APRA released the monthly banking statistics to end January 2019, and they show a further moderation in home finance lending to both owner occupiers and investors. In fact investment lending balances fell a little.

Its worth highlighting these are raw numbers, no seasonal adjustment, and are based on the returns sent from the banks (possibly data is late thanks to the holidays?).

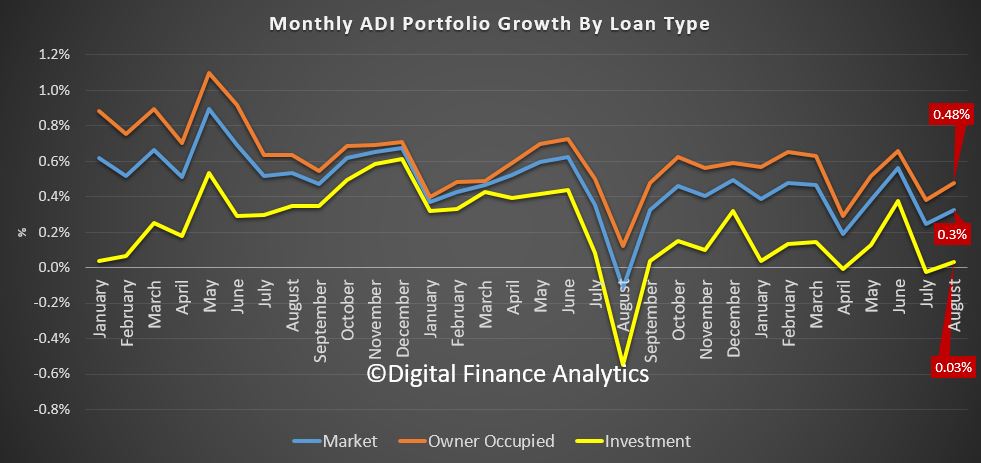

Nevertheless, it appears to show the credit impulse continues to slow, and this will translate into further home price falls ahead.

