We review the latest NAB survey, the Westpac ASIC case and the RBA’s latest excuses.

Tag: Westpac

ASIC Westpac HEM Battle Is Not Over, Yet…

The ABC, via Michael Janda is reporting that ASIC is appealing the recent judgment which found in favour of Westpac and their use of the Household Expenditure Measures benchmark.

Justice Perram’s judgment, should it stand, effectively validates the bank’s use of the HEM benchmark in assessing loan applications — a benchmark used in some way by most home lending institutions.

ASIC commissioner Sean Hughes said the regulator felt compelled to appeal after Justice Perram ruled that a lender “may do what it wants in the assessment process”.

“The Credit Act imposes a number of legal obligations on credit providers, including the need to make reasonable inquiries about a borrower’s financial circumstances, verifying information obtained from borrowers and making an assessment of whether a loan is unsuitable for the borrower,” he said in a statement.

“ASIC considers that the Federal Court’s decision creates uncertainty as to what is required for a lender to comply with its assessment obligation, nor does ASIC regard the decision as consistent with the legislative intention of the responsible lending regime.

“For those reasons, ASIC will appeal to the Full Court of the Federal Court.”

Westpac 3Q19 Stressed Assets Rise

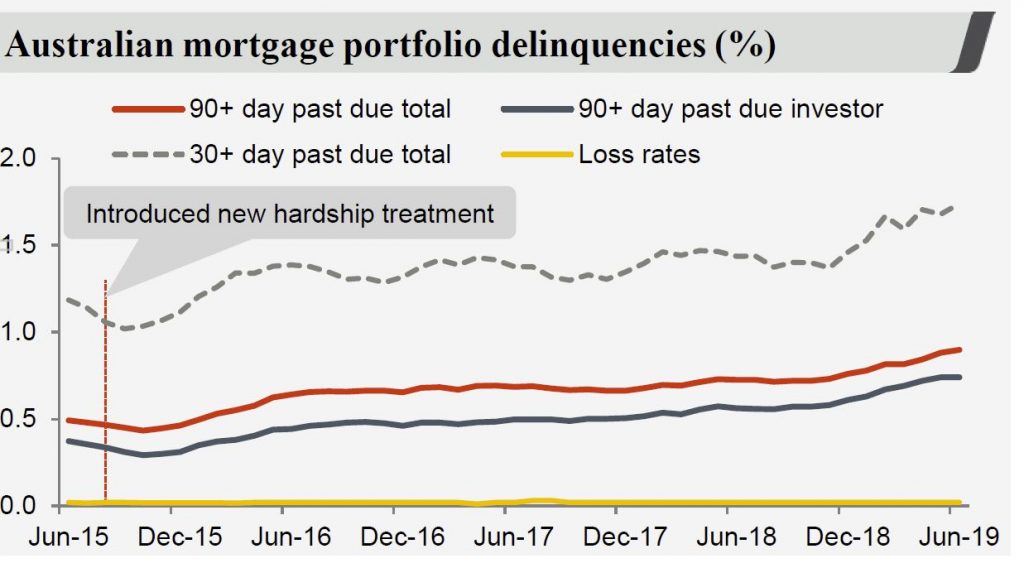

Westpac has released their 3Q19 disclosures. Mortgage delinquencies were higher which mirrors other recent bank sector results.

