Westpac released their latest disclosures today the June 2018 Pillar 3 Report and provided an update on margins for the June quarter 2018. Its not pretty. Margins down, and mortgage delinquencies up.

The share price continues lower.

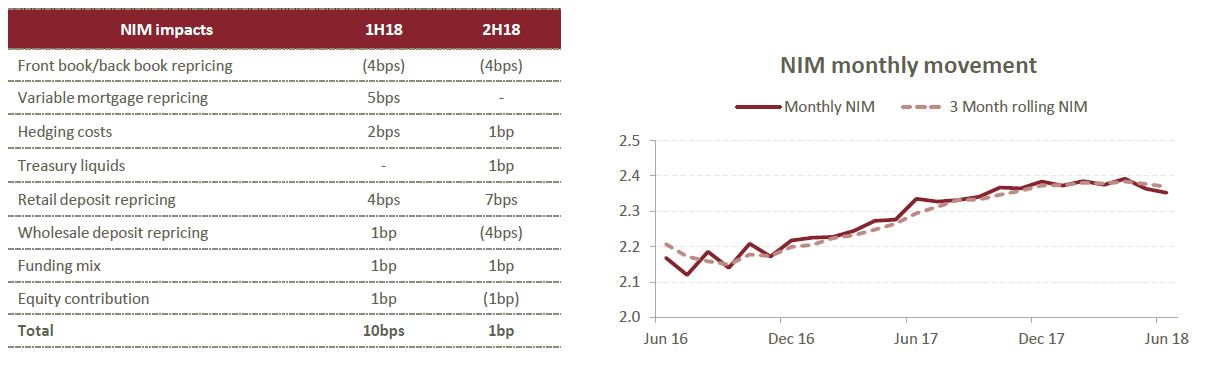

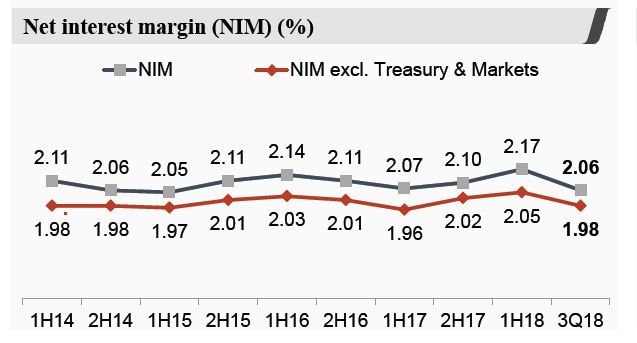

Westpac Banking Corporation has today announced that its net interest margin in June quarter 2018 (3Q18) was 2.06% compared to 2.17% in First Half 2018 (1H18). The 11bp decline mostly reflected higher funding costs and a lower contribution from the Group’s Treasury.

Westpac Banking Corporation has today announced that its net interest margin in June quarter 2018 (3Q18) was 2.06% compared to 2.17% in First Half 2018 (1H18). The 11bp decline mostly reflected higher funding costs and a lower contribution from the Group’s Treasury.

