Welcome to the Property Imperative weekly to 9th June 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Watch the video, listen to the podcast, or read the transcript.

Watch the video, listen to the podcast, or read the transcript.

Today, a story. In the great city of Ghor, all the inhabitants were blind. A king and his entourage arrived nearby. He brought his army and camped in the desert. He had a mighty elephant, which he used to increase the people’s awe. The populace became anxious to see the elephant, and some sightless from among the blind community ran like fools to find it. As they did not even know the form or shape of the elephant, they groped sightlessly gathering information by touching some part of it. Each thought that he knew something, because he could feel a part… The man whose hand had reached the ear of the elephant, said “It is a large, rough thing, wide and abroad, like a rug.” And the one who had felt the trunk said: “I have the real facts about it. It is like a straight and hollow pipe, awful and destructive.” The one who had felt its feet and legs said” it is mighty and firm, like a pillar.” Each had felt one part of many. Each had perceived it wrongly…

The parable of the three blind men and the elephant makes the point that depending on where you feel, or look, you get a very different view of what’s currently going on, and so too with the economy.

For example, superficially, the latest GDP numbers released this week by the ABS were good news, showing 1.0% growth in real GDP over the quarter and a 3.1% rise over the year. The Treasurer was effusive. But below the spin, things are not so clear cut. In fact, net exports drove most of the growth because the terms-of-trade which measures the prices received for Australia’s exports relative to the prices paid for imports rose by 3.3% over the quarter in seasonally adjusted terms and by 1.6% in trend terms. However, over the year it fell by 2.6% seasonally adjusted and by 0.7% in trend terms. And these movement could be one offs. We were fortunate. Quarterly final demand, which excludes export volumes, rose by 0.6% over the March quarter, driven largely by VIC (+1.9%) and NSW (+0.7%).

But, on a more relevant per capita basis, real GDP rose by just 0.7% over the quarter and was up by 1.5% over the year and real national disposable income per capita also rose by 1.5% over the quarter and was up 0.9% over the year. And most importantly for Australian workers, average compensation per employee rose by just 1.6% in the year to March, and remained negative by 0.3% after adjusting for inflation (1.9%). It was 0.4% in the quarter. Plus, the household savings ratio continued to fall, down another 0.2% to 2.1% – the lowest reading in the post-GFC era. And what consumption there was went to necessities like electricity and fuel.

So my take is that while there is a glow of headline growth above 3%, in truth, its mainly migration led, plus a convenient shift in export prices, and a rise in government investment. Private sector business investment is sluggish, and households continue to reel from low wages growth and rising costs as signalled by falling savings, and a rise in debt. Not such a good story then.

This is confirmed by the retail turnover figures, also out this week. The ABS data, rose 0.3 per cent in April 2018 following a similar rise the previous month. Compared to April 2017 the trend estimate rose 2.6 per cent, above income growth. Across the categories, food retailing was up 0.4%, household good up 4%, other retailing 0.2%, Cafes and takeaway food 0.1%, department stores down 0.1%, clothes and footwear down 0.2%. Across the states, the trends were strongest in NT up 0.7%, ACT up 0.6%, NSW and VIC up 0.4%, TAS up 0.2%, QLD 0.1% and SA fell 0.1%.

Elsewhere on the elephant, we reported that Mortgage Stress Notched Up Again in May 2018. You can watch our Video “Mortgage Stress Updated – May 2018” where we discuss the details and walk though to top 10 most stressed postcodes across the country. Across Australia, more than 966,000 households are estimated to be now in mortgage stress (last month 963,000). This equates to 30.2% of owner occupied borrowing households. In addition, more than 22,600 of these are in severe stress, up 1,000 from last month. We estimate that more than 56,700 households risk 30-day default in the next 12 months. We expect bank portfolio losses to be around 2.7 basis points, though losses in WA are higher at 5 basis points. We continue to see the impact of flat wages growth, rising living costs and higher real mortgage rates.

