans.[6] Most of the major banks have also sought to divest their life insurance and wealth management operations. These divestments were precipitated by changes in capital rules that required more capital to be held to support intra-group investments. But they also reflected that these investments had failed to deliver the anticipated benefits, including from cross-selling, and an appreciation of the non-financial risks that they involved.

The introduction of liquidity regulations – the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) – contributed to a substantial rise in the banks’ liquid asset holdings, to around 20 per cent of total assets (from 15 per cent pre-crisis) (Graph 1). The vast majority of this increase has comprised High Quality Liquid Assets (HQLA), in particular, government securities.

The liquidity regulations contributed to a reduction in liquidity and maturity transformation. This has substantially changed the composition of banks’ liabilities. Banks have significantly reduced their use of (more flighty) short-term debt, while increasing their use of (sticky) domestic deposits (Graph 2). By applying transfer pricing across their whole businesses, banks are now seeking to ensure that all lending decisions take account of the extent of liquidity or maturity transformation.

The regulatory changes and banks’ better recognition of financial risks and returns have restricted growth in Australian banks’ (headline) profits since 2014. The divestment of their wealth management businesses reduced total profits. However, even focusing on return on assets (ROA), profitability has declined by more than one-fifth since the financial crisis (Graph 3). Two important contributors have been the increased holdings of (safer but lower yielding) HQLA and a more general decline in risk-taking and hence reward. The fall in profitability has been even larger (about one-third) when measured by return on equity (ROE), because of the increase in banks’ equity outstanding.

However, the decline in profitability does not equate to reduced costs of financial intermediation for customers. Rather, the spread between lending rates and funding costs (or the cash rate) has increased a little. This combination of higher costs to customers and lower profits to banks reflects the (anticipated) costs of tighter prudential regulation.[7]

Banks’ absolute cost of equity (COE) has also declined. The decline in absolute COE has, however, been less pronounced than the fall in risk-free rates (Australian Government Security (AGS) yields). So the risk premium on banks’ equity has actually risen. This is consistent with equity investors having revised up their assessment of the riskiness of investing in banks, even as banks have been forced to deleverage and hold more liquid assets.

Since ROE has fallen by more than COE, banks have become less valuable. One way to think about this is that, since banks are now obliged to hold more equity (that is, they are less leveraged), they generate a lower expected return on equity in excess of the risk-free rate. If the cost of financing a bank were independent of the mix of debt and equity, that is, we lived in a world where the Modigliani-Miller theorem held,[8] then issuing more equity would reduce the cost of the bank’s debt and equity, so keeping the total cost of funding unchanged. There are many reasons why the Modigliani-Miller theorem may not hold, including government protection of banks’ deposits. This means that deposits don’t become less risky as the banks issue more equity, and so the cost of debt doesn’t decline. But with the bank issuing more relatively expensive equity, the cost of funding banks rises overall, which explains why they become less profitable when they are obliged to reduce their debt-equity ratios.

Despite the decline in ROE, Australian banks continue to generate ROE well in excess of their risk-adjusted COE. They trade at price-to-book ratios exceeding one, higher than banks in many other countries around the world, highlighting the value that investors still see in Australian banks.

While the past decade has seen substantial changes in banking in Australia, there are several issues facing banks that could potentially lead to even greater change in coming years. The first is the general increased access to, and ability to process, vast quantities of data. This is facilitating the emergence of new, technology-driven competitors to banks which could potentially impact their dominant position in the financial system.[9] A second is the impact of tighter regulation on banks. A third is expectations for banks’ obligations to the community.

A substantial influence on banking at the moment is the rapid pace of technological change. We are currently seeing a massive increase in the availability of, and ability to process, data. This could erode, or maybe even eradicate, banks’ historical advantage in credit risk assessment. There are two parts to this: regulatory changes mean that banks’ private customer data can be made available to others and, second, that non-banks have some data that is useful for banking business.

The first part is the Consumer Data Right (CDR) and Open Banking. The CDR makes it clear that the consumer owns their own data and Open Banking provides bank customers with the ability to share their account data with other institutions, including non-banks.[10] Using these data, a non-bank could, for example, suggest accounts or cards that better suit a customer’s needs or use the information for detailed credit assessment. In addition, Comprehensive Credit Reporting (CCR) will provide (bank and) non-bank lenders with greater information about potential borrowers’ credit history.[11]

The second part is non-banks’ data that are becoming more valuable for ‘banking’ services. Much of this data is collected by ‘big tech’ firms such as Google, Apple and Facebook. For example, PayPal and Amazon have substantial data on the sales of their merchant customers, while social networking interactions can be used to predict borrowers’ commitment to repay their loans.[12] Technology firms for which collecting and analysing data is in their DNA are a new type of competitor for banks that have historically struggled to take full advantage of the private data they hold. How well individual banks respond to technology challenges will no doubt influence their relative success.

Technological changes in payments are also challenging banks’ core role in facilitating payments. To date, this erosion has been most apparent in emerging market economies where payments systems were not meeting customers’ needs. For example, in China and several African countries, online marketplaces or mobile phone companies have come to dominate payments (largely bypassing the banks). However, in Australia, and other developed economies, existing electronic payment systems (including new real-time payment systems such as Australia’s New Payments Platform (NPP)) are already meeting customers’ needs. Still, new payments providers engaging with banks and card companies could reduce the banking systems’ revenue from the payments system.

Where banks have provided poor service, such as in cross-border transfers, new competitors may capture market share. This is already occurring with specialist firms undercutting the banks’ very wide spreads in cross-border payments. Cross-border payments are also a potential entry point for ‘stablecoins’ which could be used to make low-cost payments across borders, completely bypassing the banking system.[13]

A second issue for banks is the impact that tighter regulation has on the cost of intermediating borrowing and saving. Tighter prudential regulations, such as holding more capital and liquid assets, was anticipated by regulators to increase the cost of intermediation.[14] These expected higher costs were taken into account in calibrating regulations and are judged to be appropriate given the reduced chance of financial crises. But higher costs for banks can push more borrowing to non-bank financial institutions or into capital markets. The share of credit intermediated by non-banks is currently small in Australia and so there are limited implications for financial stability. But if it were to grow significantly, we would have to carefully assess what this might mean for financial stability.

