As we approach the end of the year, we got some stats from the RBA on credit to the end of November. Whilst the debt is growing the value of the housing assets are falling, this is a nasty pincer movement!

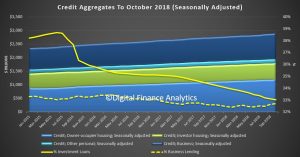

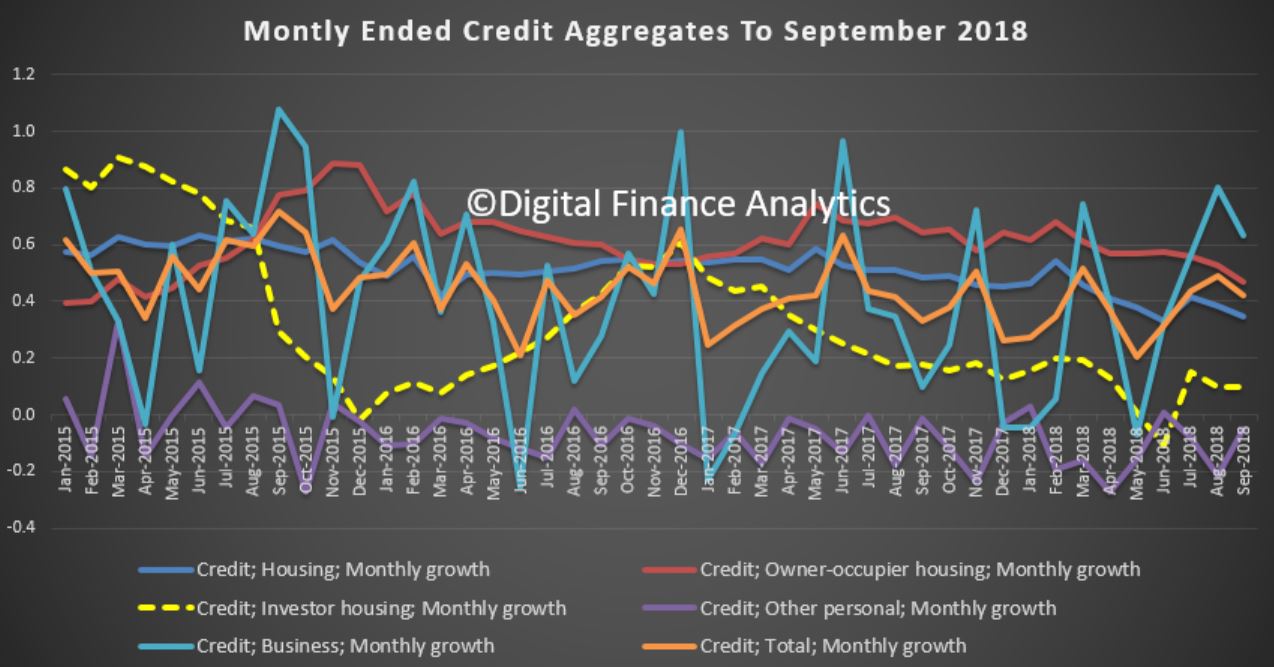

