We run our next live event tomorrow at 20:00 Sydney. Here is a link to the reminder, and to the live show/chat. You can ask questions live, or send them to me beforehand, via the blog, or YouTube.

Tag: DFA Live Q&A

DFA Latest Scenarios And Q&A Replay April 2019

This is the high quality edited version of our recent live stream event.

Here are our latest scenario results, which we discuss in the show.

This is the original unedited version with pre-show and live chat.

A Quick Reminder – Live Event 16 April 20:00 Sydney

A quick reminder we are running our live event tomorrow, where we update our property and finance scenarios and answer questions from the audience in real time. You can send questions beforehand, via the DFA blog, or in the live chat on during the session.

Here is a direct link to the event (where you can set a reminder).

DFA Updates Home Price Scenarios To March 2019

We have updated our home price and mortgage risk scenarios, based on our household surveys, and other data sources. While the risk from a global financial crisis is being pushed out temporally, as central banks do QE again, the risks of a local property crash continue to play out as expected.

As price falls pass 20%, the second order impacts on the economy also play in. We think a 20-30% fall in property values in the major markets is all but baked in now, with the risk still on the downside. The next leading indicator will be an uptick in the unemployment rate (in about 6 months time?)

We discussed the rationale for this analysis, which is driven from our Core Market Model in our live stream last night. We also answer a range of questions from viewers.

You can watch the edited edition.

Or the original live event, including the pre-show, and chat replay.

Main Show Starts here 2

A Quick Reminder – DFA Live Web Event 20:00 Sydney Tonight…

You are welcome to join DFA’s live event tonight, where you can watch the live discussion and ask a questions in real-time. We also reveal our updated property scenarios. How far will property prices fall? The link below takes you to the YouTube location.

The show will be available on demand after the broadcast if you cannot make it live.

We have already received a barrow load of questions to discuss. Should be fun!

DFA Live Q&A – Broadcast 19 Feb 2019 (Podcast Edition)

This is the edited version of our live stream event where we discuss our latest scenarios and a range of finance and property questions.