A third issue for banks comes from expectations in terms of their obligations to the community. Banks will need to adapt to a range of reforms designed to strengthen governance and culture at financial institutions. These should lead to less and better-managed non-financial risk. The measures include the Banking Executive Accountability Regime (BEAR), the Australian Prudential Regulation Authority’s (APRA) proposed standards for how variable remuneration is structured and the response required to shortcomings identified by the Financial Services Royal Commission. While these measures require banks to adapt, they will make banks more resilient, increasing their chance of responding to new competitors.

Summing up, while banks are facing various challenges, their special role in the economy gives them several advantages. Deposits are overall a lower cost, and stable, form of funding. And providing depositors with a liquid asset puts banks at the centre of the payments system and gives them a connection to customers.

Banks have adapted following the financial crisis. And they will need to continue to evolve given the challenges they will continue to face in the coming years. Greater availability of data reduces one of banks’ advantages. And changes in technology introduce a different type of competitor. For now, the banking system remains core to modern economies. Australian banks in particular serve critical functions in the Australian economy by providing credit intermediation and more generally facilitating economic activity. Australian banks are profitable and resilient and a strong banking sector has contributed to Australia’s extended run of economic growth. It’s hard to imagine a modern economy without a banking sector. The eight largest Australian banks can trace their history back, on average, over 140 years. But what role today’s individual banks play in the provision of banking services in the coming decades will depend on how they adapt to the challenges they face today.

We look at the latest Credit Aggregates from the RBA. Credit growth continues to slow – so will home price growth….

RBA’s minutes out today. Clear signals of more action next year, despite the perceived gentle turning point.

Members noted that interest rates were very low around the world, with a number of central banks having eased monetary policy over recent months in response to downside risks to the global economy and subdued inflation. Market expectations for further policy easing by central banks had been scaled back over previous months, with concerns about the downside risks receding a little. The US Federal Reserve had indicated that any further reduction in the federal funds rate would require a material change in the economic outlook. Reflecting these developments, market pricing had pointed to a narrowing in the degree of uncertainty around the expected path for the federal funds rate. Globally, long-term government bond yields had remained at very low levels, but had risen slightly in recent months as the prospects for further easing in monetary policy had diminished.

Financing conditions for corporations remained very accommodative. Robust demand for corporate debt had seen spreads narrow between corporate bond yields and government benchmarks. US equity prices had risen to new highs over the prior month, and had increased significantly since the start of the year relative to corporate earnings. Australian equity prices had also increased over the month, with the ASX 200 returning to the highs reached in July.

Foreign exchange rates had been little changed over the previous month. The People’s Bank of China had continued to implement targeted easing measures to support financing conditions, while remaining conscious of the need to contain financial stability risks. More broadly in emerging markets, central banks had eased monetary policy in recent months. However, political unrest remained a source of volatility for certain markets.

Members discussed the transmission mechanisms for monetary policy in Australia through financial markets. They noted that the reductions in the cash rate this year had been transmitted to broader financial conditions in ways that were consistent with the historical experience. Government bond yields had declined across the yield curve by more than 1 percentage point over the year, which had flowed through to lower funding costs across the economy. The Australian dollar had depreciated by around 6 per cent on a trade-weighted basis over the previous year and remained at the lower end of its range over recent times. The depreciation reflected the reduction in the interest differential between Australia and the major advanced economies, and had occurred despite an increase in the terms of trade over this period.

The recent reductions in the cash rate had been reflected in reduced funding costs for banks, and had flowed through to lower borrowing rates for households. Average variable mortgage rates had declined by around 65 basis points since the middle of the year, as competition for high-quality borrowers had remained strong and households continued to switch away from interest-only loans towards principal-and-interest loans at lower interest rates. These trends were expected to continue.

Consistent with lower mortgage interest rates and improved conditions in some housing markets, housing loan commitments had been increasing over the preceding few months, particularly for owner-occupiers. Growth in credit extended to owner-occupiers had also increased a little in recent months, while lending to investors had still been declining.

Members noted that data from lenders and information from liaison suggested that only a small share of borrowers had actively adjusted their scheduled mortgage payments following the reductions in interest rates. This was consistent with historical experience in the months immediately following a reduction in the cash rate. However, the available data indicated that, even over the longer term, as interest rates had declined borrowers had not been paying down their home loans more quickly than in the past. Mortgage payments as a share of aggregate household income had remained steady over recent years, although were slightly lower than in the first half of the decade.

Interest rates on loans to businesses had also declined to historically low levels. Despite the accommodative funding conditions for large businesses, growth in business debt had slowed, suggesting that demand for finance had softened. Lending to small businesses had been little changed over the preceding year, and access to finance for small businesses remained restricted.

Financial market pricing implied that market participants were expecting a further 25 basis point reduction in the cash rate by mid 2020.

Members discussed longer-term developments in the banking sector, including the strengthening of prudential requirements and the opportunities and challenges presented by advances in technology. Increased capital and liquidity after the financial crisis had made banks safer, but had also raised the relative attractiveness of some forms of market-based finance. Members discussed how advances in technology opened up new opportunities for banks, while also introducing potential new competitors.

Members observed that there had been little change in the global outlook over the previous month, but that some of the downside risks had receded. The near-term uncertainty around US trade policy had diminished because some of the previously planned tariff increases had been postponed and there was some prospect of an initial agreement between the United States and China. In addition, a ‘hard Brexit’ was assessed to be less likely.

Weak trade outcomes had continued to restrain growth in output, particularly for export-oriented economies. Survey indicators of manufacturing activity and export orders had stabilised, although they remained at low levels. Surveyed conditions in the services sector had declined as weaker external demand conditions had spilled over to sectors other than manufacturing. Members noted that even though geopolitical tensions had lessened recently, ongoing uncertainty had adversely affected the confidence and spending decisions of businesses. In the euro area, investment indicators had remained weak and business confidence had declined further since September. In the United States, consumer spending had been solid and employment growth had strengthened. Recently, some survey measures of manufacturing and services activity had increased a little, although industrial production and surveyed investment intentions had declined further in recent months.

