Welcome to the Property Imperative weekly to 23th June 2018, our digest of the latest finance and property news with a distinctively Australian flavour.

Watch the video, listen to the podcast, or read the transcript.

Watch the video, listen to the podcast, or read the transcript.

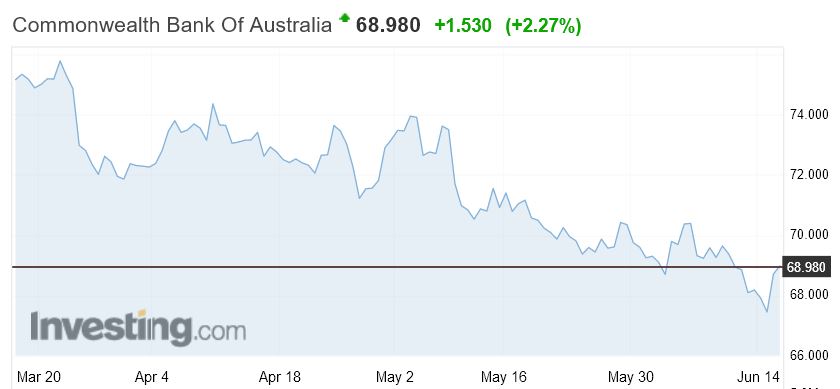

There is something weird going on at the moment. This week bank stocks rose significantly, with CBA up 1.2% on Friday as the AUSTRAC issue was finally put to be in court; Westpac up 1%, NAB up 1.2% and ANZ up a massive 2.8% as the bank announced a further stock buyback. The banks comprise more than a quarter of our market, so no surprise the ASX 200 went higher in the week, though fell back slightly by Friday, reflecting further concerns about the escalating trade wars. Potentially traders closing out their positions, the end of the financial year have driven prices higher but next week a number of key stocks go ex-dividend, suggesting this we may have seen the top. The lower Aussie dollar may also be helping, (expect it to continue to fall) as it makes Australian stocks cheaper on an international basis, and yields are still pretty good, representing better value to investors than many emerging markets which are entering a difficult phase.

