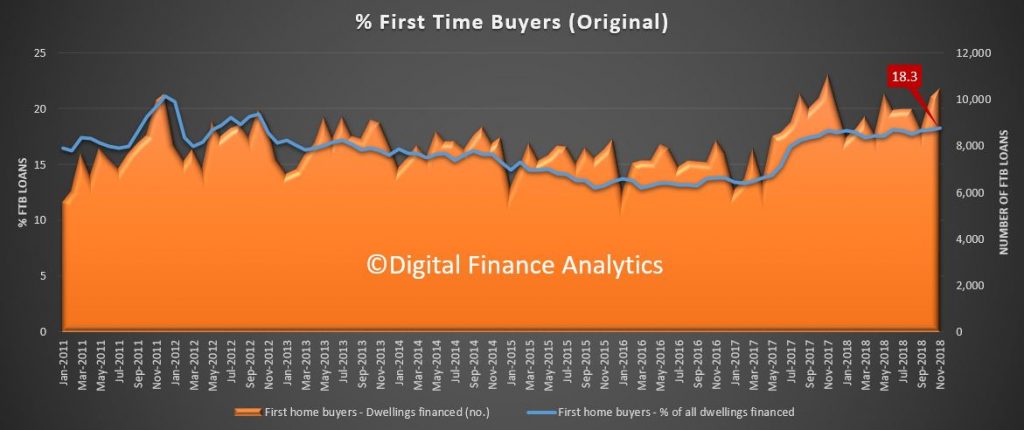

The desperate quest for housing is playing out across Australia, with renters fighting to find an affordable place, and being confronted with significant rent hikes, while others are trying to buy their way into the property market, despite tight lending conditions, and are fighting directly with some property investors who are still hoovering up more property as well as new migrants who are still arriving in their thousands. It’s a mess, and many are getting crusted in the process.