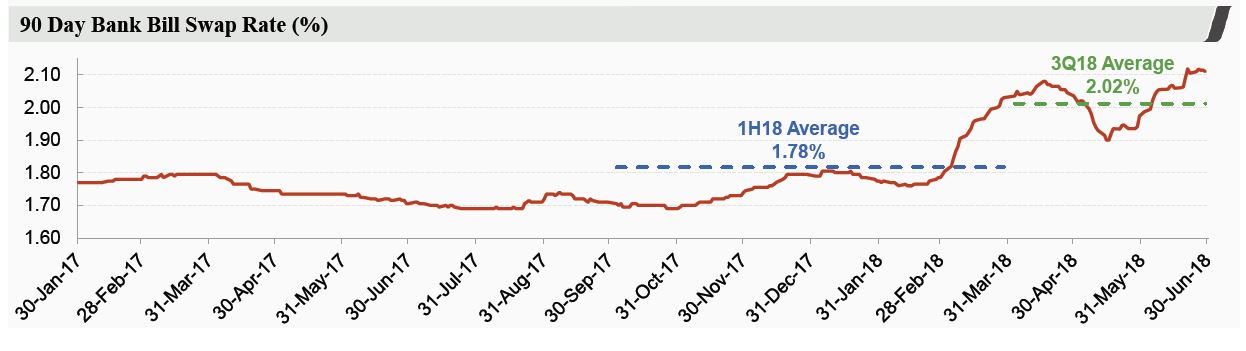

The primary source of higher funding costs has been the rise in short term wholesale funding costs as the bank bill swap rate (BBSW) increased sharply since February.

The primary source of higher funding costs has been the rise in short term wholesale funding costs as the bank bill swap rate (BBSW) increased sharply since February.

Westpac previously indicated that every 5bp movement in BBSW impacts the Group’s margins by around 1bp. Compared to 1H18, BBSW was on average 24bps higher in 3Q18. Accordingly, in 3Q18 this movement in BBSW reduced the Group’s net interest margin by 5bps.

Westpac previously indicated that every 5bp movement in BBSW impacts the Group’s margins by around 1bp. Compared to 1H18, BBSW was on average 24bps higher in 3Q18. Accordingly, in 3Q18 this movement in BBSW reduced the Group’s net interest margin by 5bps.

The remaining 6bps margin decline in 3Q18 was attributable to:

- 4bps from a reduced contribution from Group Treasury, principally from less opportunities in markets in 3Q18 compared to 1H18; and

- 2bps from all other factors. These included ongoing changes in the mix of the mortgage portfolio (less interest only lending) along with lower rates on new mortgages. Deposit pricing changes only had a small impact on margins in 3Q18.

