First Time Buyers are keeping the property ship afloat for now, but what are the consequences?

Welcome to the Property Imperative weekly to 9th December 2017. Watch the video, or read the transcript.

Welcome to the Property Imperative weekly to 9th December 2017. Watch the video, or read the transcript.

In our weekly digest of property and finance news, we start this week with the latest housing lending finance from the ABS. The monthly flows show that owner occupied lending fell $23m compared with the previous month, down 0.15%, while investment lending flows fell 0.5%, down $60m in trend terms. Refinanced loans slipped 0.13% down $7.5 million. The proportion of loans excluding refinanced loans for investment purposes slipped from a recent high of 53.4% in January 2015, down to 44.6% (so investment property lending is far from dead!)

While overall lending was pretty flat, first time buyers lifted in response to the increased incentives in some states, by 4.5% in original terms to 10,061 new loans nationally. At a state level, FTB’s accounted for a 19% per cent share in Victoria and 13.7% in New South Wales, where in both states, a more favourable stamp duty regime and enhanced grants were introduced this year. But, other states showed a higher FTB share, with NT at 24.8%, WA at 24.6%, ACT at 20.1% and QLD 19.7%. SA stood at 13% and TAS at 13.3%. There was an upward shift in the relative numbers of first time buyers compared with other buyers (17.6% compared with 17.4% last month), still small beer compared with the record 31.4% in 2009. These are original numbers, so they move around each month. The number of first time buyer property investors slipped a little, using data from our household surveys, down 0.8% this past month. Together with the OO lift, total first time buyer participation has helped support the market.

The APRA Quarterly data to September 2017 shows that bank profitability rose 29.5% on 2016 and the return on equity was 12.3% compared with 9.9% last year. Loans grew 4.1%, thanks to mortgage growth, provisions were down although past due items were $14.3 billion as at 30 September 2017. This is an increase of $1.5 billion (11.8 per cent) on 30 September 2016. The major banks remain highly leveraged.

The property statistics showed that third party origination rose with origination to foreign banks sitting at 70% of new loans, mutuals around 20% and other banks around the 50% mark. Investment loan volumes have fallen, though major banks still have the largest relative share, above 30%. Mutuals are sitting around 10%. Interest only loans have fallen from around 40% in total value to 35%, but this represents a fall from around 30% of the loan count, to 27%. This reflects the higher average loan values for IO borrowers. The average loan balance for interest only loans currently stands at $347,000 against the average balance of $264,000. No surprise of course, as these loans do not contain any capital repayments (hence the inherent risks involved, especially in a falling market).

But there has been a spike in loans being approved outside serviceability, with major banks reporting 5% or so in September. This may well reflect a tightening of standard serviceability criteria and the wish to continue to grow their loan books. We discussed this on Perth 6PR Radio. So overall, we see the impact of regulatory intervention. The net impact is to slow lending momentum. As lenders tighten their lending standards, new borrowers will find their ability to access larger loans will diminish. But the loose standards we have had for several years will take up to a decade to work through, and with low income growth, high living costs and the risk of an interest rate rise, the risks in the system remain.

On the economic front, GDP from the ABS National Accounts was 0.6%. This was below the 0.7% expected. This gives an annual read of 2.3%, in trend terms, well short of the hoped for 3%+. Seasonally adjusted, growth was 2.8%. Business investment apart, this is a weak and concerning result. The terms of trade fell. GDP per capita and net disposable income per capita both fell, which highlights the basic problem the economy faces. The dollar fell on the news. Households savings also fell. No surprise then that according to the ABS, retail turnover remained stagnant in October. The trend estimate for Australian retail turnover fell 0.1 per cent in October 2017 following a relatively unchanged estimate (0.0 per cent) in September 2017. Compared to October 2016 the trend estimate rose 1.8 per cent. Trend estimates smooth the statistical noise.

So no surprise the RBA held the cash rate once again for the 16th month in a row.