Slower growth in China and India, largely unrelated to trade tensions, had also continued to be a feature of the recent pattern of global growth. In China, indicators of activity had been weaker in October. The real levels of retail sales and fixed asset investment had declined in October and the output of a broad range of industrial products had remained subdued. Members noted that, in response to slowing growth, Chinese authorities had eased minimum equity capital requirements for a variety of infrastructure projects (including port, road, rail, logistics and ecological protection projects). In India, the extended monsoon season had exacerbated existing weakness in the economy.

Inflation remained low in the major advanced economies and was below target despite tight labour markets and higher wages growth. Members observed that inflation had generally declined in Asia. In China, although headline consumer price inflation had increased, reflecting higher pork and other meat prices, core consumer price inflation had remained broadly unchanged at a relatively low rate.

Movements in commodity prices had been mixed since the previous meeting. The announcement of further measures to support steel-intensive economic activity in China had supported iron ore prices. At the same time, reports of a tightening in coal import controls in China had weighed on coking and thermal coal prices. Base metals prices had generally been lower since the previous meeting. Supply developments had continued to support the prices of some rural commodities.

A number of indicators suggested that growth in Australia had continued at a moderate pace since the middle of the year.

Members discussed survey measures of business confidence and conditions, and consumer sentiment. Business confidence had been below average and below its recent high levels in 2017 and early 2018, with the decline broadly based across industries. In contrast, survey measures of current business conditions had remained around average in recent months. Members noted that, historically, business conditions had been a better indicator of current economic activity than measures of business confidence, although its main advantage was timeliness rather than adding information not present in other indicators.

Growth in household disposable income had been weak over recent years, in both nominal and real terms. Members noted the importance of income growth as a key driver of consumption growth, although the earlier downturn in the housing market had also had a noticeable effect. The recent recovery in the established housing market was expected to be positive for consumption growth in the period ahead. Retailers in the Bank’s liaison program had suggested that nominal year-ended sales growth had been little changed in October and November.

Households’ expectations about future economic conditions had declined significantly since June. Members noted that the prolonged period of slow income growth had affected both consumer sentiment and growth in household consumption. Members observed that the decline in sentiment had coincided with an increasingly negative tone in news coverage of the economy. Notwithstanding this, households’ assessment of their own financial situation relative to a year earlier had remained broadly steady and somewhat above average. Historically, households’ assessments of their own finances generally have mattered more for household consumption decisions than their expectations about future economic conditions.

Conditions in established housing markets had continued to strengthen over the previous month. Housing prices had increased further in Melbourne and Sydney and this experience had been broadly based across both cities. Growth in housing prices had increased in Brisbane, Adelaide and regional areas, and housing prices had increased in Perth for the first time in two years. Non-price indicators had also pointed to a strengthening of conditions in the established housing market: auction clearance rates had remained high in Sydney and Melbourne, and auction volumes had picked up, albeit from a very low base.

By contrast, conditions in the new housing construction market had remained subdued. Residential construction activity was expected to continue to contract for several quarters, despite conditions in established housing markets having strengthened. Although there had been tentative signs of an improvement in conditions in some of the earlier stages of building activity, most indicators had remained weak, and most developer contacts in the liaison program were yet to report increased sales of new housing.

Business investment appeared to have eased in the September quarter. Information from the ABS Capital Expenditure (Capex) survey and preliminary non-residential construction data suggested that non-mining investment had decreased in the quarter, led by a marked decline in machinery & equipment investment. The Capex survey had provided the fourth estimate of investment intentions for 2019/20. Non-mining investment in 2019/20 was expected to be weaker than previously envisaged, while the survey continued to suggest that mining investment would contribute to growth over time, as firms invested to sustain – and in some instances expand – production.

Conditions in the labour market and wages data had shown little change since earlier in the year. The unemployment rate had remained around 5¼ per cent in October. Employment had declined by 19,000 in October as both full-time and part-time employment had declined. This had followed a sustained period of stronger-than-expected employment growth, which had remained at 2 per cent over the year despite the most recent monthly decline. The employment-to-population ratio and the participation rate had both remained at high levels. Over the previous few months, measures of the number of job advertisements had not changed much and firms’ near-term hiring intentions had remained broadly stable. Employment intentions among the Bank’s liaison contacts had generally been moderate, but had been weakest for firms exposed to residential construction.

The wage price index (WPI) had increased by 0.5 per cent in the September quarter, to be 2.2 per cent higher in year-ended terms, which was broadly as had been expected. Private sector wages growth had been 2.2 per cent in year-ended terms, and had levelled out in recent quarters following its gentle upward trend of the previous couple of years. This was consistent with information from liaison that a larger share of firms expected wages growth to be stable (rather than increasing) in the year ahead compared with a year or so earlier. Growth in the private sector WPI measure including bonuses and commissions had risen to 3 per cent in year-ended terms, which was the highest rate of growth since late 2012. This was consistent with information from liaison indicating that firms had been using temporary measures to retain and reward employees rather than permanent wage increases. Public sector wages growth had slowed in the September quarter following the one-off boost from the large wage outcome for Victorian nurses and midwives in the June quarter.

Turning to the policy decision, members noted that there had been little change in the economic outlook since the previous meeting. Globally, financial market conditions had been more positive, as market participants’ concerns about downside risks had receded a little and a number of central banks had eased monetary policy. There were also signs of stabilisation in several recent economic indicators, particularly for the manufacturing industry.

Domestically, after a soft patch in the second half of 2018, the Australian economy appeared to have reached a gentle turning point. GDP growth in the September quarter was expected to have continued at a similar pace since the beginning of the year. Most of the partial data preceding release of the national accounts had been in line with expectations, although non-mining investment had been weaker and public spending a little stronger. The outlook for growth in output continued to be supported by lower interest rates, the recent tax cuts, high levels of spending on infrastructure, a pick-up in the housing market and the improved outlook in the resources sector. However, members noted that weak growth in household income continued to present a downside risk to consumer spending, and that a low appetite for risk could be constraining businesses’ willingness to invest. The drought in many parts of Australia was another source of uncertainty for the outlook.

