ANZ reported their 1H 18 results today, amid the turmoil of the Royal Commission, its good to get back to real bank results!

They announced a statutory profit after tax of $3.32 billion, up 14% and a cash profit on a continuing basis of $3.49 billion up 4% on the prior comparable period. This was a bit below consensus, thanks to lower than expected Institutional results. But the simplification of the business is paying dividends, provided the home lending markets in Australia and New Zealand continues to fire…

They announced a statutory profit after tax of $3.32 billion, up 14% and a cash profit on a continuing basis of $3.49 billion up 4% on the prior comparable period. This was a bit below consensus, thanks to lower than expected Institutional results. But the simplification of the business is paying dividends, provided the home lending markets in Australia and New Zealand continues to fire…

There was some restating of results thanks to the handling of OnePath Life and OnePath Pensions now classed as discontinued operations and shown separately. Inclusive of the $617 million negative impact, the Group cash profit would be $2.88 billion. They expect around 80 basis points of total capital benefit.

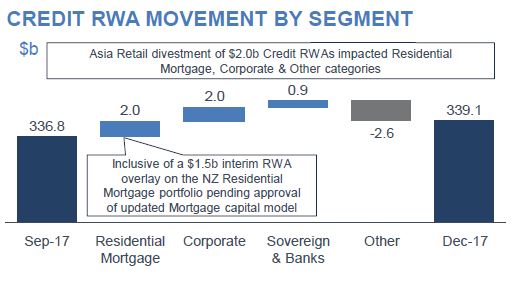

In the half they finalised the sale of six Asian retail and wealth businesses which allows the bank to further strengthen their focus on Institutional, which continues to have a regional footprint across 15 markets in Asia. Total institutional RWA fell $42 billion, down 20% since FY15. But more significantly, 60% of Group capital is now allocated to Retail and Commercial businesses in Australia and New Zealand, up from 44% in 2015. ANZ is now a very different shaped bank. Much more reliant on the performance of the local economy!