The post code with the highest count of stressed households, was NSW post code 2170, the area around Liverpool, Warwick Farm and Chipping Norton, which is around 27 kilometres west of Sydney. There are around 27,000 families in the area, with an average age of 34. There are 6,974 households in mortgage stress here. The average home price is $805,000 compared with $385,000 in 2010. 64% of properties are standalone houses, while 22% are flats or apartments. The average income here is $5,950. 36% have a mortgage, which is above the NSW average of 32% and the average repayment is about $2,000 each month, so the average proportion of income paid on the mortgage is more than 33%.

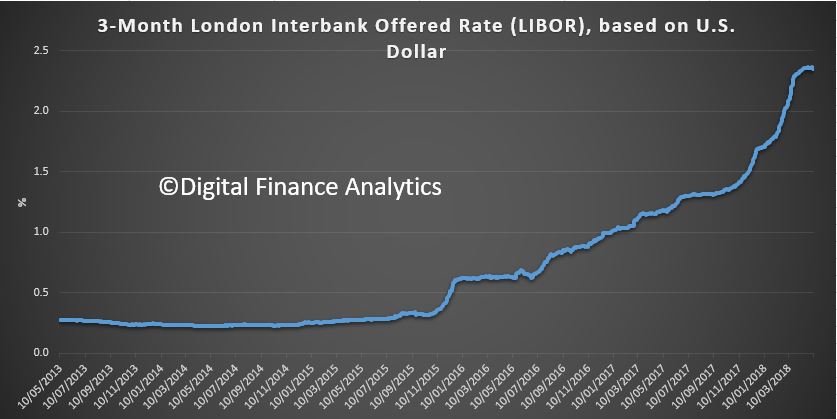

The RBA left the cash rate on hold again this week, no surprise, of course. But the pressure on rates are on the rise due to the rising borrowing costs in the USA, and as reflected in the bond markets, and the local BBSW. Credit Suisse did a good job of dissecting the problem and they estimate that banks have something like a 0.5% – or 50 basis point gap in funding thanks to the changes in the rates. We discussed this in our video So, How Much Pressure on Bank Margins Now and look the RBA’s recent outing where they sought to explain away the pressure on rates. But Credit Suisse concludes:

The key issue is that the pipeline of out of cycle rate hikes is growing, with no end in sight until the RBA resolves the pricing mystery in the interbank market. There is too much pipeline pressure for adjustment to be borne by just one lever of credit creation, because interbank spreads are so persistently, and mysteriously wide. But recent commentary and the lack of responsiveness of interbank spreads to liquidity injections suggests to us that the Bank is no closer to resolving the mystery than it was in April, when it first noted tightening. The sheer depth of the pipeline of out of cycle rate hikes due to elevated funding pressures is beyond what policy makers are currently envisaging. To be sure, Banks do not have to hike rates out of cycle, or limit pass through of potential RBA rate cuts to end borrowers. They could cut deposit rates. Or they could take a hit to profitability, effectively passing on the funding pressure to shareholders rather than borrowers. But interestingly: 1. RBA work suggests that there are non-linearities in pass through when cash rates fall, precisely because deposit rates are already so low. As the cash rate falls, the relative cost of low/no interest fixed deposits increases. Substitution out of higher yielding deposits into low/no interest fixed deposits offsets this increase in relative cost – but there is a limit to the offset once the cash rate falls too far. 2. If margins take a hit, or are likely to take a hit, potentially banks could tighten lending standards even more aggressively than they currently are doing. Interestingly, interbank credit spreads currently point to a much sharper fall in loan approvals than our proprietary credit conditions index, based on publicly available data on bank lending standards. In other words, the growth shock from incremental credit tightening may be just as bad, if not worse, than out of cycle rate hikes, or lack of pass through. The issue is that corporate credit spreads are unusually low in comparison with interbank credit spreads.

