Welcome to the Property Imperative weekly to 7th July 2018, our digest of the latest finance and property news with a distinctively Australian flavour. By the way if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content. Here is the link.

Watch the video, listen to the podcast, or read the transcript.

Watch the video, listen to the podcast, or read the transcript.

This week the RBA left the cash rate on hold once again at 1.5% and continued the trend of doing nothing. In fact, reading the release from Tuesday, it is worth noting two things. First they are being very gentle in referring to home price falls, saying “Nationwide measures of housing prices are little changed over the past six months. Conditions in the Sydney and Melbourne housing markets have eased, with prices declining in both markets. Housing credit growth has declined, with investor demand having slowed noticeably. Lending standards are tighter than they were a few years ago”. Second, we think they would like to lift rates to more normal levels, but cannot thanks to high debt, and downside risks. They are stuck. I believe the next move will be down as the economy weakens (dragged down by the fading property market, rising interest rates internationally, and concerns about China’ economic dynamo). But not yet.

Now compare this with a BIS report also out this week. The BIS is worried by the current low interest rate environment, and in a new report by a committee chaired by Philip Lowe, warn of the impact on financial stability across the financial services sector, with pressures on banks via net interest margins, and on insurers and super funds. They warn that especially in competitive markets, risks rise in this scenario. Low interest rates may trigger a search for yield by banks, partly in response to declining profits, exacerbating financial vulnerabilities. In addition, keeping rates low for longer may create the need to lift rates sharper later with the risks of rising debt costs and the broader economic shock which follows. A salutatory warning! We discussed this in more detail in our post “To “Bail-In” Or To “Bail-Out”, That Is Indeed The Question”.

The contrast between the theoretical macro policy position, and the local situation here in Australia, must at very least be giving Mr Lowe a bit of a headache!

The trajectory of global rates is upwards as we will discuss later. The latest from the FED is that further rate rises are required, and expected. So the FED is doing what the BIS report suggested. But the net result is pressure on Bank funding here, remember that around 30% of bank funding comes from overseas and the BBSW is higher still.

Two points to make here. First as credit availability is the strongest influence of home prices, the easy access to international capital markets the banks have had in recent years meant they could lend more, up to 30% more, hence disastrously higher home prices. Second the weight of evidence is that more banks will lift rates. Citigroup for example, forecasts that the rising cost of funding will prompt Australia’s four major banks to increase their mortgage interest rates independently of the RBA, with the banks tipped to begin lifting their mortgage rates by an average of eight basis points by September. Citigroup adds that the rise in banks’ short-term funding costs since early 2018 is likely to be sustained. And in effect the tenor of the RBA minutes signals to the banks they can go ahead and lift rates.

As rates have fallen, households have leveraged up, supported by lose lending policy and driving home prices to massive multiples of household income as data from IFM Investors showed this week.

And even small rate rises will hurt, as we showed in our latest Mortgage Stress release for June, which was out this week. Mortgage stress continues to rise. Across Australia, more than 970,000 households are estimated to be now in mortgage stress (last month 966,000). This equates to 30.3% of owner occupied borrowing households. In addition, more than 22,000 of these are in severe stress. We estimate that more than 57,100 households risk 30-day default in the next 12 months. We expect bank portfolio losses to be around 2.8 basis points, though losses in WA are higher at 5.2 basis points. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates. We discussed this in our post “The Debt Pips Are Squeaking”, in which we also discussed the latest anaemic retail sales figures, and the latest household debt to income ratio from the RBA which are now at a record 190.1. We are literally drowning in debt. And its structural.

