Welcome to the Property Imperative weekly to 13th October 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

This week saw major ructions on the financial markets, which may be just a short-term issue, or a signal of more disruption ahead. And locally, the latest data reveals a slowing of lending to first time buyers and owner occupied borrowers, suggesting more home price weakness ahead. So let’s get stuck in.

This week saw major ructions on the financial markets, which may be just a short-term issue, or a signal of more disruption ahead. And locally, the latest data reveals a slowing of lending to first time buyers and owner occupied borrowers, suggesting more home price weakness ahead. So let’s get stuck in.

Watch the video, listen to the podcast, or read the transcript.

And by the way you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

Let’s look at property first.

The IMF’s latest Global Financial Stability Report (FSR) says Australia is one of a number of advanced economies where rising home prices are a risk. “household leverage stands out as a key area of concern, with the ratio of household debt to GDP on an upward trajectory in a number of countries, especially those that have experienced increases in house prices (notably, Australia, Canada, and the Nordic countries). Housing market valuations are relatively high in several advanced economies. Valuations based on the price-to-income and price-to-rent ratios, as well as mortgage costs, have been on the upswing over the past six years across major advanced economies, with valuations relatively high in Australia, Canada, and the Nordic countries.

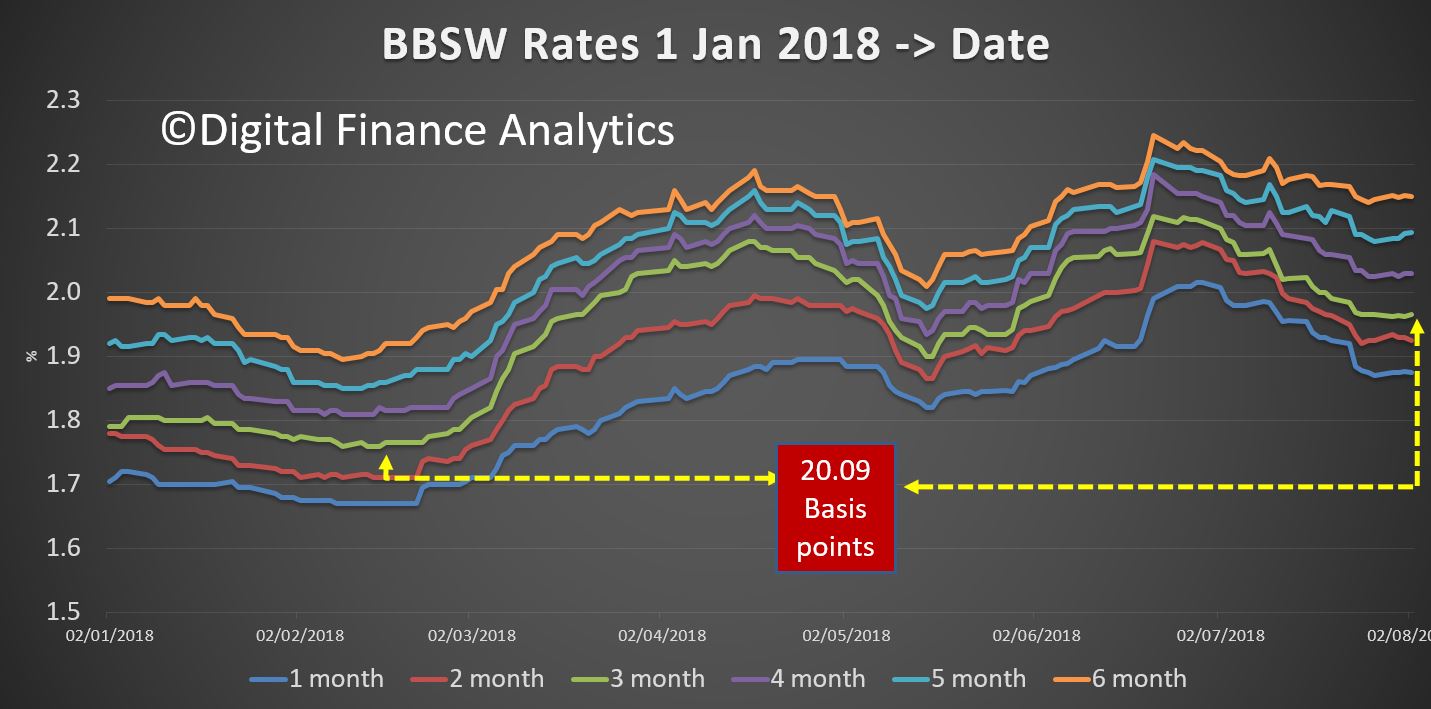

And they also warn that the effect of monetary policy tightening (lifting interest rates to more normal levels) – could reveal financial vulnerabilities. Indeed, it’s worth looking at expected central bank policy rates globally. Bloomberg has mapped the relative likelihood of increases and decreases across a number of major economies, and most advanced economies are on their way up. Worth thinking about when we look at the long term home prices trends across the globe. Guess where Australia sits? High debt, in a rising interest rate environment is not a good look, so expect more stress in the system.

Yet the latest RBA Financial Stability review, out last Friday seems, well, in a different world. They go out of their way to downplay the risks in the system, and claim that households are doing just fine, based on analysis driven by the rather old HILDA data – again.

But back in the real world, Corelogic’s auction results for last week returned an aggregated clearance rate of 49.5% an improvement on the week prior at 45.8 per cent of homes sold, which was the lowest weighted average result since 42 per cent in June 2012. There was a significantly higher volume of auctions with 1,817 held, rising from the 895 over the week prior.

Melbourne’s final clearance rate fell last week, to 51.8 per cent the lowest seen since 50.6 per cent in December 2012. There were 904 homes taken to auction across the city. Compared to one year ago, the Melbourne auction market was performing very differently, with both volumes and clearance rates significantly higher over the same week (1,119 auctions, 70.3 per cent).

Sydney’s final auction clearance rate increased last week, with 46.1 per cent of the 611 auctions held clearing, up from the 43.8 per cent the week prior when a similar volume of auctions was held. One year ago, Sydney’s clearance rate was 61.3 per cent across 818 auctions.

Across the smaller auction markets, Canberra returned the strongest final clearance rate of 64.6 per cent last week, followed by Adelaide where 62.3 per cent of homes sold, while only 11.1 per cent of Perth homes sold last week.

Looking at the non-capital city regions, the Geelong region was the most successful in terms of clearance rates with 48.5 per cent of the 41 auctions recording a successful result.

This week, CoreLogic is tracking 1,725 auctions across the combined capital cities, which is slightly lower than last week. Compared to one year ago, volumes are down over 30 per cent (2,525).

They also highlighted the growing settlement risk relating to off the plan high-rise sales. Prospective buyers may sign a contract to purchase from the plan, but when the unit is ready – perhaps a year or two later, a bank mortgage valuation may not cover the purchase price. Meaning the buyer may be unable to complete the transaction. CoreLogic says that in Sydney, 30% of off-the-plan unit valuations were lower than the contract price at the time of settlement in September, double the percentage from a year ago. In Melbourne, 28% of off-the-plan unit settlements received a valuation lower than the contract price. In Brisbane, where unit values remain 10.5% below their 2008 peak, the proportion was substantially higher, at 48%. And they also argue that loss making resales are rising, especially in the unit sector, although it does vary by location.

The latest housing finance figures from the ABS showed that lending flows for owner occupied buyers appear to be following the lead from the investment sector. Both were down. This is consistent with our household surveys. Looking at the original first time buyer data, the number of new loans fell from 9,614 in July to 9,534 in August, a fall by 80, or 0.8%. As a proportion of all loans written in the month, the share by first time buyers fell from 18% to 17.8%.

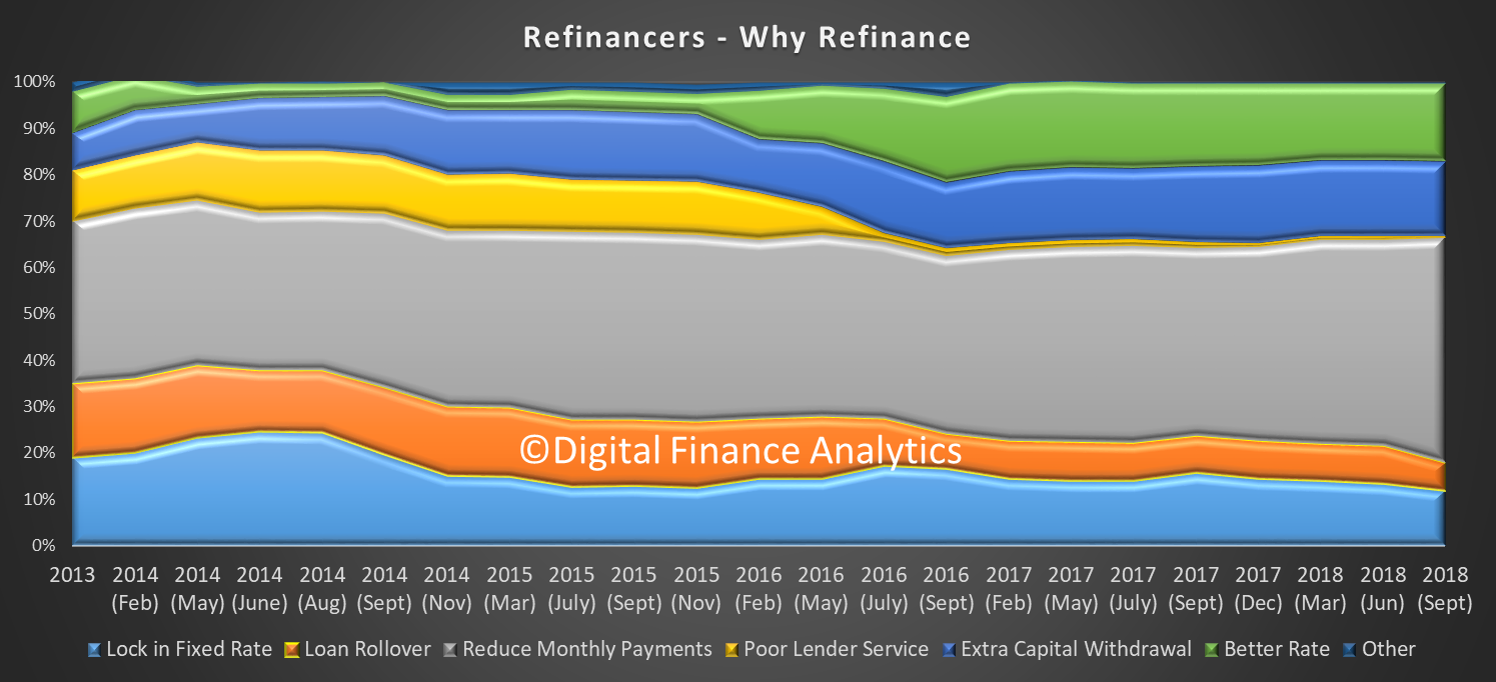

Looking at the trend lending flows, the only segment of the market which was higher was a small rise in refinanced owner occupied loans. These existing loans accounted for 20.5% of all loans written, up from 20.3%, and we see a rising trend since June 2017, from a low of 17.9%. Total lending was $6.3 billion dollars, up $31 million from last month. Investment loan flows fell 1.2% from last month accounting for $10 billion, down 120 million. Owner occupied loans fell 0.6% in trend terms, down $81 million to $14.5 billion. 41% of loans, excluding refinanced loans were for investment purposes, the lowest for year, from a high of 53% in January 2015.

On these trends, remembering that credit growth begats home price growth, the reverse is also true. Prices will fall further, the question remains how fast and how far? We will be revising our scenarios shortly.