And UBS discussed whether banks are likely to be able to pull out from their current market price falls. Australian banks they say…

have now underperformed the Australian market on a rolling 3-year timeframe and the sectors PE discount to market ex-resources has widened to the most since 2008. They rightly argue that bank profitability and share market performance is all about credit growth, and indeed the high growth in loans helped offset the fall in interest rates in the past couple of years. They conclude “UBS’s work on the prospect of a tightening credit cycle (see Credit Crunch? Seven factors to consider) suggests the ability to rebound from the current earnings lull will be very difficult, even if one subscribes to a “soft landing” scenario for house prices, credit growth and the economy. Credit growth should at a minimum grind lower over coming years. Bank NIMs are likely to be under at least moderate pressure (given BBSW trends) while bad debts at absolute best will be a neutral influence. The muted earnings outlook suggests that one can subscribe to a soft landing for housing and the economy amid tighter credit but still adhere to a strategic underweight in the sector. Of course a sharper credit slowdown will compound the headwinds for the sector.

And the fact is, so far the RBA has never started a tightening cycle at a time when dwelling prices are declining, until now.

So we hold to our view that mortgage rate pressure is on, and that will put more pressure on home prices which continue to fall. The bellwether is of course the auction clearance rates, which CoreLogic reported as now hitting a final weighted average last week of 46.91%. The signs are clear as we head into winter that fewer properties are being sold, more are being passed in and the number for sale, is growing by the day. SQM Research said this week

We continue to see a shortage of properties available for sale in Hobart. But elsewhere, the story is different, with greater supply now evident in most capitals compared to a year ago, leading to slowing growth in property asking prices as supply increases. We are also seeing more property being listed in Melbourne compared to a year ago, which has taken pressure off asking property prices for houses and units, which fell over the month. Even in Hobart, price growth has slowed despite the ongoing shortage of properties for sale there.

Corelogic’s Index shows that in Sydney, values fell by 0.11% last week and average values have fallen declined by 4.8% over the past 39-weeks. But this is an average, and some more expensive properties are more than 15% down now from their peaks. Auction clearances in Sydney’s mortgage belt – which runs in a ring from the southern beaches though Canterbury-Bankstown, Parramatta and the North West – have collapsed deep into the 30%s.

Melbourne fell by another 0.07%, and dwelling values have now also declined by 1.7% over the past 27 weeks, but is still positive by 1.9% over the past year. Two points to make here, first again the top of the market is moving sharply lower, and second, we think Melbourne is 6 to 9 months behind the Sydney trajectory, but is firming in the same direction. We are in correction territory now, and falls will accelerate. And frankly as Sydney and Melbourne contain the bulk of the population and property, what happens in these two states will set the tone elsewhere.

This week we heard about criminal proceedings against CBA relating to the AUSTRAC sage, which, subject to count approval will be settled at $700m plus costs. A big number perhaps, but much smaller than might have been the case and hardly enough to be a real deterrent. We discussed this in our separate video and podcasts “What The CBA AUSTRAC Settlement Means”.

And the ACCC is going after ANZ, plus Deutsche Bank and CitiGroup’s investment banking arms alleging they engaged in cartel-like behaviour relating to a share placement in 2015. We discussed this in our post “Now Investment Banking Is Under The Microscope”, available on YouTube or via Podcast.

And talking of YouTube, we ran our first livestreaming Q&A session last Tuesday, with a couple of hundred people joining in. You can watch the 1:20 programme on replay on YouTube including the live chat, or listen to the podcast version. Thanks to everyone who joined in, and for those who sent questions in advance. I have to admit, we did not cover them all, so I will plan an extra offline session to answer some of the outstanding questions in the next few days. We will plan another live Q&A session in a couple of months, so watch out for that too.

Before we finish, a quick scan of the global financial markets – as I have received feedback that this part of the weekly reviews are well received.

First then, U.S. stock markets rose more than 1% this week but gains were held back in the latter part of the week somewhat as focus shifted to escalating trade tension between the U.S. and its key allies as the G7 summit got underway. U.S. President Trump refused to back down from his tough stance on tariffs, as he vowed to “fight” for the United States, and criticised allies, accusing them of imposing massive tariffs and creating non-monetary barriers. Tech was also one the stories of the week after coming under pressure on Thursday and Friday as Facebook and Apple fell. Apple fell nearly 1% Friday on reports the iPhone maker warned its supply chain to make fewer parts for iPhones in the second half of 2018 amid expectations for lower sales. Shares of Tesla rallied sharply this week after CEO Elon Musk said it is “quite likely” Tesla will hit a weekly Model 3 production rate of 5,000 cars by the end of June. The S&P 500 closed more than 1% higher for the week at 2,779.03.

