From The Real Estate Conversation.

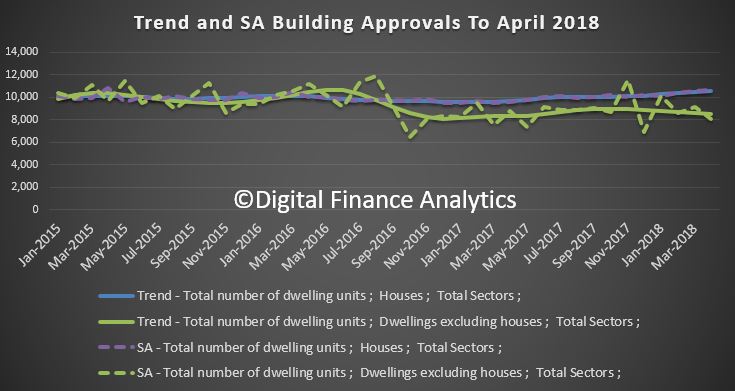

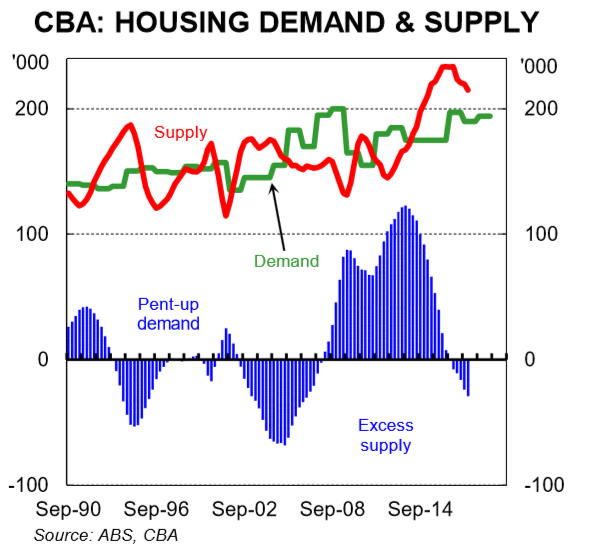

Australia’s building industry, which has been largely fuelled up to this point by investor apartment construction, looks like it’s heading from boom to bust, if the recent report from economic forecaster BIS Oxford Economics is anything to go by.

The Building in Australia 2018-2033 report predicts building commencements will drop sharply over the next two years, driven by weakening domestic and foreign investor demand in the face of tougher lending criteria and increased foreign buyer charges.

BIS Oxford Economic’s Director, Adrian Hart says the “building sector is switching from being a strong growth driver to a drag on the economy”.