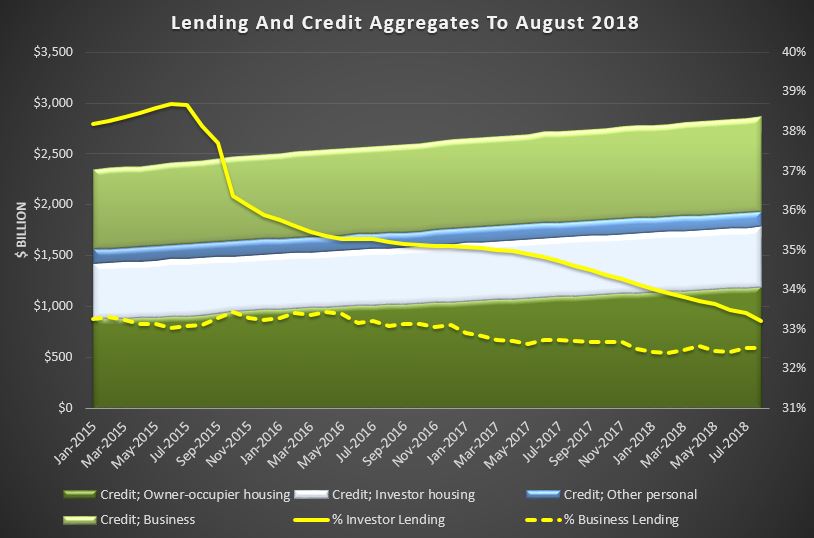

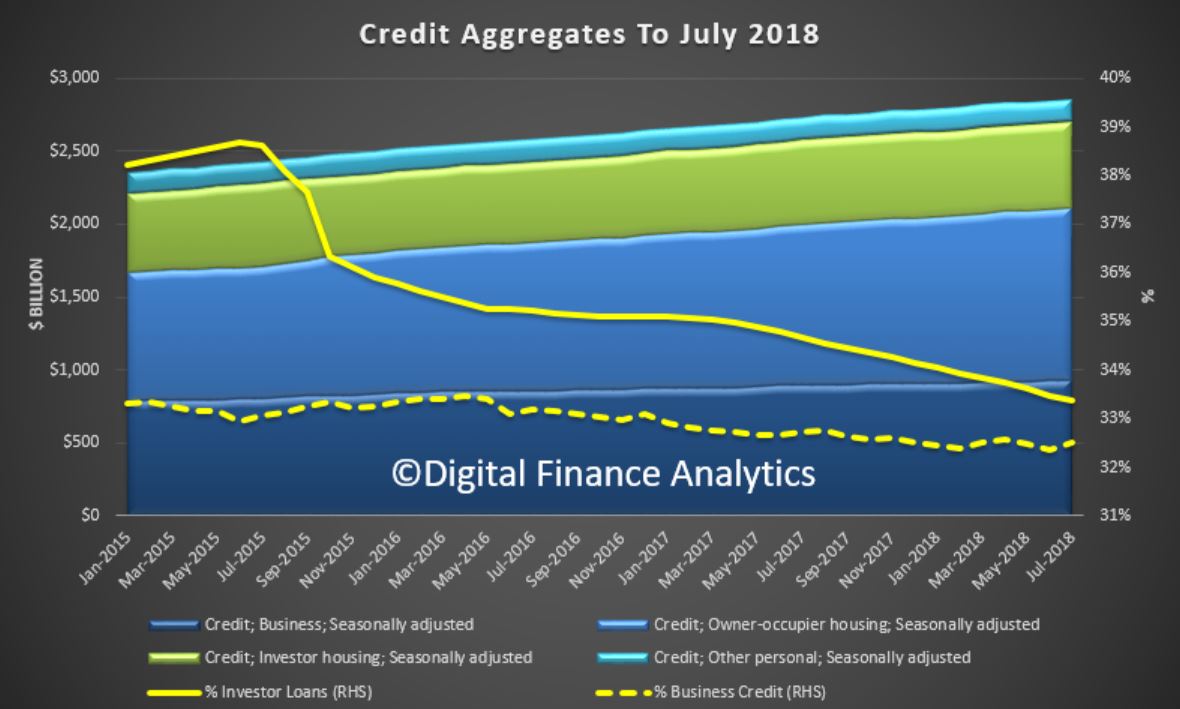

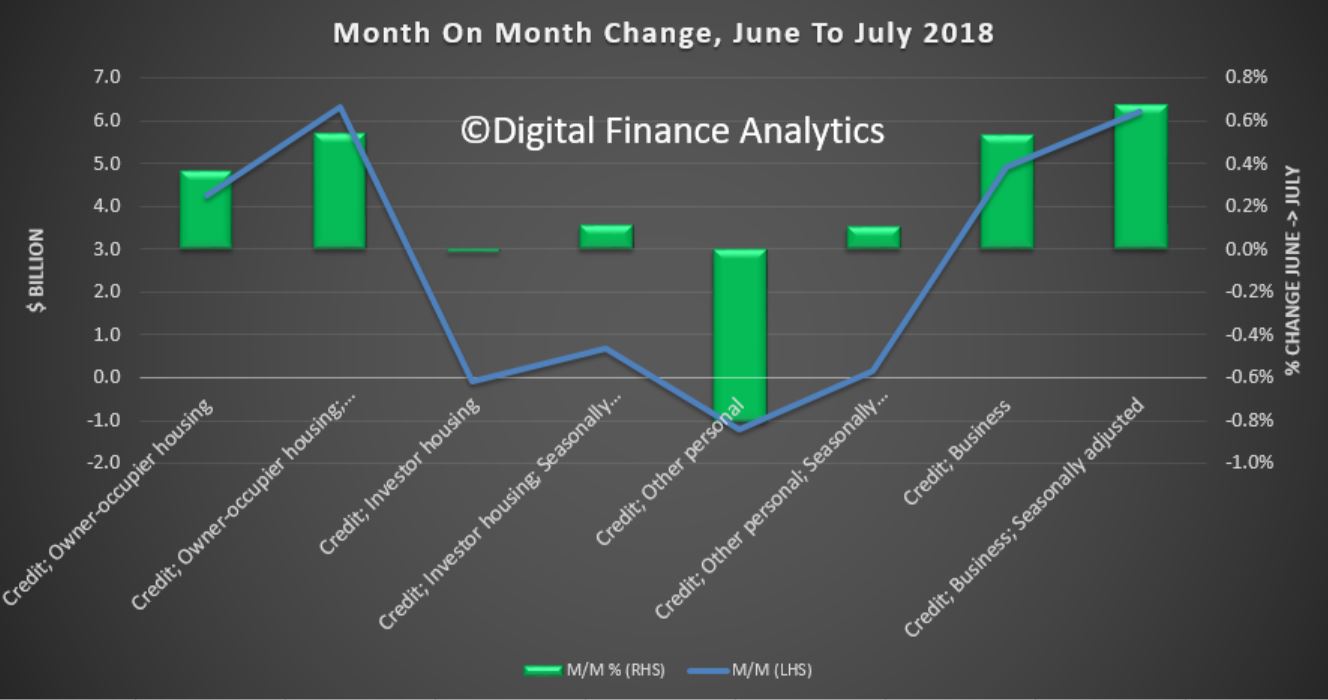

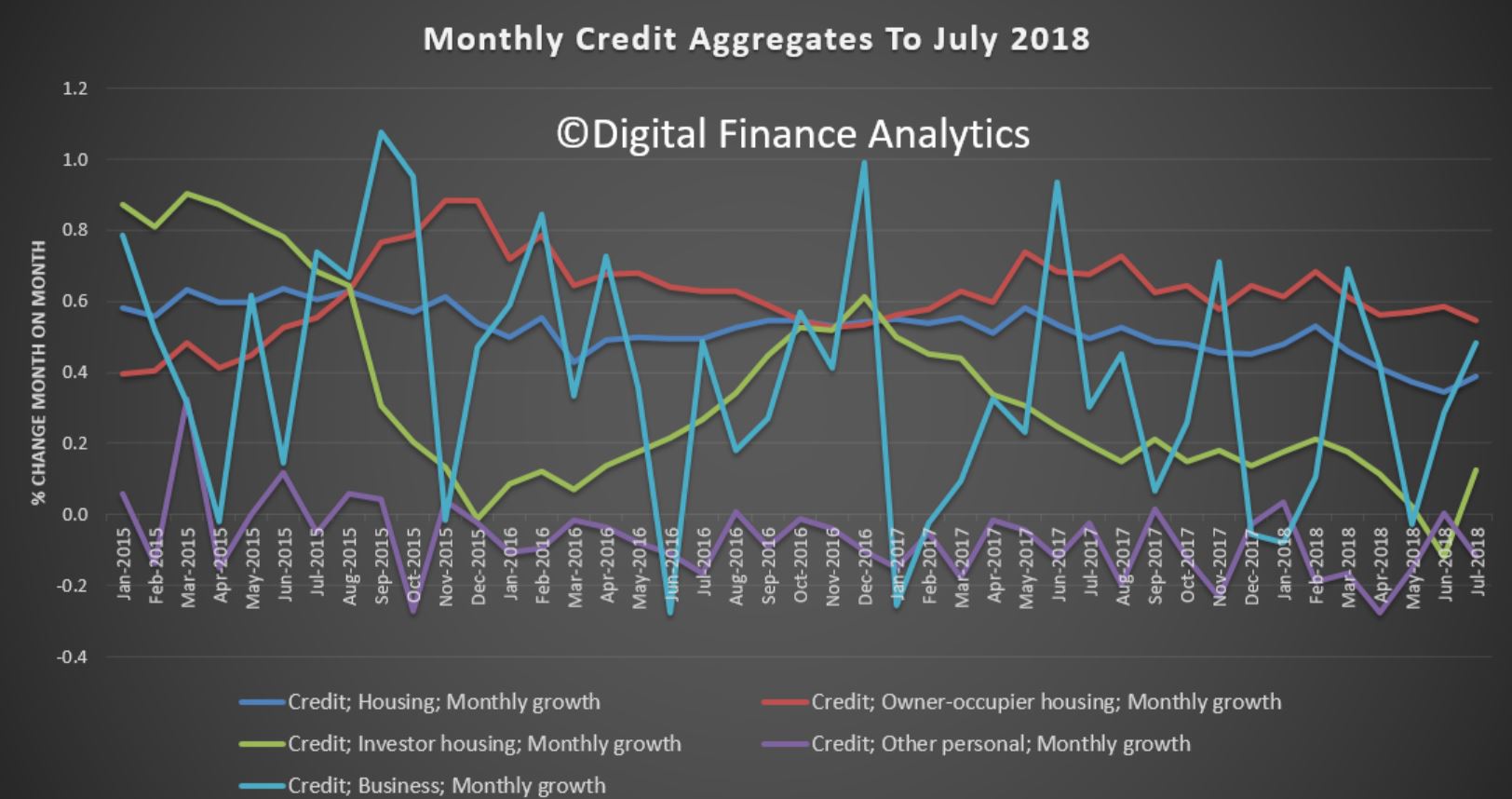

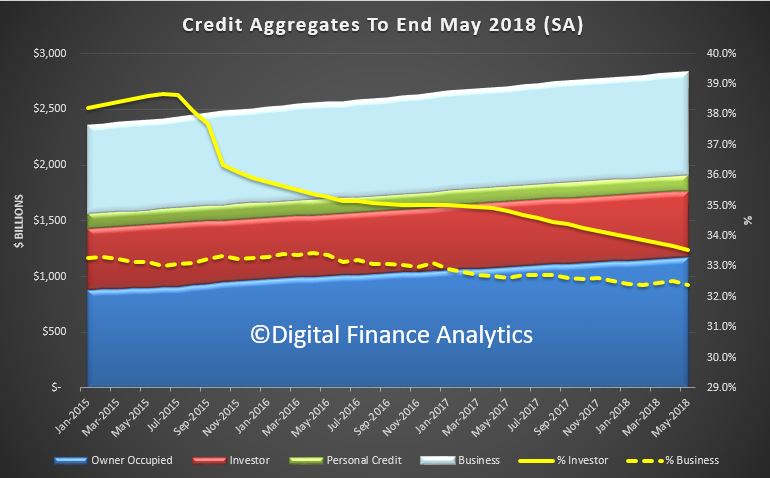

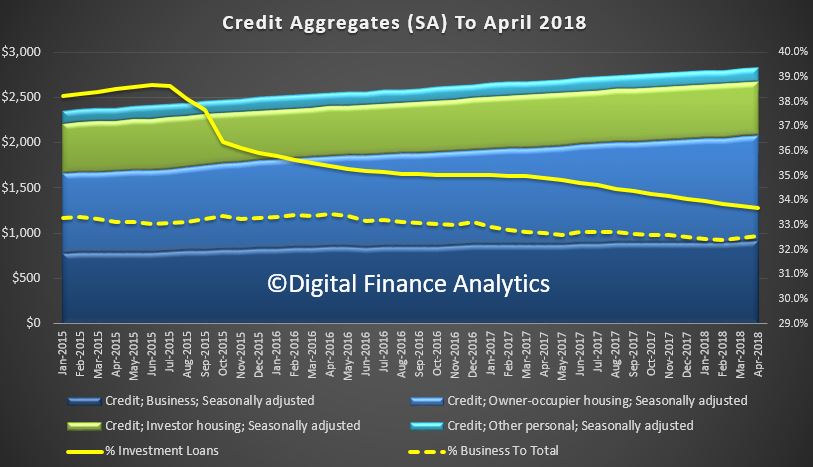

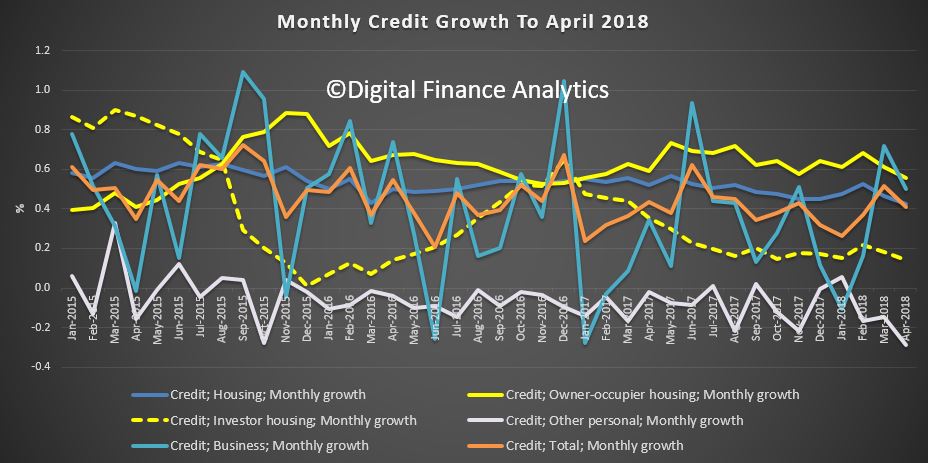

