Welcome to the Property Imperative Weekly to 1st September 2018, our digest of the latest finance and property news with a distinctively Australian flavour. Locally the bad news keeps coming, while US markets remain on the boil.

And by the way, if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

And by the way, if you value the content we produce please do consider joining our Patreon programme, where you can support our ability to continue to make great content.

Listen to the podcast, read the transcript, or watch the video show.

NineNews published an article this week, claiming that Sydney and Melbourne dwelling values “may soon rise again” because of a decline in dwelling construction, citing a report saying that the rate of construction is expected to slow down, with the number of new homes built set to fall by up to 50,000 each year. So they said, that would mean 20,000 fewer homes built across the country each year than the 195,000 needed to meet future demand.

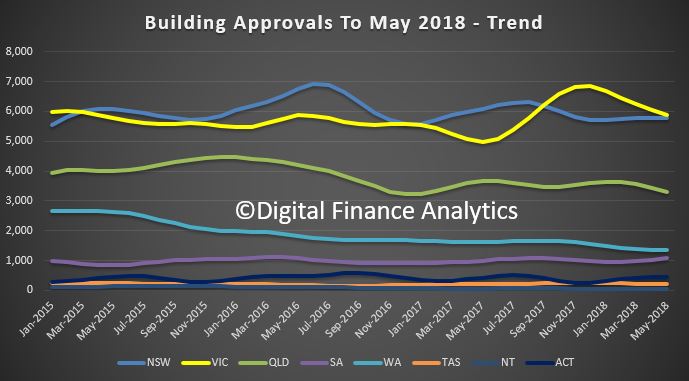

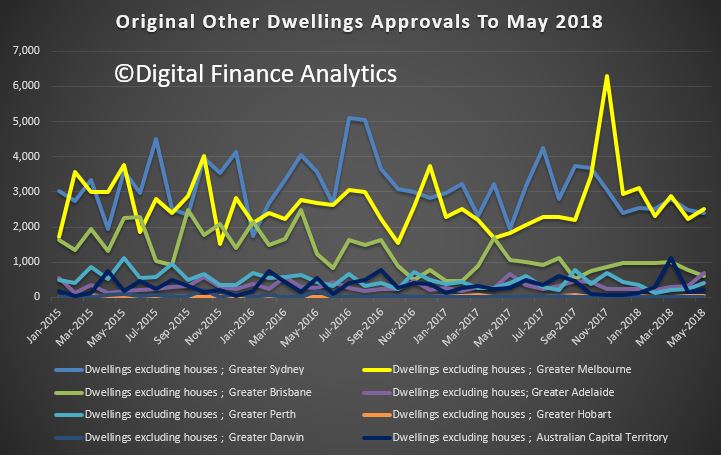

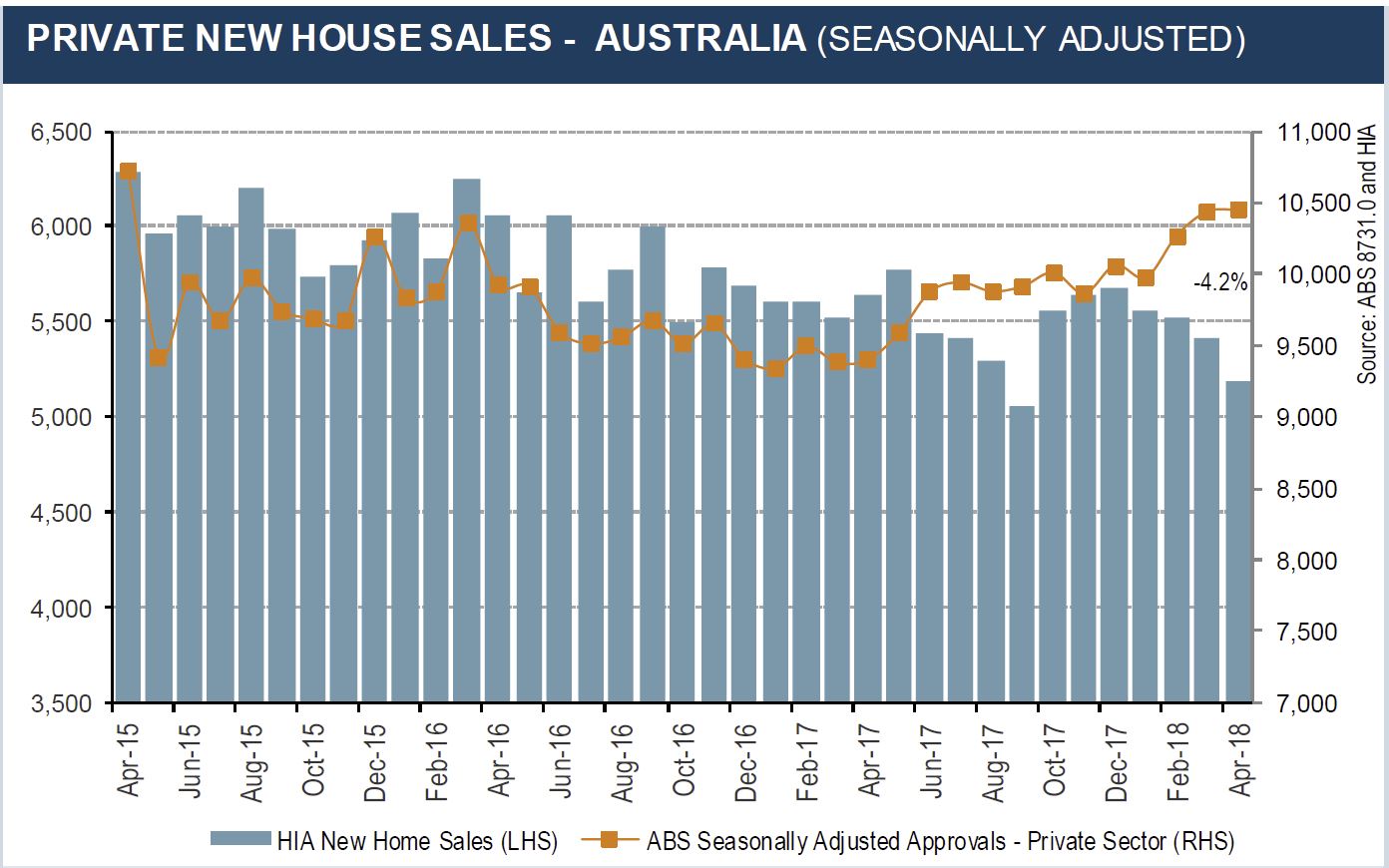

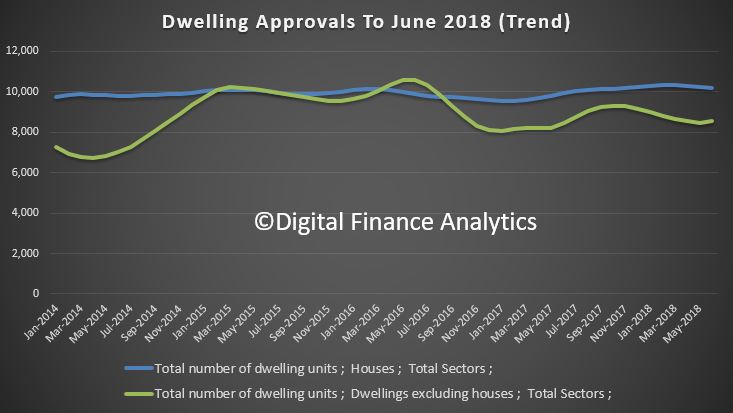

Indeed, the ABS reported this week that building approvals in July were 5.6 per cent lower than in the same month last year. Total seasonally adjusted dwelling approvals in July fell in New South Wales (-5.2 per cent), Victoria (-4.6 per cent), Queensland (-6.0 per cent), South Australia (-26.5 per cent) and Western Australia (-14.7 per cent). Seasonally adjusted approvals increased in Tasmania by 13.6 per cent. In trend terms, total dwelling approvals in July increased by 4.5 per cent in the Northern Territory and in the Australian Capital Territory (12.2 per cent).

