ANZ has become the first big lender to cut its variable home loan rate for new customers, as the banks slug it out for business in a tightening market.

While banks including the CBA have cut fixed loan rates and offered “honeymoon deals” in recent weeks, the ANZ is the first to move on variable rates.

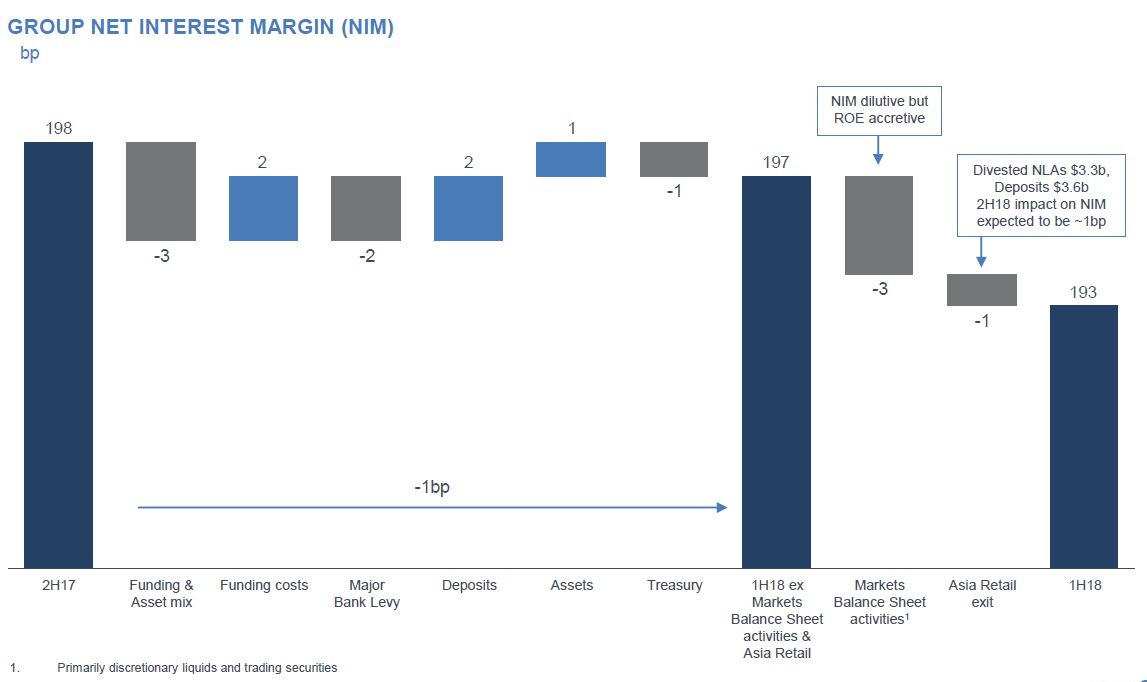

It comes at a time when there is upward pressure on interest rates as funding costs, particularly for smaller lenders, are rising.

The ANZ told mortgage brokers it was bringing down its basic principal and interest home rate for owner-occupiers by 0.34 percentage points to 3.65 per cent.

The ANZ offer only applies to new customers looking for a loan valued at 80 per cent or less than the value of their property.

Loan-to-value ratios above 80 per cent remain unchanged at 3.99 per cent.

Non-bank lenders growing market share rapidly

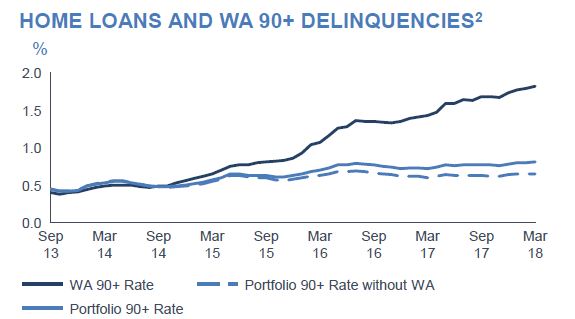

It comes at a time when small lenders have been eroding the market share of the Big Four banks.

