We discuss our submission to the Senate Inquiry into funding for the SME sector. The proposed bill will provide incentives for the big banks, but do little to address the real issues. We offer an alternative approach, using data from our SME surveys.

Inquiry into the Australian Business Growth Fund Bill 2019 [Provisions] – Submission

Summary

We are pleased to offer our submission for consideration. The Bill as proposed will do little to address the underlying SME funding issues we have in Australia, despite benefitting the incumbent major investors through their equity shares. It might play well from a “we are doing something for SME’s” perspective, but in reality, it will do little.

To address the real problem of SME funding, we recommend a FinTech style structure, as already proven in the UK and elsewhere across Europe. This would enable the allocated funds to reach more businesses, but more importantly also facilitate a transformation of lending to the SME sector in Australia, including driving incumbents to lift their game.

This transformational play would demonstrate the Governments active support for the SME sector, but also lead to broader and deeper change, to the benefit of the local economy.

Introduction

Digital Finance Analytics is a boutique research and advisory firm which curates a rolling 52,000 firm survey each year, with ~4,000 new firms added each month. The survey is a telephone omnibus and is executed on our behalf by a reputable service bureau. It is statistically accurate across the country.

We design the questions, and analyse the results using our Core Market Model. The survey has seen running for more than 15 years. We have several clients who subscribe to our data services, as well as those to receive copies of the free summaries. Clients include several financial services companies, FinTechs and Government agencies, within Australia and beyond.

We hold information about their business structure, banking relationships and financial profile, as well as their digital behaviour. This provides a multi-factorial basis for our underlying segmentation[i], which has proved to be both stable, and insightful over time.

There is tremendous diversity in the SME sector, and as a result one size certainly does not fit all. We believe strong segmentation is essential to be able to translate strategy into effectively action. We focus on what we call “the voice of the customer”.

This enabled us to develop models and descriptors for each of the clusters. Businesses are placed within the model descriptions in a best-fit manner. We believe that the results should be judged largely on the interpretability and usefulness of results, not whether the clusters are “true” or “false”.

When these stable segments are cross-linked with our research, we can compare the different needs and opportunities across the groups, and we can prepare segment specific treatment plans for each.

The custom segmentation we use is well distributed by count across the business community. Growing business and Cash Strapped Sole Traders are the two largest groups. As expected, the count of Large Established Firms is the lowest.

In the light of our research, we have reviewed the provisions of the proposed legislation and wish to make three major points.

SME’s Are Indeed an Essential Part of Our Economy.

The small and medium business sector (SME) is a critical growth engine for the economy, with more than 3 million businesses offering employment for more than 7 million Australians. The characteristics of these businesses are varied from newly founded part-time entities, through to businesses employing up to 100 people and with a turnover of up to $10 million each year. More than 77% have a turnover of less than $500,000 each year. 91.3% have an annual turnover of less than $2 million each year. So, one size does not fit all.

The largest industry segment is Construction (17%), followed by Professional, Scientific and Technical (12.5%) and Rental, Hiring and Real Estate Services (11.5%). Financial Services (9%) and Agribusiness (8.25%) are the next two. Note that Mining accounts for only 0.4% of all SME’s.

Nearly half of all businesses have been trading for less than 4 years. Cash Strapped Sole Traders are most likely to fail (55% in 5 years), followed by Cash Strapped Sole Traders and Stable Subcontractors. The highest failure rates are found in Transport, Financial Services, Real Estate and Construction.

Most SME’s are true small businesses and one quarter of SME’s have a sales turnover off less than $50,000 each year, and more than half have a turnover of less than $150,000 per annum. Most low turnover businesses are unincorporated. Those businesses with larger turnovers are more likely to be formed as a company.

Looking at the state distribution, 60% of businesses are in NSW and VIC.