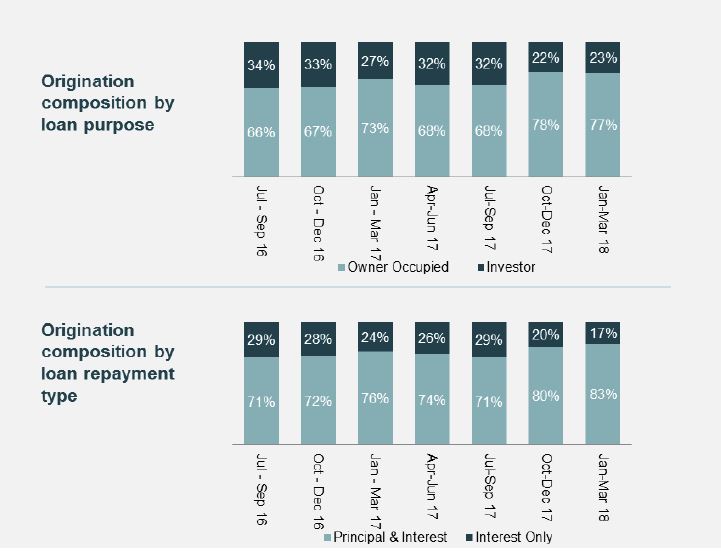

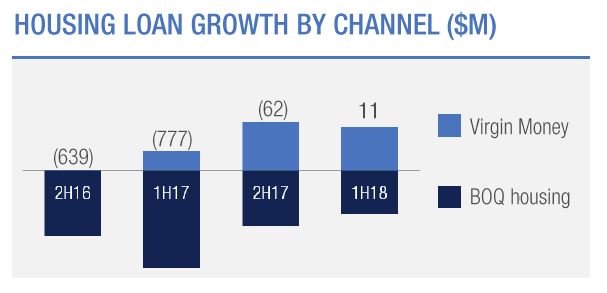

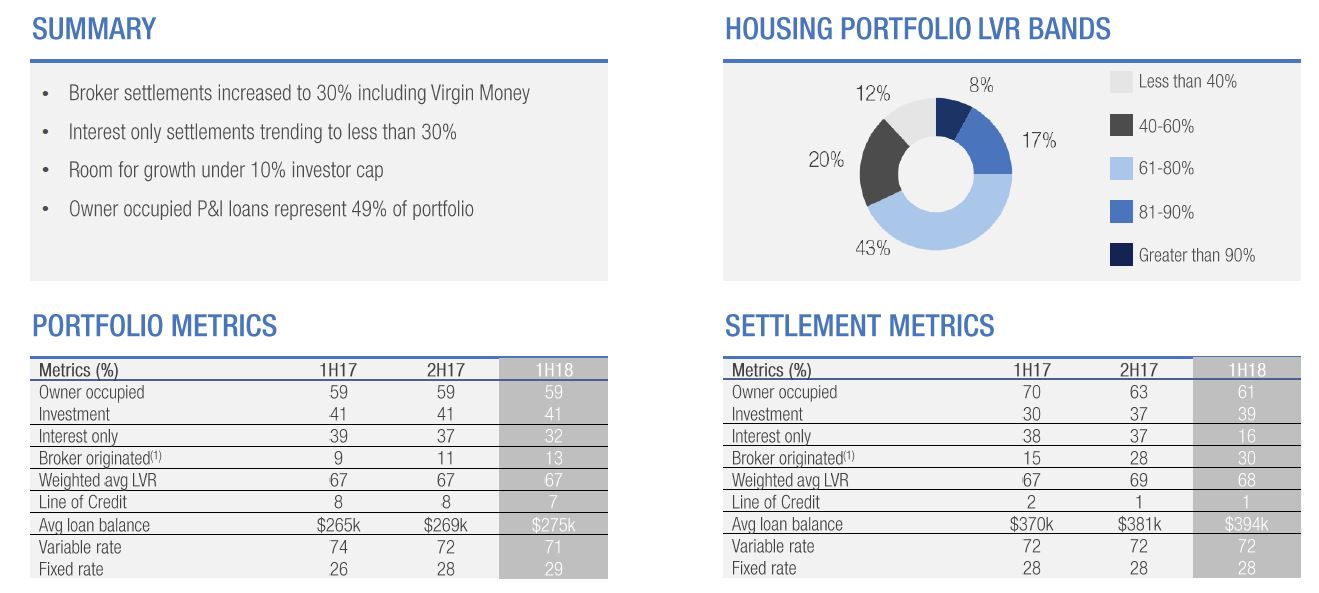

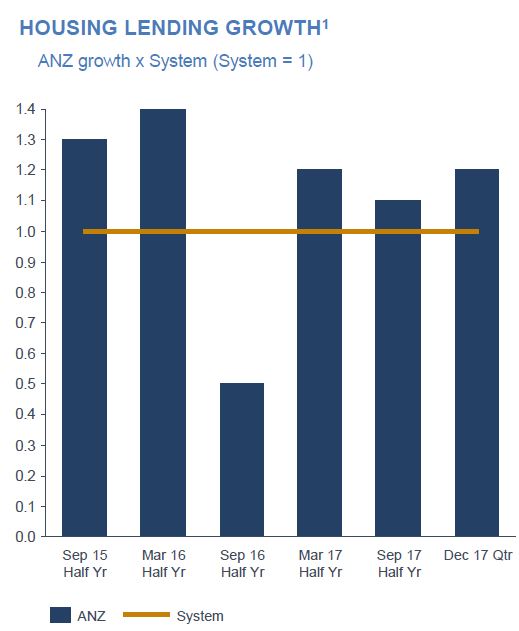

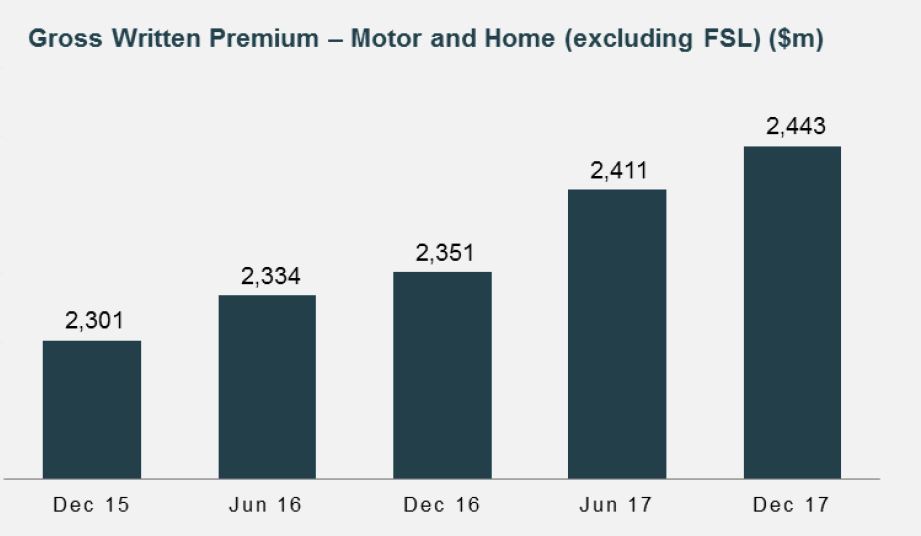

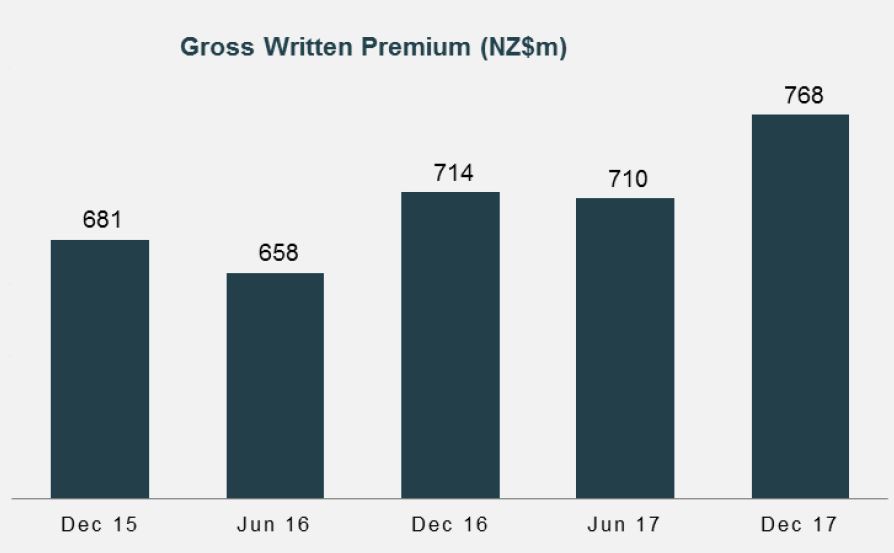

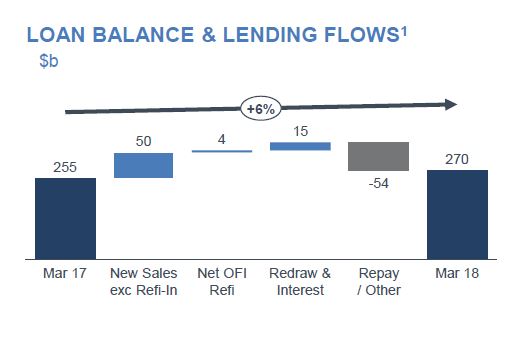

They grew home loans in Australia, by 6%, with a strong focus on owner -occupied (P&I) and 5% in New Zealand.