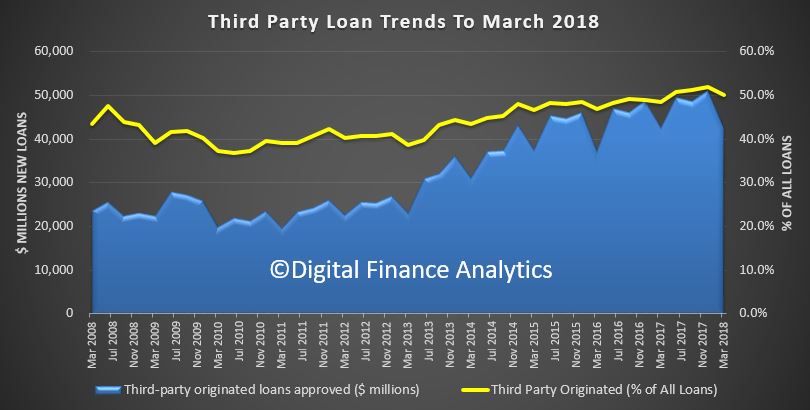

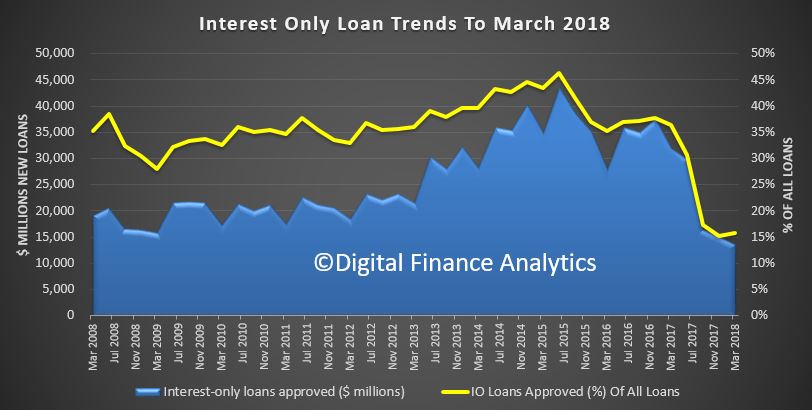

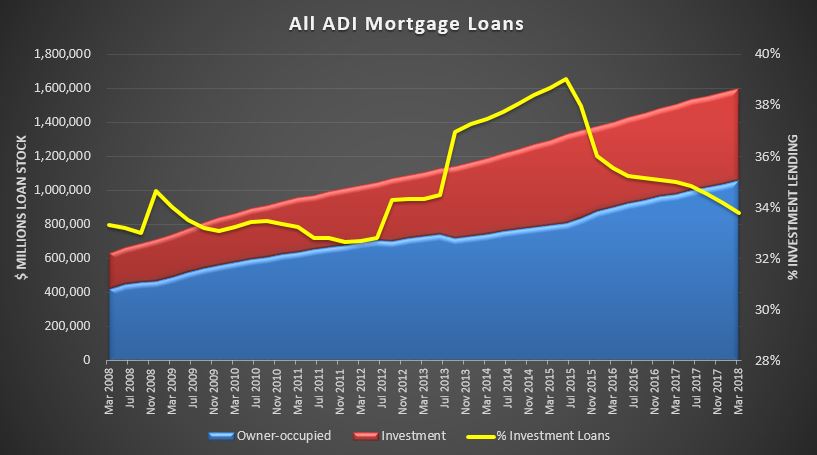

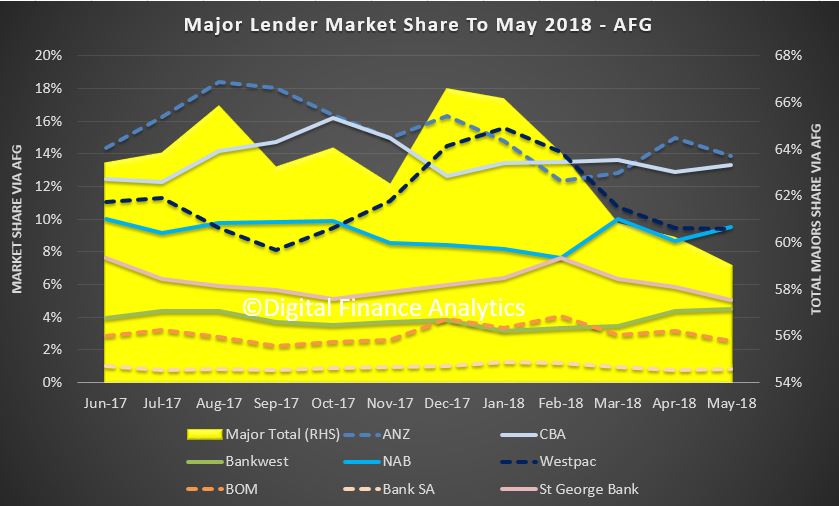

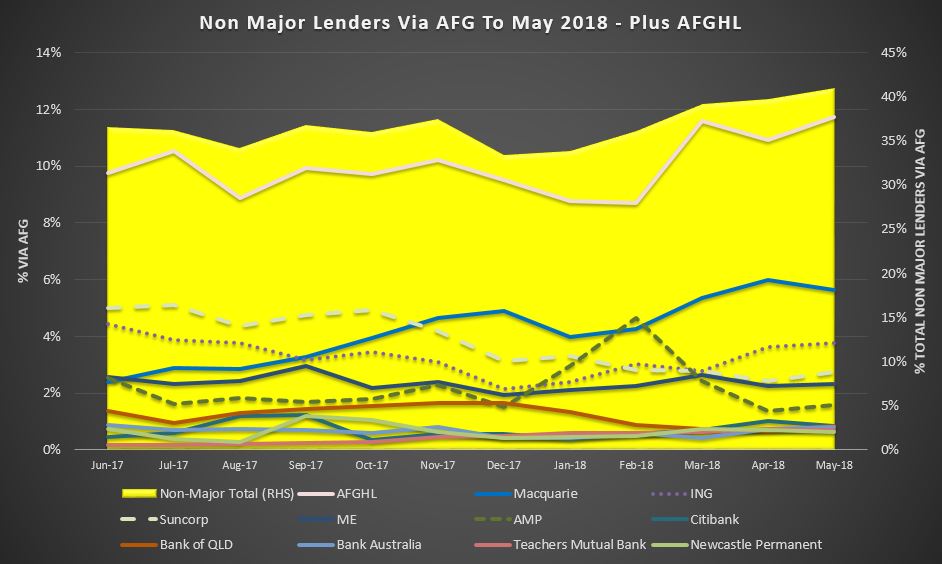

But scratch below the surface and things look less certain. For example, APRA’s March 2018 property exposure data showed a significant fall in investment lending, and a massive fall in interest only loans, at 16%, dropping the stock of loans by $93 billion, plus more loans are being approved outside normal serviceability criteria, and lending standards tighten. We discuss this in more detail in our post “The State of Mortgage Lending In Three Slides”. Remember that our analysis shows that around $120 billion of interest only loans will require refinancing each year for the next few years, and many – around 20% – won’t pass muster, meaning they have to switch to more expensive loans, or sell. ABC’s 7:30 did a segment on IO Loans this week.

As UBS put it, the data signals the “end of the beginning of the housing market correction” and the risks of a credit crunch is rising. Mortgage underwriting standards continue to tighten, as lenders finally comply with the existing legalisation and guidelines, the Royal Commission will not necessarily need to recommend tighter rules, the question in our view is compliance with the existing ones – APRA please note!

UBS also made the point that Debt To Income has been in focus since APRA directed ADI’s to develop “internal risk appetite limits on the proportion of new lending at very high DTI levels [>6x], and policy limits on maximum DTI levels for individual borrowers” in April 2018. Prior to this, DTI was not a focus, largely because neither APRA nor the banks had reliable data available. However, that will soon change with the introduction of Comprehensive Credit Reporting (CCR – the first phase of Open Banking) expected on July 1 2018. They conclude that If APRA does decide to impose a hard cap on loans to customers with a DTI > 6x we should expect a further tightening in credit availability.