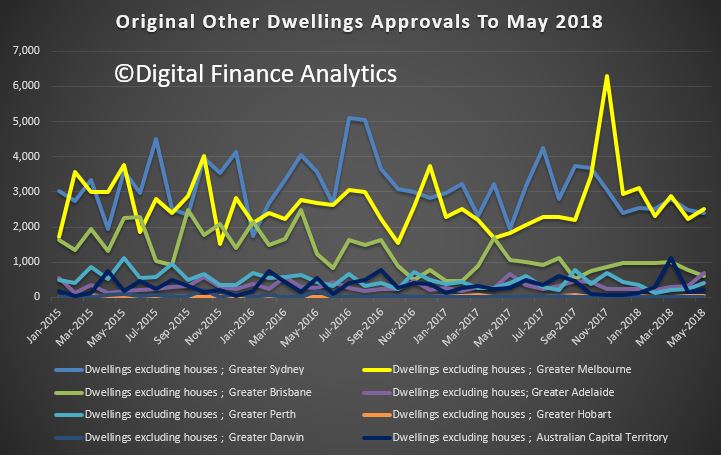

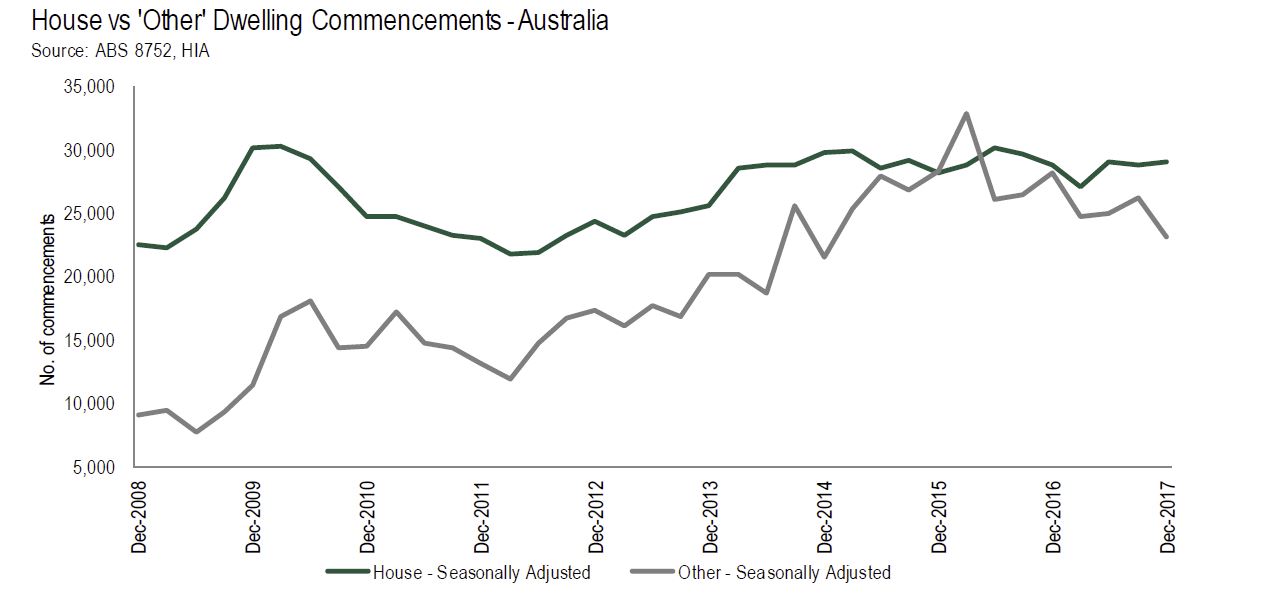

“Over the next two years, the fall in residential building starts will accelerate sharply, particularly in the investor-driven apartments segment, which is set to fall 50 per cent.

Hart notes the “very mild drop in residential commencements in 2017/18 is just the beginning”.

Slowdown won’t reach the ‘apocalyptic’ levels predicted

Despite the report, some are saying the fallback predicted won’t be as bad as what is being reported.

