Please support our content creation efforts at Patreon.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

We discuss the latest employment and mortgage default data

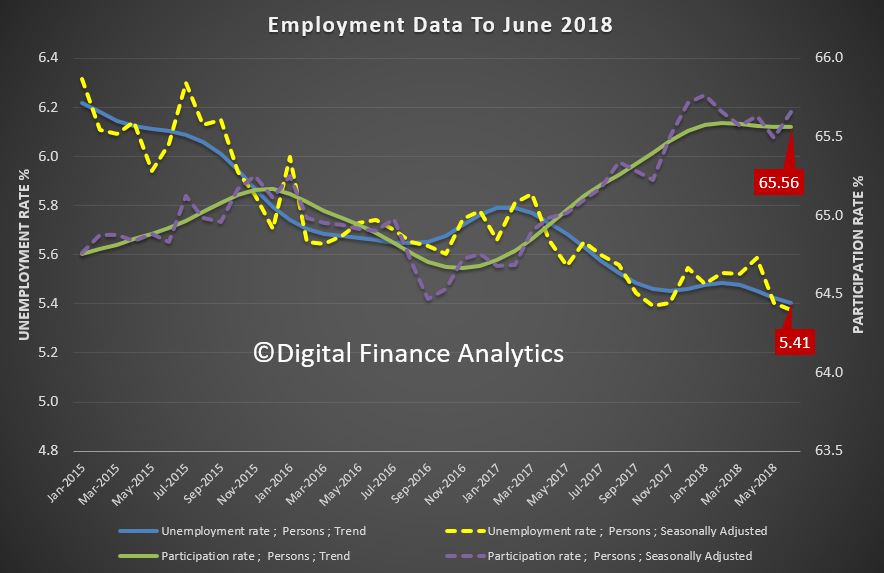

The ABS released their employment data for June 2018 today. The headline will read a fall to a 5 year low.

The trend unemployment rate was 5.4% in the month of June 2018, according to latest figures released by the Australian Bureau of Statistics (ABS) today. The trend participation rate remained steady at 65.6 per cent in June 2018, after the May figure was revised up.

“Over the year to June, the unemployment rate declined by 0.2 percentage points. This continues a gradual decrease in the trend unemployment rate from late 2014 and is the lowest rate since January 2013,” said the Chief Economist for the ABS, Bruce Hockman.

Employment and hours

Trend employment increased by around 27,000 persons in June 2018 and the growth was evenly split between full-time and part-time employment, with both increasing by over 13,000 persons. The net increase of 27,000 persons comprised well over 300,000 people entering employment, and more than 300,000 leaving employment in the month.

Over the past year, trend employment increased by 318,000 persons or 2.6 per cent, which was above the average year-on-year growth over the past 20 years (2.0 per cent).

15 to 19 year olds have contributed around a third of trend employment growth since January 2018. Employment for 15 to 19 year olds increased by over 6,000 in June 2018 and grew by around 58,000 over the last year.

The trend monthly hours worked increased by 3.4 million hours or 0.2 per cent in June 2018, and by 2.6 per cent over the past year.

States and Territories

Year-on-year growth in trend employment was above the 20 year average in all states and territories except for Victoria and Western Australia. Over the past year, the states and territories with the strongest annual growth in trend employment were New South Wales (3.7 per cent), Australian Capital Territory (2.9 per cent) and Queensland (2.6 per cent).

