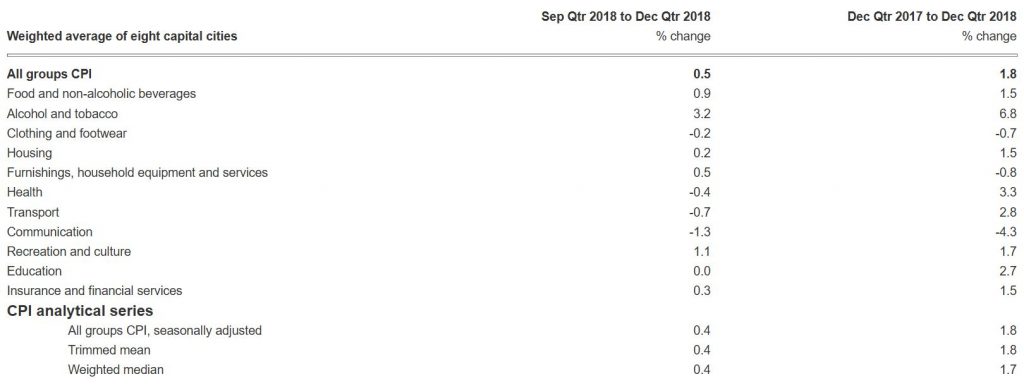

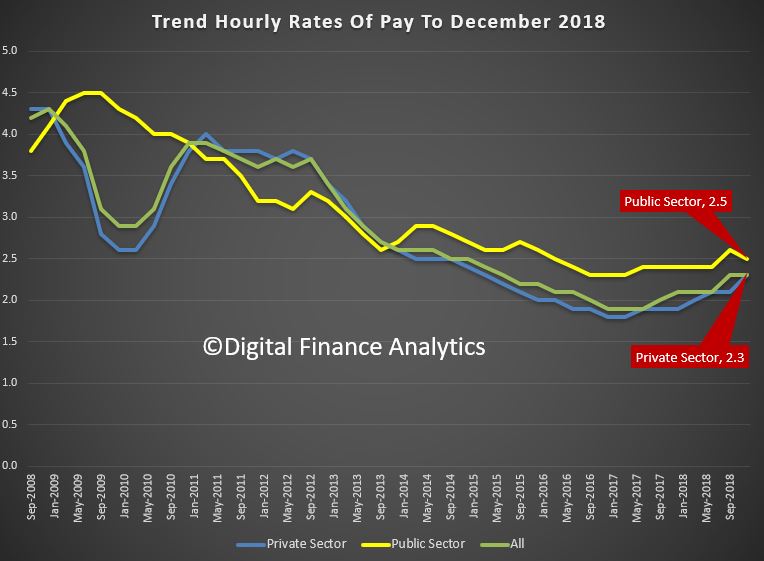

The trend Wage Price Index (WPI) rose 0.5 per cent in December quarter 2018 and 2.3 per cent through the year, according to figures released today by the Australian Bureau of Statistics (ABS). Growth remains anemic.

The trend quarterly rise of 0.5 per cent continues an extended period of moderate hourly wage growth. Annually, private sector wages rose 2.3 per cent and public sector wages grew 2.5 per cent.

ABS Chief Economist Bruce Hockman said that the annual rates of growth in the private sector have been lower than those recorded for the public sector over the last four years.

Remember that from last July the Fair Work Commission lifted the minimum wage by 3.5%. This factor impacted more than 2 million workers and has been responsible for lifting the overall results. But many households have seen no uplift at all.

In original terms, annual growth to the December quarter 2018 ranged from 1.6 per cent for the Information Media and telecommunication services industry to 2.8 per cent for the Electricity, gas, water and waste services and Health care and social assistance industries.

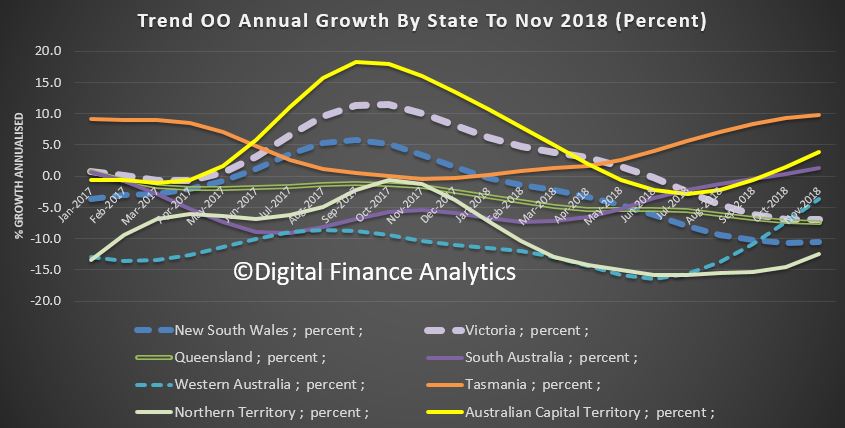

Western Australia once again recorded the lowest through the year wage growth of 1.6 per cent while Victoria recorded the highest of 2.7 per cent.

So if wages growth is stirring, its at the margin, and hardly noticeable.

In fact in a report from the Fair Work Commission, they recognised the slow growth rate.

“This report finds that trends in wages growth across the various measures considered have been fairly similar over the last 20 years. However, growth across these measures has been below the long-term average over the last five or so years,” it said, noting a relatively steady fall in growth rates since the global financial crisis (GFC).

Among the various reasons investigated by the report as potential contributors to low wage growth were the rates of unemployment and inflation, productivity, as well as “structural factors” such as changes across different industries, technology — particularly automation and the gig economy — and changes in employee bargaining power”.