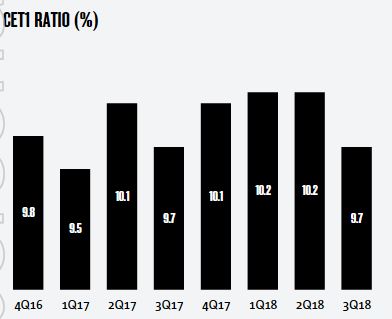

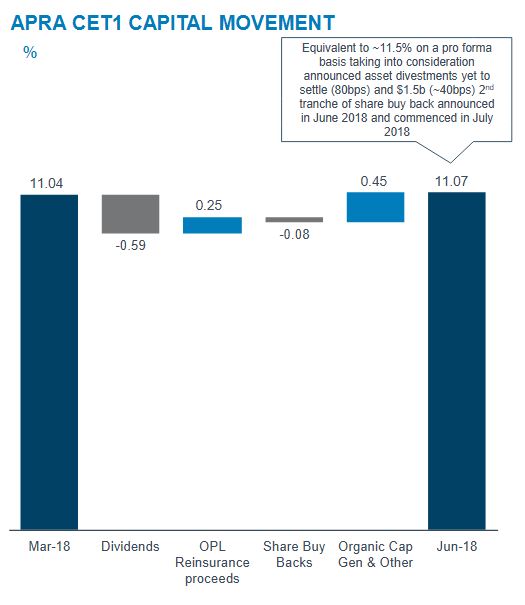

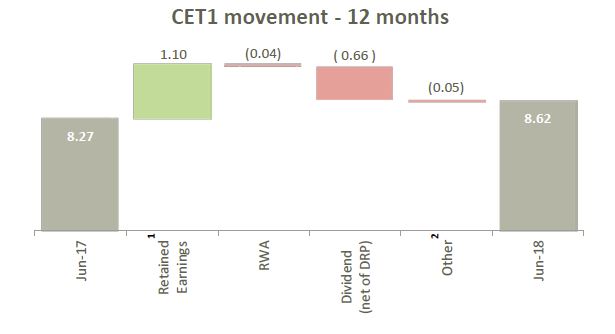

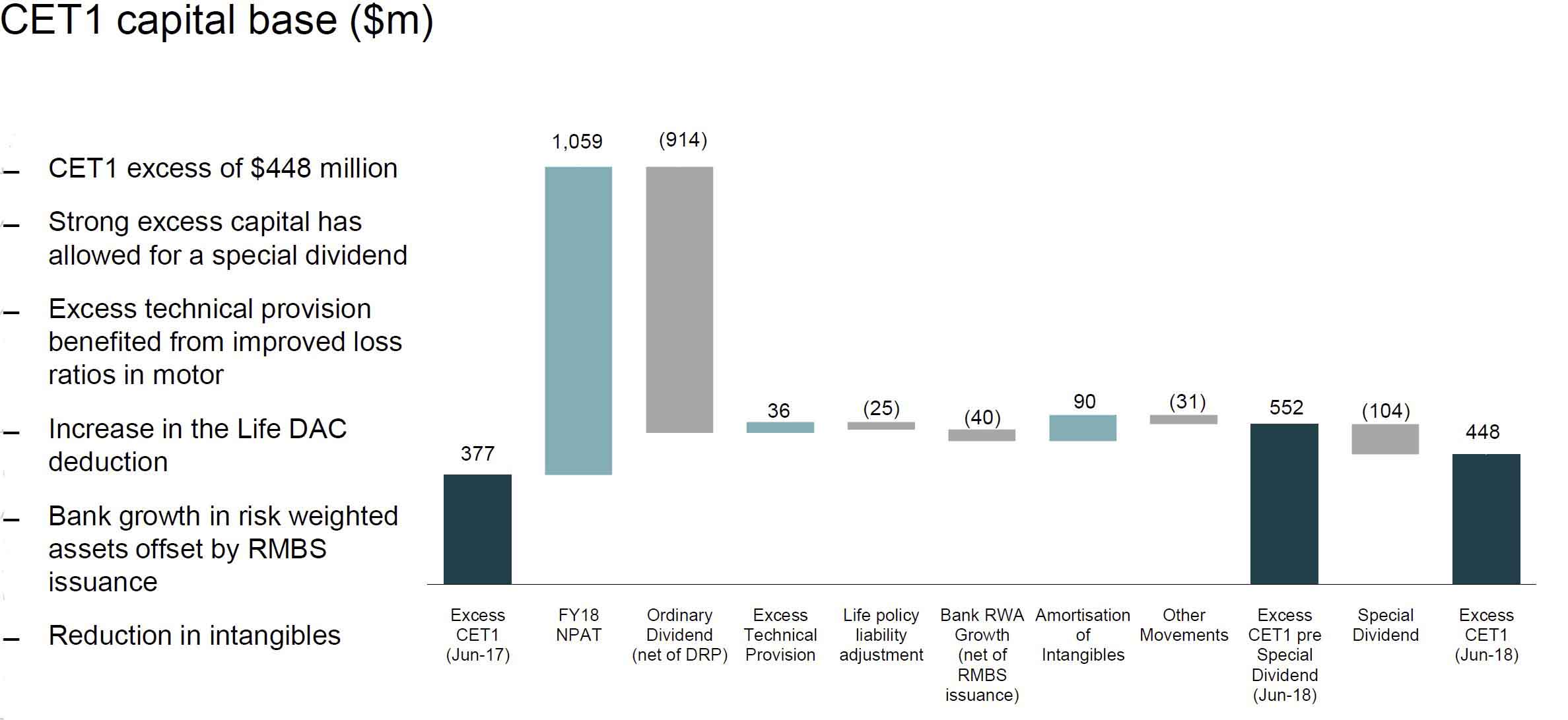

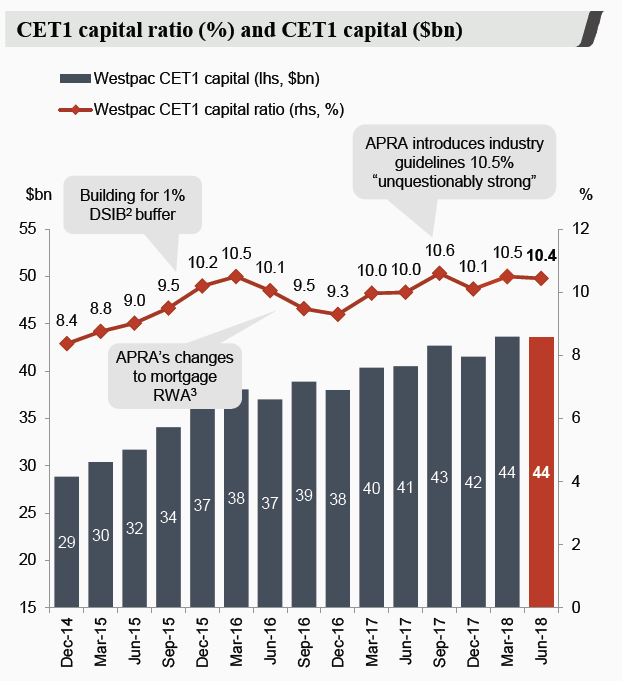

In Westpac’s June 2018 Pillar 3 report released today the Group reported a Common equity Tier 1 capital ratio of 10.4% at 30 June 2018. The ratio was lower than at 31 March 2018 as capital generated over the quarter was more than offset by determination of the First Half 2018 dividend.