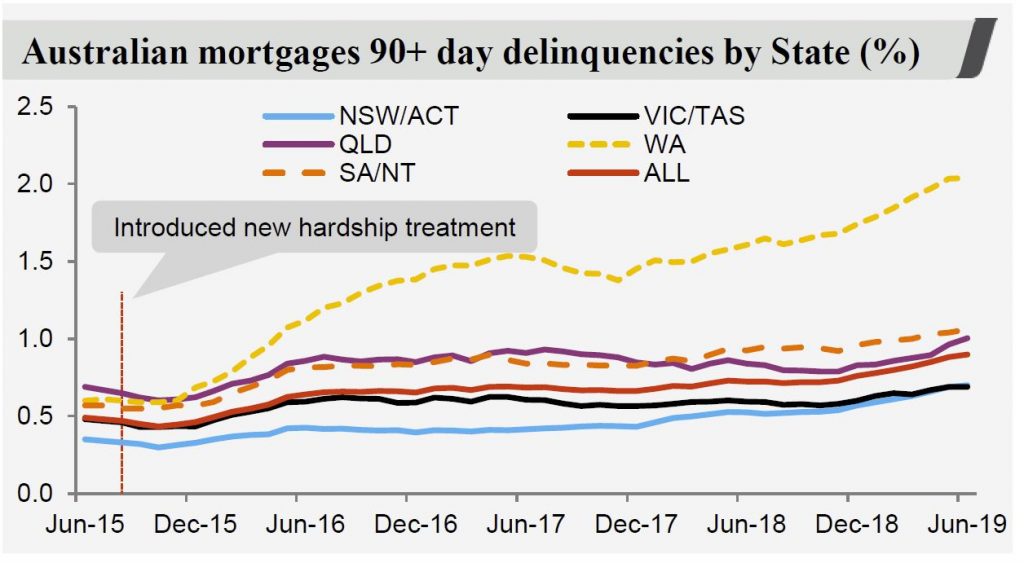

They reported an increase in impaired assets over the quarter, up $0.1 bn to $1.9 bn. Stressed assets to total committed exposures rose 10 basis points to 1.20%, of which 1 basis point was from impairments, 3 basis points from watch-lists etc (mainly in the retail, manufacturing and property segments), and 6 basis points related to 90+ day past due (mainly mortgages).

Total provision balances were up 1.8%.

Australian mortgage 90+ delinquencies were up 8 basis points to 0.9%, with properties in possession rising by 68 to 550 in the quarter, mainly from WA and QLD.

They said that the higher stress in the portfolio combined with softness in the property market has contributed to an increase in time to sell a property. In addition, a greater proportion of P&I loans in the portfolio are lifting delinquencies, and NSW delinquencies rose to 71 basis points, though below the portfolio average.

RAMS loans continue to have a higher rate of delinquency.

