The Finance Brokers Association of Australia has excoriated UBS for releasing reports “based on assumptions and not data”.

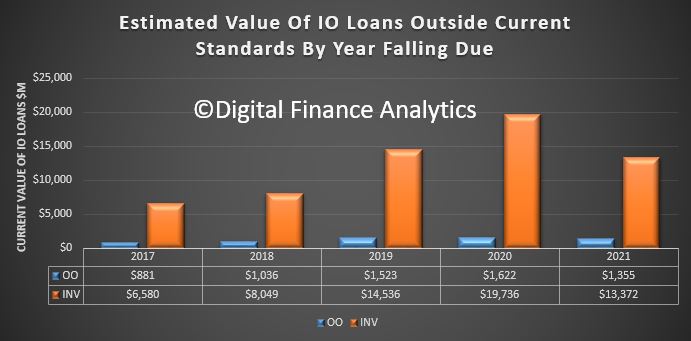

Earlier this week, banking analysts at UBS released a banking sector update that suggested a third of borrowers with interest-only (IO) loans “do not know or understand that they have taken out an IO mortgage”.

According to the results, 23.9 per cent (by value) of respondents stated that they were on an IO mortgage.

UBS analysts were reportedly surprised by this finding, as it was much below APRA’s figure that stated 35.3 per cent of loan approvals in the year to June were for IO loans.

However, the analysts suggested that instead of its figures/APRA’s figures being at fault, the disparity was down to the ignorance of borrowers.

The report concluded: “While we initially suspected that this was a sample error… We believe a more plausible explanation is that around one-third of IO customers do not know or understand that they have taken out an IO mortgage.”

While the analysts acknowledged that this could appear “farfetched”, they went on to say that the conclusion “needs to be considered in the context of the lack of financial literacy in Australia”.

It’s this conclusion that many, including the executive director of the FBAA, have taken exception to.

Speaking to The Adviser, FBAA executive director Peter White said that the conclusion was “the biggest load of nonsense on the planet”.

He said: “There is no analytical data to support what they’re saying. Their comments are that this is what they believe is the response; they are assuming that people don’t know that they have an interest-only loan. So, the conclusion is based on assumptions, not data.

“When you look at the process that a borrower goes through, it’s impossible for them not to know that they are on interest-only. From the conversation they have with their broker or lender, leading into the paperwork, the quote, credit guide, the loan documentation, communications from the broker or lender, the loan contract, the key fact sheets for their home loan — all of that spells out what kind of loan they have and what kind of repayments they will be making. “

He continued: “There are so many documents that people get over and above just the conversation that is had, that it is impossible for somebody not to know that they have an interest-only facility.”

Mr White did acknowledge that while borrowers may not know the “nuances” of their loan structures, he also did not expect borrowers on principal & interest loans to know all the nuances of their loan either.

“But the reality is that they know they are paying off part interest and part principal and how that works. And the reality is that those with interest-only know they are paying off the interest.”

Ties to ASIC remuneration review

The head of the FBAA went on to decry the trend of data not being taken in context or taken to some considerable degree.

He highlighted that some of the findings and proposals of the ASIC review into broker remuneration was another case where the data “didn’t go to the end of the lending journey”.

Adding that he believed ASIC “did a good job” and that its data research was “extensive”, Mr White suggested that some of the conclusions were “based on assumptions of what the data meant.”

He gave the example of the finding that brokers write higher loan-to-value ratio loans, and were responsible for loans with larger loan sizes.

“They assume that’s perceived to be a bad outcome driven by commission (but, of course, we know that this isn’t commission chasing). But, more importantly, they didn’t ask the borrower whether they thought it was a bad outcome.

“So, while [their conclusion] is one possible result of the data, it’s not the only one.

“Likewise, with the UBS report, they said that they believe that this result came from people not understanding that they are on interest-only. But there is no evidence. That’s absolutely ludicrous. To me, it puts a big question mark over the competencies of the people named as conducting this research.”

Mr White concluded: “UBS are not lenders in this space, so they’re making commentary outside of their knowledge and skill set and coming up with the wrong answers. They aren’t doing themselves any favours.

“Consumers are not idiots. They do understand what they are doing. They are well informed.”