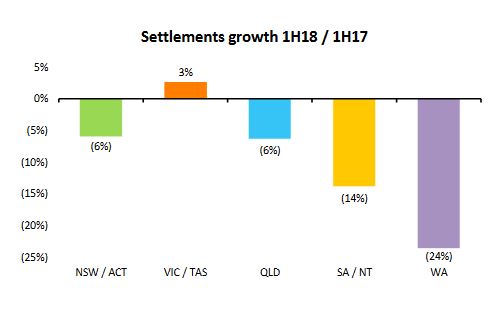

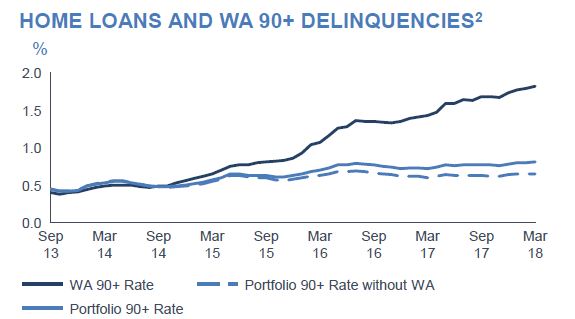

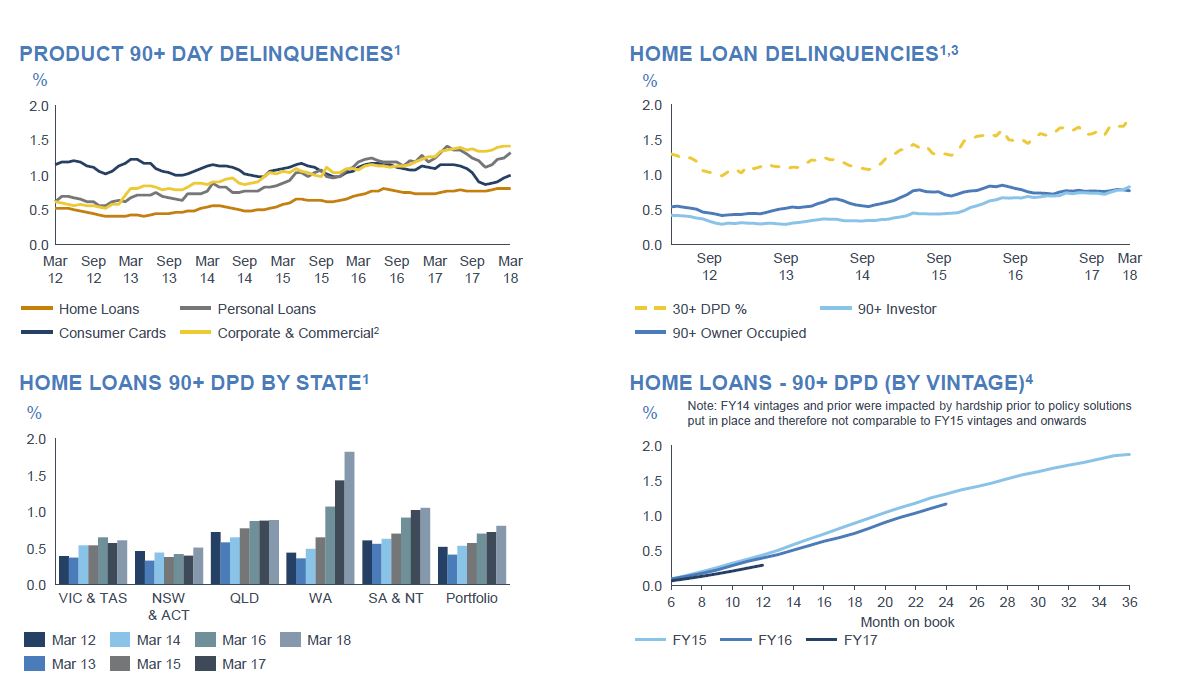

Australian home loan delinquencies were higher, mainly thanks to ongoing issues in WA. WA is 13% of portfolio but 30% of 90+ and half of portfolio losses.

Australian home loan delinquencies were higher, mainly thanks to ongoing issues in WA. WA is 13% of portfolio but 30% of 90+ and half of portfolio losses.

More recent loans (written at higher underwriting standards?) are performing a little better, but there are some issues with older loans.

More recent loans (written at higher underwriting standards?) are performing a little better, but there are some issues with older loans.

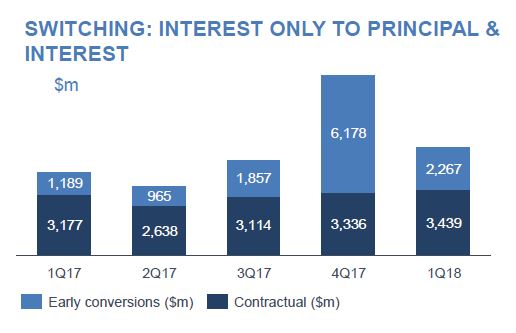

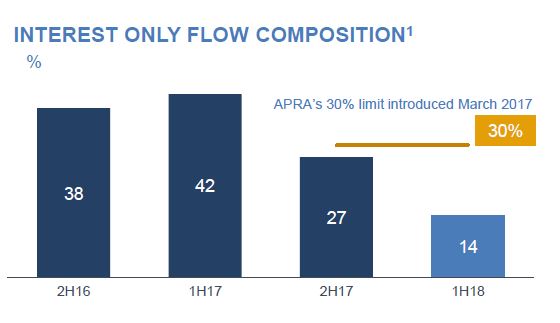

ANZ has throttled back IO loans, and they say serviceability assessment is based on ability to repay principal & interest repayments calculated over the residual term of loan. Serviceability assessment is based on ability to repay principal & interest repayments calculated over the residual term of loan. Proactive contact strategies are in place to prepare customers for the change in their cash repayments ahead of Interest Only expiry.

ANZ has throttled back IO loans, and they say serviceability assessment is based on ability to repay principal & interest repayments calculated over the residual term of loan. Serviceability assessment is based on ability to repay principal & interest repayments calculated over the residual term of loan. Proactive contact strategies are in place to prepare customers for the change in their cash repayments ahead of Interest Only expiry.

