The Reserve Bank hosted a roundtable discussion on small business finance today, along with the Australian Banking Association and the Council of Small Business Australia. The roundtable was chaired by Philip Lowe, Governor of the Reserve Bank.

Small businesses are very important for the economy. They generate significant employment growth, drive innovation and boost competition in markets. Access to external finance is an important issue for many small businesses, particularly when they are looking to expand.

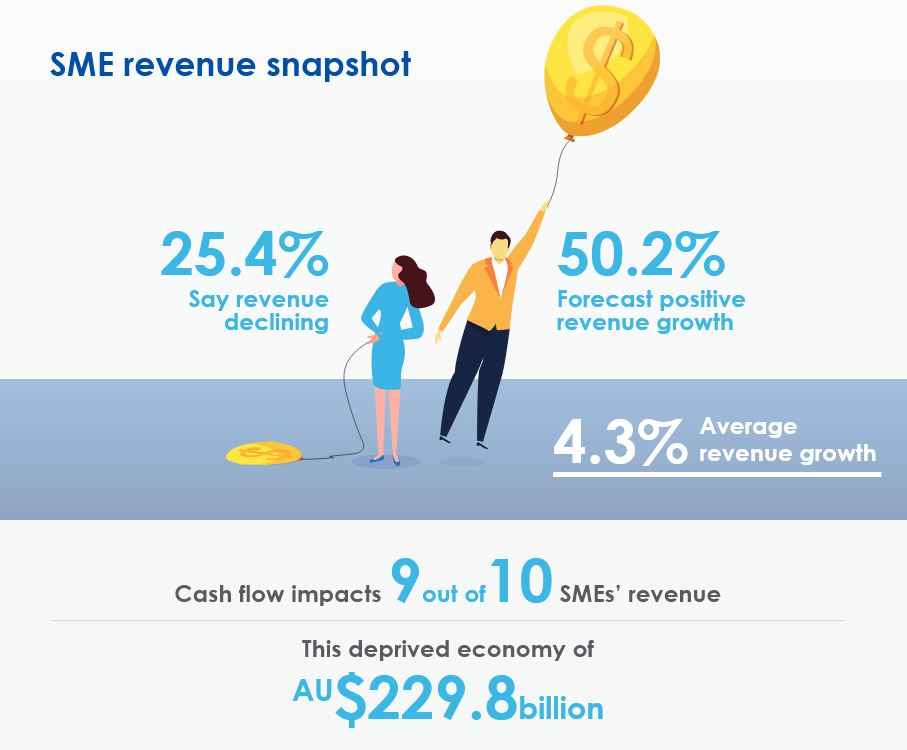

Our own SME survey highlights the problems SME’s face in getting finance in the face of the banks focus on mortgage lending. The latest edition of our report reveals that more than half of small business owners are not getting the financial assistance they require from lenders in Australia to grow their businesses.

The aim of the roundtable was to provide a forum for the discussion of small business lending in Australia. The participants included entrepreneurs from the Reserve Bank’s Small Business Finance Advisory Panel along with representatives from financial institutions, government and the financial regulators.

The challenges faced by small businesses when borrowing were discussed. The entrepreneurs highlighted a number of issues, including:

- access to lending for start-ups

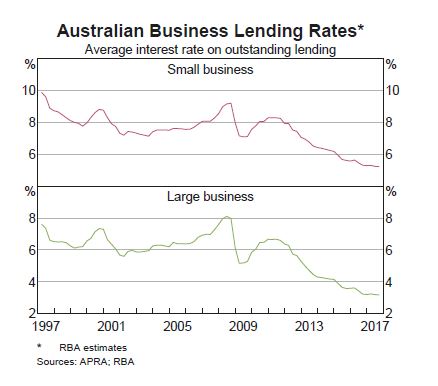

- the heavy reliance on secured lending and the role of housing collateral and personal guarantees in lending

- the loan application process, including the administrative burden

- the ability to compare products across lenders and to switch lenders.

The participants discussed a range of ideas for addressing these challenges. Financial institutions shared their perspectives and discussed some of the steps that are being taken to address concerns of small business. The roundtable heard some suggestions about how to improve the accessibility of information for small businesses about their financing options. The roundtable also heard from the Australian Prudential Regulation Authority regarding the proposed revisions to the bank capital framework that relate to small business lending.

The roundtable discussed some other policy initiatives that are currently underway, including the introduction of comprehensive credit reporting and open banking. Participants agreed that these initiatives could help to improve access to finance, and the Reserve Bank will continue to monitor developments closely.

Background

The Small Business Finance Advisory Panel was established by the Reserve Bank in 1993 and meets annually to discuss issues relating to the provision of finance, as well as the broader economic environment for small businesses. The panel provides valuable information to the Reserve Bank on the financial and economic conditions faced by small businesses in Australia.

The Reserve Bank has previously hosted discussions on small business finance issues, including a Small Business Finance Roundtable in 2012 and a Conference on Small Business Conditions and Finance in 2015.

The Australian Banking Association, along with the Australian Council of Small business, representatives for member Banks and other stakeholders were also in attendance to bring their own perspective on the issues and to answer questions. The event was agreed to and organised at the end of last year.

Australian Banking Association CEO Anna Bligh said that the Roundtable was an important opportunity for Australia’s banks to listen first hand to the needs of small business.

“Small business is the engine room of the Australian economy, accounting for more than 40% of all jobs or around 4.7 million people,” Ms Bligh said.

“This Roundtable was an important step in building the relationship between banks, small businesses and their representatives.

“Banks are working hard to better understand the needs of business, their challenges and how they can work with them to help them achieve their goals,” she said.