We review the recent BIS paper which highlights the issues with low interest rates.

Category: Economics and Banking

NAB To Drop 2H19 Cash Earnings By ~$1,123 Million

National Australia Bank Ltd (NAB) announced additional charges of $1,180 million after tax ($1,683 million before tax) relating to increased provisions for customer-related remediation and a change to the application of the software capitalisation policy. This is expected to reduce 2H19 cash earnings by an estimated $1,123 million after tax and earnings from discontinued operations by an estimated $57 million after tax.

Customer-Related Remediation

The 2H19 result will include charges of $832 million after tax ($1,189

million before tax) for additional customer-related remediation. The key

driver of these additional charges is inclusion of a provision for

potential customer refunds of adviser service fees paid to self-employed

advisers. NAB now has in place provisions for the estimated costs and

customer payments relating to all known material customer-related

remediation matters based on information currently available. However,

until all customer payments have been completed, the final cost of such

remediation matters remains uncertain.

NAB Chief Executive Officer, Philip Chronican, said: “NAB is moving forward with rigour and discipline to make things right for customers. While we previously noted additional customerrelated remediation provisions were expected in 2H19, the size of these provisions is significant. We understand that shareholders will be rightly disappointed. However, we also recognise the need to prioritise dealing with these past issues and fixing them for customers.

“We have undertaken to significantly uplift customer remediation practices, as part of a broad program of reform to change the way we operate and ensure NAB meets customer and community expectations. We have made approximately 450,000 payments to customers with a total value of $202 million between June 2018 and August 2019, and have a dedicated remediation team of about 400 people helping to bring greater discipline and focus to remediating customers.”

Of the 2H19 charges, approximately 92% are for Wealth and Insurance-related matters, with the remainder for Banking-related matters. In combination with provisions raised in 2H18 and 1H19 which have not yet been utilised, this brings total provisions for customer-related remediation at 30 September 2019 to $2,092 million.

The key items giving rise to increased provisions for customer-related remediation include:

- Adviser service fees charged by NAB Advice Partnerships (self-employed advisers). Provisions have been increased to include allowance for customer refunds based on total ongoing advice fees received between 2009-2018 of approximately $1.3 billion, with an assumed refund rate of 36% (or approximately 55% including interest costs). Key considerations in estimating a refund rate include assumptions about circumstances where documents are not available or readily accessible, including where advisers are no longer working in the industry;

- Consumer Credit Insurance sales through certain NAB channels. This relates to a previously disclosed remediation program which arose from an ASIC industry-wide review. Provisions have been increased mainly to reflect higher refund rates based on experience to date;

- Non-compliant advice provided to Wealth customers which is being addressed as part of NAB’s ongoing wealth advice review. Provisions have been increased mainly to cover higher expected costs to undertake the program; and

- Adviser service fees charged by NAB Financial Planning (salaried advisers). Provisions have been increased to reflect higher expected costs and a higher assumed refund rate of 28% (or approximately 39% including interest costs).

Capitalised Software Policy Change

Following a review of NAB’s software capitalisation policies, the

minimum threshold at which software is to be capitalised has increased

from $0.5 million to $2 million, reflecting NAB’s focus on

simplification and the increasingly shorter useful life of smaller

software items. The change will be applied to both current and future

software balances and is expected to reduce NAB’s capitalised software

balance at 30 September 2019 by $494 million and NAB’s 2H19 cash

earnings by $348 million (post tax). There is no impact on Group capital

given capitalised software balances are already deducted from Common

Equity Tier 1 capital. This change in approach will significantly

reduce the number of individual capitalised assets on the balance sheet from approximately 1,390 to 340.

Earnings Impact

Details of the expected 2H19 cash earnings impact are provided in the

table below. As has been the case in prior periods, 2H19

customer-related remediation costs and capitalised software change will

be excluded from FY19 and FY20 expense growth guidance of ‘broadly

flat’. Further detail will be provided when NAB releases its 2019 Full

Year results on 7 November 2019, including an update on progress towards

achieving unquestionably strong capital requirements. The matters in

this announcement remain subject to finalisation of NAB’s 2019 Full Year

results, including review by the auditors.