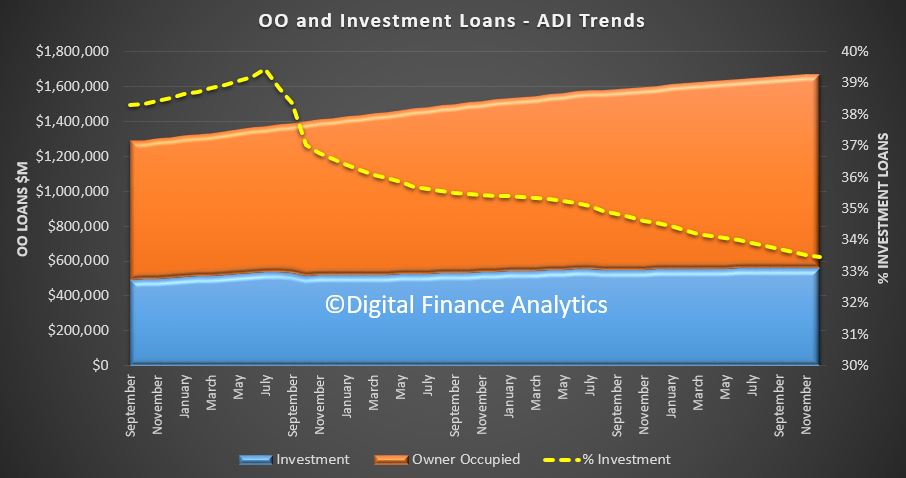

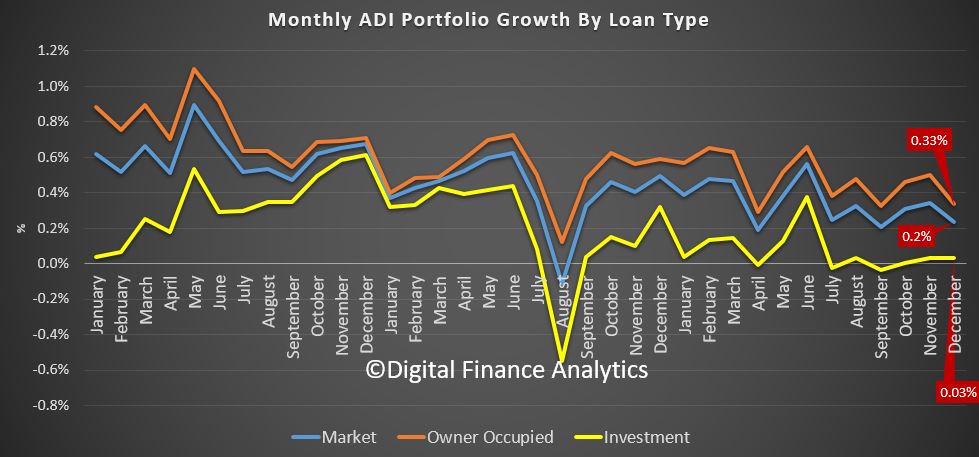

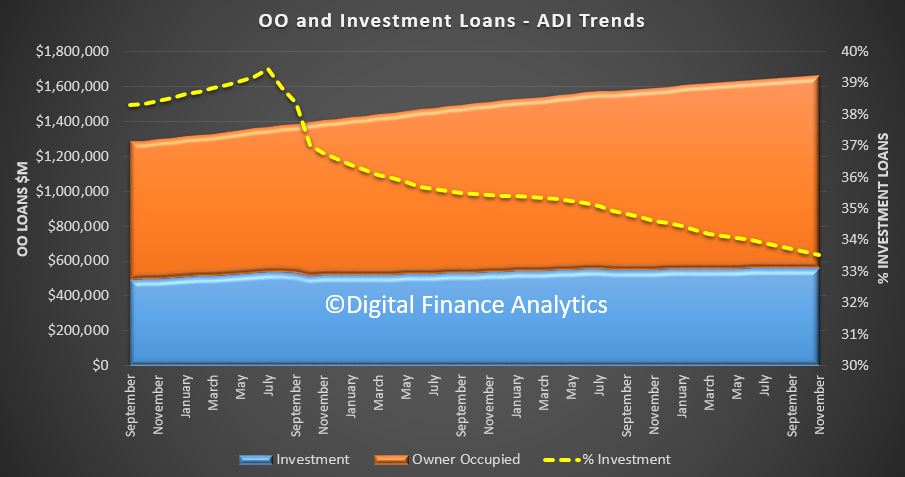

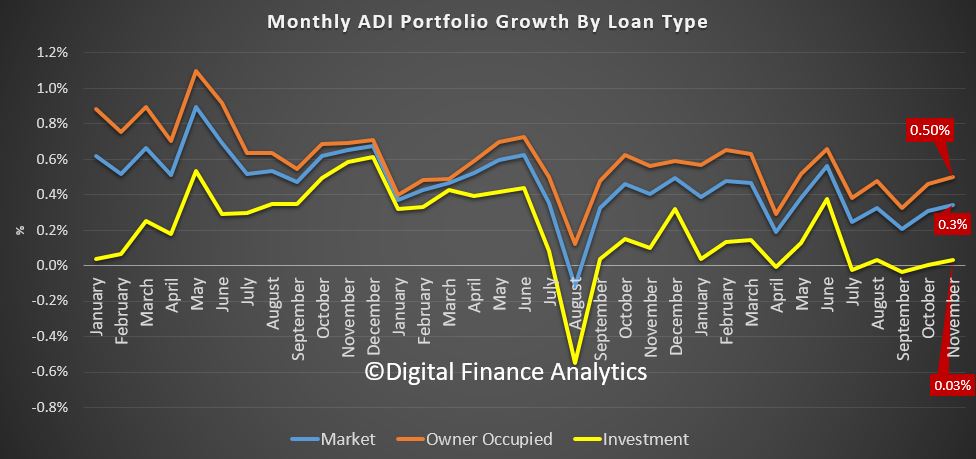

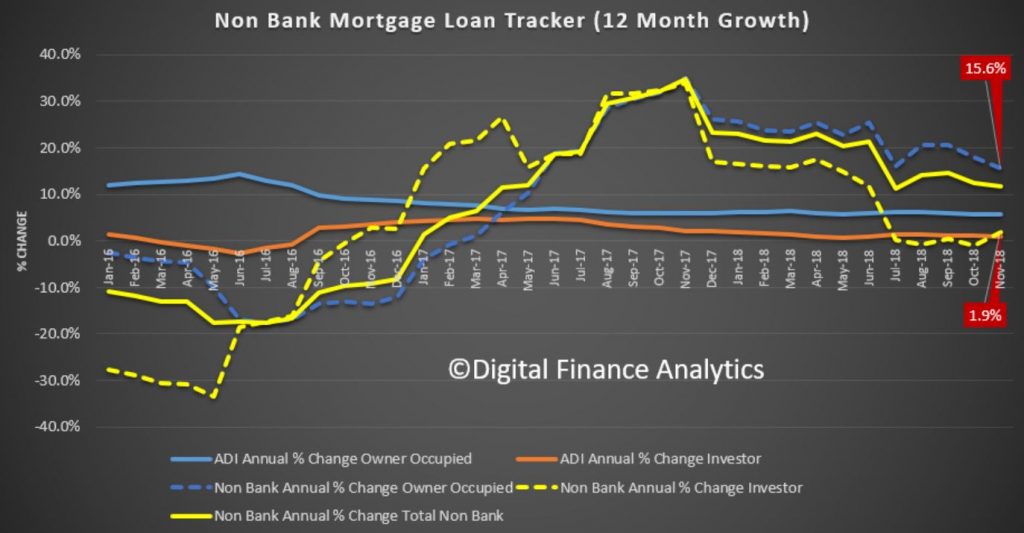

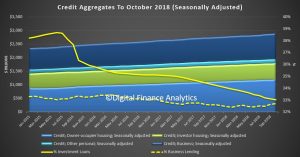

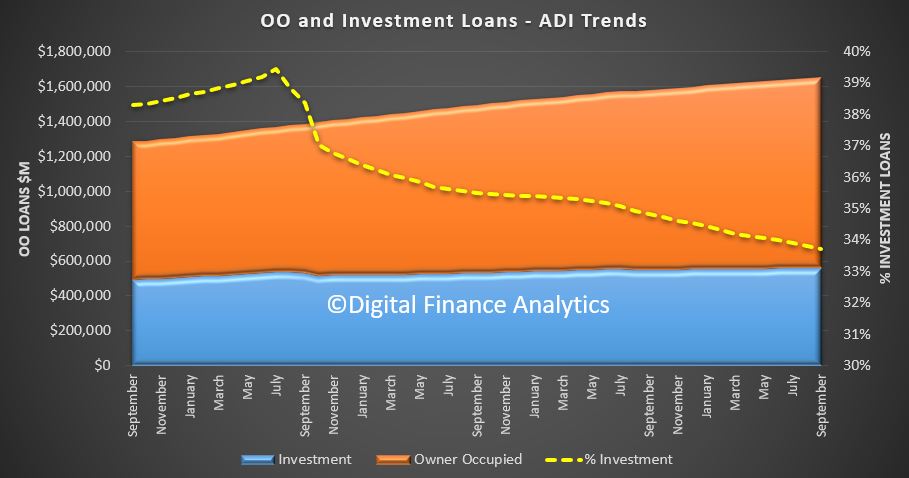

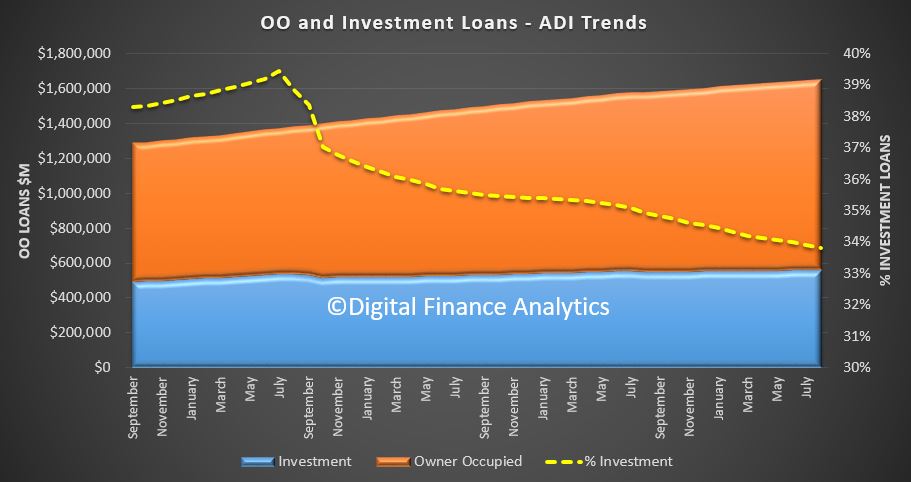