Morgan Stanley discussed what they call Macroprudential 3.0 saying that this is consistent with international trends restricting consumer leverage in a low interest rate environment. They say the adoption of DTI limits provides a further restriction and may become a binding constraint for customers who have very low assumed living expenses or purchased multiple investment properties. The sustainability of Sydney house prices at >9x median income and Melbourne at ~8x median income become problematic when borrowing limits are restricted to 6x income. A 6x DTI limit assuming a 20% deposit would put the median Sydney house out of range for the median buyer.

The ABS home price data confirmed falls in the major centres. We discussed this in our post “Property Prices are Officially falling”. You can watch our video on this, or listen to our podcast, (our podcasts by the way are being well received, judging by the number of listens). As the ABS said “Sydney recorded the third consecutive quarter of falling property prices down 1.2 per cent and the first annual price fall down 0.5 per cent since the March quarter 2012, while Melbourne property prices fell 0.6 per cent, the first quarterly price fall since September quarter 2012”. We also contributed to a piece on ABC’s The Business, discussing the future outlook for prices.

More recent data from CoreLogic continues to confirm falls, with weekly drops in Sydney, Melbourne, Brisbane and rises in Adelaide and Perth. But of course, Sydney prices on average are still up 66.8% from their previous lows, Melbourne 56.3% Brisbane 20.9%, Adelaide 18.9% and Perth 0.9%. This suggests that further falls in the eastern states are likely as credit dries up. And elsewhere CoreLogic made the point that more property is being listed, its taking longer to sell, and it has become a buyers’ market saying “Overall as the housing market is slowing, the number of properties for sale is climbing in Sydney and Melbourne, providing for less urgency amongst buyers and more time to negotiate. As stock levels rise, buyers become more empowered and vendors may need to rethink their pricing expectations and marketing strategies.”

SQM research also released this week showed that rental vacancies decreased over the year in Adelaide down 0.4%, Perth down -1.0%, Brisbane down 0.6% and Canberra down 0.2%, but significantly, increases were recorded in Sydney up 0.8%, Darwin up 0.2% and Hobart up 0.2%, and Melbourne’s vacancy rate was flat. Annual asking rents are rising faster than incomes in Melbourne, Canberra and Hobart, while weak or falling asking rents were recorded in Sydney, Adelaide, Brisbane, Perth and Darwin. SQM said “there are considerably more vacancies in Sydney now compared to a year ago, so landlords have lowered their asking rents slightly, which is favouring renters”. More pressure on investors then.

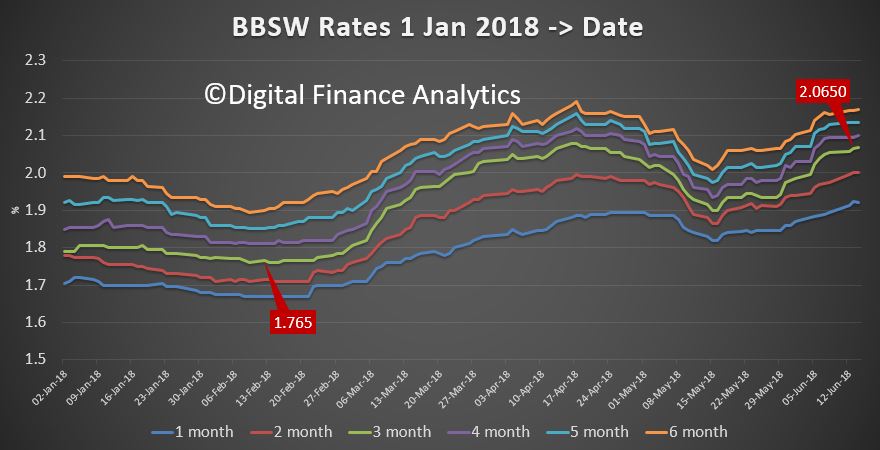

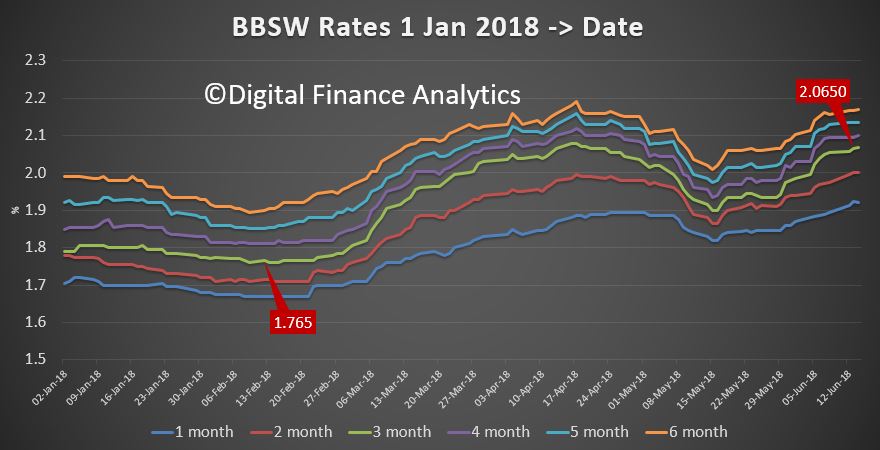

Macquarie said that they expect the current modest rate of decline in national dwelling prices to continue for some time, but they suggest a fall of only around 2% over the course of 2018. Over the next couple of years, they expect national prices to have fallen 4-6% from the peak, with Sydney prices forecast to be down around 10% from the mid-2017 peak. Australia has had six previous episodes of declining housing prices since 1980, with the peak-to-trough range of 2.5% to 8%. Nearly all previous corrections occurred following interest rate rises, a drag unlikely to be repeated anytime soon in this cycle. To which I reply, credit tightening is continuing and the BBSW rate is rising, so past performance may not be helpful here.