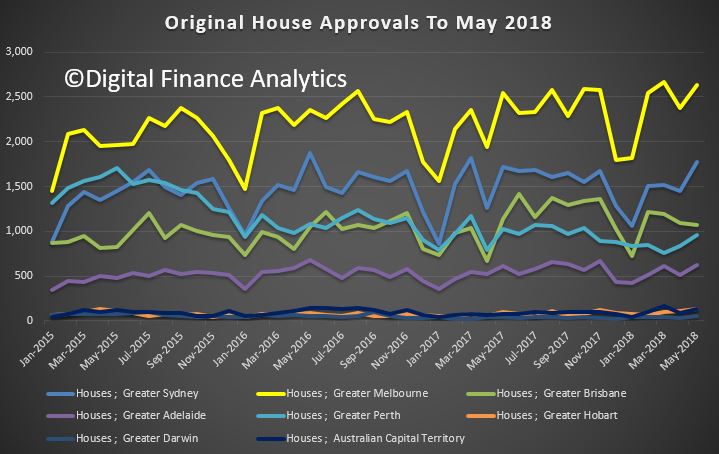

The data shows its high rise apartments which are slowing the fastest (in response to slowing demand from investors) but it is worth noting that the volume of approvals for new detached houses have been tracking around their strongest levels in 15 years. The HIA said that weaker conditions in a number of states have typically been overshadowed by strong activity in Victoria. With Victorian home approvals now showing signs of weakness they expect the national trend – of declining building approvals – will continue throughout 2018.

The HIA also reported on new home sales for July, saying that consistent with the trend for much of 2018, July saw sales fall by 3.1 per cent compared to the previous month. Sales in 2018 thus far are 6.1 per cent lower than in the corresponding time in 2017. The noticeable new trend is that new home sales in Victoria are weakening. Victoria has experienced exceptionally strong conditions, which have been sustained over a number of years, obscuring weaker conditions in a number of other states. With Victorian new home sales now showing signs of weakness we expect the national trend – of declining sales – will continue throughout 2018.

The Sydney market has also been cooling throughout the year particularly in the new growth areas. The high volume of new apartments in metropolitan cities are competing for first home buyers and resulting in a slowdown in new detached home sales. Other regions in New South Wales, such as the Hunter, around the ACT and South and North Coasts, are continuing to see strong growth. They say the market for new home sales across the country is cooling for a number of reasons including a slowdown in inward migration since July 2017, constraints on investor finance imposed by state and federal governments and falling house prices. They expect that it will continue to slow over the next two years due to the adverse factors now starting to take effect the market.

Specifically, they say that finance has become increasingly difficult to access for home purchasers. Restrictions on lending to investors and rising borrowing costs have seen credit growth squeezed. Falling house prices in metropolitan areas have also contributed to banks tightening their lending conditions which have further constrained the availability of finance. An increase in interest rates charged by banks, which had been anticipated, will accelerate the slowdown in sales and ultimately new home building activity.

The latest data from the RBA and APRA confirm the fall in credit, with the monthly RBA credit aggregates for July showing total credit for housing up 0.2% in the month, to $1.77 trillion, with owner occupied credit up 0.5% to $1.18 trillion and investment lending down 0.1% to $593 billion. Investment housing credit fell to 33.4% of the portfolio, and business credit was 32.5%. APRA’s data showed that investor loan balances at Westpac, CBA and ANZ all falling, while NAB grew just a tad. Macquarie, HSBC. Bendigo Bank and Bank of Queensland grew their books, highlighting a shift towards some of the smaller lenders. Suncorp balances fell a little too. You can watch our separate video “Rates Up, Lending Down”, for more on this.