The Australian Institute of Health & Welfare released a new report showing that home ownership is out of reach to growing numbers of Australians, thanks to high prices and poor affordability. They say that over the last 20 or so years Australia has seen a shift from outright ownership to owning with a mortgage, and a shift from overall home ownership to private rental Between 1995 and 2015, the proportion of outright owner-occupied households fell from 41.8% to 30.4%. Comparatively, the proportion of households owning with a mortgage has increased, from 29.6% to 37.1%, over the same period. Overall, the proportion of households in home ownership fell from 71.4% to 67.5%. There has also been an increase in the proportion of households renting privately (from 18.4% to 25.3%), and a decline in the proportion of households renting through state and territory housing programs (from 5.5% to 3.5%). Equally telling is home ownership rates between 1971 and 2016, by selected 5-year age groups. The home ownership rate of 30–34 year olds was 64%, and 50% for 25–29 year olds, in 1971. Forty-five years later these rates have decreased notably, with the home ownership rate of 30–34 year olds falling 14 percentage points to 50%. Similarly, that of 25–29 year olds fell 13 percentage points (to 37%). While declines are evident for other age groups they are much less marked. So fewer Australians are tending to own their home at retirement. For Australians nearing retirement, for example, age groups 50–54, 55–59, and 60–64, home ownership rates peaked in 1996 at 80%, 82% and 83%, respectively Since 1996 however, there has been a gradual decline in home ownership rates, most notably in the 50–54 age group which has seen a 6.6 percentage point fall over these 20 years (from 80.3% to 73.7%). This is one reason why we are watching closely our “Down Trader” segment – people seeking to sell and release capital. There are 1.2 million in this state, compared with around 600,000 up Traders, and 150,000 first time buyers. So on simple supply demand logic, more people selling than buying means prices will fall further.