ANZ also opined on home prices. We now expect to see peak-to-trough price declines of around 10 per cent in Sydney and Melbourne, with smaller declines elsewhere. This cycle is being driven by tighter credit, rather than higher interest rates. Exactly. Sydney and Melbourne are expected to be the primary drivers of this fall, as their high prices and highly leveraged households will be more sensitive to tighter credit conditions and rising interest rates.

It’s also worth noting here the heroic assumptions in the NSW state budget which was out this week, and included a projection of future stronger auction clearance rates, after a small blip. Lower stamp duty flows will lead to a shortfall, as Moody’s observed when they said “NSW is projecting average revenue growth of 2.5% from fiscal 2019 to 2022, reflecting a drop in growth for transfer duties, particularly from housing, where the state forecasts that residential turnover will drop around 8% in fiscal 2019 and price growth will moderate. Additionally, at 2.5%, average revenue growth is expected to fall below the average expenditure growth of 3.2%. This imbalance would lead to growth in debt over the forecast period, challenging NSW’s credit profile”. So recovering home prices, and interest rate cuts are required to bring this home. As I say, heroic!

There was some interesting commentary on the ever rising benchmark Bank Bill Swap Rate (BBSW). The AFR reported that Nomura rates strategist Andrew Ticehurst, observed that multinationals outside the US are holding fewer US dollars and there is a global dimension to this starting with the US”. Tamar Hamlyn, portfolio manager at fixed income boutique Ardea said “There’s nothing to suggest that it’s sinister just yet, we expect these things to be high as we get to quarter-end as the historical pattern shows,”. But we suspect its more about rising concerns in the risk profile of the banks, as the spread movements are larger here than in other countries. This will put pressure on bank margins, and may force them to lift mortgage prices, or further trim rates on deposits. Oh, and commendatory this week from the RBA suggests that official rates are not going anywhere, despite the fact that the latest minutes omitted the oft repeated clause that the next move will be up.