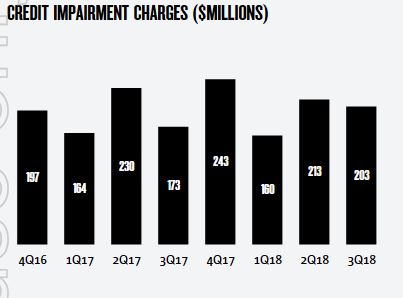

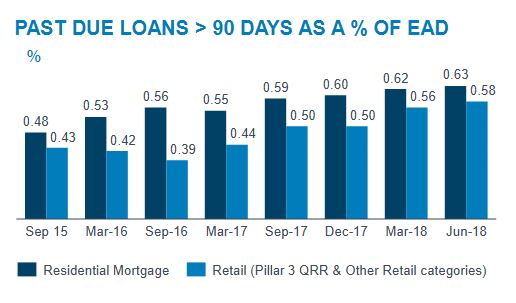

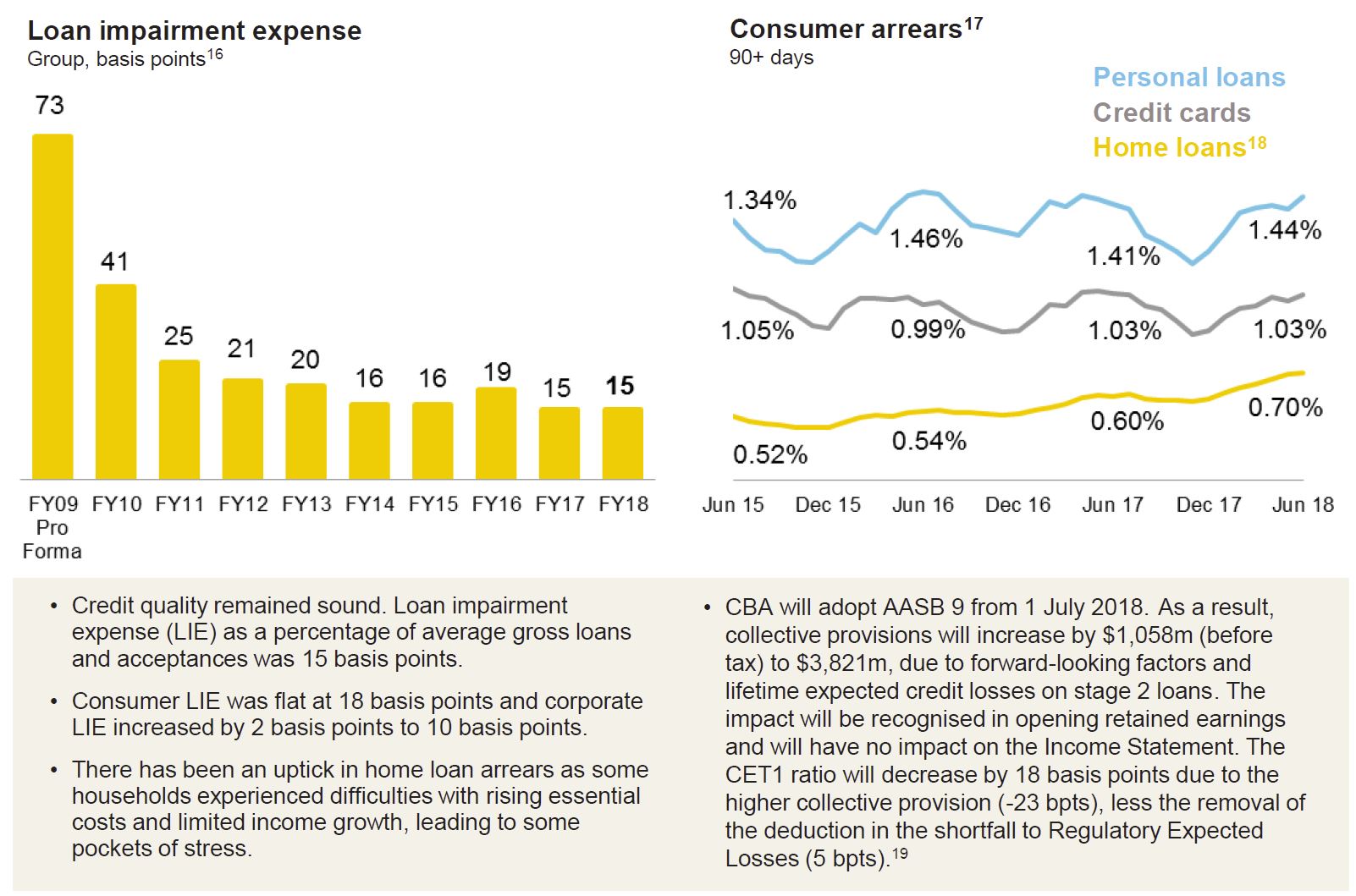

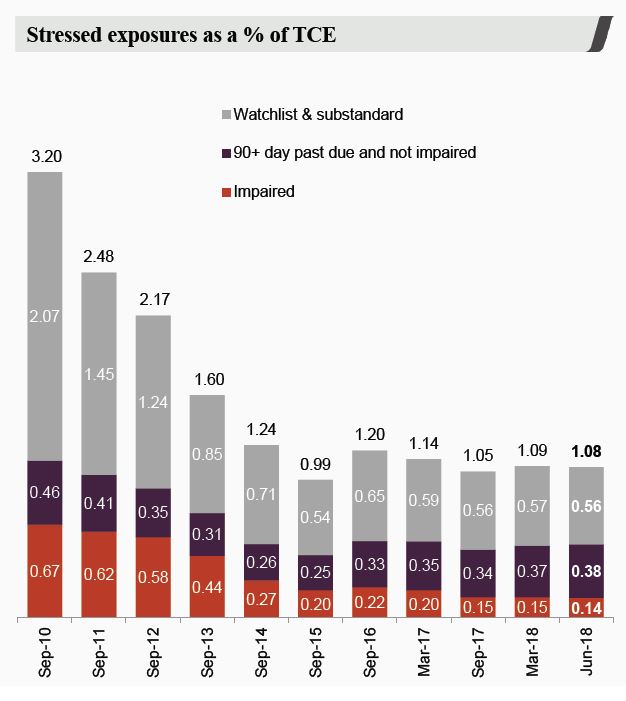

Credit quality has continued to be sound with stressed assets to total committed exposures down 1bp from 31 March 2018 to 1.08%.