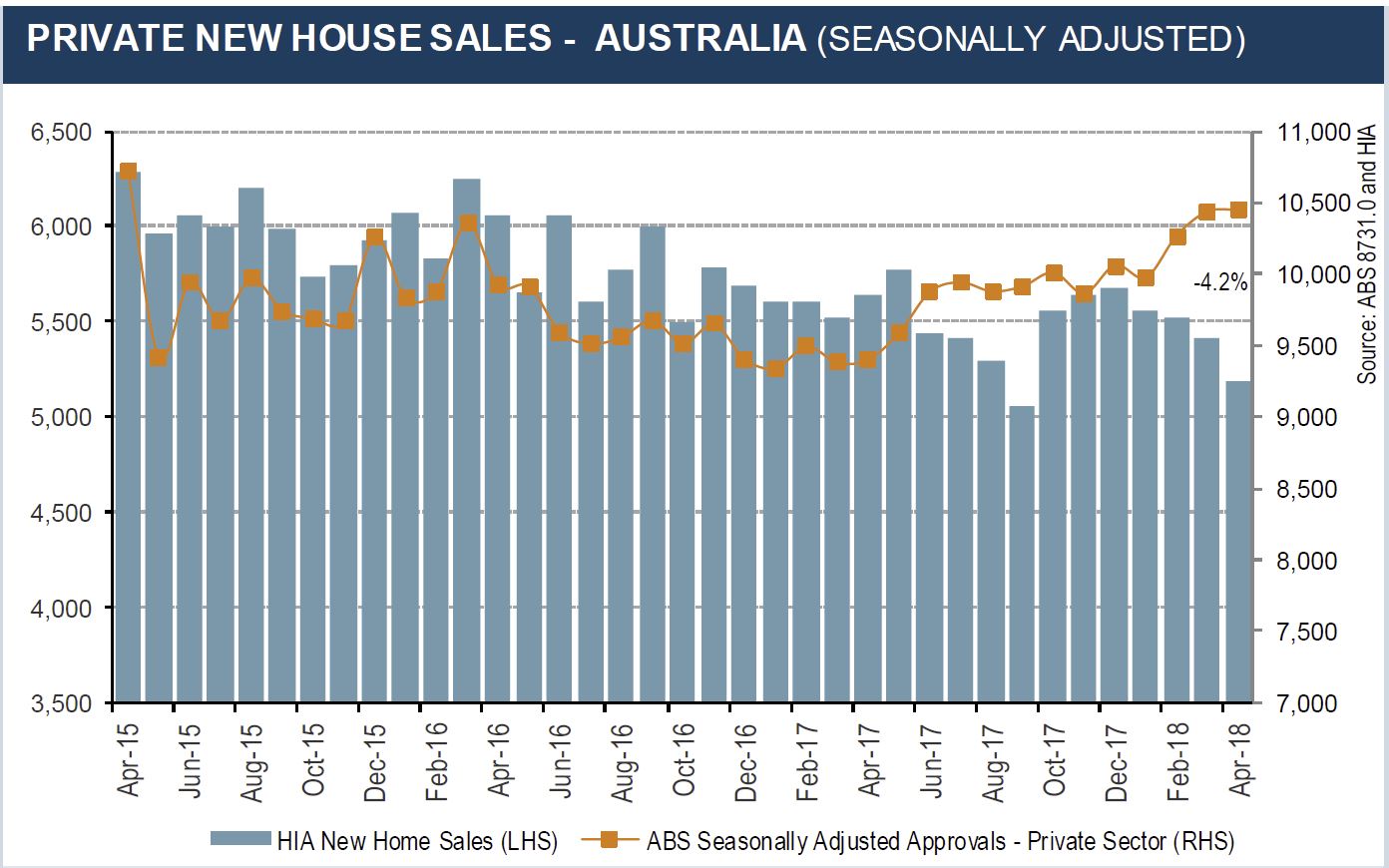

Tim Reardon, principal economist for the Housing Industry Association (HIA), told WILLIAMS MEDIA that while building growth is expected to slow, it is nowhere near as bad as the BIS Oxford Economics report would have you believe.