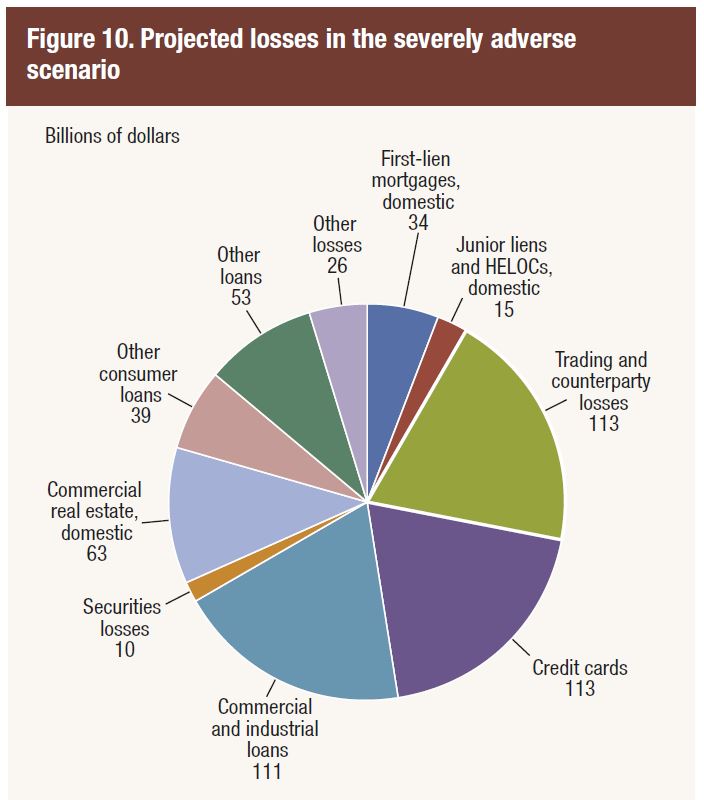

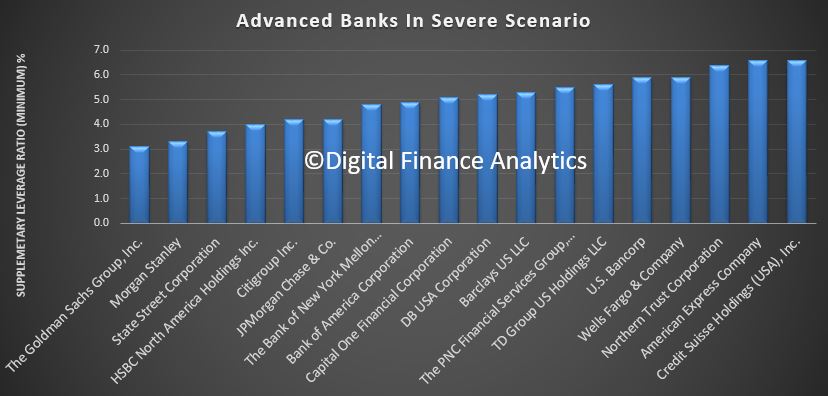

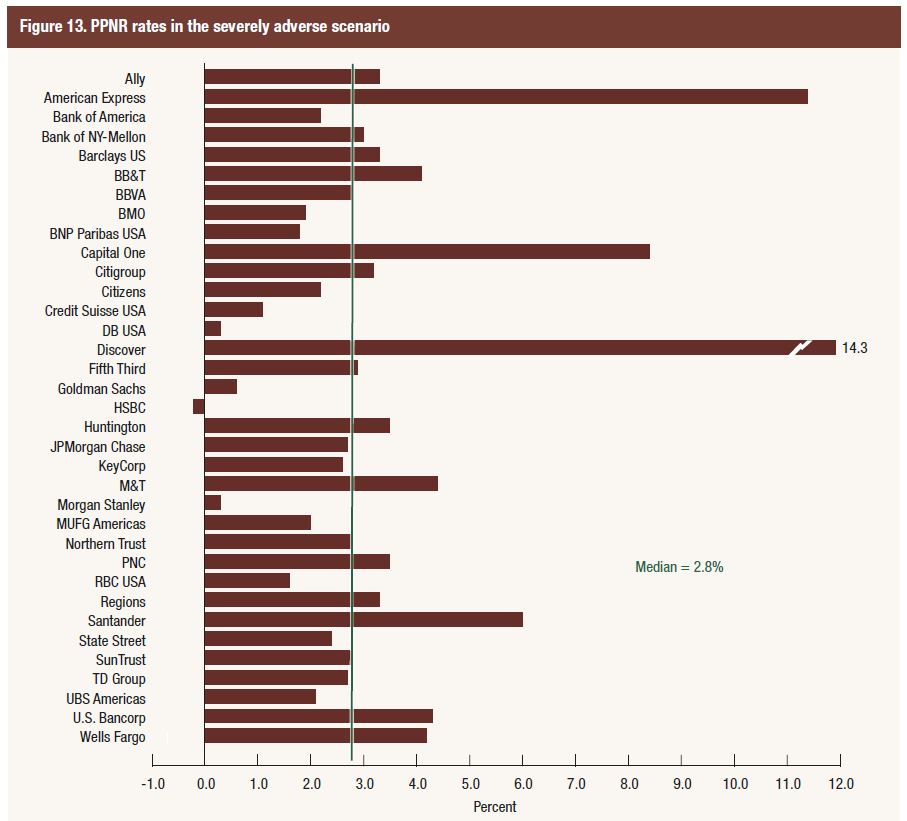

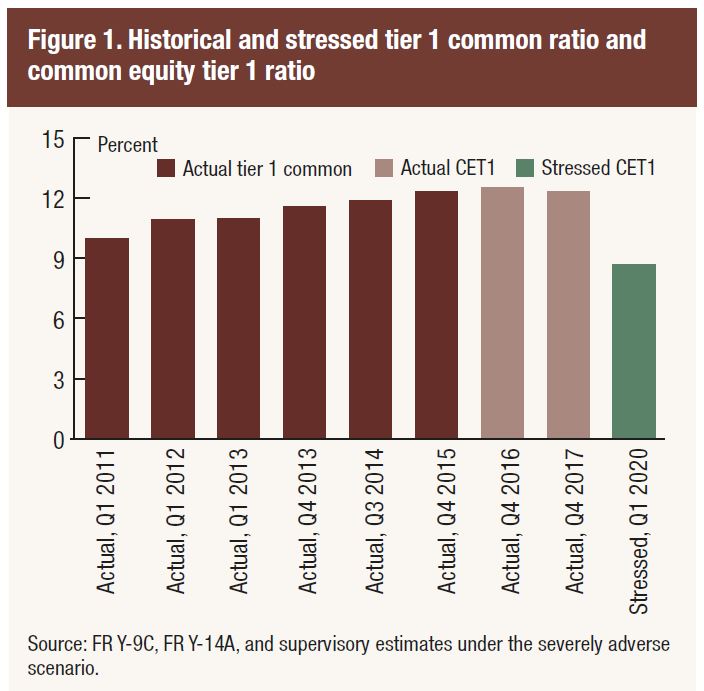

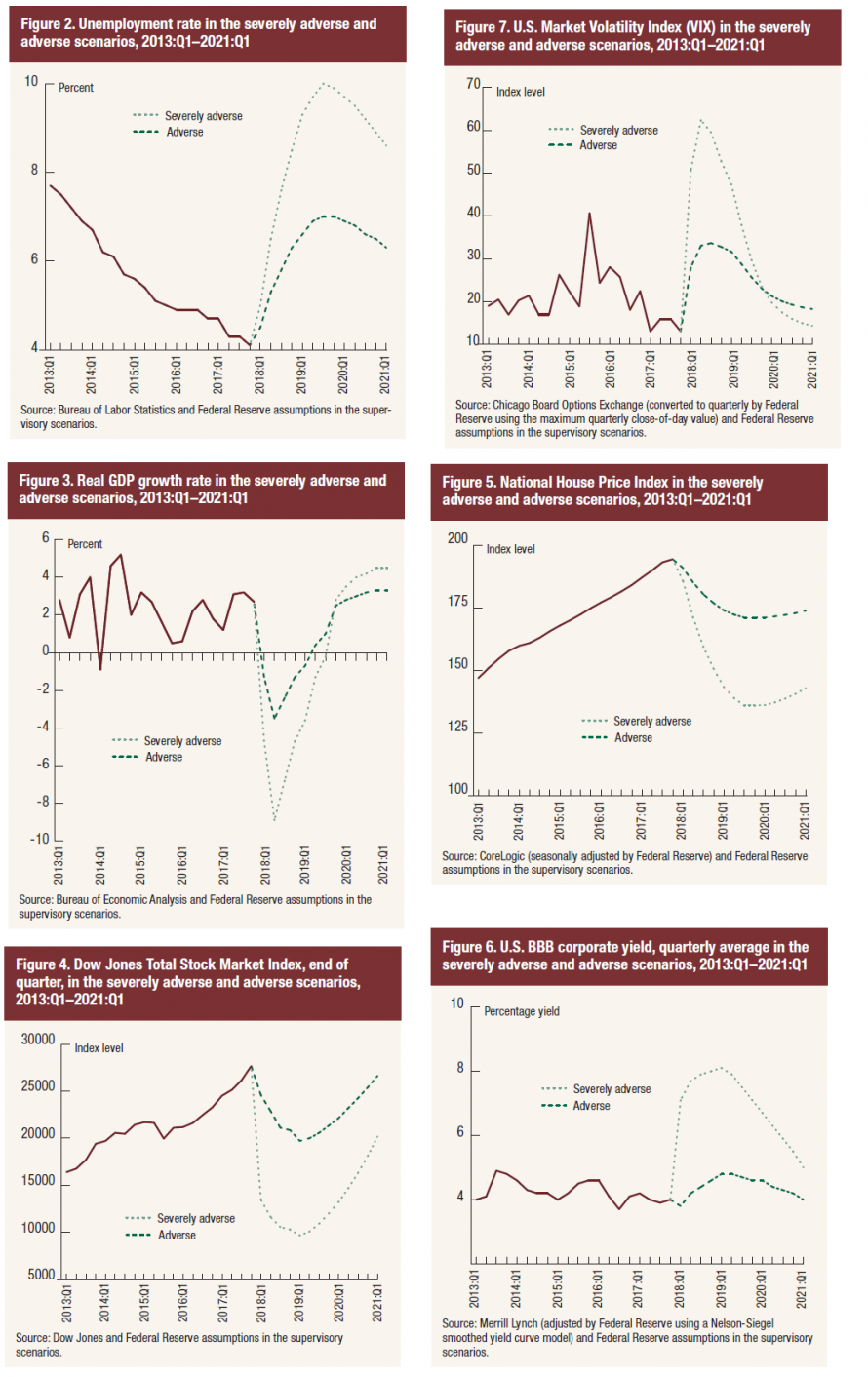

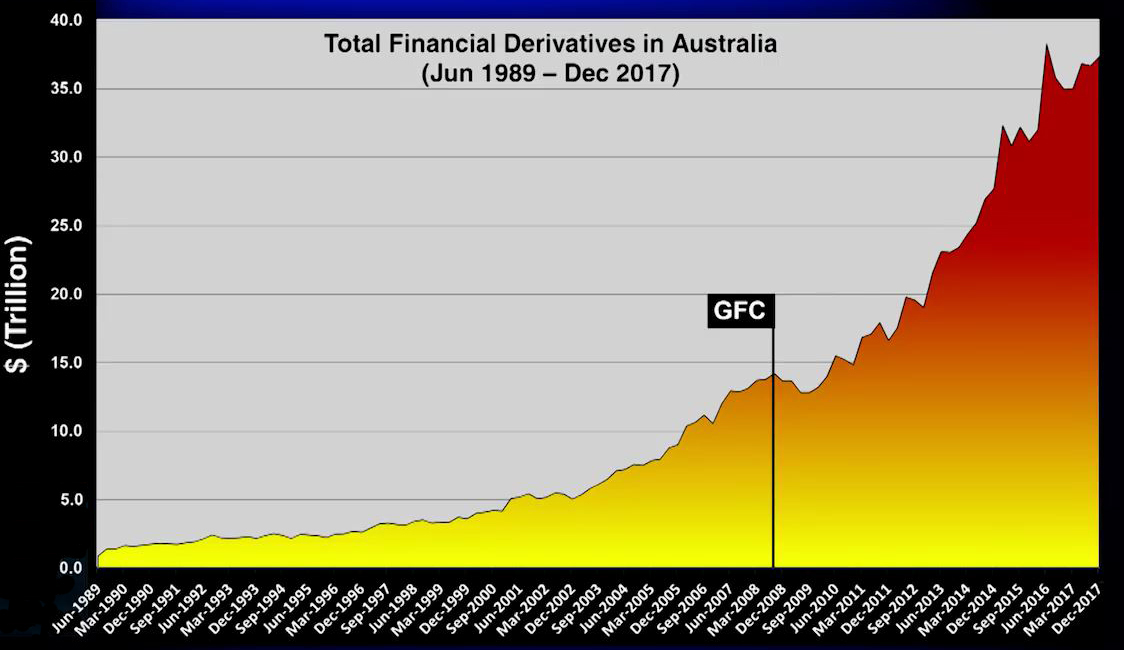

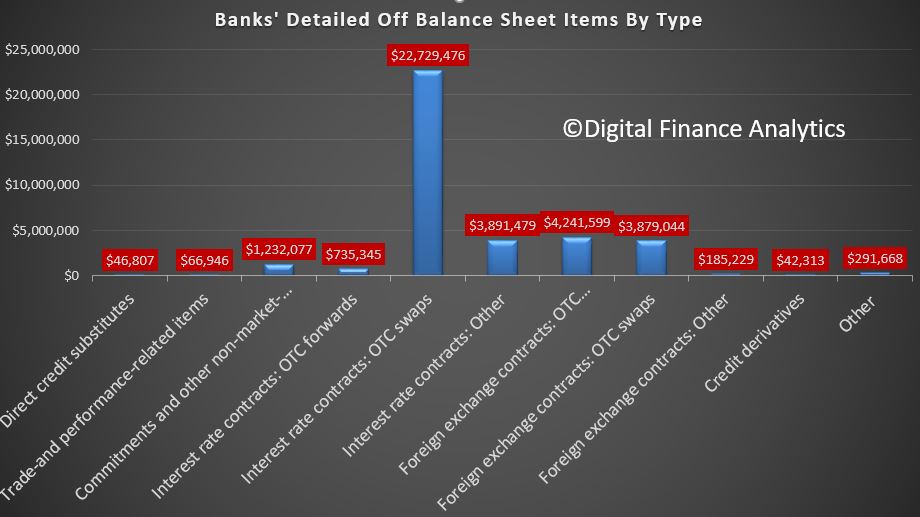

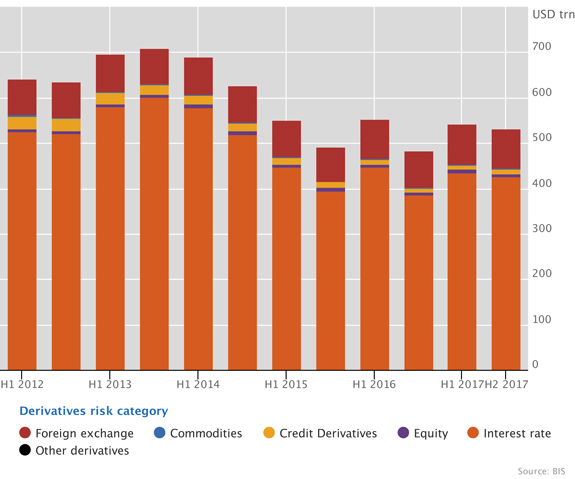

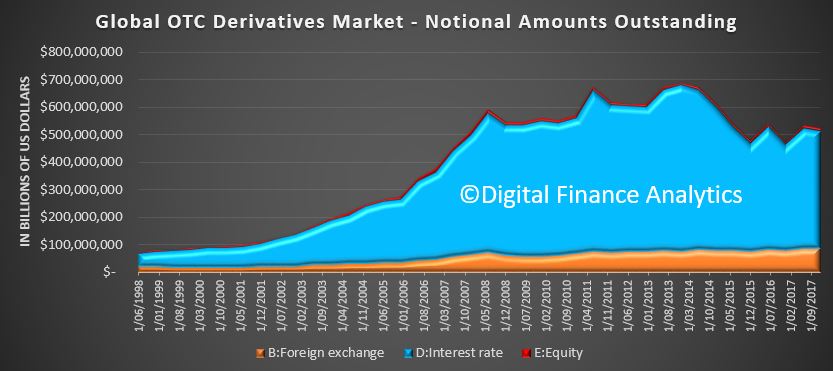

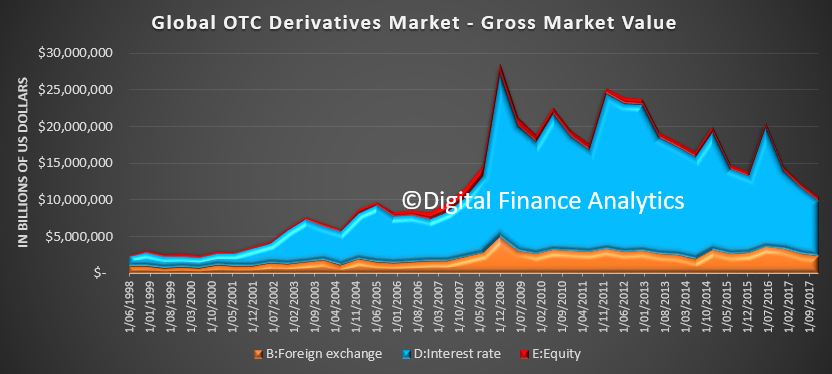

The FED released their stress testing of major US banks, and gave them a clean bill of health, though in our separate post “Testing, Testing..” we discussed the limitations of their approach. First, losses from trading and counter-party losses were estimated at only $133 billion US dollars, stemming from 9 institutions, including $17.3 billion from Bank of America Corporation, $16.3 billion from Citigroup, $13.3 billion from Goldman Sachs, $29.4 billion from JP Morgan $29.4 billion, Morgan Stanley $11.7 billion and $12.2 billion from Wells Fargo. These estimate of losses are calibrated based on historical performance, but given the massive size of the derivatives market, this is just a best guess. We discussed the size and shape of the derivatives market recently in the $37 trillion dollar black hole post. Second, it’s hard to estimate the potential impact of contagion and freezing of the markets as happened into 2007, as each bank is modelled separately. This begs the question as to whether the system level modelling is robust enough. Especially if one major counter-party fell over during a crisis. 