I discussed today’s GDP out-turn on ABC Illawarra today.

Digital Finance Analytics (DFA) Blog

"Intelligent Insight"

I discussed today’s GDP out-turn on ABC Illawarra today.

I discuss the GDP question with American in OZ Salvatore Babones, Associate Professor, University of Sydney.

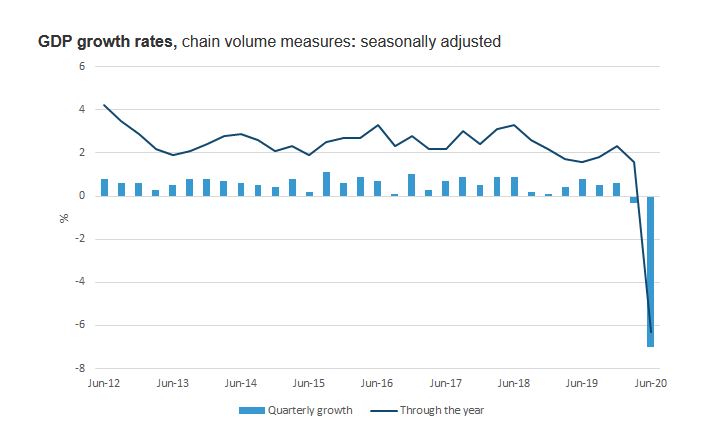

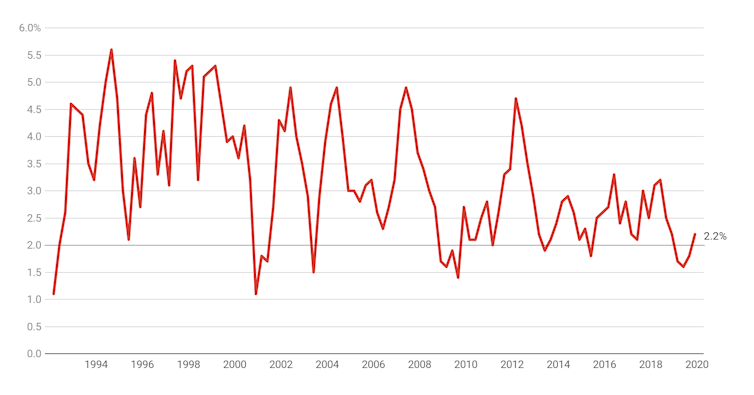

We had the latest national accounts to end of December 2019 this week. The ABS advised that:

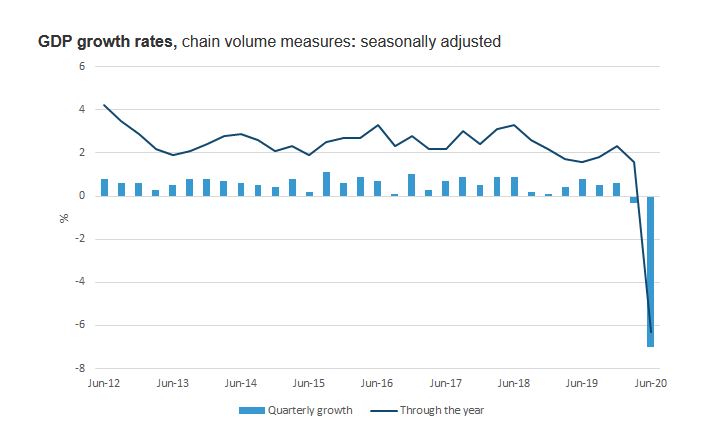

The Australian economy grew 0.5 per cent in seasonally adjusted chain volume terms in the December quarter 2019 and 2.2 per cent through the year, according to figures released by the Australian Bureau of Statistics (ABS).

Chief Economist for the ABS, Bruce Hockman, said: “The economy has continued to grow and picked up through the year, however the rate of growth remains below the long run average.”

Domestic demand remained subdued with 0.1 per cent growth in the December quarter. A pick up in household discretionary spending and continued increases in the provision of government services was dampened by falls in dwelling and private business investment.