Credit quality has continued to be sound with stressed assets to total committed exposures down 1bp from 31 March 2018 to 1.08%.

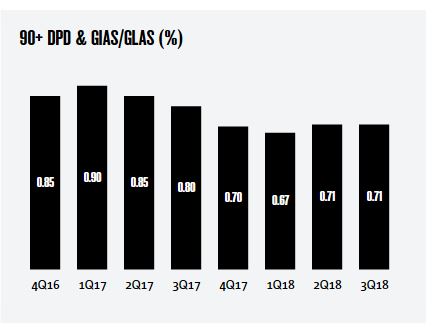

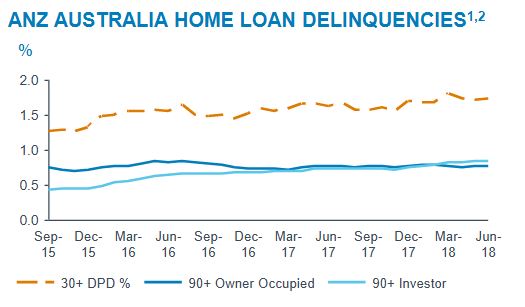

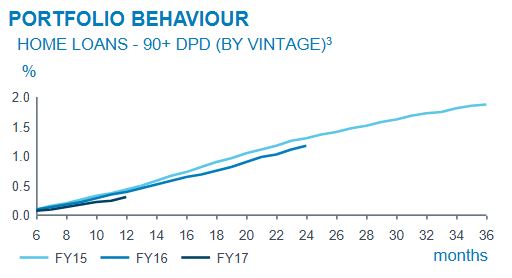

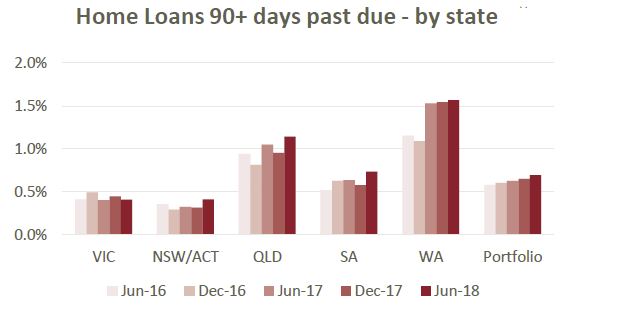

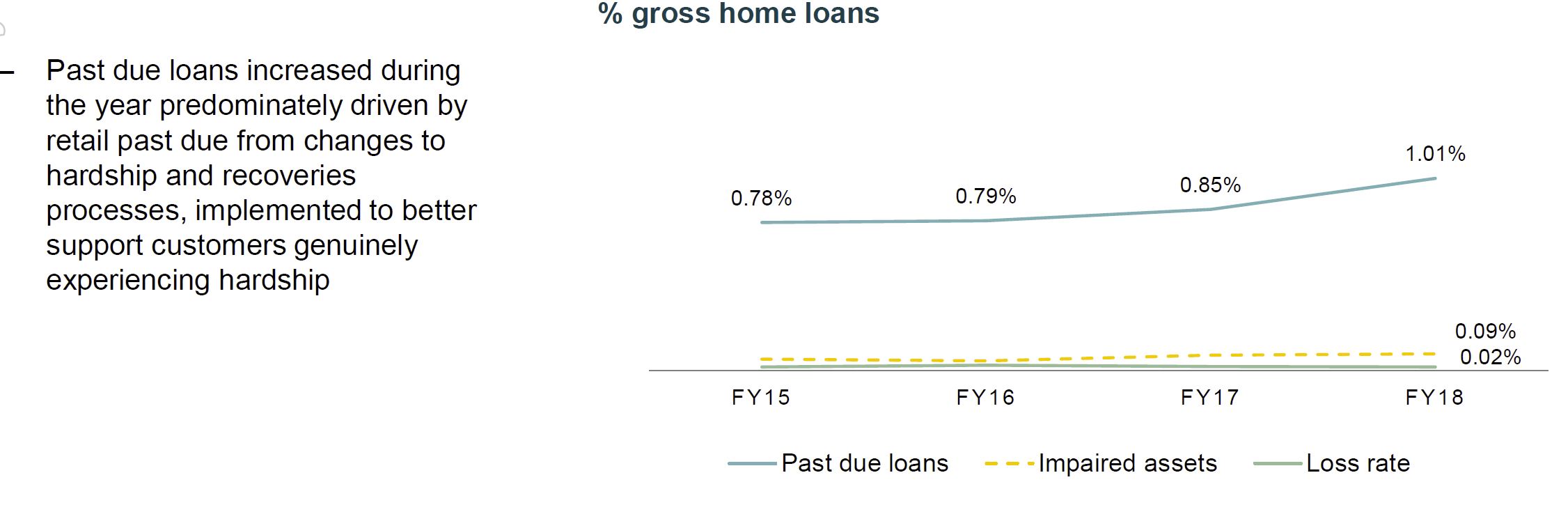

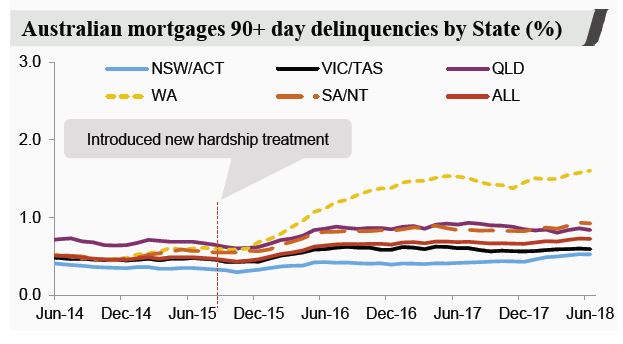

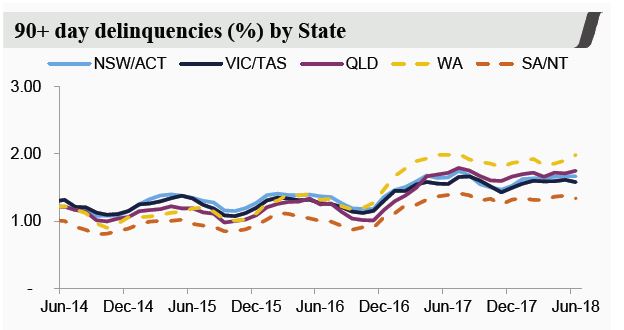

Mortgage 90+ day delinquencies in Australia were up 3bps over the three months ended June 2018 with most States recording some increase.

Mortgage 90+ day delinquencies in Australia were up 3bps over the three months ended June 2018 with most States recording some increase.

Mortgage 30+ day delinquencies were flat over 3Q18 while properties in possession were lower at just 392.

Mortgage 30+ day delinquencies were flat over 3Q18 while properties in possession were lower at just 392.

Unsecured consumer credit delinquencies rose.

