According to Moody’s, Global risk aversion has spread to the European banking sector and the debt at the bottom of capital structures is selling off severely. Investors have quickly reassessed the virtues of contingent convertible (CoCo) securities, with which the risk of losing coupon payments is elevated under a diminishing outlook for profits and economic growth. As with other novel classes of financial securities that rapidly expanded, the future of the CoCo will be greatly influenced by its first substantial market stress test.

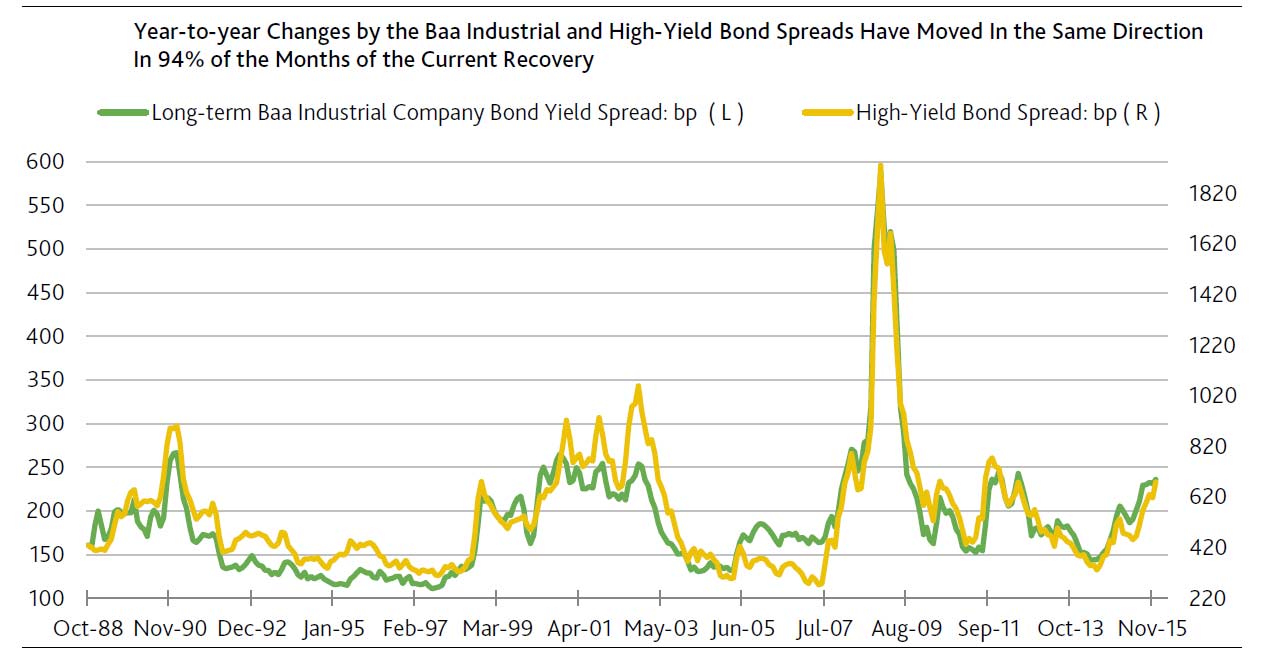

Weak earnings reports from major European banks ignited a sharp decline in the value of debt and equity across their sector in early February. This shakeout was particularly pronounced for CoCos, with the spread on such debt spiking to the Barclays index record high of 600 bp on February 9 from 497 bp at the end of January (Figure 1). The market value of such debt now trades at 93% of the par value or value at maturity after never having traded below par value until one week prior. Murkiness about the conditions under which these hybrid securities will convert to equity, combined with downwardly revised global growth forecasts, weighs on CoCos valuations.

Issuance of CoCos in Europe was prodded in recent years by the Basel III regulatory accord’s guidelines on bank capital and leverage. Yet while regulators are enamored by the flexibility provided by securities that convert from debt to equity in times of stress, investors must assess the distinct risks of such hybrids. Ranking above only common equity in claims on an institution’s assets, CoCos demand higher coupons compared to more traditional classes of debt. The amount of such hybrids outstanding issued by European banks and tracked by Barclays increased from €55 billion in mid-2014 to €108 billion today, yet only €7 billion of that increase has transpired since mid-2015. That slowing rate of growth for CoCos can largely be ascribed to generally unfavorable capital markets conditions late last year, but greater focus on banking sector fundamentals has further wounded the prospects for future issuance.

Issuance of CoCos in Europe was prodded in recent years by the Basel III regulatory accord’s guidelines on bank capital and leverage. Yet while regulators are enamored by the flexibility provided by securities that convert from debt to equity in times of stress, investors must assess the distinct risks of such hybrids. Ranking above only common equity in claims on an institution’s assets, CoCos demand higher coupons compared to more traditional classes of debt. The amount of such hybrids outstanding issued by European banks and tracked by Barclays increased from €55 billion in mid-2014 to €108 billion today, yet only €7 billion of that increase has transpired since mid-2015. That slowing rate of growth for CoCos can largely be ascribed to generally unfavorable capital markets conditions late last year, but greater focus on banking sector fundamentals has further wounded the prospects for future issuance.

Recent rising concerns about the banking sector outlook have centered around Deutsche Bank AG, Germany’s largest lender by assets. Deutsche reported an annual loss of €6.1 billion, weighed down by impairments and legal charges. An extensive reorganization of the bank and losses on legacy assets provide challenges for future returns. Deutsche has a $1.5 billion CoCo issued in November 2014 that was quoted at a price as low as 71 cents on the dollar on February 9 after having been valued at over 97 cents per dollar at the end of last year. The negative sentiments expressed in this price decline prompted statements from the bank’s executives that pointed to ample resources for coupon payments on its hybrid securities over the next two years.

Holders of European banking sector debt can take comfort in the banks’ substantial increase in capital buffers since the financial crisis. In the second quarter of last year, large European banks had an aggregate tier 1 capital ratio (measuring equity as a percent of risk-weighted assets) of 13.1%, up significantly from 8.3% in 2007 before the crisis broke out. Banks have made radical adjustments to their balance sheets, with considerable reductions in assets bolstering their capital firewalls. This transformation has naturally reduced potential profits, with the return on equity (ROE) in mid-2015 for large European banks of 4.0% down sharply from 9.8% in 2007. Lower bank ROE can be seen as credit positive, in that it points to reduced leverage and investment in relatively less risky assets. Yet an especially weak ROE raises concerns about maintaining capital adequacy in the event of a slump, particularly among peripheral European banks still burdened with large amounts of problem loans.