Falls in dwelling investment continued, declining 3.4 per cent during the quarter, the sixth consecutive fall. This fall was consistent with the decline in construction industry value added, falling 2.3 per cent. The housing market recovery is evident in the increase in ownership transfer costs, rising 12.3 per cent during the quarter to be up 6.5 per cent through the year.

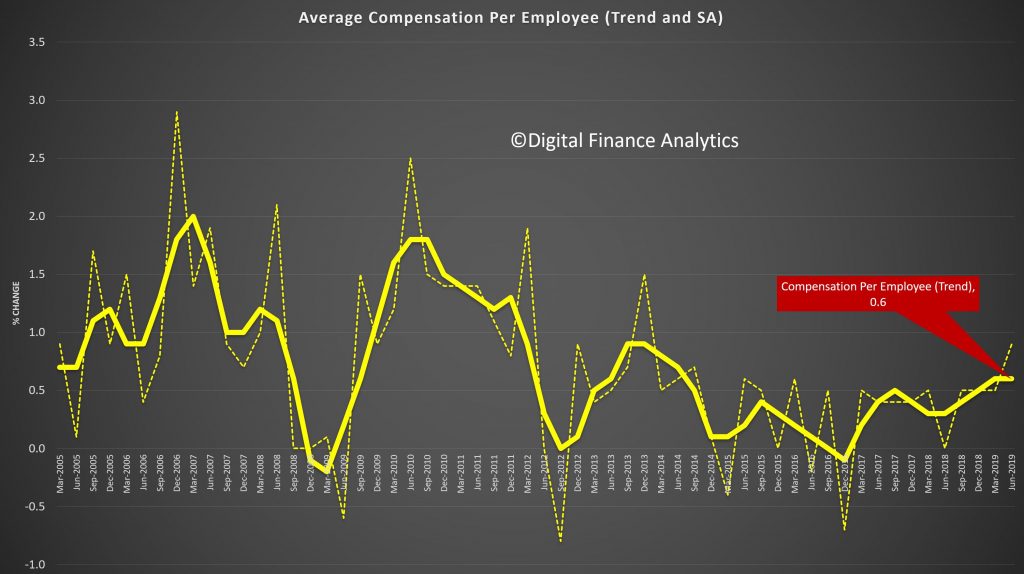

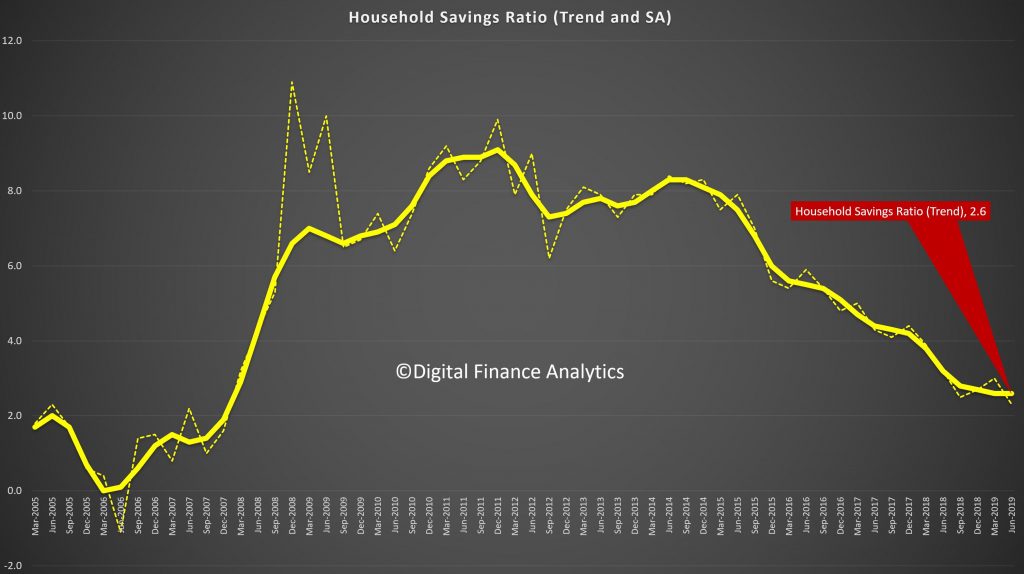

Household income remained steady with compensation of employees recording its twelfth consecutive rise, increasing 1.0 per cent during the quarter. This reflects a rise in the number of wage and salary earners as well as a steady increase in the wage rate. Non-life insurance claims contributed to household income reflecting increased claims attributed to natural disaster occurrences in the quarter. The household saving to income ratio was 3.6 per cent, driven by the subdued consumption coupled with steady increases in wages and a boost in insurance claims.