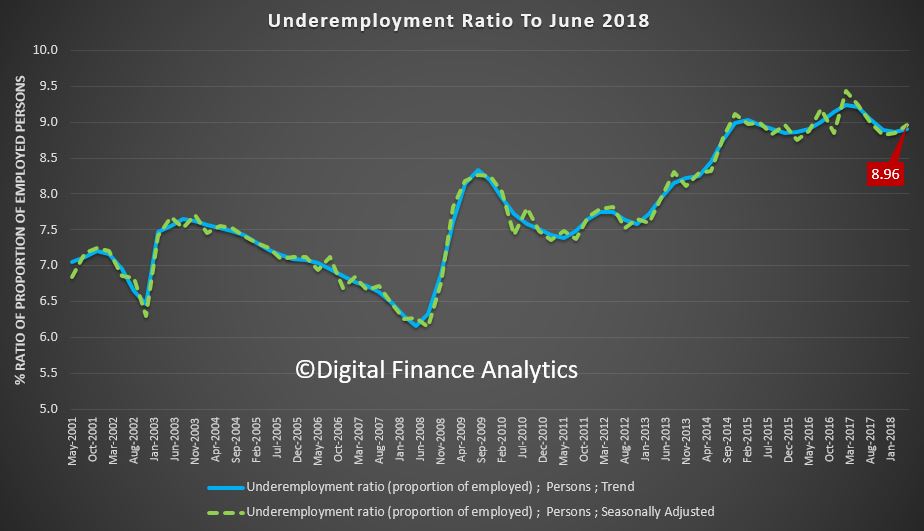

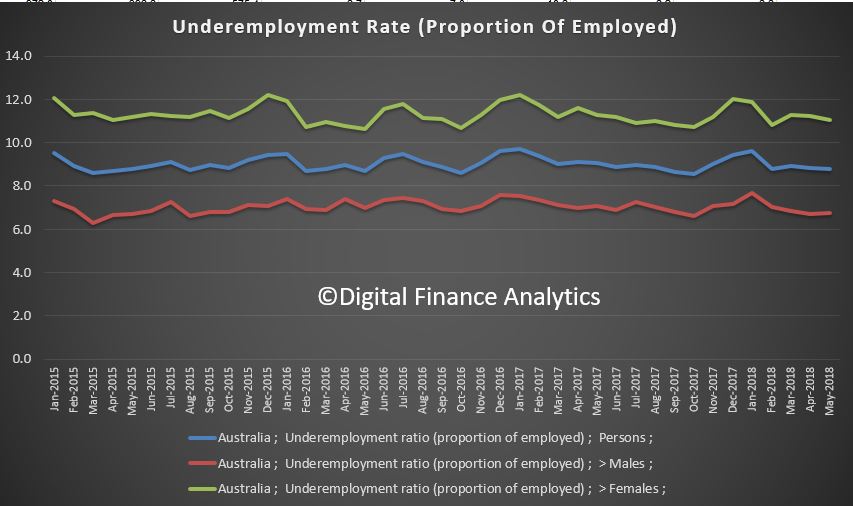

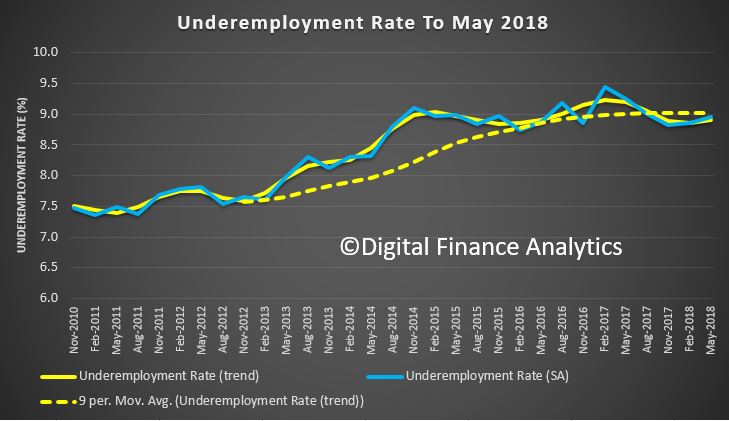

Underemployment (those in work who want more work) is at 9%, and is trending up a little. This is significantly higher than in 2011 when the employment rate was in a similar region, suggesting that more people feel the need for additional work.

Of course the stats are based on a wide definition of “employed” as even a small number of working hours a week shows as an employed person. Alternative measures of unemployment report much higher rates, so there is a question as to the significance and reliability of the numbers. But the trend remains down, which is good news, but in the region above 5%, the level at which the RBA says income growth may start to rise. So we are not there yet!

Of course the stats are based on a wide definition of “employed” as even a small number of working hours a week shows as an employed person. Alternative measures of unemployment report much higher rates, so there is a question as to the significance and reliability of the numbers. But the trend remains down, which is good news, but in the region above 5%, the level at which the RBA says income growth may start to rise. So we are not there yet!

Over half of permanent migrants aged 15 years and over (54 per cent) were buying or owned their own home, according to figures released by the Australian Bureau of Statistics (ABS) today.

“With the release of the 2016 Australian Census and Migrants Integrated Dataset (ACMID), new information on household, family and dwelling characteristics of permanent migrants is now available,” said Denise Carlton, Program Manager of Population Statistics at the ABS.

“This data allows for new insights into the household and family characteristics of permanent migrants in Australia which was previously not available, including home ownership levels.”

Home ownership and rental levels differed by the visa stream of the permanent migrant.

Renting

Overall, 42 per cent of permanent migrants were renting in 2016. Migrants who entered the country through the Humanitarian stream were more likely to be living in rented accommodation (63 per cent) than migrants in the Skilled and Family streams (40 per cent).

Home Ownership

Over half of Family and Skill stream migrants were buying (i.e. had a mortgage) or owned their own home (58 per cent and 57 per cent respectively), compared with almost one third (31 per cent) of Humanitarian migrants.

Migrants in the Family stream had the highest incidence of outright home ownership at 14 per cent, followed by Skill stream (8.0 per cent) and Humanitarian stream migrants (4.7 per cent).

We view the latest data on home lending and APRA’s latest speech.

Today the ABS published their housing lending statistics for May 2018, and APRA Chair Wayne Byers spoke on the resilience in the financial sector. Interesting timing.

APRA pretty much says they called it just right, and their tightening has not really impacted overall growth, and any further tightening will be marginal.

APRA pretty much says they called it just right, and their tightening has not really impacted overall growth, and any further tightening will be marginal.

First, the changes in lending practices to date do not seem to have had an obvious impact on housing credit flows in aggregate. Total housing lending grew at around 6 per cent in the year to May 2018, which is only marginally below long-run averages and roughly in line with the average run rate since 2011 (covering the period since house prices last went through a period of softening in Australia). Indeed, cumulative credit growth in the roughly three and a half years since APRA stepped up the intensity of its actions was greater than cumulative credit growth in the preceding three and a half years. Credit growth appears to be slowing somewhat at the moment, but that is not surprising in an environment of softening house prices and rising interest rates.

Second, it is evident that the composition of housing credit has shifted notably. Lending to investors is certainly now growing more slowly compared to three or four years ago. But despite the tightening in lending standards – which, it’s important to remember, also apply to owner-occupiers – lending to owner-occupiers grew at a very healthy 8 per cent over the past year. This relatively high rate of rate of growth for owner-occupiers (running broadly at almost 3x household income growth) has been sustained during a period in which lending policies and practices have been gradually strengthened.

Despite the prominence it has been given, our goal in seeking to reinforce standards and practices has been relatively modest: ensuring that internal policies are followed in practice, and applying what is, in most cases, a healthy dose of common sense. This has been an orderly adjustment, and we expect it to continue over time. While there is more “good housekeeping” to do, the heavy lifting on lending standards has largely been done. Any tightening from here on is expected to be at the margin as banks seek to get a better handle on borrower expenses, and better visibility of borrower debt commitments.

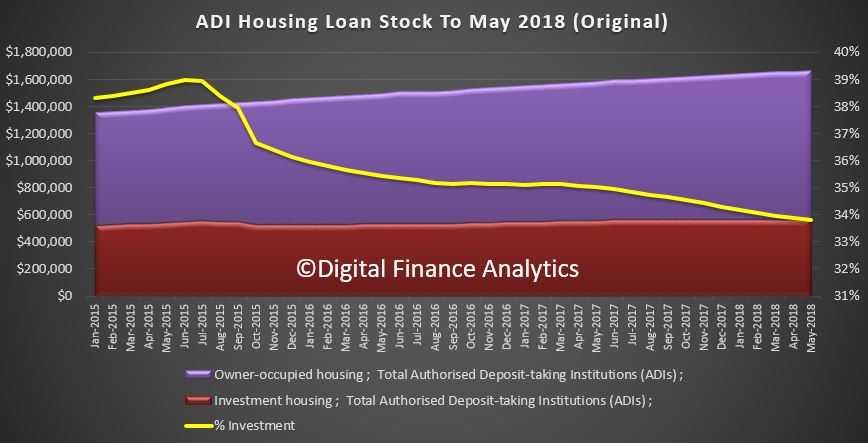

The ABS data shows that total lending stock grew again in May. This is original data split between owner occupied and investment loans.