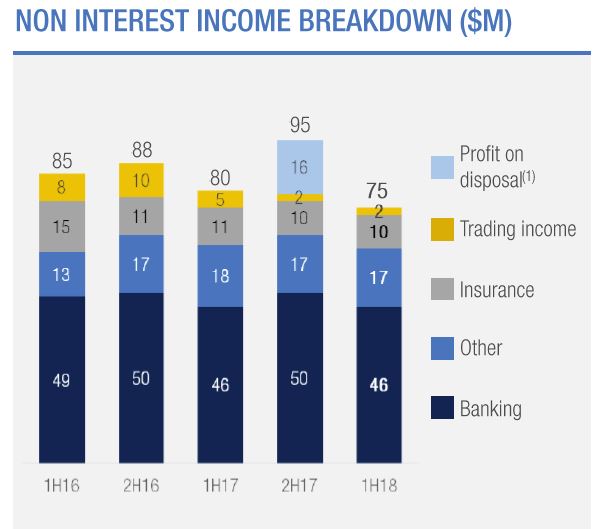

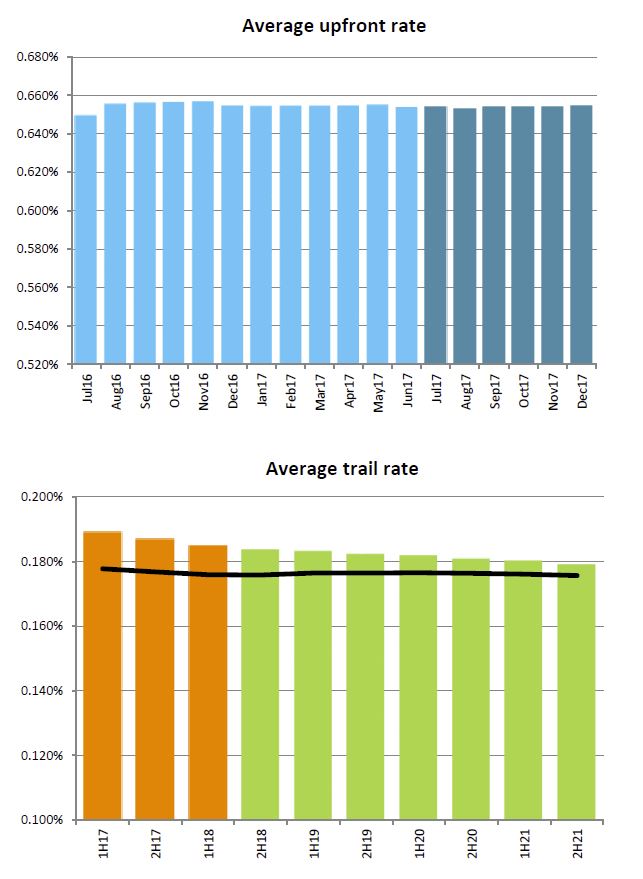

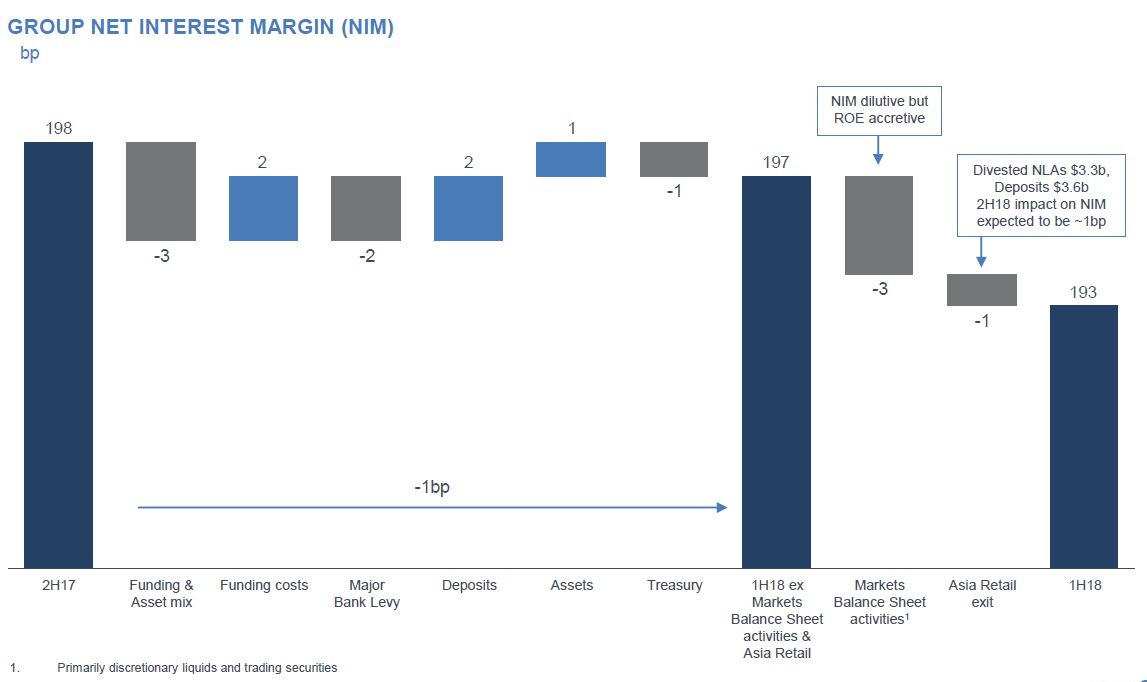

Group Net interest margin fell 5 basis points from 2H17. However, NIM was up in Australia (+5 basis points) and New Zealand (+6 basis points).

Group Net interest margin fell 5 basis points from 2H17. However, NIM was up in Australia (+5 basis points) and New Zealand (+6 basis points).

