The SMH reported today on research from UBS suggesting that around one third of interest only mortgage holders are not aware of the fact that the loan will revert, normally at the end of 5 or sometimes 10 years to principal and interest only borrowing. A roll to a further IO period is not guaranteed.

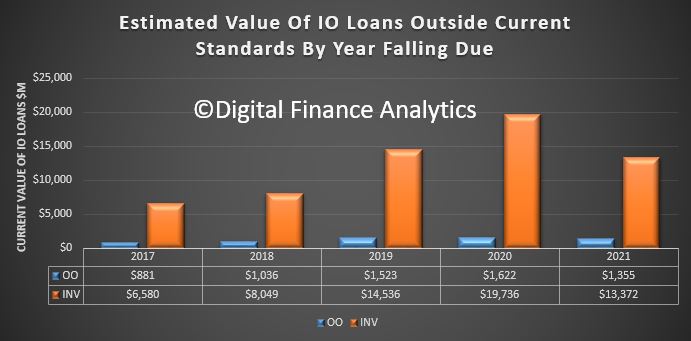

We discussed a couple of years back, as well in this in October, Citi covered it a few months back, and last week we got Finder.com.au to discuss what borrowers might do; so there should be no surprise to readers of this blog. This chart shows the estimated value of IO loans which will now fall due outside current lending criteria, based on our research.

This is an extract from the SMH article:

This is an extract from the SMH article:

A third of customers with interest-only mortgages may not properly understand the type of loan they have taken out, which could put many in “substantial” stress when the time comes to pay their debt, UBS analysts warn.

Amid a regulatory crackdown on interest-only loans, a new report by analysts led by Jonathan Mott highlights the potential for repayment difficulties with this type of mortgage

Their finding is based on a recent survey conducted by the investment bank, which found only 23.9 per cent of 907 respondents had an interest-only loan, compared with economy-wide figures that show 35.3 per cent of loans are interest-only.

Mr Mott said he initially suspected the survey sample had an error, but now believed a “more plausible” reason was that interest-only customers did not properly understand their loan.

“We are concerned that it is likely that approximately one third of borrowers who have taken out an interest-only mortgage have little understanding of the product or that their repayments will jump by between 30 and 60 per cent at the end of the interest-only period (depending on the residual term),” he said.

You can read more about the risks from IO loans in our recent Property Imperative Report, free on request.