The current environment of low growth and the resulting low interest rates are already having significant economic, legal and social repercussions.

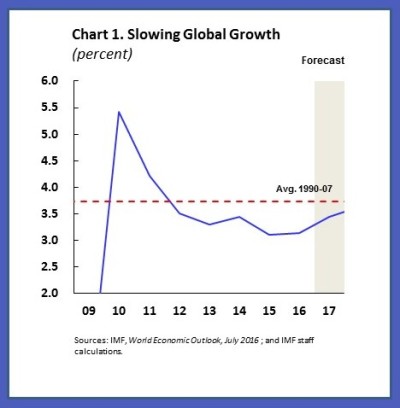

We are in a phase of weak growth and low interest rates – not only in Europe but in many mature economies. Without there being a final consensus, experts are providing a colourful bunch of possible explanations for the decline in growth potential over the past few years. Regardless of whether the causes are on the demand or supply side, there is broad agreement that the strong relative surplus of savings – some call it a savings glut – has resulted in a worldwide fall in long-term interest rates.

In a speech by Mr Yves Mersch, Member of the Executive Board of the European Central Bank, at the University of the Deutsche Bundesbank, Hachenburg, 27 October 2016, he looks at the economic, legal and social implications.

In a speech by Mr Yves Mersch, Member of the Executive Board of the European Central Bank, at the University of the Deutsche Bundesbank, Hachenburg, 27 October 2016, he looks at the economic, legal and social implications.

Impact of low interest rates on the economy

The low interest rate environment is having an impact on our lives in many different ways. Let us start with what you as central bankers of the future will certainly be most interested in: the economic challenges for the European Central Bank (ECB).

Low investment and an increased tendency to save have resulted in a fall in the equilibrium interest rate – the price at which savings and investment are in equilibrium. This is important because this interest rate plays an important role in the orientation of our monetary policy. But more about that later.

Perhaps the greatest risk in such an environment is that individual developments can reinforce one other: the expectation of lower growth in the future can lead to lower investment and excessive saving today.

As I have said before, it is important to avoid a Ricardian angst effect, meaning that persistently low interest rates result in savers developing a higher tendency to save in order to accumulate the same wealth as they would have at higher interest rates.

The fact that the gross savings ratio has been rising again recently in many euro are countries – standing currently at 17.5% in Germany, 14.4% in France – demands our attention.

The International Monetary Fund has put forward similar arguments, warning recently of a “low growth trap“.

Such a development would lead to even lower interest rates, as ever more savings would compete for ever fewer investment opportunities. Greater risks of deflation could ensue.

A central bank cannot disregard such risks. Our mandate is based on maintaining price stability, which is defined as an inflation rate of below, but close to, 2% over the medium term. If we see this objective at risk, we must act.

Let us remind ourselves how monetary policy traditionally works.

In his main work “Geldzins und Güterpreise” (1898), Knut Wicksell investigated the influence of monetary policy on investment and savings behaviour, as well as on the economy. He stated that if the key interest rate is reduced to below the natural interest rate, savings are lower and consumption is higher. The natural rate is “the loan interest rate at which this reacts in an entirely neutral way to goods prices.”

As a result, aggregate demand increases. This will raise the incentives for businesses to invest and they will demand more loans. If the demand for loans is so large that it is not met by the existing savings, the gap will be filled by newly created money.

Interest rate cuts thus lead to loan creation, investment and greater consumption. Investment will lead to higher salaries. As a result, the prices of goods will rise more rapidly. Conversely, higher interest rates dampen demand and price increases.

In short: if the market rate is lower than the natural rate, inflation will tend to occur, and when the opposite is true, then disinflation or even deflation are likely to result.

The problem of a lower equilibrium rate is that it limits a central bank’s leeway for supporting measures. If then in such an environment further economic shocks occur on the demand side, the central bank has to resort rather to unconventional measures, as it can only lower the policy rate to a limited extent.

The package of measures taken by the ECB reflects this situation. It consists of a mixture of conventional and unconventional measures: first of all, we have reduced the key rate to zero, and the rate on the deposit facility is even at -0.4%. In addition, we have launched an asset purchase programme and offered long-term loans to banks at favourable conditions which reward additional loan provision. The aim of all our measures is to keep market rates below their long-term level and thus create an incentive for investment and consumption.