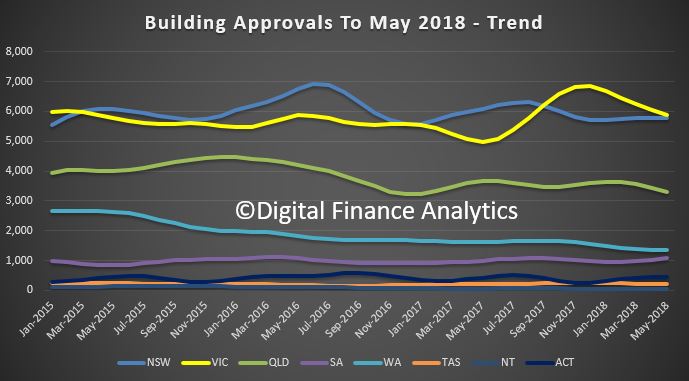

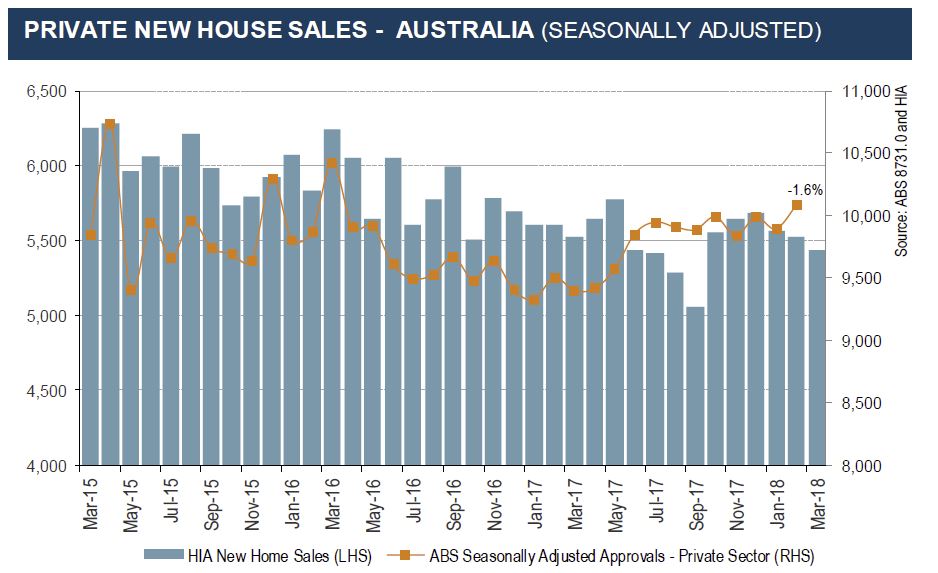

“The market has been slowing for the last 12 months, it peaked in 2016, and it’s still at one of the highest levels on record,” Reardon said.

“We are forecasting that the market will continue to slow over the next couple of years, but it will remain well above long term averages.

“Given we’re coming off a massive high, with a record number of new homes being built, the slowdown is well and truly expected and is well within the industry’s ability to cope.

“Victoria reached a peak in March this year and has begun slowing. With population growth slowing, we expect building growth to follow suit but we don’t expect anything other than a normal correction in the cycle.

“The previous peak prior to this cycle was 185,000 homes built per year. We’ve had three years with 200,000 homes built per year, and it appears we will continue building more than 185,000 homes per year for the next three years.

“While that is a slowdown it is nowhere near what they are saying,” Reardon said.