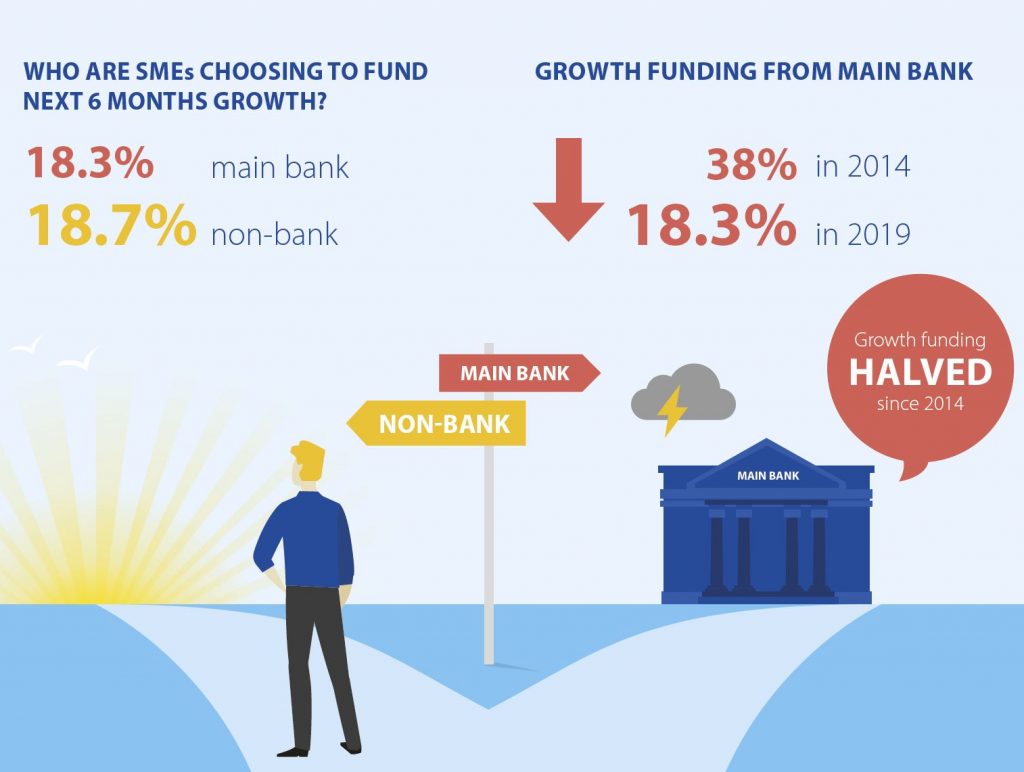

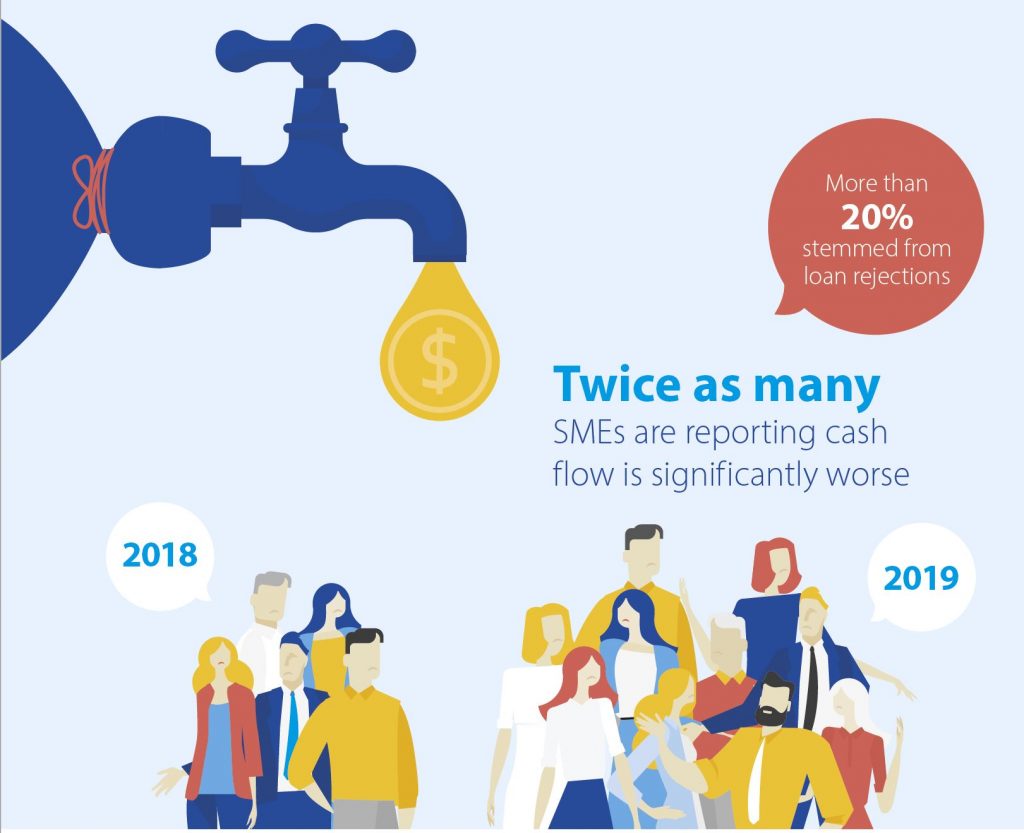

Funding Is Indeed A Growing Problem for SME’s.

We have detected an increasing problem where more businesses are unable obtain suitable finance to enable them to grow and invest in their businesses. Underlying this is the fact that demand from households and businesses for services from the SME sector is waning as the broader economy falters. SME’s are the canary in the economic coalmine!

For many segments, the need for working capital is the main issue, and the main cause of this need relates to delayed payments. This is particularly a concern among some smaller businesses. The average debtor days is still elevated, with 45% of firms reporting an average settlement time from invoicing of 50-60 days. There were minor variations across the states. Debts from Large Corporates and Government entities are both taking longer to settle due to “enhanced” cash flow management techniques.

The average number of banking relationships varies across the segments. Larger and more complex businesses are likely to spread their relationships. Others, in need of funding, will also try to access facilities from many sources, and so have more complex relationships.

Satisfaction with banking services remains in the doldrums, with around half of all businesses dissatisfied, or very dissatisfied with their bank, and only 17% very satisfied.

The satisfaction rating did vary by segment, with more established firms who do not need to borrow the more satisfied, while newer smaller firms, seeking to borrow, the least satisfied. For them access to credit was a significant issue.

Compliance and price were the two most significant causes of dissatisfaction, though only 5% said obtaining funding was the root cause of their concerns. When asked about their propensity to switch lenders, 61% said they would consider moving. However, when we examined their length of time with existing banking relationships, many are rusted on long term. The inertia, and the gap between intent to switch and switching is explained by a combination of time constraints, complexity of switching and lack of available alternatives. Again, this footprint varies by segment.