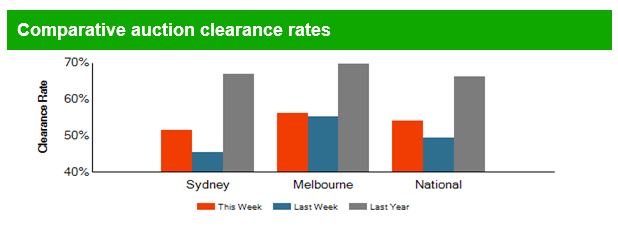

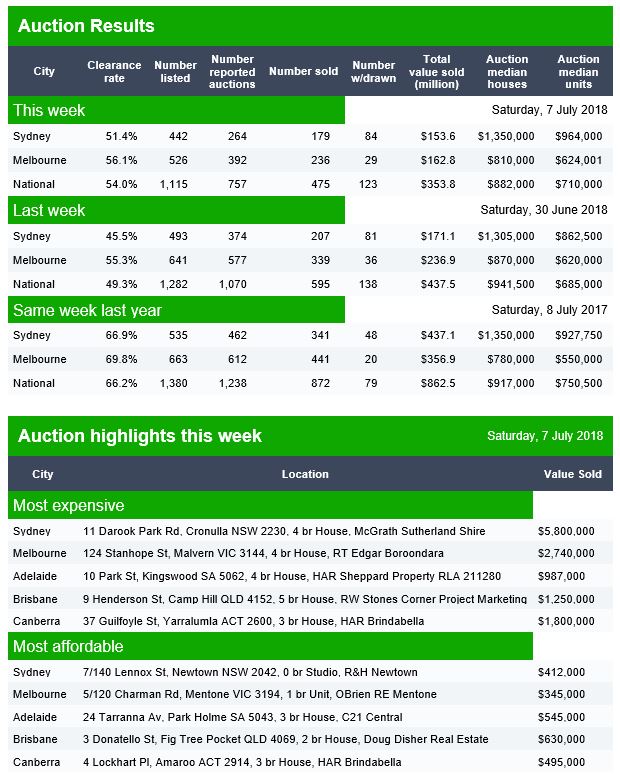

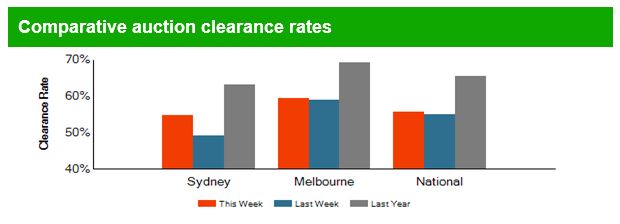

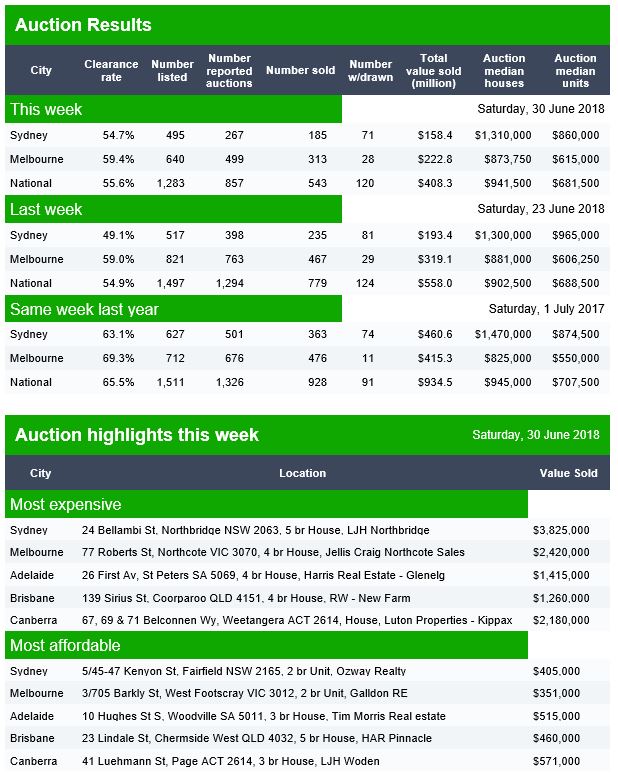

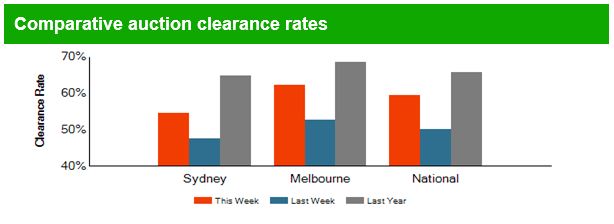

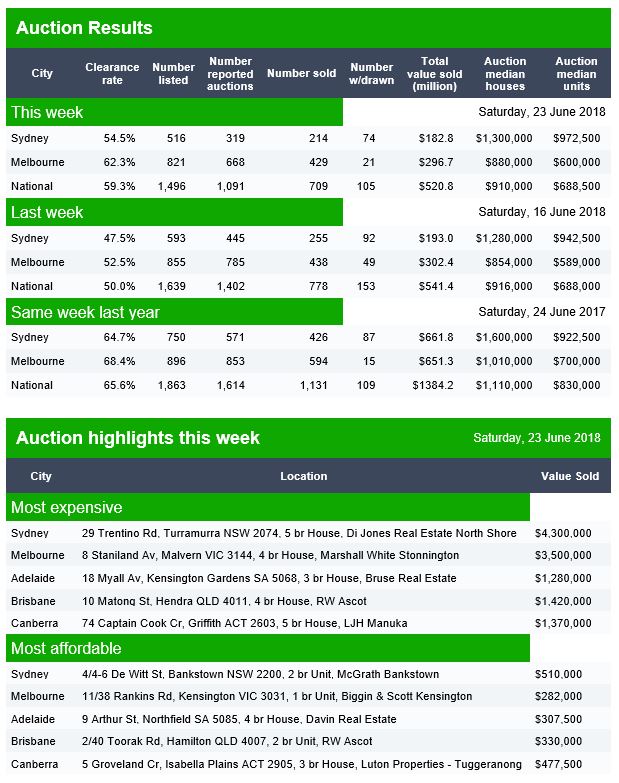

And on that note, CoreLogic said that the weighted average clearance rate has tracked below 60 per cent for 8 consecutive weeks now, while over the same 8-week period last year clearance rates were tracking within the low 70 to high 60 per cent range. Last week Melbourne’s final auction clearance rate fell to 57.2 per cent across a lower volume of auctions week-on-week with 791 held, down on the 941 auctions over the week prior when a higher 59.9 per cent cleared. In Sydney, less than half of the homes taken to auction sold last week. The city returned a final auction clearance rate of 49.7 per cent, down slightly on the 50.1 per cent the previous week, with volumes across the city remaining relatively steady over the week with a total of 634 held. All of the remaining auction markets saw a lower volume of auctions last week, with the final clearance rate across each market also falling week-on-week. There were also a large number of passed in auctions.

Gerard Minack from Minack Advisors said this week that the housing market looks ‘thin’, hinting that prices may be unusually sensitive to a change in demand. Historically housing market turnover tracked price growth. However, turnover has been soft relative to price gains over the past 3-4 years, and in the March 2018 quarter turnover fell to the lowest level since the 1990 recession.

There are still many economists talking of just a small slide in prices over the next few months, but we suspect they are underestimating the impact of tighter credit. For example, Macquarie suggested from their annual mystery shopping survey mortgage power – the amount people could get when applying for a mortgage had not dropped that much at all. But in fact, it seems the non-banks, those not under so much scrutiny from APRA is where the bigger loans reside.

