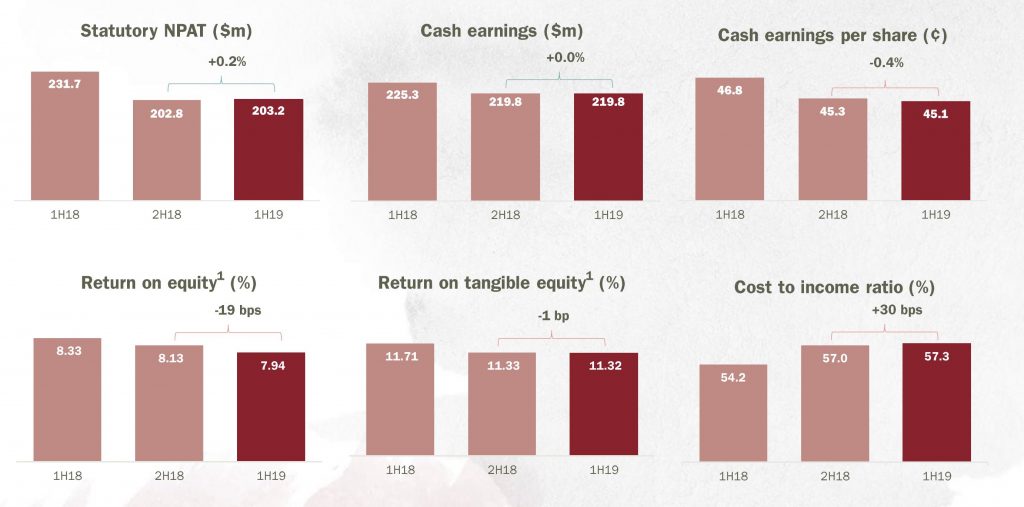

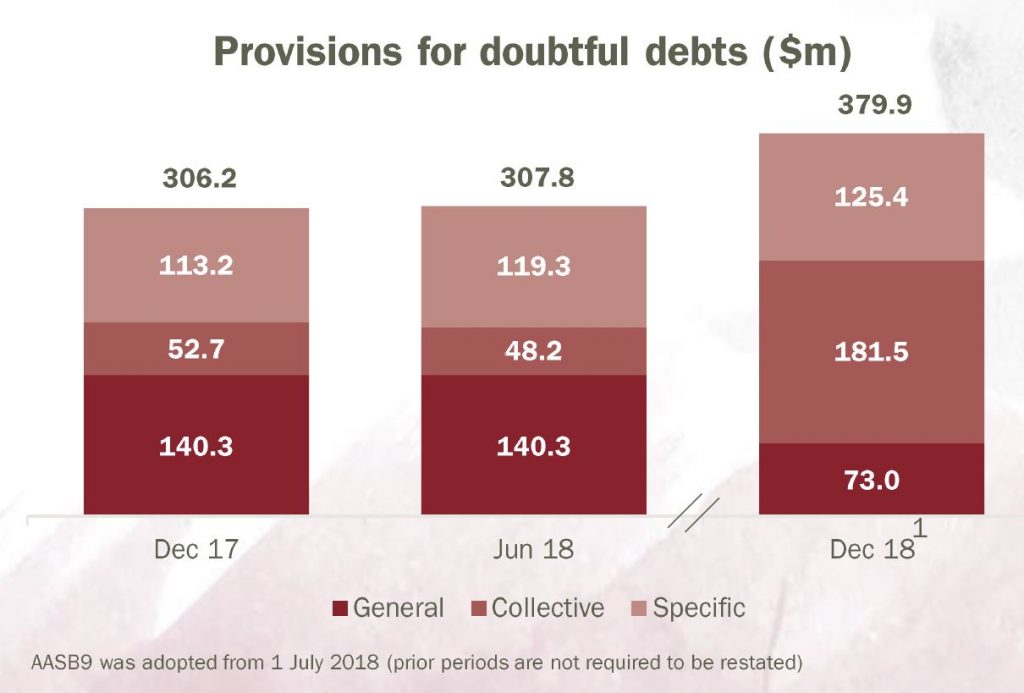

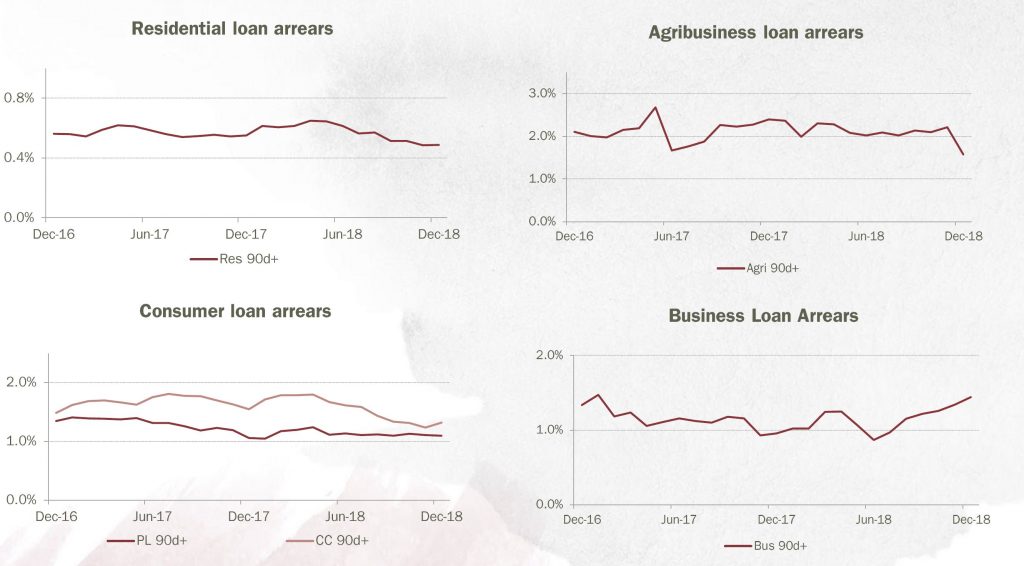