Members observed that labour market conditions had been broadly unchanged since earlier in the year. While this outcome had largely been in line with forecasts, it remained an area to monitor, both because an improving labour market was important for its own sake and also because a tightening in the labour market would put upward pressure on wages growth and inflation. It was noted that the current rate of wages growth was not consistent with inflation being sustainably within the target range, unless productivity growth was extraordinarily weak, nor was it consistent with consumption growth returning to trend.

Members discussed the transmission to the economy of the interest rate reductions since the middle of the year. They noted in particular that the available evidence suggested that more stimulatory monetary policy had been working through the usual channels of lower bond yields, a depreciation of the exchange rate and lower interest rates on mortgages. There had also been an effect on housing prices, increased housing turnover in the established market and some early signs of a stabilisation in housing construction activity. The upturn in the housing market was a positive development for the economy in the near term, but could become a source of concern if borrowing were to run too quickly ahead of income growth.

Members also discussed community concerns about the effect of lower interest rates on confidence, noting the decline in business confidence and consumer sentiment this year. This decline had coincided with heightened economic uncertainty globally, a period of softer growth in the Australian economy and weakness in household income growth, and the Board had responded to these factors in preceding months. While members recognised the negative confidence effects for some parts of the community arising from lower interest rates, they judged that the impact of these effects was unlikely to outweigh the stimulus to the economy from lower interest rates.

In assessing the evidence, members noted that monetary policy had long and variable lags and that indebted consumers may take some time before increasing their spending in response to a decline in their mortgage interest payments. More generally, the persistently low growth in household incomes continued to be a source of concern for the consumption outlook. Economic growth and the unemployment rate remained broadly consistent with the forecasts, but members agreed that it would be concerning if there were a deterioration in the outlook. As in other countries, there was no real concern of inflation rising quickly.

The Board concluded that the most appropriate approach would be to maintain the current stance of monetary policy and to continue to assess the evidence of how the easing in monetary policy was affecting the economy. Members agreed that it would be important to reassess the economic outlook in February 2020, when the Bank would prepare updated forecasts. As part of their deliberations, members noted that the Board had the ability to provide further stimulus to the economy, if required. Members also agreed that it was reasonable to expect that an extended period of low interest rates would be required in Australia to reach full employment and achieve the inflation target. The Board would continue to monitor developments, including in the labour market, and was prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

The Board decided to leave the cash rate unchanged at 0.75 per cent.

Governor Lowe spoke at the Australian Payments Network Summit yesterday. He discussed the rise of electronic transactions, especially though the New Payments Platform, the high relative costs of international retail payments, and the need for, and potential of a Strong Digital Identity System. He also highlighted the decline in cash transactions which now accounts for just around a quarter of day-to-day payments.

A recurring theme across these summits has been the need to improve customer outcomes. I am very pleased to see that this focus has been continued at this year’s summit. The focus on customer outcomes aligns very closely with the focus of the Payments System Board. The Board wants to see a payments system that is innovative, dynamic, secure, competitive, and that serves the needs of all Australians.

Increasingly, this means that the payments system needs to support Australia’s digital economy. With the digital economy being an important key to Australia’s future economic prosperity, we need a payments system that is fit for purpose. We will only fully capitalise on the fantastic opportunities out there if we have a payments system that works for the digital economy. The positive news is that we have made some substantial progress in this direction over recent years and in some areas, Australia’s payments system is world class. However, in the fast-moving world of payments, things don’t stand still and there are some important areas we need to work on.

In my remarks today, I would like to do three things.

The first is to talk about some of the progress that has been made over recent years.

The second is to highlight a few areas where we would like to see more progress, particularly around payments and the digital economy.

And third, I will highlight some of the questions we will explore in next year’s review of retail payments regulation in Australia.

Over recent years there have been significant changes in the way that we make payments. We now have greater choice than ever before and payments are faster and more flexible than they used to be.

The launch of the New Payments Platform – the NPP – in early 2018 has been an important part of this journey. This new payments infrastructure allows consumers and businesses to make real-time, 24/7 payments with richer data and simple addressing using PayIDs.

After the NPP was launched, it got off to a slow start, but it is now hitting its stride. Monthly transaction values and volumes have both tripled over the past year (Graph 1). In November, the platform processed an average of 1.1 million payments each day, worth about $1.1 billion. The rate of take-up of fast retail payments in Australia is a little quicker than that in most other countries that have also introduced fast payments (Graph 2).

I expect that we will see a further pickup in usage once the CBA has delivered on core NPP functionality for all its customers. The slow implementation has been disappointing and we expect the required functionality to be available soon.

There are now 86 entities connected to the NPP, including 74 that are indirectly connected via a direct NPP participant. There are at least six non-ADI fintechs that are using the NPP’s capabilities to innovate and provide new services to customers. All up, approximately 66 million Australian bank accounts are now able to make and receive NPP payments.

Use of the PayID service has also been growing, with around 3.8 million PayIDs having been registered to date. If you have not already got a PayID, I encourage you to get one. I also encourage you to ask for other people’s PayIDs when making payments, as an alternative to asking for their BSB and account number. It is much easier and faster.

One specific example of where the NPP is bringing direct benefits to people is its use by the Australian Government, supported by the banking arm of the RBA, to make emergency payments. During the current bushfires, the government has been able to use the NPP to make immediate payments to people at a time when they are most in need, whether that be on the weekend or after their bank has shut for the night.

One other area of the payments system where we have seen significant change is the take-up of ‘tap-and-go’ payments. Around 80 per cent of point-of-sale transactions are now ‘tap-and-go’, which is a much higher share than in most other countries. This growth has been made possible by the acquirers rolling out new technology in their terminals and by the willingness of Australians to try something different. There has also been rapid take-up of mobile payments, including through wearable devices.

Progress has also been made on improving the safety of electronic payments, particularly in relation to fraud in card-not-present transactions. The rate of fraud is still too high, but it has come down recently (Graph 3). I would like to acknowledge the work that AusPayNet has done here to develop a new framework to tackle fraud. This framework strengthens the authentication requirements for certain types of transactions, including through the use of multi-factor authentication.[1] This will help reduce card-not-present fraud and support the continued growth in online commerce.