Whereas UBS, the arch property bears, suggest that credit tightening will continue, as lending flows ease, saying one of the key recommendations of the Royal Commission is likely to be a stricter interpretation of Responsible Lending. In particular “reasonable steps” required to verify customers’ financial positions. This is likely to require credit licensees (banks and non banks) to verify living expenses from customers’ transaction banking and credit card data over a period of around 12 months. They go to say that as ANZ stated in its submission to the Royal Commission, verifying living expenses from transaction accounts and credit cards is operationally complex and will likely require substantial investment in technology to automate this process. So UBS believes that while the major banks will be able to absorb these costs, such technological investments may be prohibitive for many of the smaller players. Therefore, they believe that any potential regulatory mismatch benefiting the smaller banks and non-banks is unlikely to be sustainable. In other words, credit will be tighter soon, driving prices lower.

The Corelogic’s Housing Index showed that prices slipped again last week in Sydney, down 0.13%, Melbourne down 0.11%, Adelaide down 0.01% and Perth down 0.07%. Brisbane rose 0.02%. On a 12 month basis, Sydney on average has dropped 4.69%, while Perth has fallen 2.08%. The other centres have risen just a little. But it is worth remembering that Sydney prices are still 66% from the last trough, Melbourne 56%, Brisbane 21% and Adelaide 19%. Perth is only 0.4% higher, thanks to the prevailing weak economic conditions in the West. This weakness also has translated into rental rates, with Perth seeing just a 3% rise over the past 10 years for houses, and a small fall for units. Compare this with a national rise in rentals over the same period of 25.7%. At the other end of spectrum rentals rose 53.8% for Hobart houses, and 44.7% for units, highlighting the housing cost pressure there.

Despite the falls in property values, and the expected future further falls, the AFR said Labor has shrugged off suggestions from the property industry that its planned changes to negative gearing rules should be scrapped because of market conditions. They reported that Shadow treasurer Chris Bowen told a Property Council of Australia forum in June the changes were about making long-term structural adjustments, rather than addressing the short-term cycle. The policy was a once in a generation reform. We think he is right.

The Royal Commission in Darwin this week heard about the thousands of Aboriginal people who are sold unsuitable financial products and vulnerable consumers are targeted by instant cash loan machines because the financial landscape supports predatory practices. Insurance agents were able to exploit and target Aboriginal people because the industry isn’t fully regulated. An excellent The Conversation Article made the point that the cultural, economic and political arrangements that allow this to happen are called “practice architectures”. They include the complex language used to deceive consumers into buying unsuitable products, incentivised high pressures sales tactics, and a lack of care and concern for vulnerable consumers. All of these aspects are within the scope of financial regulators. The funeral insurance industry can push dodgy products because no one is watching. Predatory financial practices will continue until governments and/or regulators do something about it.

More evidence of regulators not doing their job, and the financial sector simply exploiting their customers to make a quick buck.

We heard this week that ASIC has accepted court enforceable undertakings from the Commonwealth Bank of Australia and Australia and New Zealand Banking Group under which the banks have agreed to change the way they distribute superannuation products to their customers. ASIC investigated CBA’s distribution of its Essential Super product and ANZ’s distribution of its Smart Choice Super and Pension product through bank branches. ASIC found a common practice of offering those products to customers at the conclusion of a fact-finding process about customers’ overall banking arrangements. ASIC was concerned that customers may have thought, due to the proximity of the fact-finding process to the offer of Essential Super or Smart Choice Super, that the CBA branch staff or the ANZ branch staff were considering risks specific to the customer when this was not the case. These court enforceable undertakings prevent CBA from distributing Essential Super in conjunction with a Financial Health Check and ANZ from distributing Smart Choice Super in conjunction with an A-Z Review. They also require CBA and ANZ to each make a $1.25 million community benefit payment. If there is a breach of the undertaking ASIC can, under the ASIC Act, apply for orders from the court to enforce compliance. But whilst individuals risk being sent to prison as one Perth finance broker, did this week, or permanently banned from the finance industry for loan fraud, the asymmetric penalties between the small guys and the big firms is – well shameful. It seems to me regulators are going for the easy targets who cannot fight back, whilst imposing mild penalties on the big guys, for fear of court proceedings. The balance is just wrong.