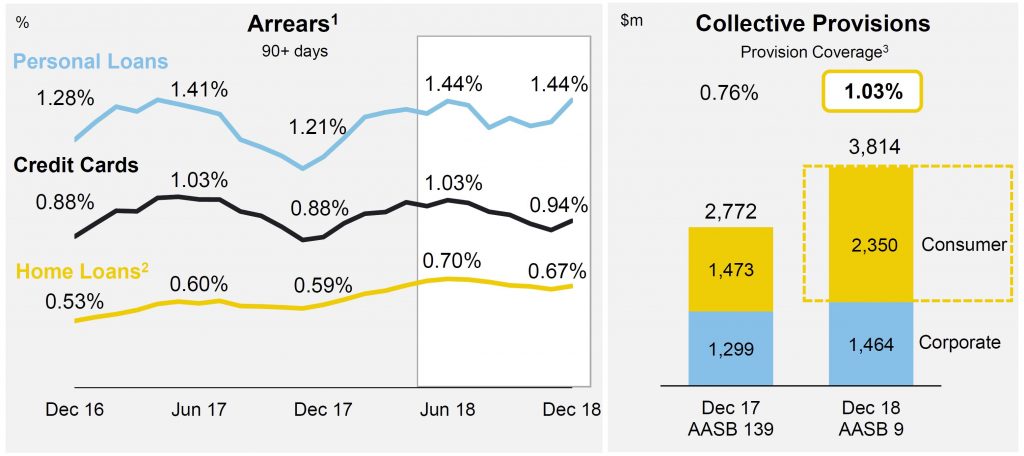

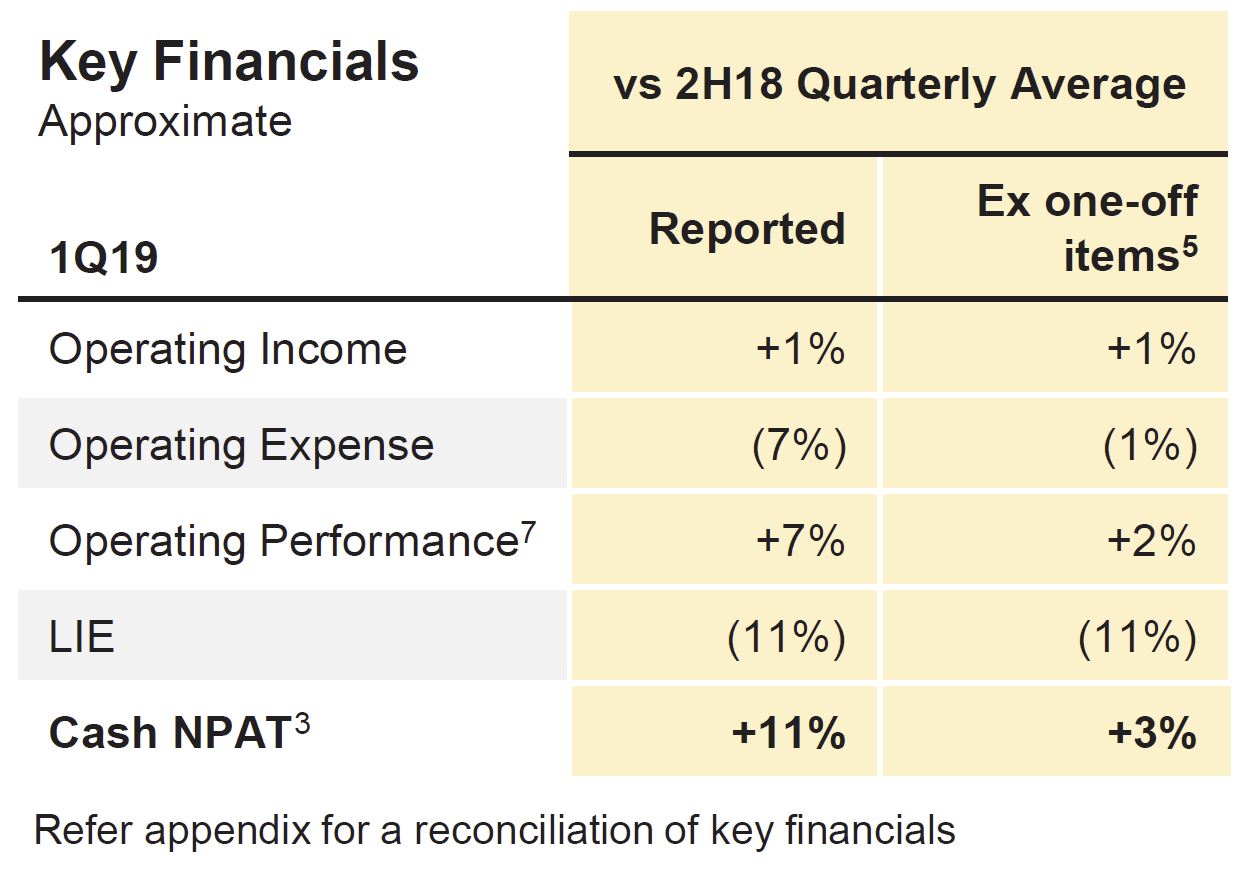

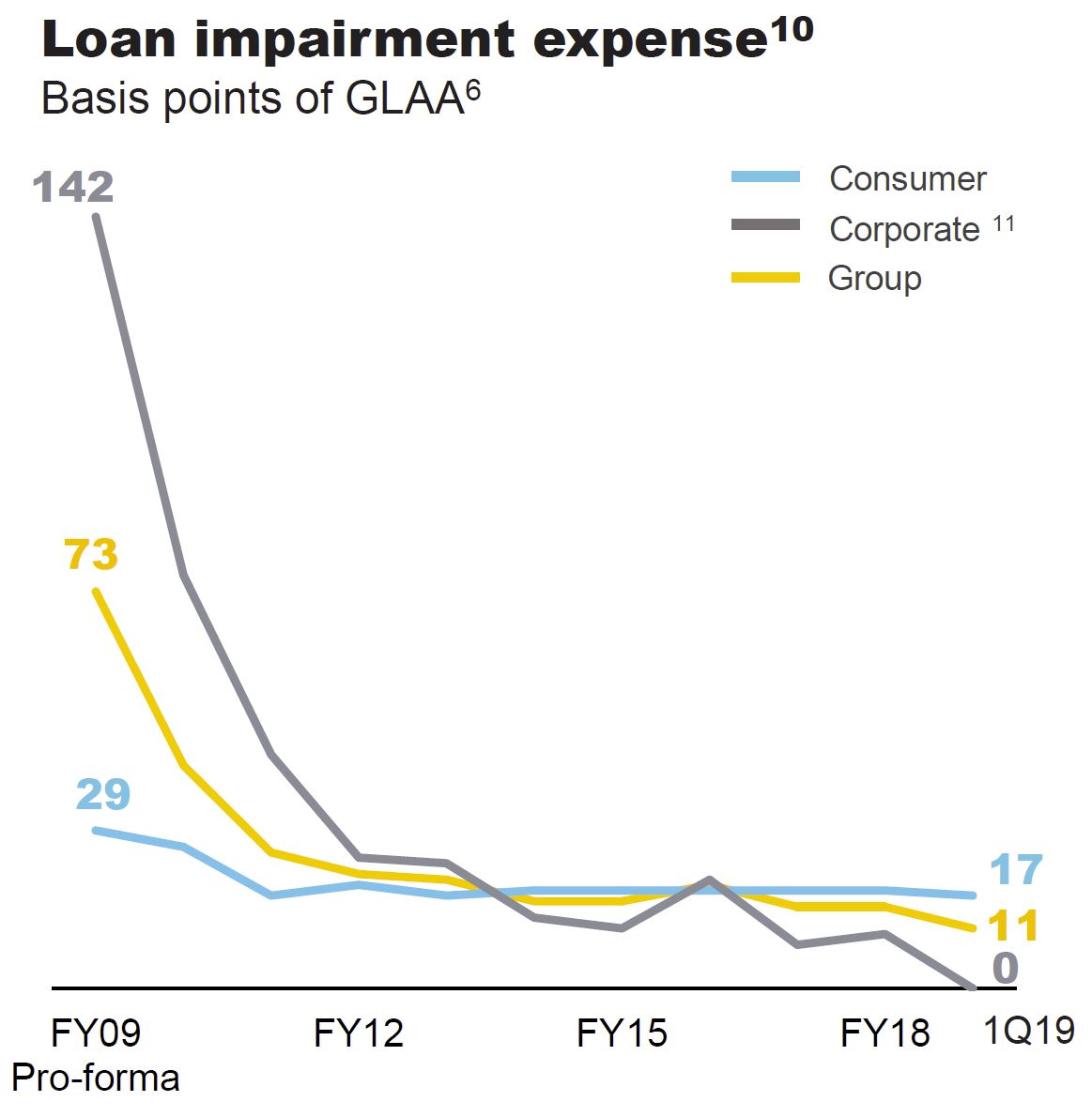

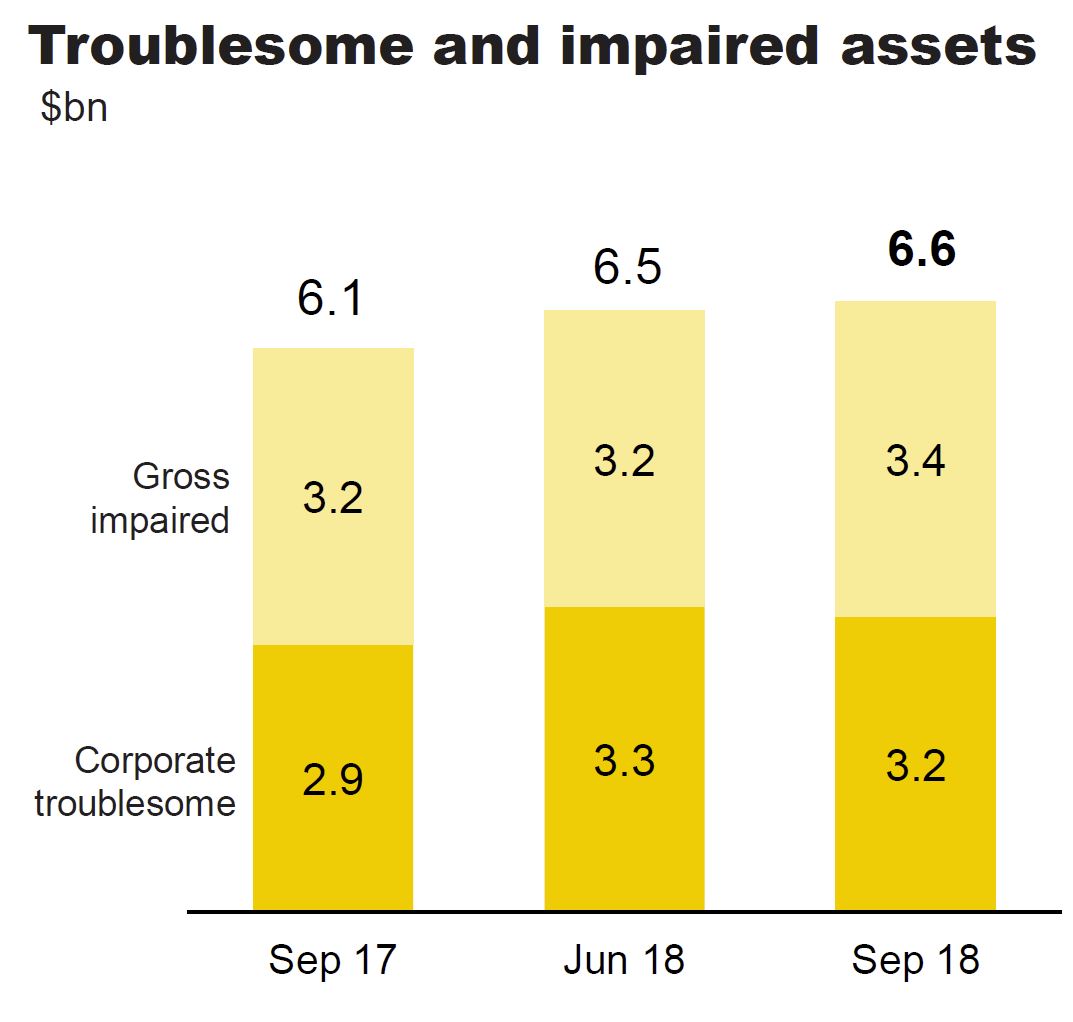