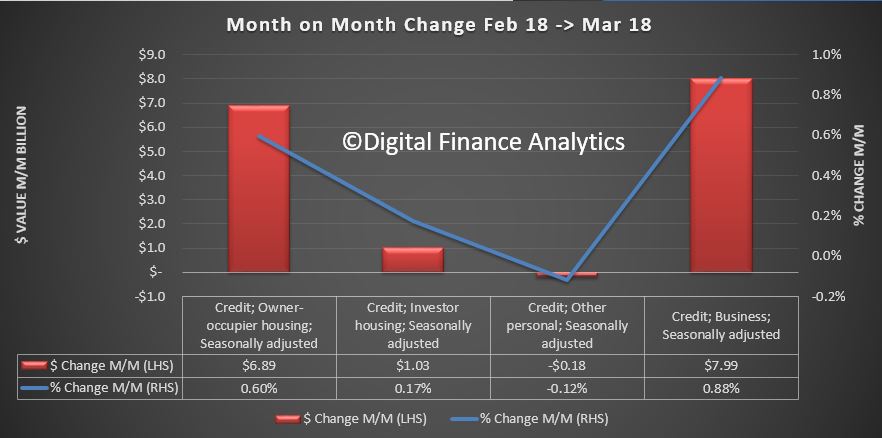

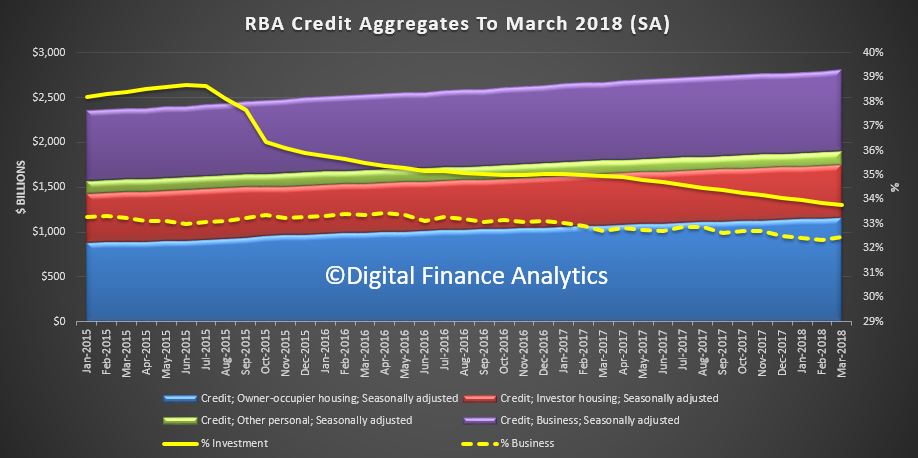

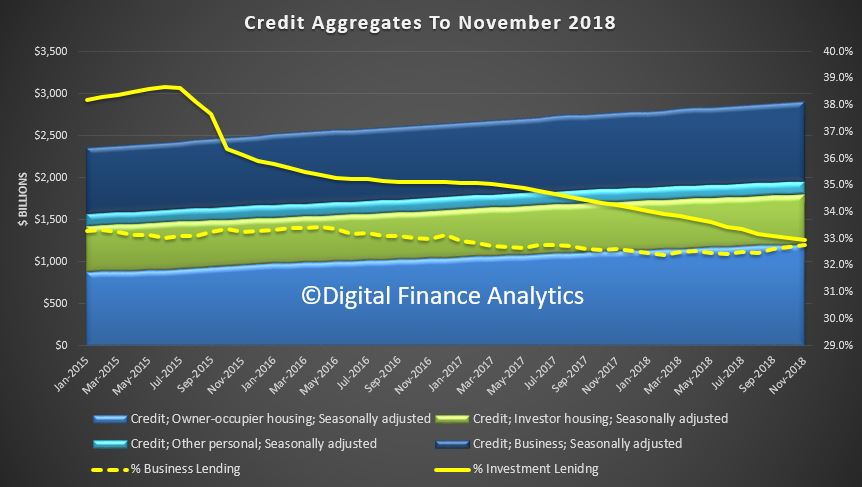

Their credit aggregates reveals that in seasonally adjusted terms total credit rose by 0.34% or $9.9 billion dollars, to a new record of $2.9 trillion dollars.

