We look at the latest ABS lending flow data for April 2019.

Tag: ABS

Retail turnover fell 0.1 per cent in April

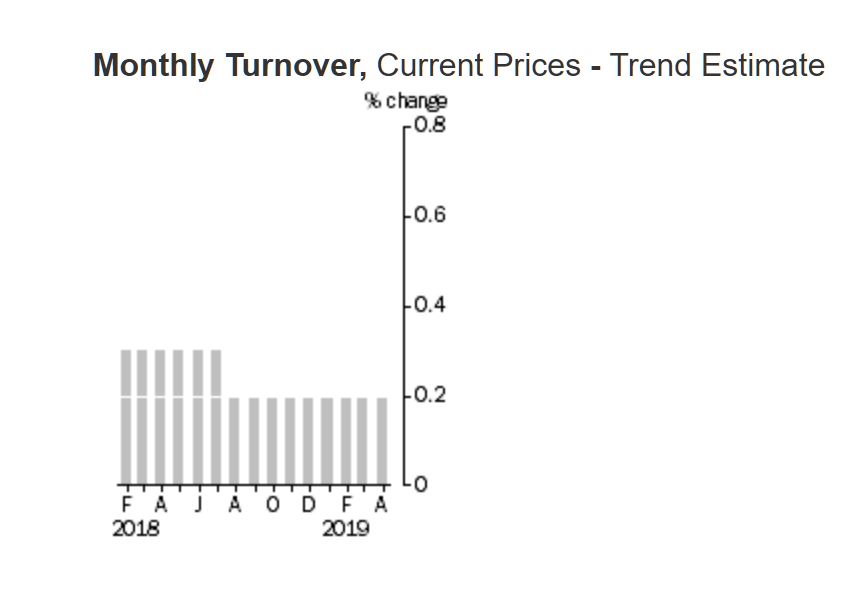

Australian retail turnover fell 0.1 per cent in April 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures. This follows a rise of 0.3 per cent in March 2019.

The trend estimate for Australian retail turnover rose 0.2 per cent in April 2019, following a 0.2 per cent rise in March 2019. Compared to April 2018, the trend estimate rose 2.9 per cent.

- In trend terms, Australian turnover rose 2.9% in April 2019 compared with April 2018.

- The following industries rose in trend terms in April 2019: Food retailing (0.4%), Cafes, restaurants and takeaway food services (0.4%), Other retailing (0.1%), Department stores (0.2%), and Clothing, footwear and personal accessory retailing (0.1%). Household goods retailing (-0.2%) fell in trend terms in April 2019.

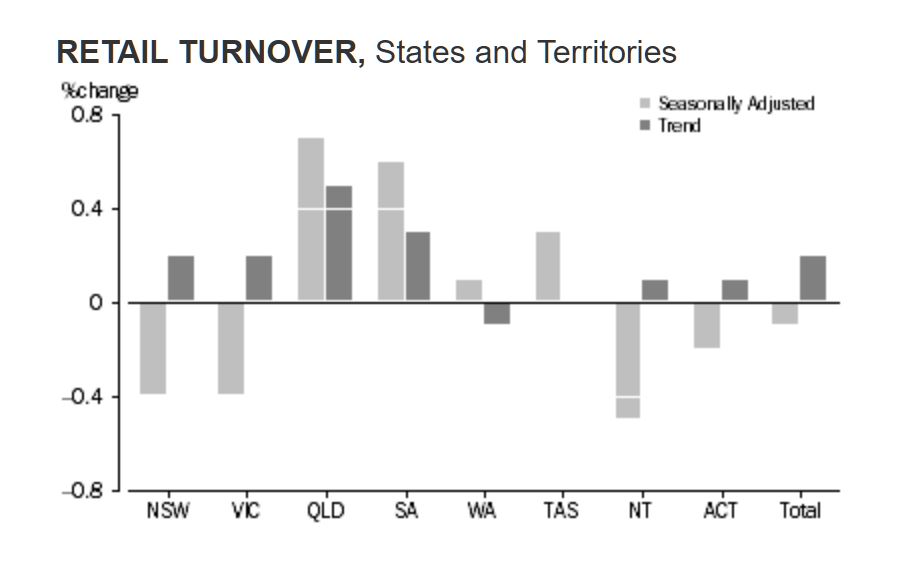

- The following states and territories rose in trend terms in April 2019: Queensland (0.5%), New South Wales (0.2%), Victoria (0.2%), South Australia (0.3%), the Northern Territory (0.1%), and the Australian Capital Territory (0.1%). Tasmania (0.0%) was relatively unchanged. Western Australia (-0.1%) fell in trend terms in April 2019.