We continue to see the rise of FinTech lenders operating in Australia. Around 23% of SME’s have applied, and a further 10% say they will apply for funding. Overall awareness is rising, although there are some concerns about the true costs of borrowing from this source.

Many lenders are reluctant to lend to the sector, require security (mortgage over property for example) and funding is expensive. Banks prefer to lend to households as opposed to businesses, partly because of the relative capital ratio costs and lower risk profiles.

Some businesses are turning to the growing FinTech sector, where unsecured finance is available, at a price, but getting funding through these channels can be expensive because of lack of true competition and high demand.

Finally, we agree with the proposition that Australia currently lacks a patient capital market for small and medium enterprises. But this is not the main issue blocking the growth of the sector. Access to straightforward credit is.

But the Proposed Bill Is Targeting the Wrong SME Segments

We understand the fund will invest between $5 million to $15 million in small and medium enterprises that have a turnover of between $2 million and $100 million, where they can demonstrate three years of revenue growth and a clear vision to expand.

Established Australian businesses will be eligible to apply for equity capital investments between $5 million and $15 million. Small-business owners will not have to give up control for this investment.

The Business Growth Fund’s investment stake will range from 10 to 40 per cent, setting a balance between business owners keeping control of their business and providing enough incentives for investors. Initially, the Business Growth Fund could support 10 investments per year, with the aim to increase to 30 per year as the fund develops. Banks and superannuation contributions could enable the fund to grow to $500 million.