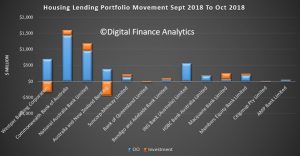

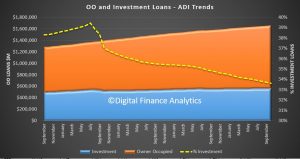

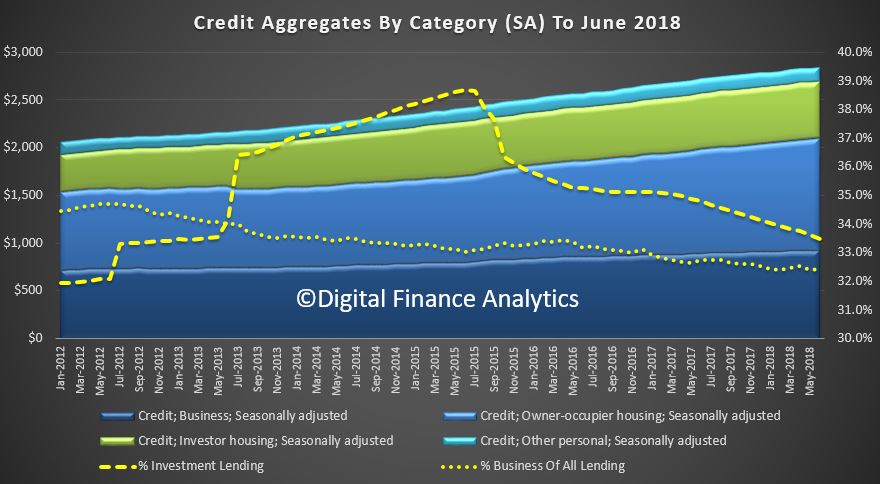

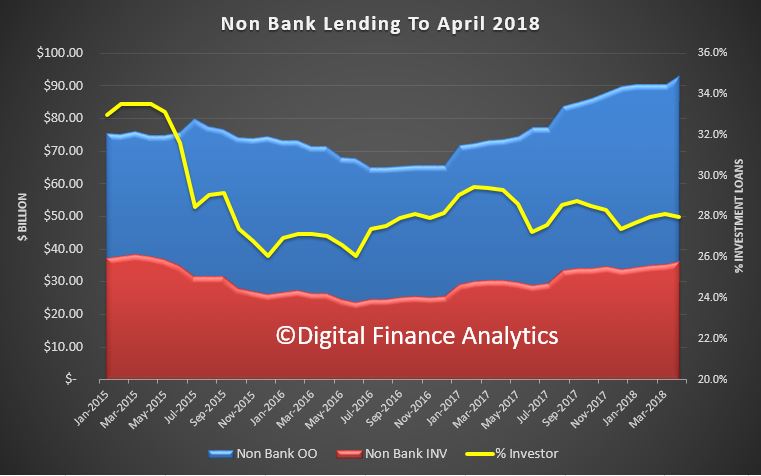

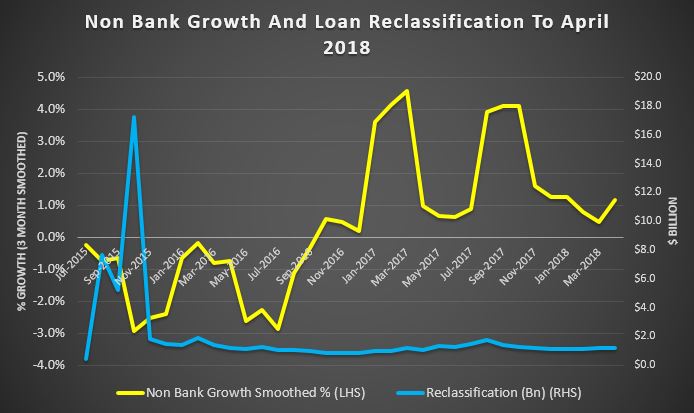

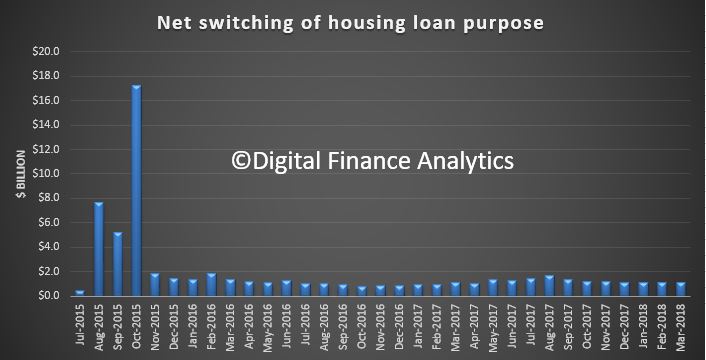

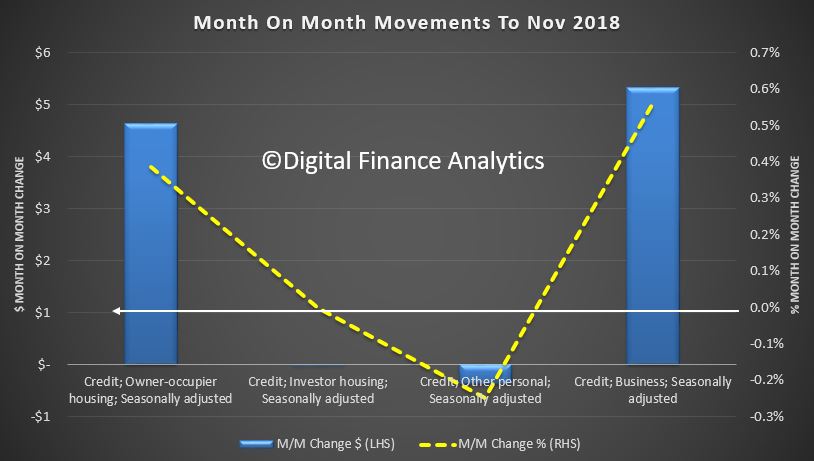

Within that credit for owner occupied housing rose 0.38%, or $4.63 billion to a new record $1.21 trillion dollars, lending for property investment was flat, standing at $0.59 trillion dollars and lending for business rose 0.56%, or $5.32 billion to $0.95 trillion dollars, another record. The proportion of business lending to all lending rose to 32.8%, while the share of residential property lending for investment property fell to 32.9%, the lowest in years (but still too high in my book!). Credit growth is too fast.