- Online retail turnover contributed 5.7 per cent to total retail turnover in original terms in April 2019, which was unchanged from March 2019. In April 2018, online retail turnover contributed 5.4 per cent to total retail.

A Small Reality Check [Podcast]

We look at the latest data from the ABS and auction results. Maybe no rebound yet?

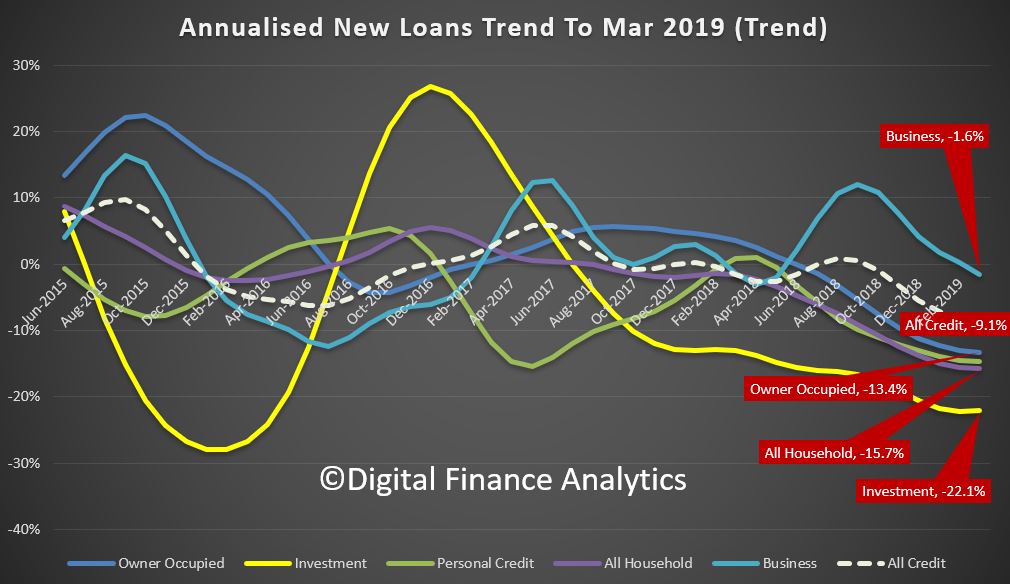

The Credit Impulse Under The Microscope

We review the latest ABS lending flow data to March 2019.

The value of lending commitments to households fell 3.7% in seasonally adjusted terms. This follows a 2.2% rise in February 2019.

Lending to households fell across all components in seasonally adjusted terms, with the largest falls in personal finance (down 11.2%) and owner occupier dwellings (down 3.4%).

In trend terms, lending commitments for owner occupier dwellings fell 0.9% and investment dwellings fell 2.1% in March 2019.

The number of lending commitments made to owner occupier first home buyers recorded a relatively small fall (down 0.5%) compared to the fall in the number of lending commitments made to non-first home buyers (down 3.3%) in March, seasonally adjusted.

Personal finance excluding refinancing fell 11.2% in seasonally adjusted terms during March 2019 and is down 23.8% from March 2018. Lending to households for refinancing was down 0.4% in seasonally adjusted terms, following a 2.3% rise in February 2019. In trend terms, the value of lending commitments to businesses fell 2.0% in March, and is down 1.8% from March 2018.

Wages rise 0.5% in the March quarter 2019

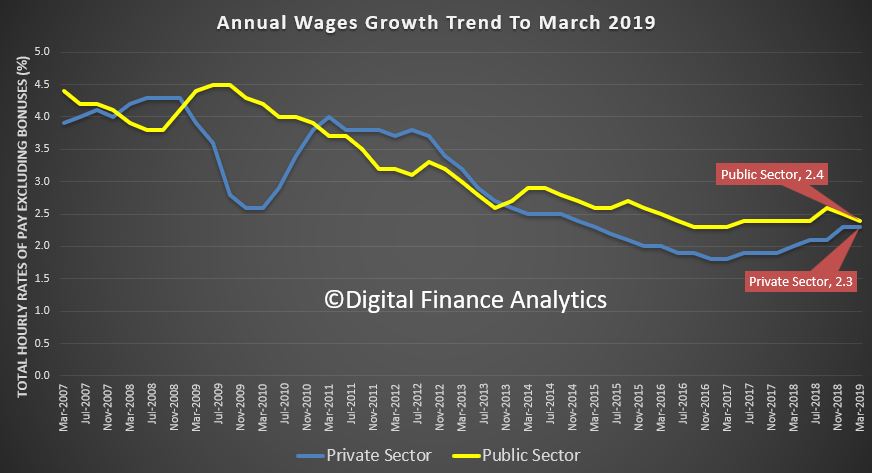

The trend Wage Price Index (WPI) rose 0.6 per cent in the March quarter 2019 and 2.3 per cent through the year, according to figures released today by the Australian Bureau of Statistics (ABS).

