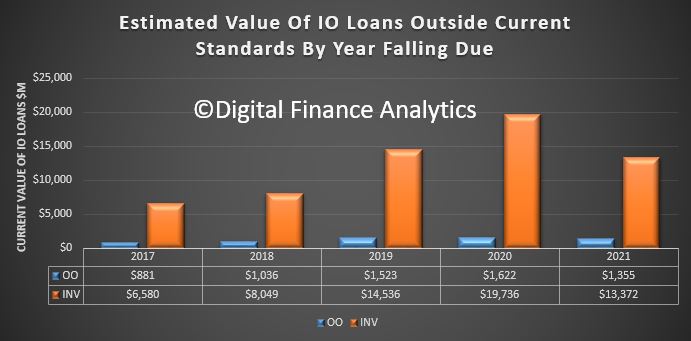

OK, so there has been lots of noise about the Mortgage Interest Only Exposures the banks have, and both APRA and the RBA say they are potentially risky, compared with Principal and Interest Loans. We already showed that conservatively $60 billion of IO loans will fail current underwriting standards. That is more than 10% of the portfolio.

But how many loans are interest only, and what is the value of these loans? A good question, and one which is not straightforward to answer, as the monthly stats from the RBA and ABS do not split out IO loans. They should.

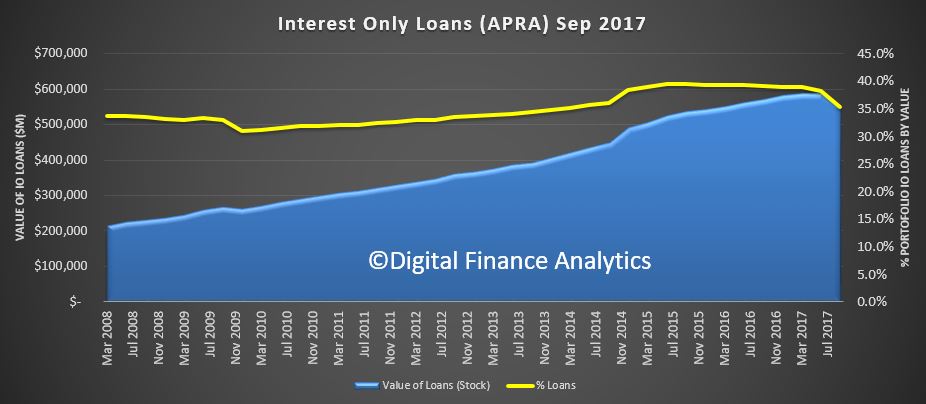

The only public source is from APRA’s Quarterly Property Exposures, the next edition to December 2017 comes out in mid March, hardly timely. So we have to revert to the September 2017 data which came out in December. This data is all ADI’s with greater than $1 billion of term loans, and does not include the non-bank sector which is not reported anywhere!

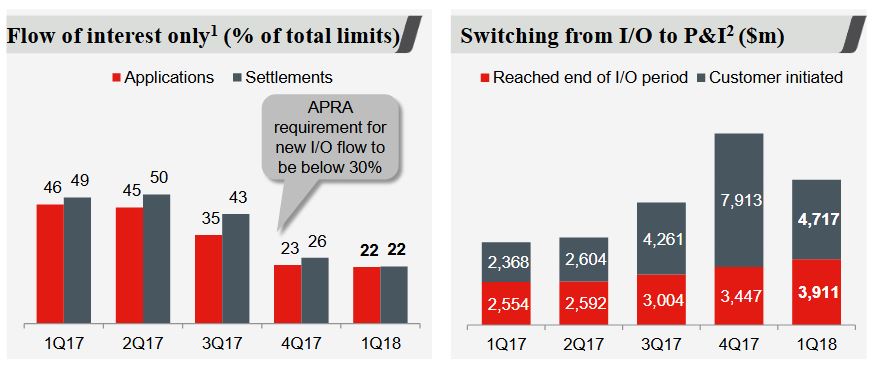

They reported that 26.9% of all loans, by number of loans were IO loans, down from a peak of 29.8% in September 2015. They also reported the value of these loans were 35.4% of all loans outstanding, down from a peak of 39.5% in September 2015.

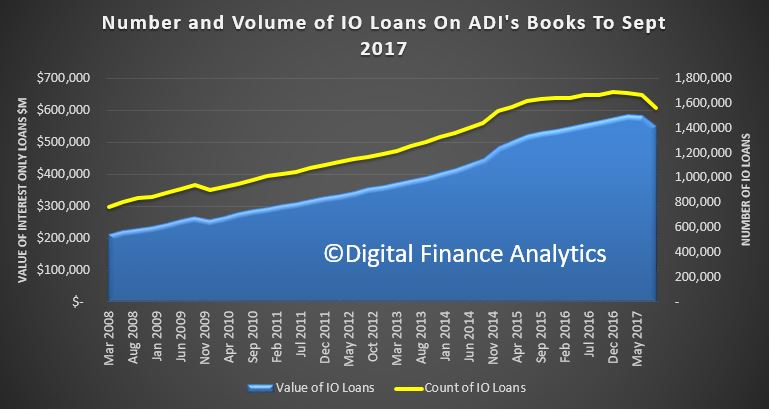

So, what does this trend look like. Well the first chart shows the value of loans in Sept 2017 was $549 billion, down from a peak of $587 billion in March 2017. The number of loans outstanding was 1.56 million loans, down from a peak of 1.69 million loans in December 2016.

If we plot the trends by number of loans and value of loans, we see that the value exposed is still very high.

If we plot the trends by number of loans and value of loans, we see that the value exposed is still very high.

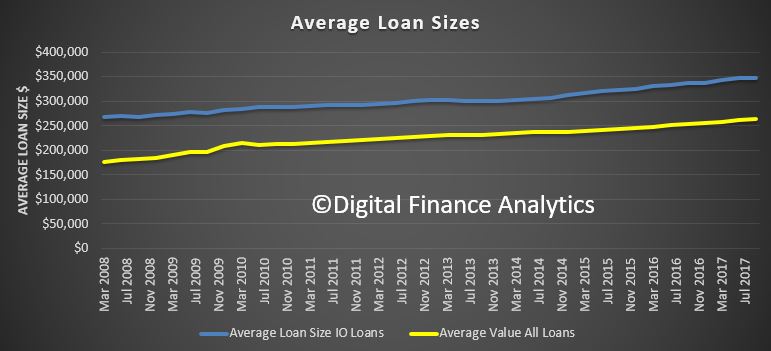

Finally, the average loan size for IO loans is significantly higher at $347,000 compared with $264,300 for all loans. Despite the fall in volume the average loan size is not falling (so far).

Finally, the average loan size for IO loans is significantly higher at $347,000 compared with $264,300 for all loans. Despite the fall in volume the average loan size is not falling (so far).

The point is the regulatory intervention is having a SMALL effect, and there is a large back book of loans written, so the problem is risky lending has not gone away.

The point is the regulatory intervention is having a SMALL effect, and there is a large back book of loans written, so the problem is risky lending has not gone away.