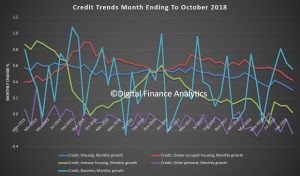

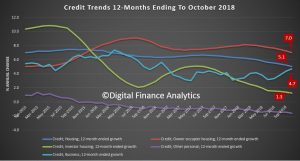

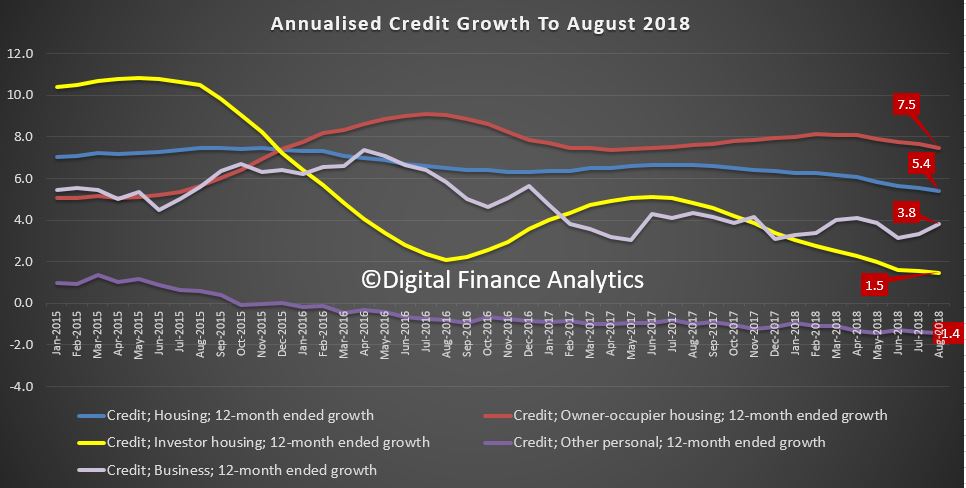

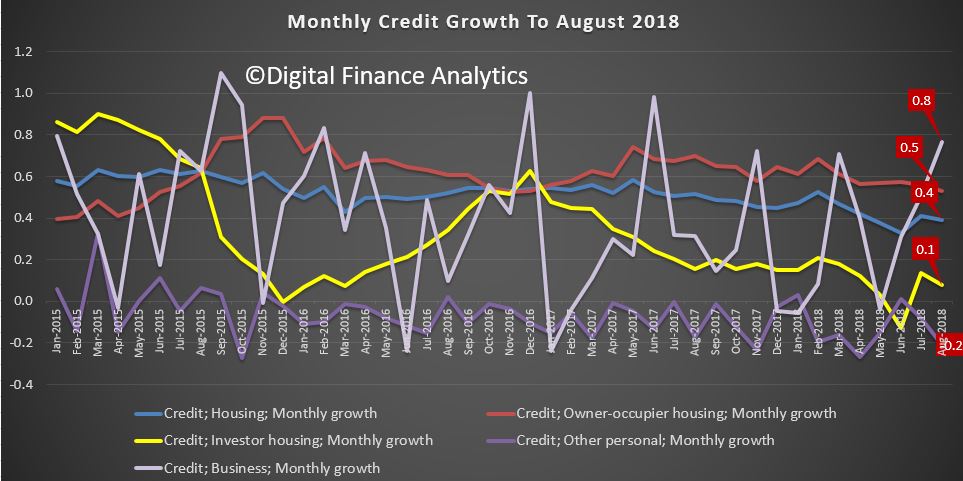

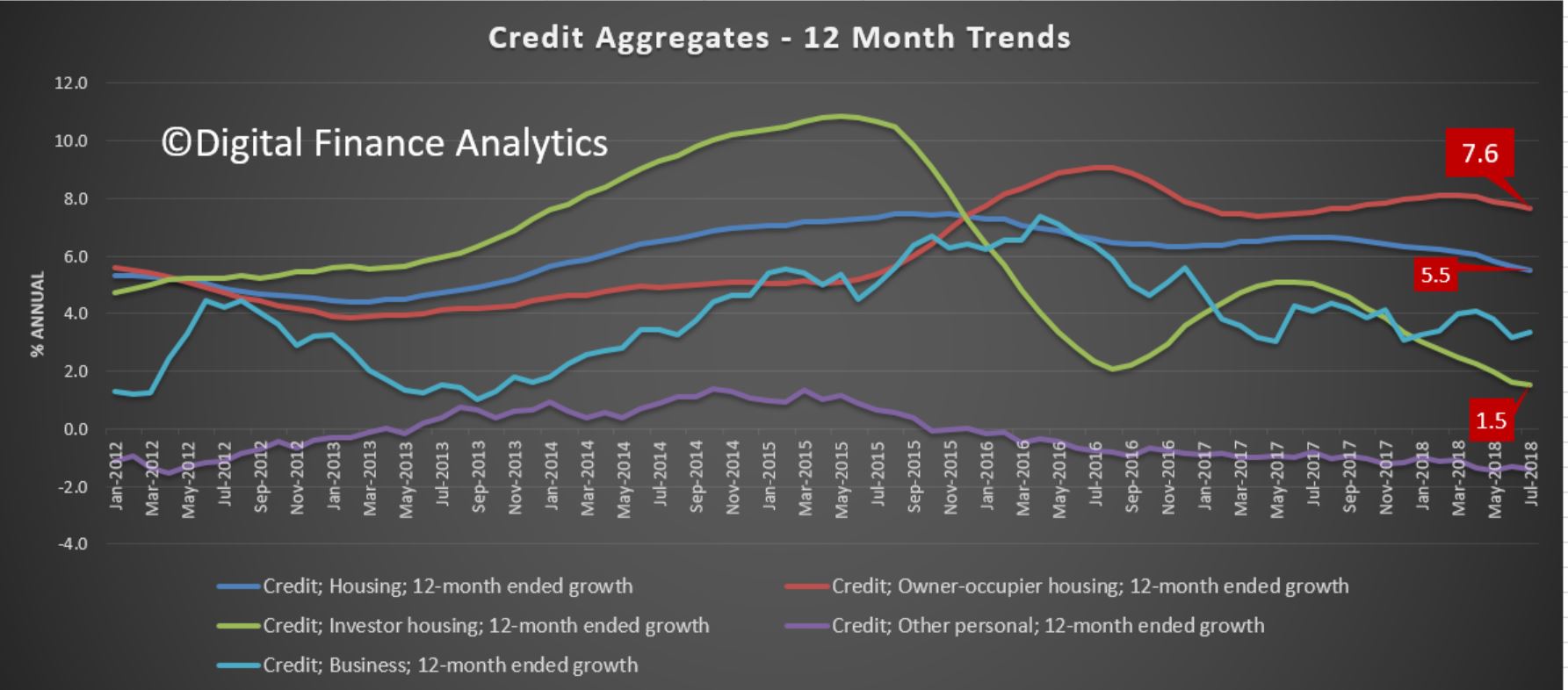

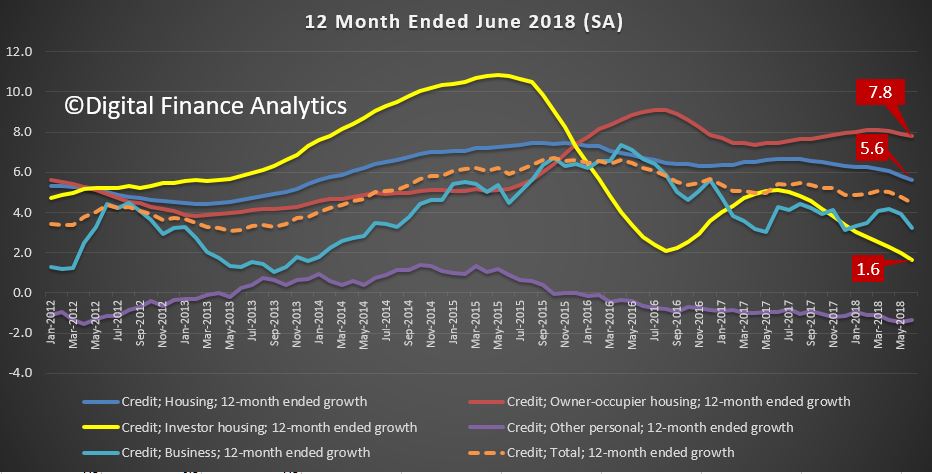

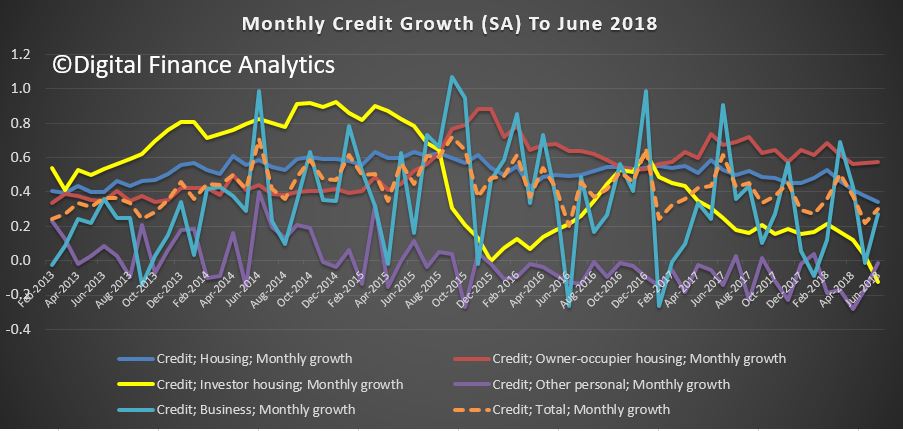

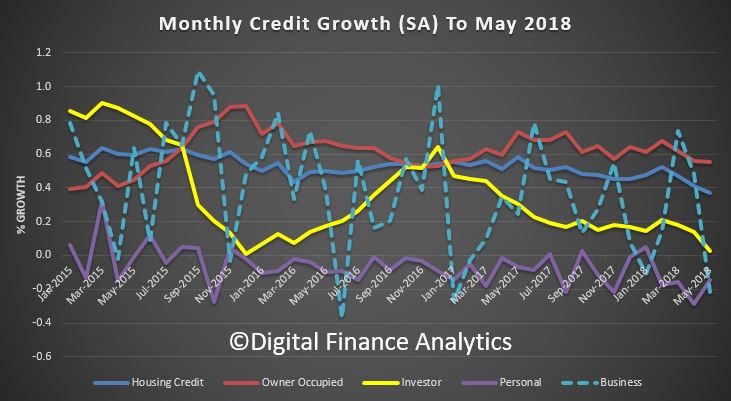

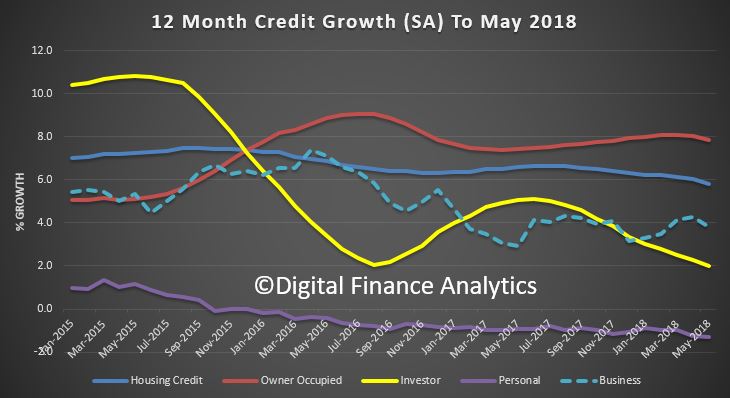