As our electronic payments system continues to improve, we are seeing a further shift away from cash and cheques. The RBA recently undertook the latest wave of our three-yearly consumer payments survey. We are still processing the results, but ahead of publishing them early next year, I thought I would show you the latest estimate on the use of cash (Graph 4). As expected, there has been a further trend decline in the use of cash, with cash now accounting for just around a quarter of day-to-day transactions, and most of these are for small-value payments. Given the other innovations that I just spoke about, I expect that this trend will continue.

The progress across these various fronts means that there is a positive story to be told about innovation in Australia’s payments system.

At the same time, though, there are still some significant gaps and areas in our payments system that need addressing and where progress would support the digital economy in Australia. I would like to talk about four of these.

The first of these is further industry work to realise the full potential of the NPP, including its data-rich capabilities.

The NPP infrastructure can help make electronic invoicing commonplace and help invoices be paid on time. It can also support significant improvement in business processes, as more data moves with the payment. Real-time settlement and posting of funds also enables some types of delivery-versus-payment, so that the seller can confirm receipt of funds and be confident in delivering goods or services to the buyer.

The layered architecture of the system was designed to promote competition and innovation in the development of new overlay services. Notwithstanding this, one of the consequences of the slower-than-promised rollout of the NPP by some of the major banks is that there has been less effort than expected on developing innovative functionality. Payment systems are networks, and participants need to know that others will be ready to receive payments and use the network. Some banks have been reluctant to commit time and funding to support the development of new functionality given that others have been slow to roll out their ‘day 1’ functionality. The slow rollout has also reduced the incentive for fintechs and others to develop new ideas. So we have not yet benefited from the full network effects.

The Payments System Board considered this issue as part of its industry consultation on NPP access and functionality, conducted with the ACCC earlier this year. As part of that review we recommended that NPPA – the industry-owned company formed to establish and operate the NPP – publish a roadmap and timeline for the additional functionality that it has agreed to develop. The inaugural roadmap was published in October and NPPA also introduced a ‘mandatory compliance framework’. Under this compliance framework, NPPA can designate core capabilities that NPP participants must support within a specified period of time, with penalties for non-compliance. This is a welcome development.

One important element of the roadmap is the development of a ‘mandated payments service’ to support recurring and ‘debit-like’ payments. This new service will allow account-holders to establish and manage standing authorisations (or consents) for payments to be initiated from their account by third parties. This will provide convenience, transparency and security for recurring or subscription-type payments and a range of other payments.

Another element of the roadmap that has the potential to promote the digital economy is the development of NPP message standards for payroll, tax, superannuation and e-invoicing payments. The standards will define the specific data elements that must be included with these payment types, which will support automation and straight-through processing. We would expect financial institutions to be competing with each other to enable their customers to make and receive these data-rich payments.

Less positively, there is still uncertainty about the future of the two remaining services that were expected to be part of the initial suite of Osko overlay services. These are the ‘request-to-pay’ and ‘payment with document’ services. We understand there are still challenges in securing committed project funding and priority from NPP participants to move ahead, even though BPAY has indicated it is ready to complete the rollout. The RBA strongly supports the development of these additional NPP capabilities, which are likely to deliver significant value for businesses and the broader community.

A second area where the Payments System Board would like to see further progress is the provision of portable digital identity services that allow Australians to securely prove who they are in the digital environment.

Today, our digital identity system is fragmented and siloed, which has resulted in a proliferation of identity credentials and passwords. This gives rise to security vulnerabilities and creates significant inconvenience and inefficiencies, which can undermine development of the digital economy. These generate compliance risks and other costs for financial institutions, so it is strongly in their interests to make progress here. It is fair to say that a number of other countries are well ahead of us in this area.

The Australian Payments Council has recognised the importance of this issue and has developed the ‘TrustID’ framework. The Government’s Digital Transformation Agency has also been working on a complementary framework (the Trusted Digital Identity Framework), which specifies how digital identity services will be used to access online government services. The challenge now is to build on these frameworks and develop a strong digital identity ecosystem in Australia with competing but interoperable digital identity services.

The rollout of open banking and the consumer data right should bring additional competition among financial services providers, and digital identity is likely to reduce the scope for identity fraud, while providing convenient authentication, as part of an open banking regime.

A strong digital identity system would also open up new areas of digital commerce and help reduce online payments fraud. It will also help build trust in a wide range of online interactions. Building this trust is increasingly important as people spend more of their time and money online. So we would like to see some concrete solutions developed and adopted here.

A third area where we would like to see more progress is on reducing the cost of cross-border payments.

For many people, the costs here are still too high and the payments are still too hard to make. It is important that we address this. It is an issue not just for Australians, but for our neighbours as well. I recently chaired a meeting of the Governors from the South Pacific central banks, where I heard first-hand about the problems caused by the high cost of cross-border payments.

Analysis by the World Bank indicates that the price of sending money from Australia has been consistently higher than the average price across the G20 countries (Graph 5). And a recent ACCC inquiry found that prices for cross-border retail payment services are opaque. Customers are not always aware of how the ‘retail’ exchange rate they are being quoted compares with the wholesale exchange rate they see on the news, or of the final amount that will be received in foreign currency.[2] There are also sometimes add-on fees.[3]

As part of the RBA’s monitoring of the marketplace, our staff recently conducted a form of online shadow shopping exercise, exploring the pricing of international money transfer services by both banks and some of the new non-bank digital money transfer operators (MTOs).

This exercise showed that there is a very wide range of prices across providers and highlighted the importance of shopping around.

The main results are summarised in this graph (Graph 6). In nearly every case, the major banks are more expensive than the digital MTOs. For the major banks, the average mark-up over the wholesale exchange rate is around 5½ per cent, versus about 1 per cent for the digital MTOs.

The graph illustrates why the cost of cross-border payments is such an issue for the South Pacific countries. These costs are noticeably higher than for payments to most other countries. This is a particular problem as many people in the South Pacific rely on receiving remittances from family and friends in Australia and New Zealand. In many cases, low-income people are paying very high fees and it is important that we address this where we can. As is evident from the graph, most digital MTOs do not service the smaller South Pacific economies, which limits customers’ choice of providers.

In part, the high costs – and slow speed – of international money transfers is the result of inefficiencies in the traditional correspondent banking process. It is understandable why some large tech firms operating across borders see an opportunity here. Where people are being served poorly by existing arrangements, new solutions are likely to emerge with new technologies. This represents a challenge to the traditional financial institutions to offer better service at a lower cost to their customers, while still meeting their AML/CTF requirements.