Australia’s Debt Bubble Is Falling Apart!

Economist John Adams and Analyst Martin North discuss the consequences of the RBA’s cash rate cut, and supporting monetary policy. Is the Central Bank’s position credible?

NZ Reserve Bank Seeks Views on Expanded Stewardship Role For Cash

Cash system participants and the wider public are being asked for their views about the Reserve Bank of New Zealand taking a more active role in the cash system.

A consultation paper has been released today as part of the Bank’s ongoing Future of Cash – Te Moni Anamata programme which is considering the implications for New Zealanders of falling cash use for every-day transactions, including the impacts on the system that supplies, moves and stores it.

Assistant Governor Christian Hawkesby says the Reserve Bank is just one cog in a cash system machine which includes the banking system, armoured truck companies, retailers, and independent ATM providers. “We see roles for all parts of the system – along with interest groups, whānau and individuals – in ensuring people who want or need to access or use cash can do so.”

The consultation paper proposes that the Reserve Bank take on a stewardship role in the cash system, providing system-wide oversight and coordination. It also proposes two tools which, though not currently required, may be needed in the future to respond flexibly to changes in the cash industry and the evolving needs of the public:

- The Reserve Bank be given the power to set standards for machines that process and dispense cash.

- The Reserve Bank Act set out regulation-making powers that enable the government and the Reserve Bank to require banks to provide access to cash deposits and withdrawals.

“These proposals are not the complete answer, but they would help create a foundation for the Reserve Bank to be more than the issuer of notes and coins when it comes to how we use cash which is an important component of our social and economic activity,” Mr Hawkesby says.

Mr Hawkesby says the Reserve Bank is grateful to the large numbers of individuals, groups, banks and other cash system providers, business and community organisations, and public sector agencies who are participating in the Future of Cash programme and sharing their views.

“Nearly 2400 individuals and groups gave feedback on our earlier issues paper discussing the potential impacts from a fall in cash use, particularly for people who are already financially or digitally excluded for whatever reasons. Meanwhile 3100 people randomly selected from the electoral roll have responded to a scientific survey updating our understanding of how New Zealanders are using cash and how this use is changing. We expect to publish results from both these efforts in November, and these will also feed into final recommendations in respect of the proposals released today.

”The changes in our latest consultation document would have significant consequences for all participants in the cash system. Banks, cash-in-transit providers, independent ATM operators, and the broader retail sector would likely be particularly affected. We want to continue to hear views and feedback from everyone about the purpose and desired attributes for the mechanics of the cash system, and how we could collectively improve it,” says Mr Hawkesby.

The paper is published on the The Future of the Cash System – Te Pūnaha Moni Anamata page, and feedback closes on 6 November 2019.

From The Data Analysis Property Front Line – Nerida Conisbee

I discuss the state of the property market with Nerida Conisbee, Chief Economist at REA and Realestate.com.au.

What’s happening to property prices, and volumes, and across the regions? And how will monetary policy and rate cuts interact?

CBA Withholds Some Of The Rate Cut Margin

Commonwealth Bank has responded to the Reserve Bank of Australia’s cash rate decision by reducing home loan interest rates.

New Standard Variable Rates

- Owner Occupied Principal and Interest Standard Variable Rate home loans reduced by 0.13% per annum (p.a) to 4.80% p.a.

- Investor Principal and Interest Standard Variable Rate home loans reduced by 0.13% p.a. to 5.38% p.a.

- Owner Occupied Interest Only Standard Variable Rate home loans reduced by 0.13% p.a. to 5.29% p.a.

- Investor Interest Only Standard Variable Rate home loans reduced by 0.25% p.a. to 5.64% p.a.

New Fixed Rates

- 2 and 3 Year Owner Occupied Principal and Interest Fixed Rates in the Wealth Package reduced to 2.99% p.a. available from Thursday.

Commonwealth Bank has responded to the Reserve Bank of Australia’s (RBA) cash rate decision by reducing the Standard Variable Rate (SVR) for home loan customers by between 0.13% p.a. and 0.25% p.a.

