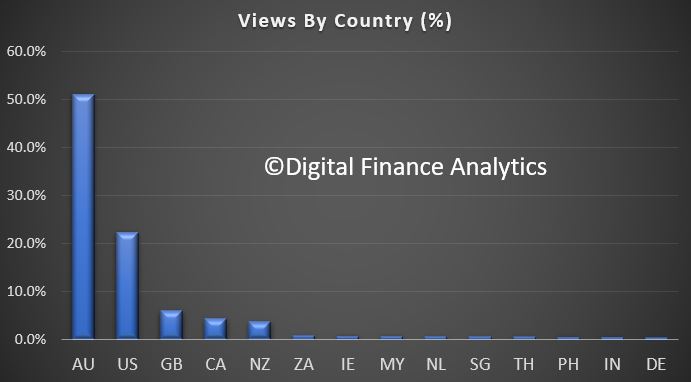

So we got the Mid Year economic Forecast today from the Treasurer, and there was plenty of spin about necessary uplifts in spending, recent tax cuts and government support, and even that the Government is supporting women more than ever.

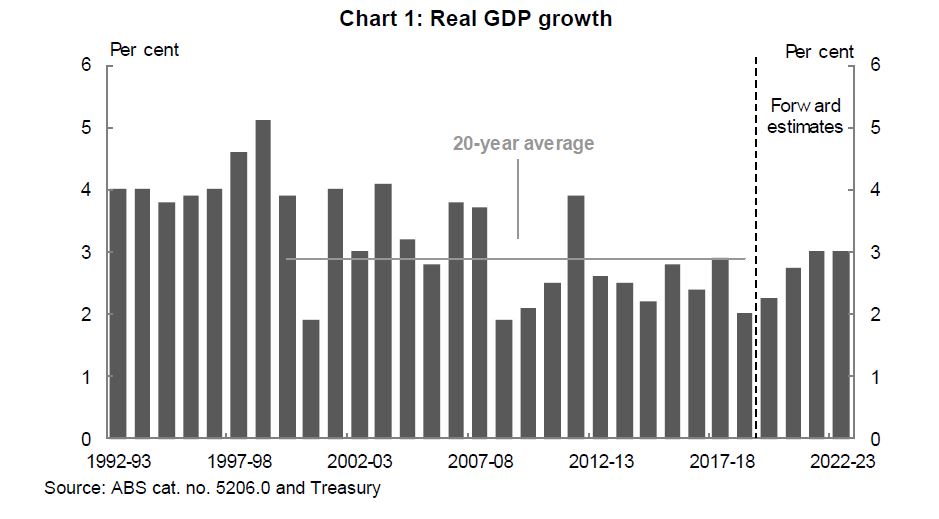

They were also keen to compare their own efforts with the previous Governments efforts (through they were including the COVID years), and international comparison which showed Australia’s economy still has more capacity, and is in some respects still the best dirty shirt.

But as I discussed with Leith van Onselen just yesterday in our live show, all is not well with this budget, and there will be consequences.

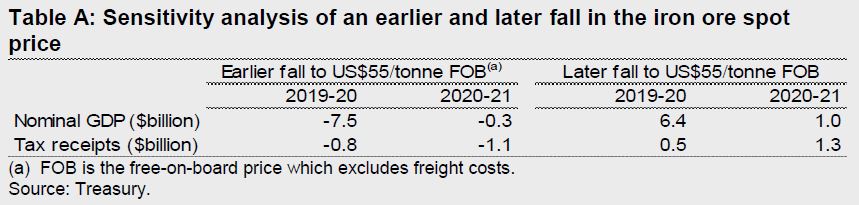

One notable issue was that federal government has cut company tax receipts for the first time since the pandemic because of weaker profits from the mining sector.

But the treasurer maintained most of the government’s long-run commodity price assumptions from the May budget. Iron ore, coking coal, thermal coal and LNG were unchanged at respectively $US60 a tonne, $US140 a tonne, $US70 a tonne and $US10 a metric million British thermal unit. Are these too conservative, and does it represent a hollow log for more spending – probably.