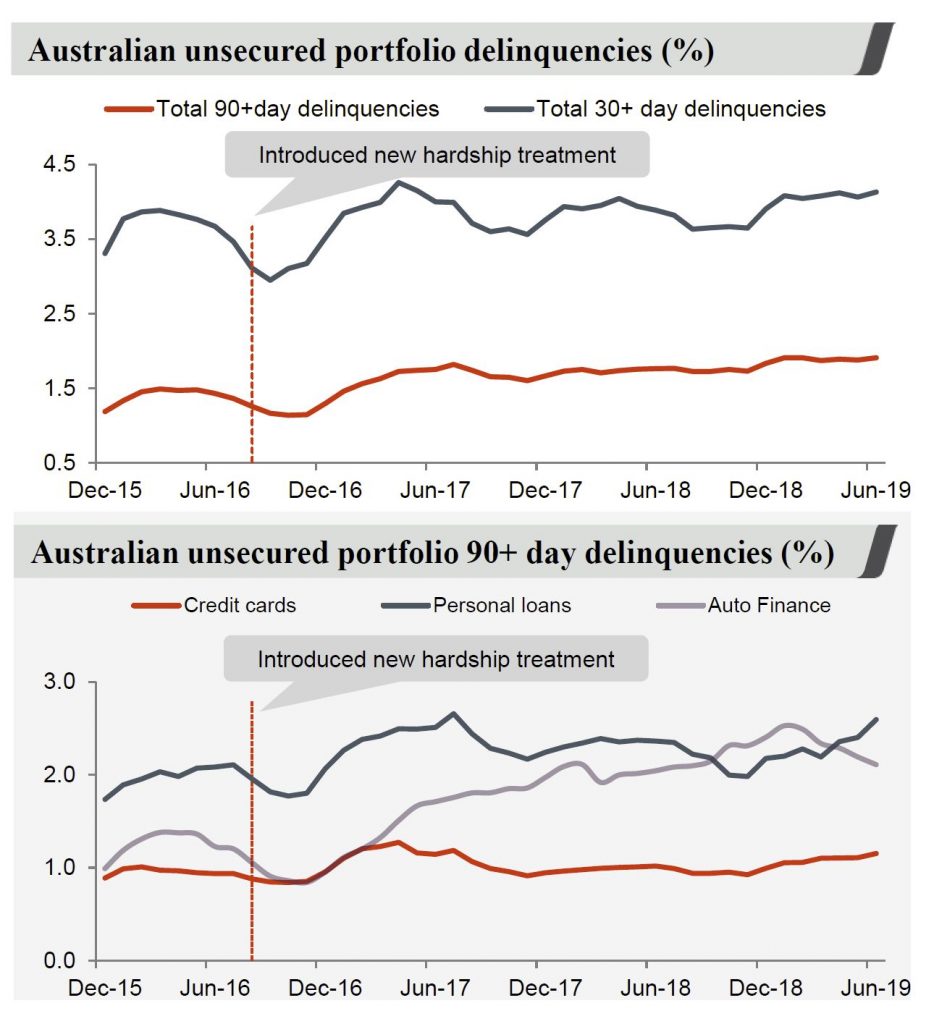

In addition consumer unsecured delinquencies rose 4 basis points, though auto finance was lower thanks to increased collection activities, to 1.91%

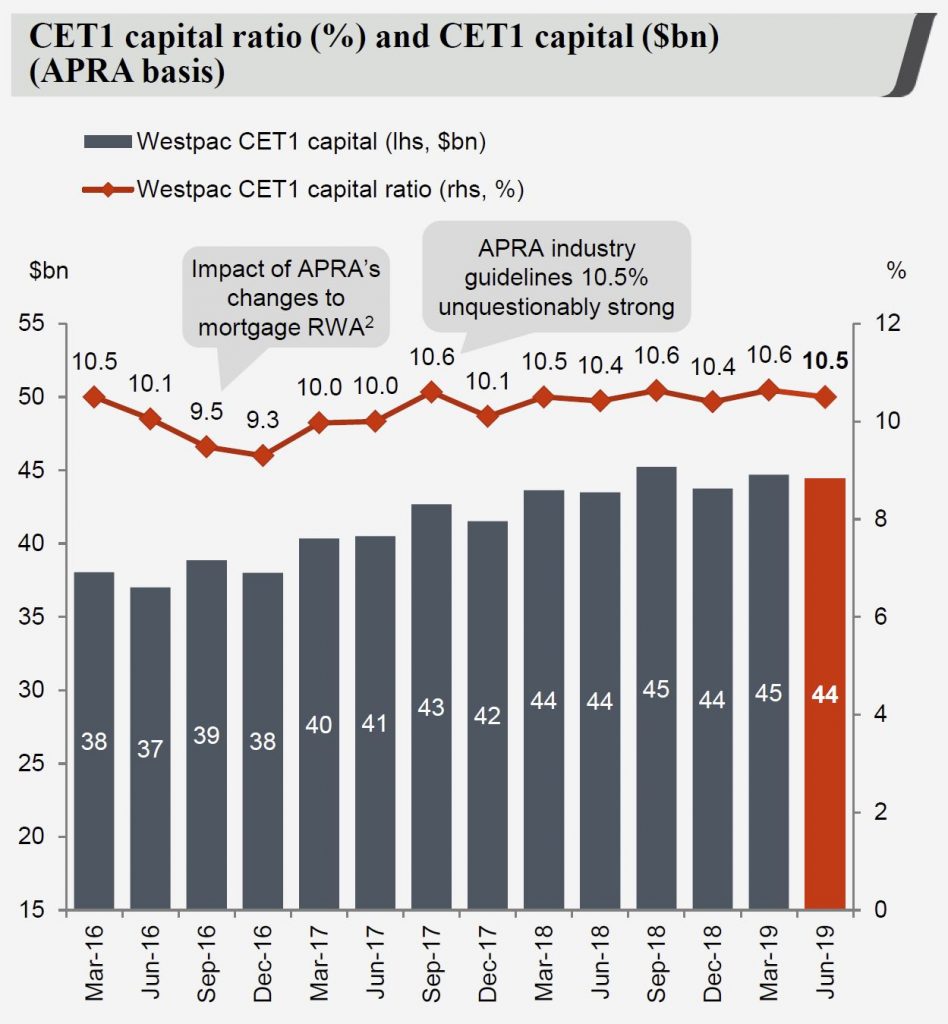

The CET1 ratio dropped to 10.5%, partly thanks to the 2019 dividend payment. The “internationally comparable” CET1 ratio was 15.9% as at June 2019.