2007 showed the problem when trust across the markets falls, and margins widen significantly. Third the assumptions are that things will revert to normal conditions in a few years – suggesting this is a “blip type crises.” Some of the smaller banks may have performed better in the tests than they would in the real world. But the bottom line, according to the FED is that the banks can stand on their own two feet in the mother of all crises, so not excuse for any bail-out then… We will see.

Looking more broadly across the global markets, the trade war continues to threaten, leaving the major U.S. indexes nursing a weekly loss. The U.S. and China exchanged a fresh volley of trade threats, scaling back investor appetite for risker assets amid fears of a tit-for-tat trade war between the world’s two largest economies. This is in my view now getting quite serious.

However, trade war concerns failed to stem demand for tech stocks as major tech blue chips such as Facebook, Netflix and Google rallied sharply, helping the Nasdaq close at a record high this week. This despite internet retailers like eBay and Amazon coming under pressure after the U.S. Supreme Court overturned the Quill ruling, allowing states and local governments to start collecting sales taxes from internet retailers. The S&P 500 posted a weekly loss despite closing 0.25% higher Friday at 2,759.50.

OPEC agreed Friday to a modest increase in output, sending crude oil prices soaring on expectations that the fresh supply into the market would be curbed as some countries lack the capacity to raise output. OPEC said it wanted countries –part of the production cut agreement – to increase production, returning