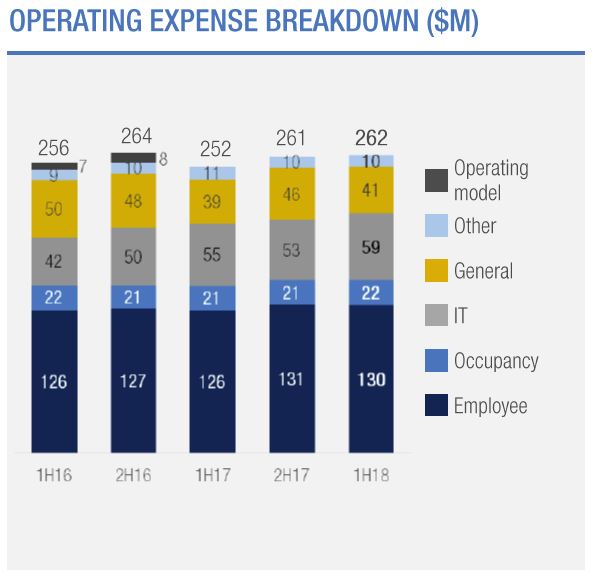

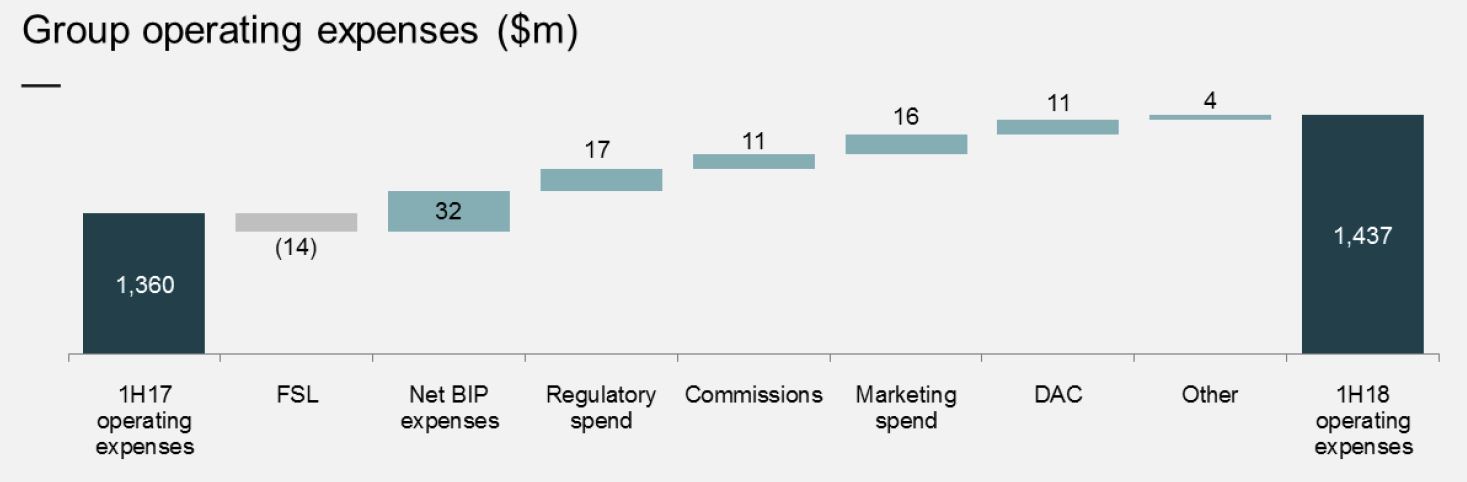

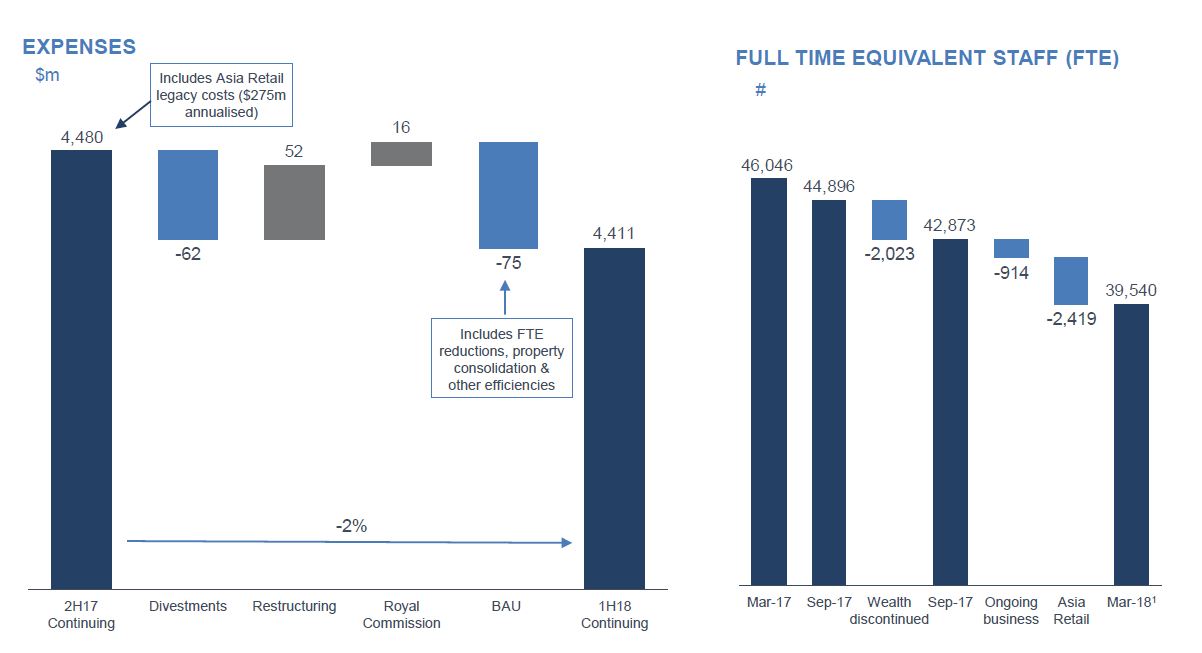

Expenses fell, thanks to a reduction in staff and consolidation.

Expenses fell, thanks to a reduction in staff and consolidation.