Total housing loan stock rose 0.5% in the month to $1.66 trillion. Within that owner occupied lending rose 0.5% to $1.1 trillion and and investment lending rose just 0.1% to $563 billion. Investment loans fell to be 33.8% of all loans. Overall growth is circa 6% annualised. As for whether growth at 3 times income is “healthy” to quote Wayne Byers; well that’s another story. Remember debt has to be repaid, eventually.

Total housing loan stock rose 0.5% in the month to $1.66 trillion. Within that owner occupied lending rose 0.5% to $1.1 trillion and and investment lending rose just 0.1% to $563 billion. Investment loans fell to be 33.8% of all loans. Overall growth is circa 6% annualised. As for whether growth at 3 times income is “healthy” to quote Wayne Byers; well that’s another story. Remember debt has to be repaid, eventually.

Growth has been strongest in owner occupied lending, but investment lending was also higher.

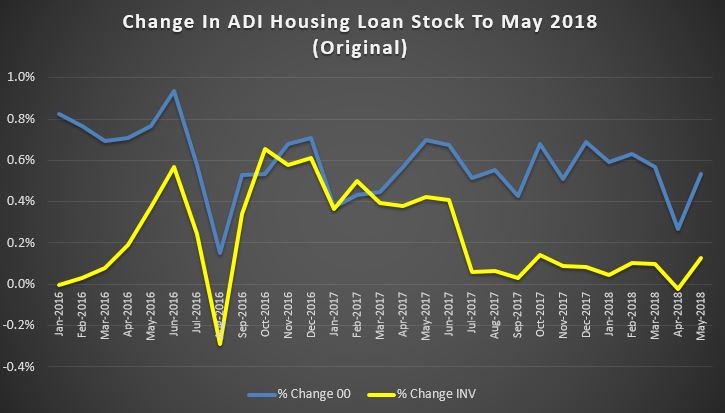

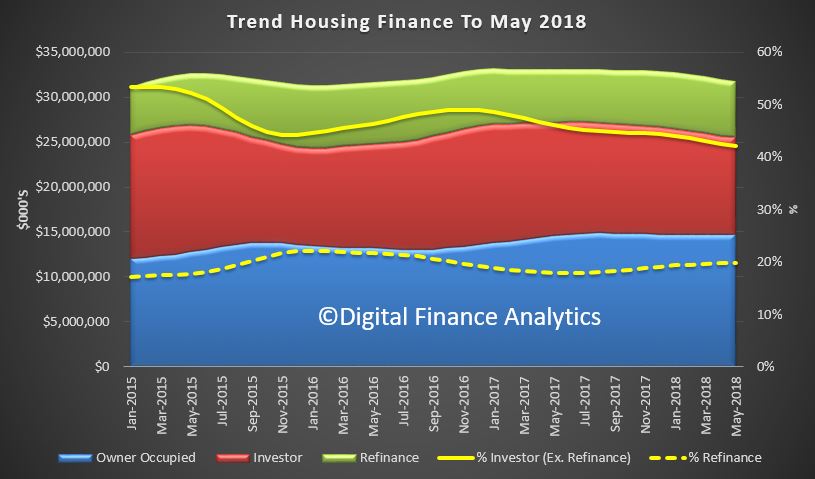

The trend housing flows were down month on month with a fall of 0.1% in owner occupied lending to $14.7 billion and investment lending down 1.9% to $10.7 billion. There was$6.3 billion of refinancing, a drop of 0.4%. 42% of lending was for investment purposes (excluding refinancing) and 19.9% of lending was refinancing, this proportion rose a little.

The trend housing flows were down month on month with a fall of 0.1% in owner occupied lending to $14.7 billion and investment lending down 1.9% to $10.7 billion. There was$6.3 billion of refinancing, a drop of 0.4%. 42% of lending was for investment purposes (excluding refinancing) and 19.9% of lending was refinancing, this proportion rose a little.

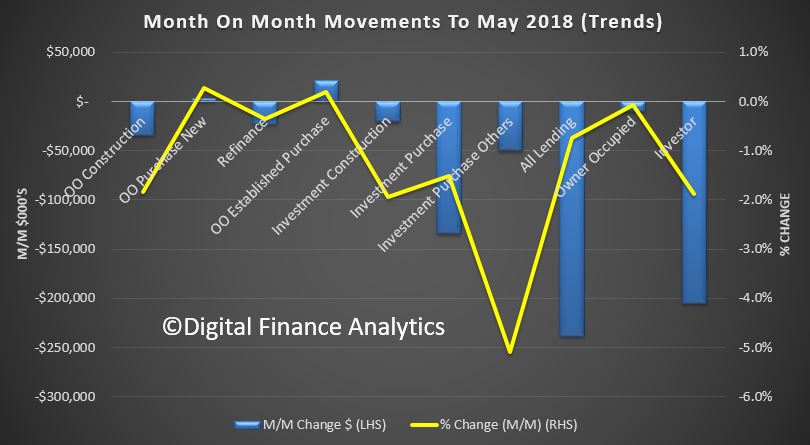

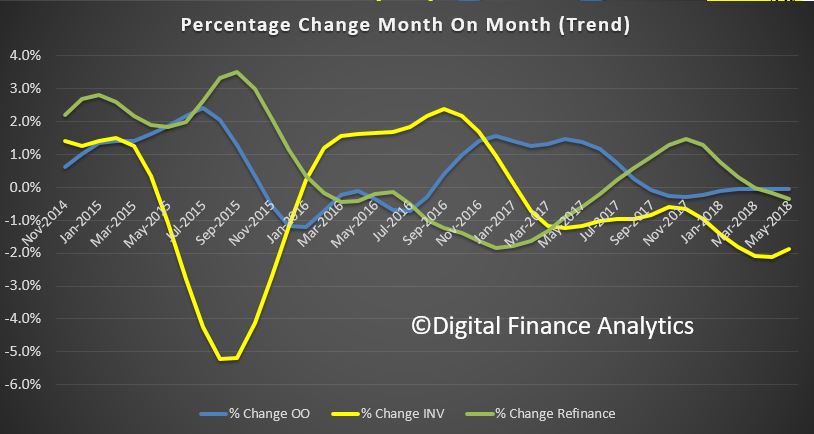

Looking in more detail at the trend movements by category, only owner occupied purchase of established dwellings rose, all other categories fell back. Investor lending continued to slide on a relative basis.