Live recording and chat can be found at: https://youtu.be/BNrTHJ2MWjo

DFA Updates Property Price Scenarios

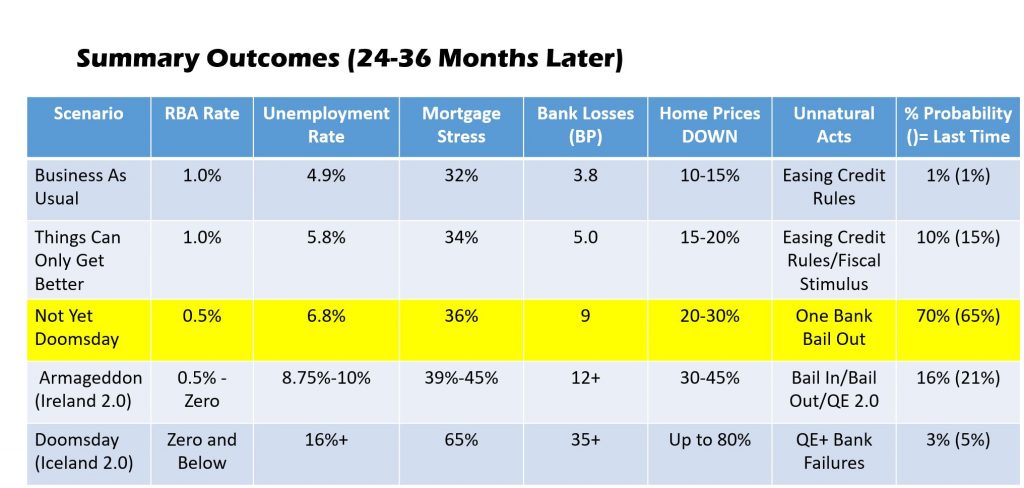

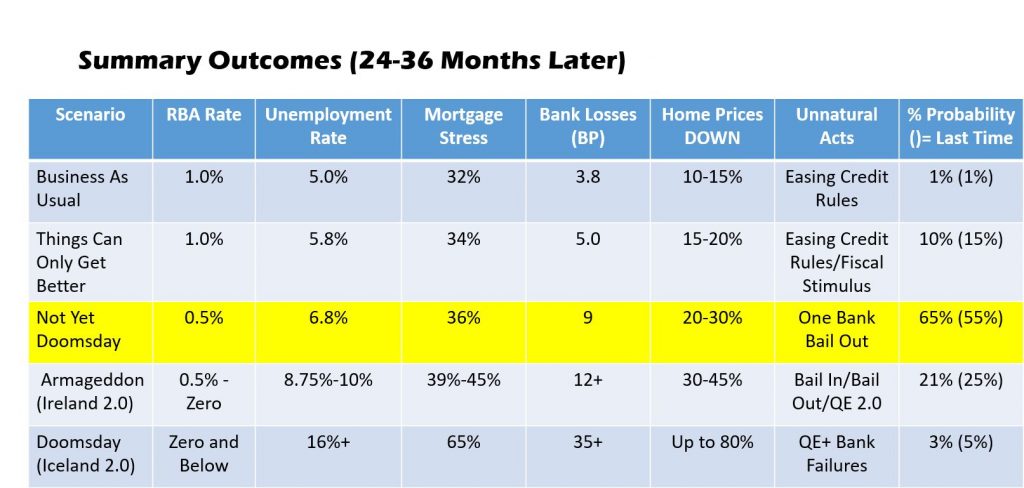

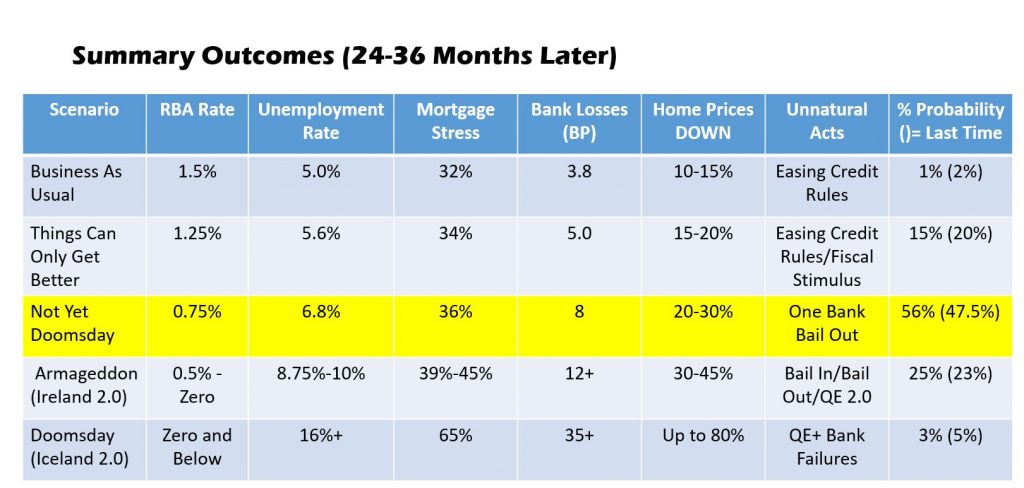

We have updated our scenarios to take account of a range of new data, and the latest input from our household surveys. A peak to trough fall of 20-30% over 2-3 years remains our base case, but with risks to the downside. On the other hand the RBA’s base case gets only a 1% probability now.

The factors we have taken into account include:

- Lower inflation and growth rates ahead according to the RBA

- Fed future rate hikes on hold

- Potential for more QE (Euro Zone, Japan, others)

- Recent home price falls in Australia driven by weaker credit impulse

- Underemployment still a significant issue and wages flat

We also have used updated households intention to transaction data, mortgage stress and affordability metrics.

ANZ yesterday revealed their mortgage underwriting standards are now ~20% tighter. Others are even tighter. “Mortgage Power” has been significantly curtailed.

Here are the results from our Core Market Model, with a probability rating.

Business As Usual: RBA driven scenario

Things Can Only Get Better: Economy is weaker, as wages continue to grow only slowly, costs rise, and RBA cuts later in the year. Some Government tax stimulation either before or after the election, or both. Some easing of credit rules so lending growth accelerates.

Not Yet Doomsday: A locally driven downturn, as wages are flat, despite some mortgage rate repricing. RBA cuts significantly. Employment rises, and one Bank requires assistance. Fiscal stimulus does not have significant impact as household consumption falls.

Ireland 2.0: International crisis overlaid on scenario 2, with QE and lower rates, in response. May be from Europe (Brexit), China, or US, or some combination as global growth falls. In response cash rate is cut hard to zero bounds, QE in Australia commences, and banks are rescued/restructured via bail in and bail out.

Iceland 2.0: As above, but no bank rescues, so banks fail. RBA moves to negative interest rates (see Japan).

We discussed these scenarios during our live stream Q&A event last night. Here is the edited version of the event:

The podcast edition:

You can also watch the full live version of our stream, complete with live chat, and a couple of system errors, due to a camera overheating!

DFA Live Stream Event Commences In 8 Mins

A Quick Reminder And Some More Updates

We discuss the latest data from Westpac and Bank of Queensland, look at off the plan building and consider financial advice versus general advice in the ASIC case.

Plus a quick reminder of tomorrows live streaming event where we update our scenarios.

Feb 2019: https://youtu.be/BNrTHJ2MWjo

A Quick Reminder And Some More Updates

We discuss the latest data from Westpac and Bank of Queensland, look at off the plan building and consider financial advice versus general advice in the ASIC case.

Plus a quick reminder of tomorrows live streaming event where we update our scenarios.

Feb 2019: https://youtu.be/BNrTHJ2MWjo