Finally, looking across the markets, shares in Australia started the new financial year well, with most banking stocks going higher. Bendigo Bank was up 1.72%, Suncorp up 0.54% and even the languishing Bank of Queensland rose 0.77%. Westpac was up 0.85%, ANZ up 1.97% on its buybacks, NAB up 1.6% and CBA up 1.2%, though still below its peak in 2017 when it was above $82. So risks in the mortgage book are clearly not worrying investors that much just now. This despite the 90-Day mortgage default rates going higher as reported in the S&P Ratings SPIN Index. Macquarie, who has more business offshore than on shore rose 0.42%, at 122.96, just off its all-time highs, The ASX 200 ended higher up 0.91% to 6,272, a solid rise. The Aussie Dollar did a little better too against the US Dollar settling at 74 cents, up 0.57% and against the Chinese Yuan up 0.7% to $4.94.

Now back to global debt. Deutsche Bank published a chart which showed that of the $50 trillion global bond market, about $8 Trillion of these bonds are now trading at negative interest rates, thanks to changes in interest rates across the market. Within the $50 trillion, the amount of nonfinancial corporate bonds has increased 2.7 times over the past decade to $11.7 trillion, according to Mckinsey. Debt in China has outgrown that in the USA, based on GDP, with non-financial corporate debt in China sitting at 160% of GDP, compared with 97% in the USA, according to JP Morgan. The China credit boom, is well, booming…

This all signals more trouble ahead, given that the US 3 Month bond rate and LIBOR are sitting at highs, and the 10 Year US Bond Rate remains elevated, reflecting the expectation of more FED rate hikes ahead. And the latest from the FED is that further rate rises are required, and expected.

U.S. stocks finished the week mostly higher, thanks mainly to low-volumes of buyers on Friday. The S&P 500 finished the week up about 1.5% and the Dow ended about 0.8% higher for the week. The big winner was the tech-heavy NASDAQ Composite, which closed up about 2.4% for the week. The DOW ended the week up 0.41% to 24,456 after light holiday trading.

US employment data showed still-solid growth in payrolls, but lower-than-expected wages, which eased inflation concerns. Nonfarm payrolls rose by 213,000 in June. That was higher than the consensus estimates of 200,000. The jobless rate unexpectedly rose to 4.0% from 3.8%, missing consensus expectations for it to remain unchanged as more people entered the labor force. Average hourly earnings advanced 0.2% month-on-month in June, below expectations. The data still suggests the Federal Reserve will gradually raise interest rates. The markets are still pricing in two more rate hikes this year.

The real unknown though is the U.S, China Trade Battle which is now officially underway. The U.S. has put tariffs in place on $34 billion worth of Chinese goods and the Chinese hit right back with tariffs on $34 billion on U.S. goods going into effect. China said the U.S. had “launched the largest trade war in economic history to date.” And the U.S. administration is already looking at ramping up the amount of tariffed goods, threatening another 16 billion dollars in two weeks, and then more later. No one knows where this will lead. But there are risks for Australia and other countries getting caught in the cross-fire.

The U.S. dollar endured a tough week that was not helped by the mixed jobs numbers that offered little encouragement for traders looking for faster Fed hikes. The dollar index, which compares the greenback to a basket of six currencies, was down about 0.7% for the week. The dollar also faced pressure from the euro during the week. German Chancellor Angela Merkel resolved an immigration battle and with her interior minister that had threatened the future of her coalition government.

Oil continued higher through the week, as supply limits kicked in, up 1.33% to 73.91, and Gold fell again, down 0.23% as risks abated.

And finally, Bitcoin recovered a little to 6,615 but remains volatile, while the broader VIX index sits slightly above the lows seen last year, but below the peak of a few months back.

So it seems that investors are banking on the debt elastic not snapping back anytime soon, but we will be watching for further signs of stress given the massive amount owing out there as rates rise. Meantime banks are making hay, despite the levels of uncertainly out there. As the BIS report put it “A key takeaway is that, while a low-for-long scenario presents considerable solvency risk for insurance companies and pension funds and limited risk for banks, a snapback would alter the balance of vulnerabilities,”. We have been warned.

Before I sign off, mark your diary. On the 17th July at 8 PM Sydney time I will be running our next live streaming session, where you can discuss in real time the issues in play. Judging by the previous session, it will be a lively event. I will schedule it shortly on our YouTube channel.