Central banks have a role to play here too, and there is an increased focus globally on what we can do to reduce the cost of cross-border payments. One example of this is the promotion of standardised and richer payment messaging globally through the adoption of the ISO20022 standard. The RBA is also working closely with the Reserve Bank of New Zealand, AUSTRAC and other South Pacific central banks to develop a regional framework to address the Know-Your-Customer concerns that have limited competition and kept prices high.

A fourth area where we would like to see more progress is improving the operational resilience of the electronic payments system.[4]

Disruptions to retail payments hurt both consumers and businesses. Given that many people now carry little or no cash, the reliability of electronic payment services has become critical to the smooth functioning of our economy.

We understand that, given the complexity of IT systems, some level of payments incidents and outages to services is inevitable. But it is apparent from the data we have that the frequency and duration of retail payments outages have risen sharply in recent years. In response, the RBA has begun working with APRA and the industry to enhance the data on retail payment service outages and to introduce a suitable disclosure framework for these data. These measures will provide greater transparency around the reliability of services and allow institutions to better benchmark their operational performance.

The third and final issue I would like to touch on is the Payments System Board’s review of retail payments regulation next year.

The review is intended to be wide-ranging and to cover all aspects of the retail payments landscape, not just the RBA’s existing cards regulation. As the first step in the process, we released an Issues Paper a couple of weeks ago and have asked for submissions by 31 January.[5] There will also be opportunities to meet with RBA staff conducting the review.

The review will cover a lot of ground, including hopefully some of the issues that I just mentioned. There are, though, a few other questions I would like to highlight.

The first is what can be done to reduce further the cost of electronic payments?

Both the Productivity Commission and the Black Economy Taskforce have called for us to examine this question. It is understandable why. As we move to a predominantly electronic world, the cost of electronic payments becomes a bigger issue. The Payments System Board’s regulation of interchange fees and the surcharging framework, as well as its efforts to promote competition and encourage least-cost routing, have all helped lower payment costs.

At issue is how we make further progress: what combination of regulation and market forces will best deliver this? Relevant questions here include: whether interchange fees should be lowered further; how best to ensure that merchants can choose the payment rails that give them the best value for money; and whether restrictions relating to no-surcharge rules should be applied to other arrangements, including the buy-now-pay-later schemes.

A second issue is what is the future of the cheque system?

Cheque use in Australia has been in sharp decline for some time. Over the past year, the number of cheques written has fallen by another 19 per cent and the value of cheques written has fallen by more than 30 per cent, as the real estate industry has continued to shift to electronic property settlements (Graph 7). At some point it will be appropriate to wind up the cheque system, and that point is getting closer. Before this happens, though, it is important that alternative payment methods are available for those who rely on cheques. Using the NPP infrastructure for new payment solutions is likely to help here.

Third, is there a case for some rationalisation of Australia’s three domestically focused payment schemes, namely BPAY, eftpos and NPPA? A number of industry participants have indicated to us that they face significant and sometimes conflicting investment demands from the three different entities. This raises the question of whether some consolidation or some form of coordination of investment priorities might be in the public interest.

Fourth, and finally, what are the implications for the regulatory framework of technology changes, new entrants and new business models?

The world of payments is moving quickly, with new technologies and new players offering solutions to longstanding problems. At the same time, expectations regarding security, resilience, functionality and privacy are continually rising. Meeting these expectations can be challenging, but doing so is critical to building and maintaining the trust that lies at the heart of effective payment systems. The entry of non-financial firms into the payments market also raises new regulatory issues. As part of the review, it would be good to hear how the regulatory system can best encourage a dynamic and innovative payments system in Australia that fully serves the needs of its customers.

The latest trade figures, RBA decision and market movements all signal important economic messages. We examine the data.

As expected the RBA held the cash rate today, but still leaves the door open for cuts next year. Given the weaker economic data we are seeing, those further cuts are pretty much assured.

At its meeting today, the Board decided to leave the cash rate unchanged at 0.75 per cent.

The outlook for the global economy remains reasonable. While the risks are still tilted to the downside, some of these risks have lessened recently. The US–China trade and technology disputes continue to affect international trade flows and investment as businesses scale back spending plans because of the uncertainty. At the same time, in most advanced economies unemployment rates are low and wages growth has picked up, although inflation remains low. In China, the authorities have taken steps to support the economy while continuing to address risks in the financial system.

Interest rates are very low around the world and a number of central banks have eased monetary policy over recent months in response to the downside risks and subdued inflation. Expectations of further monetary easing have generally been scaled back. Financial market sentiment has continued to improve and long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are at historically low levels. The Australian dollar is at the lower end of its range over recent times.

After a soft patch in the second half of last year, the Australian economy appears to have reached a gentle turning point. The central scenario is for growth to pick up gradually to around 3 per cent in 2021. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, the upswing in housing prices and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending. Other sources of uncertainty include the effects of the drought and the evolution of the housing construction cycle.

The unemployment rate has been steady at around 5¼ per cent over recent months. It is expected to remain around this level for some time, before gradually declining to a little below 5 per cent in 2021. Wages growth is subdued and is expected to remain at around its current rate for some time yet. A further gradual lift in wages growth would be a welcome development and is needed for inflation to be sustainably within the 2–3 per cent target range. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation is expected to pick up, but to do so only gradually. In both headline and underlying terms, inflation is expected to be close to 2 per cent in 2020 and 2021.

There are further signs of a turnaround in established housing markets. This is especially so in Sydney and Melbourne, but prices in some other markets have also increased recently. In contrast, new dwelling activity is still declining and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The easing of monetary policy this year is supporting employment and income growth in Australia and a return of inflation to the medium-term target range. The lower cash rate has put downward pressure on the exchange rate, which is supporting activity across a range of industries. It has also boosted asset prices, which in time should lead to increased spending, including on residential construction. Lower mortgage rates are also boosting aggregate household disposable income, which, in time, will boost household spending.