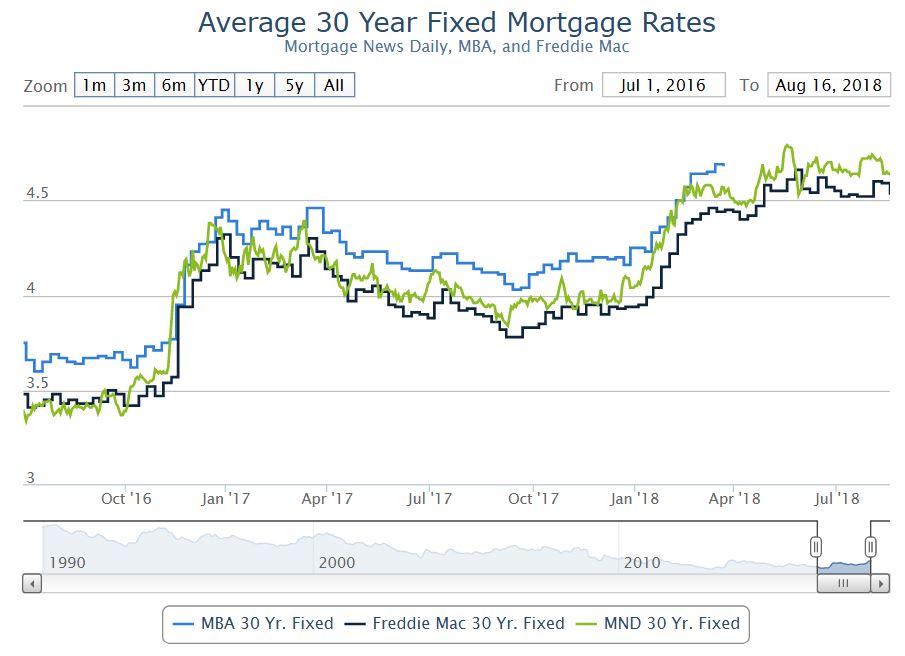

And of course we saw more out of cycle rates hikes from Westpac, who lifted variable rates for owner occupies and investors holding loans with them by 14 basis points – see out video “Westpac Blinks” for more on this – where we discuss the margin compression the experienced, thanks to rising international funding rates (see the BBSW) and the switch from interest only to principal and interest loans. Then on Friday, Suncorp and Adelaide Bank, both of whom had already lifted a couple of months back, lifted again. As I said yesterday, what is happening here is that funding costs are indeed rising. But the real story is that they are also running deep discounted rates to attract new borrowers, (especially low risk, low LVR loans) and are funding these by repricing the back book. This is partly a story of mortgage prisoners, and partly a desperate quest for any mortgage book growth they are capture. Without it, bank profits are cactus. Once again customer loyalty is being penalised, not rewarded. Those who can shop around may save, but those who cannot (thanks to tighter lending standards, or time, or both) will be forced to pay more

Damien Boey at Credit Suisse, writing before Suncorp And Adelaide Bank moved again said Westpac was the latest of the banks to hike variable rates across new and existing customers, following similar moves from BOQ, BEN, MQG and SUN over the past few months. Not only are out of cycle rate hikes broadening out across the system – we think that they will continue to broaden out across the majors, and become a recurring theme. This is because:

- Money market rates are a significant driver of the marginal cost of funds. Arguably, the banks that have hiked out of cycle to date have been more exposed to money markets than the banks that have not. Therefore, money market stress has had a bigger impact of their profitability, putting more pressure on them to hike rates. However, if there are question marks about why certain systemically important banks are facing liquidity or credit problems, then funding costs must inevitably rise for everyone, even if we are only talking about small, but fat tail risks. Also, RBA research suggests that as rates approach the zero bound, the relative cost of no/low fixed rate deposits increases to the point that perversely, margin pressures can emerge.

- Interbank spreads should be negligible unless … If a central bank targets a cash rate like the RBA does, it must be willing to provide any and all reserves that the banking system needs. In other words, it must be the lender of last resort. And if it is possible to obtain reserves from the RBA in almost any situation, there should be no need to borrow them from other banks. In turn, the spread of bank bill swap rates (BBSW) to overnight indexed swap rates (OIS, the risk free rate), should be negligible. Unless of course, there is counterparty credit risk over and above liquidity risk. Interestingly, the RBA has gone out of its way recently to remind the market that it is indeed the lender of last resort. But the BBSW-OIS spread remains elevated at European crisis highs, around 45bps.

- Wide interbank spreads are hard to explain using conventional factors. For as long as there is a pricing premium mystery, there is no visible end to the cycle of out of cycle rate hikes. Interestingly, in its August Statement on Monetary Policy the RBA provided some alternative explanations for wide interbank spreads, after witnessing the USD liquidity narrative break down in recent months. But even Bank officials do not find these explanations convincing. Therefore, the mystery remains unresolved.

- The marginal funding cost drives the change in the average funding cost. Therefore, we do not need to forecast further increases in the BBSW-OIS spread to have conviction that banks will continue hiking rates out of cycle. We only need to know that the BBSW-OIS spread will persist at wide levels. Again, for as long as there is uncertainty about why the spread is so wide to begin with, it is hard to argue with conviction that spreads ought to narrow and normalize.

Even after some banks have hiked rates out of cycle, we still think that in aggregate there are more than 50bps of variable rate mortgage hikes in the pipeline based on already known developments in the money market. But the RBA only has 1.5% worth of rate cut ammunition left in its bag of tricks.