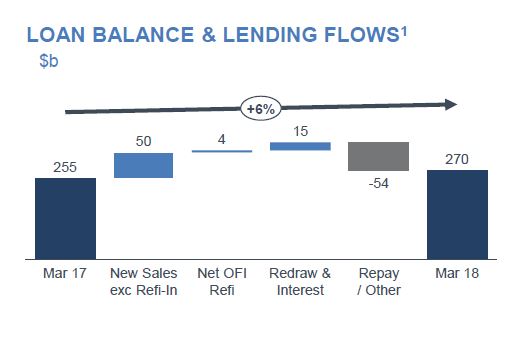

While non-bank lenders hold less than 8 per cent of the mortgage market, their loan books have grown by about 14 per cent over the year, while growth at the Big Four is at a historically low level, a little over 1 per cent.

Ratecity research director Sally Tindall said it was a surprising move from ANZ to buck the rate-hike trend.

“It shows that the bank is competing hard to get new customers as non-banks threaten their market share,” Ms Tindall said.

“This comes at a time when the market was expecting ANZ to hike rates and not cut them and the [banking] royal commission has turned the playing field on its head.”

There are lower rates offered by the big banks in the market but they are generally so-called honeymoon deals that step up markedly after two or so years, or four years in the case of most fixed loan products.

Ms Tindall said the other three big banks were likely to come under pressure to follow ANZ’s lead or risk a further erosion of their market share.

Carefully targeted cut

Shaw and Partners bank analyst Brett Le Mesurier said ANZ’s move was carefully targeted.