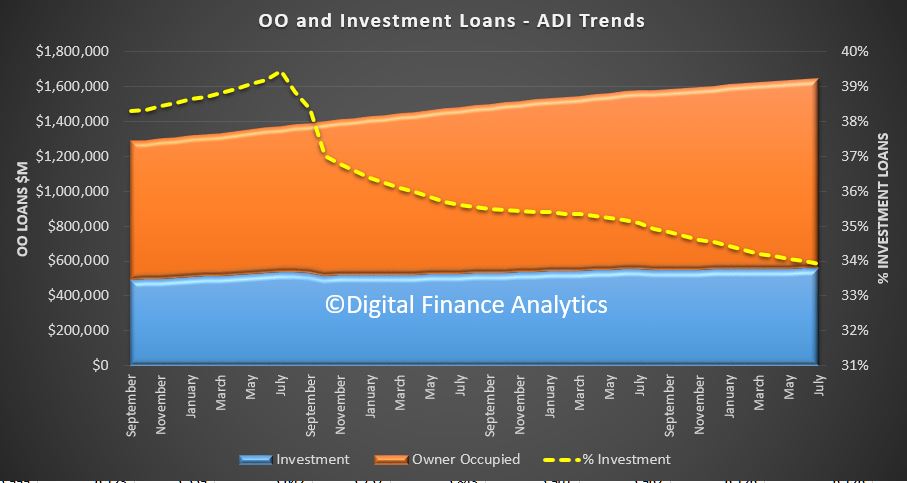

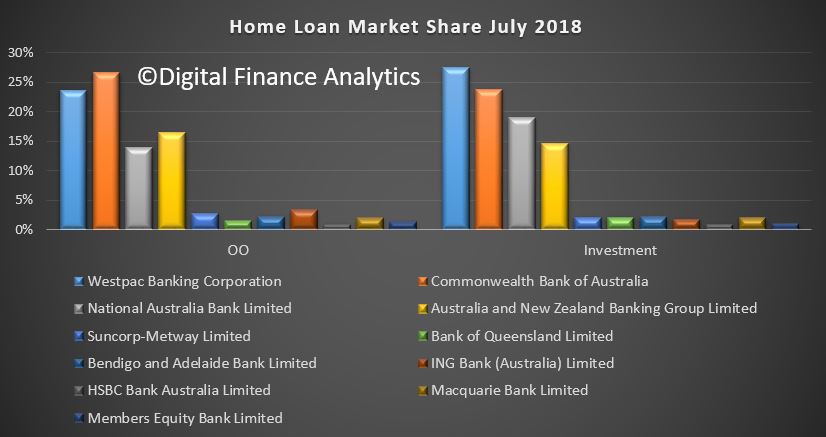

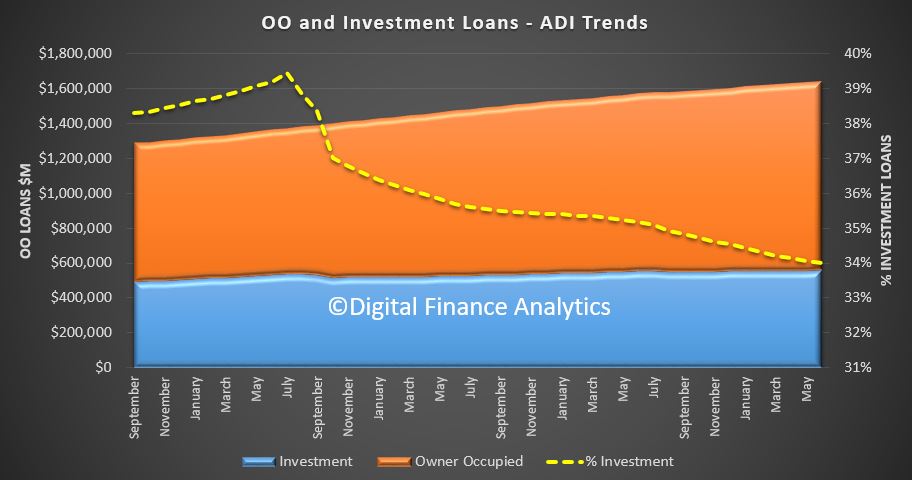

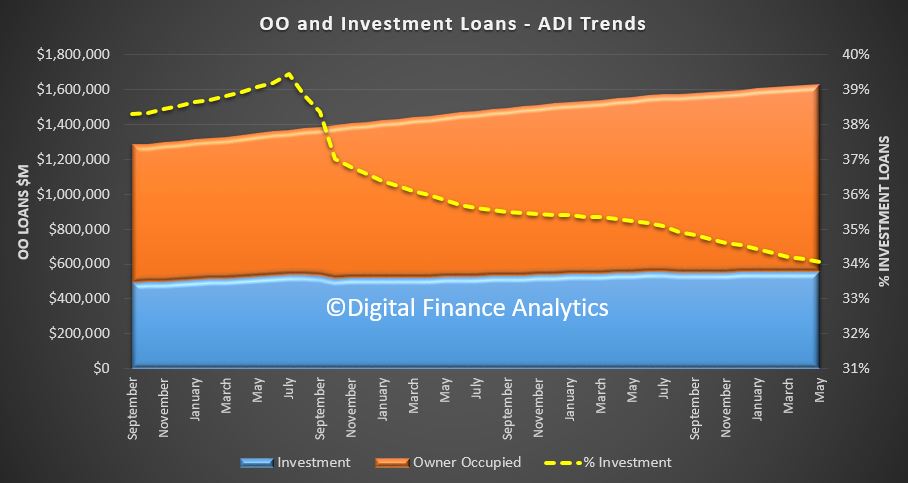

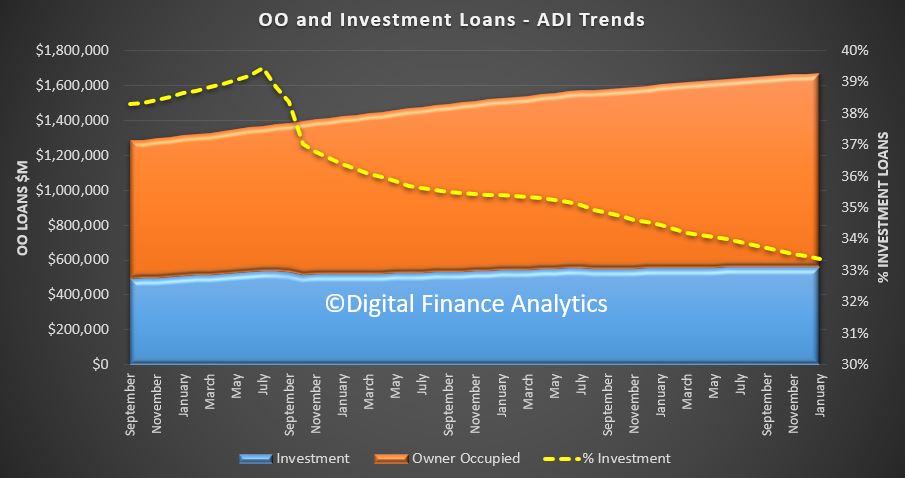

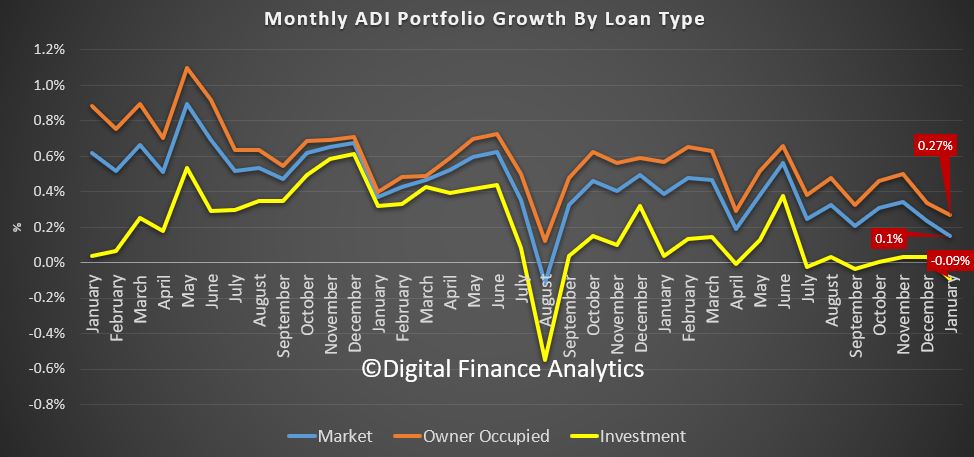

Overall the value of home lending from the banks rose 0.15% in the month, to $1.67 trillion dollars. This be be equivalent to an annual rate of just 1.8%. This is the lowest growth rate for years. Within that lending for owner occupation rose by 0.27% to $1.11 trillion dollars and lending for investment purposes FELL 0.09% to $557 billion. Investment loans comprise 33.37% of all loans on book.

