The RBA released their data to end of July today . Off the bat in should be noted they made a number of reporting changes, and the growth rates have been “adjusted” as well as applying seasonal adjustments (we assume based on earlier years, though this year might be unique!).

This data shows the total domestic lending commitments (allowing for new loans written, old loans repaid or refinanced – so this is net stock movements.

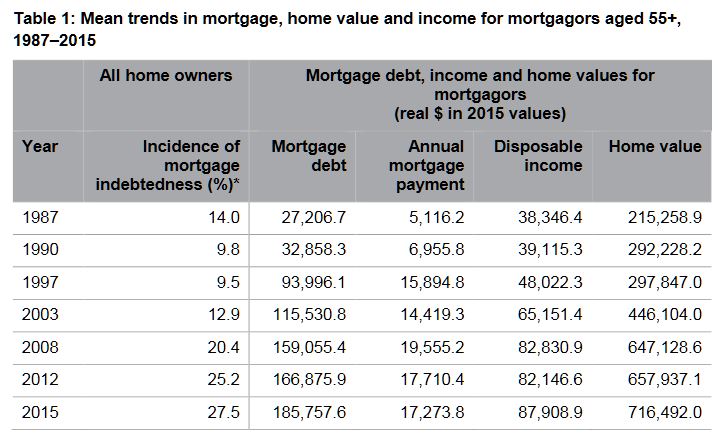

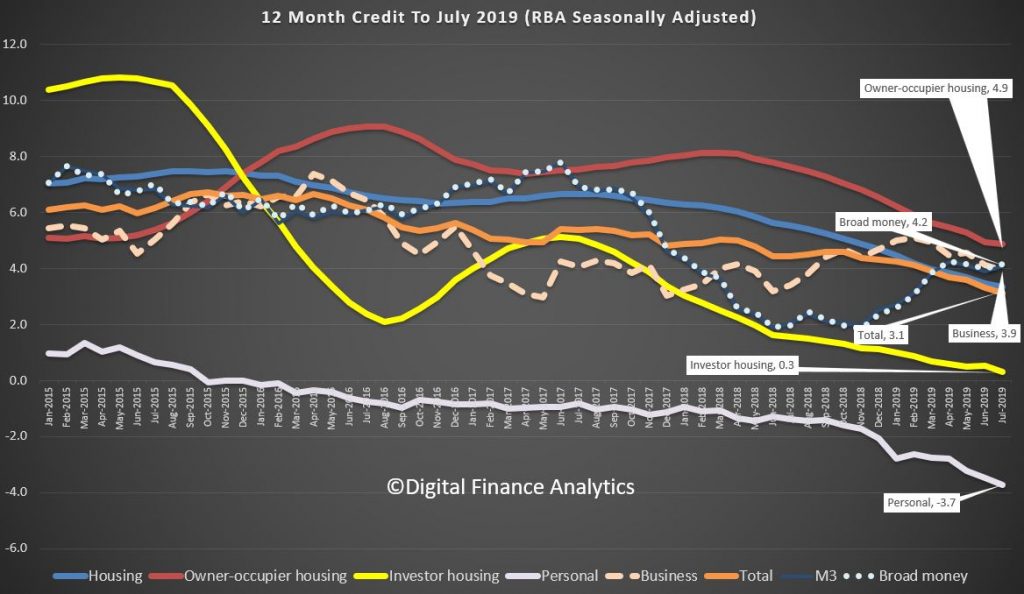

In the D1 data we see that owner occupied lending growth for the past 12 months fell again, down to 4.9%, investment housing lending was down to 0.3%, and so total housing growth fell from 3.5% to 3.3%, another record low. Business lending grew at 3.9% over the past 12 months. Personal lending fell 3.7% and total credit grew 3.1%.

So no evidence of any pick-up on these annualised numbers.