“Today’s announcement means our SVR for Owner Occupied customers, with Principal and Interest repayments, will be at record low levels,” Angus Sullivan, Group Executive Retail Banking Services said.

“As the Reserve Bank cash rate has reached record lows, we face a difficult balancing act between the multiple, valid interests of our stakeholders. Particularly given it is currently not feasible to pass on the full rate reduction to more than $160 billion of our deposits which are at, or near, zero rates.

“In balancing these interests, we have carefully considered how to best meet the needs of over 6 million savings customers – who may find it challenging to make ends meet with record low savings interest rates – with the needs of our 1.6 million home loan customers, who want to pay less on their mortgages; and the needs of our shareholders, many of whom are retirees who rely on our dividend.

“In this environment, while reducing the SVR for home loan customers by between 0.13% p.a. and 0.25% p.a., we have also decided to limit the base rate reduction for savings customers in our popular NetBank Saver product to 0.05%. These changes are in addition to the fee removals, fee reductions and pre-emptive fee alerts we have already introduced, which have helped save our customers over $415 million.

“We are also announcing a new 2.99% p.a. 2 and 3 year Owner Occupied Principal and Interest Fixed Rate, available to new and existing Wealth Package customers taking out a Fixed Rate loan. This allows customers who prefer certainty to lock-in this historically low rate. This means we have reduced our 2 and 3 year Fixed Rates by 0.80% p.a. since July for Owner Occupied Principal and Interest customers,” Mr Sullivan said.

For Owner Occupied customers paying Principal and Interest, the SVR has reduced by 0.57% p.a. since June, which on a $400,000 home loan equates to a reduction in the minimum monthly repayment of $140 or an annual saving of $1680.

For Investor customers paying Interest Only, the SVR has reduced by 0.75% p.a. since June, which on a $400,000 home loan, equates to a monthly saving of $250 or an annual saving of $3000.

Customers who have questions regarding today’s rate change are encouraged to speak to one of our home lending specialists in branch or over the phone.

- The new SVR will take effect on 22 October 2019

- The new Fixed Rates will be available to new and existing customers switching to a Fixed Rate on 3 October 2019

- The NetBank Saver base rate reduction will take effect on 4 October 2019

RBA Cuts Yet Again!

At its meeting today, the Board decided to lower the cash rate by 25 basis points to 0.75 per cent.

While the outlook for the global economy remains reasonable, the risks are tilted to the downside. The US–China trade and technology disputes are affecting international trade flows and investment as businesses scale back spending plans because of the increased uncertainty. At the same time, in most advanced economies, unemployment rates are low and wages growth has picked up, although inflation remains low. In China, the authorities have taken further steps to support the economy, while continuing to address risks in the financial system.

Interest rates are very low around the world and further monetary easing is widely expected, as central banks respond to the persistent downside risks to the global economy and subdued inflation. Long-term government bond yields are around record lows in many countries, including Australia. Borrowing rates for both businesses and households are also at historically low levels. The Australian dollar is at its lowest level of recent times.

The Australian economy expanded by 1.4 per cent over the year to the June quarter, which was a weaker-than-expected outcome. A gentle turning point, however, appears to have been reached with economic growth a little higher over the first half of this year than over the second half of 2018. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth. The main domestic uncertainty continues to be the outlook for consumption, with the sustained period of only modest increases in household disposable income continuing to weigh on consumer spending.

Employment has continued to grow strongly and labour force participation is at a record high. The unemployment rate has, however, remained steady at around 5¼ per cent over recent months. Forward-looking indicators of labour demand indicate that employment growth is likely to slow from its recent fast rate. Wages growth remains subdued and there is little upward pressure at present, with increased labour demand being met by more supply. Caps on wages growth are also affecting public-sector pay outcomes across the country. A further gradual lift in wages growth would be a welcome development. Taken together, recent outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation pressures remain subdued and this is likely to be the case for some time yet. In both headline and underlying terms, inflation is expected to be a little under 2 per cent over 2020 and a little above 2 per cent over 2021.