The latest BIS data on Debt Servicing ratios shows Australia is second highest after the Netherlands. We are above Norway and Denmark, and the trajectory continues higher. Further evidence that current regulatory settings in Australia are not correct. As the BIS said, such high debt is a significant structural risk to future prosperity. They published a special feature on household debt, in the December 2017 Quarterly Review. They call out the risks from high mortgage lending, high debt servicing ratios, and the risks to financial stability and economic growth. All themes we have already explored on the DFA Blog, but it is a well-argued summary. Also note Australia figures as a higher risk case study. They say Central banks are increasingly concerned that high household debt may pose a threat to macroeconomic and financial stability and highlighted some of the mechanisms through which household debt may threaten both. Australia is put in the “high and rising” category. The debt ratio now exceeds 120% in both Australia and Switzerland. Mortgages make up the lion’s share of debt. In Australia mortgage debt has risen from 86% of household debt in 2007 to 92% in 2017.

Basel III was finally agreed this week by the Central Bankers Banker – the Bank for International Settlements – many months later than expected and somewhat watered down. Banks will have to 2022 to adopt the new more complex framework, though APRA said that in Australia, they will be releasing a paper in the new year, and banks here should be planning to become “unquestionably strong” by 1 January 2020. We note that banks using standard capital weights will need to add different risk weights for loans depending on their loan to value ratio, advanced banks will have some floors raised, and investor category mortgages (now redefined as loans secured again income generating property) will need higher weights. Net, net, there will be two effects. Overall capital will probably lift a little, and the gap between banks on the standard and internal methods narrowed. Those caught transitioning from standard to advanced will need to think carefully about the impact. This if anything will put some upwards pressure on mortgage rates.

The Treasury issues a report “Analysis of Wages Growth” which paints a gloomy story. Wage growth, they say, is low, across all regions and sectors of the economy, subdued wage growth has been experienced by the majority of employees, regardless of income or occupation, and this mirrors similar developments in other developed western economies. Whilst the underlying causes are far from clear, it looks like a set of structural issues are driving this outcome, which means we probably cannot expect a return to “more normal” conditions anytime some. This despite Treasury forecasts of higher wage growth later (in line with many other countries). We think this has profound implications for economic growth, tax take, household finances and even mortgage underwriting standards, which all need to be adjusted to this low income growth world.

Mortgage Underwriting standards are very much in focus, and rightly, given flat income growth. There was a good piece on this from Sam Richardson at Mortgage Professional Australia which featured DFA. He said that over four days in late September two major banks added extra checks to an already-extensive application process. ANZ introduced a Customer Interview Guide requiring brokers to ask questions about everything from a customer’s Netflix subscription to whether they were planning to start a family. Three days later CBA introduced a simulator that would show interest-only borrowers how their repayments would change and affect their lifestyle. Customers would be required to fill in an ‘acknowledgement form’ to proceed with an interest-only application.

Getting good information from customers is hard work, not least because as we point out, only half of households have formal budgeting. So, when complete the mortgage application, households may be stating their financial position to the best of their ability, or they may be elaborating to help get the loan. It is hard to know. Certainly banks are looking for more evidence now, which is a good thing, but this may make the loan underwriting processes longer and harder. Improvements in technology could improve underwriting standards for banks while pre-populating interactive application forms for consumers and offering time-saving solutions to brokers and Open Banking may help, but while Applications can be made easier, this does not necessarily mean shorter.

More data this week on households, with a survey showing Australians have become more cautious of interest only loans with online panel research revealing that 46 per cent of Australians are Adamant Decliners of interest-only home loans according to research from the Gateway Credit Union. In addition, a further quarter of respondents are Resistant Approvers, acknowledging the benefits of interest-only loans yet choosing not to utilise them. Of the generations, Baby Boomers are most likely to be Adamant Decliners and therefore, less likely to use interest-only products. While Gen Y are most likely to be Enthusiastic Users.

