Property insider Edwin Almeida recorded a show with me, post the election and the APRA loosening. He also wrote a companion piece, below.

SUMMARY OF MY THOUGHTS MOVING FORWARD POST ELECTION 2019

@justthink1 Edwin Almeida ‘Ribbon Property Specialist’

Thumb on the scale

If property owners ever needed a thumb on the scale to give people a false sense of ‘property price increase and rebound,’ the outcome of this election was timed perfectly for them. It will be short lived however.

Nonetheless, many NEW buyers will fall for the false sense of economic security, value growth in property and like sheep to the slaughter, will jump right in and get a “mortgage.” Their very own voluntary life sentence which may well end up under water and at 20,000 leagues.

The savvy owners

Smart property owners will now take this opportunity to list their property and bail out, a welcomed relief for many. They will do so to take advantage of the new found sentiment of prosperity post the election. The smart sellers will jump on the newly revived ‘property prosperity (bubble)’ which many property-pundits will be preaching.

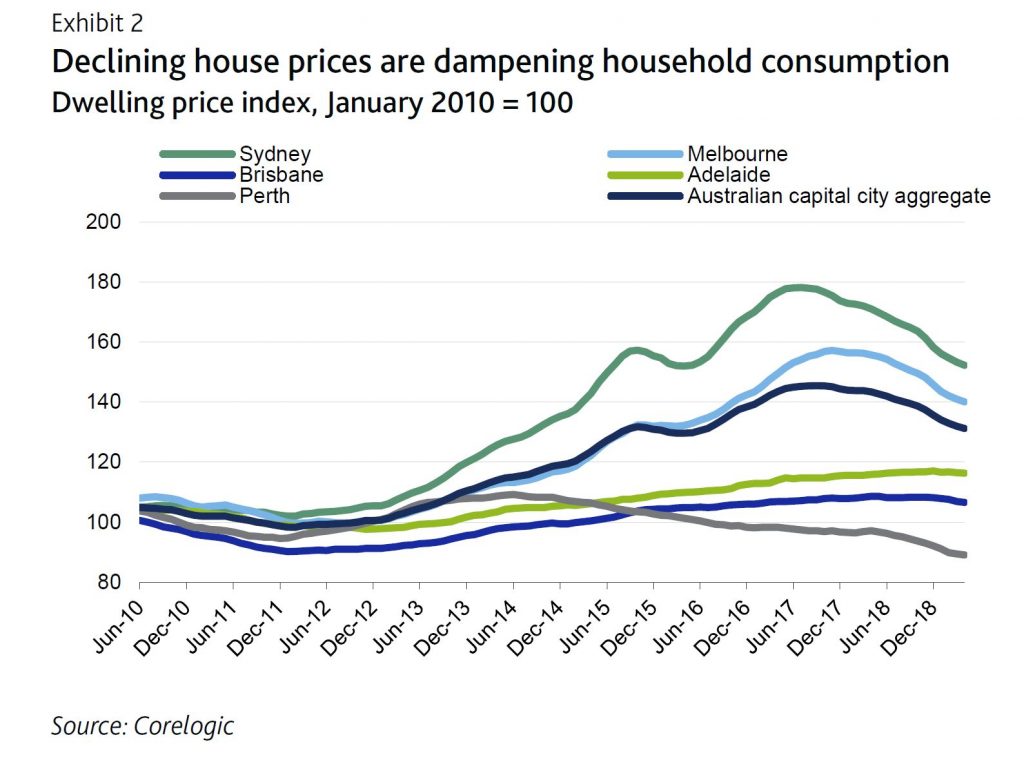

Nonetheless, this revival will only create and turn out to be a short lived slowdown to the prop-market drop, in ‘real time’ that is. CoreLogic daily numbers will continue to show a downward trend for the time, as it catches up with live data.

But hell, make hay whilst the sun shines and get on the market. Why you say? Read on and see.

Buyers will jump the gates and take on anything and everything on offer as the MSM puts out upbeat propaganda of a market turnaround and stability under the elected government.

I believe there will also be a quick run to the Property Portals by vendors that withdrew their listings from the market as they couldn’t pallet further drops in prices and long days on market and all due to the pre-election uncertainty. Keep an eye on Domain and REA Numbers over the next 2-4 weeks and see if I’m on the money or not.

Personally, I can already see the emails hitting agent’s in-boxes with highlighted and bold text: Relist, re-advertise and place my property back on the market; we’re back in business.