There are further signs of a turnaround in established housing markets, especially in Sydney and Melbourne. In contrast, new dwelling activity has weakened and growth in housing credit remains low. Demand for credit by investors is subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

The Board took the decision to lower interest rates further today to support employment and income growth and to provide greater confidence that inflation will be consistent with the medium-term target. The economy still has spare capacity and lower interest rates will help make inroads into that. The Board also took account of the forces leading to the trend to lower interest rates globally and the effects this trend is having on the Australian economy and inflation outcomes.

It is reasonable to expect that an extended period of low interest rates will be required in Australia to reach full employment and achieve the inflation target. The Board will continue to monitor developments, including in the labour market, and is prepared to ease monetary policy further if needed to support sustainable growth in the economy, full employment and the achievement of the inflation target over time.

Westpac Revises Broker Remuneration Policy

Westpac Group has announced that it will remove the claim process for upfront commissions paid on post-settlement drawdowns on broker-originated home loans, via InvestorDaily.

For all subsequent upfront commissions payable from 1 January 2020, brokers and third-party introducers will automatically receive remuneration.

Westpac revealed that subsequent upfront commission will remain payable for each eligible home loan following the 12-month anniversary of the loan settlement.

“This change delivers on our commitment to continue to review and improve the broker commission model,” Westpac stated.

Westpac’s announcement comes amid calls from broking industry stakeholders for more equitable remuneration arrangements.

Last month, Connective director Mark Haron noted the impact of contrasting remuneration policies adopted by lenders off the back of the Combined Industry Forum’s move to limit the upfront commission paid to brokers to the amount drawn down by borrowers (net of offset).

Mr Haron said that some lenders had opted to withhold the payment of commission for additional funds arranged by a broker, which are utilised by a borrower after a pre-determined period post-settlement.

The Connective director added that the disparity in the application of the CIF reforms had increased risks of “lender choice conflicts”, which could hinder compliance with the newly proposed best interests duty.

Loan Market’s executive chairman Sam White, has also noted his concerns with existing net of offset arrangements.

Mr White called for an arrangement that better aligns with existing clawback provisions, which, under the federal government’s newly proposed bill, would limit the clawback period to two years.

“Our belief is that net of offset should mirror clawback provisions,” Mr White said.

“If it is good enough for banks to claw back the money over two years, it should also be good enough to increase the upfronts over that same time period.”

Like Mr Haron, Mr White revealed that Loan Market would also be lobbying for reform to existing net of offset arrangements as part of the consultation process for the government’s best interests duty bill.

The push for reforms to net of offset policies follow the release of the Mortgage & Finance Association of Australia’s Industry Intelligence Service report, which revealed that, over the six months to March 2019, the national average annual gross value of commissions collected per broker dropped by 3 per cent when compared to the previous corresponding period, falling to a historic low of $128,709.

The decline was driven by a 10.6 per cent fall in the average upfront commission received by a broker, down from $75,604 to $67,554 – offset by a 6.9 per cent increase in the average annual gross trail commission received per broker, from $57,189 to $61,155.

Reductions in commission revenue have also prompted calls from both industry associations and aggregators for “fair and equitable” clawback arrangements.

Mr Haron and the Australian Finance Group’s head of industry and partnerships Mark Hewitt, recently indicated that they would be lobbying for clawback reform during the consultation period for the federal government’s proposed best interests duty bill.

Discussing Rate Cuts On ABC Illawarra

A segment on local ABC radio where I discussed the prospect of a rate cut and the broader economy.