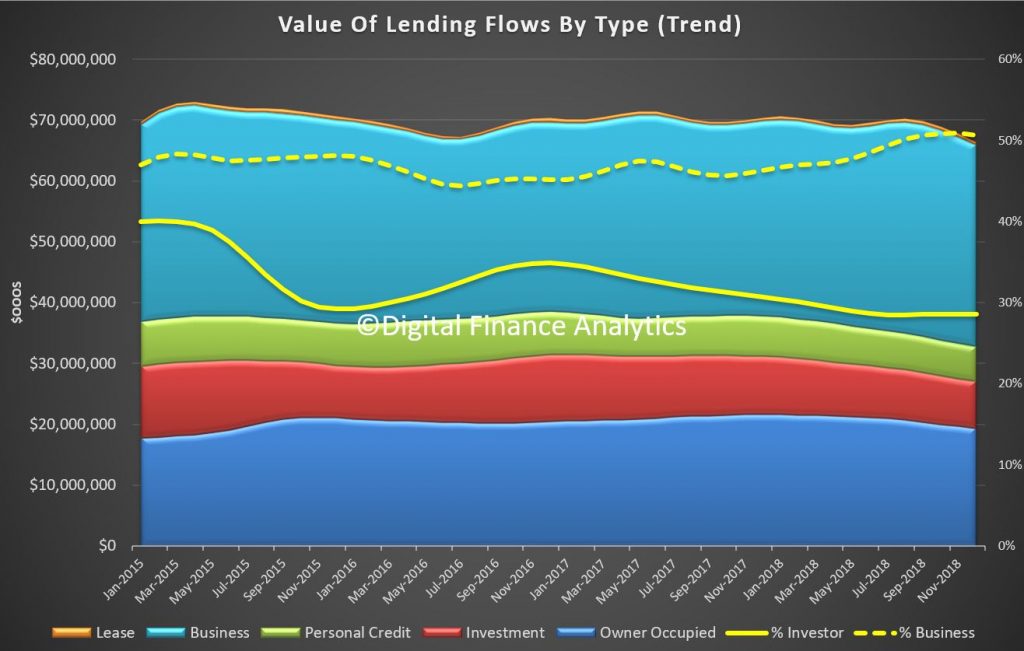

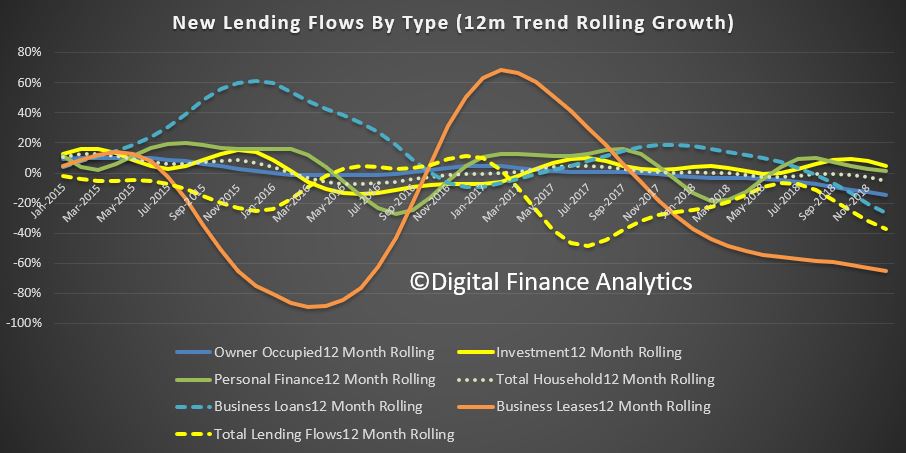

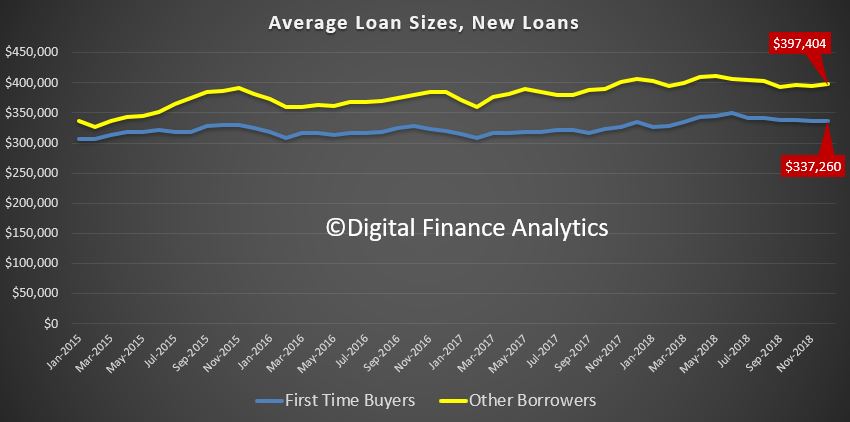

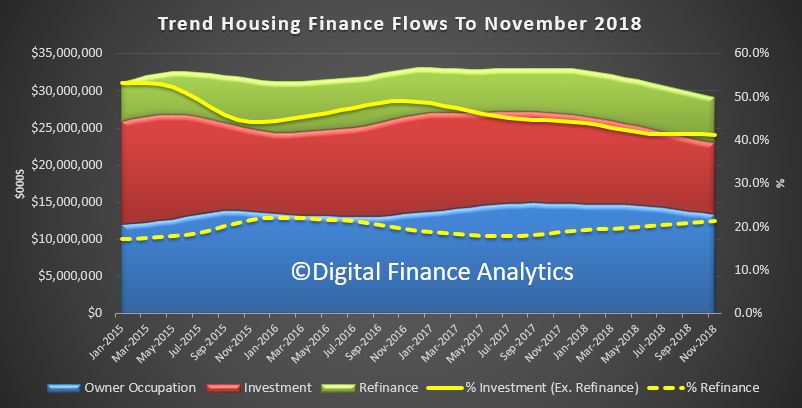

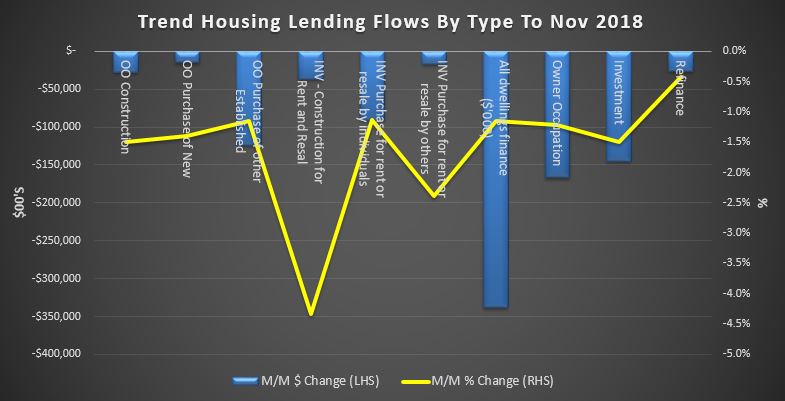

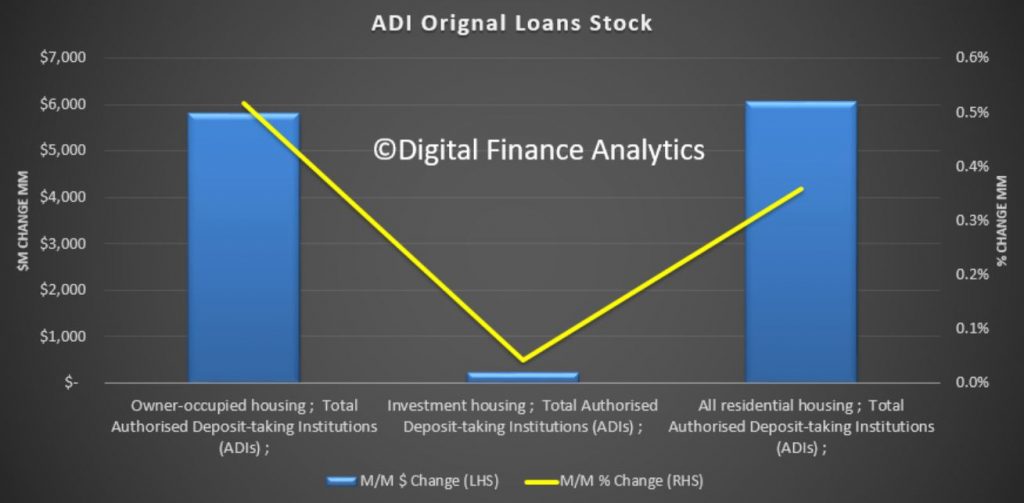