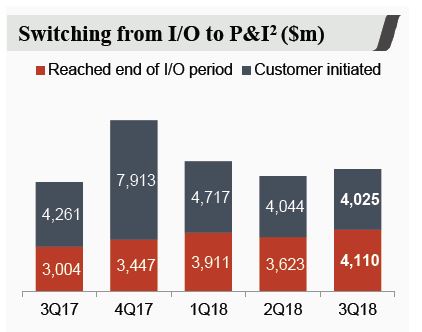

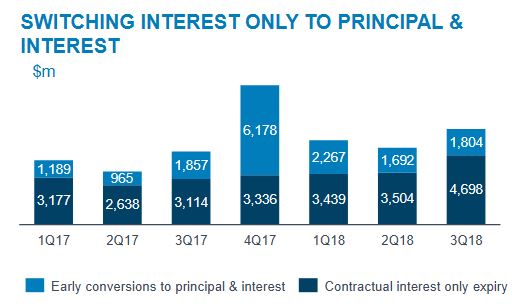

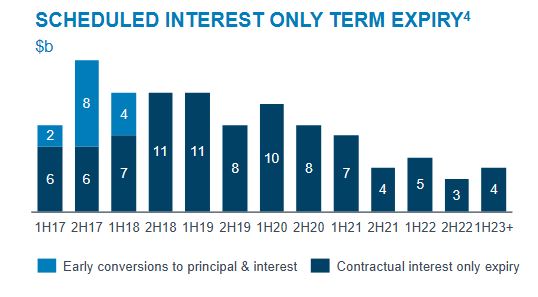

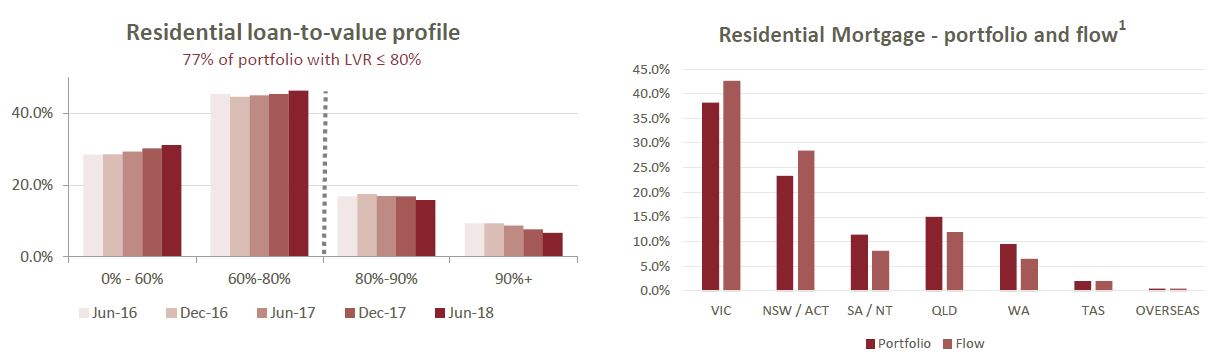

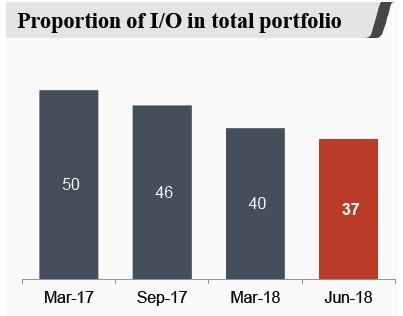

The proportion of interest only loans has dropped from 50% in March 17 to 37% in June 18. This had a 2 basis point impoact on margins.

The proportion of interest only loans has dropped from 50% in March 17 to 37% in June 18. This had a 2 basis point impoact on margins.

More than $8 billion of IO loans were refinanced to Principal and Interest in the 3Q18, with slightly more than half because they ended their term.

More than $8 billion of IO loans were refinanced to Principal and Interest in the 3Q18, with slightly more than half because they ended their term.

The Group has maintained strong liquidity metrics with the Net stable funding ratio of 112% and the Liquidity coverage ratio of 127%, both comfortably above regulatory minimums.

For the 10 months to 31 July 2018, the Group had raised $31bn in term wholesale funding at an average duration of over 6 years. This largely completes Westpac’s Full Year 2018 term funding requirements.