Banks continue to offer attractive rates for new home loans, seeking to pull borrows from competitors. Westpac for example, announced a series of mortgage rate cuts to attract new borrowers, as it seeks to continue to grow its portfolio, leveraging lower funding costs, and the war chest it accumulated earlier in the year from back book repricing, following APRA’s tightening of underwriting standards and restrictions on interest only loans. Rates for both new fixed rate loans and variable rate loans were reduced. For example, the bank has also increased the two-year offer discount on its flexi first option home for principal and interest repayments from 0.84% p.a. to 1.00% p.a. putting the current two-year introductory rate at 3.59% p.a.

The RBA released their latest Bulletin and it contained an interesting section on Housing Accessibility For First Time Buyers. They suggest that in many centers, new buyers are able to access the market, thanks to the current low interest rates. But the barriers are significantly higher in Melbourne, Sydney and Perth. They also highlight that FHBs (generally being the most financially constrained buyers) are not always able to increase their loan size in response to lower interest rates because of lenders’ policies. Indeed, the average FHB loan size has been little changed over recent years while the gap between repeat buyers and FHBs’ average loan sizes has widened. They also showed that in aggregate, rents have grown broadly in line with household incomes, although rent-to-income ratios suggest housing costs for lower-income households have increased over the past decade.

Housing affordability has improved somewhat across all states and territories, allowing for a large increase in the number of loans to first-home buyers, according to the September quarter edition of the Adelaide Bank/REIA Housing Affordability Report. The report showed the proportion of median family income required to meet average loan repayments decreased by 1.2 percentage points over the quarter to 30.3 per cent. The result was decrease of 0.6 percentage points compared with the same quarter in 2016. However, Housing affordability is still a major issue in Sydney and Melbourne they said. In addition, over the quarter, the proportion of median family income required to meet rent payments increased by 0.3 percentage points to 24.6 per cent.

Our own Financial Confidence Index for November fell to 96.1, which is below the 100 neutral metric, down from 96.9 in October 2017. This is the sixth month in succession the index has been below the neutral point. Owner Occupied households are the most positive, scoring 102, whilst those with investment property are at 94.3, as they react to higher mortgage repayments (rate rises and switching from interest only mortgages), while rental yields fall, and capital growth is stalling – especially in Sydney. Households who are not holding property – our Property Inactive segment – will be renting or living with friends or family, and they scored 81.2. So those with property are still more positive overall. Looking at the FCI score card, job security is on the improve, reflecting rising employment participation, and the lower unemployment rate. Around 20% of households feel less secure, especially those with multiple part time jobs. Savings are being depleted to fill the gap between income and expenditure – as we see in the falling savings ratio. As a result, nearly 40% of households are less comfortable with the amount they are saving. This is reinforced by the lower returns on deposit accounts as banks seek to protect margins. More households are uncomfortable with the amount of debt they hold with 40% of households concerned. The pressure of higher interest rates on loans, tighter lending conditions, and low income growth all adds to the discomfort. More households reported their real incomes had fallen in the past year, with 50% seeing a fall, while 40% see no change. Only those on very high incomes reported real income growth.