Given these effects of lower interest rates and the long and variable lags in the transmission of monetary policy, the Board decided to hold the cash rate steady at this meeting while it continues to monitor developments, including in the labour market. The Board also agreed that due to both global and domestic factors, it was reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

The end of the working month heralds another set of credit stats from both the RBA and APRA. The RBA reports via their Credit Aggregates, which is all credit stock in the system, while APRA reports on the banks (ADI’s) and also provides some individual lender loan stock data. And which ever way you look at it, credit growth is still anaemic, as the “great deleveraging” continues. And given the weak credit impulse, home prices may also be growing more slowly than many are claiming, though that is another story, for another day.

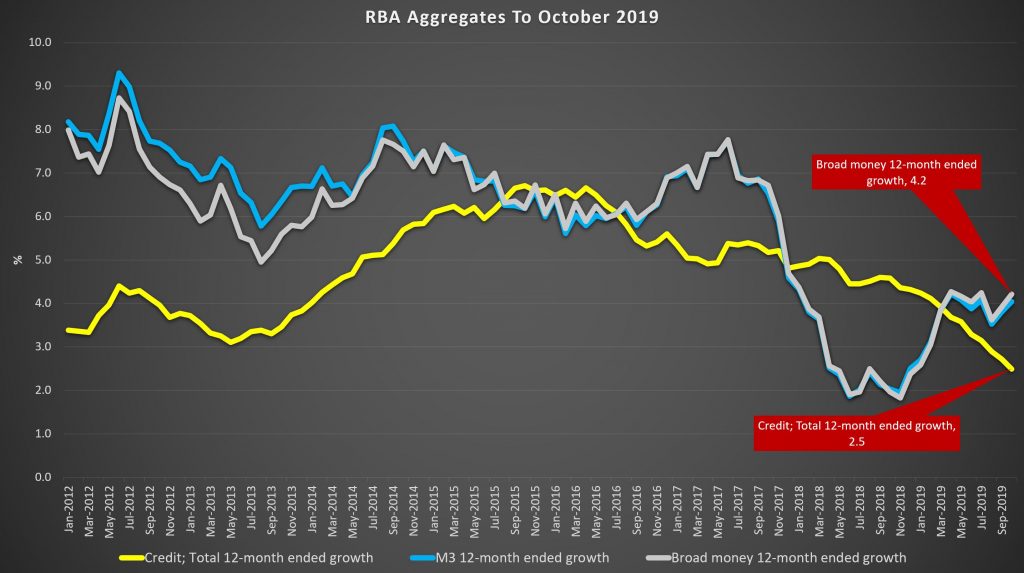

The RBA said that housing credit growth overall was 0.3% higher in October, compared with 0.2% in September. This translates to an annual rate of 3% to October (3.1% last month), compared with 5% just a year back.

Monthly owner occupied lending rose 0.4% while investor housing lending was flat. Personal credit fell another 0.6% in the month, and business lending was down 0.1%. As a result total credit rose just 0.1%, down from 0.2% last month. Broad money was higher though.

Over a rolling 3 months view, owner occupied credit grew 1.3% while investor credit was down 0.2%, other personal credit was down 1.8% and business credit was up 0.6%.

Looking across the rolling 12 month view, housing credit growth dropped from 3.1% to 3%, with owner occupied lending at 4.8% and investor lending down 0.2%. Business credit was 2.7% higher, and personal credit dropped by 4.7%.

As a result, total credit was just 2.5%, as lower as its been for many years, although broad money rose 4.2%.

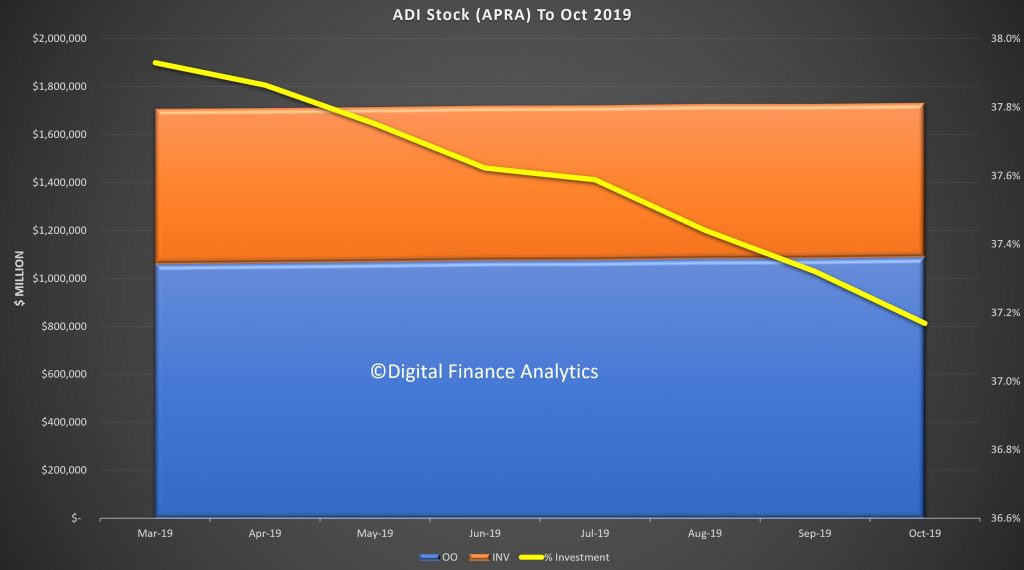

APRA’s new data series continues to contain some surprises. Total lending stock by the banks rose to $1.73 trillion, up 0.2% in the month.