The Credit Impulse Hiccups In August 2019

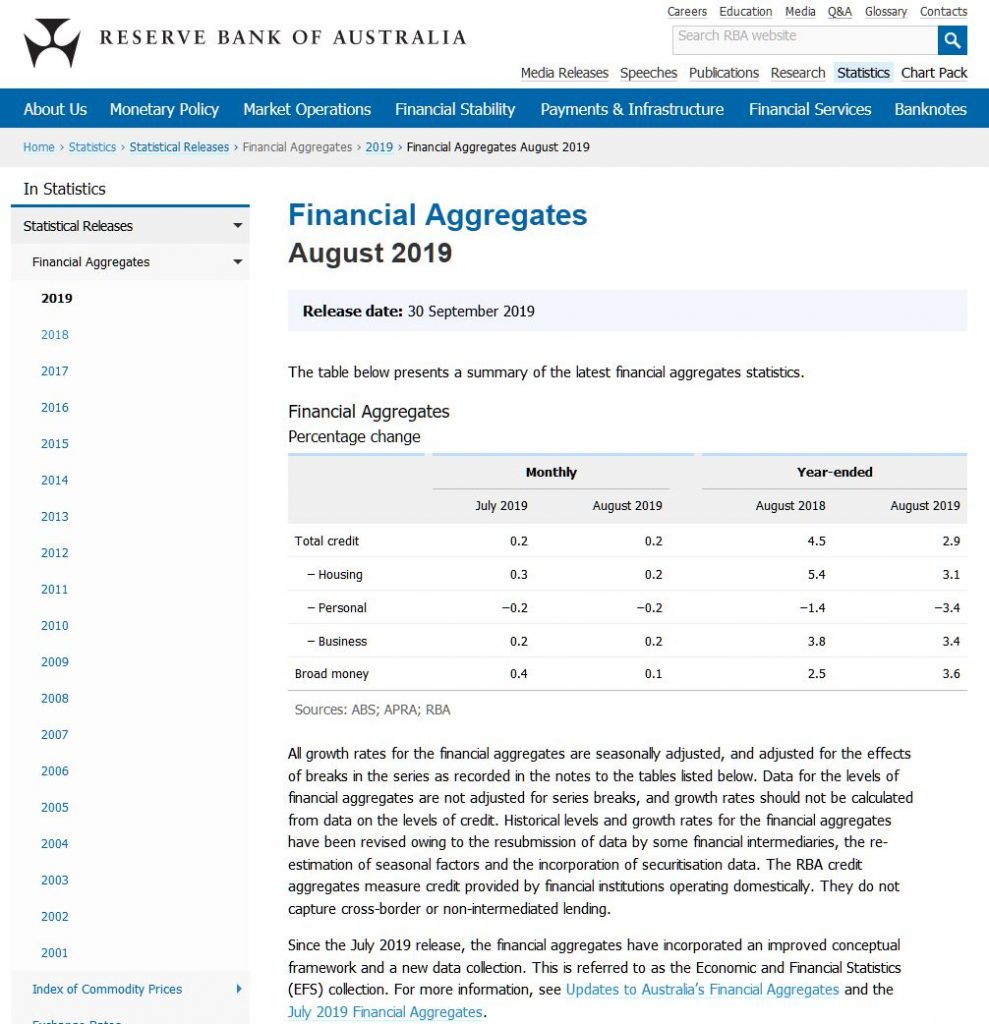

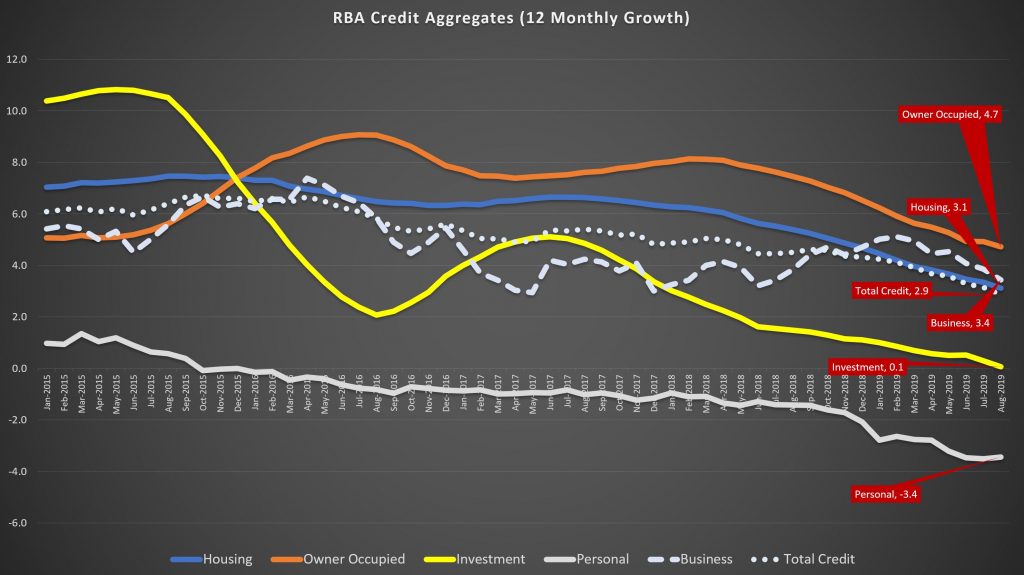

Both the RBA and APRA released their respective credit aggregates to end August today. And its not running to script, despite the rate cuts, some stronger buying signs in some housing markets (but on low, low volumes), and increased competition for loans. Overall credit growth rates continue to decline.

The RBA data over the rolling 12 months showed that credit growth dropped to 2.9%, compared with 4.5% just one year ago. That is the slowest rate of growth since 2011. It peaked in 2015 at 6.6%.

Housing sector growth rose 3.1% over 12 months, compared with 5.4% a year back and from a high of 7.4% back in 2015. Within that owner occupied lending