Looking in more detail at the trend movements by category, only owner occupied purchase of established dwellings rose, all other categories fell back. Investor lending continued to slide on a relative basis.

The month on month changes show the movements, and we note a slower rate of decline in investor lending.

The month on month changes show the movements, and we note a slower rate of decline in investor lending.

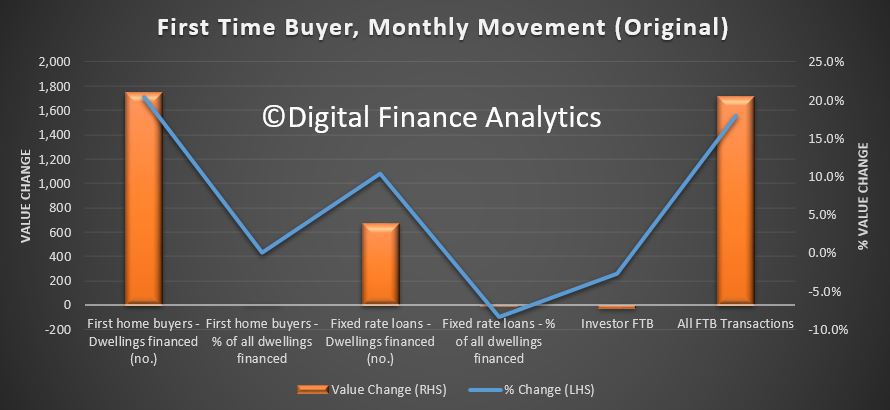

First time buyers continue to support the market, with a 17.6% share of all loans written but a significant rise in the absolute number of first time loans written (up 20.5% on last months) as well as a rise in non first time buyer borrowers. These are original numbers, so they do move around from month to month, and does reflect the incentives for first time buyers in some states.

First time buyers continue to support the market, with a 17.6% share of all loans written but a significant rise in the absolute number of first time loans written (up 20.5% on last months) as well as a rise in non first time buyer borrowers. These are original numbers, so they do move around from month to month, and does reflect the incentives for first time buyers in some states.

![]() The number of investor first time buyers continues to fall.

The number of investor first time buyers continues to fall.

![]() The month on month movements show the additional 1,750 buyers in the month. Worth noting also that the average loan size continues to grow, at $412,000 for non-first time buyers, up 0.4% on the previous month and $344,000 for a first time buyer, up 0.5%. There are some variations across the states, but I won’t include those here. There was also a further fall in the number of fixed rate loans being written, down to 12.1% from 13.2% last month.

The month on month movements show the additional 1,750 buyers in the month. Worth noting also that the average loan size continues to grow, at $412,000 for non-first time buyers, up 0.4% on the previous month and $344,000 for a first time buyer, up 0.5%. There are some variations across the states, but I won’t include those here. There was also a further fall in the number of fixed rate loans being written, down to 12.1% from 13.2% last month.

To me this begs the question, if credit is still running at these levels, and APRA says the tightening is all but done, will we see home prices starting to trend higher? Clearly the plan is to keep the debt bomb ticking for yet longer.

To me this begs the question, if credit is still running at these levels, and APRA says the tightening is all but done, will we see home prices starting to trend higher? Clearly the plan is to keep the debt bomb ticking for yet longer.

But this may well mean the RBA will lift rates sooner than I expected.

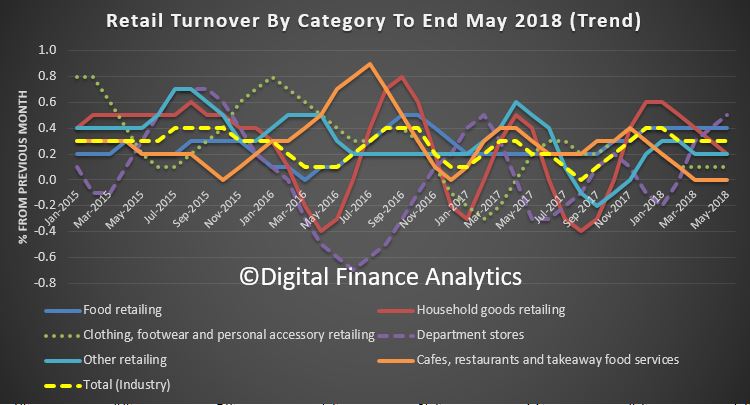

The ABS says the trend estimate for Australian retail turnover rose 0.3 per cent in May 2018 following a rise (0.3 per cent) in April 2018. Compared to May 2017, the trend estimate rose 2.8 per cent, so still stronger than wages growth (as people raid savings and put more on credit cards).

Across the categories department stores rose 0.5% on the previous month, thanks to sales being brought forward from June, food retailing was up 0.4%, household goods and other retailing were 0.2% and clothing and footwear rose just 0.1%.

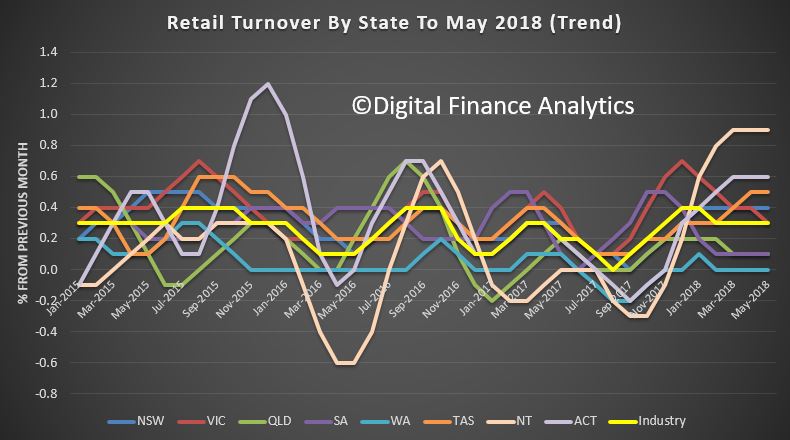

Across the states, the northern territories rose 0.9, ACT 0.6%, Tasmania 0.5%, New South Wales 0.4%, Victoria 0.3%, Queensland and SOuth Australia 0.1% and there was no change in Western Australia.

Across the states, the northern territories rose 0.9, ACT 0.6%, Tasmania 0.5%, New South Wales 0.4%, Victoria 0.3%, Queensland and SOuth Australia 0.1% and there was no change in Western Australia.