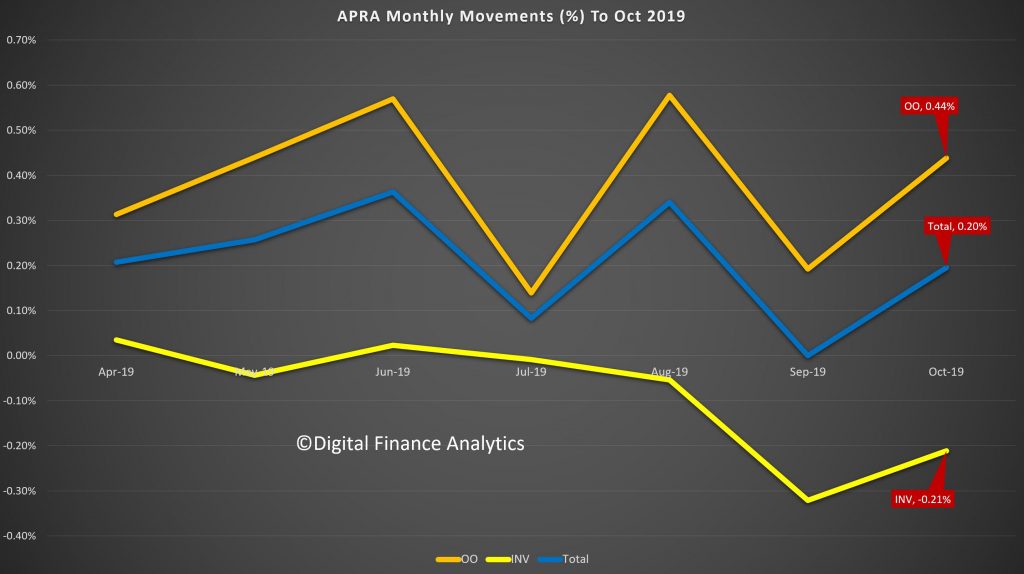

The share of investor loans continues to fall, to around 37.2%, and this is explained by investor loan stock falling by 0.21% in the month, compared with a rise of 0.44% for owner occupied loans. The series still looks a bit weird, so we wonder if there are still reporting issues.

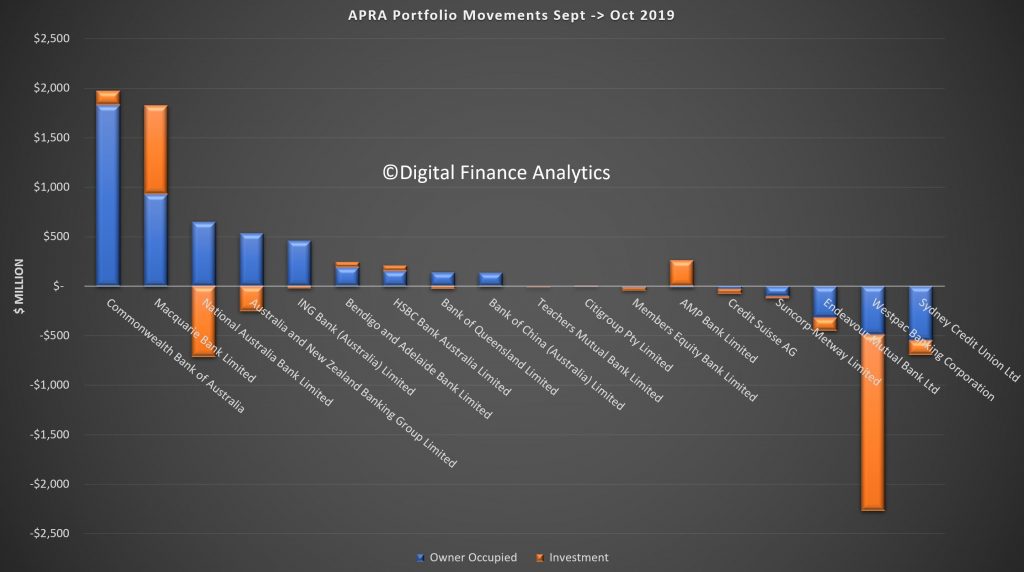

The individual banks stocks of loans varied, with CBA extending their book (consistent with our industry research, as one of the easier lenders at the moment), along with Macquarie – both of which grew both investor and owner occupied pools. NAB and ANZ dropped investor loans, but extended owner occupied loans. But Suncorp and Westpac dropped BOTH investor and owner occupied loan balances (assuming the reporting is correct – lets see if we get a reversal next month).

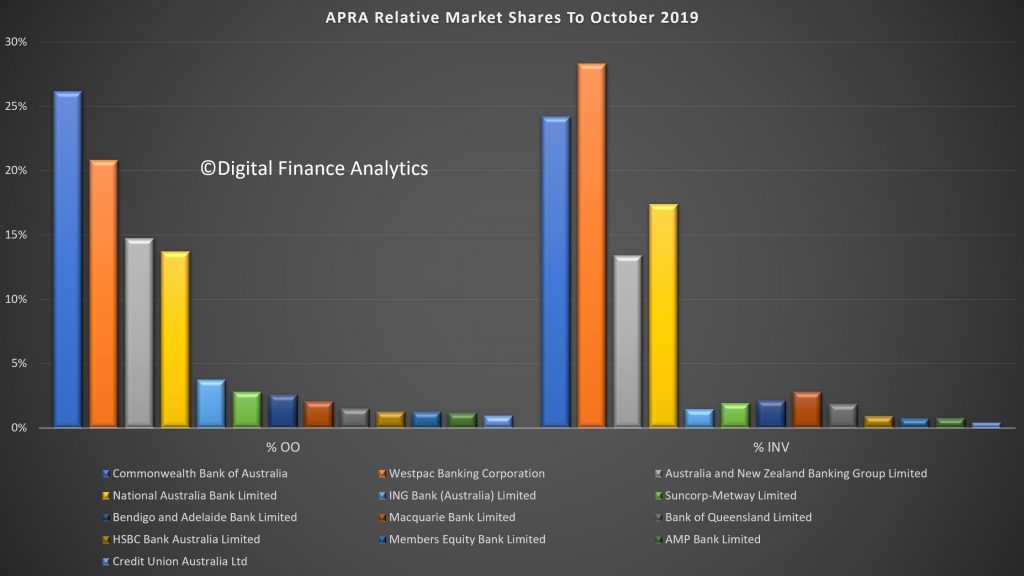

Finally, market shares hardly changed, with CBA the largest owner occupied lender and Westpac the largest investor loan provider.

Given the weak credit growth, this puts into sharp contrast the reported rises in home prices. We know transaction volumes remain low, but our industry contacts indicate a stronger pipeline of applications. Despite this the run-off of existing loans is translating to low net growth.

Even then, loan growth is still strong relative to income growth. But actually the most significant element is the fall in business credit, as more sectors come under pressure.

These results appear to be at odds with the RBA’s glass half full view of the economy, and may indicate more weakness in the GDP out-turn next week.