fell to 4.7%, compared with 9.1% back in 2016, and investment lending rose at just 0.1% over 12 months, compared with 10.8% back in May 2015.

Business credit growth eased back to 3.4% annualised, from 3.8% a year ago, and 7.4% back in 2016, reflecting weaker business confidence and concerns about the local and international economic outlook.

Annual personal credit is down 3.4%, compared with down 1.4% a year ago, and up 0.3% in 2015.

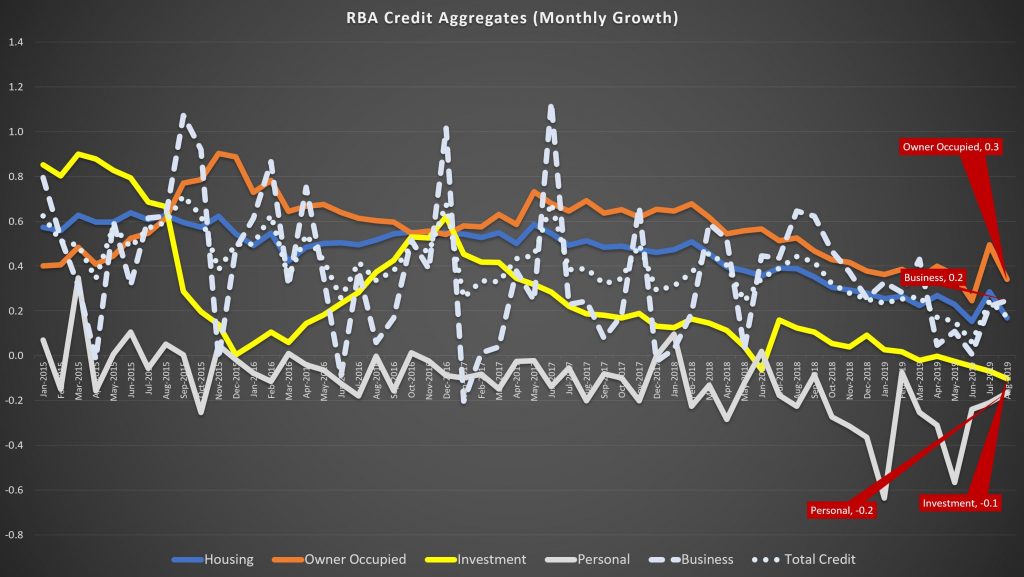

The more noisy one month series shows that owner occupied lending rose 0.3%, compared with 0.9% in 2015, investment lending fell 0.1%, compared with a rise of 0.9% in 2015, business credit rose 0.2%, way lower than peaks of more than 1% in 2015 and 2017, and personal credit fell 0.2% again.