Fake and Ineffective Regulation

From the excellent Wilson Sy, reproduced with permission.

Recently, on 13 August, the Federal Court rejected the case of Australian Securities and Investments Commission (ASIC) against Westpac for irresponsible mortgage lending and ordered the regulator to pay the bank’s costs. Such failures at enforcing regulation have occurred numerous times in the past and have cost taxpayers many millions, for little benefit.

The paper “The farce of fake regulation: royal commission exposed Australia” explains how enforcement failures have led to fake regulation in Australia. In relation to ASIC, the paper noted:

The new commissioner Sean Hughes declared that the mantra at ASIC going forward will be “Why not litigate?” He appears to have a short memory because he should know well from his past experience working at ASIC how costly, unsuccessful and unpopular litigation has been for the regulator. What is the point of more litigation recommended by HRC, if it only ends in failures?

The Hayne Royal Commission (HRC) discovered the lack of enforcement of regulation for past decades, but did not go far enough to discover why. The reason is: due to the underlying neoliberalist assumption of market efficiency, Australian financial regulation was not designed to protect consumers. Indeed, it is caveat emptor as noted by Wayne Byres, the chair of the Australian Prudential Regulation Authority (APRA).

In the ASIC vs Westpac case, the judge probably did not understand why a lender such as Westpac would knowingly make bad housing loans risking losses to the bank itself. So the litigation hinged around the interpretation of responsible lending as to whether there is legal flexibility on the part of the lender to assess mortgage serviceability by using the benchmark Household Expenditure Measure (HEM) rather actual expenditures of individual borrowers.

Clearly, complex rules by regulators on how a business should be run can usually be refuted by actual evidence and experience. That is, ASIC does not have enough business knowledge or access to hard data to prove conclusively that the HEM criterion is the main cause of irresponsible lending. Therefore, unproven causality was inadequate to compel a conviction.

There are so many other aspects of mortgage serviceability to which one could attribute irresponsible lending that it is difficult to see how picking one single aspect will lead to successful prosecution by the regulator. Probably, by taking on Westpac, ASIC was merely showing that it was following the HRC recommendation for more enforcement. Without understanding the real problem, HRC has been ineffective in reforming the financial system, as nothing much will change.

The real reason for why the banks lend irresponsibly is not incompetence, but conflict of interest, because the bad loans they create can be packaged and on-sold to unwary investors as mortgage-backed securities. Those mortgage-backed securities can be used for speculation with credit default swaps (CDS) and they can be sliced and diced to create other derivative securities such as collateralized debt obligations (CDO).

Hence irresponsible lenders can avoid adverse consequences to themselves by securitizing their loans. One proven way of removing the perverse incentive to lend irresponsibly is to remove banks’ ability to securitize their mortgages by separating commercial lending from securitization under the prohibition which was the US Glass-Steagall Act. When banks are broken up so that they are no longer “too big to fail”, they can be allowed to suffer the natural consequences of bad loans without being rescued with “bail-out” or “bail-in” and without protection from bank-runs by banning cash.

Westpac Changes Mortgage Underwriting Policies

Following its Tuesday victory against ASIC, with the court dismissing the regulator’s allegations of irresponsible lending, Westpac has announced a spectrum of changes to its home lending policies. From Australian Broker.

The updated guidelines are set to go into effect on 20 August, at not only the major, but its associated brands: St. George, Bank of Melbourne, and Bank SA.