The Mining industry provided additional strength to the economy, with growth in production volumes of 1.6 per cent, strengthening through the year to 7.3 per cent. This was reflected in the growth in mining exports and inventories.

Falling prices for key export commodities impacted the terms of trade in the December quarter, which fell 5.3 per cent. This reduced nominal GDP, which fell 0.3 per cent, as lower coal, iron ore and gas prices contributed to more subdued company profits. Mining profits declined 2.6 per cent for the quarter.

Real net national disposable income declined 0.9 per cent. “Fluctuations in commodity prices have significant effects on the Australian economy in terms of export revenues and real income,” added Mr Hockman.

But the real question is, does the GDP really tell us anything useful? I discuss the GDP question with American in OZ Salvatore Babones, Associate Professor, University of Sydney.

The good news is our economy was performing better than had been thought in the lead-up to the bushfires and coronavirus. Via The Conversation.

Updated figures in Wednesday’s national accounts show the economy grew 0.6% in the three months to September, rather than the 0.4% previously reported, and a healthier-than-expected 0.5% in the three months to December.

Combined, these figures pushed annual economic growth up above 2% to 2.2% for the first time in a year in which it had been below 2% for the longest period since the global financial crisis.

Annual GDP growth

Not to put too fine a point on it, it looks as if we were actually experiencing the the “gentle turning point” repeatedly promised by Reserve Bank Governor Philip Lowe.

As Lowe put it during the second half of last year:

After having been through a soft patch, a gentle turning point has been reached. While we are not expecting a return to strong economic growth in the near term, we are expecting growth to pick up.

The figures show the economy began (gently) picking up after the Reserve Bank began cutting rates in June. Counting this week’s latest interest rate cut, it has cut four times.

But the coronavirus and the bushfires have consigned the turning point to history.

Not for a minute does Treasurer Josh Frydenberg believe the economy continued to improve this quarter, the March quarter.

Reminded that the support package promised by the prime minister will come too late for the three months to March, and reminded that many businesses haren’t been able to trade much, Frydenberg was asked to assess the risk the economy might now be going backwards, a state of affairs that if it continued long enough would be a recession.

He replied that the Treasury believes the bushfires alone will shave 0.2 points from growth in the March quarter. Added to that will be the risk from the spread of the coronavirus, which he believes will be “substantial”.

Tonight (Wednesday) Frydenberg and Treasury officials will take part in a phone hookup with other members of the International Monetary Fund to discuss developments including interest rate cuts in both Australia and the United States.

The Treasury will finalise its estimate of the impact of the coronavirus on March-quarter GDP later in the evening and report it to a Senate estimates hearing beginning at 9am Thursday.

It means we will know the likely impact at about the same time as the treasurer.

To support retirees hurt by four near-consecutive rate cuts, the treasurer is considering cutting the deeming rate – the rate investments are deemed to have earned for the purposes of the pension income test. It’ll be the second deeming rate cut in the space of a year and will make it easier for retirees earning very little to remain on the pension.

The focus of the support package will business investment, which slid an unexpected 1.1% in the final three months of the year and 3.4% over the course of the year in defiance of budget forecasts it would climb.

Although not ruling out support for householders, Frydenberg said mortgage holders had done well out of the past four rate cuts. Households with A$400,000 mortgages could soon be paying $3,000 less per year than they had in June.

Living standards, as measured by the Reserve Bank’s preferred measure, real net national disposable income per capita, went backwards in the December quarter, slipping 1.3%. Over the year, it climbed just 1.2%.