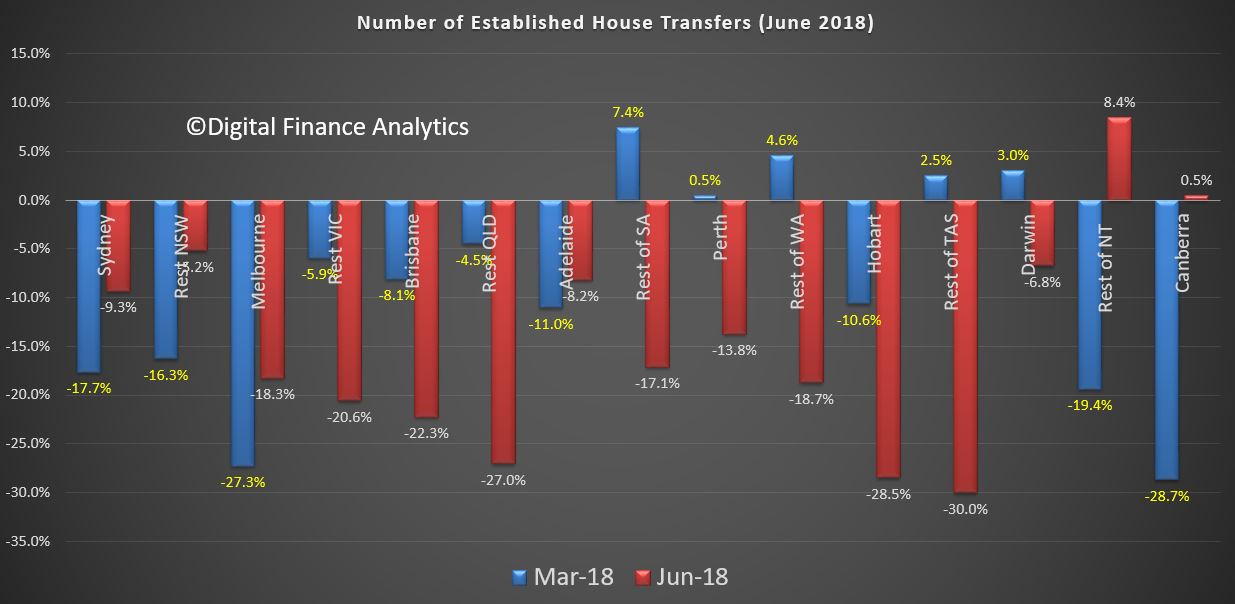

The latest weekly indices from CoreLogic shows price falls in Sydney, down 0.16%, Melbourne down 0.18%, Brisbane down 0.08%, Adelaide down 0.09% and Perth down 0.38% giving a 5 cities average of down 0.18%.

Morgan Stanley revised their house prices forecasts, down. They say “We struggle to see improvement in any of our components over the next year. We now see a 10-15 per cent peak to trough decline in real house prices (from 5-10 per cent), which would mark the largest decline since the early 1980s. With households 2x more leveraged to housing than back then, the impact on housing equity would be larger again. This downgrade largely reflects the downturn’s extended length, as we expect the relatively orderly declines to date will continue. However, an acceleration of declines is in our bear case, and we will continue to monitor stress points, including arrears trends. Strong employment growth and temporary migration has helped contain reported vacancy rates thus far, but we see a sustained overbuild into 2019 weighing on rentals”.

NABs latest quarterly property survey index fell sharply in Q3, to the lowest level in 7 years, Sentiment was dragged lower by big falls in NSW and VIC. NAB’s view is the orderly correction in house prices will continue over the next 18-24 months with Sydney falling around 10% peak to trough and Melbourne 8%. This reflects a bigger fall than previously expected but would still leave house prices well up on 2012 levels. Their central scenario does not include a credit crunch event leading to disorderly falls in house prices. They also say the boom in Australian real estate sales to foreign investors has run its course, with NAB’s latest survey results continuing to highlight a decline in foreign buying activity resulting from policy changes in China on foreign investment outflows and tighter restrictions on foreign property buyers in Australia. In Q3, there were fewer foreign buyers in the market for Australian property, with their market share falling to a 7-year low of 8.1% in new housing markets and a survey low 4.1% in established housing markets.

Expect the calls for an increase in migration, and a freeing of lending standards to reach fever pitch – both of which MUST be ignored. We have to get back to more realistic home price ratios, despite the pain. So it was interesting to note that the NSW State Government this week, suggested that migration needed to slow, to provide breathing space, and for infrastructure to catch up. Better late than never. Remember the 2016 Census revealed that Australia’s population increased by 1.9 million people (+8.8%) in the five years to 2016, driven by a 1.3 million increase in people born overseas (i.e. new migrants)!