Perhaps most notably, Westpac is to update and add new expense categories to its household expenditure measure “to reflect industry guidelines on the HEM values we use as our customer expense benchmarks” – bringing the total number of categories from 13 to 18.

Further, the bank will apply income-based HEM bands based on total gross unshaded income, including gross rental income.

Particularly relevant in light of the recently dismissed court case, in instances when total liability is seven times or more higher than total gross income, the loan applications will be reviewed by a credit assessment officer rather than run through the automated system.

ASIC’s case against the bank had hinged on the allegation Westpac breached the National Consumer Credit Protection Act 2009 through assessing loans via its automated system which solely considers the benchmark HEM rather than customers’ declared living expenses.

Westpac additionally addressed the changes being made to tax debt through changing its approach to margin loans. They will now be assessed on the higher of 1% of the balance or the customer’s monthly declared commitment.

Further, Westpac will require a more comprehensive understanding of payment plans businesses have made with the ATO and decline to lend to customers with an overdue amount payable to the ATO for the previous year’s tax without a formal payment plan in place.

The policy changes will impact all new and re-submitted applications made from Tuesday, requiring brokers to utilise the expanded 18 categories for expenses, as well as heed the new seven times debt-to-income ratio.

Westpac also announced that changes to the commercial, SME and private wealth broking channels will be made later this year.

Are The Mortgage Lending Taps About To Open? [Podcast]

Are The Mortgage Lending Taps About To Open?

What The HEM Decision Means

The key question now is will the banks revert to their previous practices of doing little to validate household spending patterns as part of the mortgage assessment processes. Some are already saying “buy now” with renewed vigour.

The Royal Commission revealed last year that some lenders ignored household expense data favouring the automated HEM decisioning. But on the basis of the finding, they are now in the clear.

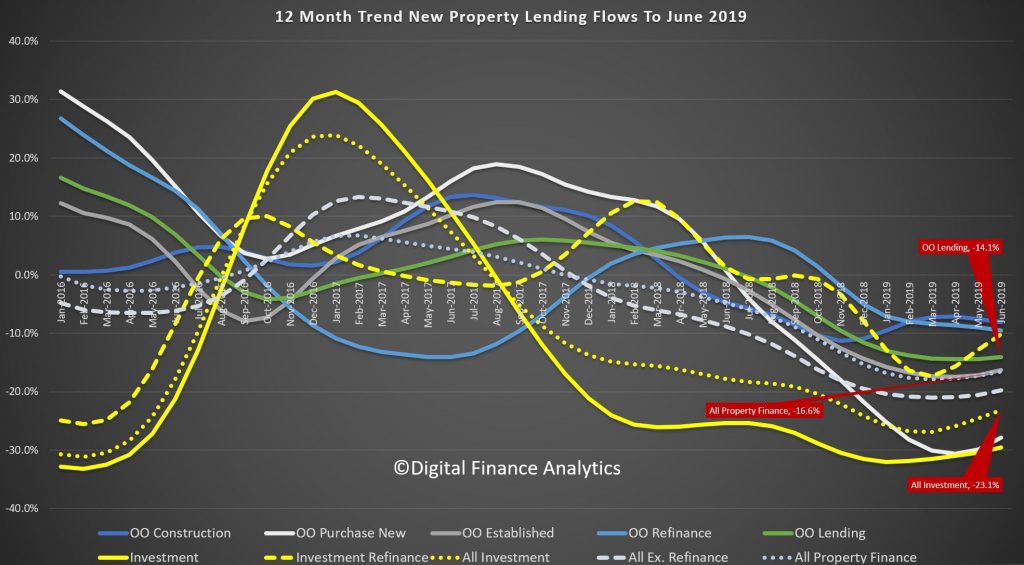

Banks of course need mortgage lending to grow to enable their profits to rise, and in recent times that has been a problem. New lending momentum has been pretty slow.

HEM standards were tightened in July, meaning that the minimum spending benchmarks were lifted especially for households on higher incomes. Some banks have been asking for painful detail and history in lieu of using HEM, and this has slowed lending decisions but around half of loans are still approved by HEM.

We also need to link this with the APRA loosening of the interest rate hurdle which gives lenders flexibility on their decisioning (within limits).