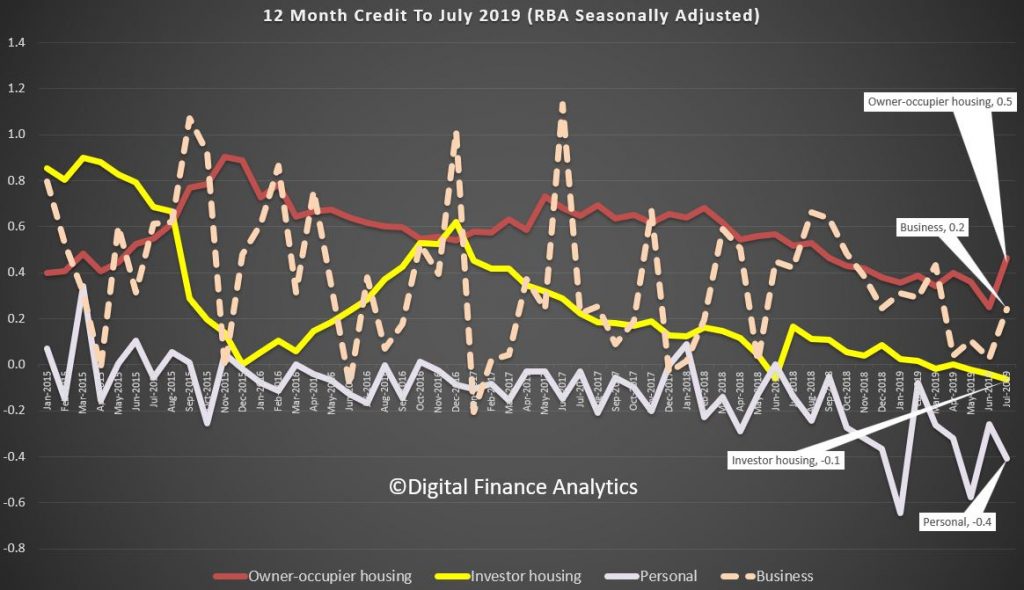

The one month numbers show a small rise in owner occupied loans from 0.2% last month, to 0.5%, a level last seen in September. Investment lending fell down 0.1%. Personal credit fell 0.4% from the previous month, and business lending up from 0.0% to 0.2%. Even with those of the bullish disposition, this is weak. And this data is always noisy, so there is really little to see which signals an improvement.