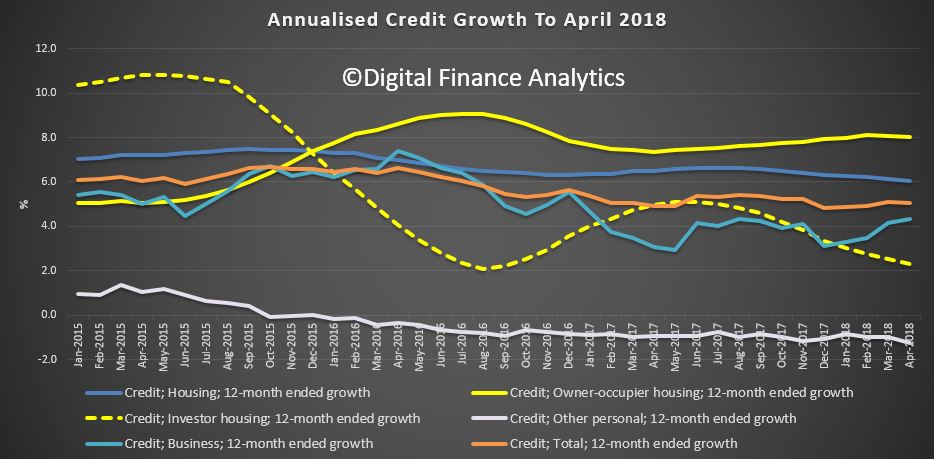

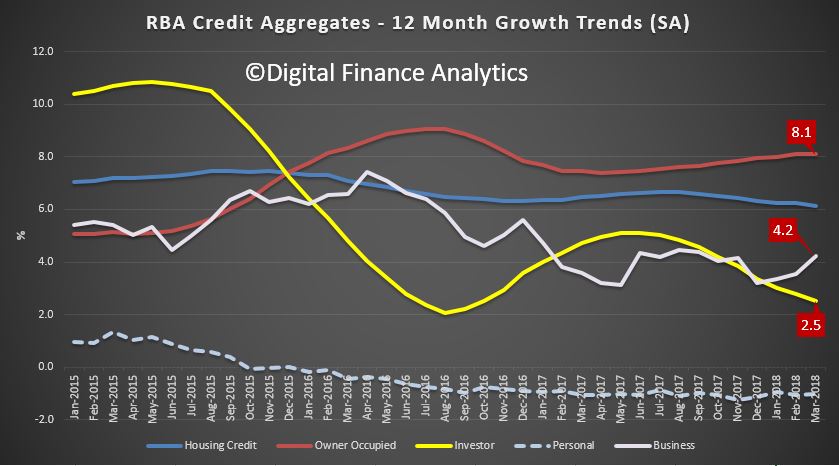

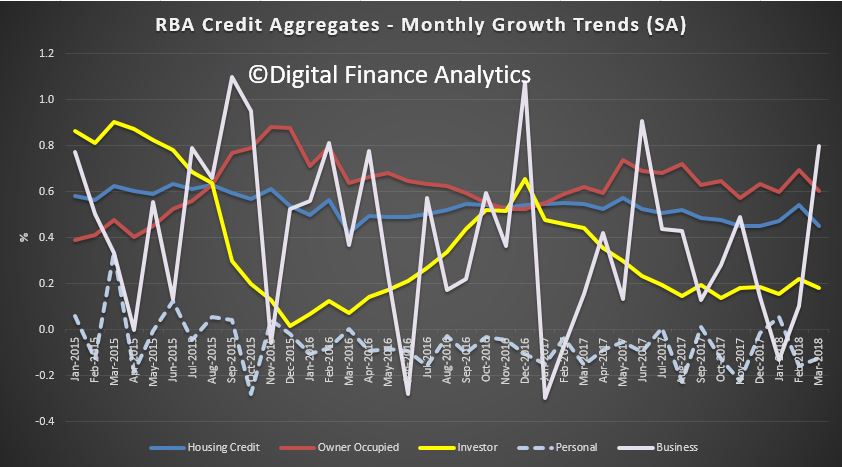

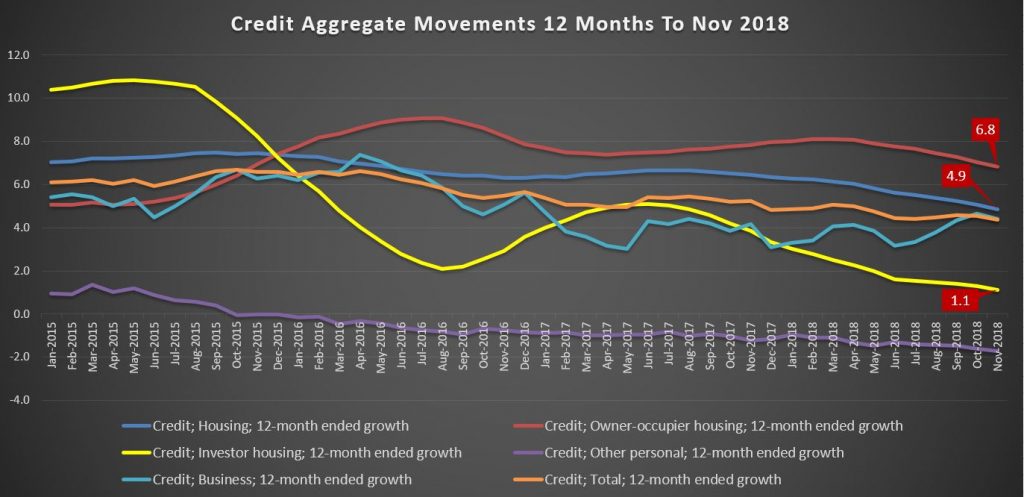

The trend charts show that on a 12 month basis, investment lending has now only growth 1.1%, while owner occupied lending is still running at 6.8%, still faster than business lending. Personal credit continues to fall.