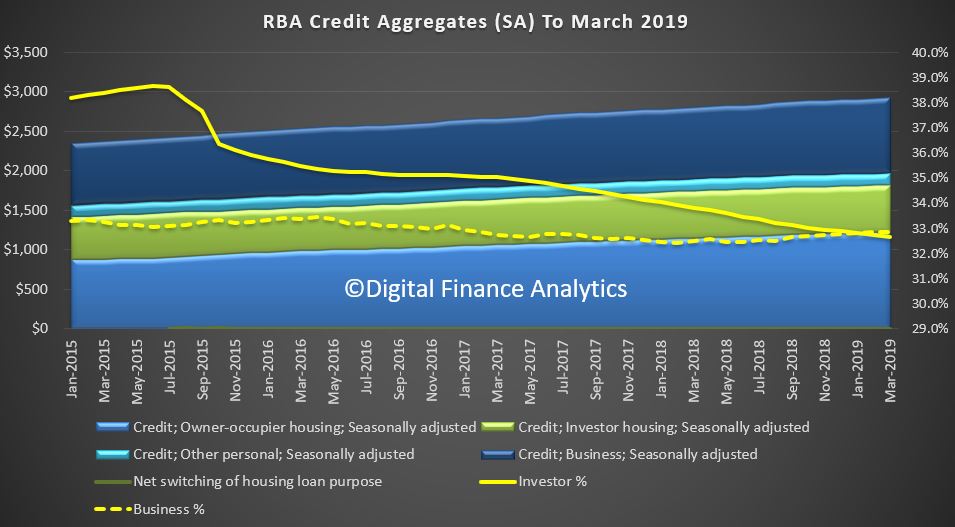

In the short term, it will be a small run and good for the owners that hit the market quickly, BUT in the medium to long term, it will only add more stock on the market as the majority of buyers still have to navigate through banking restrictions.

However, the fever may hit enough of the cashed up buyers that have been waiting on the sidelines. Enough numbers to make the mainstream property analysts declare victory over the doomsayers.

Interest Only Investors

If there was a time for the IO investors to bail out and not lose more than what they have been, now is it. I dare say many will take opportunity and list. Well, the smarter ones that is and the ones that are not so much into debt and so deeply under water with mortgages.

After all, the mainstream analysts and property-pundits have rang the bell, the real estate hounds are out and the starter’s gun has fired. First Home Buyers are on the grounds once more with newly found HOPE, and the selling agents smell blood and are on the hunt.

Will the Banks bend over for the Government and loosen their grip on credit?

Maybe they will, maybe they won’t. I’ll leave this to John Adams and Lindsay David to enlighten us on the subject. I personally don’t believe they want to and particularly not when they can see the storm ahead.

Most of my internal banking sources tell me, the landscape of economic pain still remains and the ship will take a while to turn around.

The Achilles Heel

Our weakest link continues to be OVERSUPPLY, yet no party policy addressed it before the election, rather both were more focused on building more.

Lending more to build more, will only make this worse. More property equals less rent and so on but heck, we just see things on the front line, what do I know right?

Truth be told, the savvy investors aren’t interested in NG, they want; high yields, growth & to add value to make a gain.

Besides, would you buy a newly built, badly engineered apartment or home now and after the fiasco of Opal Tower and the issues around Private Certification? Didn’t think so.

Cost of living & employment

Will cost of living lessen all of a sudden under the elected Morrison government? Like you, I don’t believe it will.

Just because the Liberal party are back in, doesn’t mean we receive a $5K bonus in our accounts next time we go to the teller. Hold on, I better run and check maybe I did get a bonus. Just checked online banking and nope, didn’t get the bonus.

Yes, the mainstream noise says ‘brighter times ahead.’ Let’s see how bright they really are as we navigate the next quarter. Will there be announcements of new FULL time jobs being created? Jobs to actually help pay a mortgage? Or will we have more part-time job numbers?

My overall opinion

In my personal opinion, I just see what transpired on the weekend and what will happened in the next quarter as the last bastion of the property demigods to keep the property bubble inflated. The property analysts that once say drops of up to -25% may well have a change of heart. Others will begin to call the trough and the revival.

However, I still believe and feel there are way too many holes in this economy and property market. Frankly, not the Libs nor Labor were and are going to stop it from hitting my predicted 2004-2005 property prices in most parts of Sydney.

Call what I see on the ground and at firsthand experience ‘the vibe,’ or call it what you will. Most definitely, don’t call it ‘delusional economics’ nor mix my thoughts with those of the mainstream that propagate and preach a rebound.

A brief overview of what I see that will transpire over the next few months. But please don’t stone me, as I say it’s just ‘the vibe’ on the ground and what we see on the property front line.