This means that the RBA has lost some autonomy over the monetary transmission mechanism, because effective borrowing rates can rise independently of the cash rate. In particular, Australian-US yield differentials are likely to further invert, undermining the carry trade appeal of the AUD/USD. The Fed still seems quite determined to hike rates. But the RBA is unlikely to be matching the Fed’s hawkishness given the slowdown in train, and given what the banks are doing to rates and credit supply.

So we are in for a period of more out of cycle rate rises, as well as tighter lending standards. No surprise, then that refinance rejections are rocketing, as we reported this week, and mortgage prisoners are getting locked in. The ABC story even got picked up by ZeroHedge in the US.

So back to that NineNews report, they missed completely the real reason why home prices are falling, it’s all about credit availability. Lending standards are tighter now – borrowing power is reduced, and so new loans are only available on tighter terms. If you want to understand the link between credit and home prices, which is still not widely understood, I recommend you watch my recent conversation with Steve Keen, who explains the mechanisms involved, and the policy failures behind them. See “Are Icebergs Fluffy? … A Conversation with Steve Keen”. This show has already become one of the most popular in the site, and it is really worth a watch.

The upshot though is home prices are likely to continue to fall. CoreLogic’s dwelling price index showed another fall in August, recording a 0.38% decrease in values at the 5-city level. This is the 11th consecutive monthly decline in home values, down a cumulative 3.4% over that period at the 5-city level: Quarterly values also fell another 1.3% In the year to August, with home values down by 3.09% at the 5-city level, driven by Sydney (-5.64%). Significantly, Perth’s housing bust continues to roll on, with dwelling values now down 13% since peaking in June 2014 after falling another 0.6% in August: the cumulative loss in values at 13% is greater than the 11.5% peak-to-trough falls experienced between 2009-09, and the duration of the downturn has hit 50 months – more than twice as long as prior downturns. Plus, rents there have similarly fallen, with median asking rents down 29% for both houses and units since June 2013.

My theory is, where Perth has gone, other centres are likely to follow as the great property reset rolls on. Melbourne and Victoria is deteriorating significantly, and remember there net rental yields are some of the lowest across the country. No, prices are not likely to recover anytime soon.

And if you want further evidence, auction clearance rates remain in the doldrums. It is interesting to see now the main stream media is beginning to talk about this, and I have been busy this week with interviews on Radio Melbourne, 2GB and elsewhere. Remember this is only the end of the beginning. I continue to believe 2019 will be a really bad year, what with more rate hikes, interest only loan switches, and decaying sentiment. As one industry insider told me this week, “some of my property investor clients have decided to try and sell before the falls bite”. It may be too late.

And to add to the mix, ABC’s Michael Janda wrote an excellent piece this week on the advantage some large banks have with regard to how APRA assesses their capital base. The big four banks between them hold around 80 per cent of all Australian home loans. There are many factors that have led to this extreme market dominance: economies of scale, better credit ratings and an implicit Federal Government guarantee — all of which are linked. But the major banks — plus Macquarie and, recently, ING — also enjoy a regulatory benefit that is little known outside the financial sector, but provides a substantial competitive advantage. “The average capital risk weights of the standard banks is around 39 per cent, the major banks average around 25 per cent, and the actual cost [difference] of that equates to around 15 basis points in margins, so it’s not insignificant at all,” the chief executive of second-tier lender ME Bank, Jamie McPhee, told The Business. Those 15 basis points, or 0.15 percentage points, either have to be added onto the interest rate of mortgages that ME Bank and other smaller lenders offer or they take a hit to their profit margins.

For regional banks on the “standardised” system, the safest high-deposit, fully documented housing loans are considered just 35 per cent at risk, meaning they only have to hold $35,000 in capital on $1 million home loan. However, the major banks, plus Macquarie and ING, are allowed to set their own risk weights, using internal financial modelling under the internal ratings-based (IRB) approach. Until the Financial System Inquiry (FSI) there was no floor on how low these could be — a couple of the major banks were averaging less than 15 per cent on mortgages, meaning they held less than $15,000 in capital to protect against losses on $1 million home loan. Smaller banks have ‘disadvantage baked in’. However, on recommendations from that inquiry, the bank regulator APRA introduced a floor of 25 per cent on the average mortgage risk weight for these banks. That still leaves a significant difference between the amount of capital the big banks hold and what the smaller banks have to put aside.

APRA continues to argue that these more sophisticated banks deserve benefit from their investment in more advanced management systems, and yet APRAs recent reviews suggest significant issues. Here is a recent discussion between Senator Whish-Wilson and APRA Chair Wayne Byers discussing in a Senate committee hearing in May the outcomes from their targeted reviews of major bank lending practices in 2017, but only released publicly through the royal commission process earlier this year.