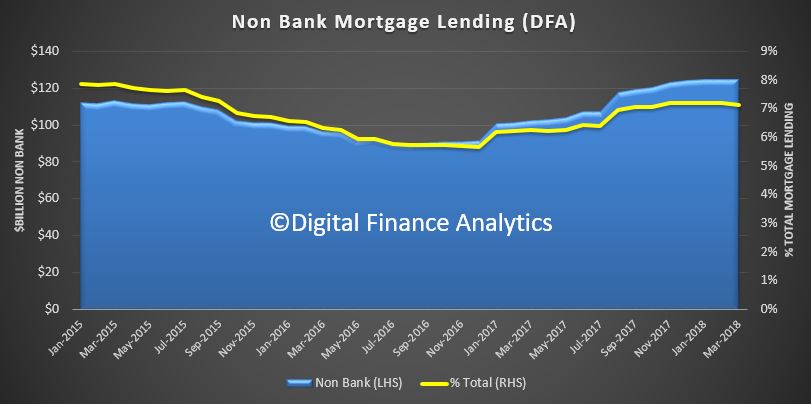

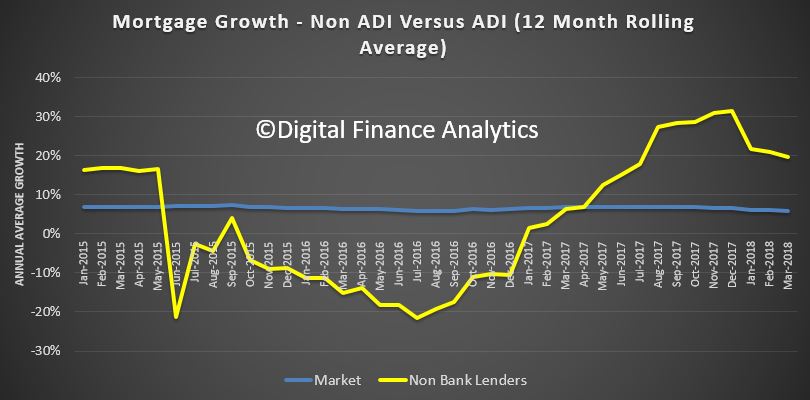

This indicates that despite all the hype about tight lending, loans are still being written, at a growth rate which is well above inflation and income. As a result the total debt burden is still rising. RBA please note.

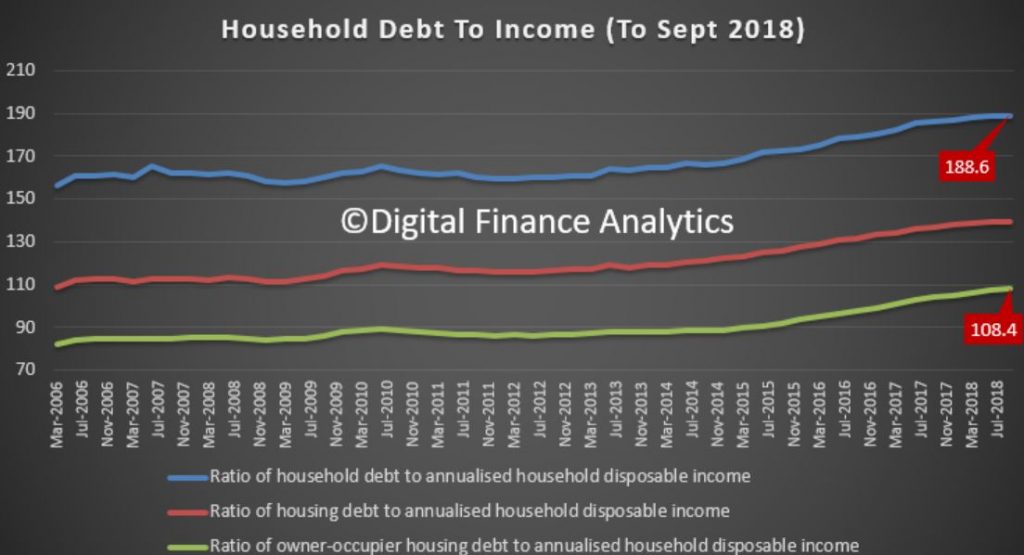

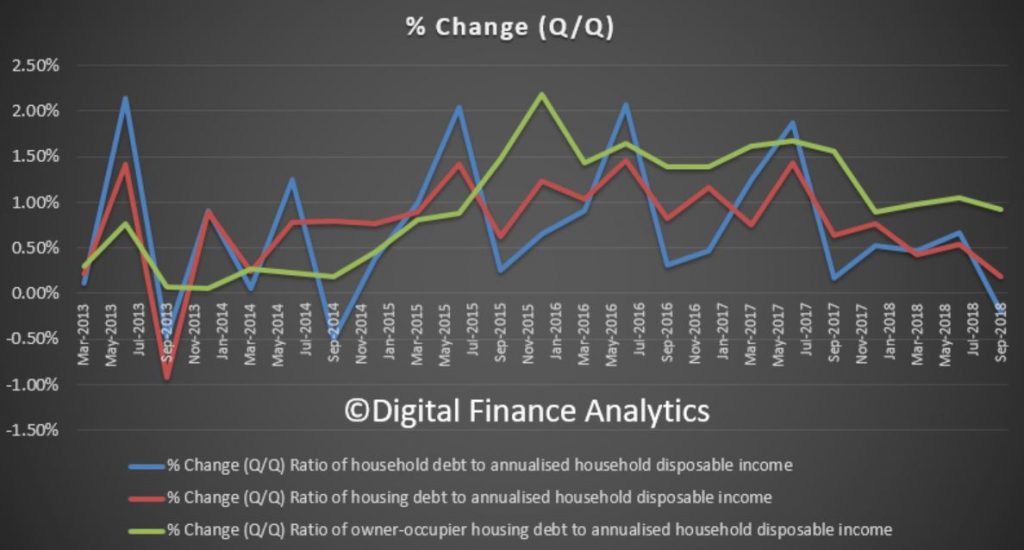

We can see the consequences working out by looking at the latest Household Finance Ratios from the RBA, using ABS data

This shows that total household debt to income to September 2018 fell from 189 to 188.6, whilst the housing debt to income rose from 139.4 to 139.6 and the owner occupied ratio rose from 107.4 to 108.4. Now this ratio includes households and unincorporated businesses – small businesses essentially. So we see the continued consolidation of debt around housing, while other forms of debt, such as credit cards, diminished. In fact, the change quarter on quarter for owner occupied housing debt is close to 1%, so have no doubt, debt relative to income for housing is still rising.