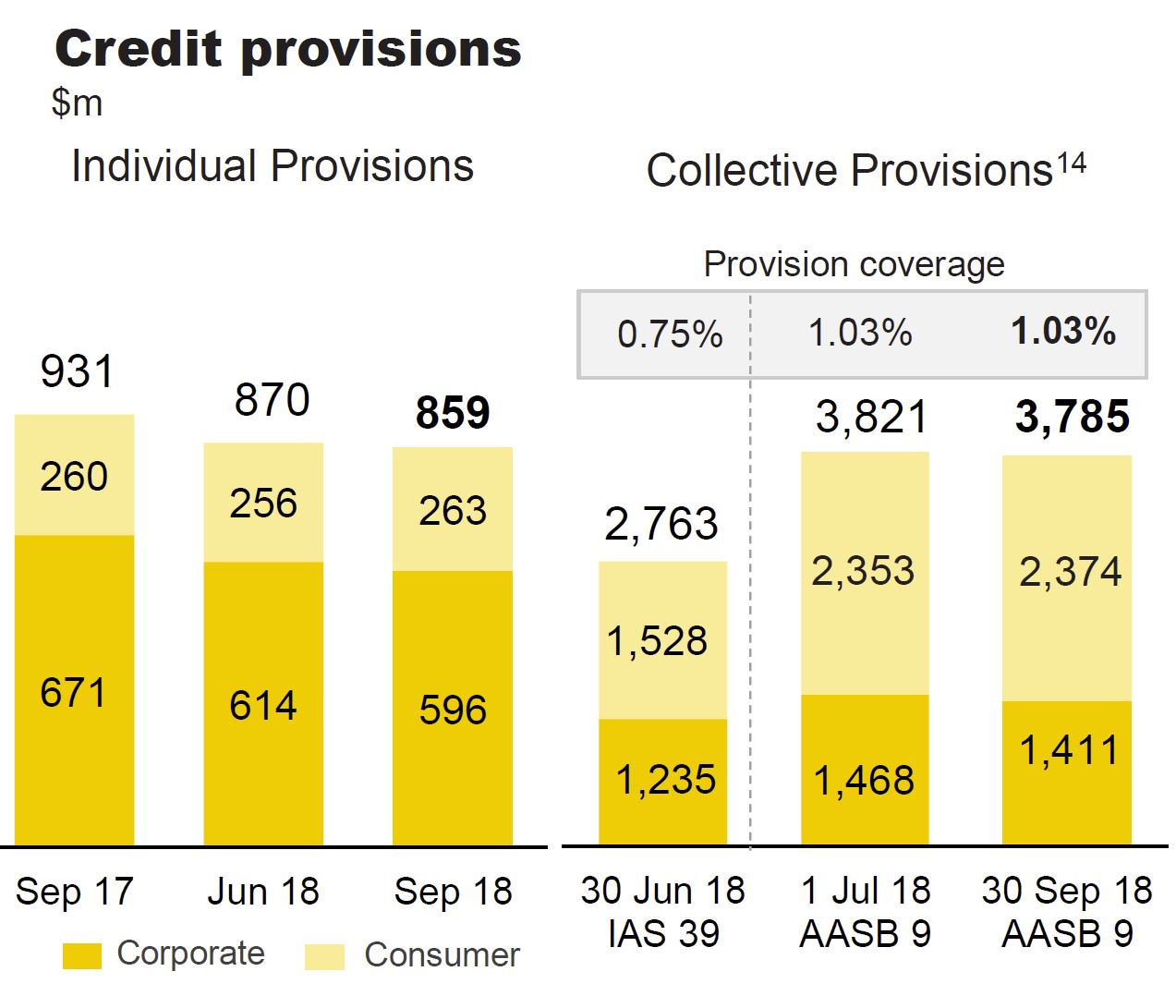

ANZ today released its scheduled APRA APS330 report covering the quarter to 31 December 2018. Credit Quality remains stable with a Provision Charge of $156 million tracking below the FY2018 quarterly average.