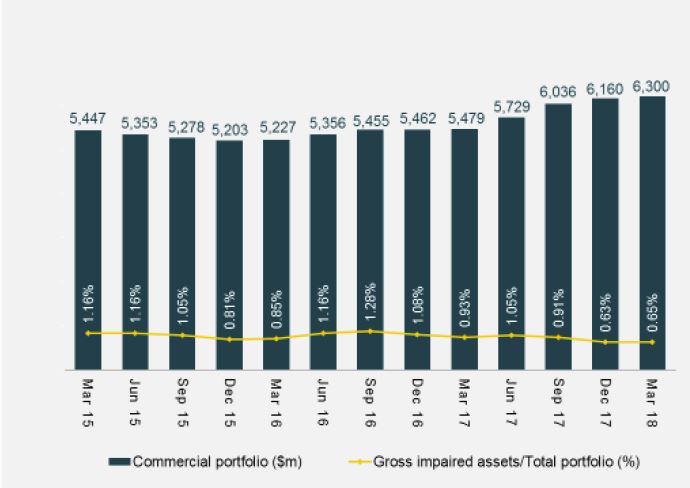

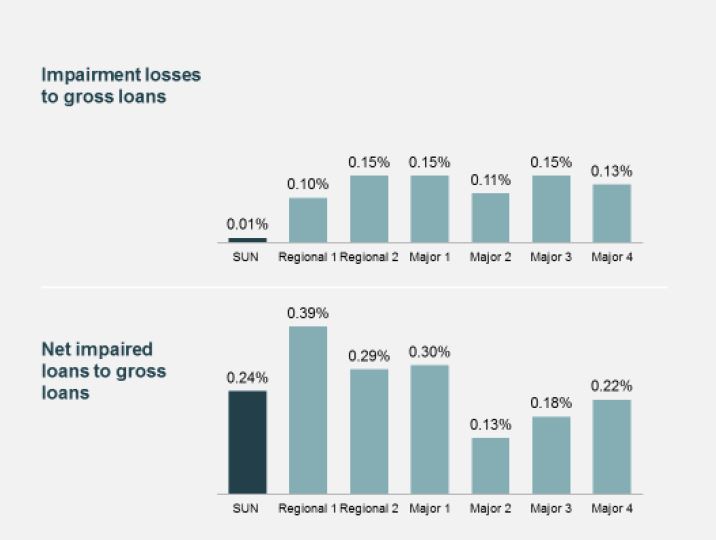

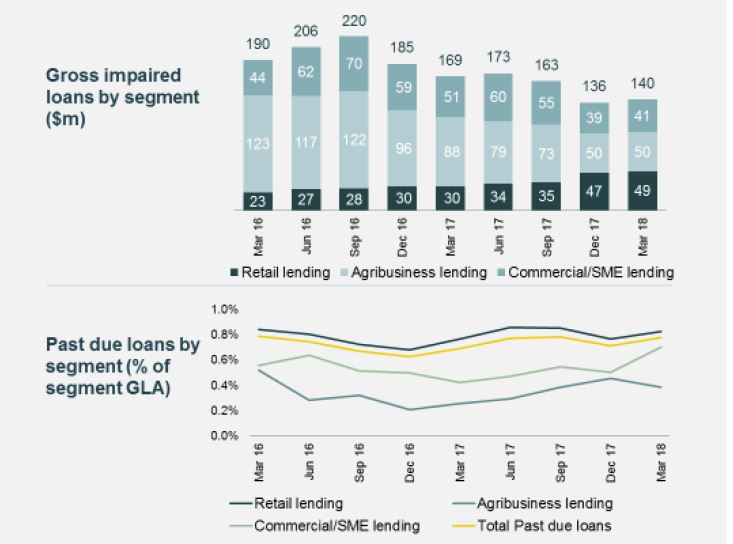

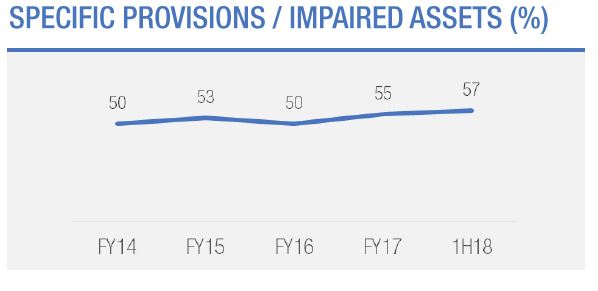

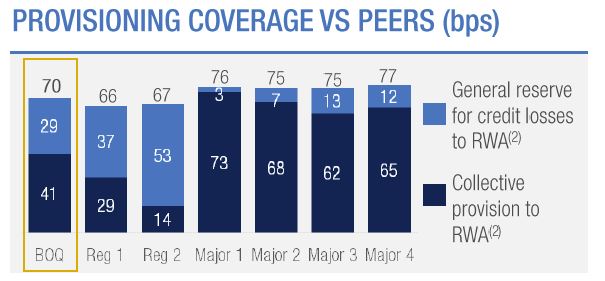

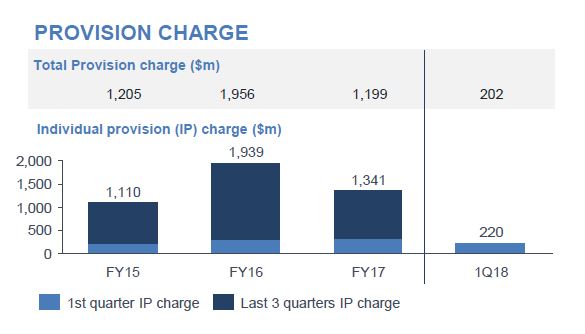

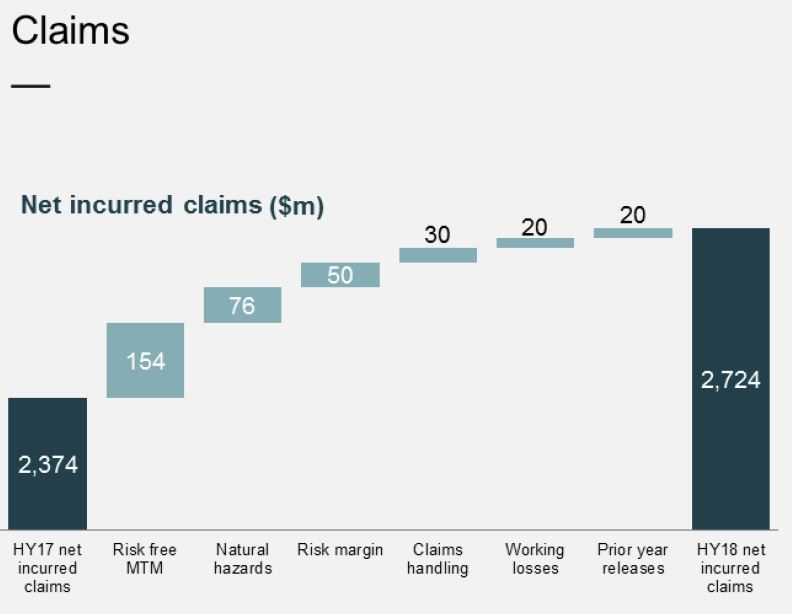

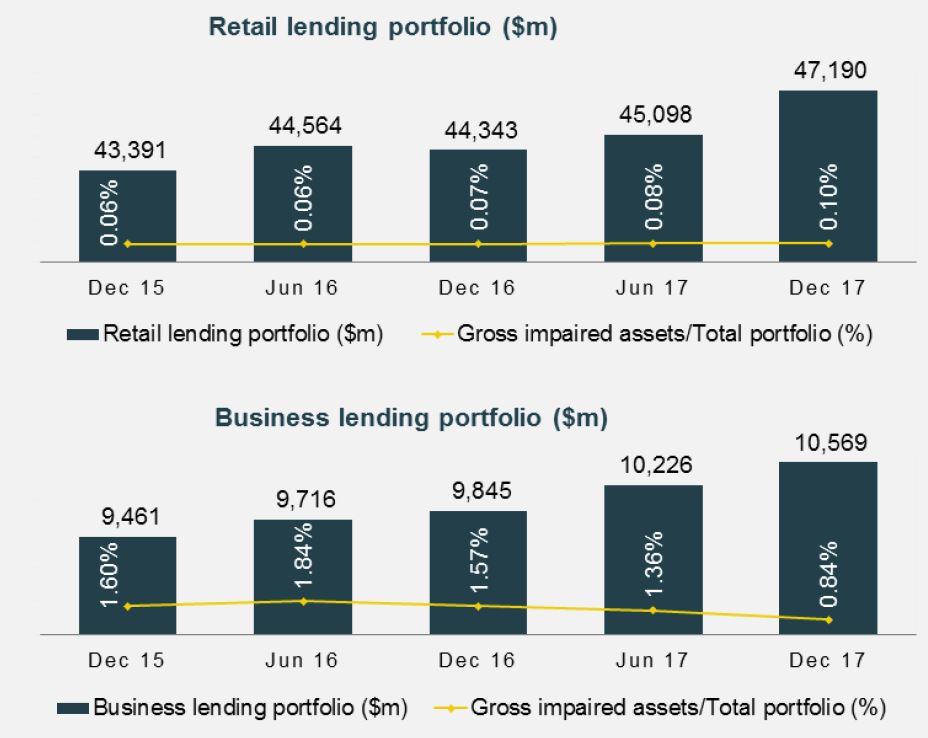

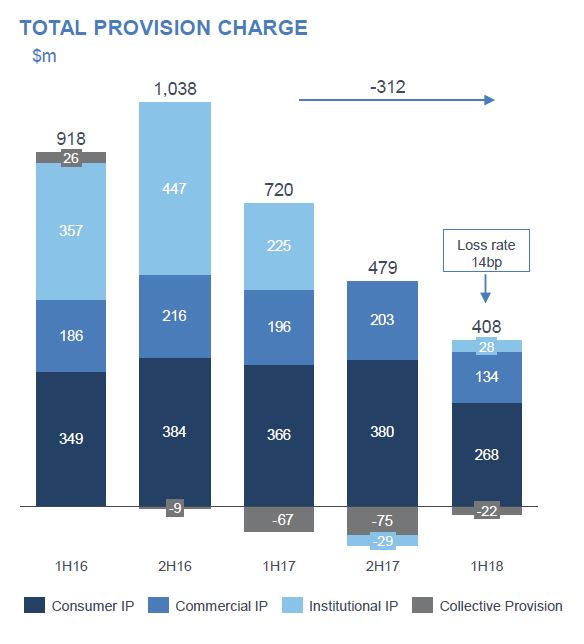

Total provision charge for the half was $408 million, which equates to a loss rate of 14 basis points, down from 21 basis points at the end of FY17. New impaired assets declined 32% over the half, with gross impaired assets down 15% over the same period.

Total provision charge for the half was $408 million, which equates to a loss rate of 14 basis points, down from 21 basis points at the end of FY17. New impaired assets declined 32% over the half, with gross impaired assets down 15% over the same period.