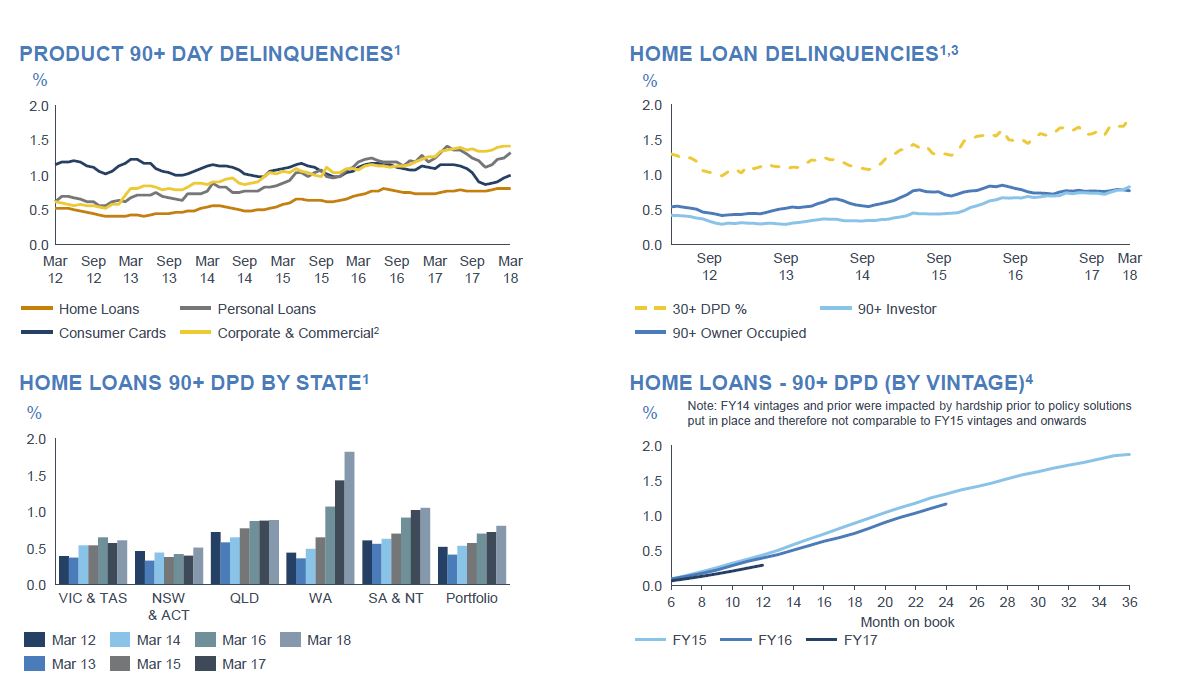

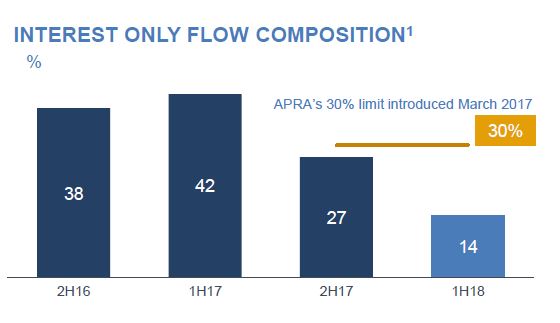

“I was surprised by the extent of the reduction but ANZ has been courting the owner-occupier market for some time, and shunning the investment market relatively — most of their loan growth has been coming from Australian owner-occupier loans,” Mr Le Mesurier said.

He said there was little doubt that the differential between high-quality owner-occupier rates and investor loan rates was likely to increase.

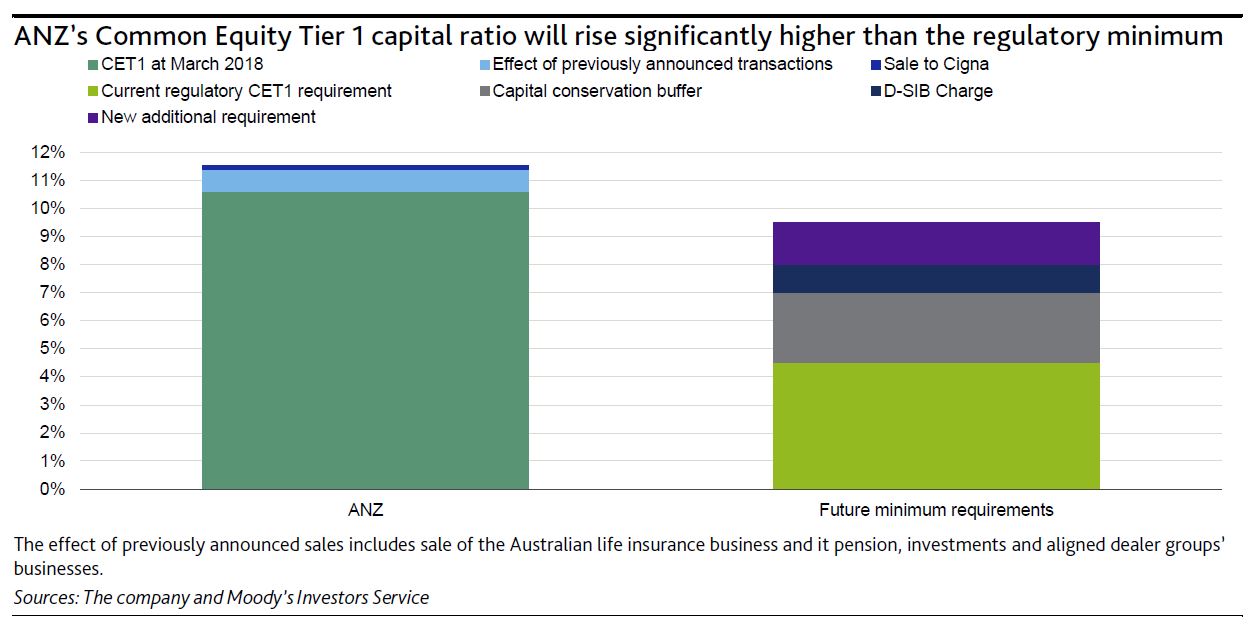

“The banks are focusing on the below 80 per cent LVR [loan-to-value ratio] owner-occupier loans and that may well be because they expect the capital charges associated with those loans to reduce.

The bank is also cutting some of it fixed rate loans by up to 0.24 percentage points, following CBA’s move to cut fixed rates on various two and three-year fixed rate loans by 0.1 percentage points earlier this week.