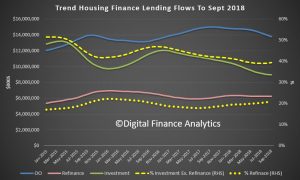

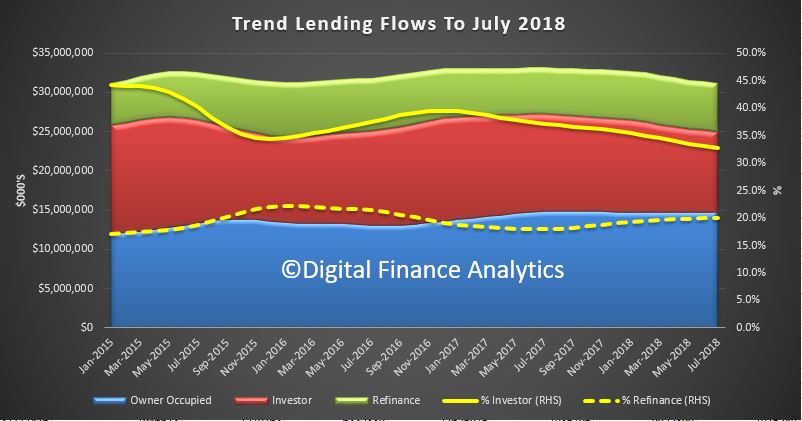

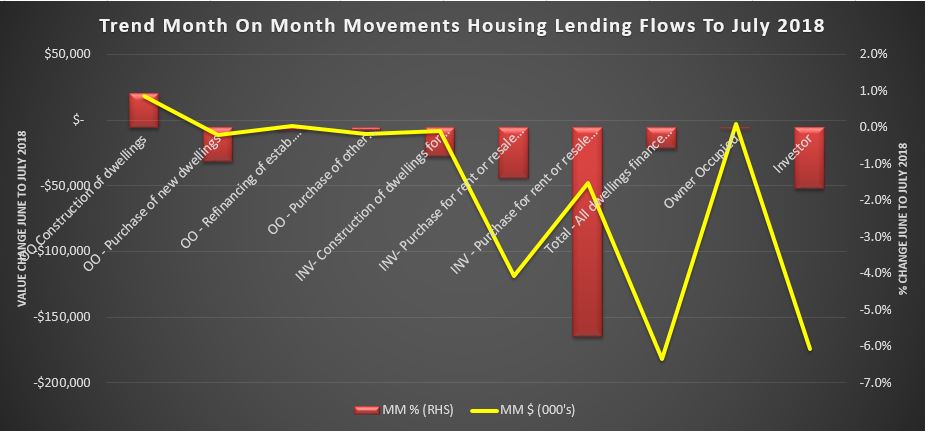

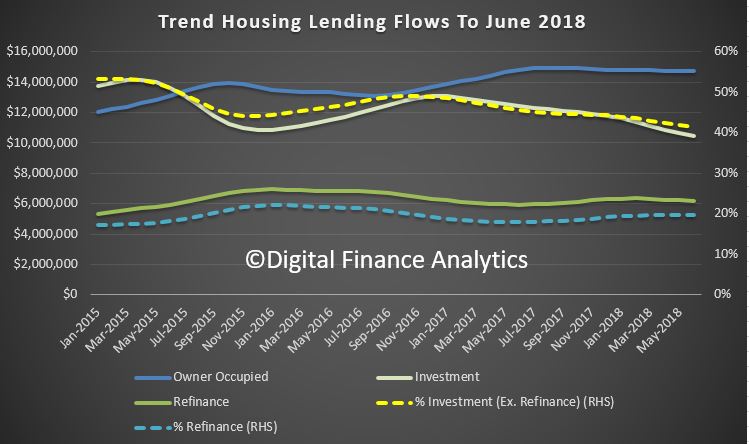

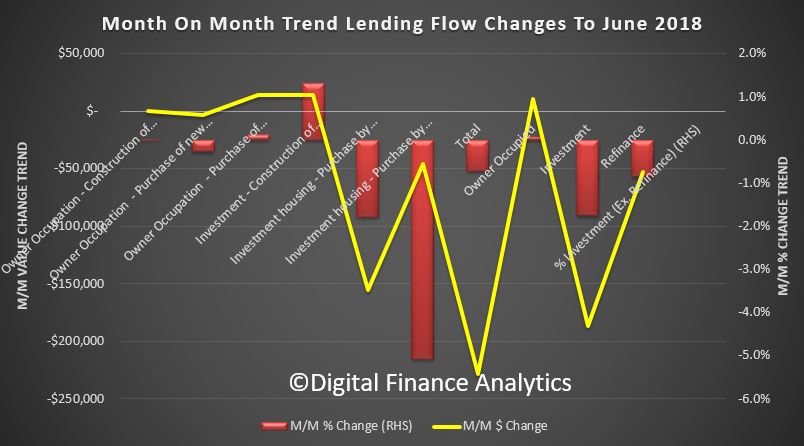

So, the latest data underscores the issue as the ABS released their lending indicators on Thursday, and they reported that for total housing new loan volumes fell 3.9% to $25.1b, after a fall of 4.1% in December. But it was still 8.5% higher compared to a year ago. Incomes of course are not growing at anything like that!