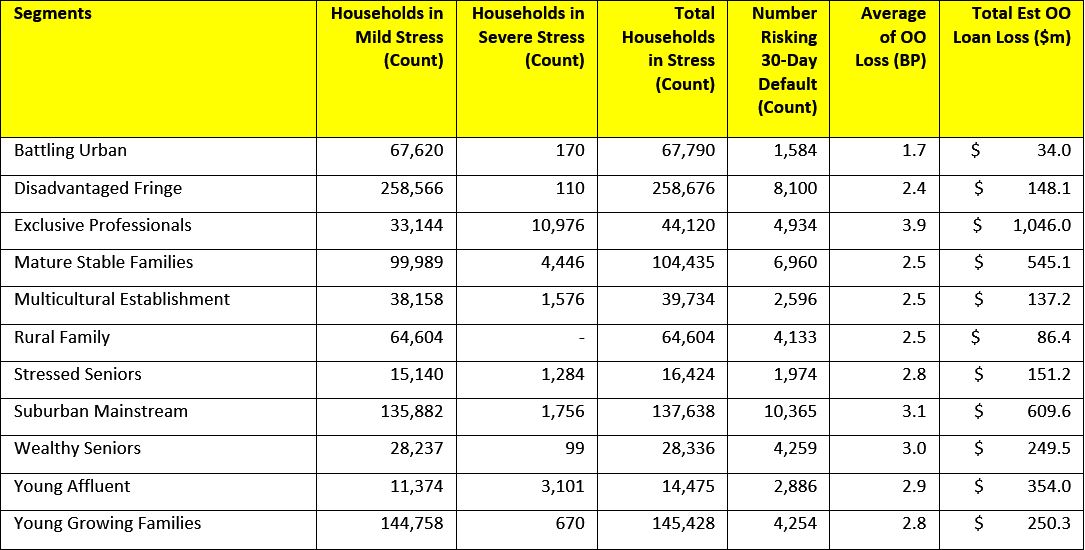

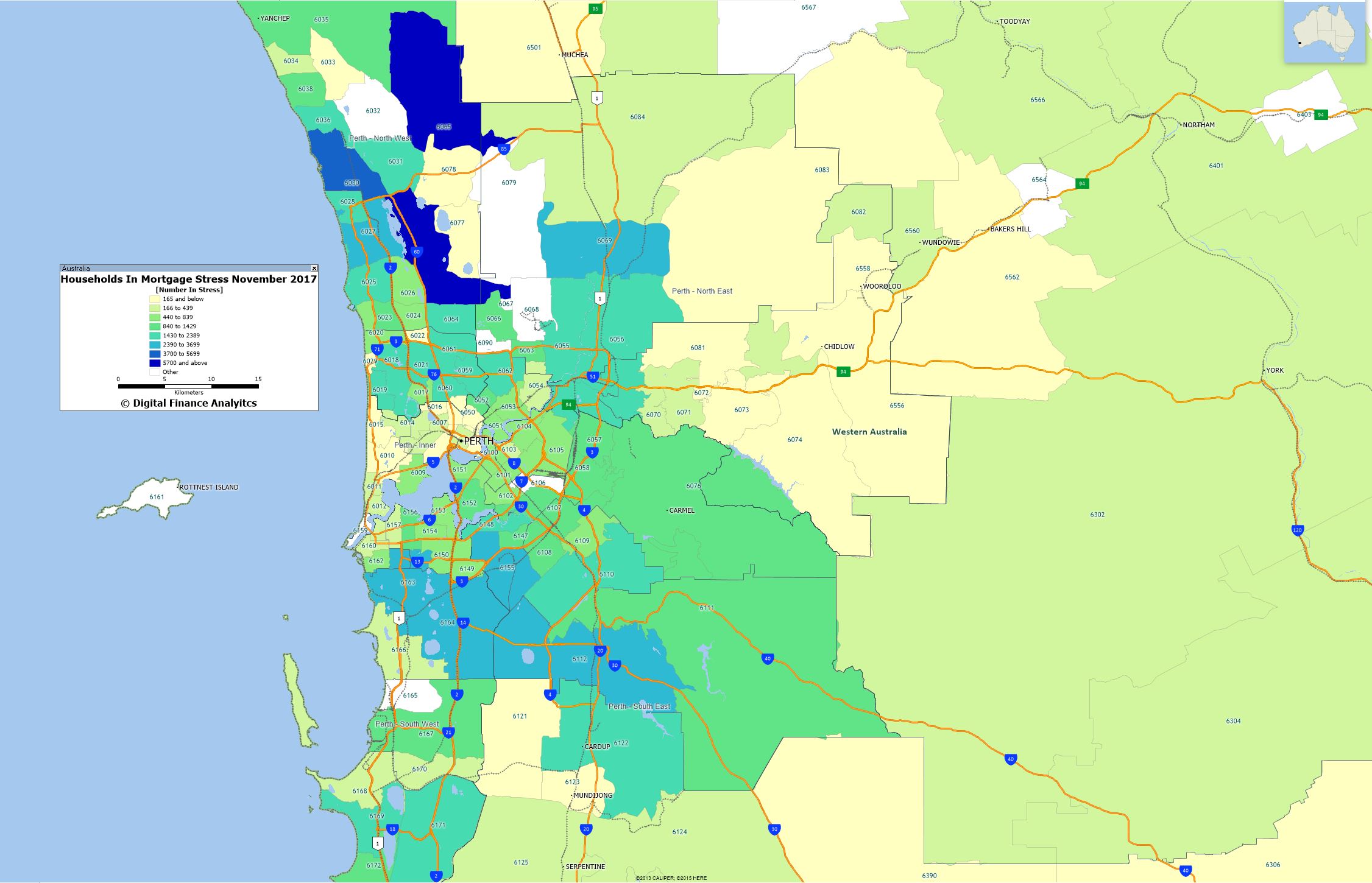

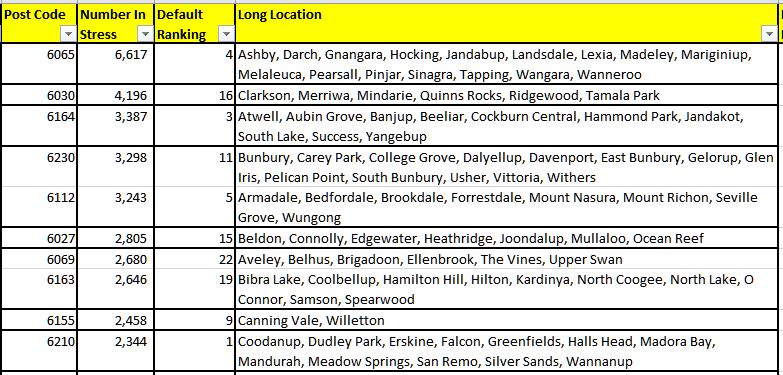

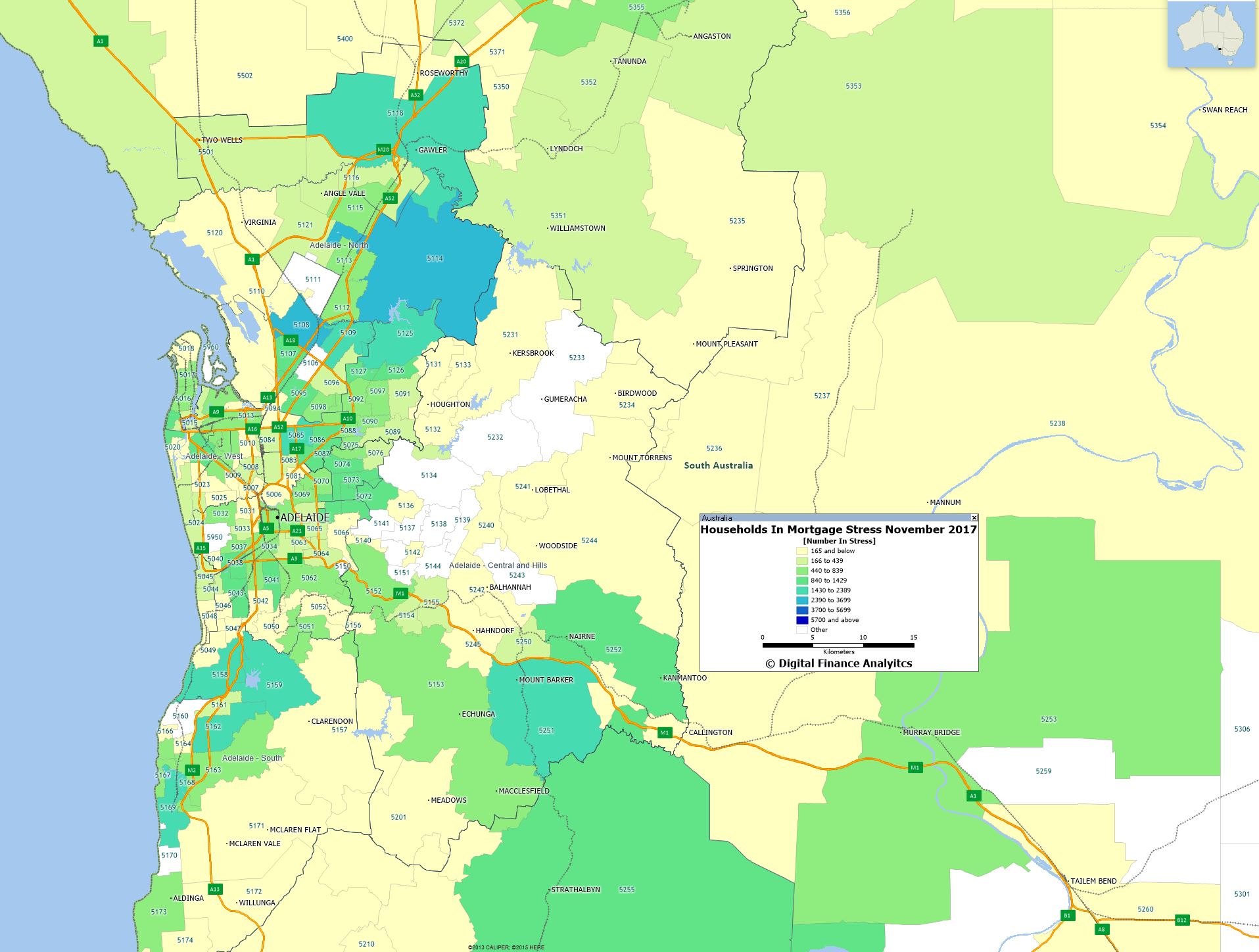

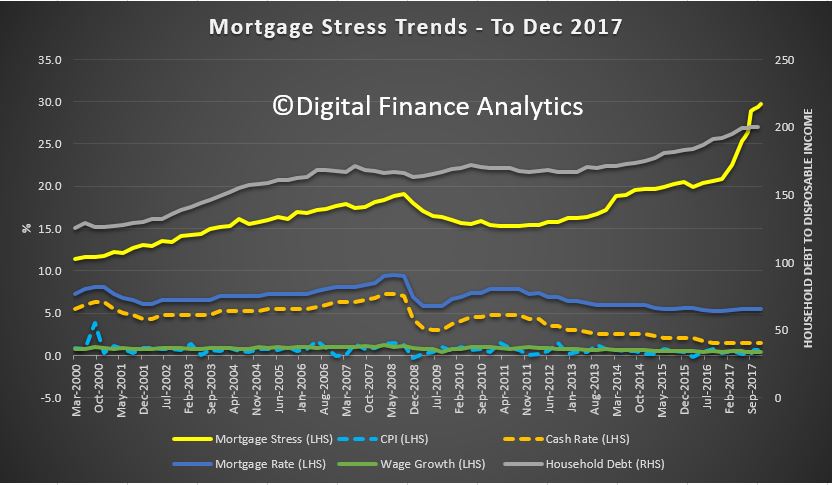

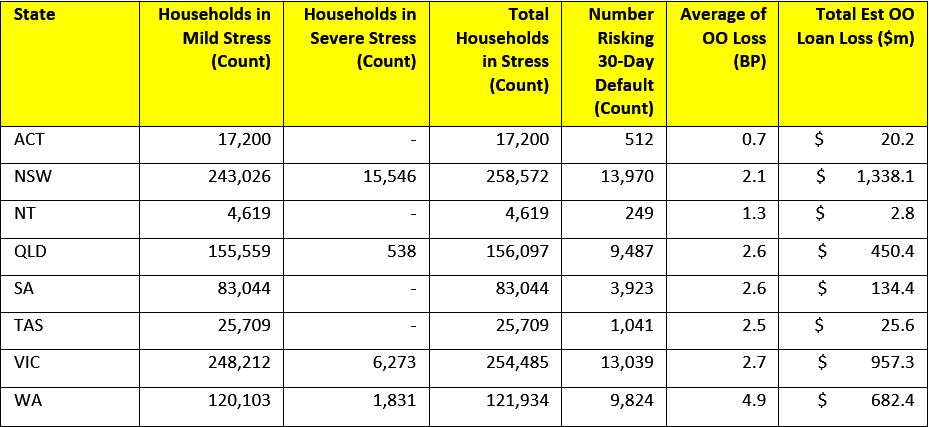

Finally, we also released the November mortgage stress and default analysis update. You can watch our video counting down the most stressed postcodes in the country. But in summary, across Australia, more than 913,000 households are estimated to be now in mortgage stress (last month 910,000) and more than 21,000 of these in severe stress, the same as last month. Stress is sitting on a high plateau. This equates to 29.4% of households. We see continued default pressure building in Western Australia, as well as among more affluent household, beyond the traditional mortgage belts across the country. Stress eased a little in Queensland, thanks to better employment prospects. We estimate that more than 