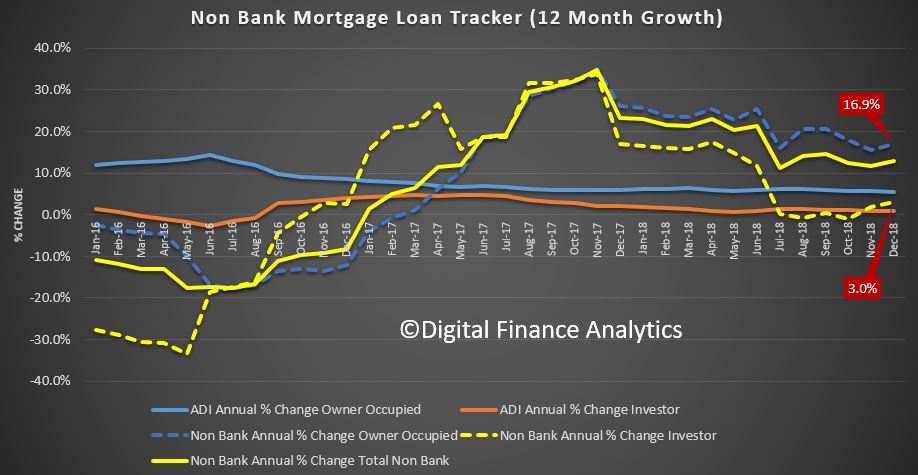

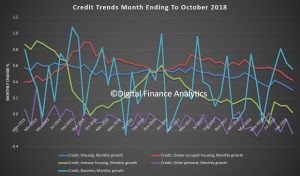

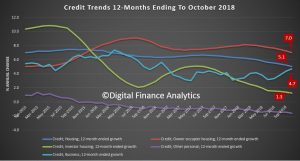

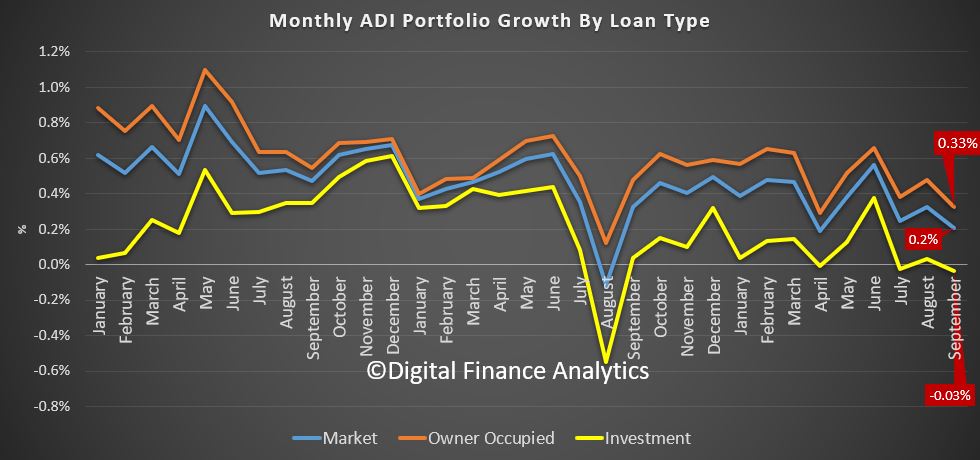

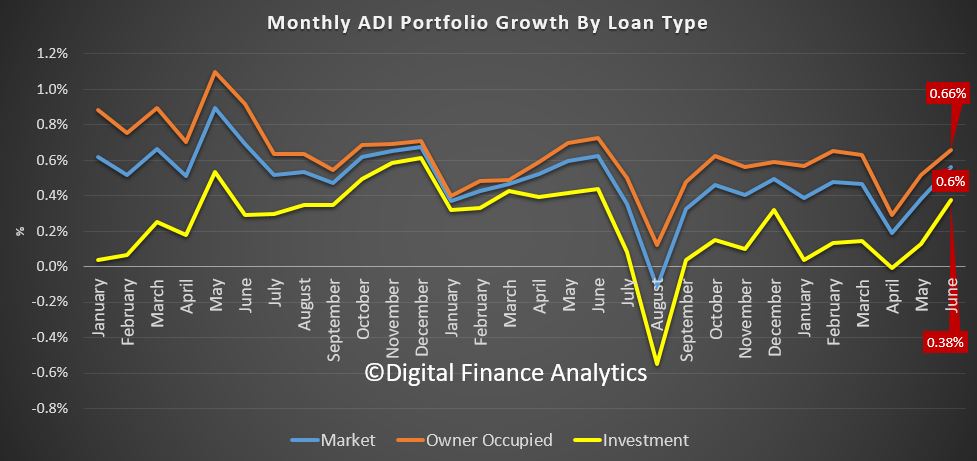

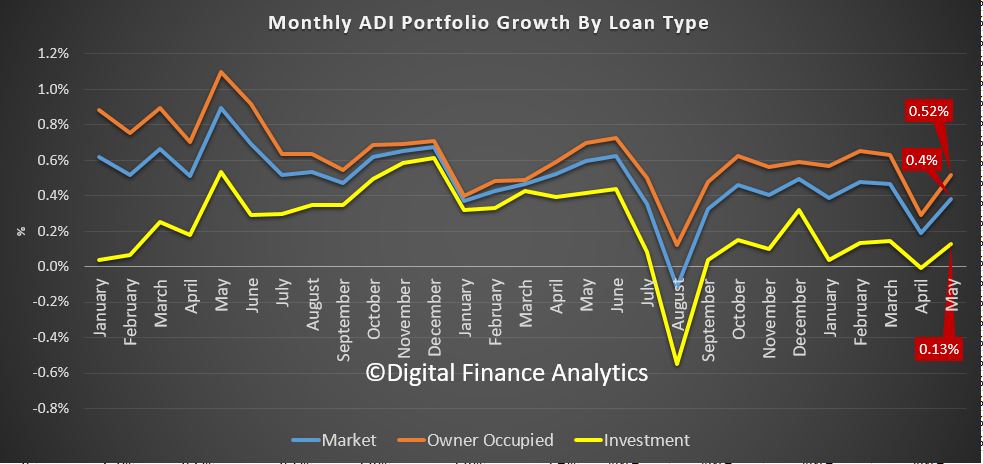

We can track the growth rates by category. Overall growth rates continue to fall across the board.