This casts doubt on whether the big four actually live up to the theory of having better risk assessment and management than the smaller banks. Is APRA still captured we ask, and should the playing field be levelled. We continue to think so.

So now to the markets. Locally, Bendigo and Adelaide Bank fell 0.26% on Friday to 11.59, Suncorp rose 0.06% to 15.49, Westpac fell 0.38% to 28.54, well down from a year ago, despite the mortgage rate hike, and CBA fell 1.26% to 71.24. More are getting negative on the banks, given recent events. The ASX 200 fell 0.51% to 6,319, just off its highs, as the financial sector fell away. The Aussie continues to fall against the US dollar, down a significant 0.96% to 71.93, and we continue to expect more weakness ahead.

Sentiment is rather different in the US markets, with the 10-year rate still elevated, and the gap to the 3 month Libor very narrow, as we discussed before a potential harbinger of a recession later. But the US stock markets remain in positive territory. The Dow Jones Industrial Average fell 0.09% to 25,964, still below its peak in February. The S&P 500 passed a new record in the week, and ended on Friday at 2,901. The VIX was down again, falling 4.95% to 12.87, indicating the market is risk off at the moment. The US Dollar Index Futures was up 0.43% to 95.05.

That said, the burst of optimism about trade in the market during the week, didn’t last until the closing bell on Friday. The U.S. announced a bilateral deal with Mexico on Monday. But tension built throughout the week as the U.S. announced there was a Friday deadline to bring Canada into a newly-revamped NAFTA. The U.S. and Canada missed that deadline, but announced that talks would resume next Wednesday, leaving the market facing more wait-and-see trading days. There was also drama during Friday’s discussions after the Toronto Star reported that Trump told Bloomberg off the record he had no plans to give any concessions at all to Canada. The president appeared to later confirm that stance in a tweet, saying Canada now knows where he stands.

Trade worries spread beyond North America, though. Trump told Bloomberg he was prepared to withdraw from the WTO if necessary. And he plans to move ahead with tariffs on $200 billion in Chinese imports as soon as a public-comment period concludes next week. China’s foreign ministry said Friday that the U.S. putting pressure on Beijing would not work.

The Yuan rose a little against the US Dollar, but remains way down on a year ago.

Meantime retail earnings dominated the calendar this week, leading to strong stock movements in the low-volume environment. The S&P Retail index ended up slightly for the week.

Among big movers, Abercrombie & Fitch stock plummeted on second-quarter revenue and same-store sales missed estimates. Best Buy stock tumbled despite better-than-expected second quarter revenue and earnings as online sales slowed and the company warned that it is “expecting a non-GAAP operating income rate decline in the third quarter.” And Tiffany & Co spiked on second-quarter results and strong outlook, but then tumbled in later sessions.

In tech, Tesla shares started the week with a quick drop and finished it lower as it scrapped plans to go private. CEO Elon Musk wrote in a blog late last week that he would not move forward with a plan to take the company private, noting that after speaking with retail and institutional shareholders that “the sentiment, in a nutshell, was ‘please don’t do this.’”

Musk had surprised the market out of the blue, tweeting he was thinking of taking the company private at $420 per share and had funding secured. The SEC was interested in whether the tweet was designed in a way to punish short sellers, according to reports.

The NASDAQ rose 0.26% to 8,109.5 in record territory driven by the booming sector.

Data out this week illustrated two contrasting segments of the U.S. economy, one stronger and one weaker. Economic indicators on the consumer side remained very strong. The Conference Board’s index of consumer confidence increased to 133.4 this month, compared to a reading of 126.7 forecast by economists. That was its highest level since October 2000. The University of Michigan’s August consumer confidence index was revised up to 96.2 from its preliminary measure of 95.3. And consumer spending, which accounts for more than two-thirds of U.S. economic activity, rose 0.4% last month, matching June’s reading and analyst forecasts.

But the National Association of Realtors said its pending home sales index, which measures signed contracts for homes where transactions have not yet closed, fell 0.7% to a reading of 106.2 after rising by a revised 1.0% in the previous month. Economists had forecast pending home sales rising 0.3% last month. So more questions on the housing sector ahead.