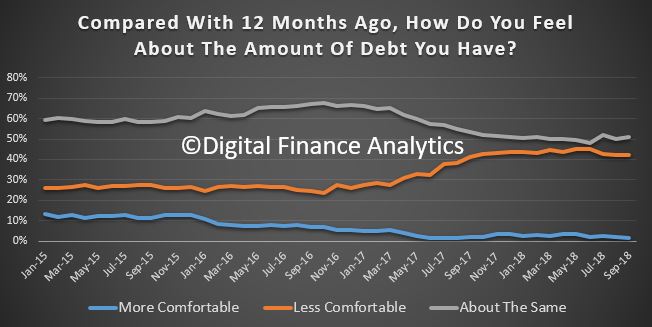

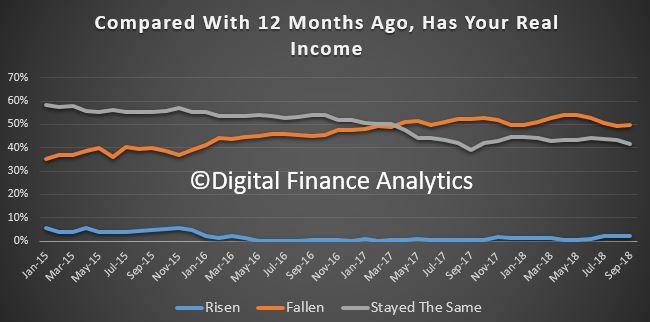

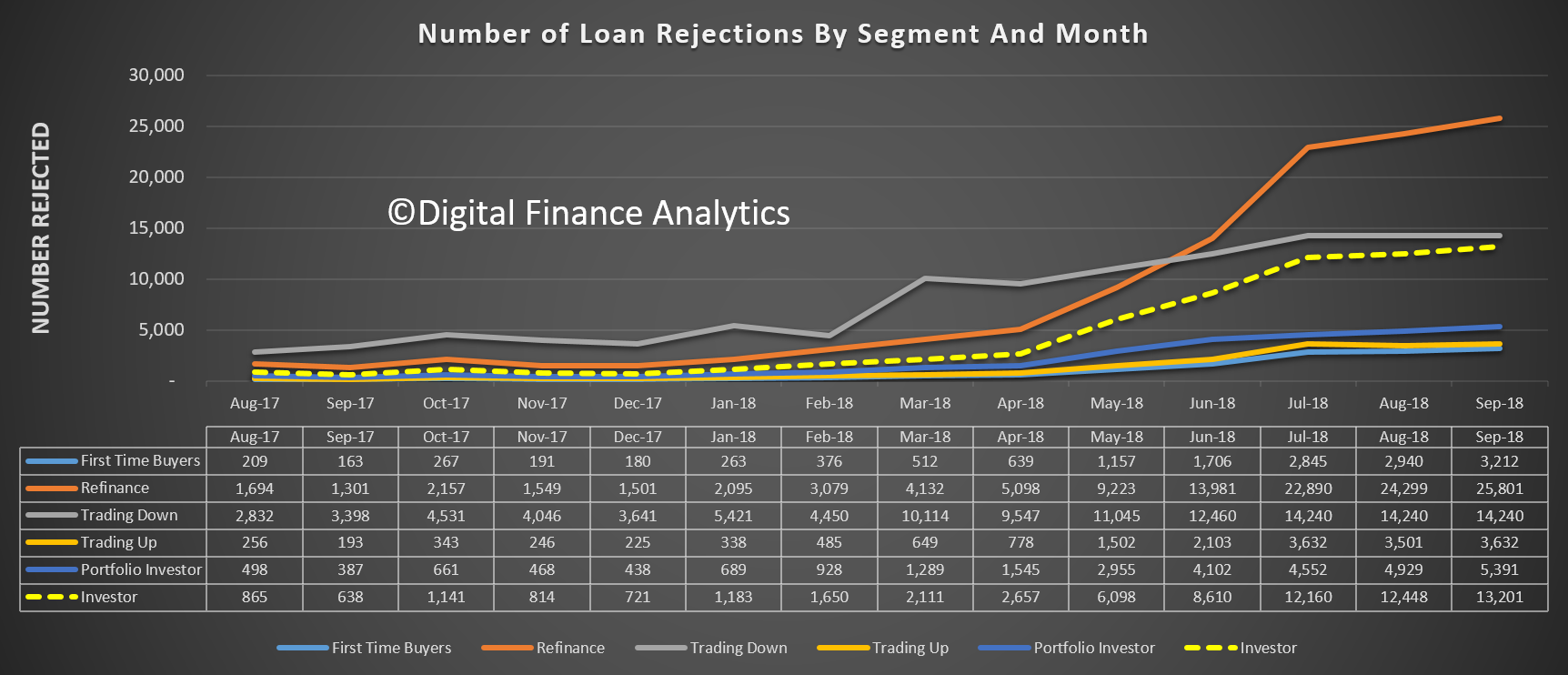

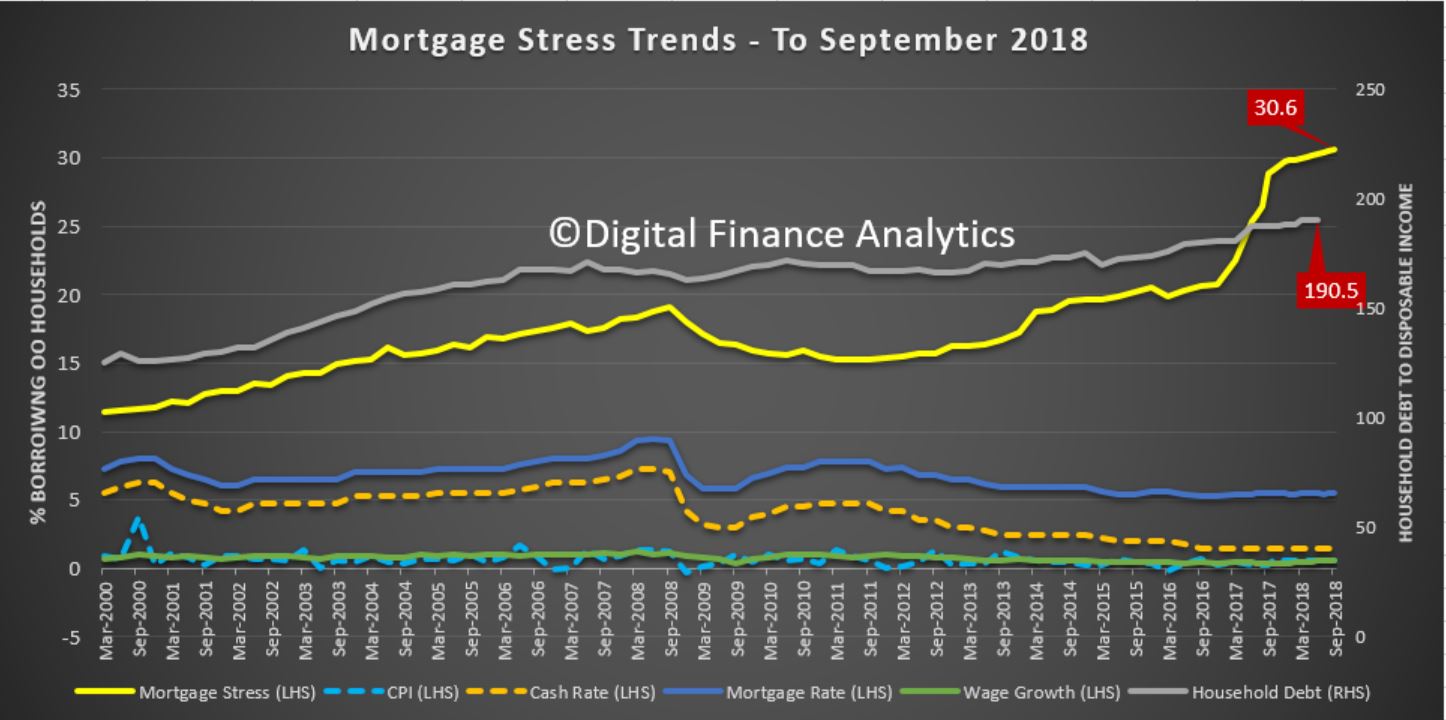

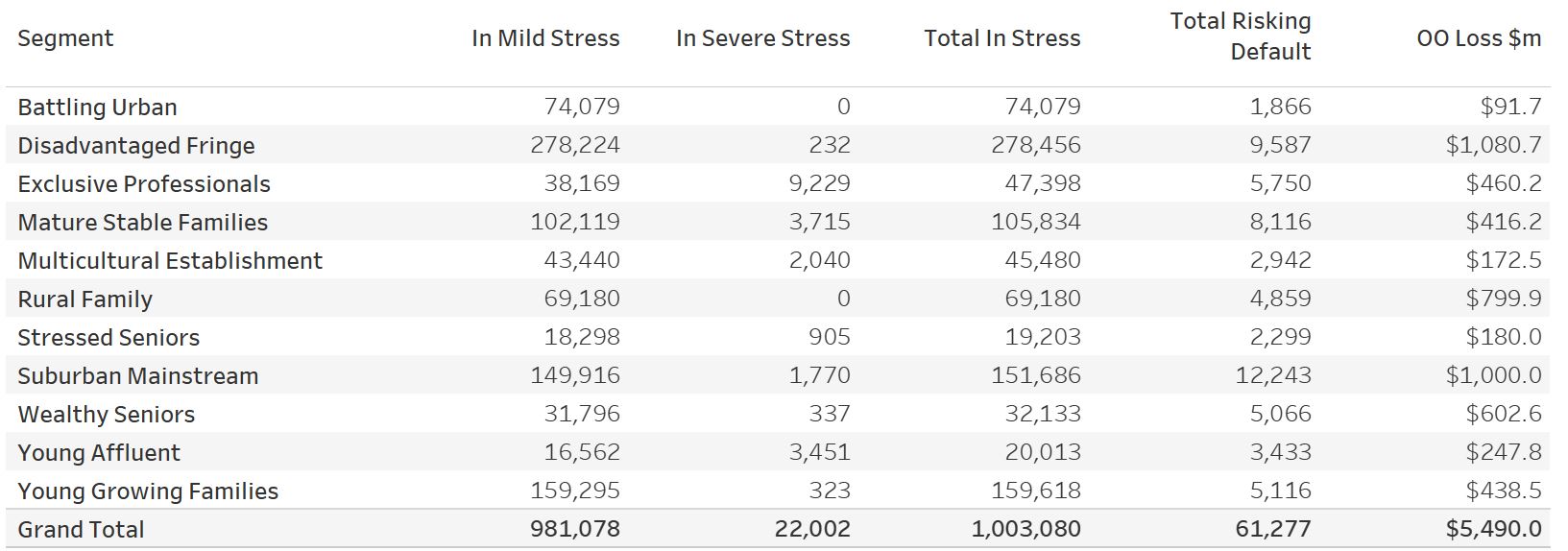

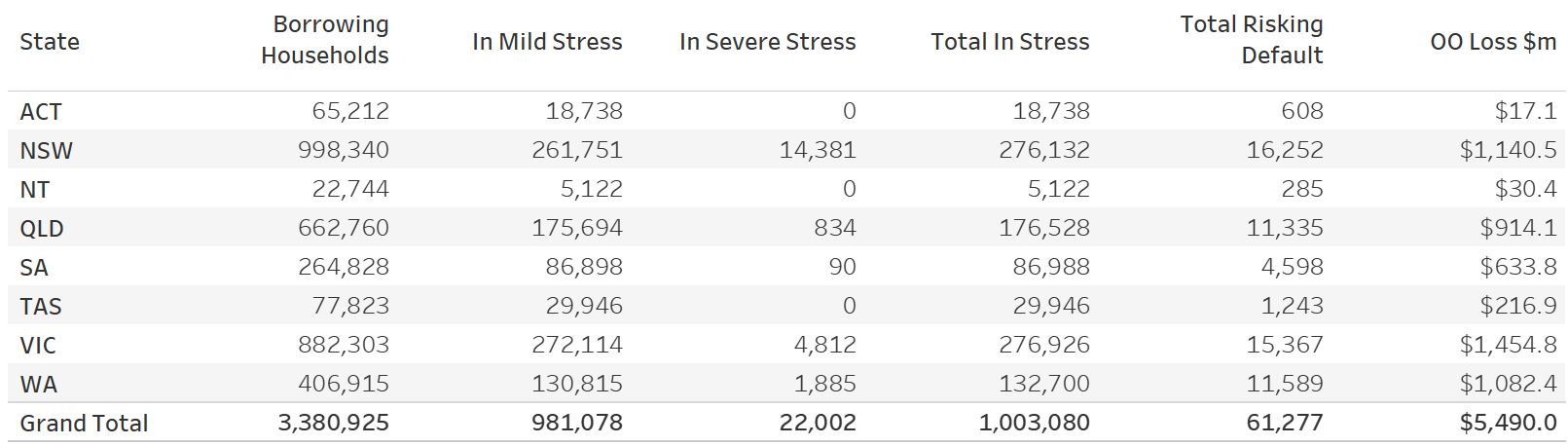

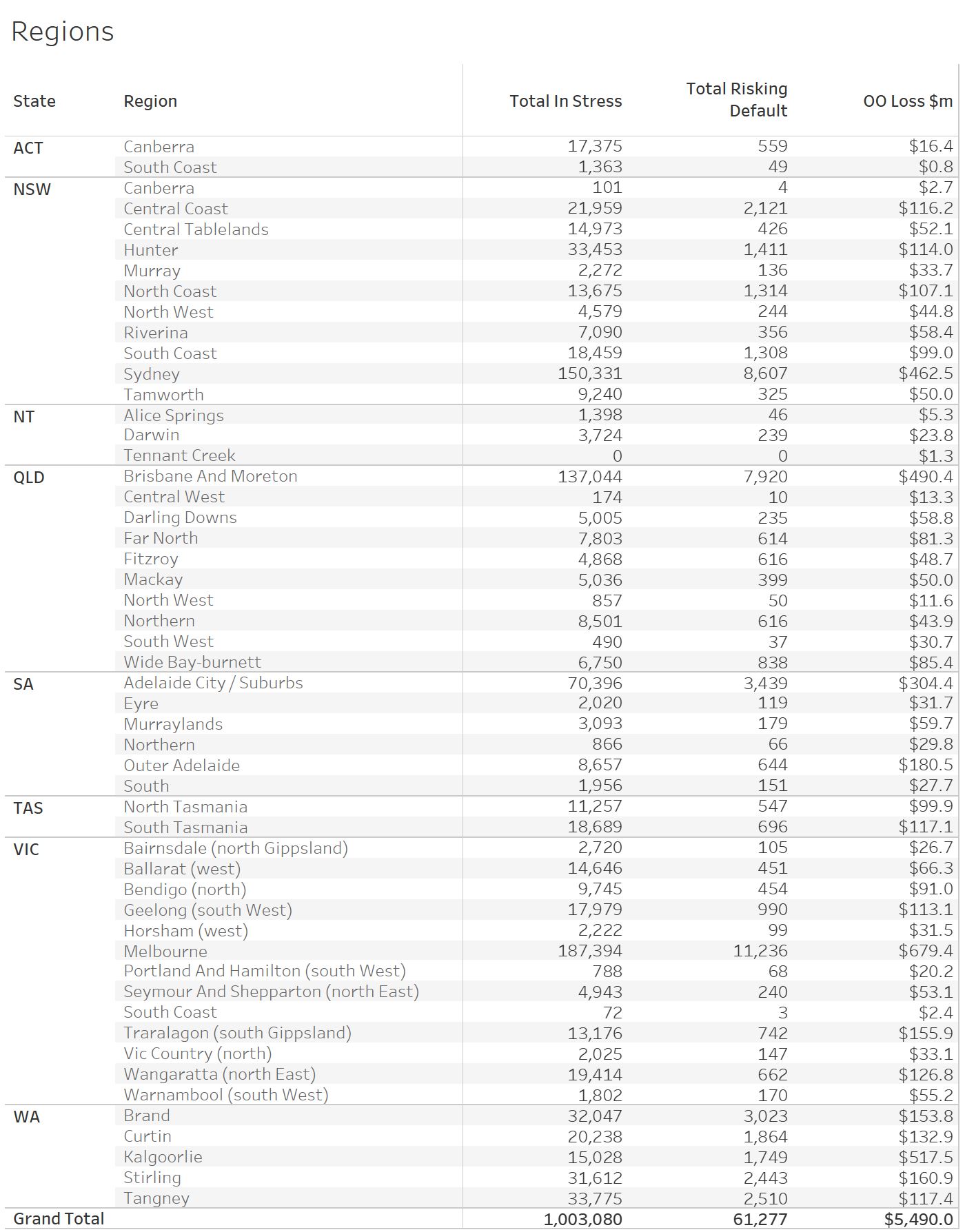

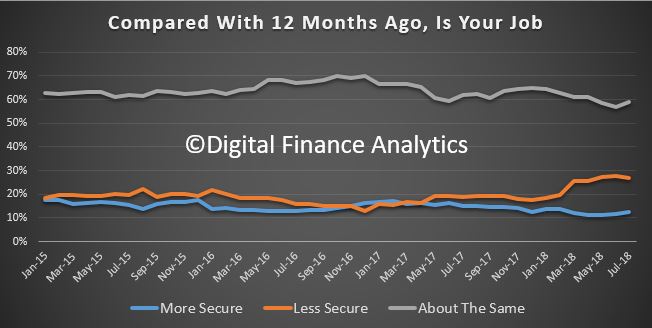

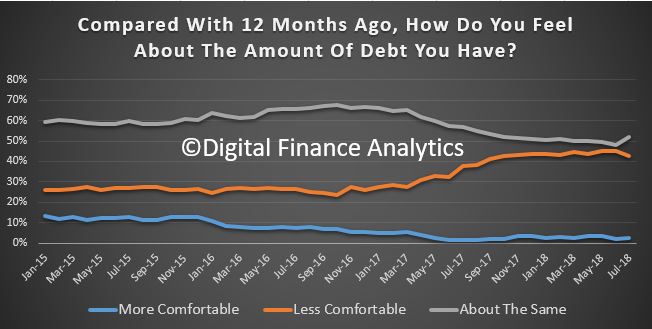

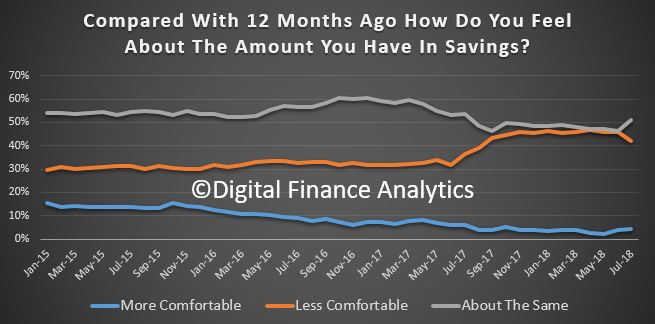

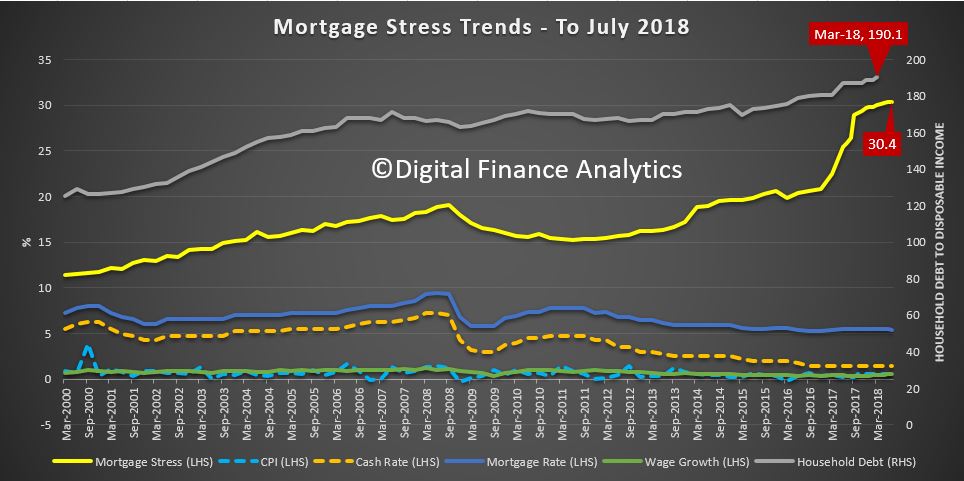

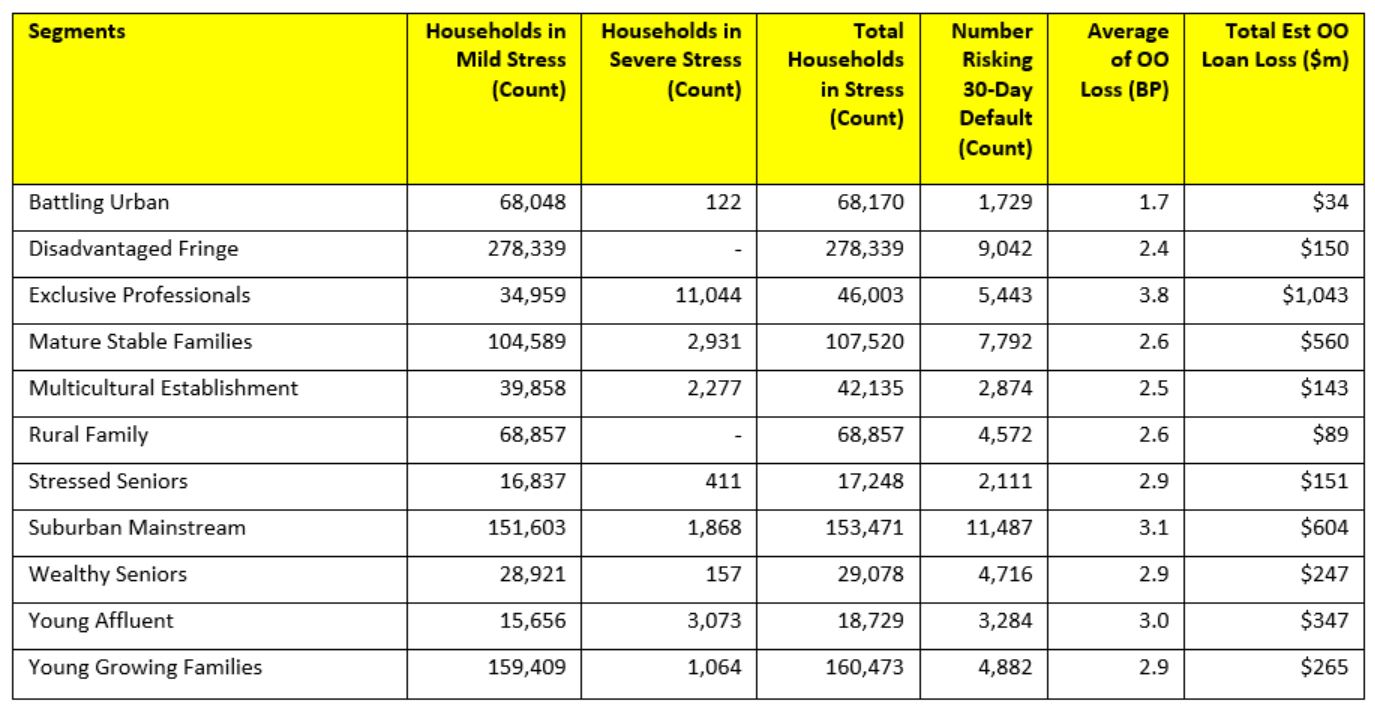

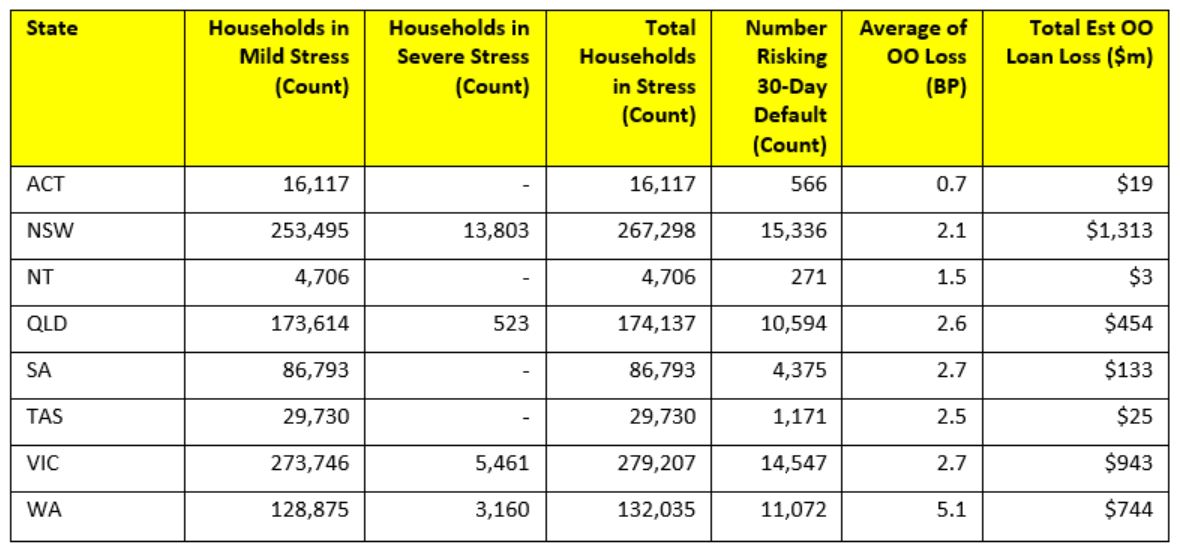

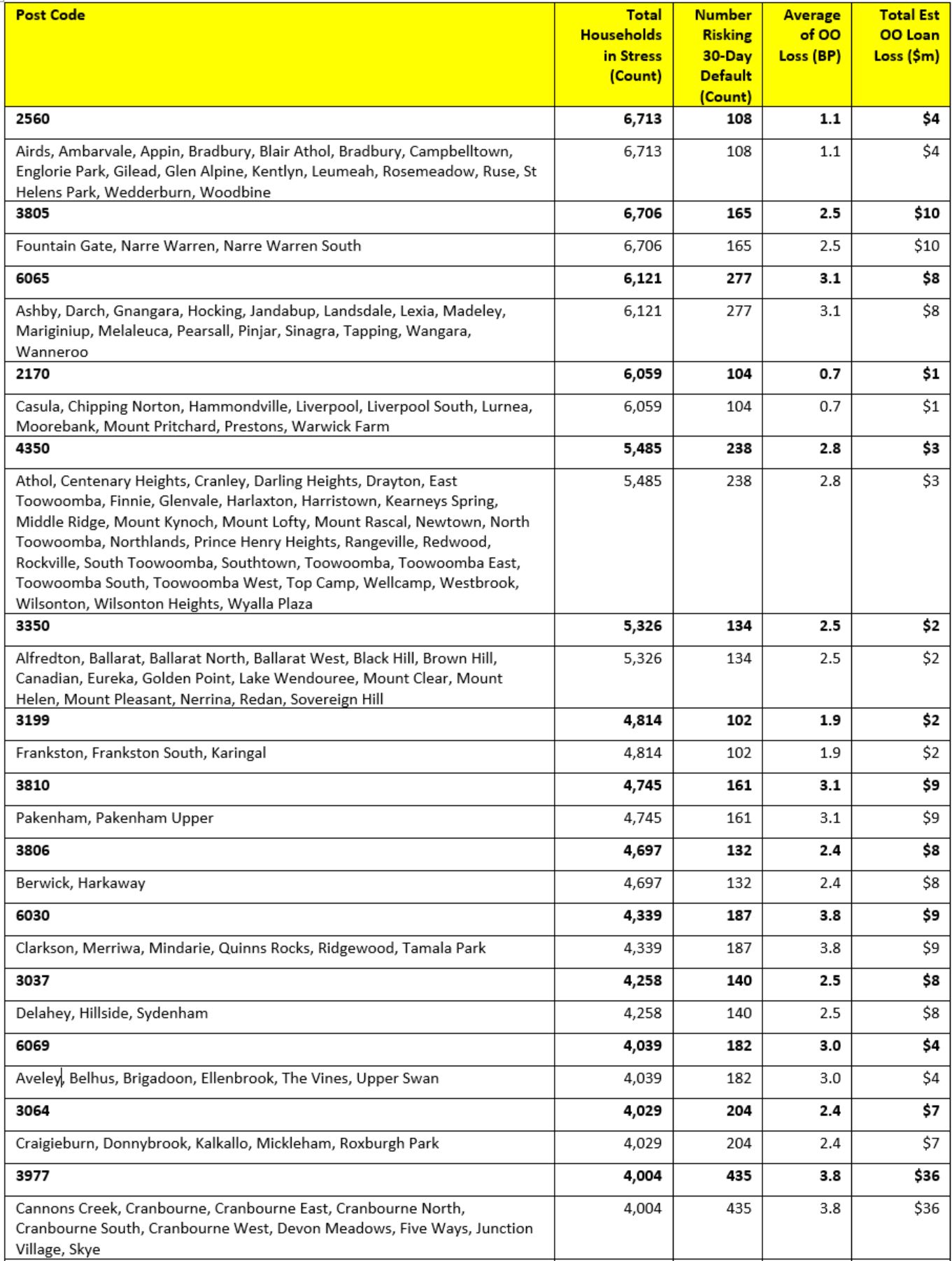

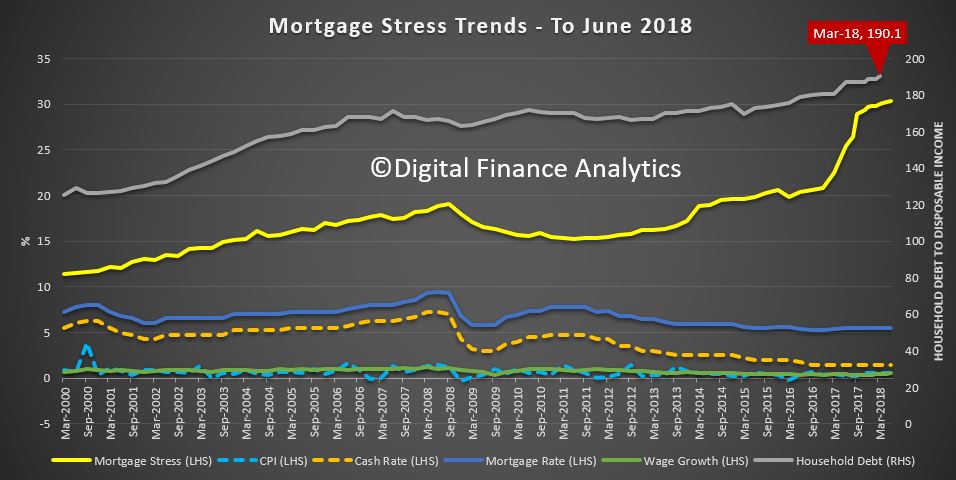

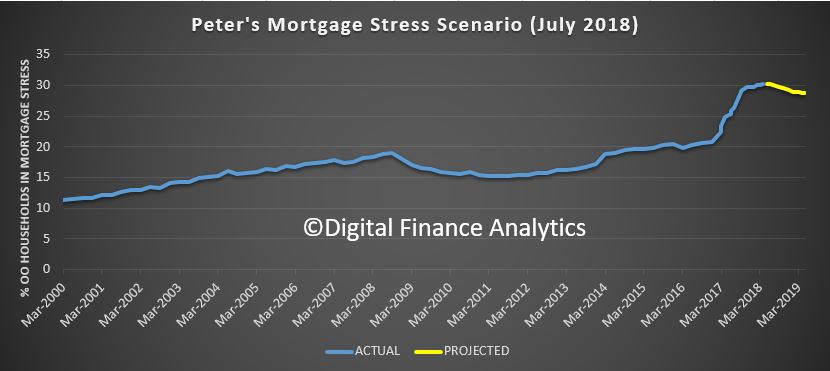

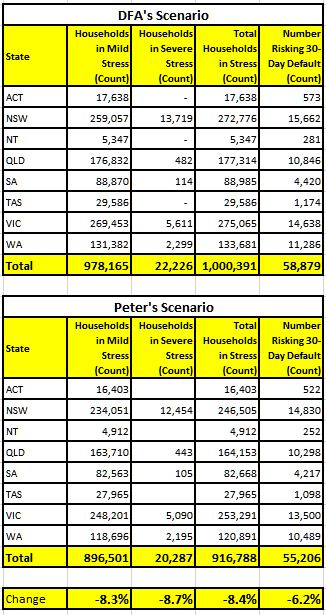

We published our latest household survey data this week. Mortgage stress rose again, to cross the one million households for the first time ever. We discussed the results in full in our post “Mortgage Stress Breaks One Million Households” The latest RBA data on household debt to income to June reached a new high of 190.5. This high debt level helps