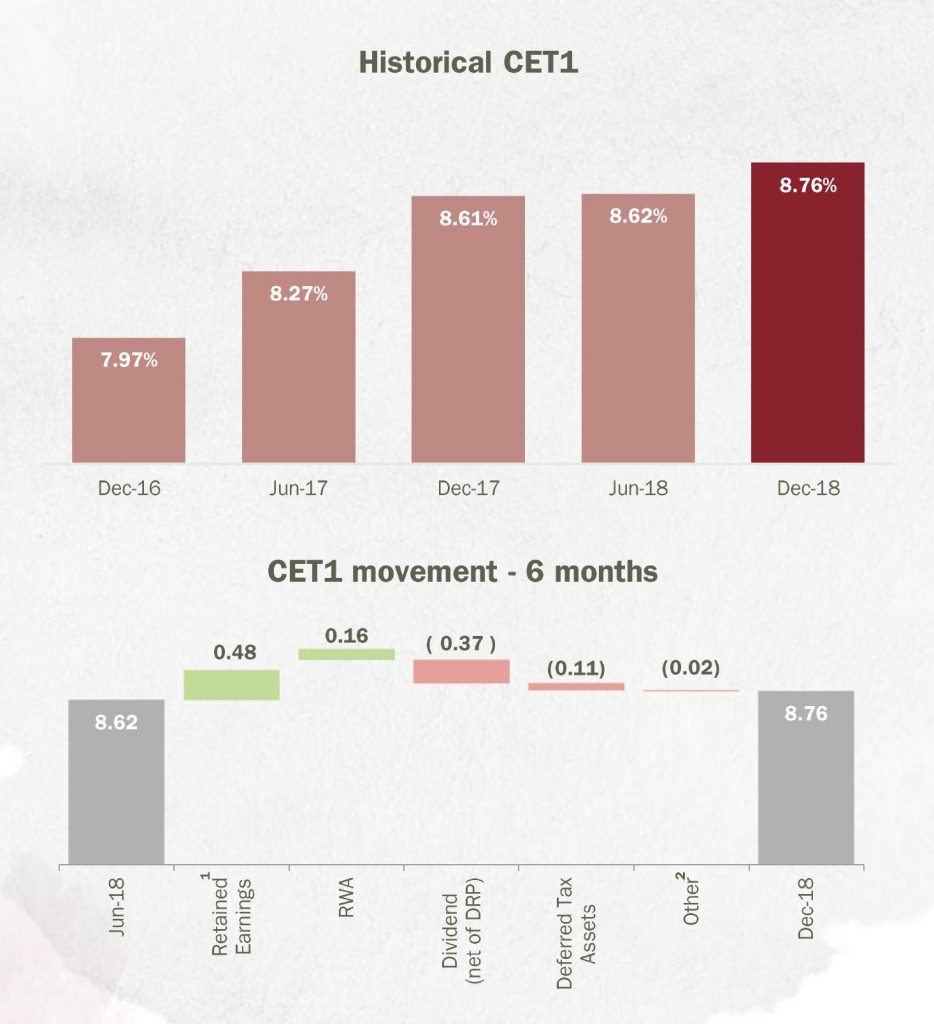

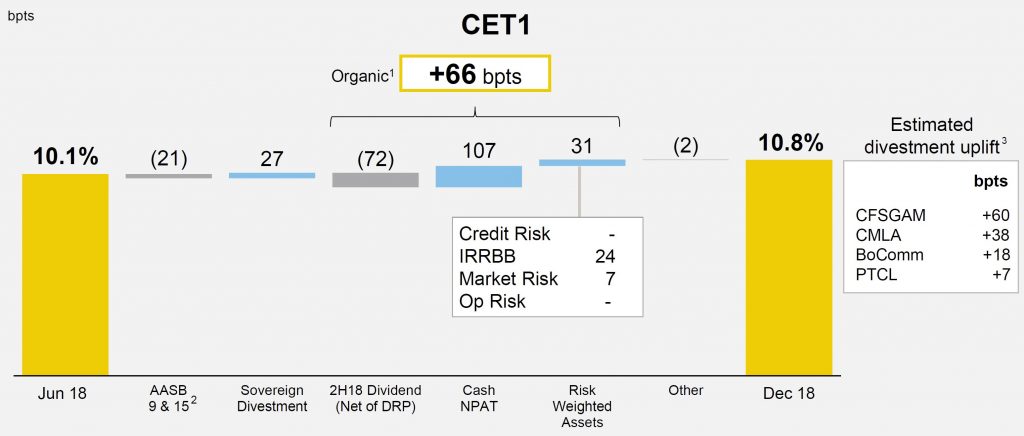

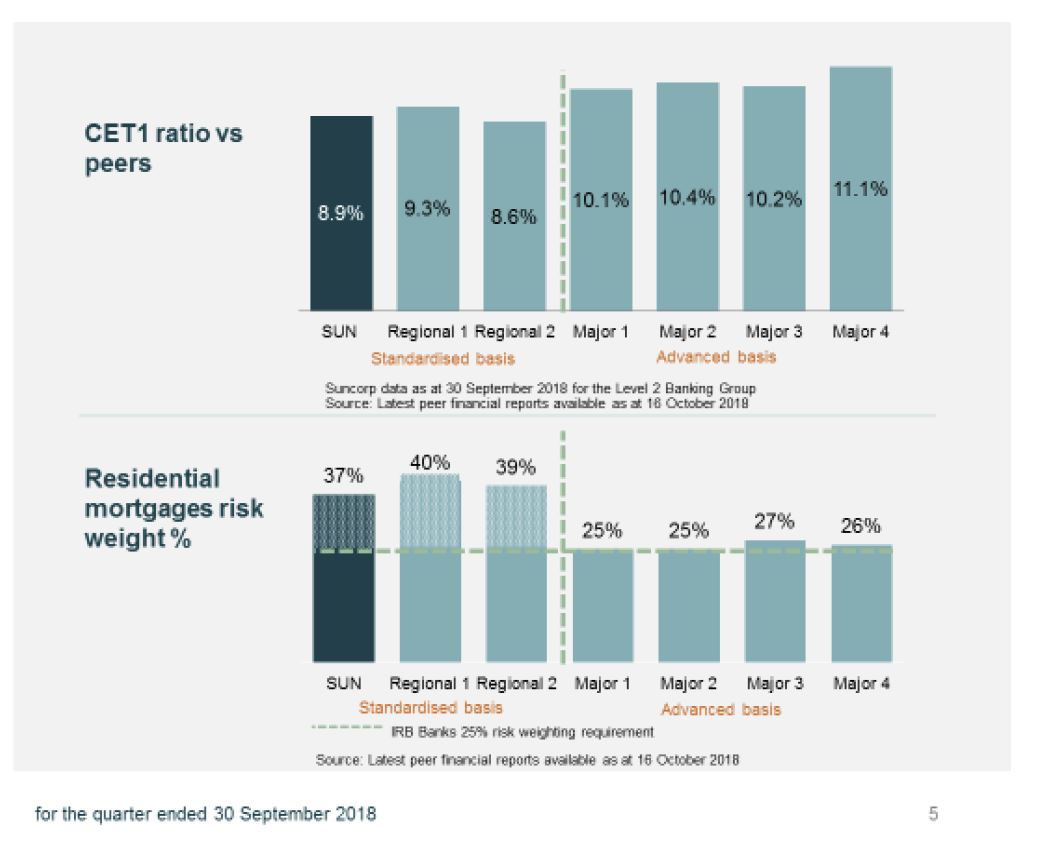

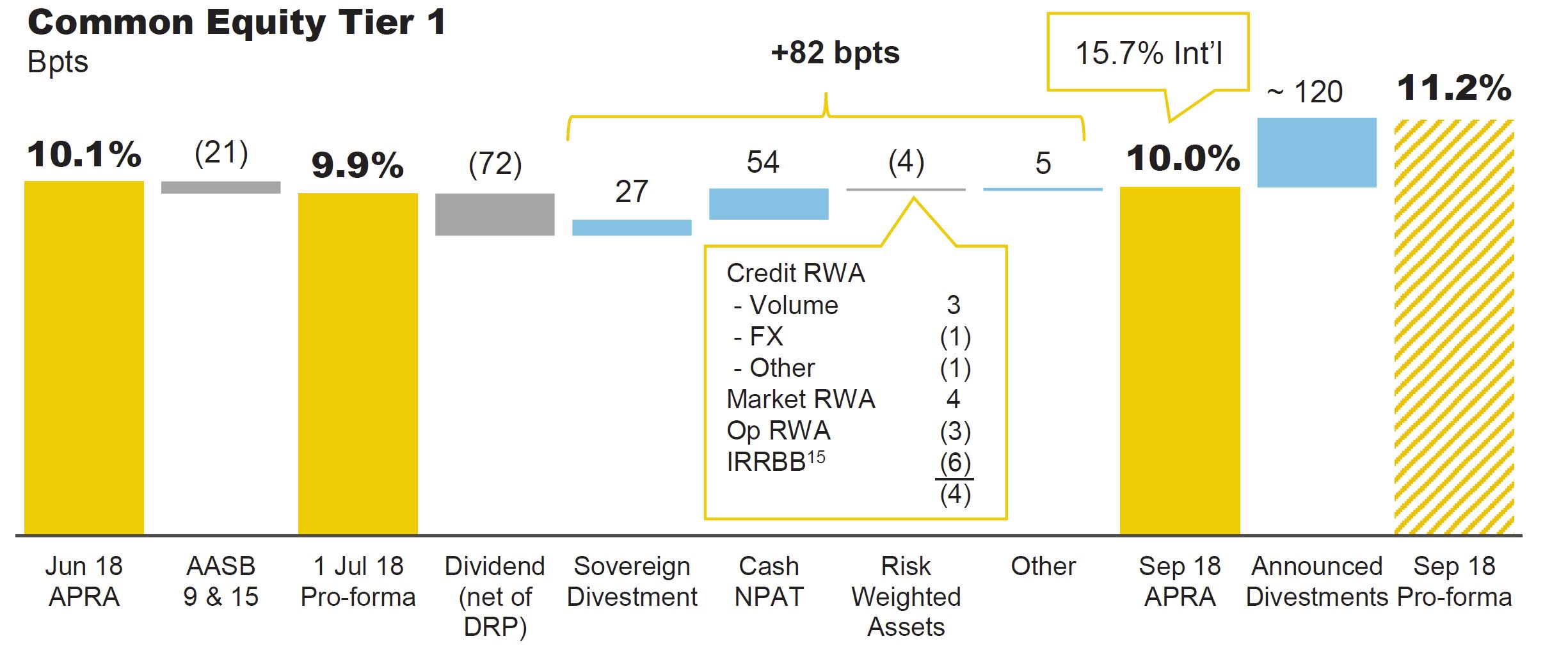

The Group loss rate was 10 basis points1 (14 bps 1Q18). Group Common Equity Tier 1 (CET1) was 11.3% at the end of the quarter.Consistent with usual practice, ANZ also released a chart pack to accompany the Pillar 3 disclosure.