ASIC is currently taking evidence from the industry on potential changes to responsible lending, and has said we should expect some revisions by years end. Plus they have previously stated that even if they lost the Westpac case, they would still insist that while HEM is a useful too it is not necessary and sufficient to meet their requirements.

The trouble is the original ASIC guidelines were vague, and the “non-unsuitable” formulation left significant ambiguity. This needs to be changed.

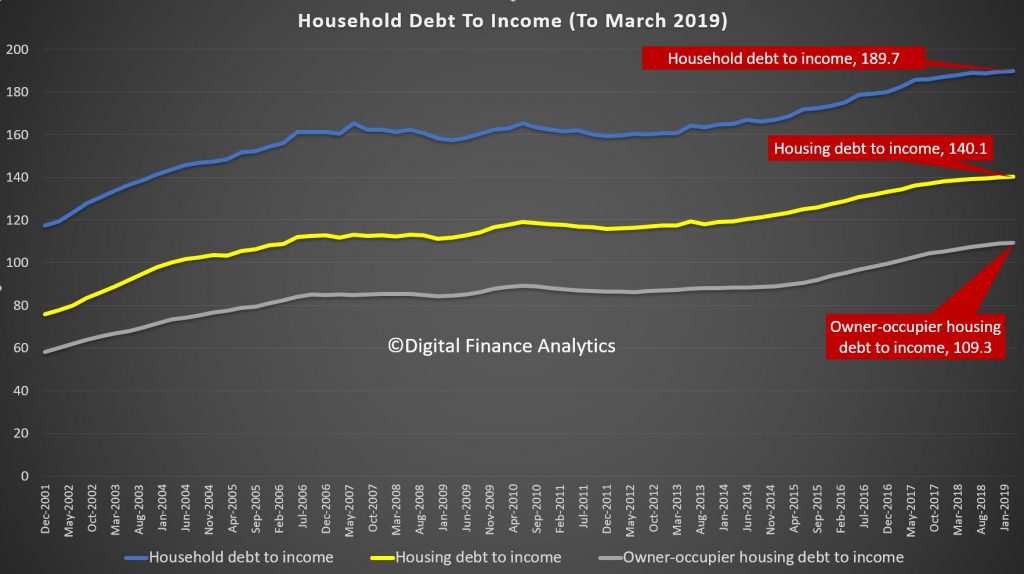

The way through this is to use debt to income ratios, something which has been in place in the UK and NZ for some time, as we know the risks of loss are greater when the Debt To Income ratios are higher.

But then the question will become, how prescriptive should the regulators be, and of course in the current weakening economic environment there will be an attempt to push lending harder.

So, my expectation is there will be some loosening of underwriting standards (which is bad) while the Banks can assume class actions relating to responsible lending will be unlikely to proceed.

I expect households will be required to certify the accuracy of their expenses, but that banks once they have that protection will be will to lending within the HEM framework.

So the bottom line is, yes, I expect more credit will be offered, the question is will households lap it up – leading to rises in prices (as credit growth and home price growth are linked), or will the weak wages growth, high costs of living and home price momentum (or lack of it) reduce demand.

The finance and real estate sector will be spinning hard to try and entice people into the market. Just remember we have the biggest debt bomb ticking away.

But the banks are also on notice now.

Amidst the court proceedings with ASIC, Westpac updated its group credit policies “to enhance the way [it] captures customer living expenses, commitments, and verify documentation.”

A Westpac spokesperson said, “We recognise sometimes it can be difficult for customers to provide a complete picture of their expenses and the enhancement of our expense categories means our staff and brokers have the opportunity to prompt customers to remind them about particular expenses they may have forgotten.”

HEM Westpac Win

The Federal Court has dismissed ASIC’s responsible lending case against Westpac and ordered the regulator to pay the bank’s costs. Via ABC.

I will make a separate post on the implications of this finding, in the light of ASIC stated intent to change the responsible lending laws, and the current hearings underway.