Trend growth in the public sector was 2.4% over the past year, compared with 2.3% in the private sector.

ABS Chief Economist Bruce Hockman said: ” The main contributors to growth over the quarter were regularly scheduled wage rises in the Health care and social assistance and Education and training industries, as was the case in the previous March quarter.”

In original terms, annual wages growth to the March quarter 2019 by industry ranged from 1.8 per cent for Construction and the Information, media and telecommunication services industries to 3.0 per cent for Health care and social assistance.

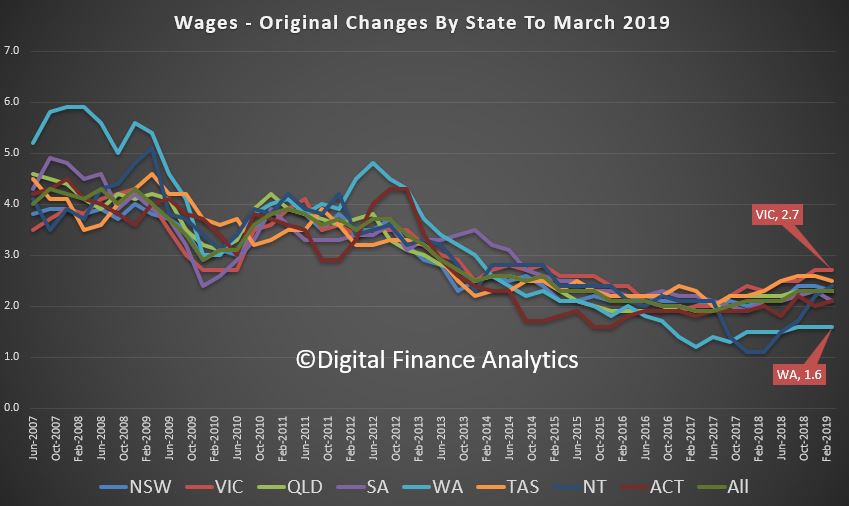

Western Australia recorded the lowest through the year wage growth of 1.6 per cent while Victoria recorded the highest of 2.7 per cent.

Credit Impulse Dies Some More

The value of new lending commitments to households fell 3.7 per cent in March 2019, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) figures on new lending to households and businesses.

The fall in lending to households in March follows a 2.2 per cent rise in February 2019.

ABS Chief Economist, Bruce Hockman said: “All components of new lending to households were weaker in March, more than offsetting a bounce in lending activity seen in February.”

“There were large falls in the value of lending for owner occupier dwellings in seasonally adjusted terms in both New South Wales (-5.7 per cent) and Queensland (-5.3 per cent) in March, after rises in both states the previous month” he said.Nationally, lending for investment dwellings also contracted further in March, with the series down 25.9 per cent (seasonally adjusted) compared to March 2018. The level of new lending for investment dwellings is at its lowest level since March 2011.

While nationally there was a fall in the number of loans to owner occupier first home buyers (-0.5 per cent) in March, in a similar pattern to recent months this fall was again much less than the drop in the number of loans to owner occupier non-first home buyers (-3.3 per cent).

After rises in January and February, lending to households for personal finance excluding refinancing fell 11.2 per cent in March, seasonally adjusted.

In trend terms, the value of new lending commitments to businesses fell 2.0 per cent in March. All components of business lending remained subdued.

More detailed analysis to follow. Home prices will fall further.