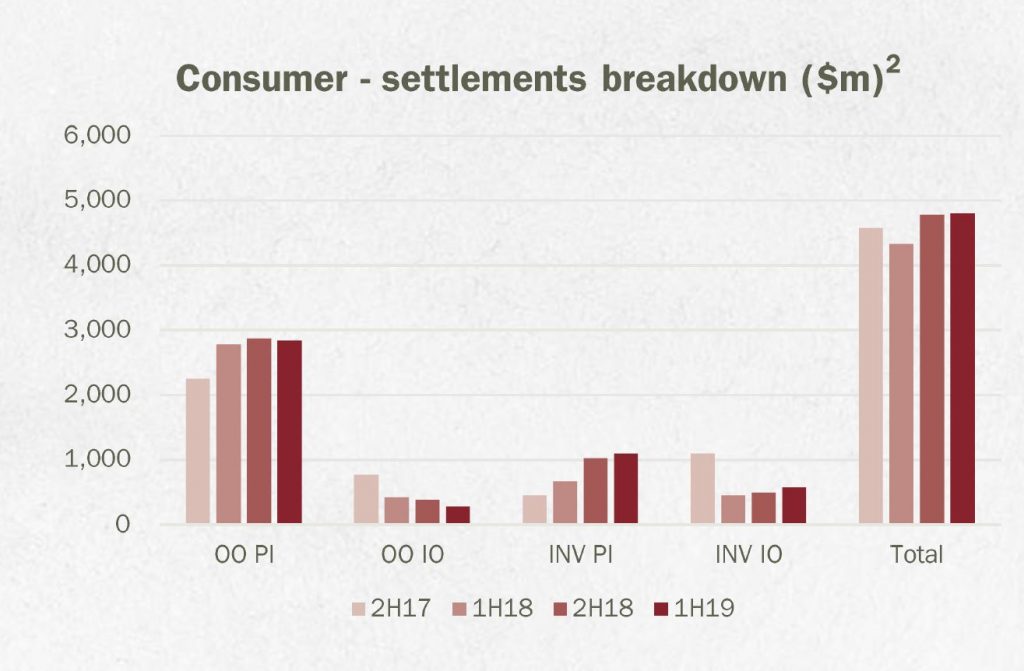

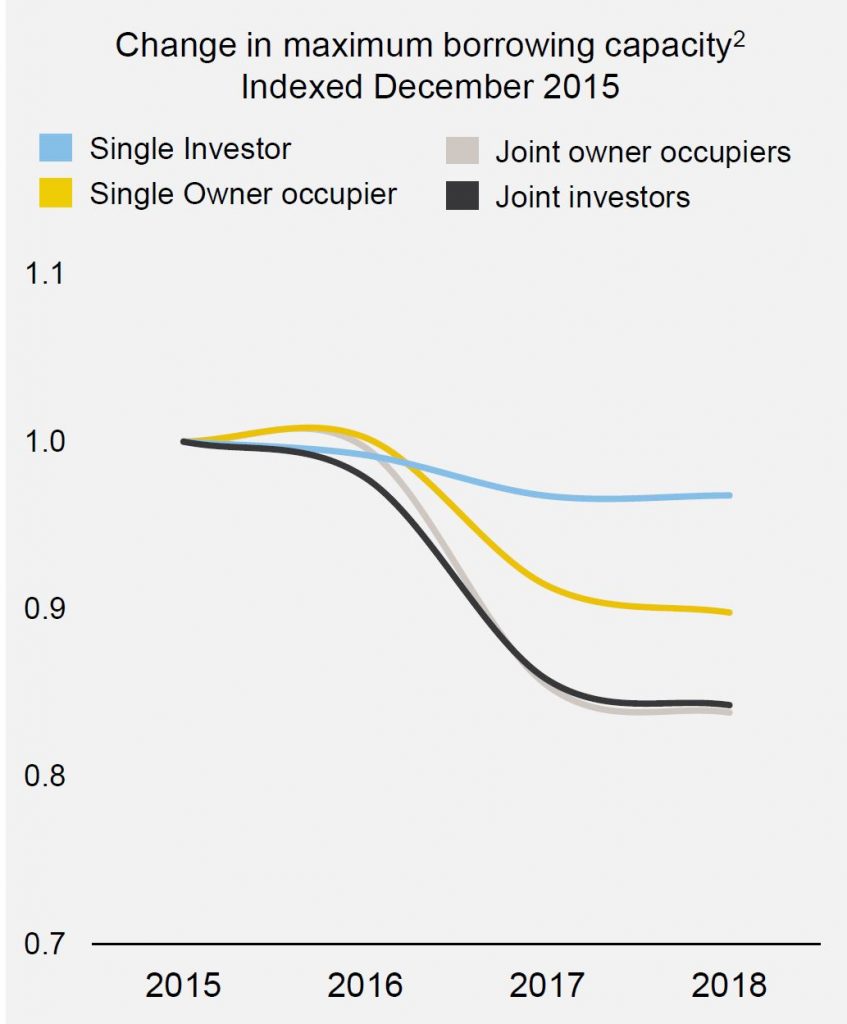

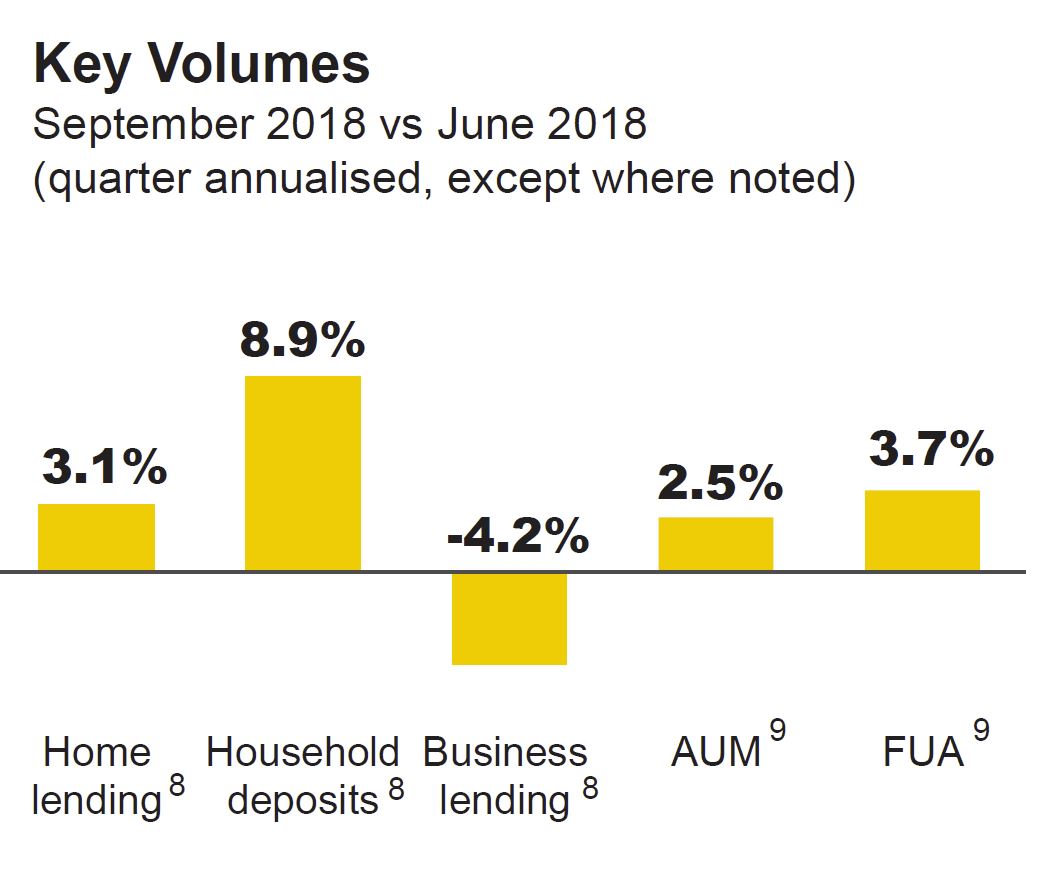

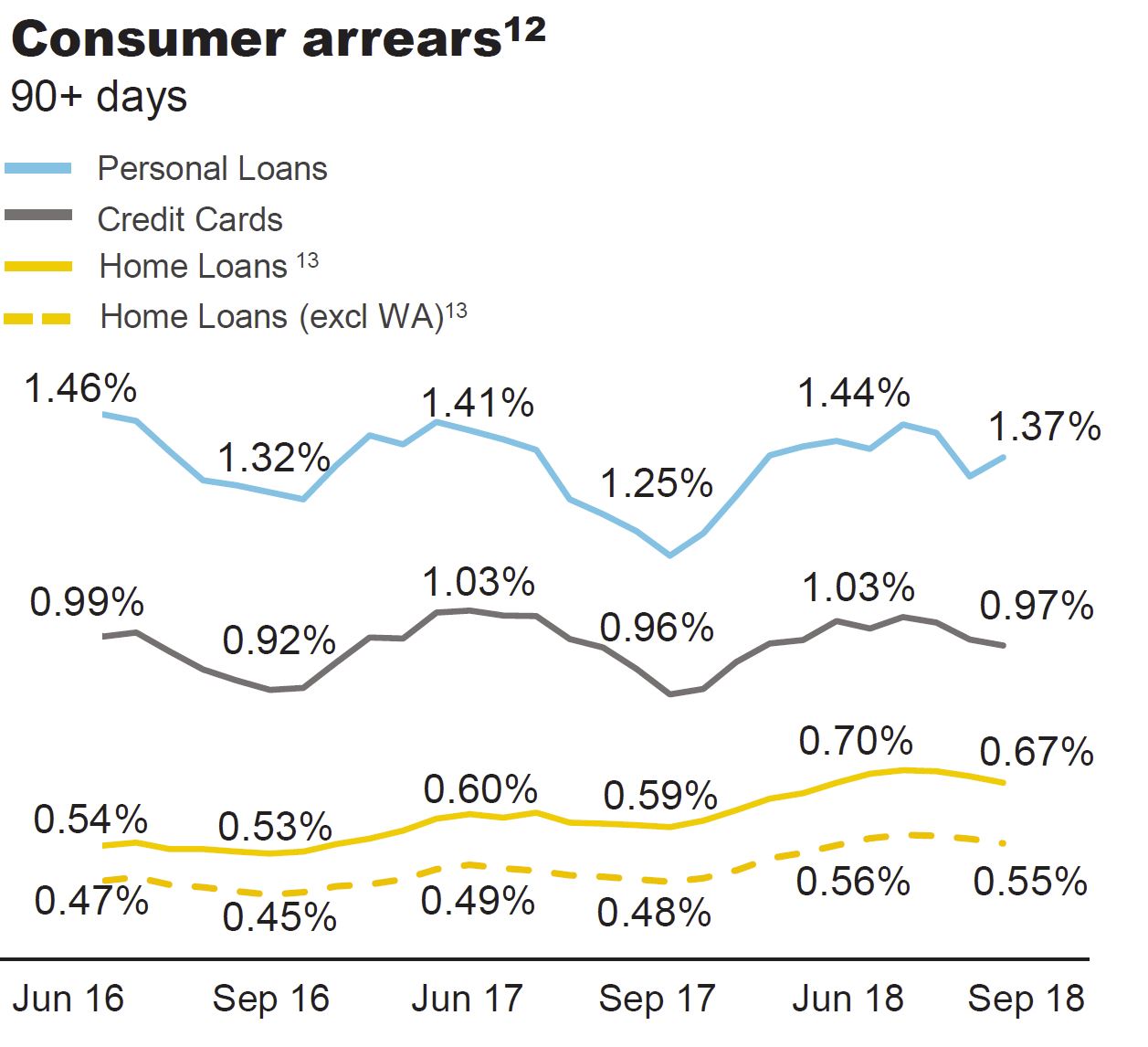

The chart pack once again includes an update on Australian housing mortgage flows and credit quality. Australia home loan system growth was 4.2%2 in the 12 months to end December 2018. ANZ’s Australian home loan portfolio grew 1.0% ($2.7 billion) in the same period with the Owner Occupier portfolio up 3.5% ($6.1billion) and the Investor portfolio down 3.8% ($3.2 billion). In the 12 months to the end of January 2019, ANZ’s home loan portfolio grew 0.4%.

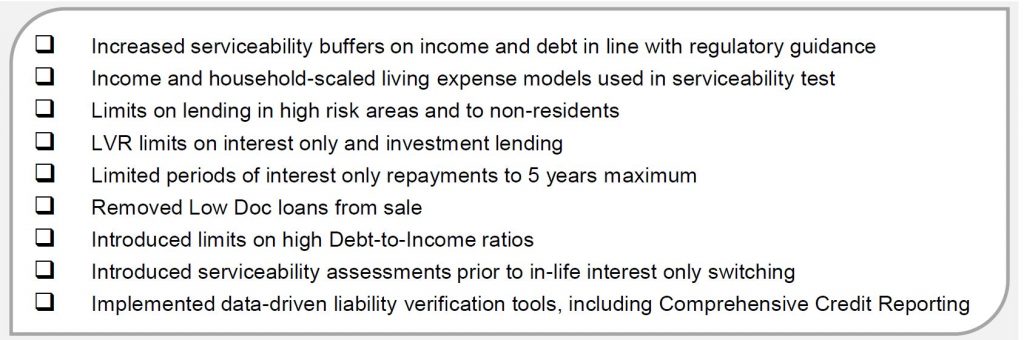

ANZ’s home lending growth trends are attributable to lower system growth, ANZ’s preference for Owner Occupier/Principal and Interest lending which drives faster amortisation, together with policy and process changes implemented in the second half of calendar year 2018.

ANZ Chief Executive Officer Shayne Elliott said: “Consumer sentiment has remained generally subdued with uncertainty around regulation and house prices impacting confidence. While we are maintaining our focus on the Owner Occupier segment, we acknowledge we may have been overly conservative in our implementation of some policy and process changes. We are also taking steps to prudently increase volumes in the investor space”.

Switching volumes for those moving from Interest Only to Principal and Interest during the quarter was $6 billion, of which $4 billion was contractual. The total amount of contractual switching scheduled for the reminder of FY19 is $12 billion. Customers choosing to convert ahead of schedule during the first quarter was in line with the quarterly average for FY18 ($2 billion). Total switching in FY18 was $24 billion.