Household spending recovered somewhat, climbing 0.4% in real terms in the December quarter after inching ahead only 0.1% in the September quarter.

Throughout the year to December, real household spending grew 1.2% at a time when Australia’s population grew 1.5%. This means the consumption of goods and services per person went backwards.

Government spending provided substantial support. Over the year to December public spending on infrastructure grew 4.1% in real terms.

Deputy Prime Minister Michael McCormack said on Wednesday he would try and boost that by asking state and local governments to bring forward whatever projects they could, to start work in the next three to six months.

Recurrent government spending grew 5%.

Author: Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

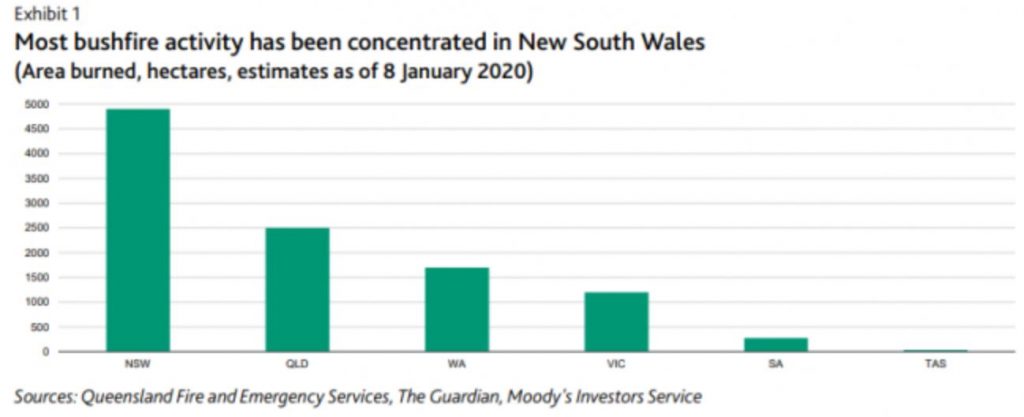

According to a Moody’s report, just out, the near-term credit implications for Australia and the states are limited given a likely contained economic impact and the availability of ample fiscal buffers.

Taking into account both the direct costs and indirect loss of revenue, Moody’s estimate that the cost of the bushfires will reduce Australia’s

general government’s fiscal balance overall by around 0.1% of GDP per year in the next two fiscal years.

The bushfires are mainly concentrated in rural areas, predominantly in national parkland. As a result, the economic cost has been limited, says Moody’s, who revised their forecast for 2020 GDP growth to 2.1% from 2.3% in 2020.

Although fires have burnt across the country, they say the bushfires have been concentrated in NSW, covering an area more than six times larger than that affected by the 2018 Californian fires, for an economy that is seven times smaller than that of California. Predictions by the Australian Bureau of Meteorology indicate that the fires are likely to continue and could even intensify over the coming months.

The Commonwealth government bears some of the direct containment and repair costs – such as for the deployment of military resources for firefighting – as well as the ultimate costs through transfers to the states. The government also incurs some expenditure on relief for affected areas, with AU$2 billion already announced to support affected farmers and businesses. Moreover, Commonwealth tax revenue from affected areas will be hit by temporarily weaker economic activity.

In 2020, reconstruction will boost economic activity, partially offsetting the initial losses from the areas which are being rebuilt.

Over the longer term, if bushfires of this severity were to become more frequent, they would expect tourism and investment, especially in rural areas, to be affected:

…over time, increasingly frequent and severe natural disasters related to climate change are likely to result in rising and recurring costs for Australia’s general and local governments, which will test their capacity – currently strong – to mitigate these costs

The latest economic data confirms the pressures on households and the broader economy are real.