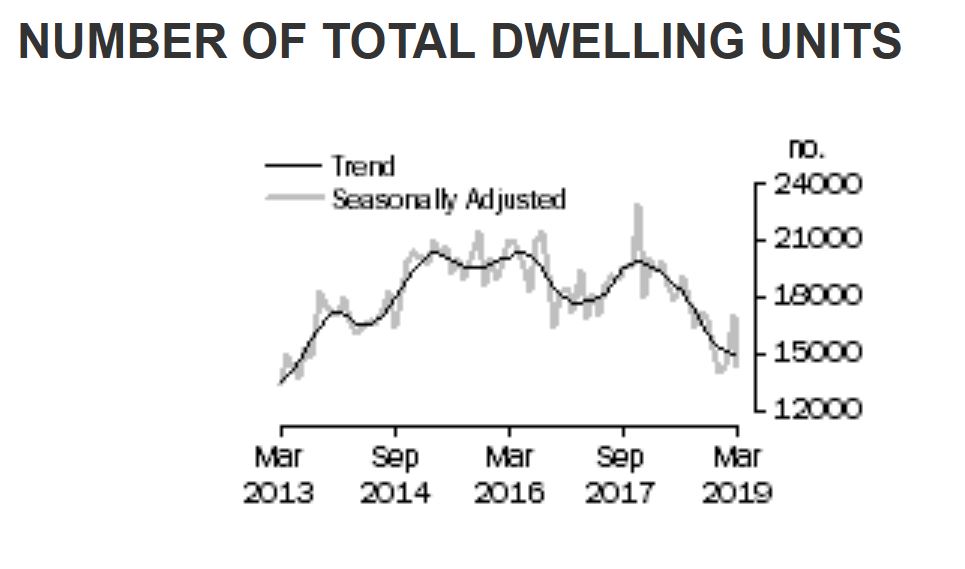

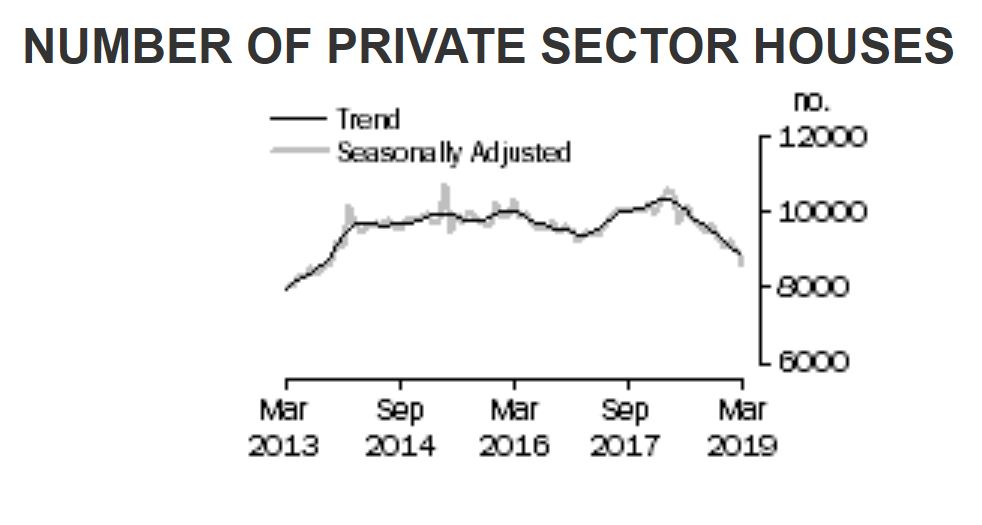

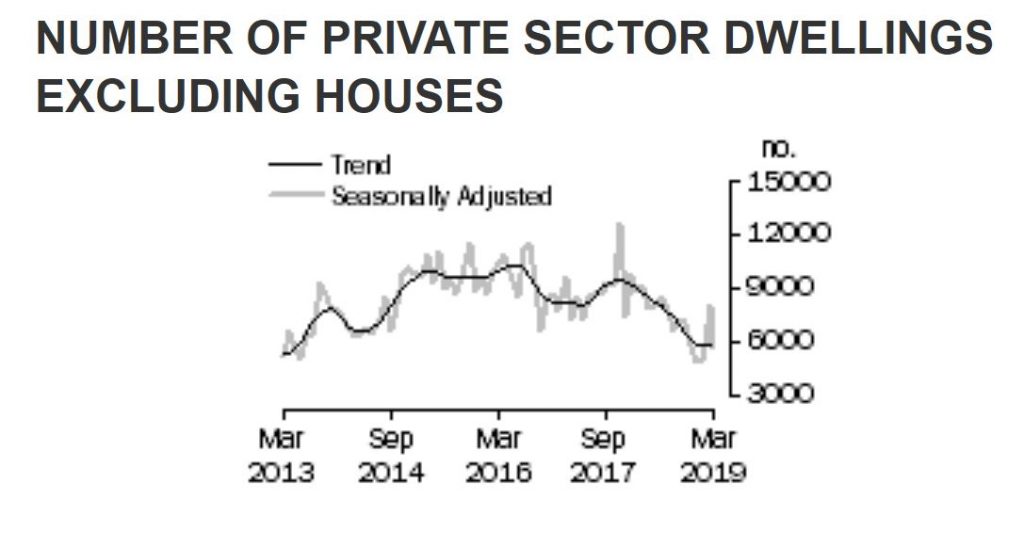

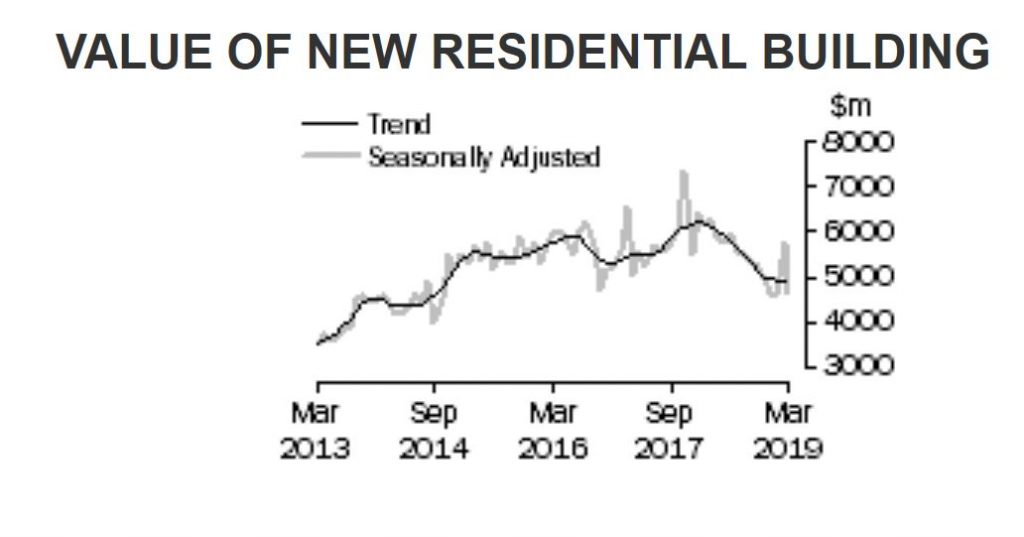

Dwelling Approvals Fall 0.6% in March

The number of dwellings approved in Australia fell by 0.6 per cent in March 2019, in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today. This won’t help the GDP or construction employment.

“The overall decrease was driven by private sector houses, which declined 1.4 per cent in trend terms,” said Justin Lokhorst, Director of Construction Statistics at the ABS. “

However, private dwellings excluding houses rose by 0.8 per cent”.

Among the states and territories, total dwelling approvals fell in Victoria (3.5 per cent) and Queensland (1.4 per cent) in trend terms. Increases were recorded in the Australian Capital Territory (4.8 per cent), the Northern Territory (3.9 per cent), Western Australia (3.8 per cent), New South Wales (0.8 per cent) and South Australia (0.4 per cent). Tasmania was flat.