Finally, we want to ensure that the inflation rate over the medium term returns to close to the 2% level. But as long-term interest rates are already at a very low level, market interest rates also have to be low and even negative in order to achieve an appropriate level of support.

In order to assess the effectiveness of our actions, it is important to observe our monetary policy measures not in isolation but as a whole: demand for loans is increasing and our staff estimate that inflation in the euro area will rise to 1.6% in 2018. In 2019 we should largely achieve our aim of below, but close to, 2%. In other words, our monetary policy is working.

However, we are also aware that our measures are having side effects and are keeping this in mind. In particular, we are aware of the fact that these side effects are heightened the longer we maintain our measures. We are therefore keeping a very close eye on the effects that the low or negative interest rate environment has on banks, insurers and savers.

Indeed, banks are complaining that the profitability of their sector is being affected by the low interest rate environment. This is particularly the case for banks whose business model depends heavily on net interest income. First of all, the margins derived from maturity transformation are declining because of the very flat yield curve. And secondly, deposit-based refinancing becomes less profitable, mainly because it is difficult to pass on negative interest rates to private customers.

Some banks have started to charge for deposits over €100,000. Ultimately, however, it will mean that some banks will have to adapt their business models to operate profitably in the long term.

Particularly in Germany there is a need for action. And this is not primarily due to the low interest rate environment. The German banking sector is one of the largest in the euro area, but at the same time the most inefficient. The cost-income ratio of German banks stands at 73%, significantly higher than the rest of the euro area.

And while other countries reduced the number of their banks by almost a quarter following the financial and economic crisis to reduce overcapacity, in Germany it was only 10%. Life insurance companies and pension funds which have promised their customers a nominal rate of return are also coming under pressure: they are finding it difficult to generate these returns in the current market environment. However, we are already seeing that the industry is adapting and focusing somewhat more on unit-linked products, and thus on the more dynamic capital market. However, it is not just banks, insurance companies and pension funds that are suffering from the low interest rates – savers in general are also affected. Private savers are asking whether, in the current environment, it is still worthwhile saving at all. In most cases they take the nominal interest rate of their deposits as a benchmark. In so doing, what they don’t take account of is the real purchasing power of their savings, namely what is left over after deducting the inflation rate. If we consider for instance the real rate of return on bank deposits of private households in Germany since 1991, these generally remained at less than 1%, and sometimes they were even negative. The real overall portfolio return shows large fluctuations over the same period as a result of different factors, and stood just above 1.5% on average between 2008 and early 2015.

In recent years, higher valuation gains above all have supported the overall rate of return, to which our asset purchase programme has also contributed. Because the scope for further valuation gains in the future is estimated to be fairly limited, analysts in Germany are assuming that overall returns in the coming year could decline or even be negative, also because of higher inflation.

These developments suggest that the low-interest phase may lead to a structural change in the financial system, which in turn could give rise to new risks.

Especially in the euro area countries which have been greatly affected by the financial and economic crisis, lending by some banks is still severely constrained by legacy assets resulting from crisis times. On the search for yield and reinforced by technological progress new participants are coming to the fore in these fields. In particular, non-banks, which also go by the unfortunate name of shadow banks, are increasingly active in the traditional banking business. At the same time, sound and liquid companies from the real economy are entering the intermediation market and providing their customers with services that used to be the preserve of banks.

While developments of this kind need not be a bad thing in principle, we should be vigilant and closely monitor the resulting risks. For example, lower lending standards or higher debt levels could result. We also have to bear in mind the liquidity risks and interconnectedness of the various sectors.

Despite all these side effects, I would like to emphasise that the benefits of our monetary policy so far are prevailing. But this situation could change the longer these special circumstances continue. Above all, we need to remember that reactions to interest rate cuts into negative territory do not necessarily follow a linear path.

Moreover, the longer the measures are in place, the less effective they may become. The fact that additional lending in the euro area is losing momentum and that German banks are saying that the negative deposit facility rate is constraining lending volumes warrants attention.

We must be vigilant that this development does not spread to other euro area countries.

So when it comes to deciding what our future monetary policy stance should be, we have to take this into account in our cost/benefit analysis. This applies to instruments, volumes and horizons.

Legal implications

Let me now turn to the legal dimension. I will make a distinction here between private law challenges and the legal framework to which the ECB is subject.