to explain the fact that mortgage stress continues to rise. Across Australia, more than 1,003,000 households are estimated to be now in mortgage stress (last month 996,000). This equates to 30.6% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

We published our latest household survey data this week. Mortgage stress rose again, to cross the one million households for the first time ever. We discussed the results in full in our post “Mortgage Stress Breaks One Million Households” The latest RBA data on household debt to income to June reached a new high of 190.5. This high debt level helps to explain the fact that mortgage stress continues to rise. Across Australia, more than 1,003,000 households are estimated to be now in mortgage stress (last month 996,000). This equates to 30.6% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 61,000 households risk 30-day default in the next 12 months. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. Bank losses are likely to rise a little ahead.

Moodys released a report suggesting that Mortgage delinquencies and defaults are more likely to occur in outer suburbs of Australian cities than inner-city areas, because of the lower average incomes and weaker credit characteristics in these suburbs. “Delinquency rates are highest in outer suburban areas. On average across Australian cities, mortgage delinquency rates are lowest in areas within five kilometers of central business districts and highest in areas 30-40 kilometers from CBDs. In the residential mortgage-backed securities they rate, delinquency rates are in many cases higher in deals with relatively large exposures to mortgages in outer areas.

We agree there are higher loan to value and debt to income ratios in the outer areas, but the overall debt commitments are higher closer in and so we suspect that many more affluent households are going to get caught, because of multiple mortgages, including investment mortgages and their more affluent lifestyles. My thesis is the banks have been lending loosely to these perceived lower risk high income households, but it ain’t necessarily so…