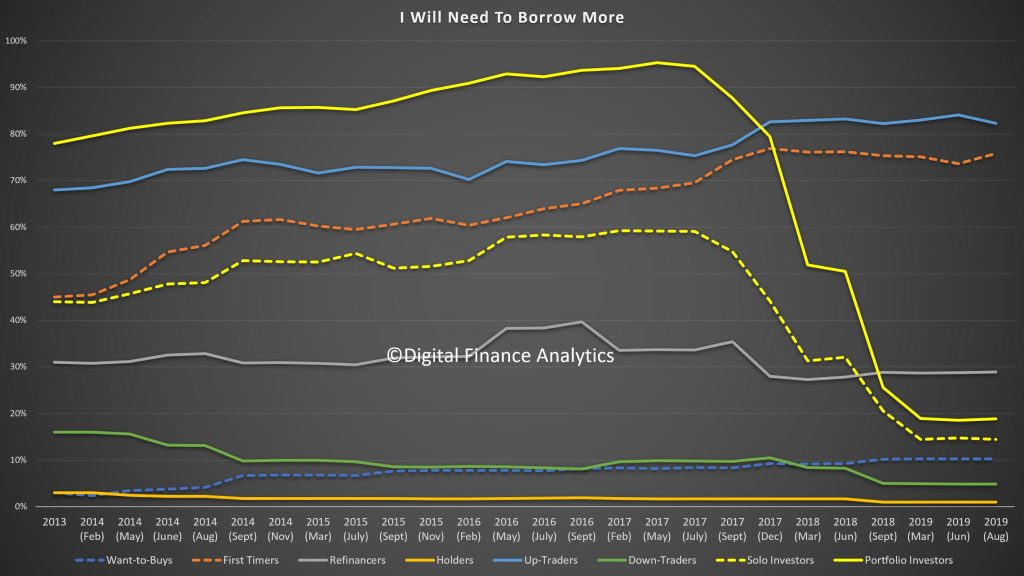

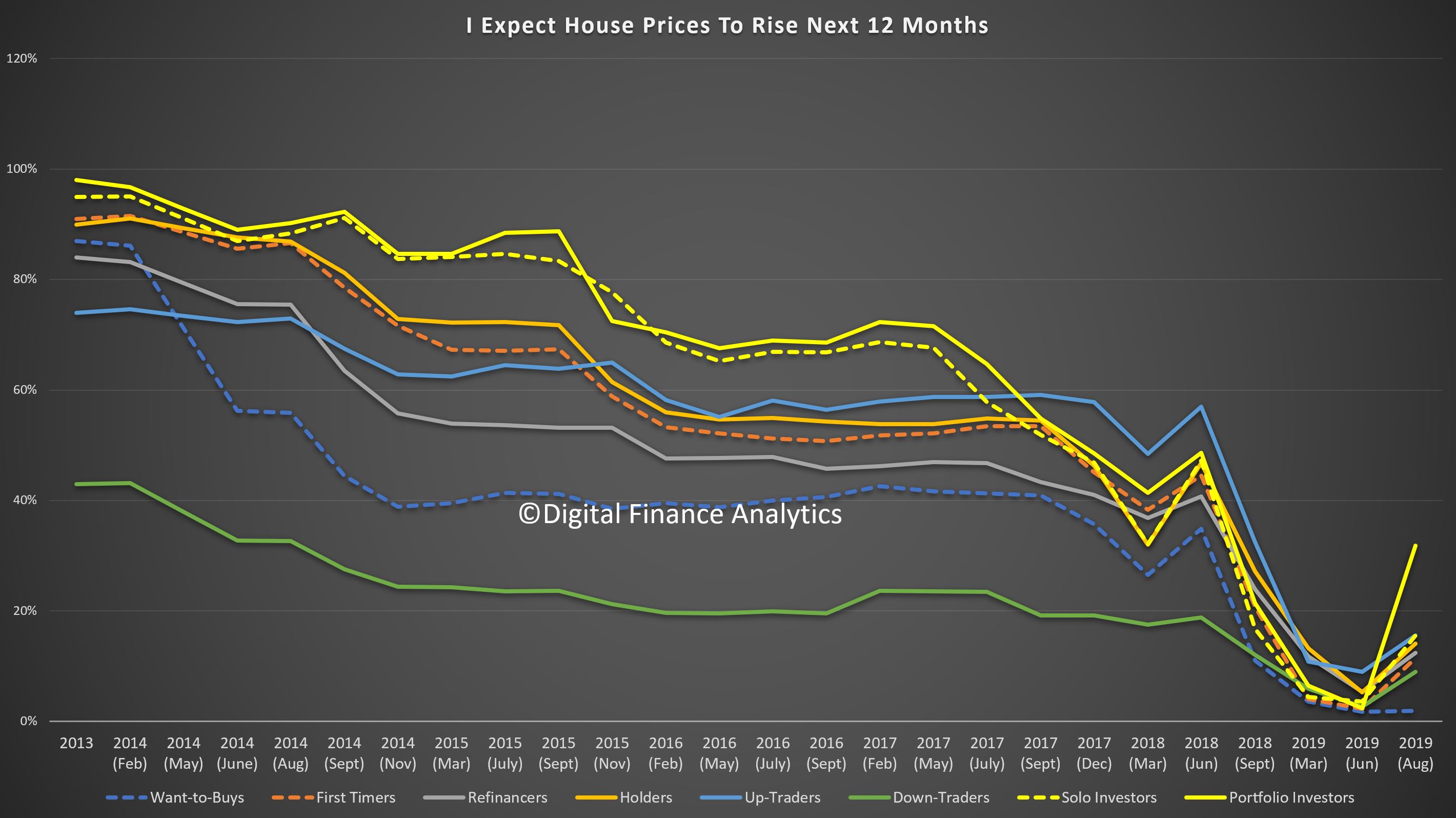

So, its true to say there is little evidence to show the stimulus from lower cash rates, or APRA’s loosening has made any substantive difference – which by the way chimes with our recent household surveys. Which begs the question, where then are the supposed home price rises coming from. Perhaps the ABS flow data in a few days will tell us more. But I remain skeptical. On any basis, property investors are sitting out still.