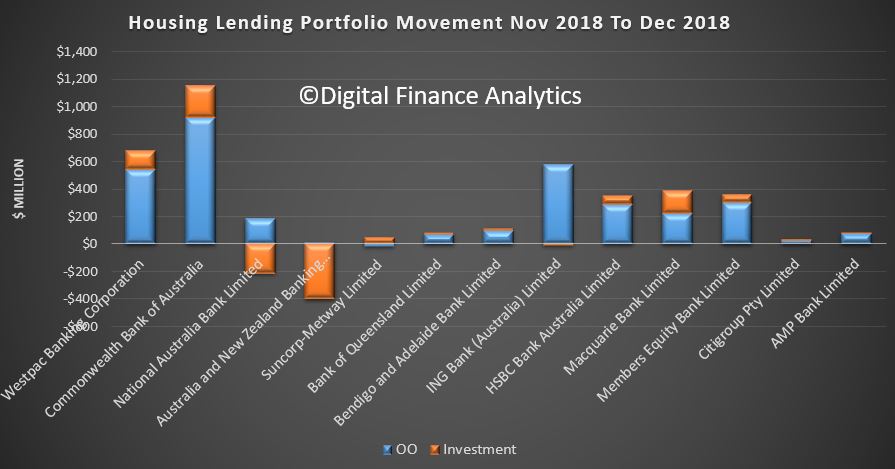

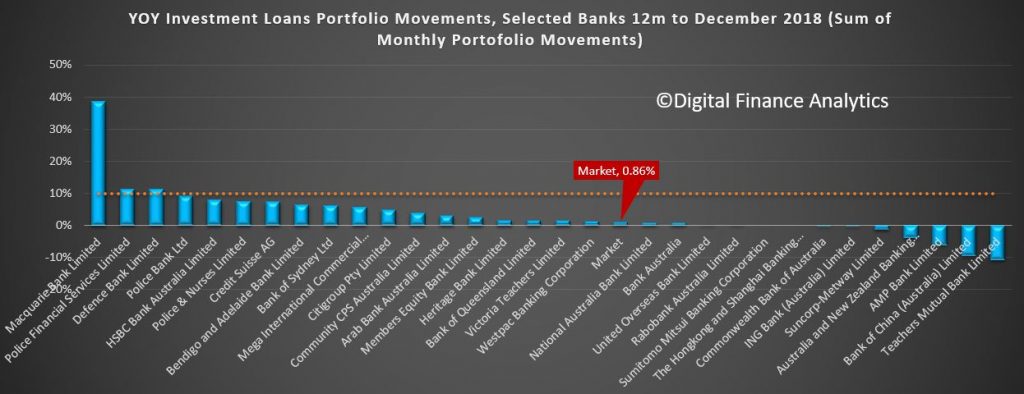

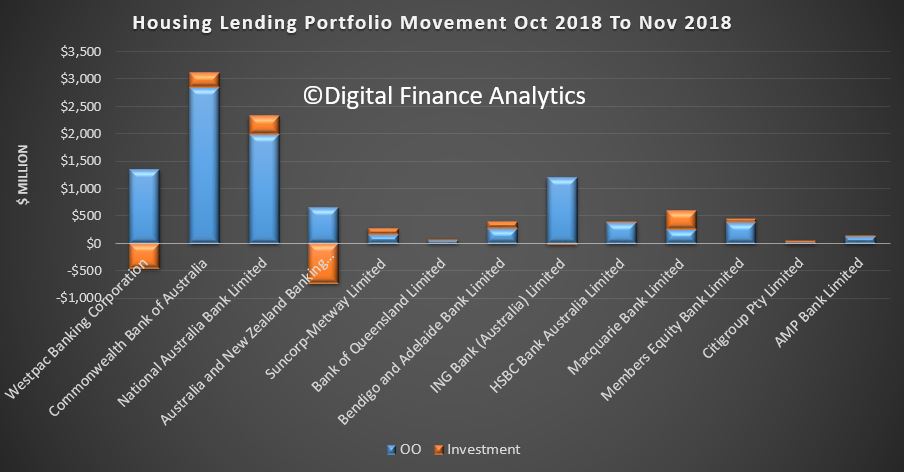

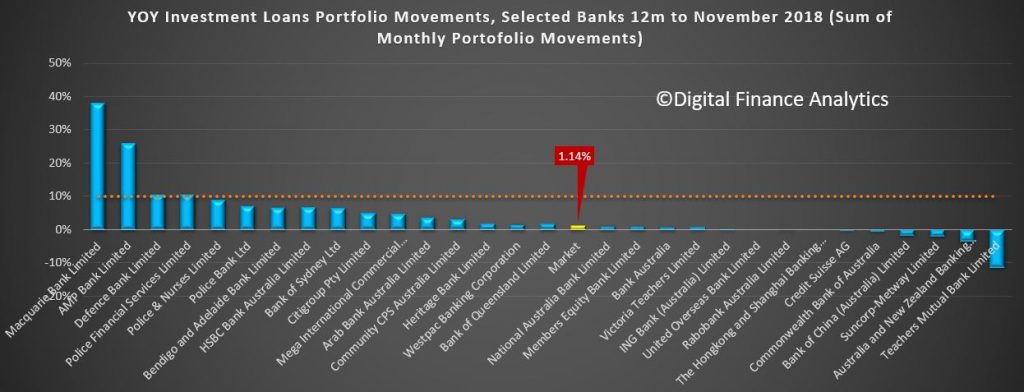

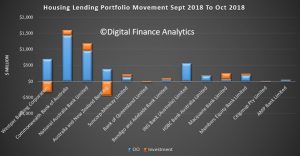

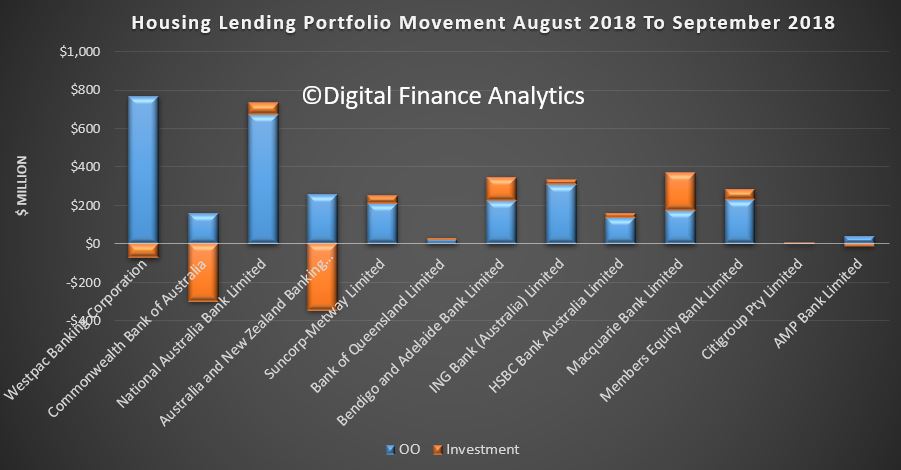

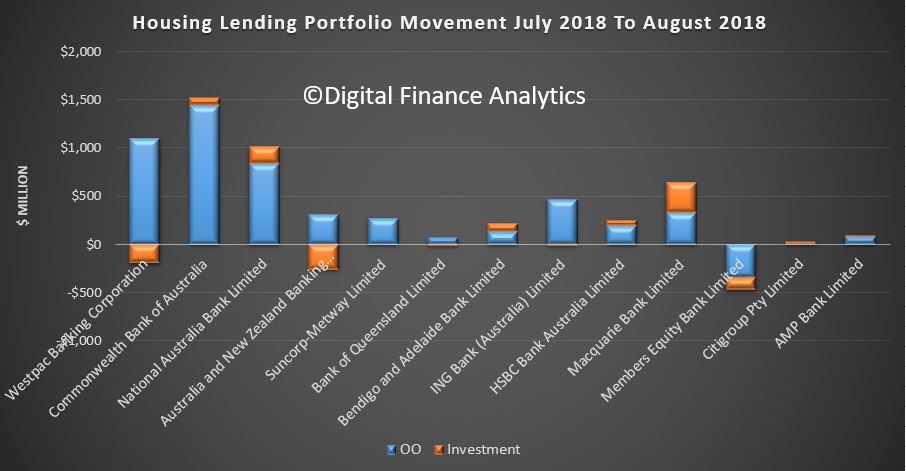

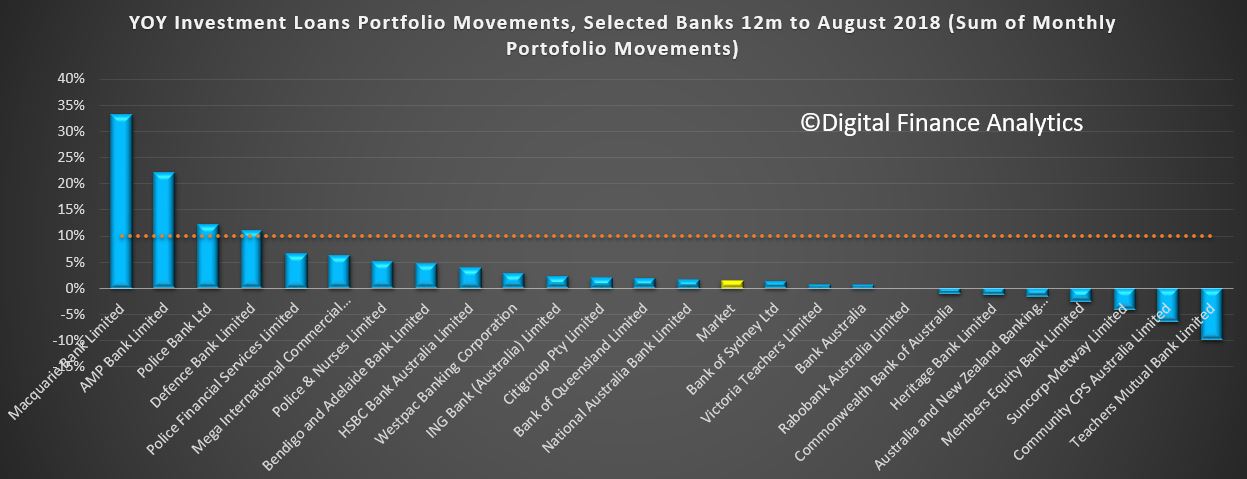

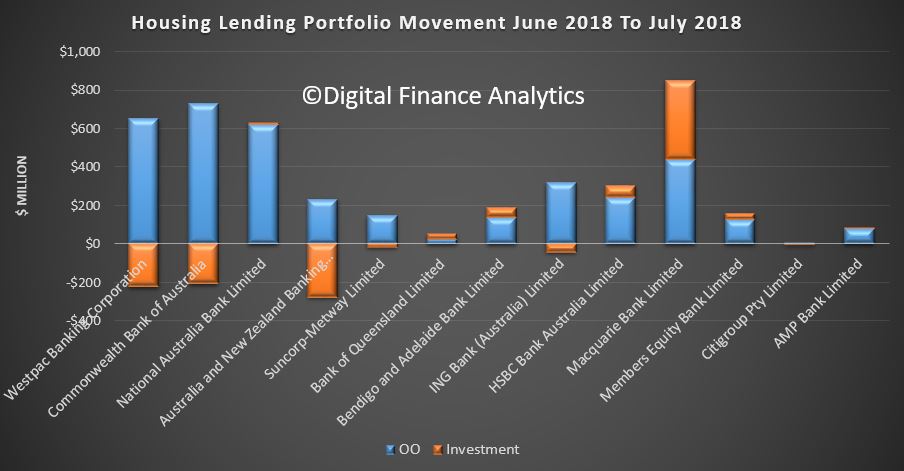

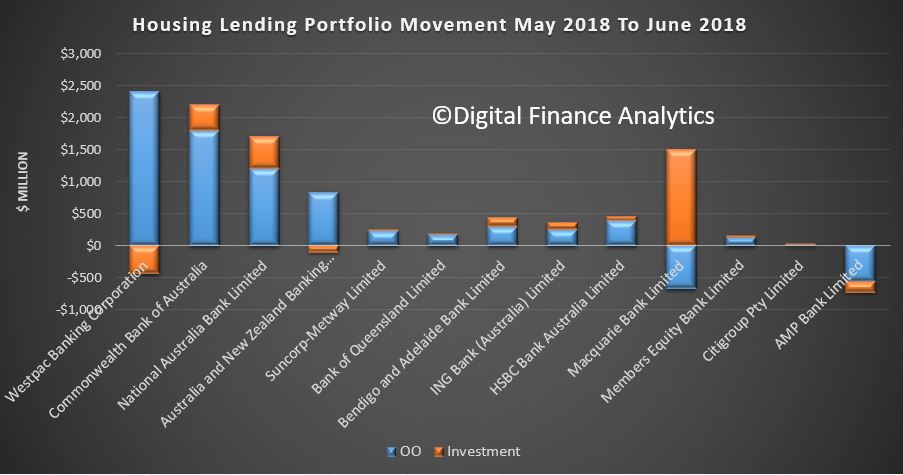