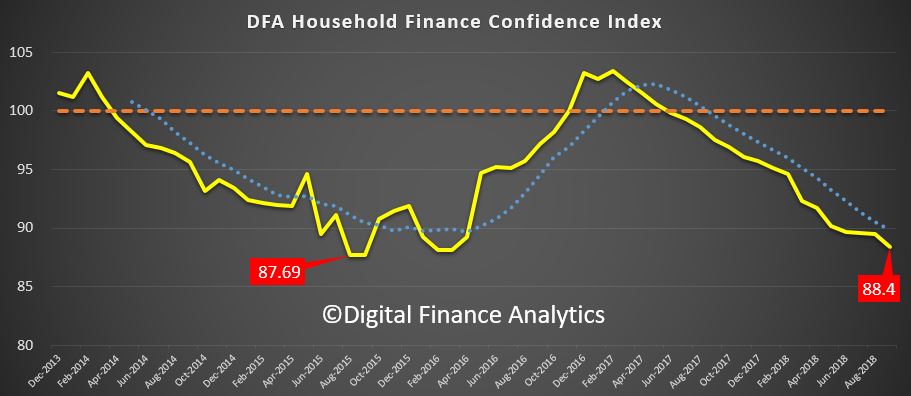

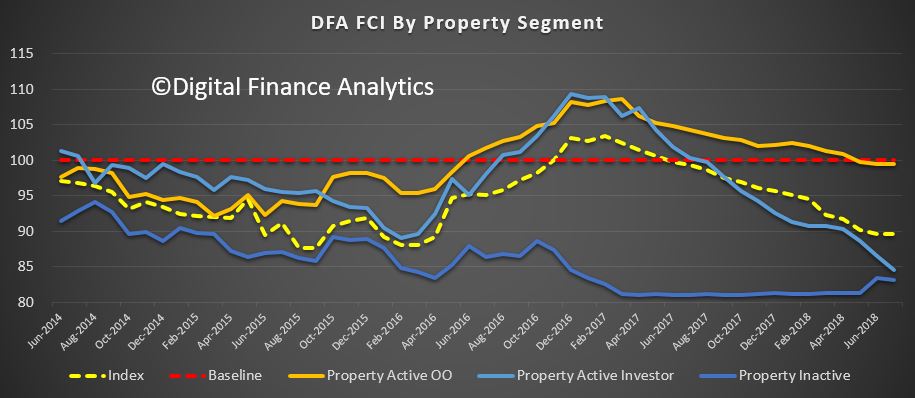

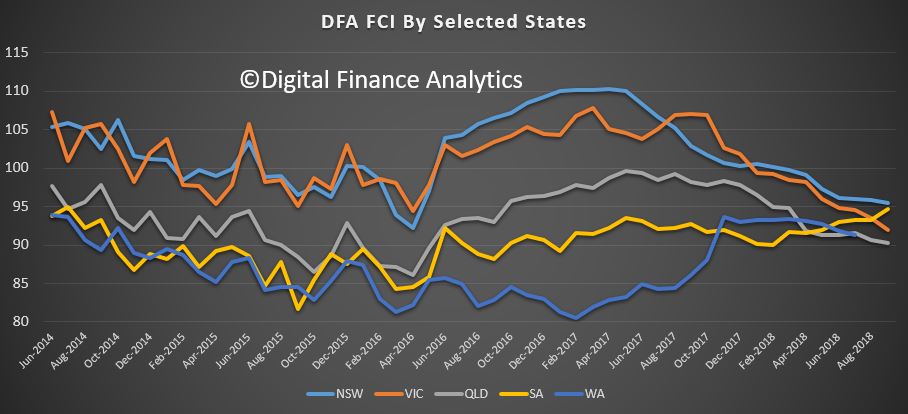

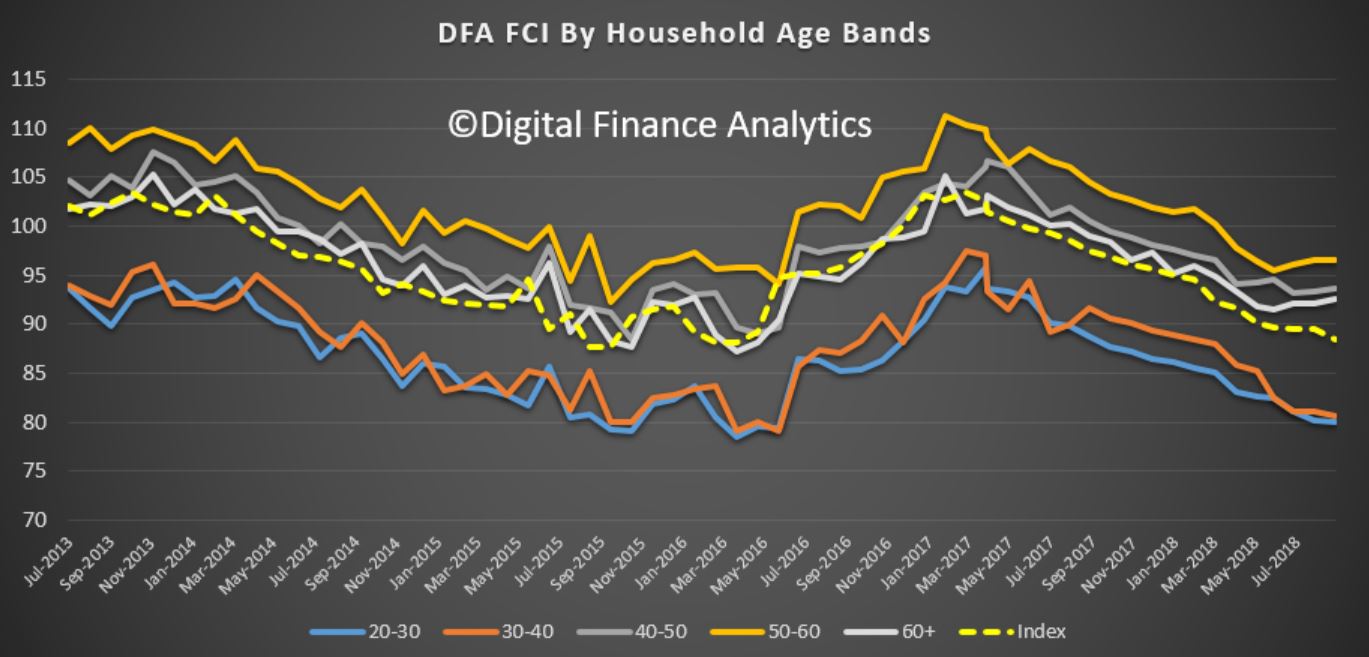

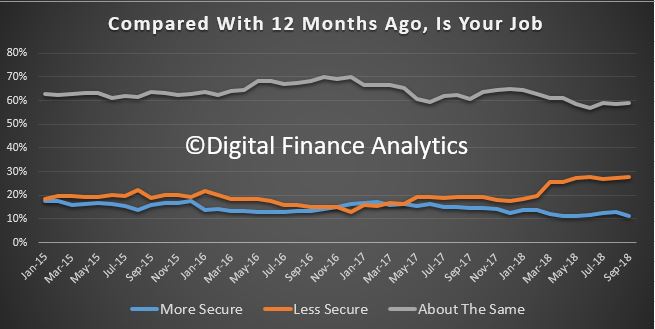

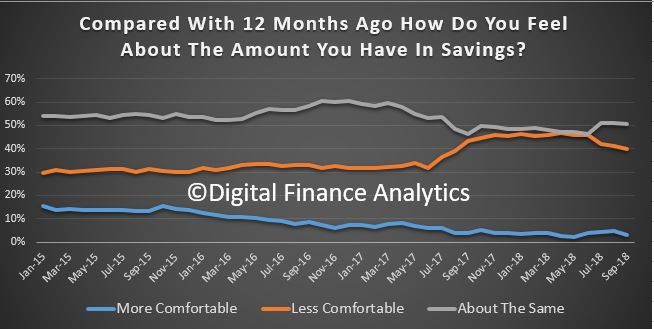

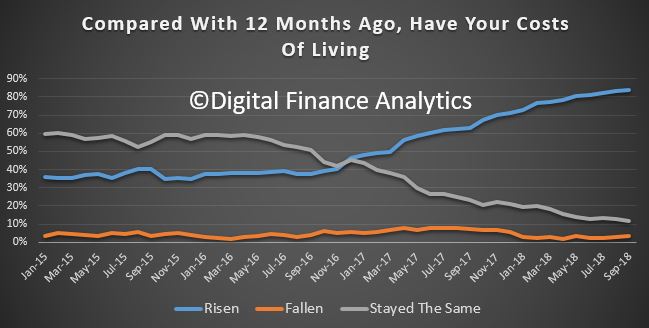

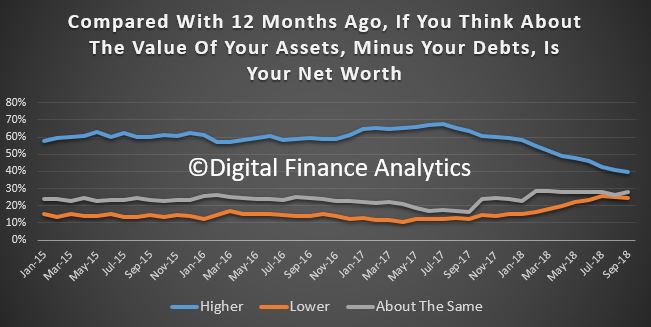

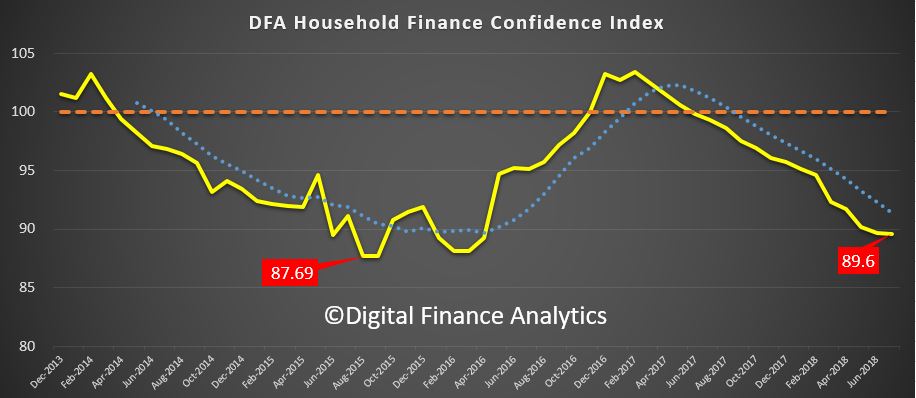

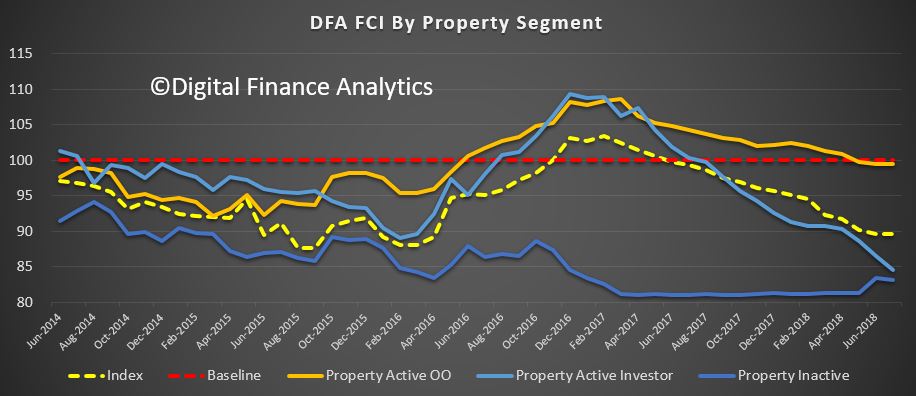

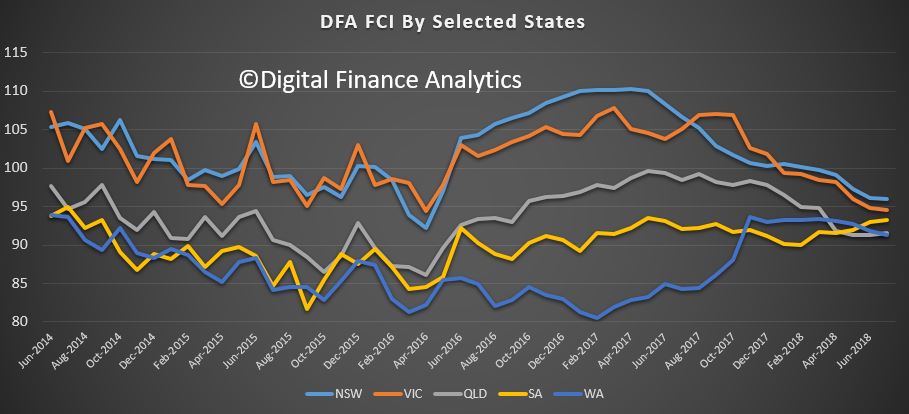

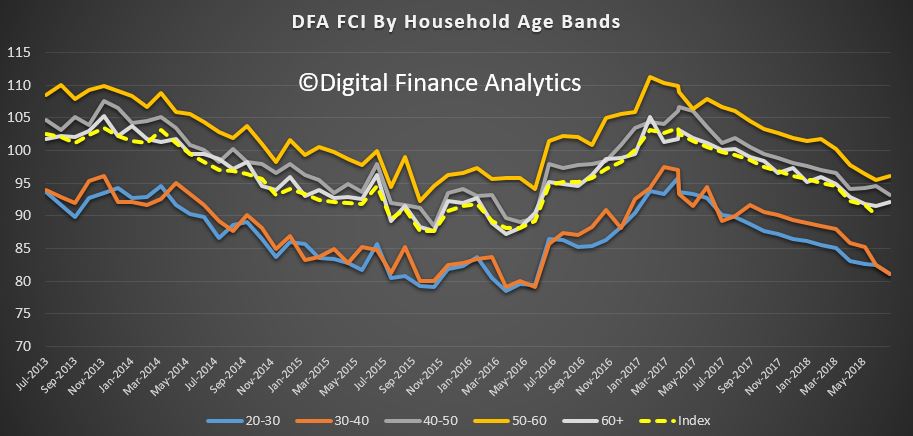

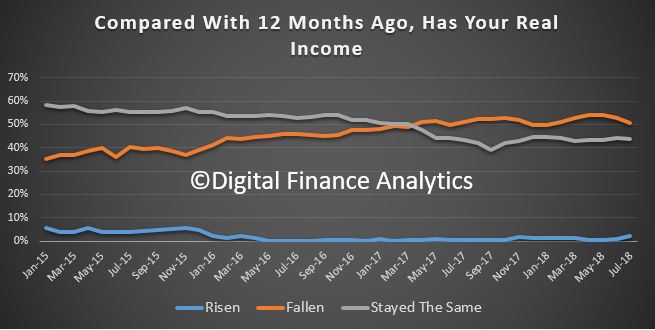

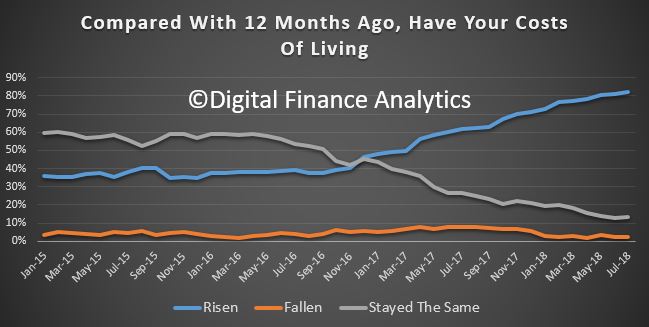

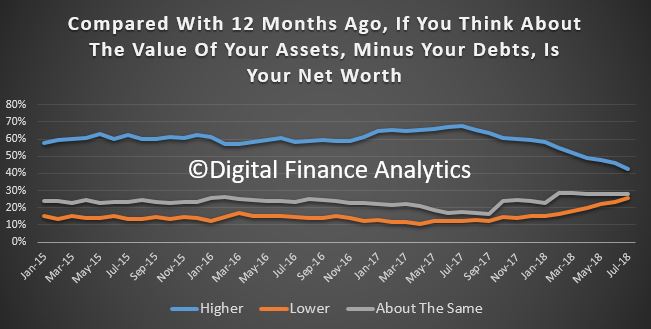

We also published our Household Financial Confidence index. The latest read, to end September shows a further fall, and continues the trend which started to bite in 2017. The current score is 88.4, just a bit above the all-time low point of 87.69 which was back in 2015. Last month – August – it stood at 89.5. You can watch our video “Household Financial Confidence Drifts Lower Again” where we discuss the results. We expect to see the index continuing to track lower ahead, because the elements which drive the outcomes are unlikely to change. Home prices will continue to move lower, the stock markets are off their highs, wages are hardly growing and costs of living are rising. Household financial confidence is set to remain in the doldrums.