Courtesy of Nucleus Wealth’s Damien Klassen. Damien runs the investment side of Nucleus, selecting stocks suggested by analysts and implementing the asset allocation

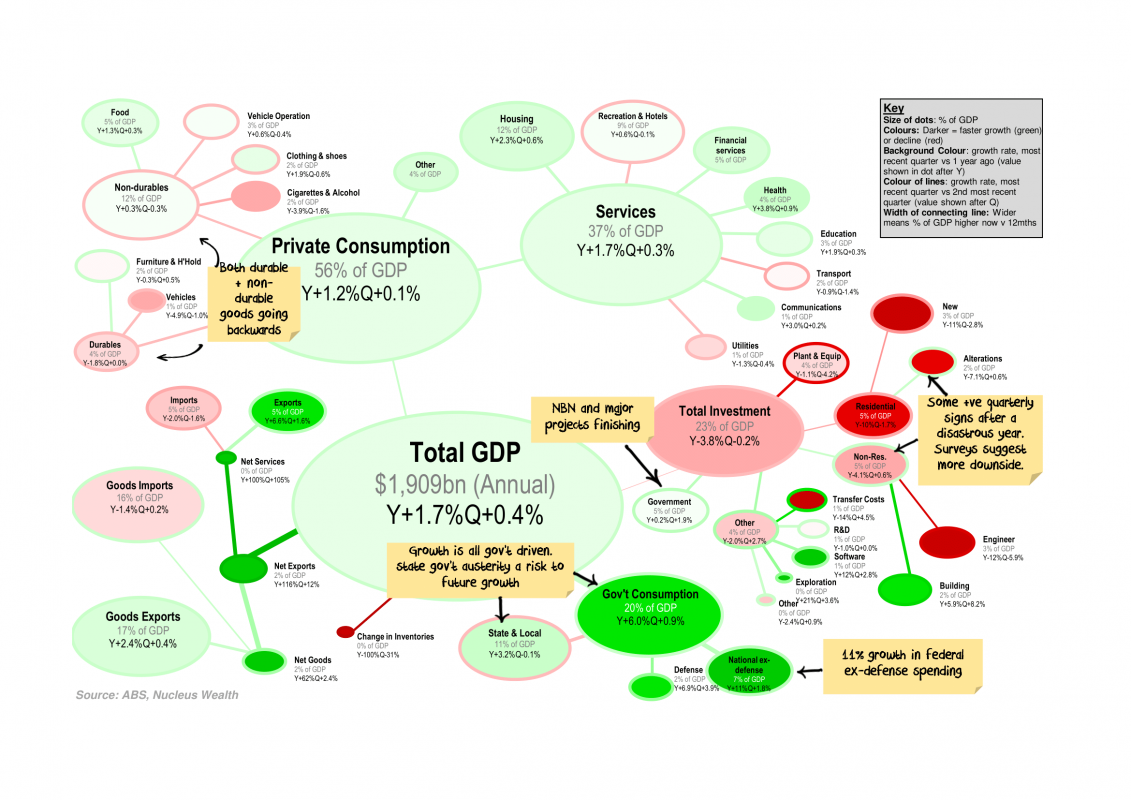

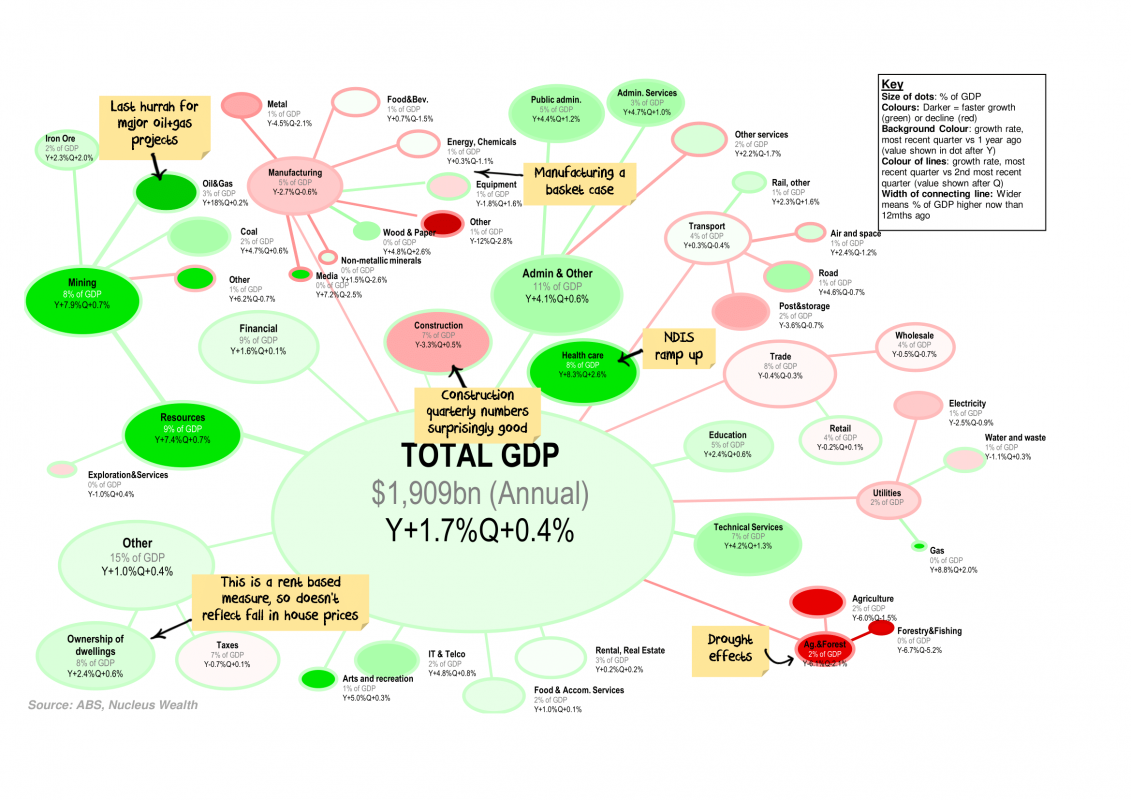

Every quarter I like to look at the changes in Australian GDP and which categories are responsible for the growth / decline. Each bubble represents a category of GDP proportionate to its size, colours represent the growth rate.

Click the charts for a large version and commentary:

This quarter the key takeaways include:

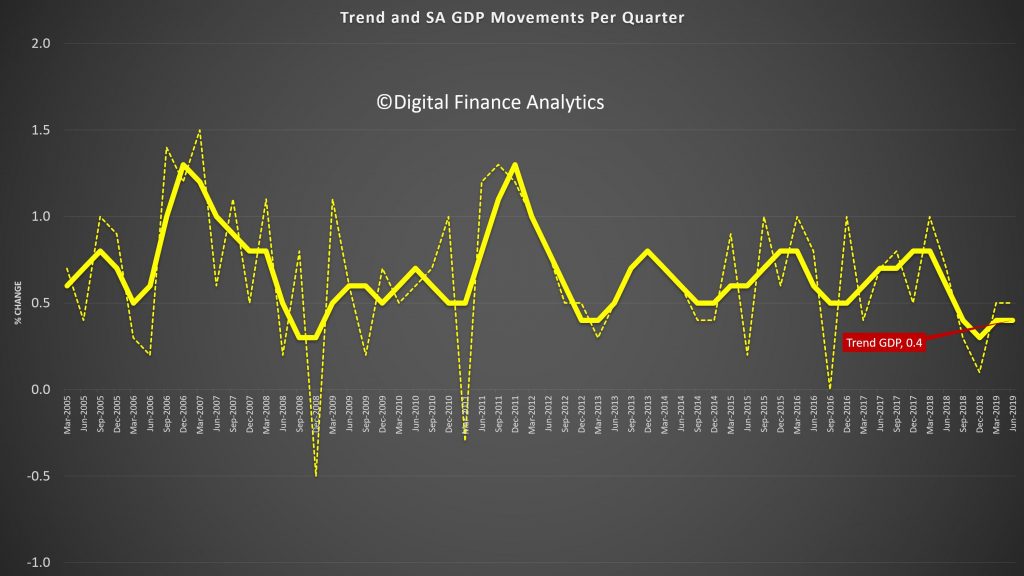

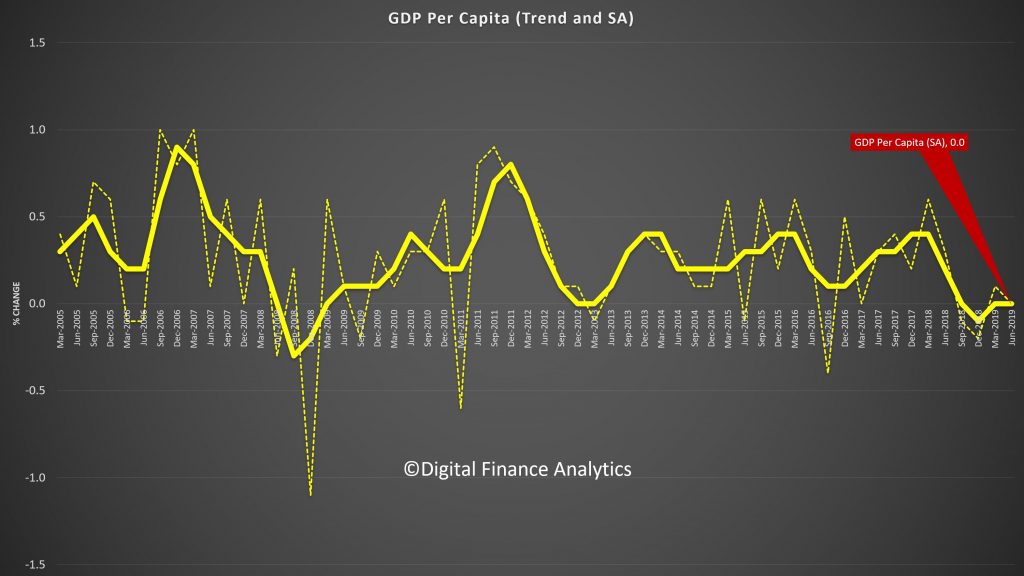

We look at the latest ABS national accounts data. We called it right! Household consumption continues to die as the savings ratio slides and GDP per capital sits at zero.

https://www.abs.gov.au/AUSSTATS/abs@.nsf/DetailsPage/5206.0Jun%202019?OpenDocument

The largest quarterly goods and services surplus on record at $19.9 billion and a narrowing net income deficit to $13.9 billion, contributed to Australia recording a seasonally adjusted $5.9 billion current account surplus for the June quarter 2019, according to latest information released by the Australian Bureau of Statistics (ABS). This is Australia’s first current account surplus since the June quarter 1975.

This is thanks to the high iron ore price, which of course has now dropped back significantly. The RBA’s expectation of a 0.8% GDP number tomorrow still seems far fetched, but we might just escape a negative quarter…

The ABS shows this quite clearly.

ABS Chief Economist Bruce Hockman said: “Six consecutive quarters of goods and services surpluses, broadly commodity driven, have laid the foundation for our first current account surplus in 44 years.

“The surplus is both a price and volume story. Similar to the March quarter 2019, continued global supply interruptions have maintained high iron ore prices into the June quarter, boosting our export receipts to record levels.

“Export volumes for the key bulk commodities of liquid natural gas, coal and iron ore were up, while volumes fell across several import categories resulting in an increased June quarter trade surplus.”

Contribution to Gross Domestic Product

In seasonally adjusted chain volume terms, the balance on goods and services surplus increased $2.7 billion, widening the surplus to $6.4 billion. The rising exports and falling imports resulted in an expected contribution of 0.6 percentage points to growth in the June quarter 2019 Gross Domestic Product.

International Investment Position

Australia’s net international investment position was a liability of $1,001.6 billion at 30 June 2019, an increase of $9.2 billion on the revised 31 March 2019 position of $992.3 billion.

Australia’s net foreign debt liability position increased $19.4 billion to $1,143.5 billion. Australia’s net foreign equity asset position increased $10.2 billion to $141.9 billion at 30 June 2019.