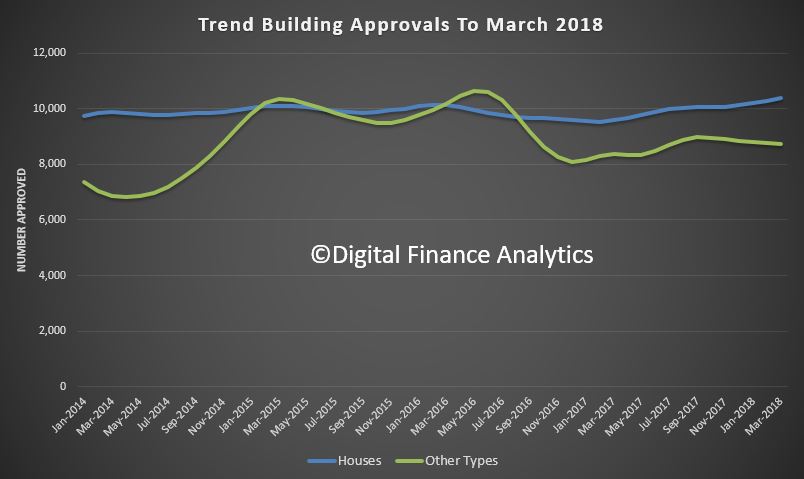

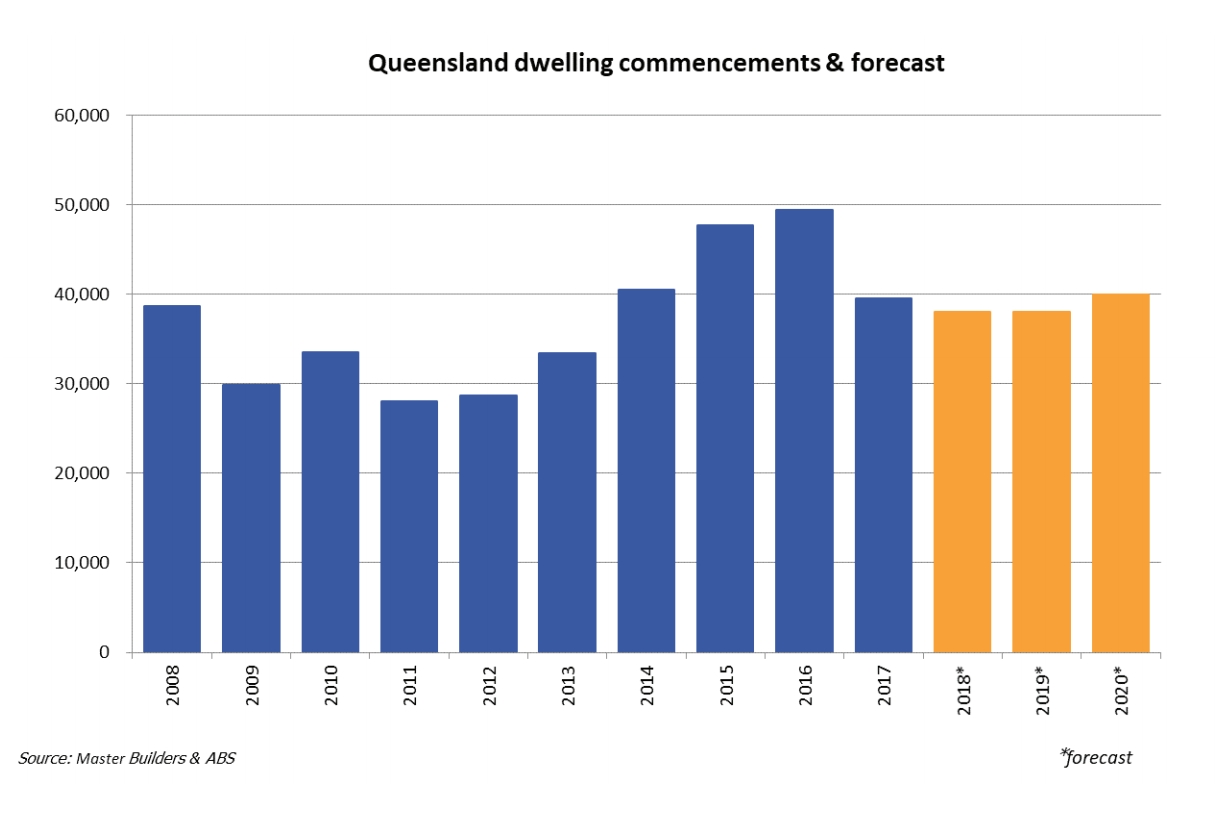

The Master Builders ‘Building Industry Outlook 2018’ also predicts that while there will be a slowdown, it won’t reach the crisis levels predicted in the BIS Oxford Economics report.

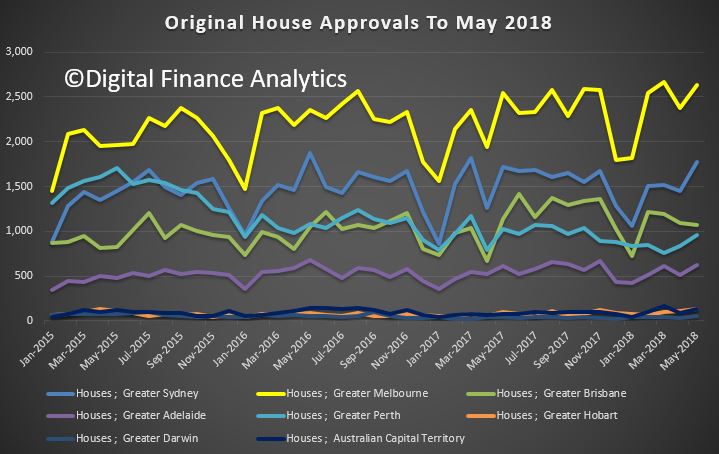

“It will be a challenging year for those who have come to rely on work on high-rise unit blocks, but there will be new opportunities in other sectors, such as tourism, aged care and student accommodation. It will be a much-improved year for those who build detached houses and those who operate out in the regions,” the report says.

“It will be a much-improved year for those who build detached houses and those who operate out in the regions.

Source: Master Builders

Source: Master Builders

“Residential Master Builders forecasts 38,000 dwelling commencements in 2018 which will be a further moderation on the record highs seen in the past few years, equating to a drop of 4 per cent on the anticipated total for 2017. In 2019 we estimate dwelling commencements will remain low before beginning to move back up in 2020.

“Owner occupiers will increasingly move into the market, while investors will remain cautious. This will help to hold up the total value of work which won’t drop as sharply as the number of new dwellings. Demand will continue to shift away from large unit blocks.

“Concentrated population growth focused on the south east will favour unit developments, but smaller infill developments, like townhouses and boutique unit developments. Detached housing will also see growth where there’s land available” the report says.

“It is still a positive year for the industry,” Reardon concluded.