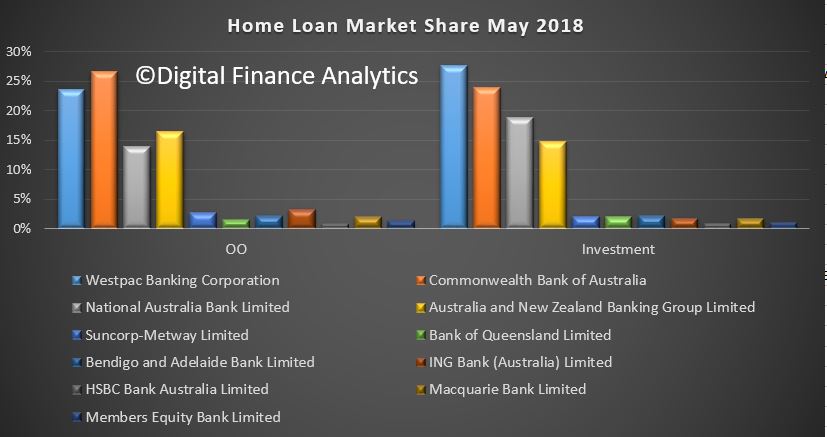

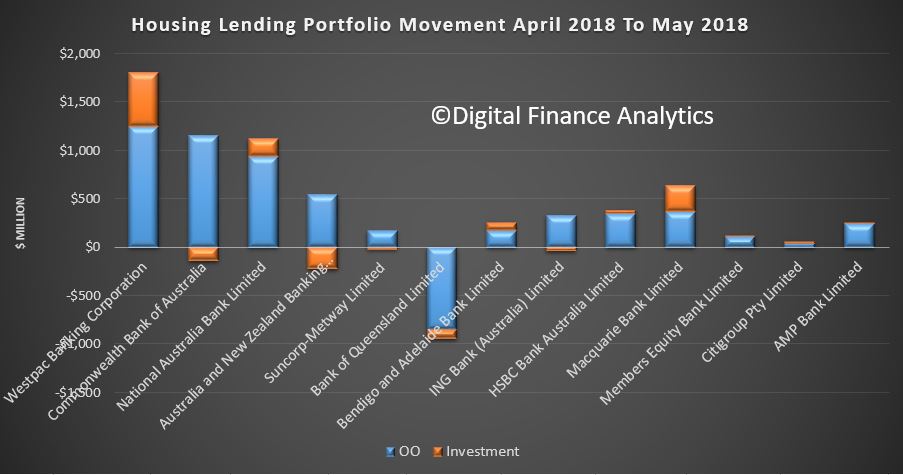

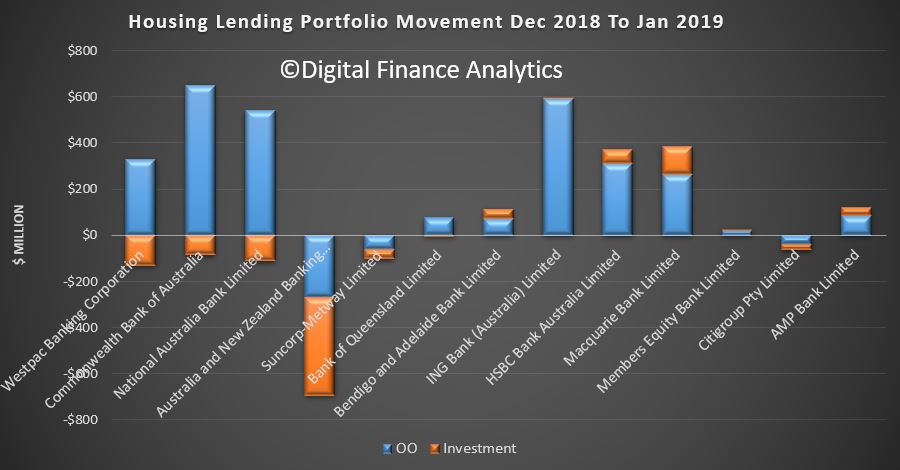

The individual movements within the banks makes interesting reading, with all the large banks seeing their investment lending pools shrinking, while Macquarie, HSBC and Bendigo/Adelaide Bank, plus AMP are taking up the slack. We hope they have adequate underwriting standards in place!