Online retail turnover contributed 5.6 per cent to total retail turnover in original terms in May 2018, a rise from 5.4 per cent in April 2018. In May 2017 online retail turnover contributed 3.9 per cent to total retail.

Online retail turnover contributed 5.6 per cent to total retail turnover in original terms in May 2018, a rise from 5.4 per cent in April 2018. In May 2017 online retail turnover contributed 3.9 per cent to total retail.

The number of dwellings approved in Australia fell by 1.5 per cent in May 2018 in trend terms, according to data released by the Australian Bureau of Statistics (ABS) today. At is all about a fall in unit approvals, with a notable decline in Melbourne. Expect more falls ahead, a further signs of trouble in the housing sector.

“Dwelling approvals have weakened in May, driven by a 2.6 per cent fall in private dwellings excluding houses,” said Justin Lokhorst, Director of Construction Statistics at the ABS.

Among the states and territories, dwelling approvals in May fell in Queensland (4.2 per cent), Victoria (2.7 per cent), Tasmania (2.0 per cent) and Western Australia (0.8 per cent) in trend terms.

Dwelling approvals rose in trend terms in South Australia (4.3 per cent), Northern Territory (2.8 per cent) and Australian Capital Territory (1.5 per cent), and were flat in New South Wales.

In trend terms, approvals for private sector houses fell 0.5 per cent in May. Private sector house approvals fell in Queensland (1.7 per cent), Western Australia (0.6 per cent), South Australia (0.4 per cent) and New South Wales (0.2 per cent). Private sector house approvals were flat in Victoria.

In seasonally adjusted terms, total dwellings fell by 3.2 per cent in May, driven by a 8.6 per cent decrease in private sector houses. Private sector dwellings excluding houses rose 4.3 per cent in seasonally adjusted terms.

The value of total building approved fell 0.7 per cent in May, in trend terms, and has fallen for seven months. The value of residential building fell 0.8 per cent, while non-residential building fell 0.4 per cent.

The HIA said:

“The market is cooling for a number of reasons including a slowdown in inward migration since July 2017, constraints on investor finance imposed by state and federal governments and falling house prices.

“A slowing in Australia’s population growth since June 2017 coincides with changes to visa requirements announced early last year. Since then Australia has experienced almost a year of slowing population growth.

“Finance has become increasingly difficult to access for home purchasers. Restrictions on lending to investors and rising borrowing costs have seen credit growth squeezed. Falling house prices in metropolitan areas have also contributed to banks tightening their lending conditions which have further constrained the availability of finance.

The Australian Bureau of Statistics has just released its latest analysis of the effects of government benefits and taxes on household income. Overall, it shows government spending and taxes reduce income inequality by more than 40% in Australia. Disparities between the richest and poorest states are also greatly reduced.

The ABS analysis provides the most up-to-date (to 2015-16) and comprehensive figures on the impacts of government spending and taxes on income distribution. As well as direct taxes and social security benefits, it estimates the impact of “social transfers in kind” – goods and services that the government provides free or subsidises. These include government spending on education, health, housing, welfare services, and electricity concessions and rebates.

The ABS analysis provides the most up-to-date (to 2015-16) and comprehensive figures on the impacts of government spending and taxes on income distribution. As well as direct taxes and social security benefits, it estimates the impact of “social transfers in kind” – goods and services that the government provides free or subsidises. These include government spending on education, health, housing, welfare services, and electricity concessions and rebates.

The figures also include a wide range of indirect taxes. Among these are GST, stamp duties and excises on alcohol, tobacco, fuel and gambling.

The 2015-16 results are the seventh in a series published every five to six years since 1984. The methodology is based on similar studies by the UK Office of National Statistics since the 1960s. The latest UK analysis coincidentally also came out on Wednesday.

The ABS analyses income distribution in a number of stages.

First, it calculates the distribution of “private income”. This includes wages and salaries, self-employment, superannuation, interest, dividends and income from rental properties, among other items. It also includes net imputed rent from owner-occupied dwellings and subsidised private rentals.

Next the ABS adds social security benefits, such as the Age Pension, unemployment and family payments, to give “gross income”.

Then it deducts direct taxes – primarily income tax – to give “disposable income”.

The next stage is to add the estimated value households derive from government services. This is mainly the value of public health care and education spending.

The final stage is to deduct the estimated value of indirect taxes.

It is possible to calculate measures of economic inequality at different stages in this process. By implication, the difference between inequality measures is the result of the different government policies taken into account.

Figure 1 shows the Gini coefficient, which ranges between zero – where all households have exactly the same income – and 100% – where one household has all of the income. The Gini coefficient for private income in 2015-16 was 44.2. The addition of social security benefits, which mainly increase the incomes of low-income groups, reduces the coefficient by 8.1 percentage points.

Deducting income taxes – which are progressive – further reduces inequality by 4.5 points. Government non-cash benefits reduce the Gini coefficient by nearly as much as the social security system. However, indirect taxes slightly increase income inequality.

The Gini coefficient for final income is 24.9. So, compared to a coefficient of 44.2 for private income, government spending and taxes reduce overall income inequality by more than 40%.

Figure 1: Effects of government spending and taxes on income inequality, measured by Gini coefficient Australia 2015-16. Data source: ABS Government Benefits, Taxes and Household Income, Australia, 2015-16, Author provided

While most of the reduction in inequality is due to government spending, taxes are obviously important to pay for this spending.

The social security system reduces income inequality (and poverty) because Australia targets benefits to the poor more than in any other high-income country.

Figure 2 shows the distribution of social security benefits and government services across income groups, from the poorest 20% to the richest 20% of households. The poorest 20% receive about seven times as much in benefits as the richest 20%. The average for OECD countries is close to one, with rich and poor receiving about the same amount.

Figure 2: Distribution of social spending ($ per week) by equivalised disposable household income quintiles, Australia 2015-16. Data source: ABS Government Benefits, Taxes and Household Income, Australia, 2015-16, Author provided

Government spending on social services is also progressively distributed. This spending is considerably greater than social security spending and includes both Commonwealth and state spending on education and health.

The poorest 20% receive about 70% more in non-cash benefits than do the richest. This is not due to income-testing. Instead, it’s largely a result of the greater value of public health spending on hospitals and Medicare for older people, who tend to be in the bottom half of the income distribution.

Taxes, of course, work to reduce income inequality, as high-income groups pay a higher share than low-income groups. Figure 3 shows that the poorest 20% pay about 5% of their disposable income in direct taxes, while the richest 20% pay about 30% of their disposable income.