Note the RBA makes seasonal adjustments to the data – though they do not disclose the basis of these adjustment, and this year has been far from typical.

They also say:

Historical levels and growth rates for the financial aggregates have been revised owing to the resubmission of data by some financial intermediaries, the re-estimation of seasonal factors and the incorporation of securitisation data. The RBA credit aggregates measure credit provided by financial institutions operating domestically. They do not capture cross-border or non-intermediated lending.

So more data noise. And talking of that the new APRA data is all over the shop. They started running a parallel series in March, and as we discussed last month, the proportion of investment loans in the stock data have risen.

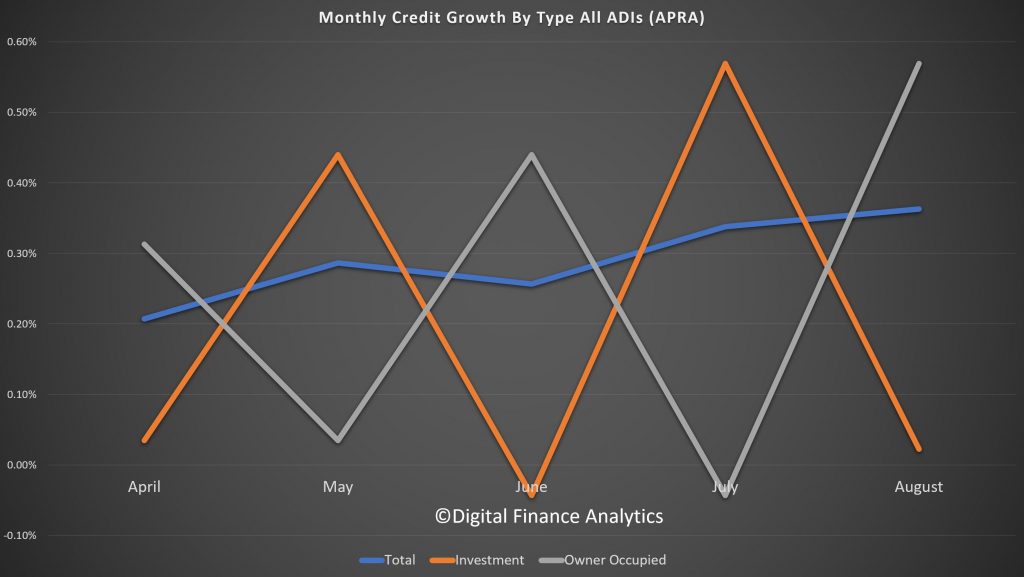

Overall credit stock of housing loans for the ADI’s is running at 0.36% and appears to be rising since April. However, the swings between growth in investor and owner occupied loans are massive, (and in opposite directions). This is not a sign of good data collection in my view.