ASIC had alleged that Westpac breached responsible lending laws on up to 262,000 home loan approvals made using an automated process that relied on the Household Expenditure Measure benchmark, rather than using each applicant’s individually assessed living costs.

In September last year, Westpac agreed to pay a $35 million settlement to ASIC and admit that it breached responsible lending laws.

However, in November Justice Nye Perram sensationally rejected the settlement, finding that it was ambiguous and that the parties did not actually agree on what the responsible lending laws required and, therefore, how many loans were in breach and what the penalty should be.

Today, Justice Perram dismissed ASIC’s case against the bank, awarding costs against the regulator and leaving it negotiating with Westpac over the legal bill in reaching the failed settlement.

In the rejected settlement, Westpac had admitted its automated loan approval system used the Household Expenditure Measure (HEM) — a relatively low estimate of basic living expenses — to calculate potential borrowers’ living costs.

The bank used the HEM instead of actually evaluating the customers’ declared living expenses, and admitted this practice breached the National Consumer Credit Protection Act in certain circumstances.

However, there was an irreconcilable difference of opinion between ASIC and Westpac over when use of the HEM breached the law.

Out of 261,987 loans approved using the HEM benchmark, 211,937 involved customers declaring expenses that were lower than the HEM — that is, below the typical household’s spending on basic goods and services, and in the bottom 25 per cent of household spending on less essential items.

In these cases, use of the HEM actually reduced the amount of money the customer could borrow compared to what they declared.

In the roughly 50,000 cases where declared living expenses were higher than the HEM, use of the benchmark increased the loan amount the customer could receive.

However, in about 45,000 of these cases, both ASIC and Westpac agreed the use of the customers’ actual expenses rather than the HEM would have had no impact on whether they were deemed suitable for the loan.

That left 5,041 loans approved using the HEM that may not have been if actual declared expenses were used — they would have been referred to manual credit assessment instead.

This meant some of those customers might have been approved for home loans they potentially could not afford to repay without financial hardship.

In rejecting the settlement, Justice Perram said neither party could explain what would have happened after that manual loan assessment process, whether any of these 5,041 loans were actually unsuitable and whether any significant harm had been done to any or all of those customers

APRA fines Westpac for failing to meet legal reporting requirements

The Australian Prudential Regulation Authority (APRA) has served infringement notices on Westpac Banking Corporation (Westpac) and two of its subsidiaries for failing to meet their legal obligations to report data to APRA.

Westpac, along with two of its registered financial corporations (RFCs), St George Finance Holdings Limited and Capital Finance Australia Limited, breached the requirements of the Financial Sector (Collection of Data) Act 2001 (FSCODA) by failing to report data by the required deadlines. Westpac was up to 20 days late in filing its reports for the month ending 31 March 2019 under the Economic and Financial Statistics program, which were due on 1 May. The two RFCs missed the same deadline by up to 37 days.

The RFCs were also up to 28 days late in submitting their reports for the month ending 30 April 2019. Additionally, all three Westpac entities were between 9 and 28 days late in filing their reports for the quarter ending 31 March 2019, which were due on 10 May 2019.

Failure to submit monthly or quarterly returns within the timeframes specified by APRA’s reporting standards is a strict liability offence.

APRA sent show cause notices to the Westpac entities on 22 July seeking their responses to APRA’s intention to serve them with infringement notices over the FSCODA breaches. After assessing Westpac’s responses, APRA has decided to proceed with the issuing of infringement notices.

Under the terms of the infringement notices, APRA requires the Westpac entities to pay a cumulative penalty of $1,501,500. This is the maximum financial penalty APRA can issue for infringement notices under FSCODA.

APRA Deputy Chair John Lonsdale said APRA’s reporting standards were legally binding in the same way as its prudential standards.

“Access to accurate and timely data is critical for APRA to monitor effectively the safety and stability of the banking, insurance and superannuation sectors.”

“By issuing these infringement notices, APRA wants to send a strong message to industry that compliance with our reporting standards is mandatory, and cannot be considered secondary to other business priorities,” Mr Lonsdale said.

The Westpac entities have until 6 September to pay the fines imposed by the infringement notices