In contrast, indirect taxes – particularly those on tobacco and gambling – are regressive. Low-income groups pay more than high-income groups as a share of their disposable income. However, the undesirable effects of smoking and gambling on the wellbeing of low-income households need to be borne in mind.

When direct and indirect taxes are added together the overall tax system is less progressive, but the richest 20% still pay nearly twice as much of their disposable income as do the poorest 20%.

Figure 3: Distribution of direct and indirect taxes (% of disposable income) by equivalised disposable household income quintiles, Australia 2015-16. Data source: ABS Government Benefits, Taxes and Household Income, Australia, 2015-16, Author provided

In addition to reducing inequalities between income groups, government spending and taxes redistribute across age groups. Government spending is much higher for households of Age Pension age than for younger households. This is because of both the Age Pension and older households’ use of the healthcare system.

For example, households where the reference person is 75 or older receive on average just over $1,000 a week in government spending but pay about $180 a week in direct and indirect taxes. Households with a person aged 45 to 54 pay the highest taxes on average – about $800 per week – and on average receive about $620 a week in social spending.

There is also redistribution across states and territories. For example, average private income is about 65% higher in Western Australia than in Tasmania. However, on average, Western Australian households receive about two-thirds of the social security benefits that Tasmanian households get. This reduces the disparity in gross income to about 45%.

Western Australian households pay about twice as much in income taxes as Tasmanians, reducing the disparity to 35%. Households in the West receive only about 3% more in spending on social services than in Tasmania, which reduces the disparity in average incomes to 28%. West Australian households also pay about 20% more in indirect taxes than Tasmanian households (although as a percentage of disposable income, this is a higher share in Tasmania).

These figures suggest that while the financing of fairly equal social services across most parts of Australia reduces inequality between states, the income tax and social security systems also significantly reduce disparities. This is because income tax and social security are national systems and because Tasmania is the poorest state largely due to the higher share of age pensioners in its population.

Overall, this publication provides an invaluable picture of how government spending and taxes affect household economic well-being. Its results are relevant not only to the political debate about tax cuts, but also to long-term policy development to prepare Australia for an ageing population.

Author: Peter Whiteford, Professor, Crawford School of Public Policy, Australian National University

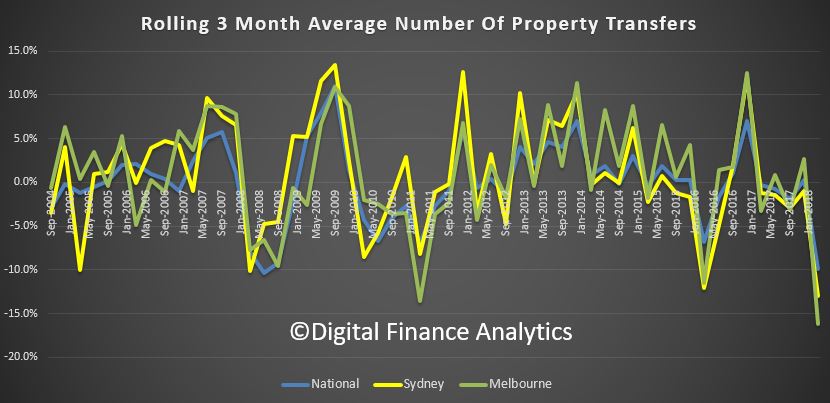

It’s official, prices are sliding in the major centres. The data from the ABS charting home price movements confirms what what we already knew. In addition, the number of property transfers are significantly down and the the total value of Australia’s 10 million residential dwellings decreased $22.5 billion to $6.9 trillion. This is just the start, in our view.

Residential property prices fell 0.7 per cent in the March quarter 2018, according to figures released today by the Australian Bureau of Statistics (ABS).

ABS Chief Economist Bruce Hockman said Australia’s two largest cities led the fall: “Sydney recorded the third consecutive quarter of falling property prices (-1.2 per cent) and the first annual price fall (-0.5 per cent) since the March quarter 2012, while Melbourne property prices fell 0.6 per cent, the first quarterly price fall since September quarter 2012.”

“Regulatory changes and tighter lending conditions have continued to affect investors, who are more active in the Sydney and Melbourne property markets. These cities have seen strong price growth over recent years particularly in detached dwellings.”

Through the year growth in residential property prices continued to moderate (2.0 per cent) in the March quarter 2018. Most capital cities have shown declines in annual growth rates since September quarter 2017, except Hobart (+14.1 per cent), which has continued to see strong rises in residential property prices.

“Positive economic conditions in Hobart, such as, solid jobs growth, rising employment, and an increase in net interstate migration, are underpinning demand for property,” Mr Hockman said. “Hobart has continued to experience consistently tight housing supply, which is leading to a strong rise in residential property prices.”

Also, the number of property transfers are down, nationally by 29% on the last quarter, 31% in Sydney and 42% in Melbourne to March 2018. While we tend to see a drop in the first quarter because of the holiday period, these falls are unprecedented, and mirrors the falls in auction values we discussed recently.

The total value of Australia’s 10 million residential dwellings decreased $22.5 billion to $6.9 trillion. The mean price of dwellings in Australia is now $687,700.

The ABS released their May 2018 employment data today. The Labour force statistics top line story looks pretty good, with an increase in the total number of jobs, and a fall in the seasonally adjusted rate of employment from 5.6% last month to 5.4% in May. But in fact we think this is another soft result, thanks to a slide in the number of hours worked, anemic and falling jobs growth, a further shift to part time employment, and a rise in underemployment.

The monthly trend unemployment rate remained steady at 5.5 per cent in May 2018, according to latest figures released by the Australian Bureau of Statistics (ABS) today.

Actually, it fell just a tad, from 5.48% to 5.46%, but then who’s counting, given the lack of precision in the data set. So lets agree with the ABS, trend, no change.

The trend participation rate decreased by less than 0.1 per cent to 65.5 per cent in May 2018, after the April figure was revised down. Over the past year, trend employment increased by 318,000 persons or 2.6 per cent, which was above the average year-on-year growth over the past 20 years (2.0 per cent).

In fact, its the fall in the participation rate which explains the fall in the unemployment rate stats. We are not seeing such strong growth in jobs, as we saw a few months back in fact.

The underlying trend really shows that underemployment is still very high.

The underlying trend really shows that underemployment is still very high.