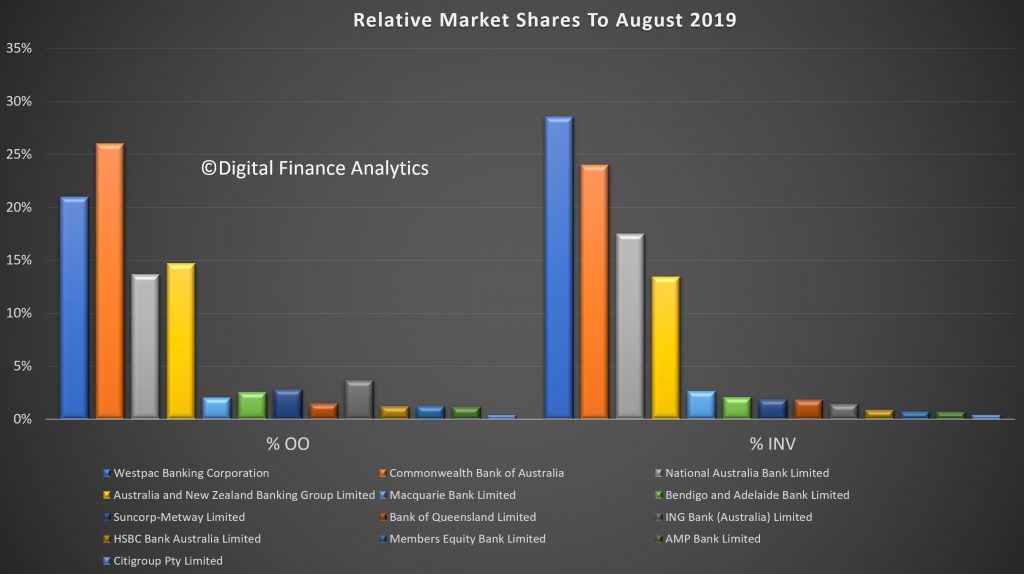

The overall portfolio market shares indicate that CBA remains the largest lender for owner occupied loans, with a 26.1% share, followed by Westpac 21%, and ANZ at 14.7%. In investment lending, Westpac remains a clear leader, with 28.6% of all lending, followed by CBA at 24% and NAB at 17.5%.

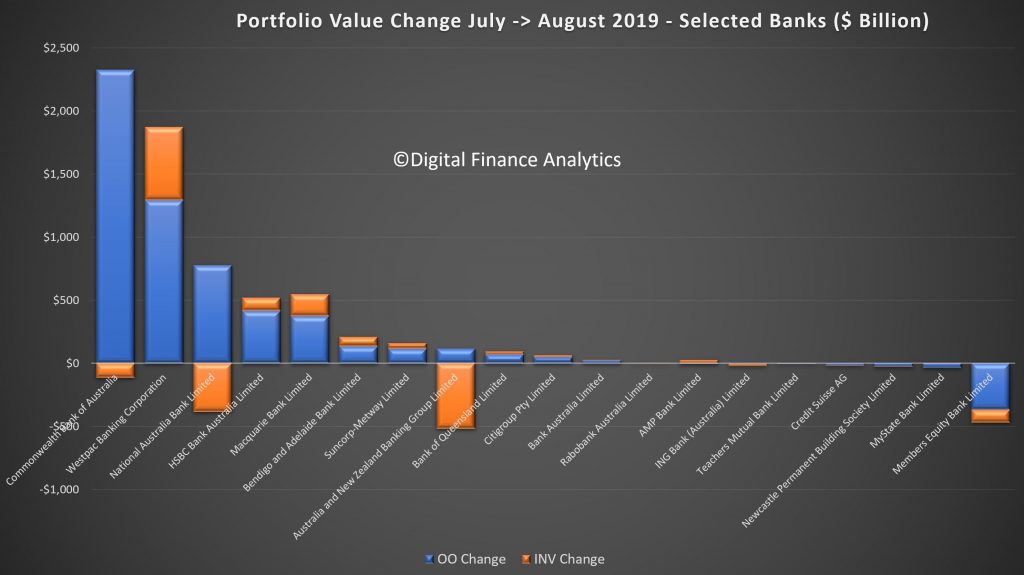

The monthly movements tells an interesting story, with CBA driving the largest growth in owner occupied loans (2.3 billion), while dropping investment loans by a small amount. Westpac extended its investment loans by $0.6 billion, and owner occupied loans by $1.3 billion. NAB and ANZ both lost investor share and ME Bank lost owner occupied and investor loans. Other lenders picked some of these up.

Finally, our analysis of the proportion of individual bank portfolios in investment loans (generally more risky in a down-turn), shows that 44.9% of Westpac’s portfolio is investment lending (worth $185 billion), compared with an ADI market average of 37.4%. NAB is at 43.4% and Macquarie at 43.7% and Bank of Queensland at 42.7%. On the other hand CBA is at 35.6% and ANZ at 35.3%.

Data from our surveys suggests weakening demand for credit, and if this eventuates, it is quite possible recent home prices will be confirmed as a bear trap. While some down traders and more affluent households are in the market, many other segments are sitting this one out.

Remember that falling credit growth will translate to falling home prices, the math is that simple. And more rate cuts won’t help much at all!