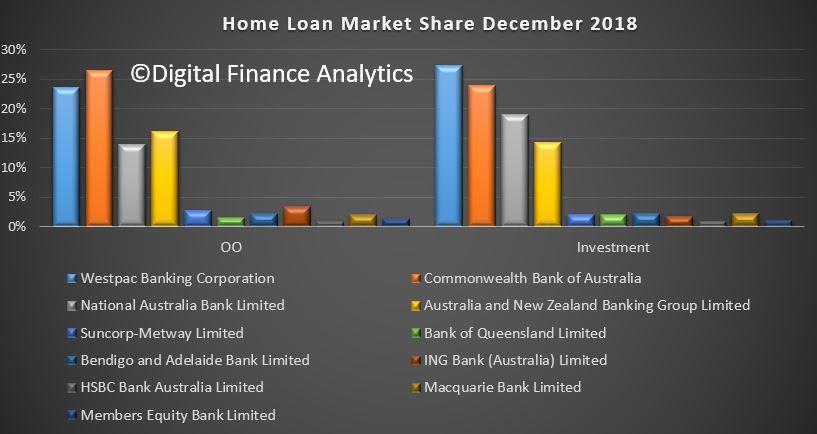

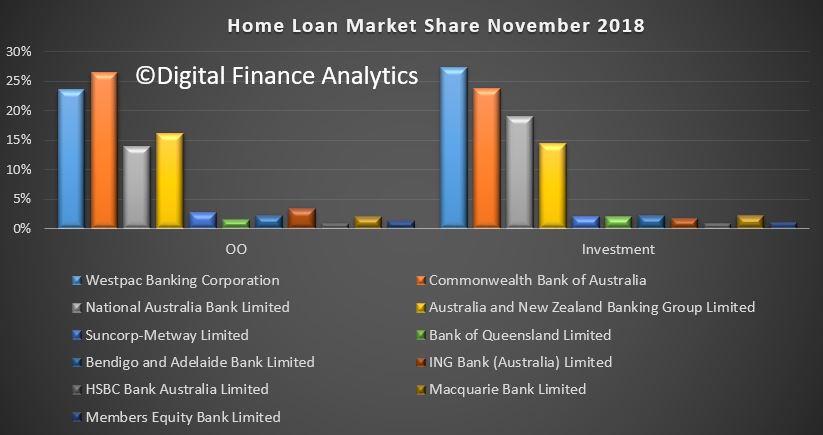

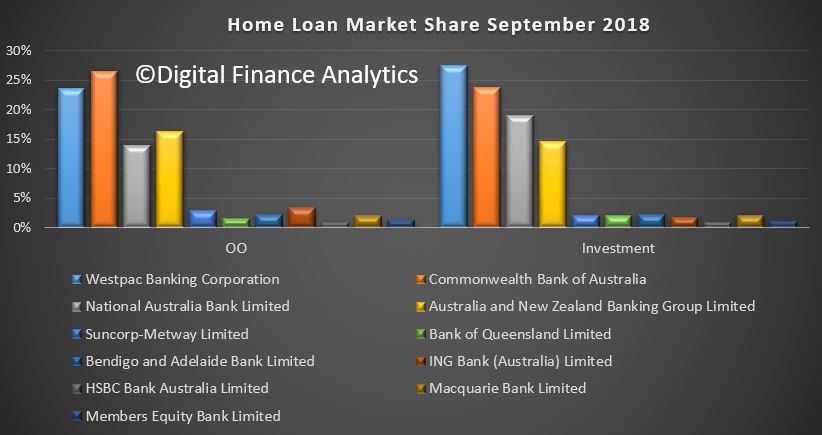

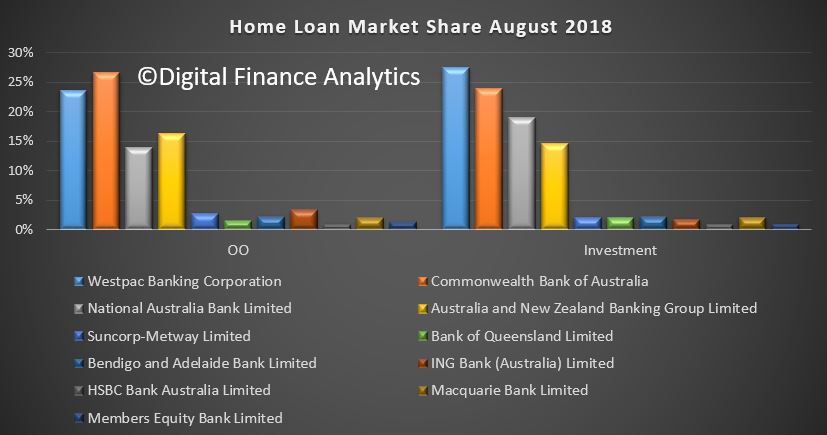

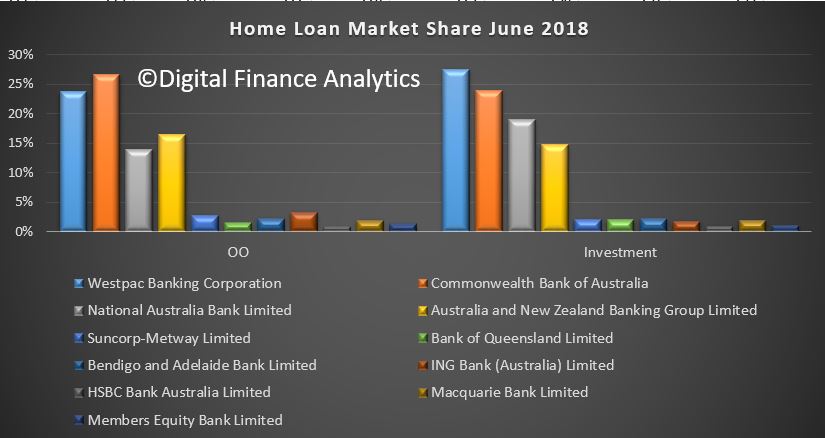

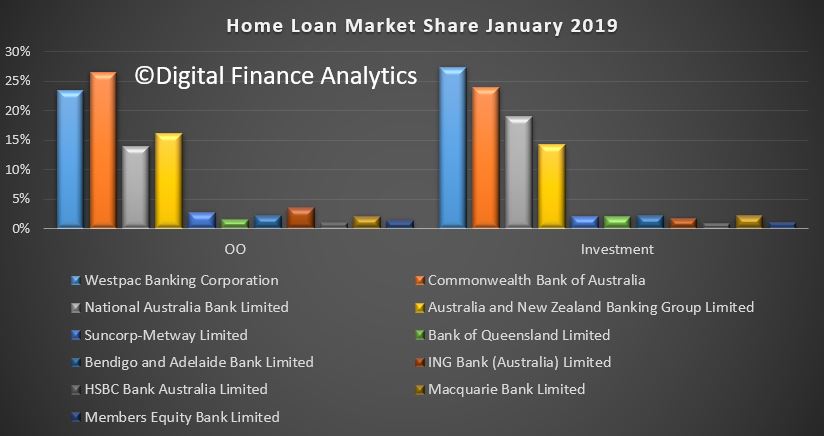

The portfolio movements remain pretty much the same, with CBA the largest owner occupied lender, and Westpac the largest investment loan lender.

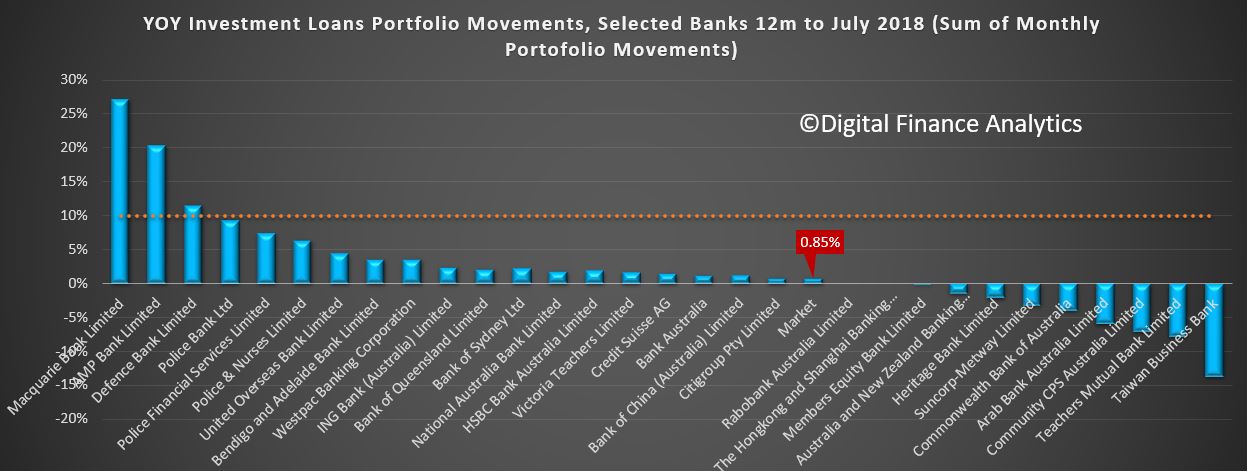

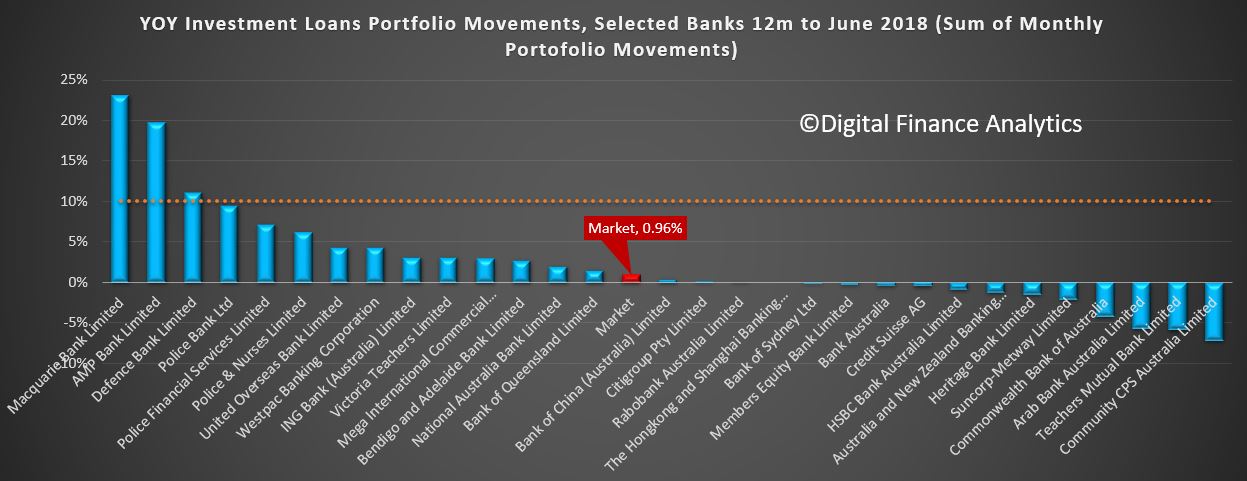

Whilst the 10% APRA speed cap is obsolete now, the annual movements show that the majors are well off the pace compared with some of the smaller lenders, and the market grew (based on monthly averages) by just 0.73%, with below zero growth rates in 4 of the past 12 months.

The investment lending party is well and truly over, but the hangover, in terms of big loans, interest only loans, and falling returns will be with us for years. The credit impulse is dying – prices will continue to fall as lending standards are normalised. Lets be clear, freely available credit inflated home prices, the reverse is also true. Short of breaking the responsible lending rules again, there is no way out.