The ABS said that over the year to May, the unemployment rate declined 0.2 per cent, while the underemployment rate also fell by 0.2 per cent over the year to 8.5 per cent. The underemployment rate, which is the proportion of people who are working but would like to work more hours, remains below the peak of 8.7 per cent seen in 2017. “The latest data tells us that over the past year both the trend unemployment rate and underemployment rate declined by 0.2 per cent, resulting in the underutilisation rate declining 0.4 per cent to 13.9 per cent”.

But the troubling thing is that there continues to be a slide towards more part time jobs, with trend employment increasing by around 16,000 persons in May 2018, with part-time employment increasing by 12,000 persons and full-time employment by 4,000 persons. This continued the recent slowing of employment growth, particularly full-time employment growth.

But the troubling thing is that there continues to be a slide towards more part time jobs, with trend employment increasing by around 16,000 persons in May 2018, with part-time employment increasing by 12,000 persons and full-time employment by 4,000 persons. This continued the recent slowing of employment growth, particularly full-time employment growth.

This is further evidence, as we discussed yesterday from our household survey results, that more and more people are in fractured or casual employment.

The net increase of 16,000 persons comprised of well over 300,000 people entering employment, and more than 300,000 leaving employment in the month. This was below the modest 19,000 increase expected by economists.

The trend monthly hours worked increased by 2.8 million hours or 0.2 per cent in May 2018, and by 2.7 per cent over the past year.

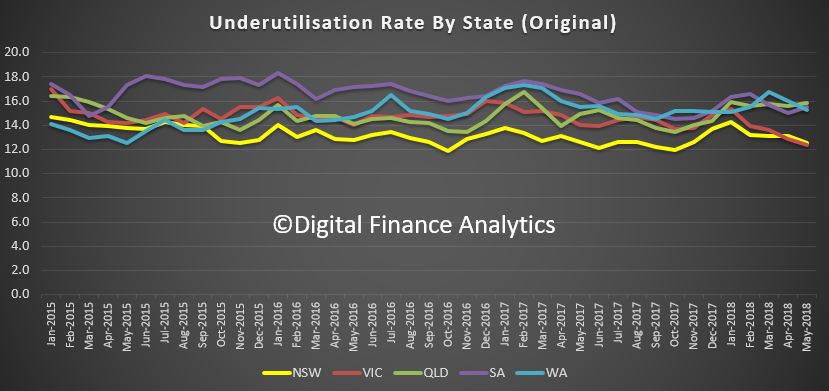

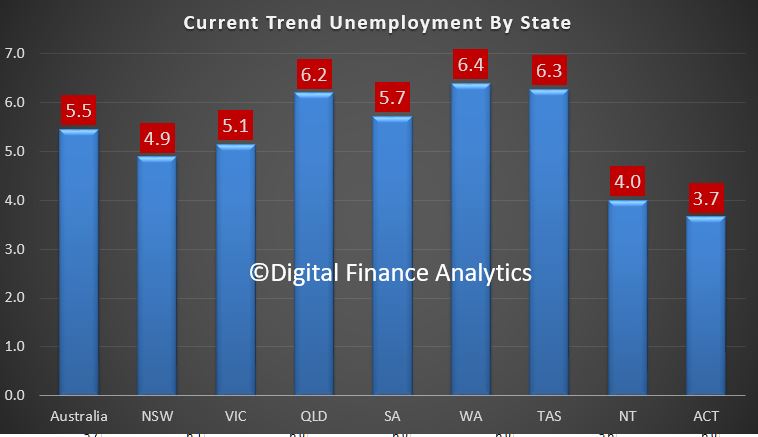

Over the past year, the states and territories with the strongest annual growth in trend employment were New South Wales (3.6 per cent), Queensland (2.9 per cent) and South Australia (2.4 per cent). NSW has led the growth in jobs. We see that NSW has an unemployment rate of 4.9%, in trend terms, just higher than the ACT at 3.7% and the Northern Territory at 4%. Victoria is sitting at 5.1%, South Australia at 5.7%, and Queensland plus Tasmania and Western Australia all well above 6%.

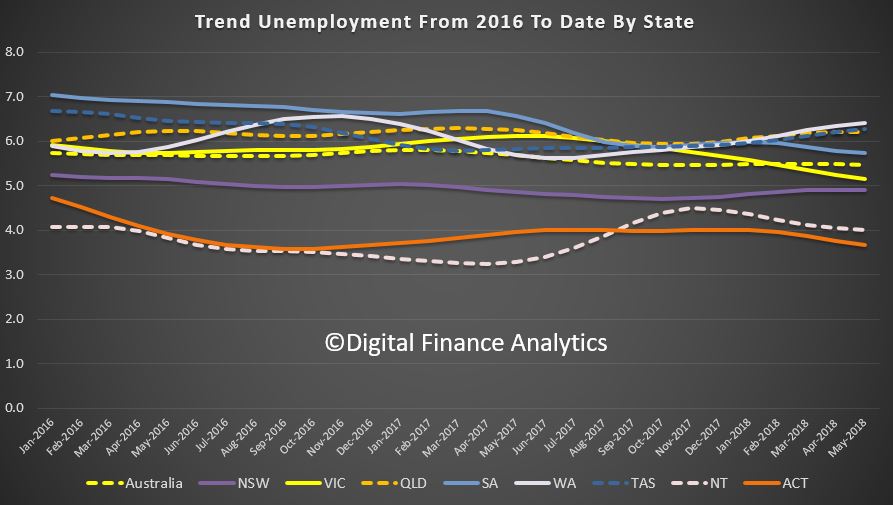

The longer term trends are also worth looking at, with Western Australia at the top of the list with highest rate, and trending higher, with Victoria and New South Wales in the middle of the pack, and the ACT and Northern Territories with the lowest rates of unemployment.

The longer term trends are also worth looking at, with Western Australia at the top of the list with highest rate, and trending higher, with Victoria and New South Wales in the middle of the pack, and the ACT and Northern Territories with the lowest rates of unemployment.