Our research indicates that this particular segment is small, can already obtain funding for such expansion (many would fit within our “Business In Transition” segment), and as a result we do not believe many would be prepared to give up such a large stake in their growing businesses. It seems this is more orientated to offer investors and the financial sector a return, than being shaped best to provide support for those small businesses which need assistance the most. The small number of transactions envisaged will also not assist many businesses, and the target is clearly not the bulk of those with real funding needs.

Thus, we cannot support the current proposal (which we also note is imprecise in terms of the assessment processes, return hurdles and other matters). Our view is that the current proposal appears rushed, and too high-level. But our main point is, it is targeting the wrong SME’s.

We Think There Is A Better Option

We believe there is a better option to assist SME’s in their growth agenda. The truth is there is a dearth of financing available from existing major players. Their risk and capital ratios mean they prefer to lend to households for mortgage purposes, then to small business. As interest rates fall, this pressure is being exacerbated.

We think a better model would be to provide funding via the emerging Fintech sector, by either providing funding to flow to existing FinTech’s, or by creating a new Government backed marketplace where FinTech’s and SME’s can transact.

There are good examples of such models[ii]. For example, in the UK, the main contenders are Tide (focused solely on SMEs, small or medium-sized companies) and Starling (which has retail accounts as well). In France, the big player is Qonto. In Germany, there’s Penta and Hufsy (which is based in Denmark). In Norway, Aprila. For “micro-businesses” of 1-10 people, there’s Holvi in Finland, Coconut, Anna and CountingUp in the UK, and Shine in France.

Tide now claims over 1.4% of the UK’s SMEs as clients (up from 1% in December 2018), and is gunning for 8% market share by 2023, aided by a £60m UK government grant.

Meanwhile, Starling has 46,000 SME members, up from 30,000 in March, with £100m from the same government grant to develop its business banking offering.

Qonto in France has grown from 15,000 small business customers to 40,000 in the past year, and is expanding into Germany, Spain and Italy this year. Finnish startup Holvi, which was bought by Spanish bank BBVA in 2016, claims 150,000 customers and is expanding into France, Italy, the Netherlands, Ireland and Belgium.

There is a lot of space for growth because the European market — with 24.5m SMEs — is still extremely dominated by the big lenders. In the UK, for example, four big banks have a 90% share of SME banking.

This was an intentional strategy from the UK Government to disrupt the inadequate SME sector. And in response the incumbents have been forced to respond and are now upping their game and starting their own digital-focused business banks as well to compete. In November 2018, NatWest launched Mettle. Santander’s “start-up” small business bank, Asto, also launched in the UK late 2018 Meanwhile, HSBC is building its own small business bank start-up, known internally as Project Iceberg.

In addition, the cost of funding to SME’s has dropped and the Fintech sector has developed, supported by the core injection of UK Government funding.

These digital plays cover a wide range of services which SME’s need, as well as basic payments, transactions and lending. And they are tending to create a marketplace where businesses and service providers and lenders can interact. This is transformational.

The SME experience has been significant, with easier access to funding, faster decisions, and the resultant rebalancing of the industry has lifted mainstream lenders too. If a similar model was replicate here, the SME sector would win. Australia would win.

Conclusion

The point to make, is rather than a thin deal flow targeting larger SME’s which really do not need assistance, a revised strategy could facilitate transformation of finance to SME sector. Thus, the planned investment could be made by the Australian Government, but leading to more productive outcomes. If we were to replicate a UK model, we think it should be the current inflight Fintech-based approach, rather than one which favours incumbents, and which does not deal with the core issues Australian SMEs face.

Thus, we recommend that the current proposed Bill is withdrawn, and the strategy redeveloped to take account of the emerging Fintech scene

Martin North

Principal Digital Finance Analytics

9th February 2020

[i] Our partitional clustering approach means that the segments are defined using multi-factor cluster analysis and split into non-overlapping tribes, rather than in a hierarchical tree. To achieve this, we developed a proprietary scoring system based on Lloyd’s algorithm, (also known as Voronoi iteration) for grouping data points into a given number of categories. This is often referred to as k-means clustering. The modelling is iterated sufficiently to enable adequate separation between clusters, as determined by Lloyds’s algorithm.

[ii] https://sifted.eu/articles/sme-small-business-banking-startups-europe-compared/