Crude oil prices posted a third straight weekly loss after settling lower Friday on concerns about ongoing U.S. output after data showed the number of U.S. oil rigs continued to climb. Oil price action was choppy for most of the week as OPEC members attempted to allay fears the oil cartel would lift limits on production curbs at its June 22 meeting. U.S. oil output, meanwhile, continued to rise as the Energy Information Administration said Wednesday U.S. oil output rose to a record 10.8 million barrels per day. Oil prices were also limited by a weekly Energy Information Administration report showing U.S. crude supplies unexpectedly rose by 2.072 million barrels in the week ended June 1. Crude futures settled 22 cents lower on Friday as data showed U.S. oil rigs continued to climb, pointing to signs of growing domestic output.

The US dollar posted its first weekly loss in four weeks despite expectations the Federal Reserve will hike rates next week for the second time this year. 33.8% of traders expect the FED to hike rates for a fourth time at its December meeting, up from under 30% last week. The Federal Reserve will also release its summary of economic projections outlining expectations for key measures of the U.S. economy including inflation, interest rates, unemployment and GDP. The dollar was held back by a resurgent euro as European Central Bank policymakers stoked expectations the ECB would tighten monetary policy sooner rather than later. The dollar rose 0.12% to 93.54 against a basket of major currencies on Friday.

Locally, the Aussie Dollar held at 76 cents to the US dollar.

Gold prices bounced back from a weekly slump as dollar weakness encouraged buying, which was tentative, however, with a widely expected Fed rate hike on the horizon. Gold prices were unable to capitalise on rising geopolitical tensions as U.S. President Donald Trump went into the G7 meeting expecting a frosty reception after lashing out at Canada and the European Union. Gold appeared to be in ‘wait-and-see’ mode through the week as trading was restricted to a narrow range ahead of the Fed rate decision and the release of the central bank’s economic estimates.

Bitcoin seesawed its way to end the week roughly unchanged as regulatory uncertainty continued to weigh on sentiment despite signs of increasing institutional demand for the popular cryptocurrency. A report this week that Wall Street giant Fidelity was eyeing a move into the crypto space, planning to create products that would push the market for bitcoin to the “next level,” attracted a muted reaction. Bitcoin rose to a high of $7,777.4, testing a price level which some have identified as resistance – price levels that trigger selling – before paring gains. On the regulatory front, SEC chief Jay Clayton said this week, bitcoin was not a security, and further clarified the U.S. financial watchdog’s position on initial coin offerings, or ICOs. Demand for cryptocurrencies modestly improved as data showed the total crypto market cap rose to about $342 billion, at the time of writing, from about $329 billion a week ago.

And so back to the elephant analogy. There are a number of lumps and bumps across the US economy which suggests that pressure is building. For example, the flatter US yield curve underscores the lift in short term rates, and there is more to come. Higher rates mean that individuals and corporations will have to pay more. This chart shows the growth in US personal debt and the fall in savings, a trend which have grown in the past decades. Debt has never been higher, and savings is through the floor.

And remember that the US Government will have to pay more for their debt. This is important because the US Government is financing almost 25% of US GDP, and you have to ask whether this is sustainable.

But we still expect US rates to move higher, putting more pressure on local rates here. And there are simply no signs yet of any improvement in wages, as costs go on rising. Meantime the tighter lending controls and lack of sales momentum will see prices fall further, and by the way ANZ was the latest to forecast bigger falls, so more are joining the chorus – but the question is still extent and timing. Our modelling suggests we will see more severe falls, and we will be discussing this in upcoming posts

But the bottom line is compared with what we have seen so far, more falls must be expected, with all the downstream consequences which follow.