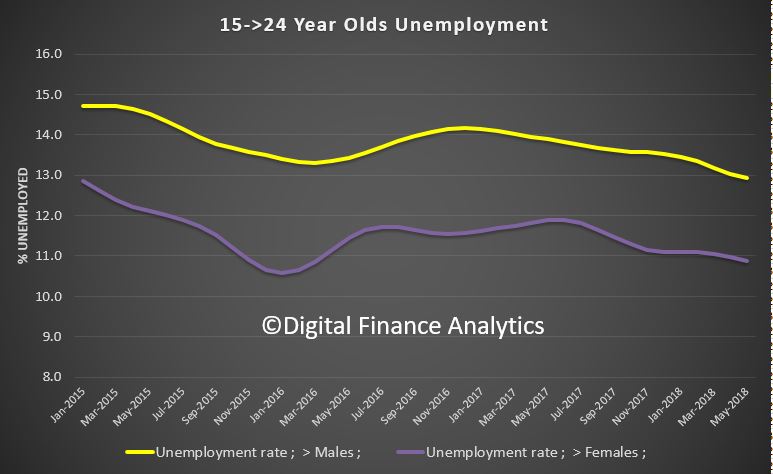

Also note the higher figures among younger Australians, with those between 15 and 24 sitting at 13% for males and 11% for females.

Also note the higher figures among younger Australians, with those between 15 and 24 sitting at 13% for males and 11% for females.

So, this suggests there is no reason to expect the employment rate to fall toward the “magic 5%” when the RBA says wages should start to rise. We think if anything unemployment may rise in the months ahead as jobs growth slows further.

So, this suggests there is no reason to expect the employment rate to fall toward the “magic 5%” when the RBA says wages should start to rise. We think if anything unemployment may rise in the months ahead as jobs growth slows further.

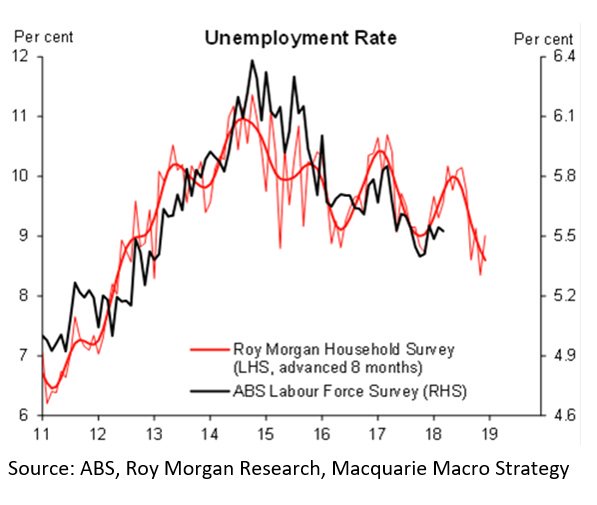

As you know we question the basis of the employment calculations, as even working for an hour or two takes people out of the count. The Roy Morgan alternative basis of calculation shows a much higher, and rising rate. This chart from Macquarie shows that there is a lagged relationship between the official figures and the Roy Morgan trends, and if this is true, then the unemployment rate is set to rise for the next few months.

Overall, even if the pace of job creation picks up again in the coming months, the excess slack and other structural forces are likely to prevent wage growth from increasing much above its current rate of 2.1% this year. This will continue to weigh on household spending and house prices and hamper the recovery.

Overall, even if the pace of job creation picks up again in the coming months, the excess slack and other structural forces are likely to prevent wage growth from increasing much above its current rate of 2.1% this year. This will continue to weigh on household spending and house prices and hamper the recovery.

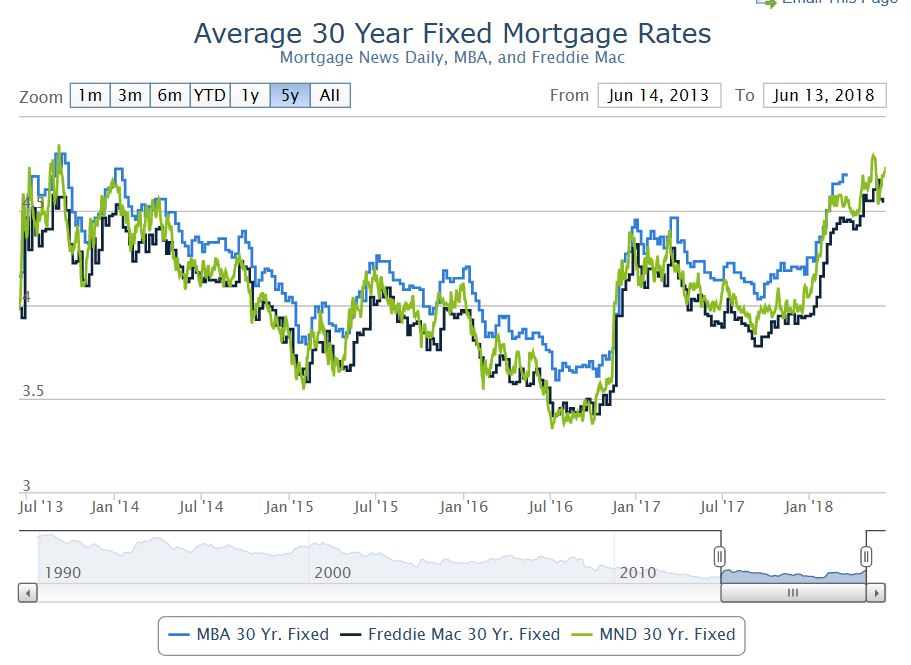

This probably puts an RBA inspired rate hike further down the track, but the US rate hike overnight means that there will be more pressure on international capital markets. The bond market moved higher. Specifically, a few of the Fed members who’d been holding out for slightly lower rates in 2018 moved their forecasts up enough to increase the odds of a 4th rate hike by December. This was already a strong possibility, but before today, those in the “3 hike” camp had a stronger case.

The FED said that in May the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Job gains have been strong, on average, in recent months, and the unemployment rate has declined.

In fact the May 2018 figure has a three in front of it, a significantly lower number than our own, even allowing for a different basis of calculation.

The FED says …recent data suggest that growth of household spending has picked up, while business fixed investment has continued to grow strongly. On a 12-month basis, both overall inflation and inflation for items other than food and energy have moved close to 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1.75 to 2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

But the kicker is probably another 2 hikes later in the year. US Mortgage Rates were higher again.

Watch for higher BBSW rates, which will be a harbinger of higher mortgage rates in Australia, despite the Reserve Bank and higher unemployment in the local market.

Watch for higher BBSW rates, which will be a harbinger of higher mortgage rates in Australia, despite the Reserve Bank and higher unemployment in the local market.