Fintech, GetCapital, one of the most interesting SME business lenders here in Australia, recently announced a distribution agreement with aggregator PLAN. So I took the opportunity to discuss the growth of the business with GetCapitals’ COO Frank Sterle in our occasional Fintech Spotlight series.

Frank Sterle COO GetCapital

GetCapital is a specialist lender to the SME sector. It was founded in 2013, and really hit the market in earnest in 2015, offering finance to businesses with an annual turnover of typically between $200k and $2m, though they have written deals for much bigger firms too. Their focus is the Australian and New Zealand Markets. They have lent more than $250 million in loans so far, and this is still growing, with a team now topping 100.

Frank, who by the way previously worked at Deutsche Bank within the Fixed Income, Currencies and Commodities (FICC) division of its Investment Bank, highlighted that they will consider deals across all sectors, and they offer loans for a range of business purposes from vehicle purchase, working capital, equipment finance and import lines of credit, with the proviso that borrowers will need to provide a personal guarantee as a minimum. They operate in the “Prime” to “Near-Prime” credit space.

Around one third of leads come via their direct channel – using an on-line application, one third from strategic partnerships, and one third from a portfolio of aggregators, including AFG, CFG, Fast, Plan, and others. In fact, this is the channel which is expanding fastest and they expect to announce additional aggregator partnerships soon.

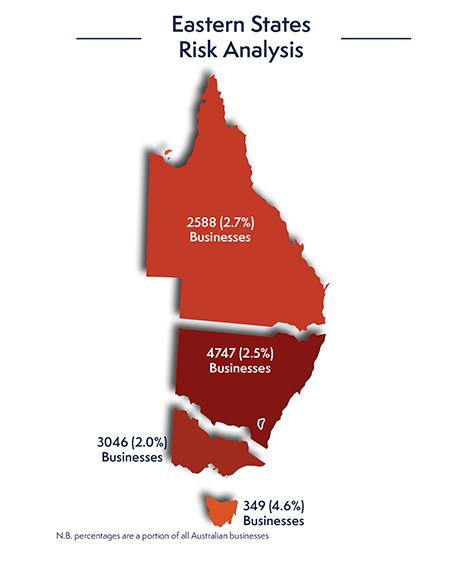

Their underwriting processes are interesting, as they have invested big in technology at the back end, for example to be able to capture bank statement data using tools from Proviso and this supports quick assessments of deals by their dedicated Relationship Managers, who will also consider credit history, and serviceability. Although a portion of loans with a low “expected loss” are fully automated, GetCapital still used a final human overlay by an experienced credit officer for larger and more complex underwrites. This also enables a broker to transparently workshop a deal with their Relationship Manger rather than being advised of a black box “computer says ‘no’ response”. They can approve finance in under 24 hours, often much less. They have three price tiers, with the lower value one typical of the sector, averaging around $40,000, but the average is much higher in the stronger credit tiers, with different pricing structures above. Frank was at pains to underscore the prime quality of the loans they write thanks to their specialist capabilities, and that their loss rates are very low, across the country. They claim to be “sharp on price” as well, though the price will depend on how long the business has been trading, their credit score and the assets backing the deal.

They are funded by a couple of institutional investors, including NAB, who provides their wholesale funding, so no crowd funding in sight here!

The experienced team also includes CEO, Jamie Osborn, ex. Managing Director at Macquarie Capital; Chief Commercial Officer Renata Cihelka, ex. ANZ, AMP, Morgan Stanley and CBA; Head of Sales, Cristian Fedrigo, ex. AFG, CBA; Head of Customer Operations, Brad Kinna, ex. ING Direct and Rabobank and Chief Risk Officer, David Hurford, ex. Westpac Institutional Bank.

Looking ahead, Frank believes the SME funding market is set to grow, but in so doing, there will be a bifurcation in the target market, with some focussing on the higher more sophisticated end of the sector, while others will battle it out at the lower end. He thinks they are well positioned for the former, and sees the prospect of further expansion in Australia ahead.

My sense is that GetCapital is indeed well positioned to disrupt core prime lending to SME’s in Australia, and as such are becoming a force to be reckoned with. Highly relevant given the feedback from our latest SME surveys which shows again that the incumbent lenders are forcing SME’s to jump though ever higher hoops to get a loan.

Further evidence of the digital disruption of finance ahead!