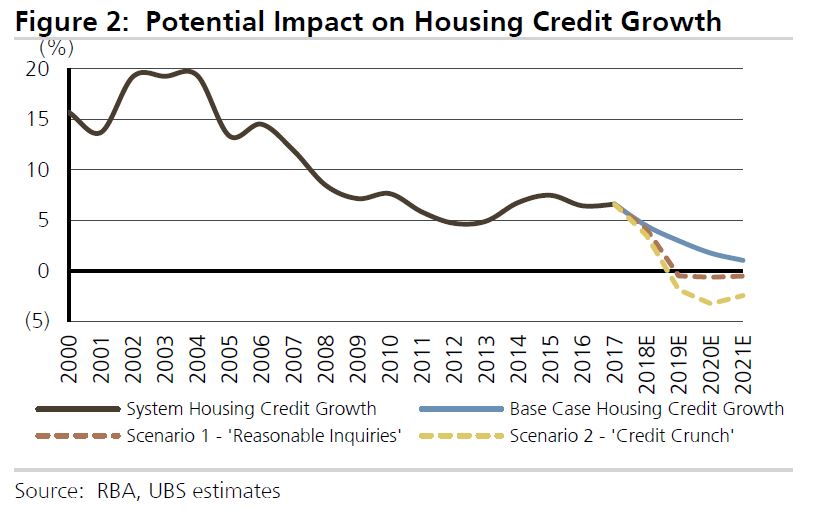

This leads to a reduction in housing credit and a further potential fall in home prices.

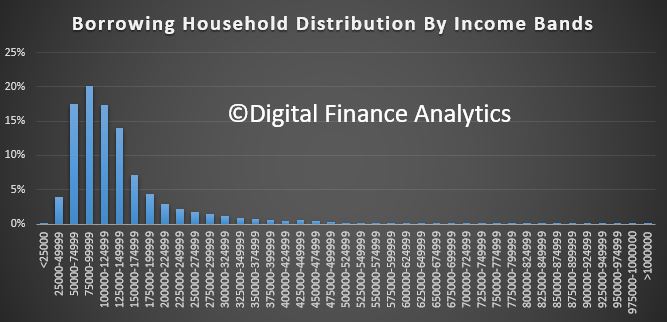

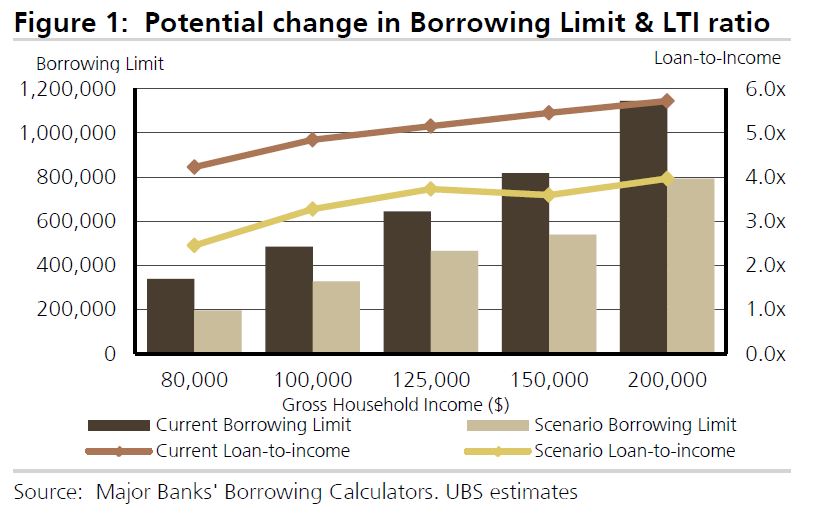

This leads to a reduction in housing credit and a further potential fall in home prices. This plays out similarly to our own scenarios, which we discussed a couple of weeks back, exploring the outcomes from a mild correction, to a crash. A 20% reduction in borrowing power has already hit, by the way, and this before the Royal Commission revelations.

This plays out similarly to our own scenarios, which we discussed a couple of weeks back, exploring the outcomes from a mild correction, to a crash. A 20% reduction in borrowing power has already hit, by the way, and this before the Royal Commission revelations.