In the financial sector, there are many products whose remuneration is based on a variable interest agreement. This means that the interest rates are regularly adapted to the prevailing market interest rates. The legal position here is very unclear, since in Europe such agreements are subject not only to private law but also to regulatory requirements, based on the implicit assumption that interest rates are always positive in a market economy

This new phenomenon of negative interest rates creates uncertainty and leaves much room for interpretation. This could lead to high legal costs if the need for clarification becomes a matter for the courts.

The legal limits to our monetary policy are, on the other hand, very clearly regulated. The EU Treaties define the objective of our monetary policy measures: maintaining price stability. The ECB has a large measure of freedom in its choice of instruments to achieve this objective. However, it must ensure that the instruments chosen are necessary, appropriate and proportionate. In addition, it must be ensured that the European System of Central Banks (ESCB) “[acts] in accordance with the principle of an open market economy with free competition, favouring an efficient allocation of resources”.

And finally, we are prohibited from conducting monetary financing. This prohibition protects monetary policy against becoming a plaything of fiscal policy. So what may at first sight seem to be a restriction is, in reality, a strengthening of our mandate and our credibility.

All the measures that we have taken over the past few years fall within this legal framework. The European Court of Justice and the German Constitutional Court have confirmed that this is the case, provided that the self-imposed boundaries are observed. We would do well not to shift these boundaries at whim, as this would call the current legal certainty into question.

In the current environment, this means that we are doing and will continue to do everything within our mandate to ensure price stability in the euro area. But it also means that others have to play their part in putting the euro area back on a sustainable growth path over the long term. And I address these remarks principally to the governments of the Member States which need to make progress on the necessary structural reforms in order to make product and labour markets more flexible, to reduce red tape and where possible to invest in education, infrastructure and productivity improvements.

Breeding ground for populist movements

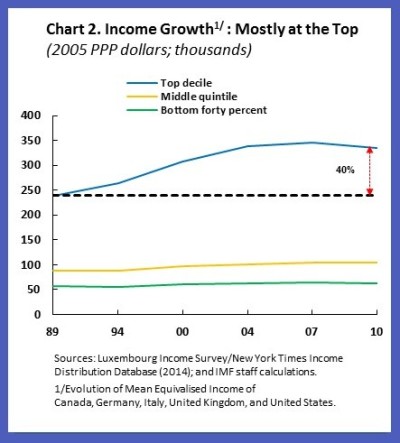

This brings me to my last point: societal change. Like the low interest rate environment in which we as a central bank are operating, the current social dislocation is being caused by, among other things, low growth and the resulting high levels of unemployment in many economic areas. The fact that the recent annual meeting of the International Monetary Fund and the World Bank addressed this issue earlier this month shows how important this issue has become.

The solution to these problems does not however lie in the hands of the central banks. As I said, we are only responsible for maintaining price stability. Fiscal redistribution, for example, for the purpose of a politically motivated correction of income differences has to be decided and implemented by democratically elected parliaments. The division of tasks is clear.

Nevertheless, the societal changes over recent years have had an impact on us, and we observe these developments with great concern.

The fact is that many people in our society are finding globalisation difficult. They believe that it only benefits large companies, some of which pursue excessive tax optimisation and question protection rights for individuals – protection rights for those who are doing their bit for society. This sentiment, reinforced by the emotional reactions to the refugee crisis, has discredited the notion of open borders.

In addition, growing uncertainty about secure pension provisions, retaining the value of savings and the deteriorating economic outlook are a breeding ground for populist parties and movements. A growing number of people are ready to sacrifice economic and social freedom for what they believe to be greater security.

In such an environment, it will be more difficult for us, as a central bank, to explain our monetary policy decisions, particularly if some groups feel discriminated against by our decisions, such as savers in Germany. We must take these feelings seriously, although the interest rate on savings reflects the state of the economy and is not primarily the result of monetary policy measures

Our monetary policy measures have prevented the euro area from sliding into a new recession. In the long term our decisions help to stabilise the value of the currency and thus ensure more fairness in society. A Bundesbank study, for example, which considers whether and in what way monetary policy influences the distribution of income and wealth, concludes that it is highly questionable that the expansionary monetary policy measures taken in recent years have increased inequality overall.