Approvals for private sector houses fell 1.4 per cent nationally in trend terms. Declines were recorded in the three largest states: New South Wales (3.4 per cent), Victoria (1.8 per cent) and Queensland (0.9 per cent), while increases were recorded in Western Australia (1.0 per cent) and South Australia (0.9 per cent).

In seasonally adjusted terms, total dwellings declined by 15.5 per cent in March, largely driven by falls in New South Wales (27.4 per cent) and Victoria (27.0 per cent). The decline was led by private dwellings excluding houses which fell 30.6 per cent, while private house approvals decreased 3.2 per cent.

The value of total building approved was flat in March, in trend terms. The value of residential building rose 0.4 per cent, while non-residential building fell 0.6 per cent.

Will International Trade Save Our Bacon?

The latest from the ABS suggests that thanks to a lift in export prices, against imports, the GDP next time will be significantly assisted. Indeed the quantum of the changes are surprising strong. This may be sufficient to stop the RBA cutting the cash rate next month.

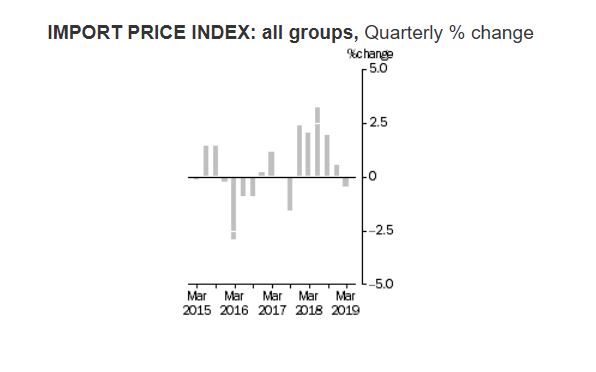

IMPORT PRICE INDEX

The Import Price Index fell 0.5% in the March quarter 2019. This follows a rise in the December quarter 2018 of 0.5%.