52,000 households risk 30-day default in the next 12 months, similar to last month. We expect bank portfolio losses to be around 2.8 basis points, though with losses in WA rising to 4.9 basis points.

So, the housing market is being supported by first time buyers seeking to gain a foothold in the market, but despite record low interest rates, and special offer attractor rates, many will be committing a large share of their income to repay the mortgage, at a time when income growth looks like it will remain static, costs of living are rising, and mortgage rates will rise at some point. All the recent data suggests that underwriting standards are still pretty loose, and household debt overall is still climbing. This still looks like a high risk recipe, and we think households should do their own financial assessments if they are considering buying at the moment – for home prices are likely to slide, and the affordability equation may well be worse than expected. Just because a lender is willing to offer a large mortgage, do not take this a confirmation of your ability to repay. The reality is much more complex than that. Getting mortgage underwriting standards calibrated right has perhaps never been more important than in the current environment!

And that’s the Property Imperative to 9th December 2017. If you found this useful, do leave a comment, sign up to receive future research and check back next week for the latest update. Many thanks for taking the time to watch.

Martin North, Principal of Digital Finance Analytics said “the number of households impacted are economically significant, especially as household debt continues to climb to new record levels. Mortgage lending is still growing at three times income. This is not sustainable”. The latest household debt to income ratio is now at a record 199.7.[1]

Martin North, Principal of Digital Finance Analytics said “the number of households impacted are economically significant, especially as household debt continues to climb to new record levels. Mortgage lending is still growing at three times income. This is not sustainable”. The latest household debt to income ratio is now at a record 199.7.[1] The largest financial losses relating to bank write-offs reside in NSW ($1.3 billion) from Owner Occupied borrowers) and VIC ($957 million) from Owner Occupied Borrowers, which equates to 2.1 and 2.7 basis points respectively. Losses are likely to be highest in WA at 4.9 basis points, which equates to $682 million from Owner Occupied borrowers.

The largest financial losses relating to bank write-offs reside in NSW ($1.3 billion) from Owner Occupied borrowers) and VIC ($957 million) from Owner Occupied Borrowers, which equates to 2.1 and 2.7 basis points respectively. Losses are likely to be highest in WA at 4.9 basis points, which equates to $682 million from Owner Occupied borrowers.