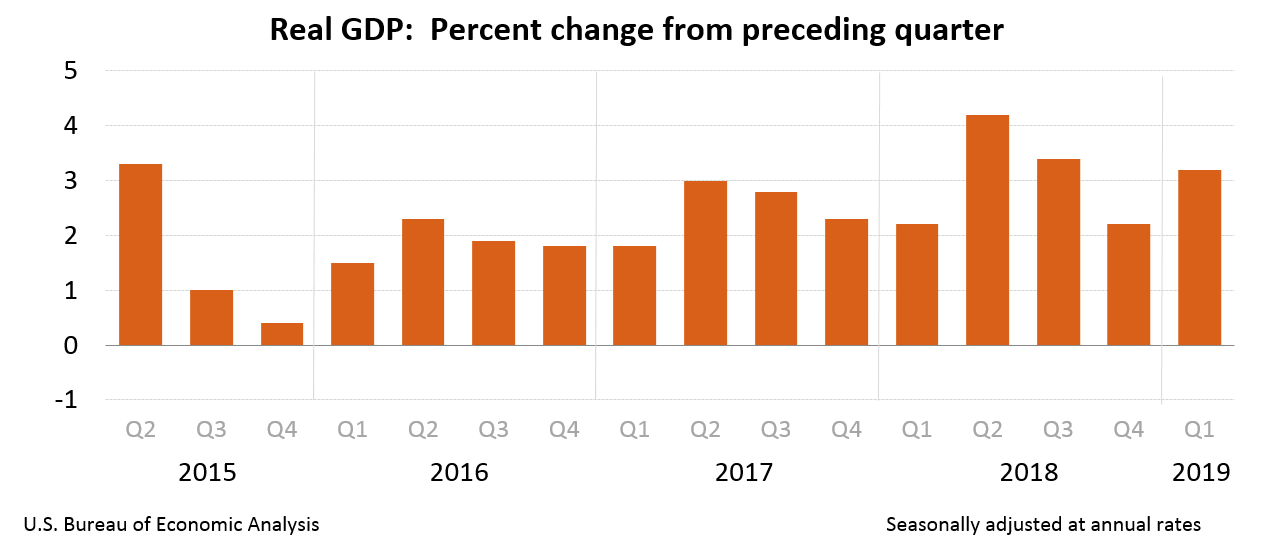

The latest data from the bea shows a GDP provisional estimate significantly above expectations, which may suggest the FED will not have to be as patient as they signalled recently. Perhaps expectations of a future recession are overblown?

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the first quarter of 2019, according to the “advance” estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2018, real GDP increased 2.2 percent.

The Bureau’s first-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the first quarter, based on more complete data, will be released on May 30, 2019.

The increase in real GDP in the first quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, state and local government spending, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased. These contributions were partly offset by a decrease in residential investment.

The acceleration in real GDP growth in the first quarter reflected an upturn in state and local government spending, accelerations in private inventory investment and in exports, and a smaller decrease in residential investment. These movements were partly offset by decelerations in PCE and nonresidential fixed investment, and a downturn in federal government spending. Imports, which are a subtraction in the calculation of GDP, turned down.

Current dollar GDP increased 3.8 percent, or $197.6 billion, in the first quarter to a level of $21.06 trillion. In the fourth quarter, current-dollar GDP increased 4.1 percent, or $206.9 billion.

The price index for gross domestic purchases increased 0.8 percent in the first quarter, compared with an increase of 1.7 percent in the fourth quarter (table 4). The PCE price index increased 0.6 percent, compared with an increase of 1.5 percent. Excluding food and energy prices, the PCE price index increased 1.3 percent, compared with an increase of 1.8 percent.

Personal Income

Current-dollar personal income increased $147.2 billion in the first quarter, compared with an increase of $229.0 billion in the fourth quarter. The deceleration reflected downturns in personal interest income, personal dividend income, and proprietors’ income that were partly offset by an acceleration in personal current transfer receipts.

Disposable personal income increased $116.0 billion, or 3.0 percent, in the first quarter, compared with an increase of $222.9 billion, or 5.8 percent, in the fourth quarter. Real disposable personal income increased 2.4 percent, compared with an increase of 4.3 percent.

Personal saving was $1.11 trillion in the first quarter, compared with $1.07 trillion in the fourth quarter. The personal saving rate — personal saving as a percentage of disposable personal income — was 7.0 percent in the first quarter, compared with 6.8 percent in the fourth quarter.