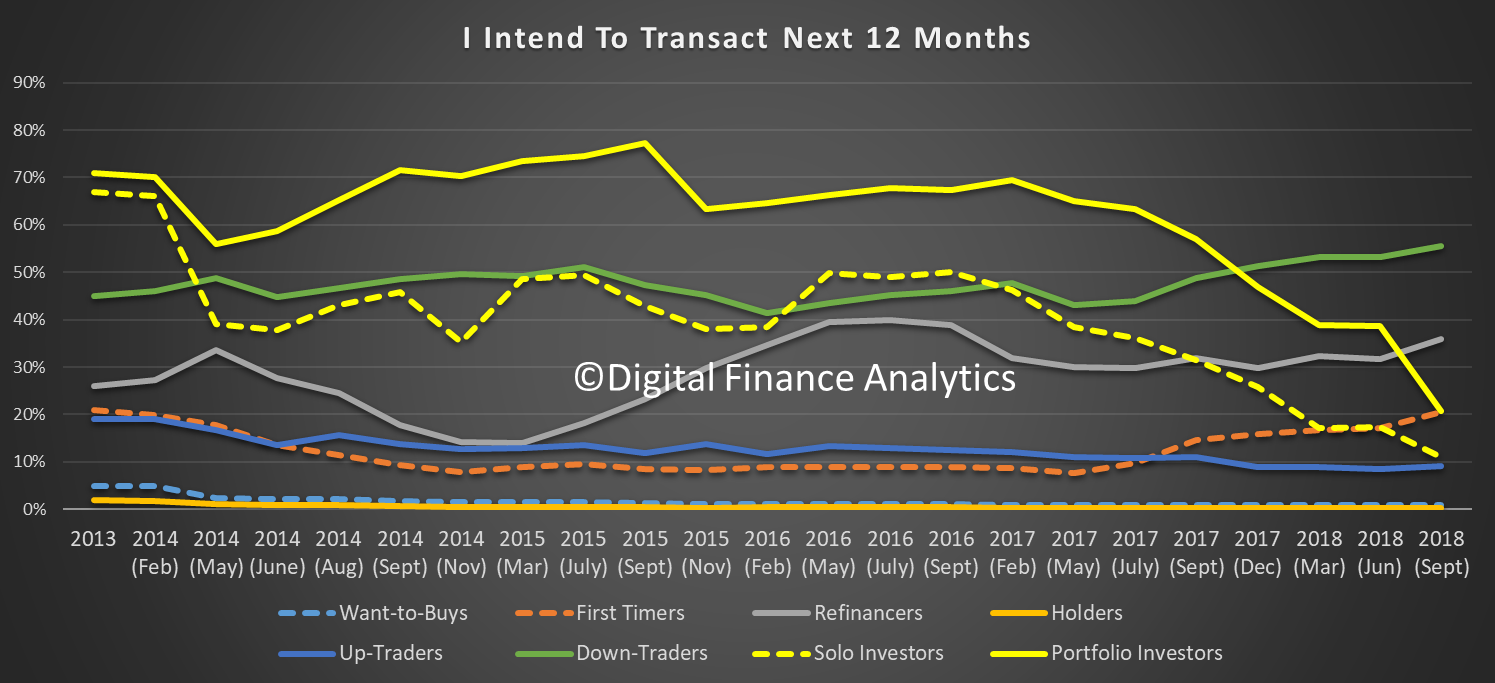

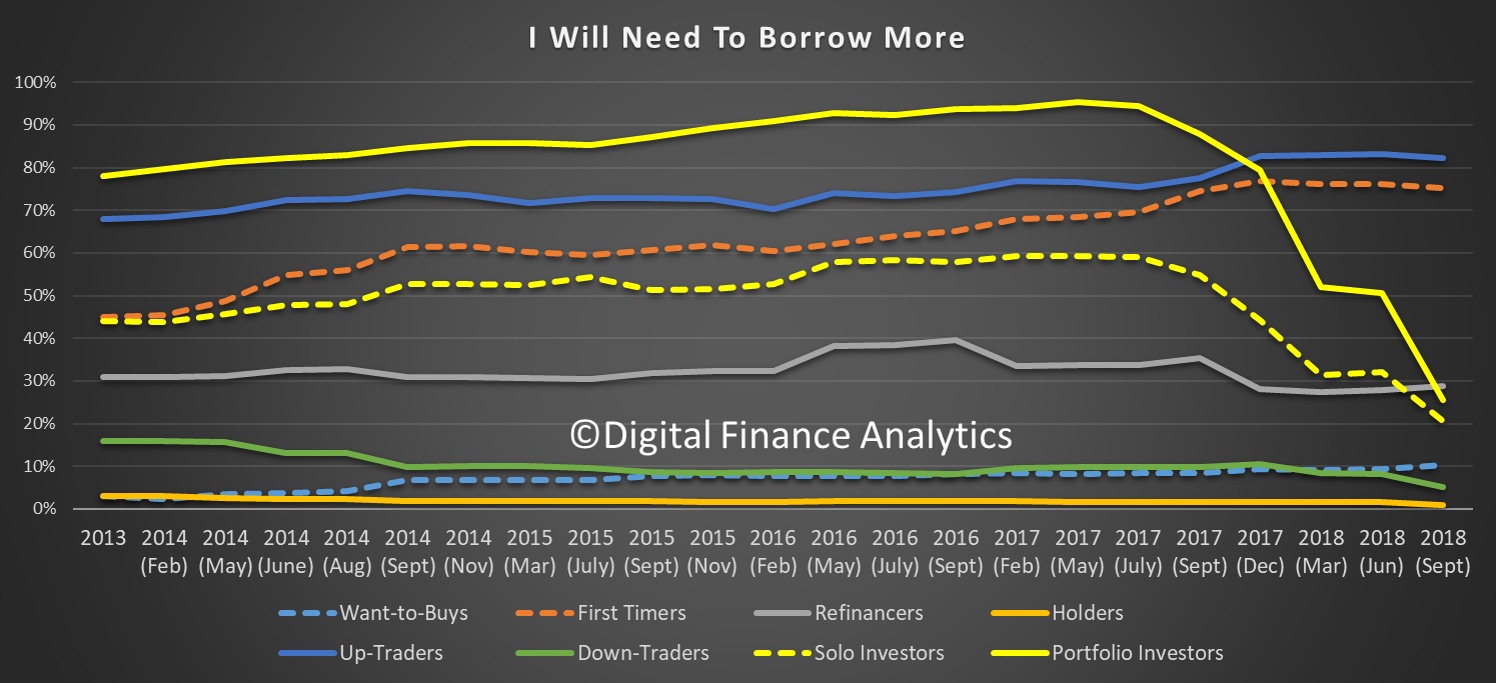

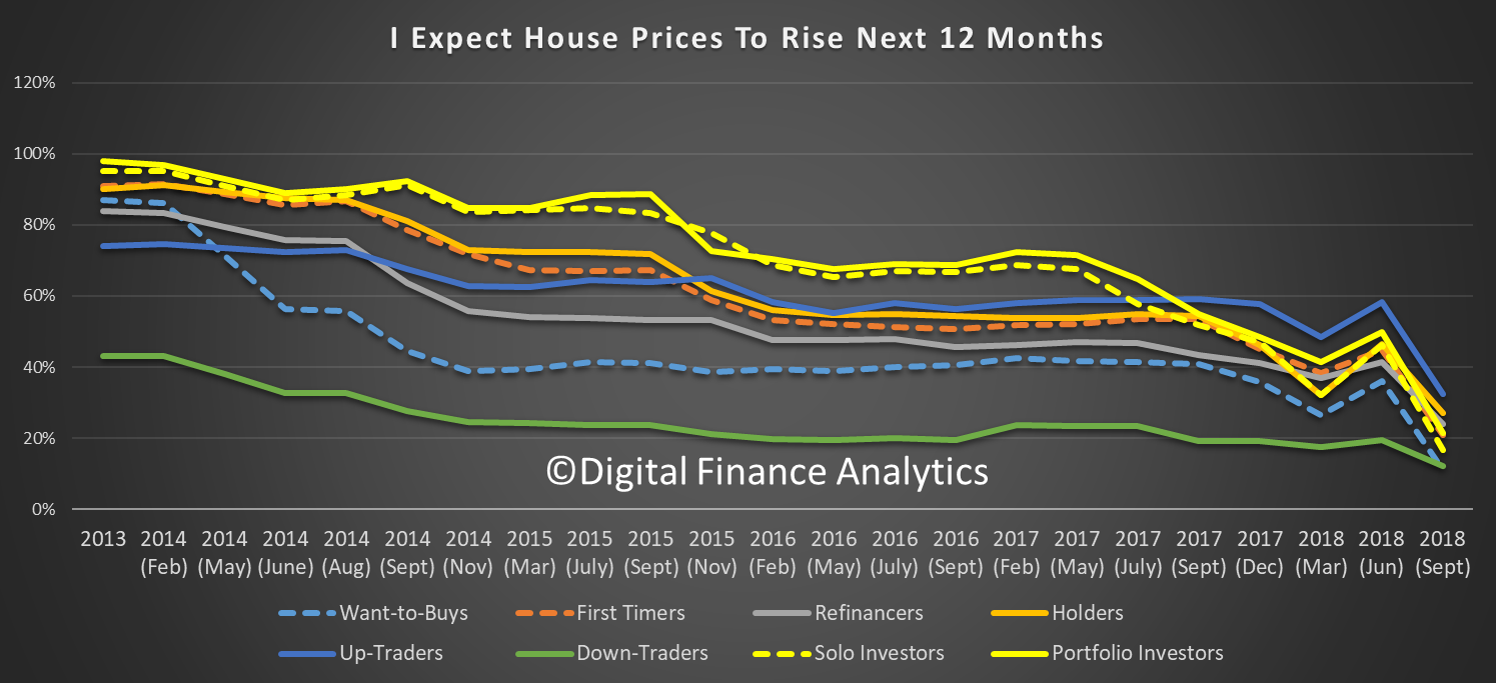

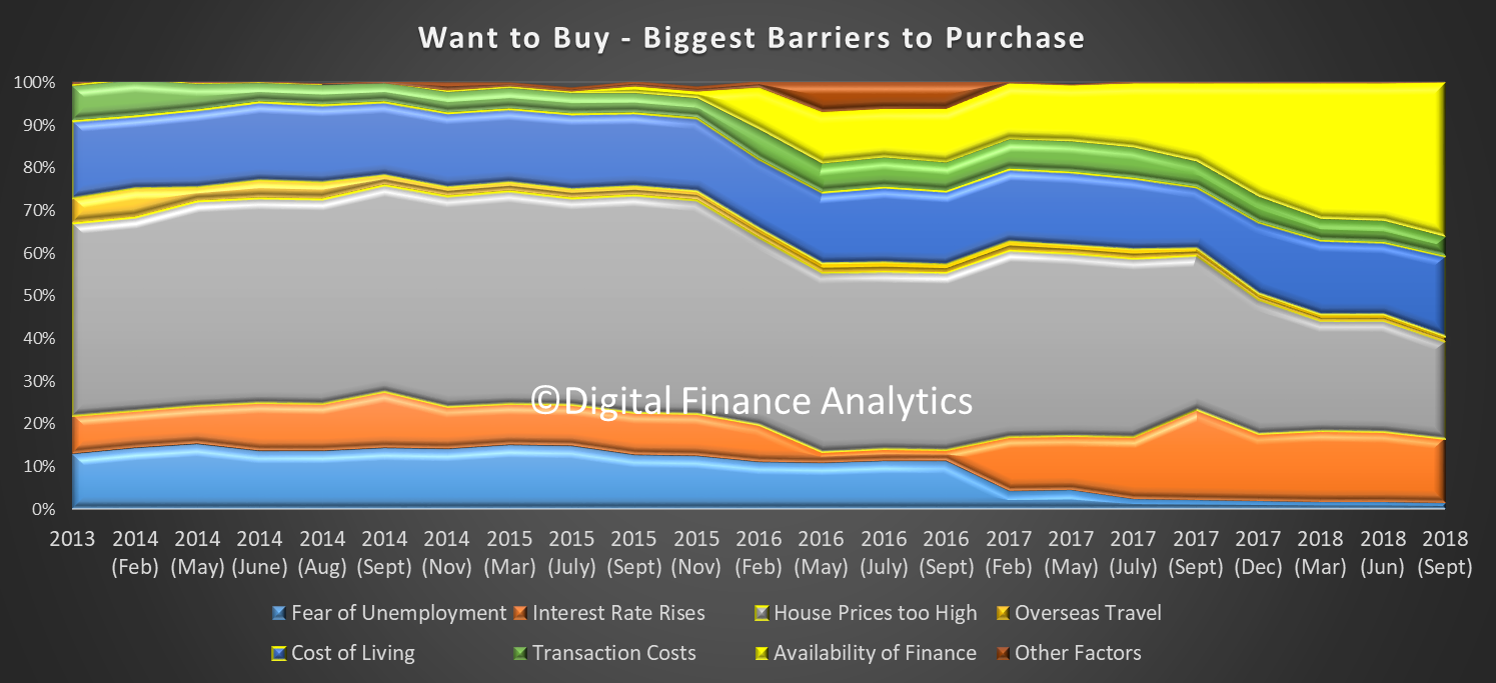

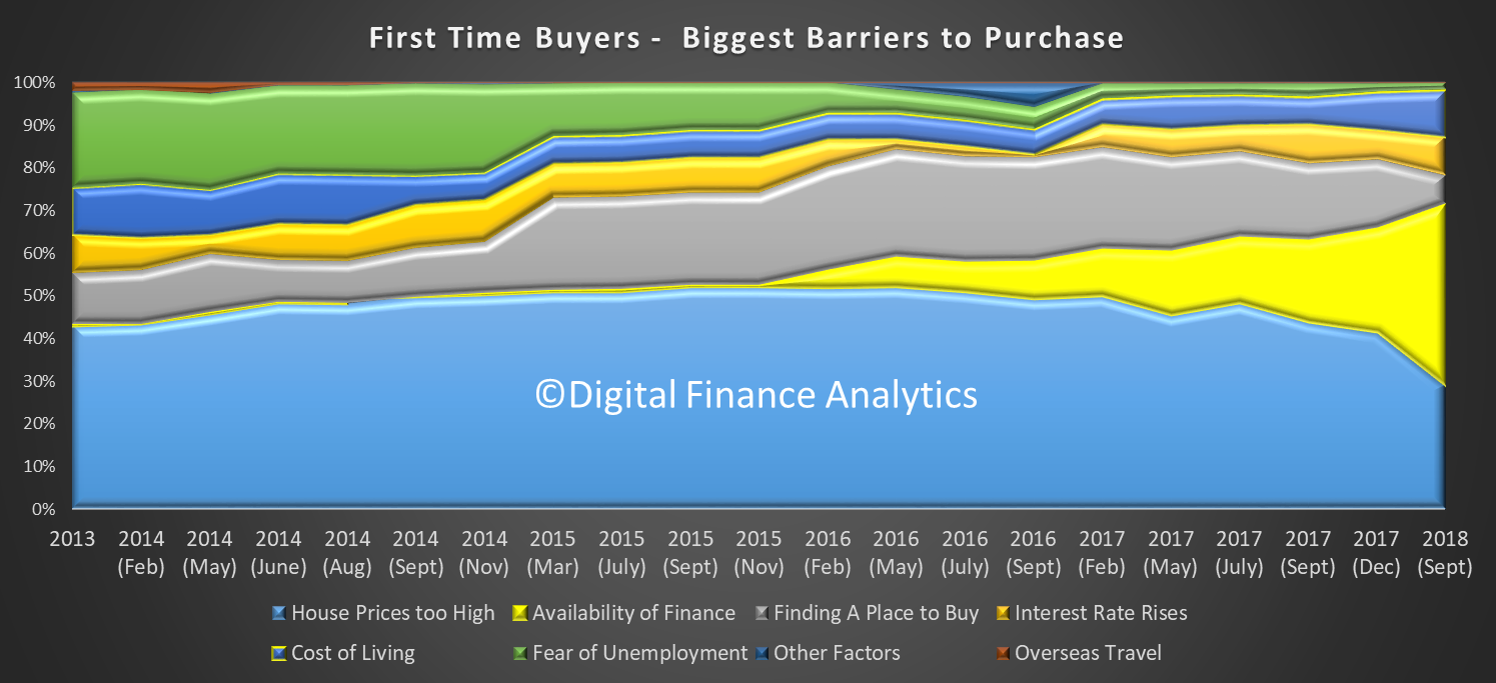

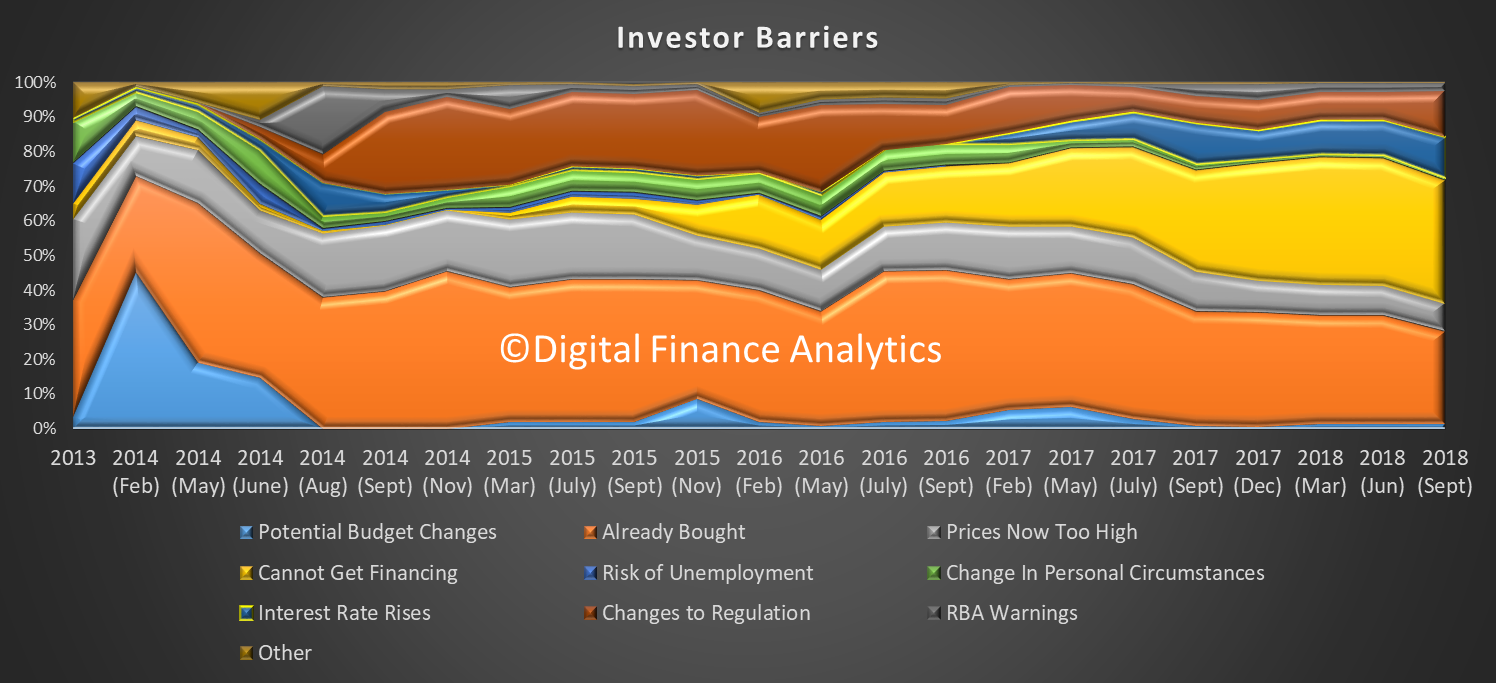

Finally, we also published our survey results in terms of forward intentions. So what is in store for the next few months? Well, in short it’s more of the same, only more so, with more households reporting difficulties in obtaining finance, fewer expecting to transact in the next year and to see home prices rise. You can watch our video “Decoding Property Buying Intentions” where we analyse the results. The single most startling observation is the fall in the number of property investors, including those who hold portfolios of investment properties intending to transact. 20% of portfolio investors are expecting to transact, and the bulk of these intend to sell a property, compared with a year ago when 50% said they would transact, and most were looking to add to their portfolios. Most solo property investors are now on the side lines, with around 10% expecting to transact, and most of these on the sell side. Demand for investment property will continue to fall, as rental yields and capital appreciation fall.

So to the markets.

Locally, the ASX 100 ended the week well down, although there was small rise on Friday, after the heavier falls earlier in the week. We ended at 4,849, up 0.20%. The local volatility index remains elevated, ending at 20.4 on Friday, though that 6.5% lower than the previous day. Expect more ahead.

The ASX Financials index however did less well, and ended at 5,744, up just 0.03% and below the June lows. The banking sector is under pressure, for example Macquarie ended at 115.5, up 0.03% on the day, but well down from its 125 range. And AMP continues to languish at 3.05. We heard from some of the major bank CEO’s this week, with Westpac and ANZ apologising for the issues revealed in the Royal Commission, but I also note that CBA has so far only addressed one of the many issues which APRA agreed with them in terms of behavioural remediation. The banks have a long way to go to regain trust, and we expect more weakness ahead. And the latest estimates are that the sector will be up for something like $2.4 billion dollars in remediation costs and other charges. And guess who will end up paying for their bad behaviour?

The Aussie ended the week at 71.10, having reached the 70.5 range in the week. This has more to do with the US dollar movements than changes in sentiment here.

It was an amazing week in the US, with significant falls, and we discussed this in our post “A Quick Update On The US Markets Overnight”, and our video “Another Sea of Red”.

There are debates about what caused the significant falls, after all the FED rate lift strategy, and the trade wars have been around for some time. But my guess is the market has finally understood the era of low-cost or no-cost money is over. Thus expect more volatility ahead. The US fear index fell back on Friday, down 13.8% to 21.31, but is still elevated.

In fact, Wall Street indexes rose on Friday after a week of significant losses as investors returned to technology and other growth sectors, but gains were hampered by ongoing worries about U.S.-China trade tensions and rising interest rates.

Energy and financial stocks continued to fall and bank stocks kicked off the third-quarter financial reporting season with a whimper, while investors fled insurance stocks after Hurricane Michael slammed into Florida.

