A multi-channel advertising campaign is being launched by the Mortgage & Finance Association of Australia to promote the value of brokers to the general public.

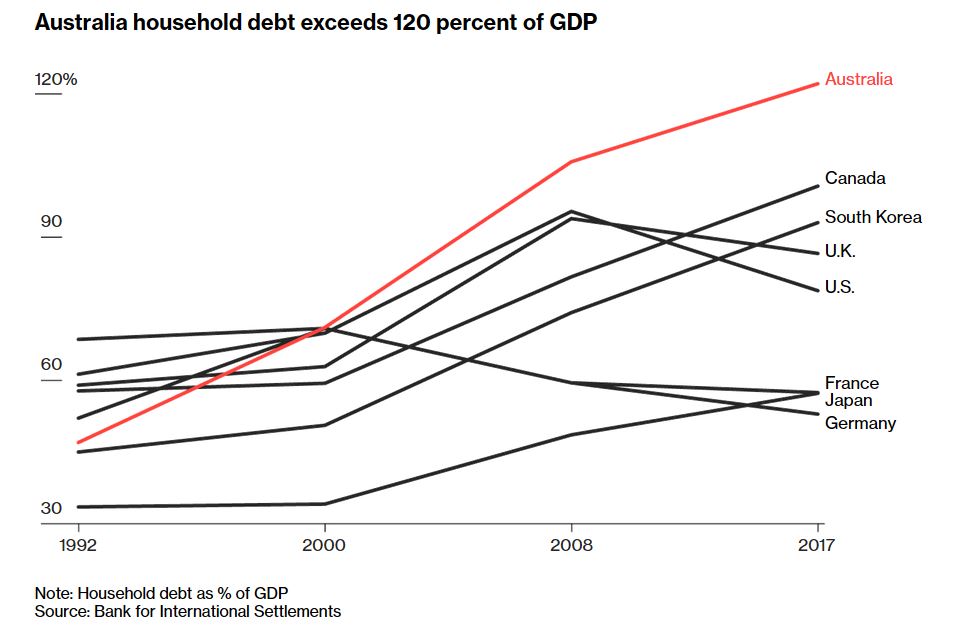

DFA comments that the industry should focus on fixing the inherent conflicts in the broker channel, as revealed in the Royal Commission. This is not marketing perception problem, it is the reality of current practices! The MFAA are fighting the wrong war… ASIC’s analysis showed that contrary to myth, borrowers who use brokers do NOT necessarily get a better deal.

Starting from this Saturday (7 July) and running through to the end of October, the Mortgage & Finance Association of Australia’s (MFAA) national advertising campaign – developed by creative agency Redhanded, in partnership with MFAA advisers GRACosway and Porter Novelli – will run across regional television, national newspapers, social media, national radio, as well as on billboards, bus stops and on branded buses, among other channels.

Featuring real broker customers, including winners of The Block, Kyal and Kara Demmrich, the advertising campaign aims to highlight the experiences customers have had with brokers and the value they place in the broker offering and service.

Several leading brokers will also front the campaign, including award-winning broker and director of Rise High Financial Solutions Marissa Schulze, and share what their typical day looks like.

The campaign, which runs with the tag line Your Broker Behind You (showcasing that the broker is supportive of the customer and their dreams of home ownership) and utilises the hashtag #findafairerdeal, also aims to involve other brokers.

The 30-second television commercial, social media posts and several other assets are being made available to brokers through the campaign website brokerbehindyou.com.au, and the MFAA is calling on all brokers to post their own videos, photos and posts using the hashtag to create a wealth of content showcasing how Australia’s brokers are making a difference.

‘We have a wonderful story to tell’

Highlighting that broker market share has increased over the past six years, with the MFAA’s recent stats showing that broker market share in the March quarter reached its higher ever figure, the association noted that while the recent negative publicity has not yet impacted the proportion of people using brokers, the association believed it was the “the right time” to come out in a public campaign to “promote and defend” the industry.

The CEO of the MFAA, Mike Felton, commented: “There is no doubt our reputation as an industry has been challenged through repeated regulatory reports, inquiries and negative media coverage over the past year, but we have a wonderful story to tell. Brokers drive competition, value and choice, which creates positive customer outcomes and fairness for all Australians.

“While we are continuing our ongoing efforts in advocacy and education, through such actions as our involvement in the Combined Industry Forum, this campaign will highlight more publicly the value of the mortgage broking industry.”

He continued: “Many broker businesses are comparatively small, but working together, we represent an industry of real significance, which is systemically important to the Australian economy. It’s time to make that size and scale count.”

Mr Felton revealed that the association tested and shaped the initiative with the help of an advisory panel made up of brokers, aggregators and lenders to ensure it reflected the views of the entire industry.

He continued: “We’re focused on the positives. The message is: ‘Your broker is behind you all the way, providing you with a choice of lenders and products, and support for the life of the loan. Your broker is on your side’.”

The marketing campaign comes off the back of calls from brokers for such an advertising campaign.

Several brokers have taken to the comment section of The Adviser in recent months to call on the associations to put out a public-facing marketing campaign on the broker proposition, with one commentator calling on the associations to “launch an Australia-wide media campaign outlining the fact that the banks are in the process of killing the broking industry and when they do consumers will be far worse off”.

Some brokers have already taken steps to rebut the negative headlines and misinformation being disseminated to the public following the financial services royal commission and Productivity Commission’s inquiry into the financial sector.

Tasmania-based broker Lance Cure launched a local TV advertising campaign to strengthen the public’s perception of the broking industry, while Steve Milligan, broker and director of Mandurah-based brokerage Launch Finance, presented a whitepaper for Federal MP Andrew Hastie titled The Value of Finance Brokers and Positive Consumer Outcomes to “get the truth out there about why brokers are doing so well”.

Likewise, the MFAA recently presented to government departments and regulatory agencies a data package to provide an evidence-based rebuttal of the negative reports and to emphasise ASIC’s review of mortgage broker remuneration, which did not conclude that the upfront and trail commissions have detrimental impacts on consumers.

The association also revealed that a new Deloitte Access Economics report, Value of Mortgage Broking, will be released in the coming weeks.