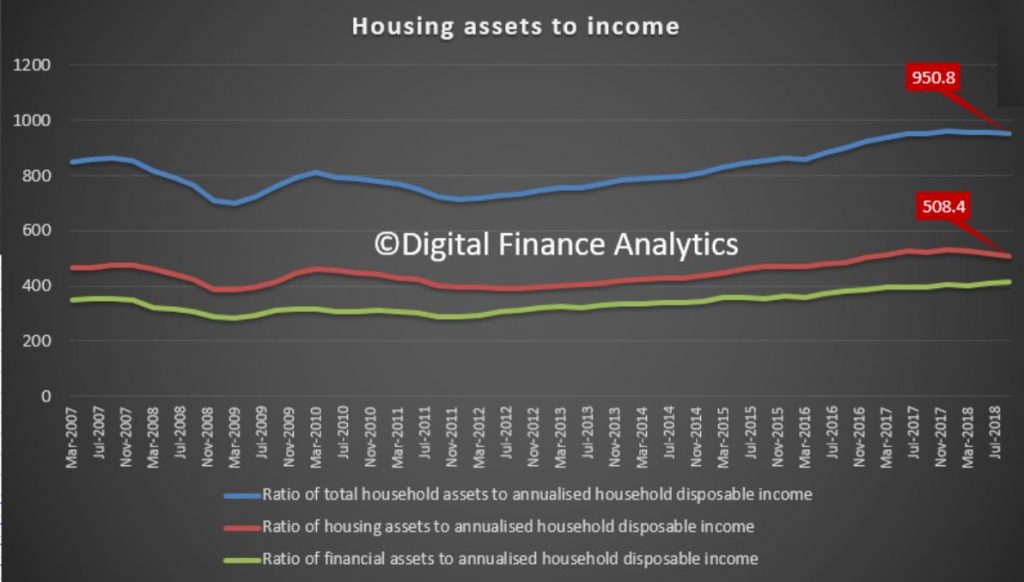

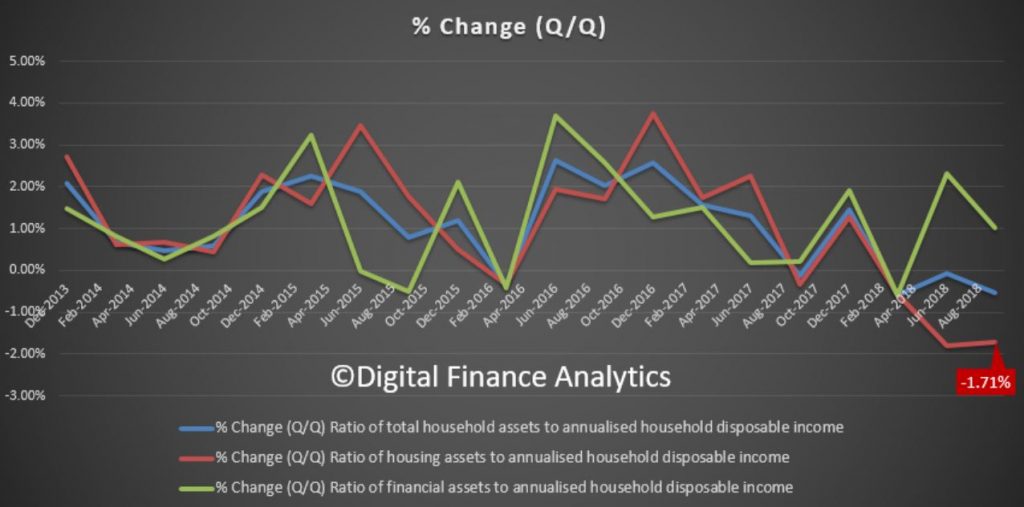

The assets to income data in the same series fell, thanks to the fall in value of housing.

The ratio of household assets to income fell from 956.0 to 950.8, the ratio of housing assets to income fell from 517.3 to 508.4, down 1.7% in the quarter and 2.7% for the year to date, while the ratio of financial assets (stocks etc.) lifted from 410.3 to 414.5 (though will be lower now thanks to the recent market falls). In other words, whilst the debt is growing the value of the housing assets are falling – a double whammy.

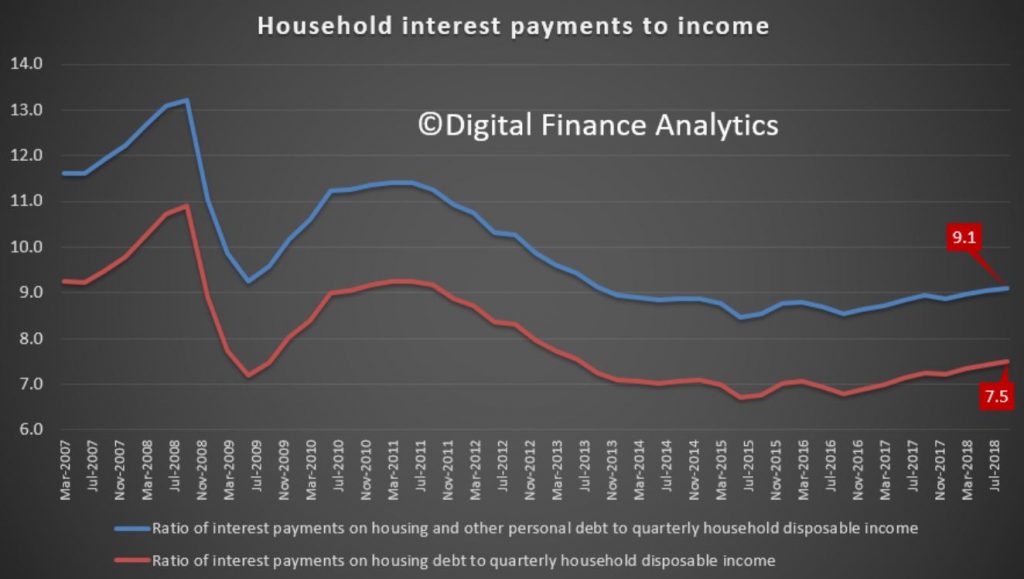

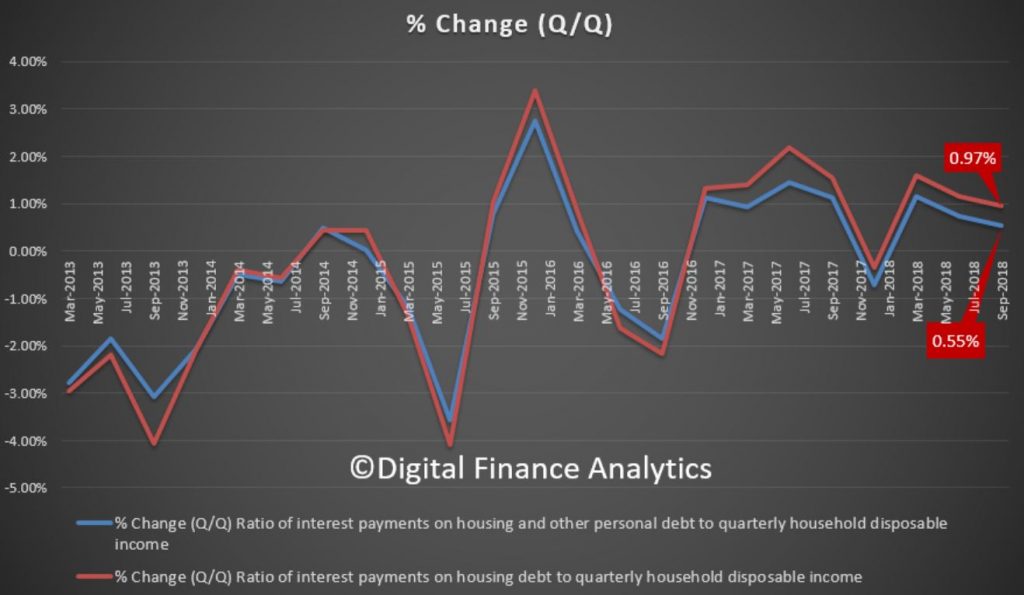

The final dimension is interest payments to debt, both of which are higher (thanks to bigger loans and only small changes in mortgage rates).

The ratio of housing debt interest repayments to income rose from 7.4 to 7.5 per cent and interest payments on all debt rose from 9.0 to 9.1 percent. This is confirming the growth trend since 2016, where the out of cycle interest repayments hit.

The point to note here is that the one third of households with mortgage debt are seeing a rise in the share of income going to support the interest repayments – at these extremely low, emergency interest rates. And that is the point, the averages mask the marginal borrower who remains under extreme pressure, which is why mortgage stress continues to rise. We will report on the December data in a week or so.

So the key take away as we move into 2019 is the debt machine is still working, more households are being encouraged to get deeper into debt, despite the clear evidence of massive over borrowing. A strategy applauded by the RBA, the Treasury and the Banks!

We really need a change in strategy because debt fueled household consumption and property speculation will be one of the nails in the economies coffin down the track. Interest rates will rise. The other is sporty corporate borrowing, but that is a story for another day!

Finally, seasons greetings to all our followers, and our best wishes for (a debt free) 2019!