Oil closed out the month higher as traders balanced expectations of crude supply losses with the potential of trade wars denting global demand. China, the world’s largest commodity importer, has seen economic growth dwindle since the trade war with the U.S. kicked off, and a further escalation could dent growth, forcing Beijing to rein in crude imports. Oil prices ended the month nearly 2% higher on bets on renewed global supply shortage as U.S. sanctions on Iran’s crude exports are expected to reduce crude from market, underpinning higher crude prices. Both WTI and Brent crude are expected gain on a potential slump in Iranian exports, although gains in WTI prices will be limited as the refinery maintenance season is set to get underway. Oil prices were helped earlier in the week by an EIA report showing crude oil stockpiles fell much more than expected.

Gold moved a little higher this week, ending up 0.16% on Friday to 1,206, Bitcoin lifted 1.23% to 7,029

So, we can see a significant divergence between the local market here, dragged down by negative sentiment on banks and housing (and the increasing realisation of more issues ahead) and the US where stocks are at the highs despite the building risks from higher corporate debt and the yield curve inversion.

The two markets are poles apart.

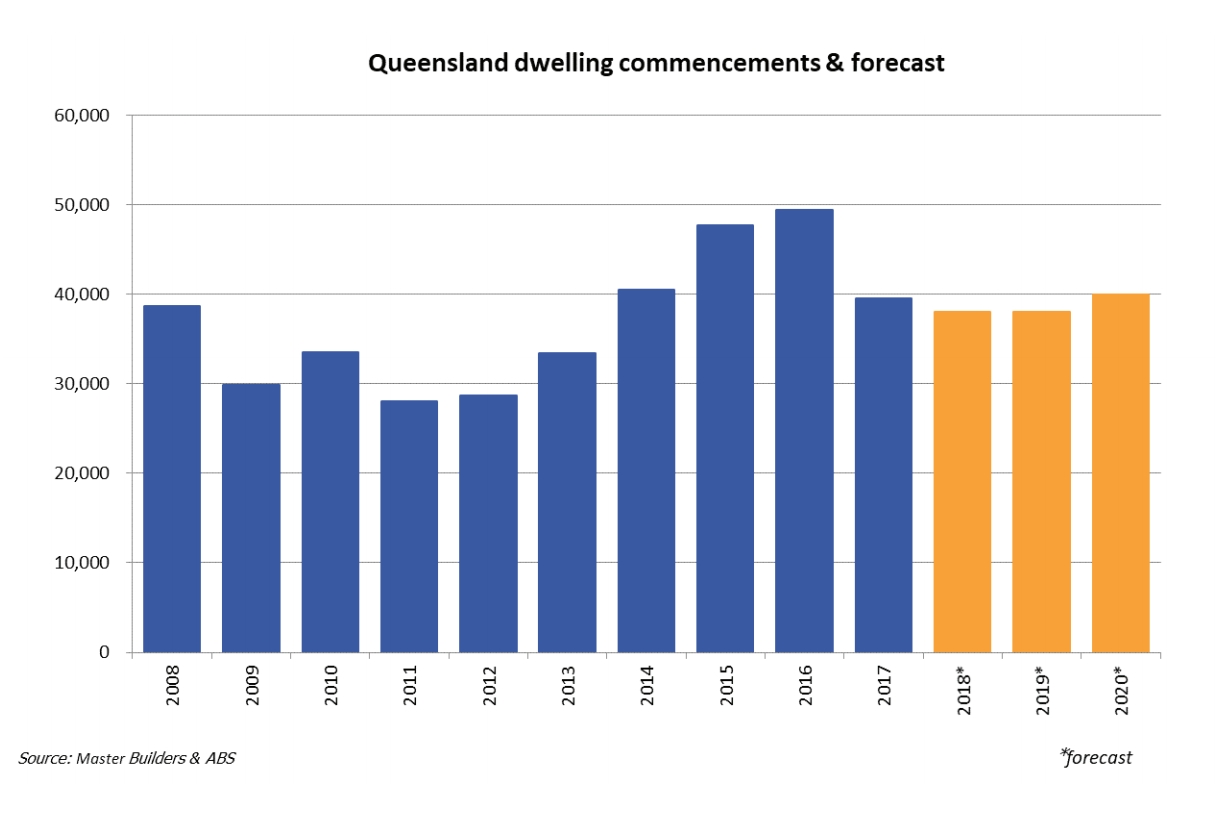

Source: Master Builders

Source: Master Builders