But we also know the RBA has done some heavy tweaking to the data. This is because the raw D2 data shows big swings between owner occupied and investment lending between June and July, thanks to their revisions. This is what they say:

From this release onward, the financial aggregates incorporate an improved conceptual framework and a new data collection. This is referred to as the Economic and Financial Statistics (EFS) collection. For more information, see Updates to Australia’s Financial Aggregates. All growth rates have been adjusted for the effects of series breaks resulting from these changes. Minor revisions to the historical growth rates of the financial aggregates reflect improvements in the RBA’s seasonal adjustment processes. Revisions to the historical growth rates of the money aggregates – specifically M3 and Broad Money – also reflect methodological improvements to their production.

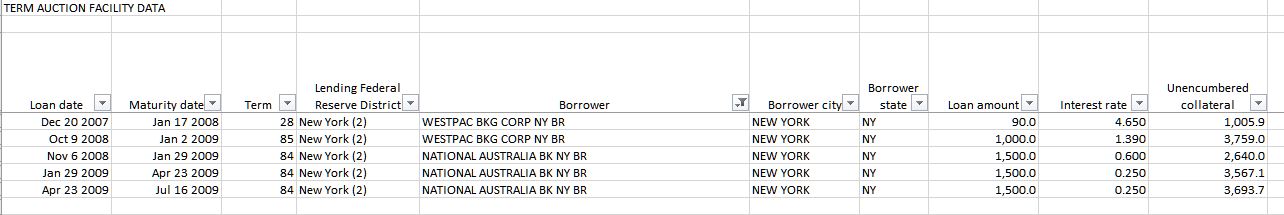

The implementation of the EFS collection has led to larger-than-usual movements in the levels of the outstanding stocks of series published in the table Lending and Credit Aggregates – D2 between June and July 2019. In particular, the EFS collection seeks to resolve ambiguity about the classification of finance according to its purpose and residency. The sample of entities participating in the collection has also changed and the measurement of housing credit extended by non-authorised deposit-taking institutions has improved. Some of the key changes resulting from the EFS collection are reclassifications between: owner-occupier housing loans and investor housing loans; housing loans and other personal loans; and loans to residents and loans to non-residents (loans to non-residents are not included in the credit aggregates). In combination, these changes have led to: decreases in the levels of total credit, business credit, housing credit and owner-occupier housing credit; and increases in the levels of other personal credit and investor housing credit. In contrast to the published growth rates, the levels of the credit aggregates are not adjusted for series breaks. Growth rates should not be calculated from data on the levels of credit.

The table Monetary Aggregates – D3 has changed; for more information, please see the change notice published on 31 July 2019. The history of M1 has been revised to include all transaction deposits, whereas previously some of these deposits were only included in M3. The history of M3 and Broad Money has also been revised, reflecting minor conceptual changes. Beyond these historical revisions, movements in transaction and non-transaction deposits between June and July 2019 are larger than usual. This is because the EFS collection used to compile the monetary aggregates more accurately classifies deposits by their type. The levels of the monetary aggregates are not adjusted for series breaks. Growth rates should not be calculated from data on the levels of money.

Owing to the EFS collection, ‘Net switching of housing loan purpose – from investor to owner-occupied within the same lender’ will now be published with a one-month delay.

As usual, all growth rates for the financial aggregates are seasonally adjusted, and adjusted for the effects of breaks in the series as recorded in the notes to the tables listed below. Data for the levels of financial aggregates are not adjusted for series breaks. The RBA credit aggregates measure credit provided by financial institutions operating domestically. They do not capture cross-border or non-intermediated lending.

More data noise in the machine. We will look at the APRA bank specific data in a later post.