to 100% compliance with agreed quotas by 1 July 2018. Analysts said the agreement would equate to increase in production of about 600,000 barrels a day as numerous countries in the accord aren’t capable of increasing production. Crude prices were also supported by a mixed U.S. inventory report as domestic crude supplies fell for the second straight week while crude products such as gasoline and distillate increased by more than analysts had forecast. Crude futures settled 4.64% higher at $68.58 higher on Friday.

The dollar ended the week lower as trade war concerns flared up, stoking demand for safe-haven yen, while a rebound in the euro on mostly positive economic data also weighed on sentiment. EUR/USD rebounded from an 11-month low seen Thursday, prompting traders to flee the greenback despite lingering concerns over Italian political uncertainty and lower-for-longer interest rates in the Eurozone. The dollar’s sluggish end to the week comes just days after its rise to fresh 2018 highs was met by a wave of resistance despite expectations that a more hawkish Federal Reserve would provide further room for upside in the greenback. “The divergence between U.S. and rest of the world monetary policy will support longer and greater USD strength than we had anticipated,” Barclays said earlier this week in a note to clients. The dollar was also held back by yen strength supported by rising trade tensions between the U.S. and China. The dollar fell 0.36% to 94.20 against basket of major currencies on Friday.

Gold prices bounced from fresh 2018 lows this week but remained under pressure struggling to take advantage of a weaker dollar and rising safe-haven demand as sentiment on the yellow metal waned. Fearing a faster pace of Federal Reserve rate hikes, investors have shunned the yellow metal even as safe-haven demand grows on the back of an ongoing trade spat between the U.S. and China.

Fresh selling was seen in Bitcoin on Friday, as the crypto hit its lowest level since February after Japan’s regulatory crackdown on the industry triggered a selloff. Japan’s largest crypto exchange, bitFlyer, suspended the creation of new accounts after Japan’s Financial Services Agency ordered several cryptocurrency exchanges to step up their efforts to combat money laundering. That sent shockwaves through the crypto industry amid fears other crypto exchanges in Japan could also be forced to scale back operations as they seek to beef up their practices. As Japan is the largest market for bitcoin trading, the threat of a reduction in fresh fund inflows, sparked selling across cryptos, wiping more than $20 billion from the crypto market in under 24 hours. The total crypto market cap fell to about $261 billion, from about $289 billion Thursday. Bitcoin was down to 6,015, down 10%. Again highlighting the volatility of the sector.

So, to conclude, while many of the major indicators were higher, this could well be the calm before the storm, as below the hood, the data does not lie. Locally, the tighter credit supply will spill over to lower home prices, and as the next round of the Royal Commission starts next week, we think the banks will be back in the spotlight, but not in a good way.