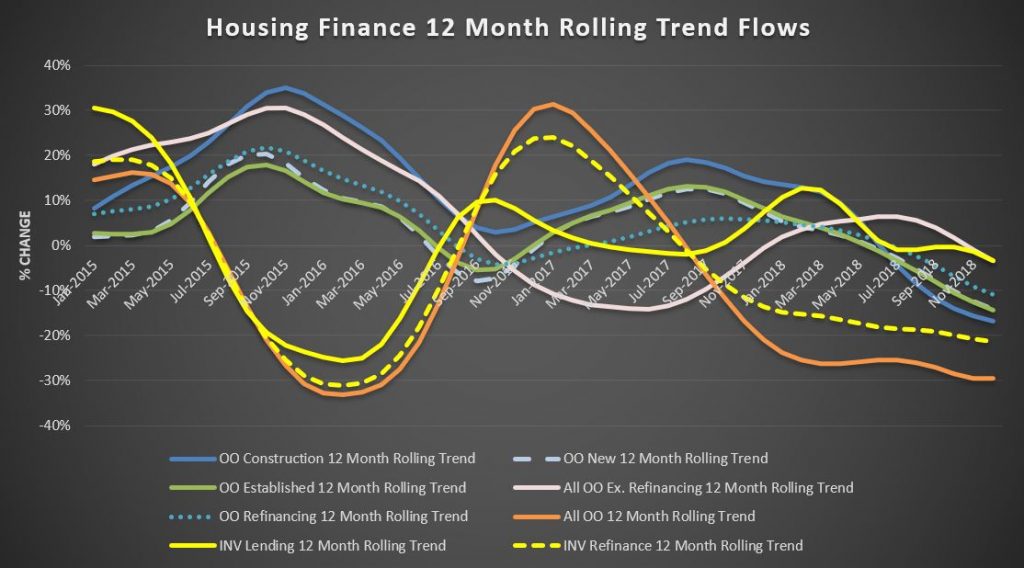

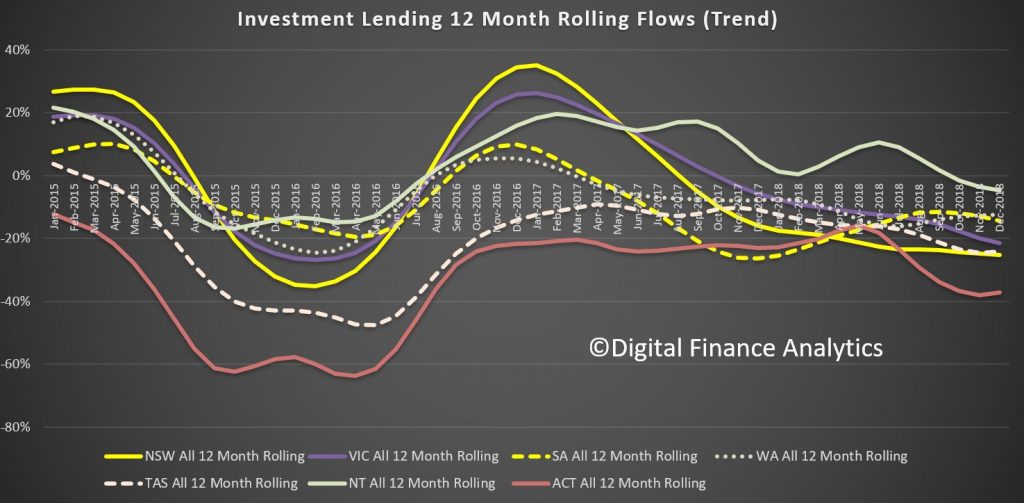

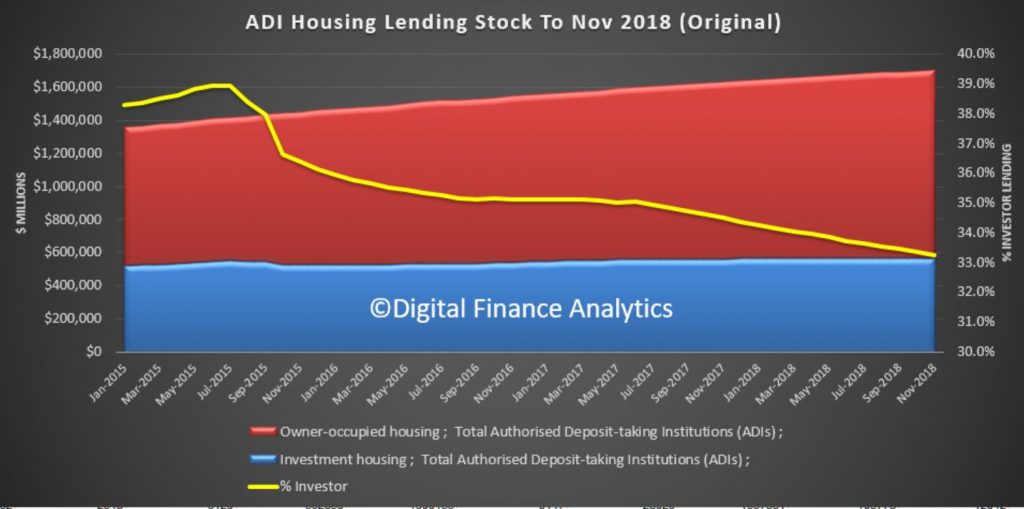

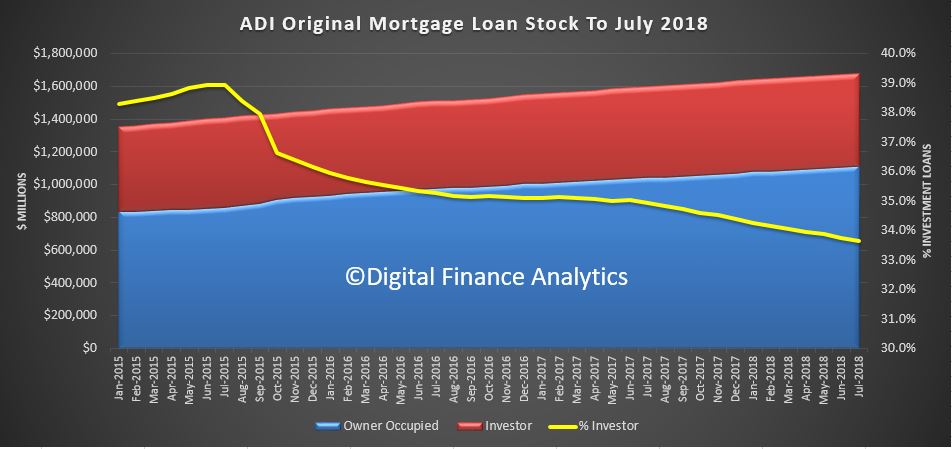

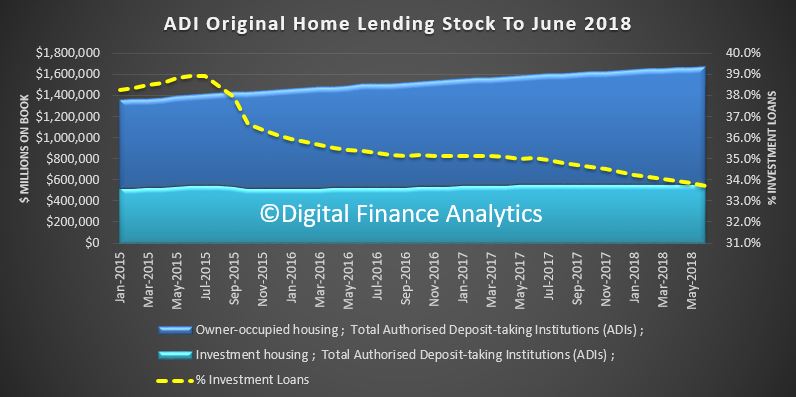

Within that, the total for owner-occupier housing fell 4.6% to $15.9b but was 3.4% higher compared to a year ago, while for investor housing new loans fell 2.6% to $9.2b but was 18.5% higher compared to a year ago.

The mortgage cliff, where cheap sub-2% loans were reset to much higher rates is coming towards the end of the road, although CBA also warned on Wednesday that debts servicing costs will continue to rise as the remaining cheap pandemic fixed rate mortgages reset to variable. And some of the cheapest fixes are yet to expire, according to my surveys. In addition, some cheap deals seem to have been extended on their original terms for some borrowers so the funding pressures will remain.