The main contributor to the fall this quarter is Petroleum, petroleum products and related materials (-6.8%), due to an increase in global supply.

Other major price falls were recorded in Inorganic chemicals and Medicinal and pharmaceutical products.

Inorganic chemicals fell 15.3%, driven by falls in the price of caustic soda, due to a global oversupply.

Medicinal and pharmaceutical products fell 3.1%, due to annual price reviews and increased competition from generic medicines.

These falls were partially offset by rises in prices for Gold, non-monetary (excluding gold ores and concentrates) (+6.8%), and General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (+2.5%).

Through the year to the March quarter 2019, the Import Price Index rose 5.2%. The main contributors to the rise are Petroleum, petroleum products and related materials (+5.6%), and General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (+8.6%).

MAJOR IMPORT PRODUCTS

The price movements of Australia’s major import products are summarised below:

- Petroleum, petroleum products and related materials (SITC 33) (-6.8%);

- Road vehicles (incl. air-cushion vehicles) (SITC 78) (-0.4%);

- Telecommunications and sound-recording equipment and reproducing apparatus and equipment (SITC 76) (-0.1%);

- Electrical machinery, apparatus and appliances, n.e.s. (SITC 77) (+1.0%);

- General industrial machinery and equipment, n.e.s., and machine parts, n.e.s. (SITC 74) (+2.5%).

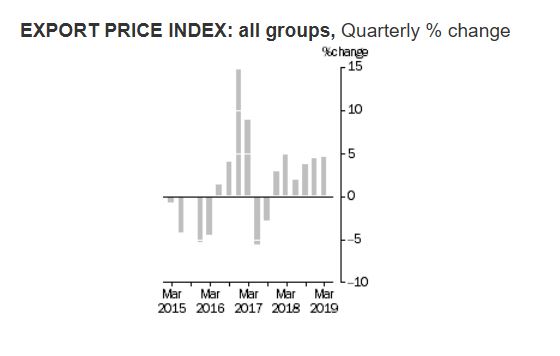

EXPORT PRICE INDEX

The Export Price Index rose 4.5% in the March quarter 2019. This follows a rise in the December quarter 2018 of 4.4%.

The main contributor to the rise this quarter is Metalliferous ores and metal scrap (+12.9%), reflecting local and global supply disruptions for iron ore and on-going demand from China.

Other major price rises were recorded in Gold, non-monetary (excluding gold ores and concentrates), Cereals and cereal preparations, Gas, natural and manufactured, and Non-ferrous metals.

Gold, non-monetary (excluding gold ores and concentrates), rose 6.6%, due to increased investor demand amid concerns over global economic growth.

Cereals and cereal preparations rose 4.3%, due to the impact of dry weather conditions globally in many wheat growing regions.

Gas, natural and manufactured rose 0.9%, due to the continuation of demand across Asia for liquefied natural gas. Export contract prices for liquefied natural gas are influenced by the international crude oil price with a four to six month lag.

Non-ferrous metals rose 3.3%, driven by increased demand for copper.

Offsetting these rises were falls in prices for Petroleum, petroleum products and related materials (-11.7%), and Meat and meat preparations (-2.3%).

Through the year to the March quarter 2019, the Export Price Index rose 15.3%. The main contributors to the rise are Metalliferous ores and metal scrap (+25.4%), Gas, natural and manufactured (+37.1%), and Coal, coke and briquettes (+9.0%).

MAJOR EXPORT PRODUCTS

The price movements of Australia’s major export products are summarised below:

- Metalliferous ores and metal scrap (SITC 28) (+12.9%);

- Coal, coke and briquettes (SITC 32) (+0.1%);

- Gas, natural and manufactured (SITC 34) (+0.9%);

- Gold, non-monetary (excluding gold ores and concentrates) (SITC 97) (+6.6%);

- Meat and meat preparations (SITC 01) (-2.3%).

Trend Employment Steady

The ABS has reported that Australia’s trend estimate of employment increased by 20,700 persons in March 2019, with:

- the number of unemployed persons increasing by 3,000 persons;

- the unemployment rate remaining steady at 5.0%;

- the underemployment rate remaining steady at 8.2%;

- the underutilisation rate remaining steady at 13.2%;

- the participation rate remaining steady at 65.6%; and

- the employment to population ratio remaining steady at 62.4%.