The technology sector was the biggest gainer of the S&P’s 11 major industry indexes, with a 1.5 percent advance, but it was still on track for its biggest weekly drop since March. The Dow Jones ended up 1.15% to 25,340, but is well off its recent highs. The NASDAQ was up more, 2.29% to 7,497, as buyers came back into the sector. The S&P 500 ended up 1.37% to 2,765.

All three indexes were on track for their biggest weekly declines since late March.

The S&P Financial index was down 0.42% to 465.07, on mixed trading results which came out on Friday. The S&P 500 banks subsector slid 1.6 percent. The biggest drag on the subsector was JPMorgan Chase & Co which reversed early gains to trade down 2 percent despite its quarterly profit beating expectations. PNC Financial led the percentage losers among bank stocks, with a 6.5 percent drop after the regional bank reported disappointing quarterly loan growth and said it expected only a small improvement in lending this quarter. The only gainers among banks were Citigroup, which rose 0.6 percent, and Wells Fargo which eked out a 0.64 percent gain after upbeat results.

The bank results launch a quarterly reporting season that will give the clearest picture yet of the impact on profits from President Donald Trump’s trade war with China.

The short term 3-Month Treasury remained flat at 2.27 at the end of the week, while the 10-Year bond rose a little to 3.165, up 1.09%. The Treasury yield is now at a 7-year high. The suspicion is that perhaps rates have turned and will go higher still, as a longer term view shows. It is also interesting to compare the US 3-Month Bill Rate minus the same rates in Germany and the UK. Short term rates in the US are higher, in fact reaching the highest positive difference since September 1984. This highlights the different path now being taken by the US, but the fall-out will be global.

Gold, which had moved higher among the market ructions, slide a little, and was down 0.52% on Friday to end at 1,221. Bitcoin finished at 6,316 up 0.57%, and continues in its marrow range for now. And Oil which had fallen earlier in the week moved up 0.72% to 71.48.

Finally, it’s worth noting that the Reserve Bank Of New Zealand is now publishing a bank specific set of scorecards to help consumers weigh up the risks bank to bank. This is essential, given the now explicit Deposit Bail-In which exists there. We discussed this most recently in our Post “The Never Ending “Bail-In” Scandal, and in the Video that Economist John Adams and I released yesterday. In fact, the bank specific data which is available in Australia is derisible compared with the NZ stats, but I came across this slide from LF Economics which highlights how the ratio of Bank Loans To Bank Deposits compares across a number of Banks, including the big four. It’s fair to assume the higher the ratio, the greater the potential risk. Westpac, CBA, NAB and ANZ are all in the top half. I believe we need more specific disclosure from the sector, and I suggest that APRA continues to provide only a partial view of the banking system here. The fact is, Bail-In, or no, we need much more transparency. It would help to negate the spin presented in the RBA’s Financial Stability Review, which in my view is not effective. Oh, and look out for our joint video on Gold, coming up in the next few days, it will surprise you!

Finally, a reminder that on Tuesday 16th October at 20:00 Sydney we are running our next live stream Q&A event. The reminder is up on YouTube, and you can send me questions before hand, or join in the live chat. So mark your dairies.