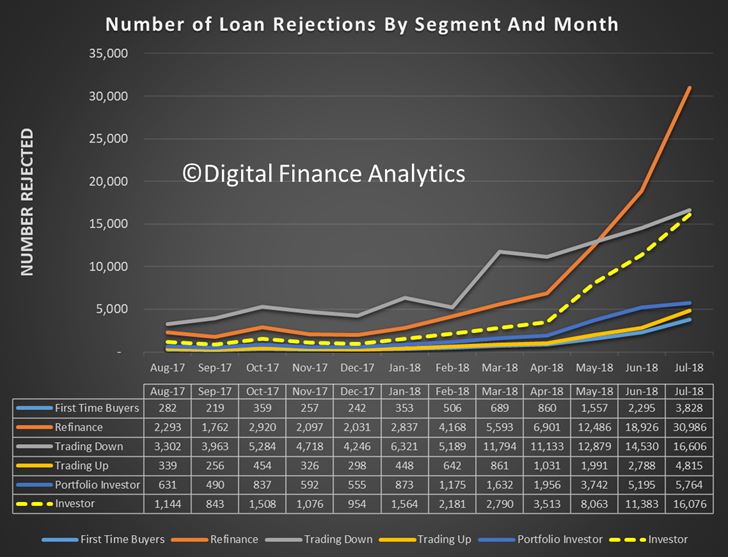

All up, the ABS said In January 2024 in seasonally adjusted terms, the value of external refinancing for total housing fell 5.0% to $16.1b and was 19.5% lower compared to a year ago, while for owner-occupier housing new loans fell 7.4% to $10.3b and was 24.3% lower compared to a year ago and for investor housing they fell fell 0.5% to $5.8b and was 9.1% lower compared to a year ago. One reason apart from the cliff problem is that lenders have reduced competitive cashback offers.

http://www.martinnorth.com/

Go to the Walk The World Universe at https://walktheworld.com.au/

Today’s post is brought to you by Ribbon Property Consultants.