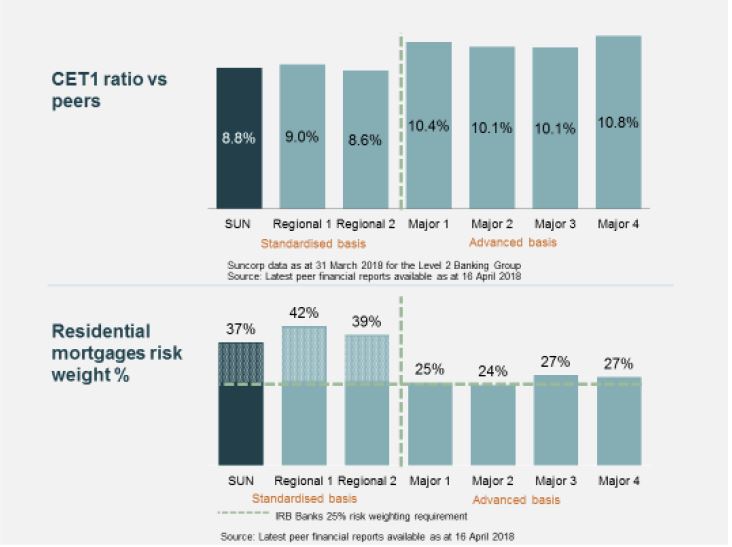

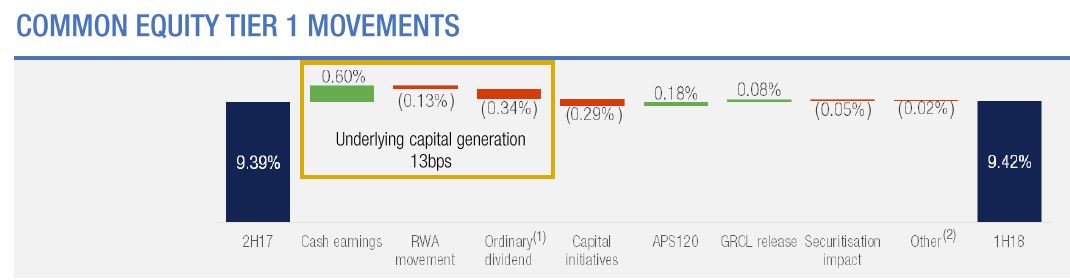

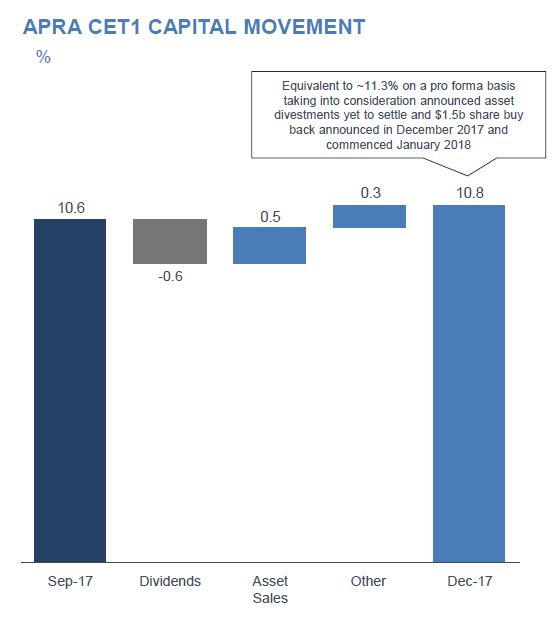

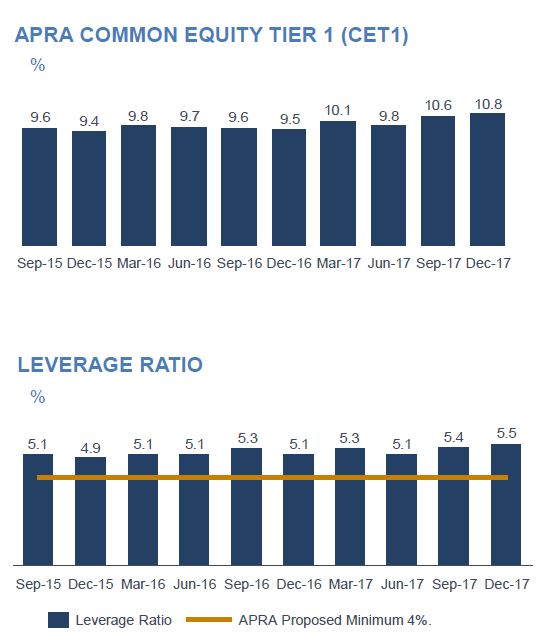

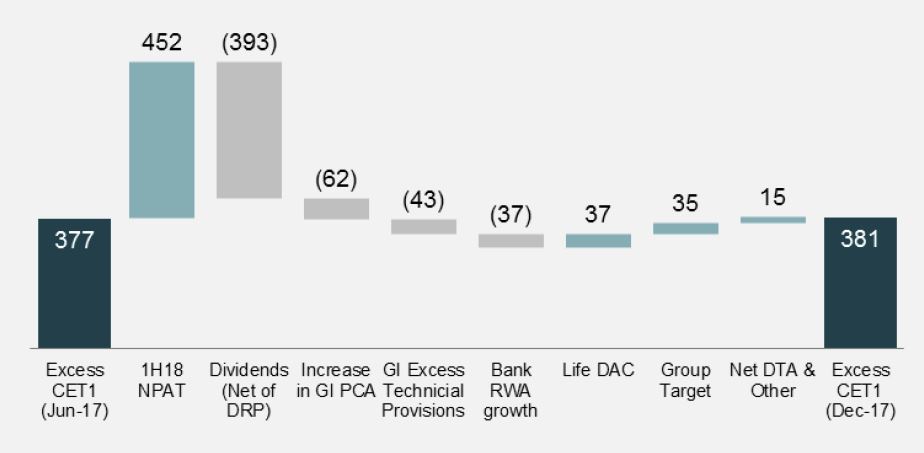

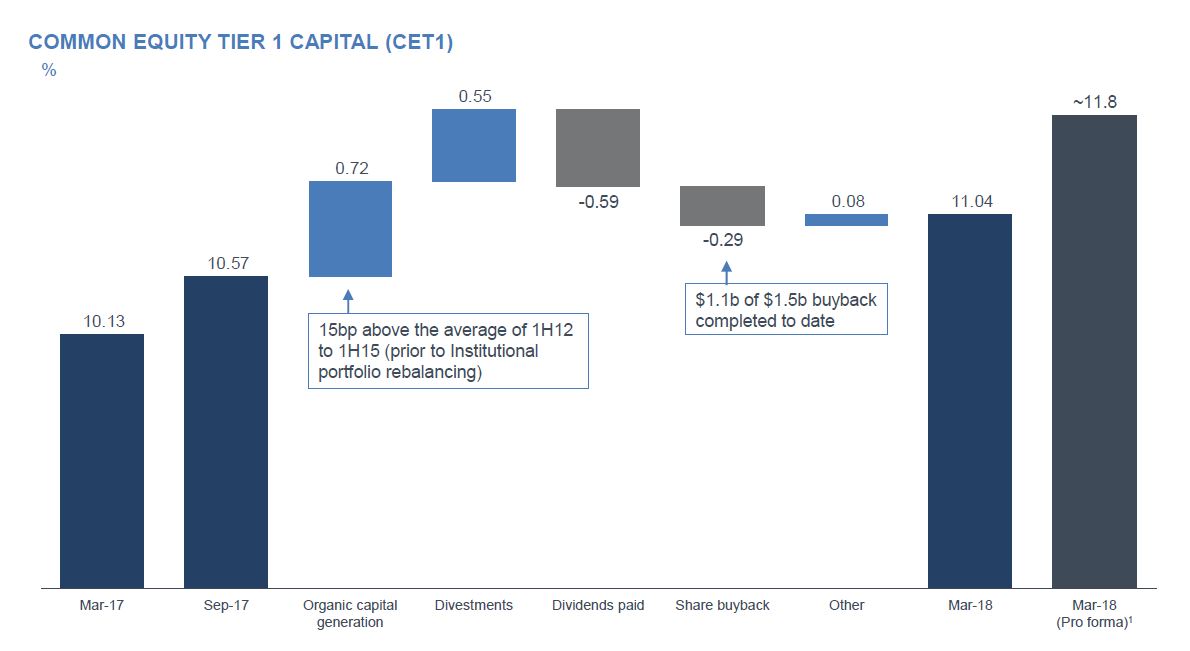

ANZ’s CET1 was 11.0%, up 91 basis points, or 16.3% on an international comparable basis.

ANZ’s CET1 was 11.0%, up 91 basis points, or 16.3% on an international comparable basis.

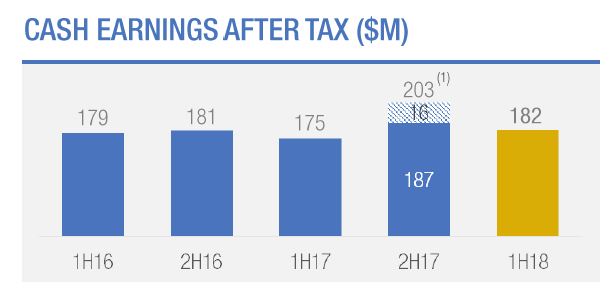

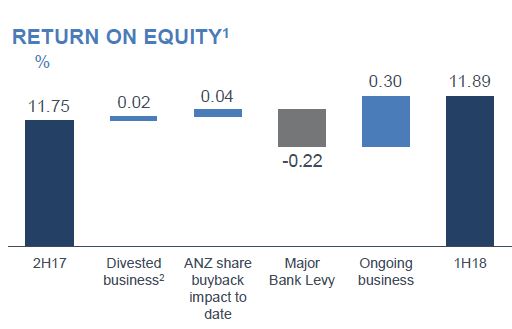

Their return on equity increased 32 basis points to 11.9% with cash earnings per share up 4% 10 119.4 cents.

Their return on equity increased 32 basis points to 11.9% with cash earnings per share up 4% 10 119.4 cents.

They announced an interim dividend of 80 cents per share, a payout ratio of 66% of cash profit.

They announced an interim dividend of 80 cents per share, a payout ratio of 66% of cash profit.

ANZ external legal costs relating to the Royal Commission will be around $50 million for 2018. They say they cannot predict the outcome of the Inquiry or its impact on either the bank or the broader Industry.