Over the past year, trend employment increased by 299,100 persons (or

2.4%), which was above the average annual growth rate over the past 20

years of 2.0%. Over the same 12 month period the trend employment to

population ratio, which is a measure of how employed the population

(aged 15 years and over) is, increased by 0.4 percentage points (pts) to

62.4%.

Trend employment increased by 20,700 persons between February and March

2019. This represents an increase of 0.16%, similar to the monthly

average growth rate over the past 20 years (0.17%), and less than the

monthly average growth rate over the past five years (0.22%).

Underpinning these net changes in employment is extensive dynamic

change, which occurs each month in the labour market. In recent months

there has been around 300,000 people entering and leaving employment.

There is also further dynamic change in the hours that people work,

which results in changes in the full-time and part-time composition of

employment.

Trend full-time employment increased by 18,000 persons between February

and March 2019, and part-time employment increased by 2,700 persons.

Compared to a year ago, there are 252,800 more persons employed

full-time and 46,300 more persons employed part-time. This compositional

shift led to a decrease in the part-time share of employment over the

past 12 months, from 31.7% to 31.3%.

The trend estimate of monthly hours worked in all jobs increased by 4.3

million hours (or 0.2%) in March 2019, to 1,776.8 million hours. Monthly

hours worked increased by 2.4% over the past year, equal to the

increase in employed persons (2.4%). The average hours worked per

employed person was 138.9 hours per month, or around 32.0 hours per

week.

The trend unemployment rate remained steady at 5.0% in March 2019. The

number of unemployed persons increased by 3,000 to 675,700 persons. Over

the past year, the trend unemployment rate decreased by 0.5 pts, with

the number of unemployed decreasing by 51,100 persons.

The trend participation rate remained steady at 65.6% in March 2019,

which was equal to March 2018 (65.6%). The female participation rate

remained steady at 60.6% and the male participation rate remained steady

at 70.9%.

The labour force includes the total number of employed and unemployed

persons. Over the past year, the labour force increased by 248,000

persons (1.9%). This rate of increase was above the rate of increase for

the total Civilian Population aged 15 years and over (360,500 persons,

or 1.8%).

The trend participation rate for 15-64 year olds, which controls (in

part) for the effects of an ageing population remained steady at 78.1%.

The gap between male and female participation rates in this age range is

less than 10 pts, at 82.8% and 73.6% respectively, continuing the long

term convergence of male and female participation.

The trend participation rate for 15-24 year olds (who are often referred

to as the “youth” group in the labour market) remained steady at 68.0%.

The unemployment rate for this group remained steady at 11.4% in March

2019 and decreased by 0.7% over the year.

The trend series smooths the more volatile seasonally adjusted estimates

and provide the best measure of the underlying behaviour of the labour

market.

SEASONALLY ADJUSTED ESTIMATES

Seasonally adjusted employment increased by 25,700 persons from February

to March 2019. The underlying composition of the net change was an

increase of 48,300 persons in full-time employment and a decrease of

22,600 persons in part-time employment. Since March 2018, full-time

employment increased by 289,800 persons, while part-time employment

increased by 14,900 persons.

Seasonally adjusted monthly hours worked in all jobs increased by 13.2

million hours (or 0.7%) in March 2019 to 1,785.4 million hours.

The seasonally adjusted employment to population remained steady at

62.3% in March 2019, and increased by 0.4 pts from the same time last

year.

GRAPH 1. EMPLOYMENT TO POPULATION RATIO, PERSONS, March 2009 to March 2019

The seasonally adjusted unemployment rate increased by 0.1 pts to 5.0%

in March 2019. The participation rate increased by 0.1 pts to 65.7%.

STATE AND TERRITORY ESTIMATES

TREND ESTIMATES

In March 2019, increases in trend employment were observed in all states

and territories except Western Australia (down 200 persons) and

Tasmania (down 100 persons). The largest increases were in Victoria (up

7,600 persons), followed by New South Wales (up 6,800 persons) and

Queensland (up 4,900 persons).

Over the past year, increases in employment were also observed in all

states except Tasmania (down 2,300 persons). Both territories recorded

falls with the Australian Capital Territory (down 1,600 persons) and

Northern Territory (down 4,800 persons). The largest increases were in

Victoria (up 127,500 persons), New South Wales (up 118,500 persons),

Queensland (up 36,100 persons). The highest annual employment growth

rates were in the Victoria at 3.9%, followed by New South Wales at 3.0%

and Queensland at 1.5%. For most states and territories, year-on-year

growth in trend employment was below their 20 year average, the

exceptions being New South Wales and Victoria.