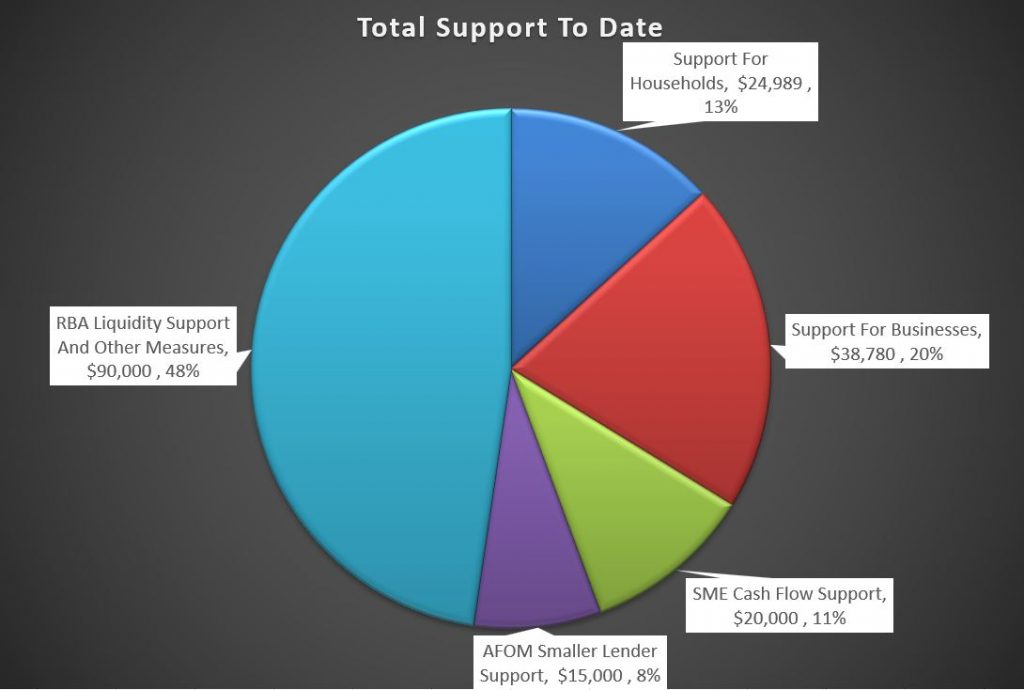

Then there is the so called off-budget issues. Today’s Mid-Year Economic and Fiscal Outlook (MYEFO), which showed that the federal government will spend a record $90 billion “off-budget” over the next four years, obscuring the true situation facing the budget. This off-budget spending does not show up in the underlying budget deficit or surplus despite it imposing a significant cost on taxpayers.

The underlying budget balance that treasurers prefer to focus on hides a heap of so-called “off-budget” spending, such as taxpayer money for the Clean Energy Finance Corporation, the $12 billion Snowy Hydro 2.0 project, wiping 20 per cent off student debts and the $15 billion National Reconstruction Fund.

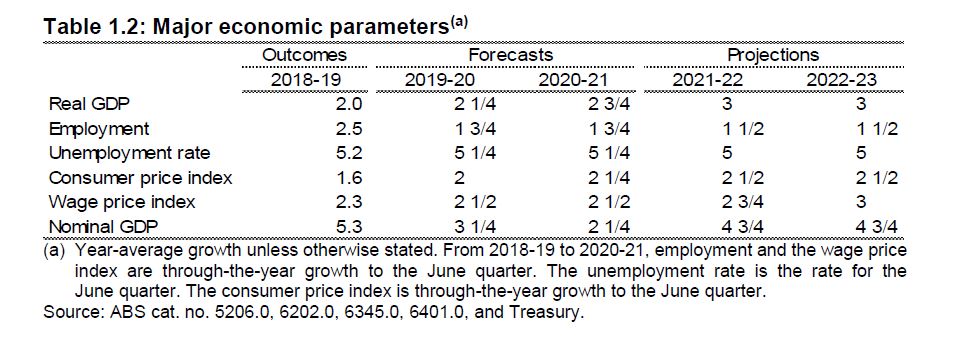

Tax and other government revenue are hovering near a sustained record high of 25.5 per cent of the economy thanks to once-in-a-generation windfalls.

The unemployment rate is a very low 3.9 per cent and personal income tax is on track for a record $335 billion this year, despite the stage 3 income tax cuts shaving off about $23 billion.

Company tax of $133 billion is just a bit below its all-time high last year, amid elevated commodity export prices.

Total budget revenue is cumulatively higher by about $380 billion over five years compared with Treasury’s forecasts on the eve of the May 2022 election.

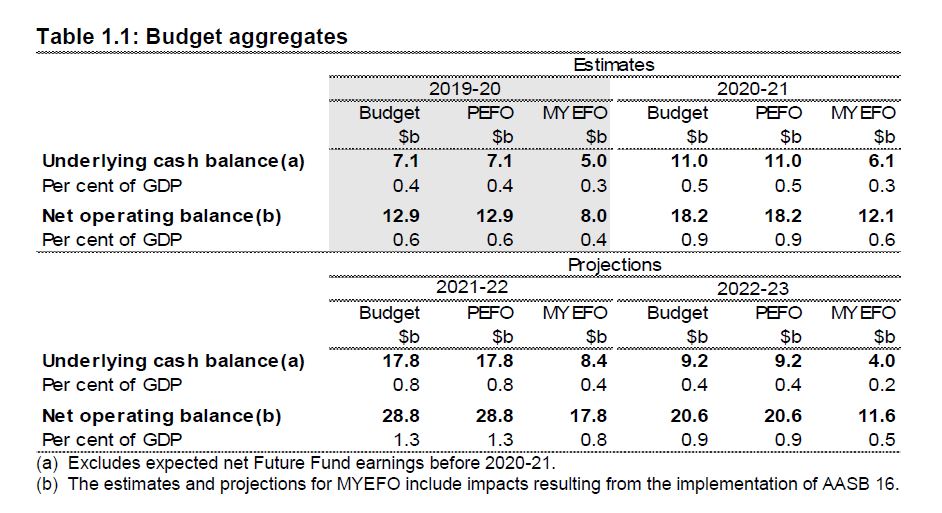

Yet, at a time when revenue is booming and the economy is operating around full capacity, the deficit in underlying terms is forecast to be $26.9 billion (1 per cent of gross domestic product), a $1.3 billion improvement since the May budget.

Cumulative underlying deficits over four years are projected to blow out to $144 billion, $21.7 billion worse than expected seven months ago.

Where are the adults in the room because from the budget point of view, they appear to have left years ago, and the result will be more pressure on ordinary households and businesses across the country.

http://www.martinnorth.com/

Details of our one to one service are here: https://digitalfinanceanalytics.com/blog/dfa-one-to-one/

Go to the Walk The World Universe at https://walktheworld.com.au/