The monthly trend unemployment rate increased by 0.1 pts in Tasmania

(6.5%) and the Australian Capital Territory (3.6%). It remained

unchanged in New South Wales (4.3%), Victoria (4.6%) and South Australia

(5.9%). It decreased by under 0.1 pts in Western Australia (6.1%) and

Queensland (5.9%), and fell 0.2 pts in the Northern Territory to 4.4%.

The monthly trend underemployment rate increased in the Northern

Territory (up 0.2 pts to 5.4%), Victoria (up 0.1 pts to 8.4%) and

Tasmania (up less than 0.1 pts to 10.1%). Decreases of up to 0.1 pts

were seen in New South Wales (7.5%), South Australia (8.9%), Queensland

(8.6%), Western Australia (8.9%) and the Australian Capital Territory

(5.9%).

Monthly trend participation rate decreases were observed in Northern

Territory (down 0.2 pts to 73.8%), Western Australia (down 0.1 pts to

67.8%) and Australian Capital Territory (down 0.1 pts to 69.2%). The

monthly trend participation rate increased less than 0.1 pts in New

South Wales (65.2%) and Victoria (66.1%). It remained unchanged in all

remaining states.

SEASONALLY ADJUSTED ESTIMATES

In seasonally adjusted terms, the largest increase in employment was in

Queensland (up 10,400 persons), followed by Victoria (up 10,000 persons)

and South Australia (up 8,500 persons). The largest decrease was in New

South Wales (down 2,600 persons) followed by Tasmania (down 1,800

persons).

The seasonally adjusted unemployment rate increased in Queensland (up

0.7 pts to 6.1%), South Australia (up 0.2 pts to 5.9%), Tasmania (up 0.2

pts to 6.7%), Western Australia (up 0.1 pts to 6.0%) and New South

Wales (up 0.1 pts to 4.3%). The only decrease in the unemployment rate

was observed in Victoria (down 0.1 pts to 4.6%).

The largest underemployment rate increase in seasonally adjusted terms

was seen in Queensland (up 0.9 pts to 8.9%) followed by South Australia

(up 0.4 pts to 8.8%), Western Australia (up 0.3 pts to 8.9%) and

Tasmania (up 0.2 pts to 9.9%). The only decrease was seen in New South

Wales (down 0.2 pts to 7.4%).

The largest increases in the seasonally adjusted participation rate were

in South Australia (up 0.7 pts to 63.2%) and Queensland (up 0.6 pts to

65.6%). The seasonally adjusted participation rate decreased in

Tasmania (down 0.4 pts to 60.3%), New South Wales (down 0.1 pts to

65.1%) and Victoria (down 0.1 pts to 66.0%).

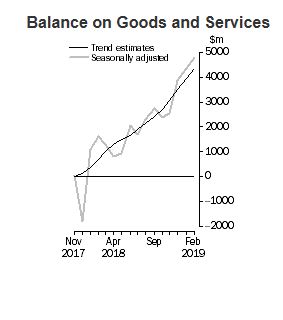

Trade Surplus Climbs to $4.8bn, a Record High

This is all about the Iron Ore price, thanks to Brazil. Fortunate yes, planned no!

The ABS reported that

- In trend terms, the balance on goods and services was a surplus of $4,348m in February 2019, an increase of $395m on the surplus in January 2019.

- In seasonally adjusted terms, the balance on goods and services was a surplus of $4,801m in February 2019, an increase of $450m on the surplus in January 2019.

This from Westpac.

The trade surplus rose to $4.8bn in February, up from a revised $4.35bn.

That exceeded expectations (market median $3.7bn and Westpac $3.8bn).

Exports: exceeded expectations, +0.2% vs a forecast -0.9%. The key surprise, the expected pull-back in gold failed to materialise.

Imports: were softer than anticipated, -1.1% vs a forecast +1.1%

Additional detail

Export earnings have been boosted by higher commodity prices, particularly for coal and iron ore. In February, metal ore export earnings (including iron ore) jumped by $1.0bn to $9.6bn, a record high – as anticipated. The spot iron ore price soared to US$85/t in the month as global supply was dented by the tailings dam tragedy in Brazil. Coal exports fell sharply, down $0.8bn on weaker volumes. Gold exports, up $1.4bn in January, held at high levels in February, down only $140mn.

Comments

The trade balance has strengthened from a $2.9bn surplus on average in the December quarter to a $4.6bn on average surplus in the March quarter. The bulk of this improvement likely reflects higher commodity prices. The lift in prices is boosting Australia’s national income, which is flowing through to higher tax revenues – providing governments with additional fiscal flexibility, as evident in recent budget updates. However, despite this, wages growth remains sluggish.